This week, we saw a “golden cross”. What does it imply for the gold market?

Is Golden Cross Bullish for Gold?

A golden cross is a relatively rare technical indicator which occurs when an asset’s short-term moving average crosses above its long-term moving average. The golden cross is often associated with important upward price movement and it is considered a bullish signal. This is what happened in the gold market this week. On Tuesday, gold’s 50-moving average crossed above the 200-day moving average. It’s the first such movement in nearly two years and many analysts believe that this moving-average crossover signals the end of the bear market.

Gold bulls have strong arguments for predicting a further rally. The yellow metal is the best performing asset in 2016. Yesterday, the price of gold ended New York trading at $1,263.90, which pushed the gold market into official bullish territory, defined as a 20 percent move from a low (gold touched a near six-year low of $1,049.60 on December 17, 2015).

However, the golden cross does not automatically translate into a further rally. Actually, long-term buying after a golden cross has failed more than it has succeeded. For example, in 2014 the market formed a golden cross, but the rallies were not sustained. The last golden cross that worked was seven years ago. It means that although the golden cross could lead to more short-term technical buying, especially from traders that follow algorithms and trading signals, it should not be a premise for long-term investing.

Gold Market in 2016

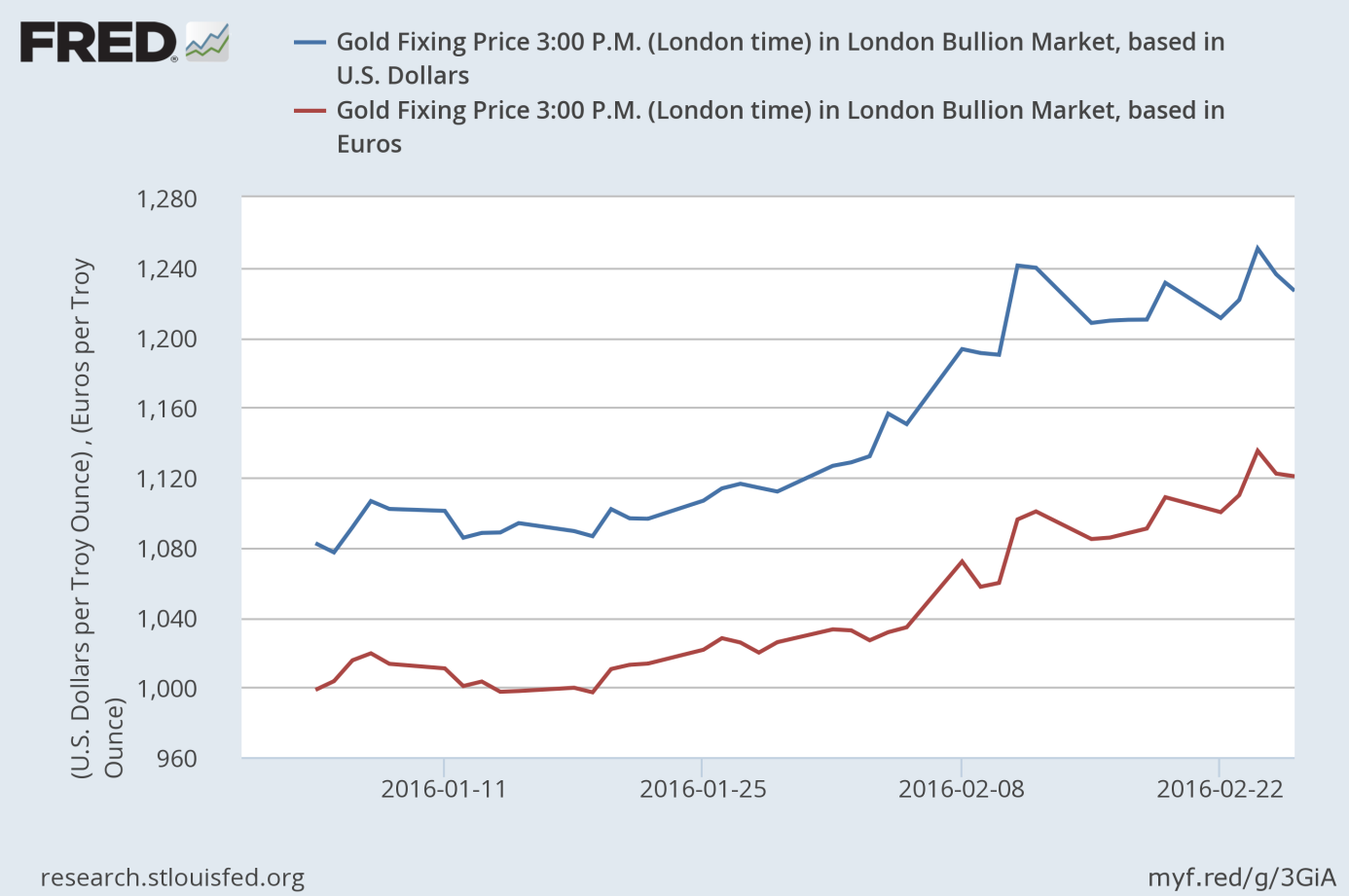

Gold has performed excellent in 2016, rising both in the U.S. dollar and the euro (see the chart below).

Chart 1: Gold priced in the U.S. dollar (blue line) and the euro (red line) in 2016.

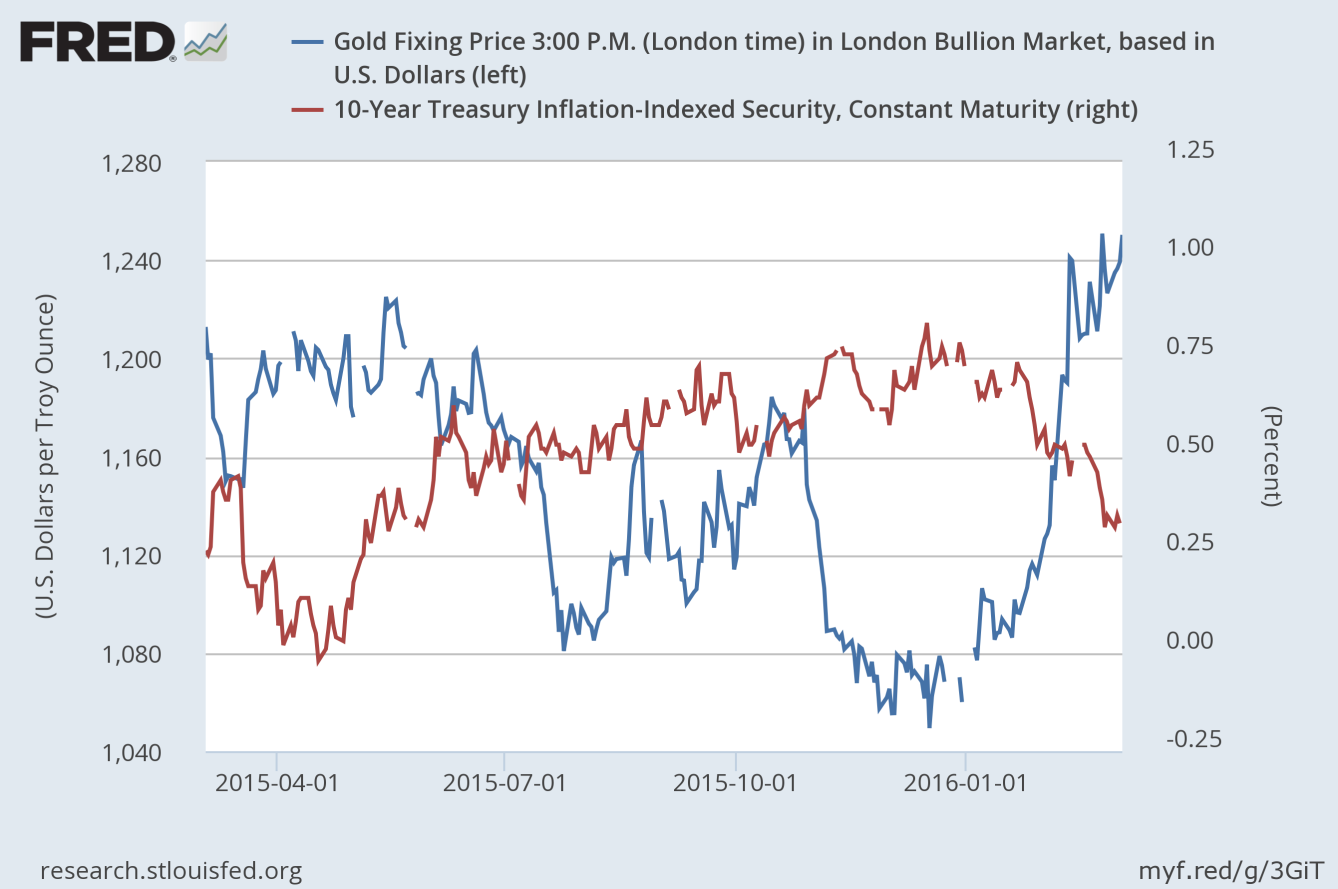

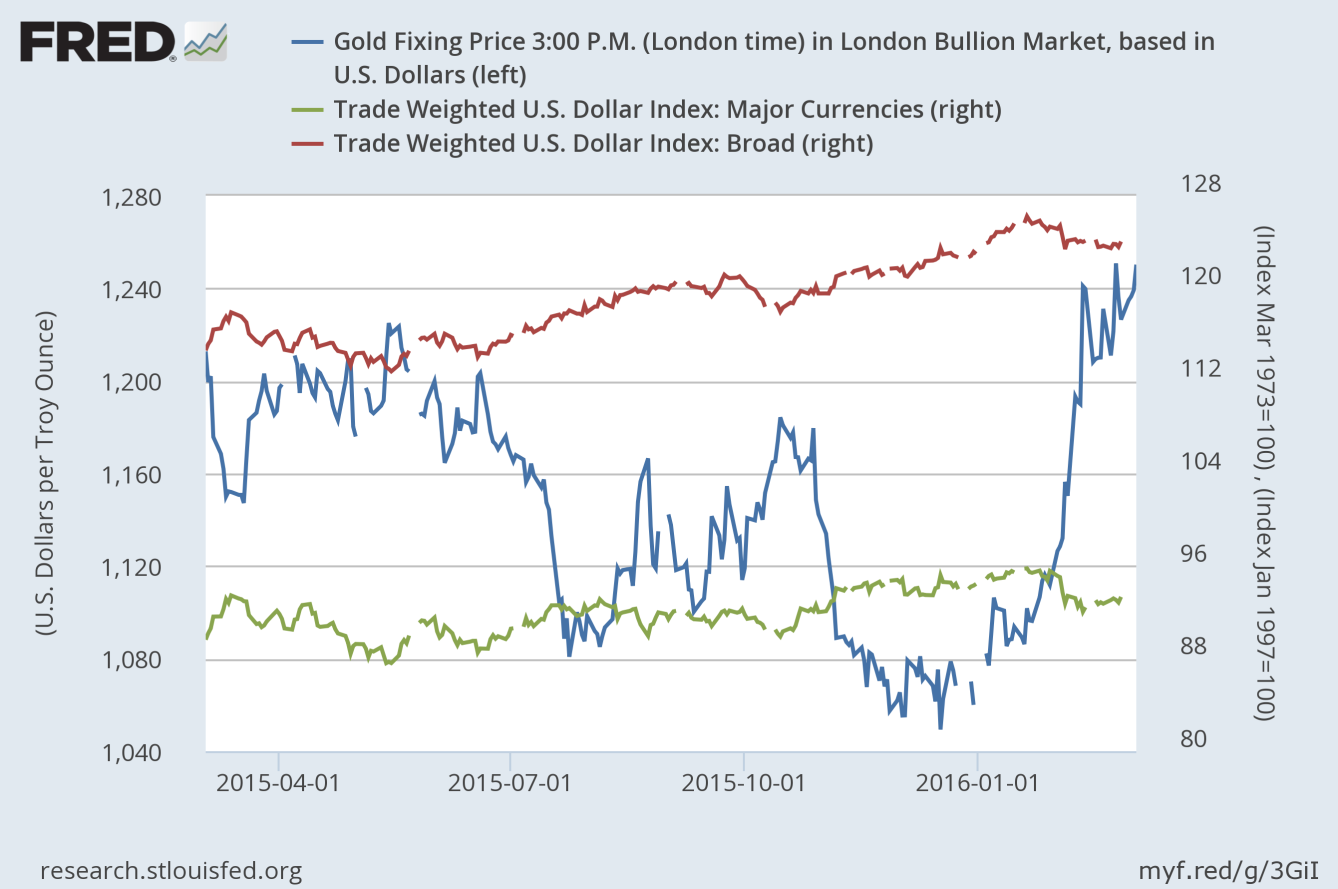

The biggest drivers of the rise in the gold price were, as usual, the decline in real interest rates (see Chart 2) and the weakness of the U.S. dollar against other currencies (see Chart 3). Long-term real interest rates fell due to a slowdown in global growth and the rise in inflation (to some extent). Thus, the moderate increase in inflation could be positive for gold, provided it will lead to a decline in real interest rates, without prompting the Fed to further hike interest rates. The U.S. dollar fell on weak economic data, soften expectations of the Fed’s pace of monetary tightening and worries about negative interest rates.

Chart 2: The price of gold (blue line, left axis, London PM Fix) and U.S. long-term real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) in the last 12 months.

Chart 3: The price of gold (blue line, left axis, London PM Fix) and the U.S. dollar indices (Trade Weighted Broad U.S. Dollar Index – red line, right axis; Trade Weighted U.S. Dollar Index against Major Currencies – green line, right axis) in the last 12 months.

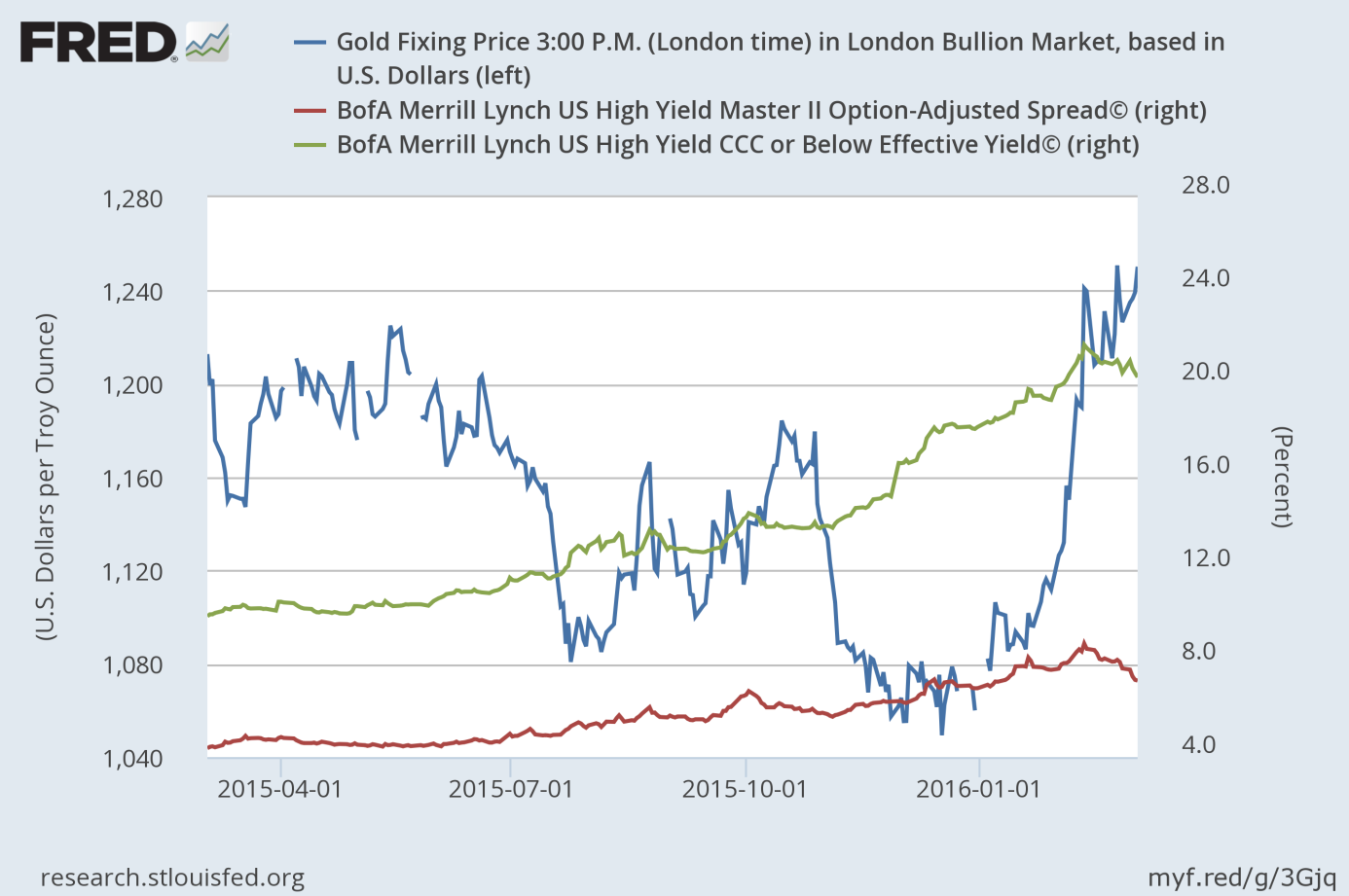

The price of gold has also been rising because of a rise in risk-aversion. The weak economic data increased the odds of a recession. The worries about China and declines in oil prices and stock prices, as well as problems in the junk bond market added to uncertainty and led to a safe-haven demand for gold. The introduction of NIRP by the Bank of Japan and Yellen’s remarks on NIRP, as well as a more dovish stance of the FOMC members erased the confidence in the central banks’ ability to spur economic growth. Therefore, credits spreads had risen until mid-February (see Chart 4), which means that investors became more risk averse and more sympathetic towards gold.

Chart 4: The price of gold (blue line, left axis, London PM Fix), the BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread (red line, right axis, in percent) and the BofA Merril Lynch US High Yield CCC or Below Effective Yield (green line, right axis, in percent).

However, the credit spreads have been narrowing since mid-February. It signals that markets are becoming calmer and investors are increasing their risk appetites. Therefore, the price of gold could see a reversion in the short-term, especially that the gains this year have been parabolic, while the possible further ECB monetary easing may not be fully reflected in the price of gold.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview