This week has been hot! Unfortunately, I could not cover the inflation report and Powell's testimonies earlier, as I attended the 8th International Conference "The Austrian School of Economics in the 21st Century," held in Vienna, to present my paper on zombie companies and the U.S. productivity slowdown, and to get inspired by the latest ideas and research topics. It was well-organized and probably the biggest Europe-based conference on the Austrian school and libertarianism this year. And it was very fruitful, just take a look what I got from one of the speakers!

Oh my God, 500 bolivars, isn't it a nice present? Nah, because of the hyperinflation in Venezuela, the banknote is rubbish, it's worth no more than few US cents.

Fortunately, another speaker handed out gold coins. Nah, I made it up. I wish it was true, but no one gives out gold for free, because unlike fiat money, gold is actually worth something. To be clear, I do not claim that all fiat currencies are as shitty as the bolivars right now are. I rather want to show what they can become, if institutional restrictions on the use of the printing press are removed. The great advantage of gold is that its supply is naturally limited, so the monetary stability does not rely on the wisdom and self-control of the FOMC members.

So, gold is naturally rare and it is indeed valuable. Actually, sometimes gold can be truly precious. Please take a look at the next photos. The conference was held in the Oesterreichische Nationalbank, i.e., the central bank of Austria (which is quite ironic, as the Austrian economists want to abandon the central banks, but the thing is that Barbara Kolm, Vice President of the General Council, supports the Austrian school of economics, and she is also the President of the Friedrich August von Hayek Institute and the Director of the Austrian Economics Center). And one could come across this impressive gold coin:

Isn't it pretty? But guess how much it weighs! No, more than 10 kilograms. And more than 20 kilograms... 31.103 kilograms, or 1,000 ounces. The coin was created for the 15th anniversary of the Vienna Philharmonic bullion coin in 2004. The so-called Big Phil has a nominal value €100,000, although it is made of pure gold and it is worth about €1.3 million. So if someone believed that coins can be used only for small payments, they have to change their minds now!

Inflation Goes Up, But Will Fed React?

The Consumer Price Index rose 0.4 percent in October after scoring flat in September. This has been the fastest increase in seven months. The acceleration was mainly caused by the jump in energy prices, although medical care also contributed (prices for medical care rose 1 percent, marking the biggest increase in more than three years). The core index, which excludes food and energy, rose 0.2 percent, following 0.1-percent upward move in September.

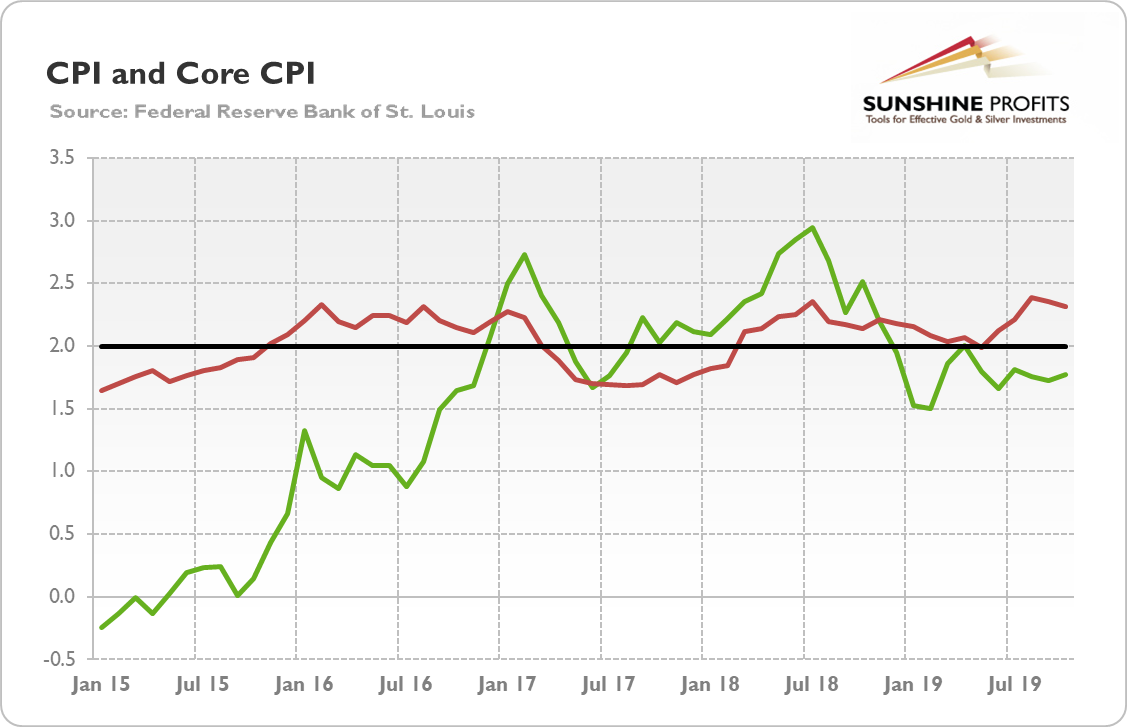

On an annual basis, the all items index jumped 1.8 percent, a slightly larger increase than the 1.7-percent rise for the 12-months period ending September. Meanwhile, the index for all items less food and energy went up 2.3 percent over the last 12 months, a slight decline from 2.4 percent one month ago, as the chart below.

Chart 1: Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to October 2019.

What do these price developments mean for the Fed's stance and the gold market? Well, not too much. After all, the annual inflation rate has barely changed. The all-item index is slightly up, while the core index is slightly down. Hence, the Fed will not be in any kind of rush to unwind the recent interest rate cuts. The CPI has edged up, but it's still well below last year's peak of nearly 3 percent. So, the U.S. central bank is unlikely to hike the federal funds rate in the near future.

Powell Says Nothing New

Indeed, this is what Powell said before the Congress this week. He reiterated that inflation pressures remain muted, signaling that the Fed will not hike the interest rates unless inflation significantly soars:

We see the current stance of monetary policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook of moderate economic growth, a strong labor market, and inflation near our symmetric 2% objective.

In essence then, Powell said nothing new. He warned again that the long-term federal budget "is on an unsustainable path" (thank you, Captain Obvious!), and maintained that the overall level of vulnerabilities facing the financial system "has remained at a moderate level". Yes, the recent repo crisis and the following Fed's liquidity injections clearly confirm the moderate risks in the financial system. And the fact that the global debt is on course to end 2019 at a record high of more than $255 trillion is another reassuring development, making clear that everything is fine.

Implications for Gold

Although you might be disappointed, the reality is that neither inflation nor Powell showed anything new. The annual CPI hardly changed, while the Fed Chair did not surprise the markets. From the fundamental point of view, gold outlook remains solid in the long-term. Although the Fed concluded its easing cycle, it will not hike interest rates anytime soon. However, the risk appetite returned to the market, while the real interest rates stopped declining. So, we could see a correction in the precious metals market. Keeping with the fundamentals, gold is unlikely to rally unless we see either a bear market in the U.S. dollar, falling bond yields, or rising risk premium.

Thank you.

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.