Recently, the WGC published a fresh Investment Update entitled It may be time to replace bonds with gold.Is it?

According to the report, investors are now facing the environment with flat to inverted yield curves, stock valuations at extreme levels that historically preceded meaningful stock sell-offs, and an increasing set of geopolitical concerns, including trade tensions, Brexit and Middle East turmoil. Given this backdrop, gold should be part of each investment portfolio as a safe-haven asset.

However, the WGC claims that gold has an even greater role to play today. This is because the central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns. The point is that with negative yielding debt at all-time highs, gold may become a more attractive portfolio diversifier.

After all, the opportunity costs of holding gold have declined recently thanks to the central banks' dovish shift and ultra-low bond yields. Normally, the fact that gold does not pay any interest or dividends can deter investors, but in a crazy world of negative interest rates totaling more than $17 trillion (that's about 30 percent of all investment-grade securities bearing sub-zero yields), the opportunity costs of holding gold have decreased substantially or even transformed into competitive advantage.

Hence, it seems that replacing some bonds with gold could be reasonable, especially since that the yellow metal has historically performed well in the year following a dovish U-turn in the Fed's stance, and it also performed exceptionally well when real interest rates were negative or just close to zero.

An analysis based on historical returns, when interest rates were at more normal levels, suggests that gold should amount to 2-10 percent of the investment portfolio, depending on the particular asset composition and the risk taken. But adjusting the model for lower expected returns for bonds in a low interest rate environment we face today, the optimal gold allocations increases by an additional 1-1.5 percentage point to 3-11.5 percent of the investment portfolio.

I certainly agree that the current world of ultra-low interest rates and negative bond yields is hmm... unusual, and that such an environment makes gold look more attractive, so rational investors could possibly increase the share of the yellow metal in their portfolios. And that they should reduce somewhat the allocation to bonds. The unpleasant truth is that investors either have to buy bonds (think about pensions funds constrained by many investment limits), or they bet that the central banks will ease further their stance, lowering the yields and boosting the bond prices even more. They could be right, but it looks suspicious when investors buy bonds traded at negative yields only because they anticipate to find later a greater fool (such as the central bank) ready to buy back the securities at even higher prices.

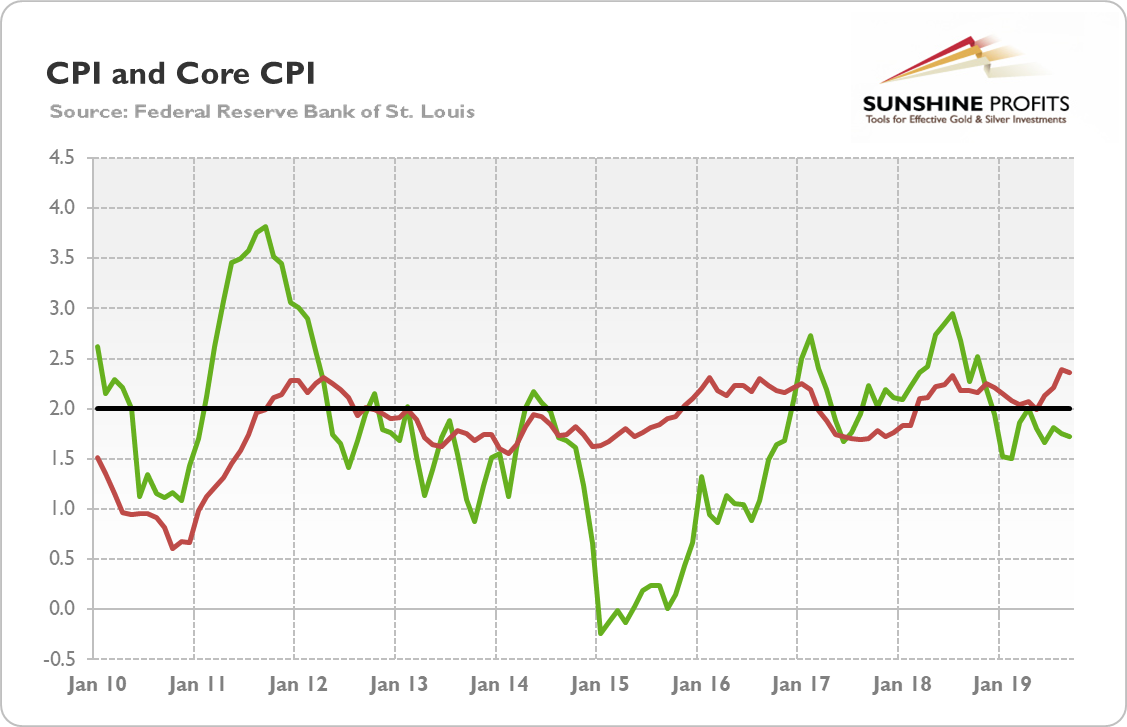

However, the irrational exuberance may take a while. You see, there are also some fundamental factors behind high bond prices. We mean here subdued inflation, which is again running below the Fed's target, as the chart below shows. High inflation is lethal for fixed-income securities (forget about TIPS now), while low inflation is supportive for bonds. Unfortunately, the reverse is true for gold, an inflation-hedge. Hence, unless we see significant jump in inflation (or in inflation expectations precisely), the bond market should not collapse, while gold would not rally like mad.

Chart 1: US CPI (green line) and core CPI (red line) as annual percentage change from January 2010 to September 2019.

To be clear: it does not mean that gold prices would collapse without inflation. After all, the lack of inflationary pressure also means pausing Fed. As Powell said during his latest press conference, the U.S. central bank would not consider tightening without a significant increase in inflationary pressures. A cap on the upside in the federal funds rate should deteriorate the outlook for the U.S. dollar, supporting gold prices.

The recent profound shift in the Fed's approach assumes a mere pause if the going is good and a rate cut if the going turns tough. This means that no matter how good the economic data gets, the U.S. central bank won't be raising interest rates. Hence, the future probability distribution of rates has substantially declined, reducing the downward pressure not only on gold but also on risky assets. If we see modest reacceleration in global growth coupled with reduced trade conflicts, investors could become less risk averse. With risk on, the stock market should go up, reducing the safe-haven appeal of gold.

However, gold may move in tandem with stocks, as the impact of capped real interest rates and weaker greenback should outweigh the eventual rise in the risk-appetite, especially as investors could remain generally cautious. And the recent inversion of the yield curve is a reason for caution.

The bottom line is that the WGC's latest investment update rightly notes that gold's attractiveness has increased in the world of ultra-low or negative interest rates. So it makes sense to replace some bonds with gold. But without inflation rearing its ugly head, which is rather unlikely in the very near future, the bullish fever in gold may not materialize to its full potential.

However, from the fundamental point of view, 2020 should be another positive year for the gold bulls. The Fed's has openly signaled its easing bias. The CME FedRate Watch tool shows that markets thinks that the chances of another interest rate cut next year are about fifty-fifty. After the Fed's U-turn, the U.S. dollar's strength may be questioned, and more investors could shift their funds into gold.

Thank you.

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.