Not even the first week of 2020 has passed and we are inching closer to war! Tensions between the U.S. and Iran have significantly risen. What does it imply for the world and gold market?

Tensions between the U.S. and Iran Are Rising

On Thursday, I wrote that "black swans are flying just above the market surface". And, indeed, not even the first week of the new year passed, and the first swan has already arrived. It landed in Iraq on December 27, when Iranian-backed militia in Iraq attacked a U.S. military base, which killed an American contractor. The U.S. responded by launching airstrikes across Iraq and Syria, killing 25 Iran-backed militiamen. This has led to the attacks on the U.S. embassy in Baghdad.

In response, the U.S. killed on Friday in a rocket attack General Qasem Soleimani, commander of the Iranian Revolutionary Guards Corps-Quds Force, the branch of Iran's security forces responsible for operations abroad. According to the Pentagon's statement, the move was defensive:

General Soleimani was actively developing plans to attack American diplomats and service members in Iraq and throughout the region. General Soleimani and his Quds Force were responsible for the deaths of hundreds of American and coalition service members and the wounding of thousands more (...) This strike was aimed at deterring future Iranian attack plans.

The strike represents a substantial escalation in the low-level conflict between the U.S. and Iran - some experts even describe the attack on the general as little short of a "declaration of war" by the Americans against Iran. The elevated geopolitical risks may support gold prices, at least in the short-term.

Implications for Gold

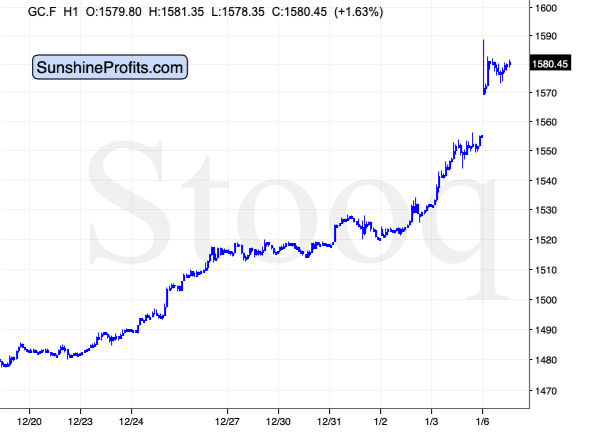

What does the escalation in tensions between the U.S. and Iran imply for the world and the yellow metal? Well, given that Soleimani was widely seen as the second most powerful figure in Iran, we should expect a response. Both Iranian president Rouhani and Supreme Leader Khamenei vowed revenge. Hence, tensions will be higher in the Gulf. The oil price has already increased about 4 percent in 2020. Similarly, the price of gold has jumped almost to $1,580 in the aftermath of Soleimani's death.

Chart 1: Gold prices from December 20, 2019, to January 6, 2020.

But what is likely to happen next in the gold market? I often repeat that impact of geopolitical events on the gold prices is short-lived, as people exaggerate the threats. The recent events in Iraq may thus entail only temporary effects on the gold prices. However, this time may be different, as people fear that the major escalation in tensions between the U.S. and Iran could transform into a full-blown war which has the potential to be one of the worst conflicts in recent times. For example, the Eurasia Group puts the chance of "a limited or major military confrontation" at 40 percent. What is important is that the U.S. would be directly involved in this conflict - and when America is threatened, gold prices move the most. A lot depends now on Iran's response. But investors should remember that gold has already been in bullish mood, so even when tensions soften, the awaited sharp downward move does not have to occur right away.

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.