The vaccines will likely arrive – sometime in the future. However, Covid-19 cases are surging now. While there is light at the end of the tunnel, the fall and winter may be harsh. What does it mean for gold?

Fed Chair Jerome Powell spoiled the fun. It was so good: the election dust settled while Pfizer announced a vaccine breakthrough. And then Powell spoke on Thursday at the European Central Bank’s (ECB) forum, pointing out the risks ahead. In particular, he said that the economy as we know it might be over, and even though it’s recovering, “we’re not going back to the same economy”. In other words, Powell worries about the possibility of the pandemic and resulting economic crisis leaving long-term scars: “the risk is that there is some longer-run damage to the productive capacity of the economy and to people’s lives who have been disrupted by the pandemic”. Not good – the pace of economic growth was already quite sluggish before the pandemic, and now it may slow down further. Or maybe it is good news – for gold.

Moreover, Powell downplayed somewhat Pfizer’s announcement. He noted that although the vaccine news is great, there remain important challenges and uncertainties about the vaccine’s timing, production, distribution, and the efficacy for different groups. And “with the virus now spreading, the next few months could be challenging that year”.

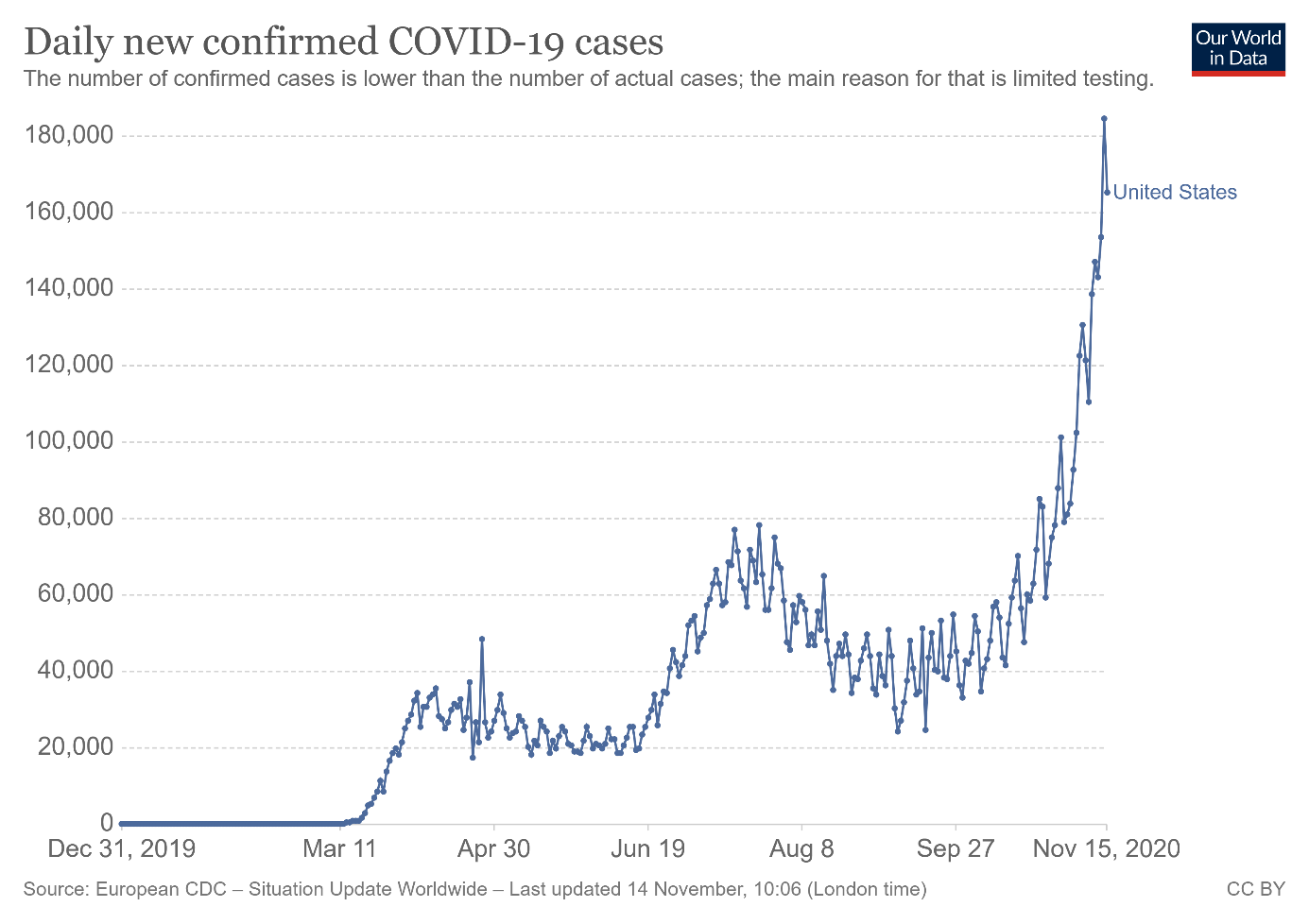

Indeed, as the chart below shows, the US epidemiological curve has recently skyrocketed. The number of daily new Covid-19 cases has surpassed 180,000 last week, and although it has slowed down to around 165,000 on Sunday, the number is still extremely high. Even worse is that these are only officially confirmed cases. According to some epidemiologists, they are just the tip of the iceberg, with 70-90 percent of all cases being unreported.

And the number of hospitalizations is also rising, as one can see in the chart below. The problem is that at the current rate of infections and hospitalizations, the healthcare system will be quickly overwhelmed. In some places, hospitals are struggling to find beds for patients and are stretching their capacity to deliver care. Some epidemiologists even warn that America is entering “Covid hell”, in which a doctor will have to decide who to treat and who dies, not because of the coronavirus, but because of other health-related issues which couldn’t be addressed due to an overwhelmed healthcare system. May it not come true.

Implications for Gold

What does this all mean for the yellow metal? Well, Pfizer’s vaccine news is great for the economy and bad for gold, as it can reduce the pandemic-related uncertainty. However, the vaccine is the song of the future and in the meantime, the U.S. will have to face the darkest moments of the epidemic. The current strong wave of infections will hit both the healthcare system and the economy.

You see, the pace of economic recovery has already moderated. The current huge rise in Covid-19 cases will slow economic growth further in the fourth quarter. So, as investors will observe the progressing epidemic, the safe-haven demand for gold may revive. Moreover, the virus’s offensive means that further economic support is likely to be needed to help the economy. A fiscal stimulus is coming – and it will have to be bigger than previously thought. The additional government spending will add to the huge pile of public debt. Oh, by the way, the U.S. government started the 2021 fiscal year with an October fiscal deficit of $284 billion, an increase of 111 percent compared to October 2019. Therefore, although the upcoming positive news about the Covid-19 vaccine could exert some downward pressure on gold prices, the macroeconomic outlook remains supportive for the yellow metal.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.