This month, the Fed has published the newest edition of its Financial Stability Report. Generally speaking, the level of vulnerabilities in the financial system has barely moved since the publication of the May edition of the report. Most of the U.S. central banks' observations are reassuring: investors' risk appetite generally appears to have returned to the middle level of its historical range, while the core of the financial sector appears resilient as leverage remains low and funding risks limited relative to the levels of recent decades.

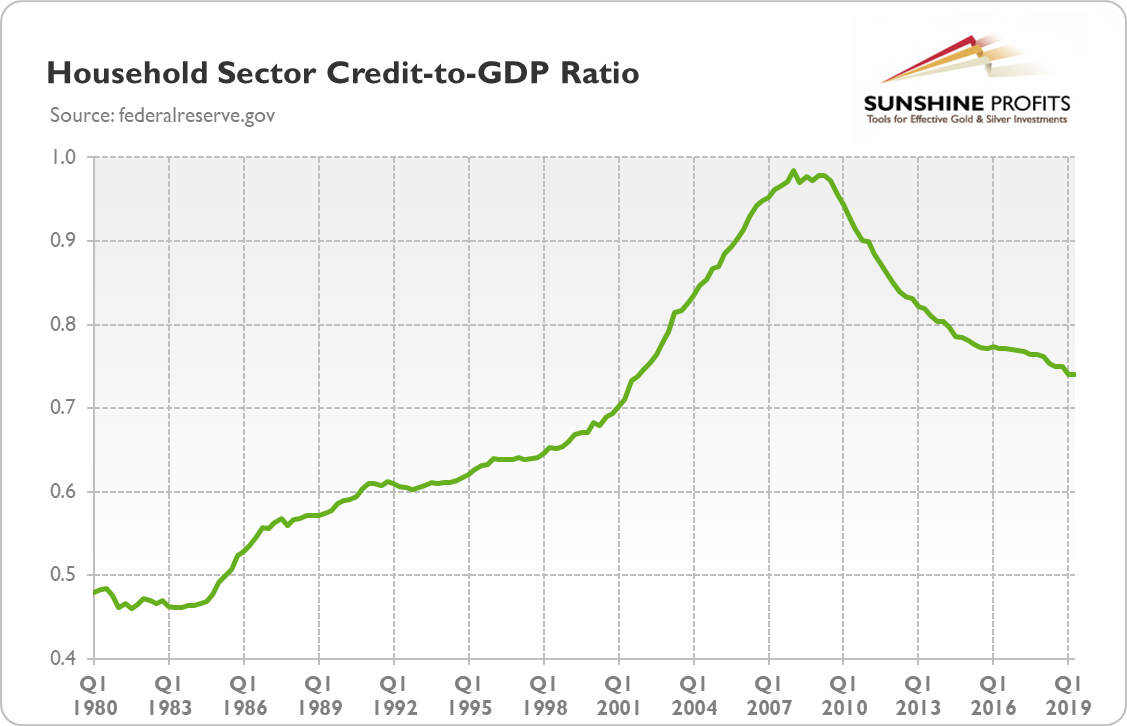

What is very important in light of the causes of the Great Recession, the largest U.S. banks remain strongly capitalized, while household borrowing remains at a modest level relative to income, as one can see in the chart below. Isn't that splendid news? Isn't this time different? Is it bad news then for the gold market?

No, and there are two reasons for it. Let's discuss the first one.

You see, the generals are fighting the previous wars, while the economists and officials are confronting the previous financial crisis. But history never repeats itself, it only rhymes. So the fact that the households are not heavily indebted this time, while big banks are finally well capitalized is praiseworthy, but it is irrelevant. I mean here that the lack of symptoms of the previous economic crisis does not exclude the next downturn, because the next crisis will be different.

Chart 1: US Household Sector Credit-to-GDP Ratio from Q1 1980 to Q2 2019

Where can the next global financial turmoil break out from? Many people worry about geopolitical conflicts, including the trade wars, that could spill over to the U.S. financial system and negatively affect the global economy. My research shows that geopolitical risks - and their impact on the gold market - are often exaggerated.

The next recession may also begin in China. Because of the size of the Chinese economy, significant distress in that country could spill over to the global markets through a rise in the risk premium, changes in the exchange rates, and declines in trade and commodity prices. Indeed, the pace of China's economic growth has already slowed down, and the global economy has weakened (while gold shined) in response.

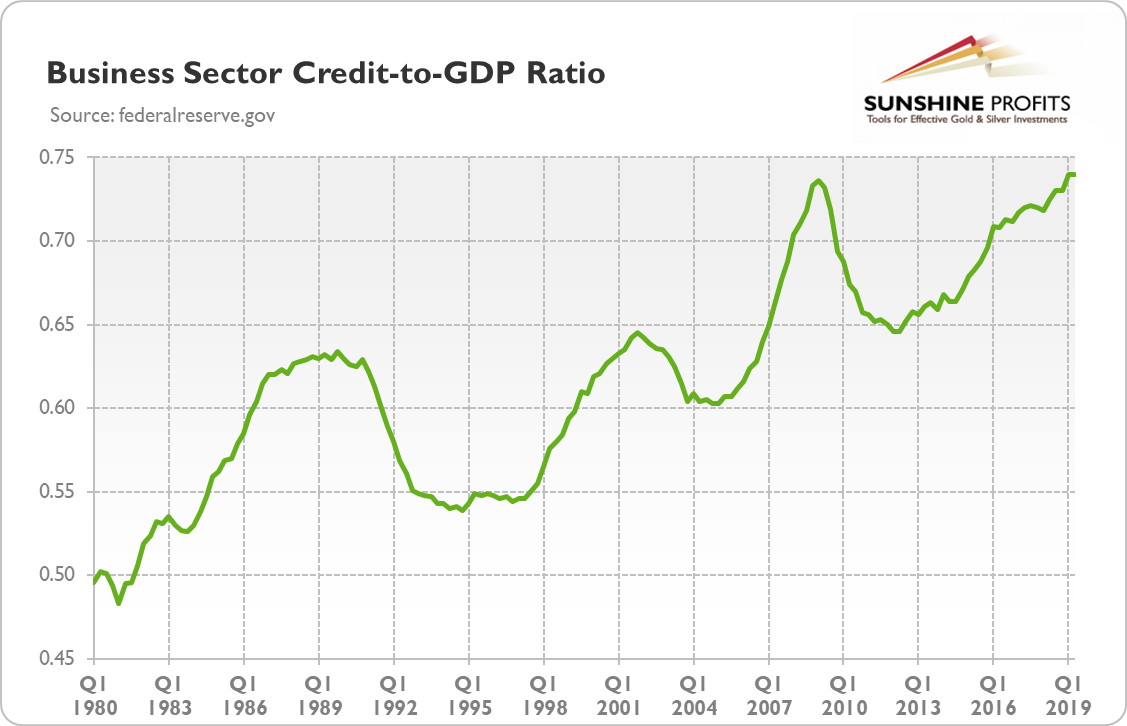

Many experts worry, myself included, about the U.S. corporate debt. And rightly so! As the Fed's report on financial stability shows, debt loads of businesses are comparatively high. Indeed, borrowing by businesses is historically high relative to either the business assets or the GDP. Indeed, as the chart below shows, although the business debt-to-GDP ratio fell after the crisis, it has expanded significantly over the past several years. The growth of this debt remained strong in the first half of 2019 and is now near its historical high.

Chart 2: US Business Sector Credit-to-GDP Ratio from Q1 1980 to Q2 2019

But what is really disturbing is that the most rapid increases in debt materialized among the riskiest firms amid weak credit standards. This is what I call the zombification of the economy: more and more firms become more and more indebted. Indeed, the ratio of debt to assets for all publicly traded nonfinancial firms is at its highest level in 20 years. Moreover, the leverage ratio among highly leveraged firms--defined as firms above the 75th percentile of the leverage distribution--is also close to a historical high. And more and more capital goes not to the most efficient companies, but to the most heavily indebted ones. Indeed, the share of new loans to large corporations with high leverage exceeds previous peaks observed in 2007 and 2014 when underwriting quality was poor. As the report finds,

about half of investment-grade debt outstanding is currently rated in the lowest category of the investment-grade range (triple-B)--near an all-time high. The volume of debt downgraded from investment grade to speculative grade in 2019 has been close to the average over the past five years. However, in an economic downturn, widespread downgrades of bonds to speculative-grade ratings could lead investors to sell the downgraded bonds rapidly, increasing market illiquidity and downward price pressures in a segment of the corporate bond market known already to exhibit relatively low liquidity.

Of course, the Fed notices the risks, but downplays them anyway, telling investors to not worry: after all, the interest rates are historically low, to the ratio of corporate earnings to interest expenses is high. Surely, the highly indebted may prosper for a time. After all, when times are good and interest rates are ultra-low, almost anybody can run a company. With interest rates at ultra-low levels, one can hardly distinguish good from bad investment projects. But the rise in the interest rates rise or the arrival of recession will expose highly leveraged sectors of the economy and separate the wheat from chaff. Unfortunately, it will be too late then for many investors, and "the subjects of the kingdom will be thrown outside, into the darkness, where there will be weeping and gnashing of teeth" (Matthew 8:12).

But there is a hope. Continuing with biblical references, if I may: the New Jerusalem was built from gold. The new monetary system should also rely on gold, as it did in the past. Until this happens, investors can buy gold as a safe haven and a hedge against the financial instability.

Thank you.

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.