Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

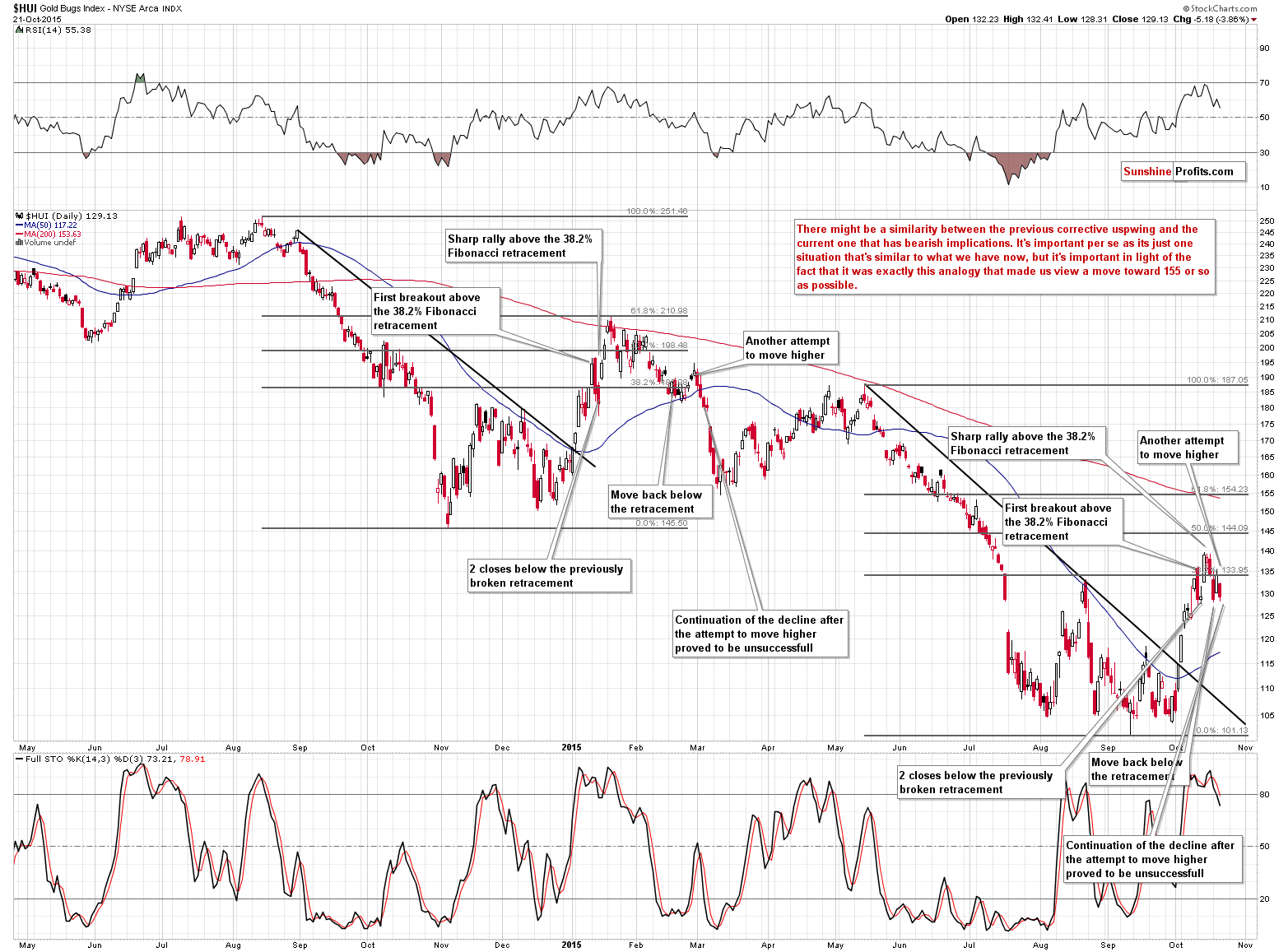

Back in January gold stocks corrected 61.8% of the August-November decline and based on the similarity between that decline and the May-September slide, several weeks ago we wrote that a move to 155 or so was possible. Today we will discuss how this analogy continued to play out and how it’s likely to play out next.

In short, there is a specific “twist” in this analogy and it’s no longer bearish. It’s unclear at best and we could even say that it’s somewhat bullish.

We don’t have anything new to comment on besides the above as the markets that we follow have either remained unchanged or moved in tune with our expectations and what we wrote previously remains up-to-date. The change in the mentioned analogy is important, because the analogy to the Aug.-Nov. decline was one of the main reasons for which we thought that higher prices were temporarily possible (not probable enough to justify adjusting the trading position, but possible).

Let’s take a look at the chart (charts courtesy of http://stockcharts.com).

The thing that creates the analogy is a number of similarities – in terms of price, time and shape of the move. The more similarities we have, the more useful and reliable an analogy gets. Both of the mentioned declines were quite similar in terms of time, price and – to a considerable extent – shape. The individual events that trigger certain moves differ, so the moves are not identical, but the overall sentiment makes the moves similar anyway. This can create a roadmap for the following days. The similarities are generally reliable in the short term, but not really in longer terms. The more distant the price projection, the more blurry it gets and the less reliable it is.

In this case, the after-breakout (early October) rally and a move to/above the 38.2% Fibonacci retracement was the more clear part of the analogy, but the detailed shape of the top and the price level that was / is about to be reached is less precise.

Is the top already in, in light of the above?

Based on the price analogy alone – no. But what about the analogy in terms of time and shape?

Regarding time: back in January it took 10 sessions (from the day of the breakout) for gold stocks to top and now the daily highs close to the 140 level were seen after 7, 8 and 9 sessions. In our opinion that’s similar to what we saw previously. Gold stocks are now 12 sessions after the breakout and it would take them at least several additional sessions to move above the October highs. Consequently, the top would be formed after 16-20 sessions after the breakout, which is much less similar to the previous pattern when gold stocks topped after 10 sessions. Consequently, the analogy in terms of time suggests that the top is likely already in.

Regarding shape: a picture can tell a thousand words and at this time it certainly does. Please take a look at the above chart (as a reminder, clicking on the chart will expand it and if it’s still not expanded sufficiently, then clicking another icon on the top of the chart should help; in most cases pressing “ctrl” and “+” or “cmd” and “+” on keyboard should make everything even bigger).

Back in January, gold stocks first moved above the 38.2% Fibonacci retracement, then declined and closed below it for 2 days (the same happened earlier this month), then they rallied to new highs (again, the same happened this month) and formed the top (perhaps that’s what happened this month as well). After that gold stocks declined back below the 38.2% retracement and attempted to move above it once again but the move was relatively small and was soon followed by another wave down. This is exactly what’s happening right now. The important thing is that after that time, gold stocks did not move higher again but rather continued to slide. Consequently, this time, we can expect lower prices without an additional short-term rally – the analogy in terms of shape suggests that the top is likely already in.

To sum up, the analogy in terms of price suggests that miners could rally further (but this is not a strong suggestion – gold stocks have already rallied substantially and what happened recently is already a rally that’s similar to what we had seen previously), the analogy in terms of time suggests that the rally is over (and it’s a quite strong suggestion – stronger than the one based on price, in our opinion) and the analogy in terms of shape provides a moderately strong suggestion that the rally is over. The overall implications of the analogy to the previous decline are therefore not bullish, but rather bearish.

The mentioned analogy is just one of the techniques that we use and just one of the signals. It’s important because it invalidates the remaining (previously bullish) signal that pointed to higher prices. The other was the positive price-volume link in mining stocks and gold, which has already been invalidated. Consequently, the situation deteriorated as the bearish factors described last week remain in place (please read this alert if you haven’t done so already as it remains up-to-date even though it was published a week ago) and those that were previously bullish are no longer valid.

Before summarizing, we would like to once again cover the reply to the question “why didn’t we go long at the beginning of the recent rally”. In short, because it was too risky to get out of the short position in light of multiple bearish signs that had and continue to have medium-term implications. All previous alerts include justifications of our outlook and actions on the day that they were posted. We would like to point out that while the charts that we feature or those that you can see somewhere else include price, sometimes volume and some indicators, but none of them will include the risk that is associated with opening a position on a given day (despite attempts to quantify it as standard deviation or Value-at-Risk etc.) That’s why looking back it’s easy to say that this or that could have been done – but in reality it’s not possible to make such judgment (at least for the short-term moves) because price is only part of the story. Speaking of past price moves – we will provide you with a complete list of our precious metals / miners trades (described in the alerts) in the past 12 months in tomorrow’s alert.

Summing up, the situation in mining stocks (and thus in the entire precious metals market) deteriorated once again as the analogy that seemed to have bullish implications no longer has them.

The key thing is that multiple bearish signals that we’ve been describing in the recent alerts remain in place and continue to have very bearish implications for the medium term. While the situation and outlook for the next few days is still rather unclear (although more bearish than not), the medium-term outlook remains clearly bearish. Again, based on multiple signals that we have right now, it seems that the next big move will be to the downside and being positioned to take advantage of it remains justified from the risk/reward point of view.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,223, initial target price for the DGLD ETN: $98.37; stop loss for the DGLD ETN $62.34

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $40.28

- Mining stocks (price levels for the GDX ETF): initial target price: $11.57; stop-loss: $18.13, initial target price for the DUST ETF: $26.61; stop loss for the DUST ETF $9.22

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $16.27; stop-loss: $25.23

- JDST ETF: initial target price: $46.47; stop-loss: $15.58

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The total amount of student loans outstanding in the United States amounts to nearly $1.3 trillion. Is it a cause for concern and how could the burst of the student loan bubble affect the gold market?

Does Student Debt Threaten the U.S. Economy?

Earlier today, official data showed that British retail sales increased by 1.9% in the previous month, beating forecasts for a gain of 0.3%. Additionally, year-on-year, retail sales rose by 6.5% in September, above expectations for a 4.8% gain. On top of that, core retail sales (without automobile sales) jumped 1.7% last month also beating forecasts for a 0.3% increase. Thanks to these bullish numbers GBP/USD rebounded sharply and climbed to the last week’s high. Will we see higher values of the exchange rate in the coming days?

Forex Trading Alert: GBP/USD Tests Last Week’s high

=====

Hand-picked precious-metals-related links:

Don’t be fooled by gold’s recent comeback: Goldman

Venezuela ready to dump 80 tonnes of gold

Blanchard: Fed overselling rate hike great for gold

=====

In other news:

Is the US headed for negative interest rates?

Five Questions for Mario Draghi on Inflation, the Euro and QE

China's big chance to steady nerves on economy

Volatility returns to China stocks: Time to worry again?

Bitcoin now tax free in Europe after court ruling

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts