Briefly: In our opinion, short (full) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view.

The USD Index soared on Friday (once again) but mining stocks, despite the usual negative correlation with the USD, actually managed to move higher – what are the implications of this bullish signal?

In short, most likely there are none. Miners had a good reason to rally in the form of rallying (on strong volume) mining stocks. Miners moved higher on low volume, so it doesn’t seem that the move was a real one. There’s quite a lot to comment on, so let’s jump right to the charts (charts courtesy of http://stockcharts.com).

In Friday’s alert we wrote the following:

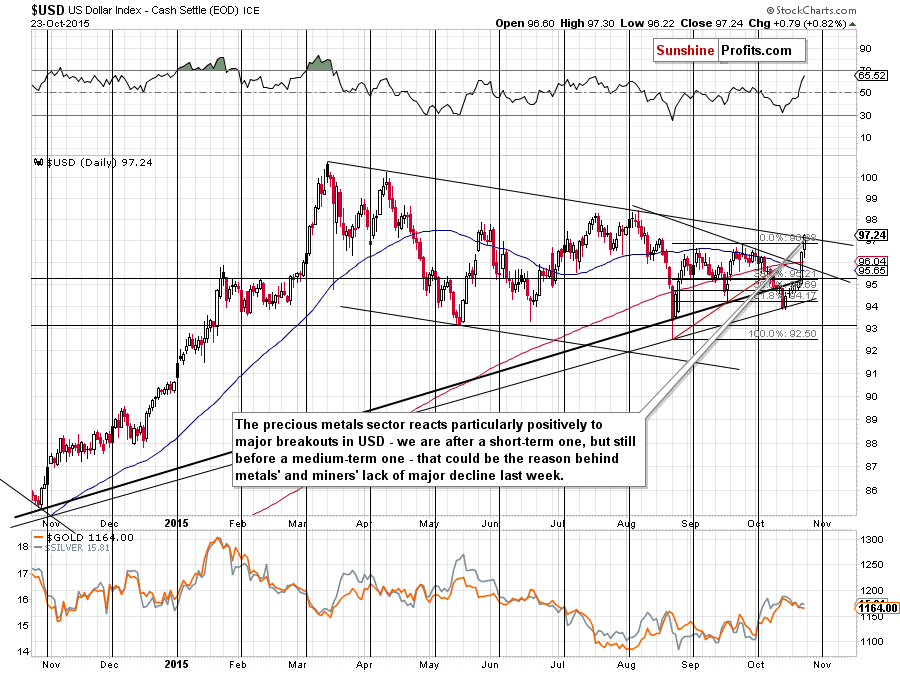

The USD Index soared and this move made the short positions on the EUR/USD currency pair very profitable, but as far as the precious metals market is concerned, there was no big reaction. Is this something that should make us concerned? No.

The precious metals market used to react very positively to breakouts in the USD Index’s price performance, but the one that we saw yesterday was minor. The major one is still ahead of us and consequently, we should not view the metals’ lack of declines as a bullish reaction. It’s ahead of us, but not yet present – and nothing more.

Besides, the precious metals sector declined on Wednesday, while the USD didn’t rally – perhaps it was the USD Index that was “late to the party”.

The above remains up-to-date to a large extent. The USD moved even higher, but still, there was not breakout above the medium-term resistance line. Consequently, the lack of gold’s decline doesn’t really surprise.

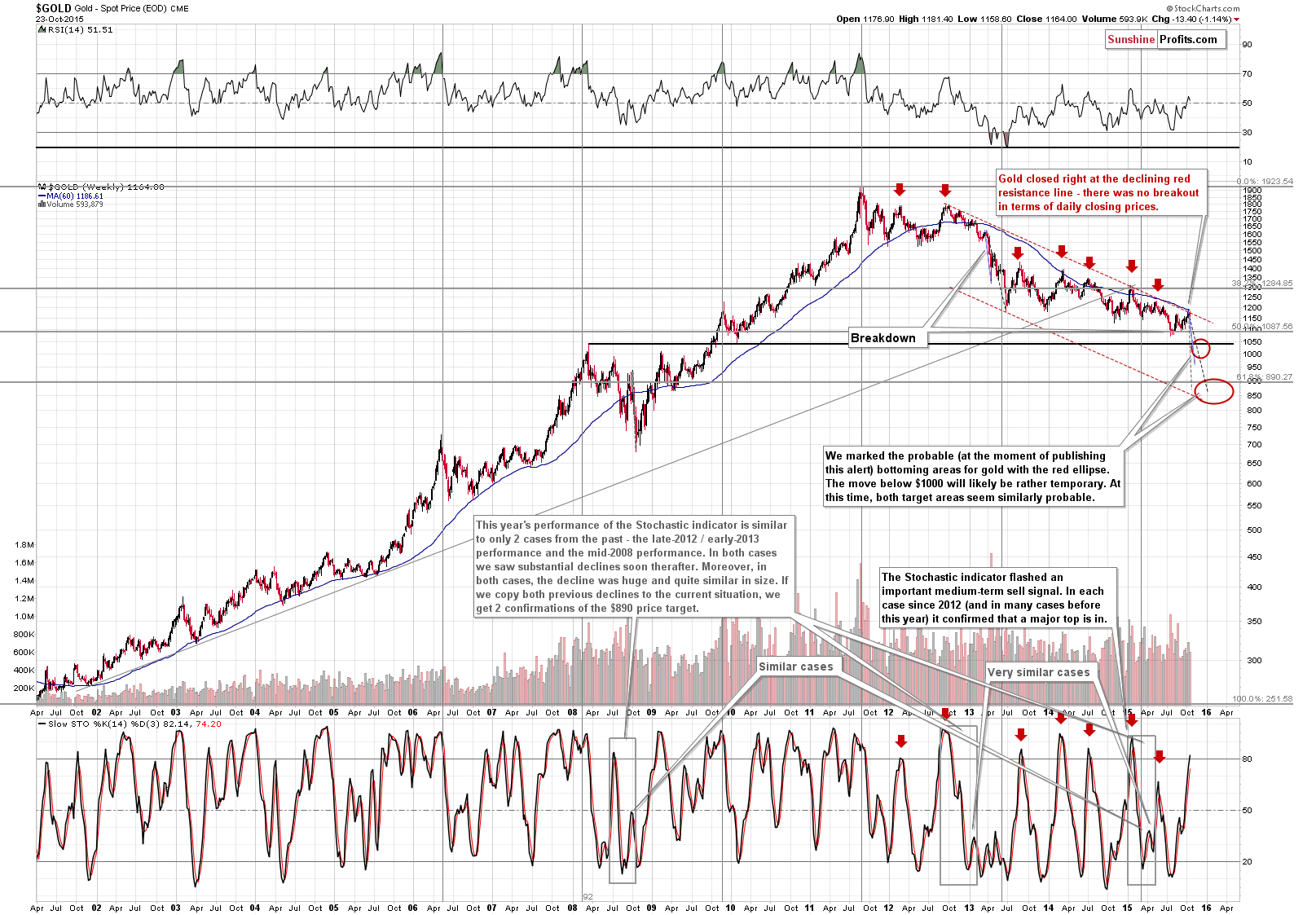

Speaking of gold, let’s take a look at its long-term chart.

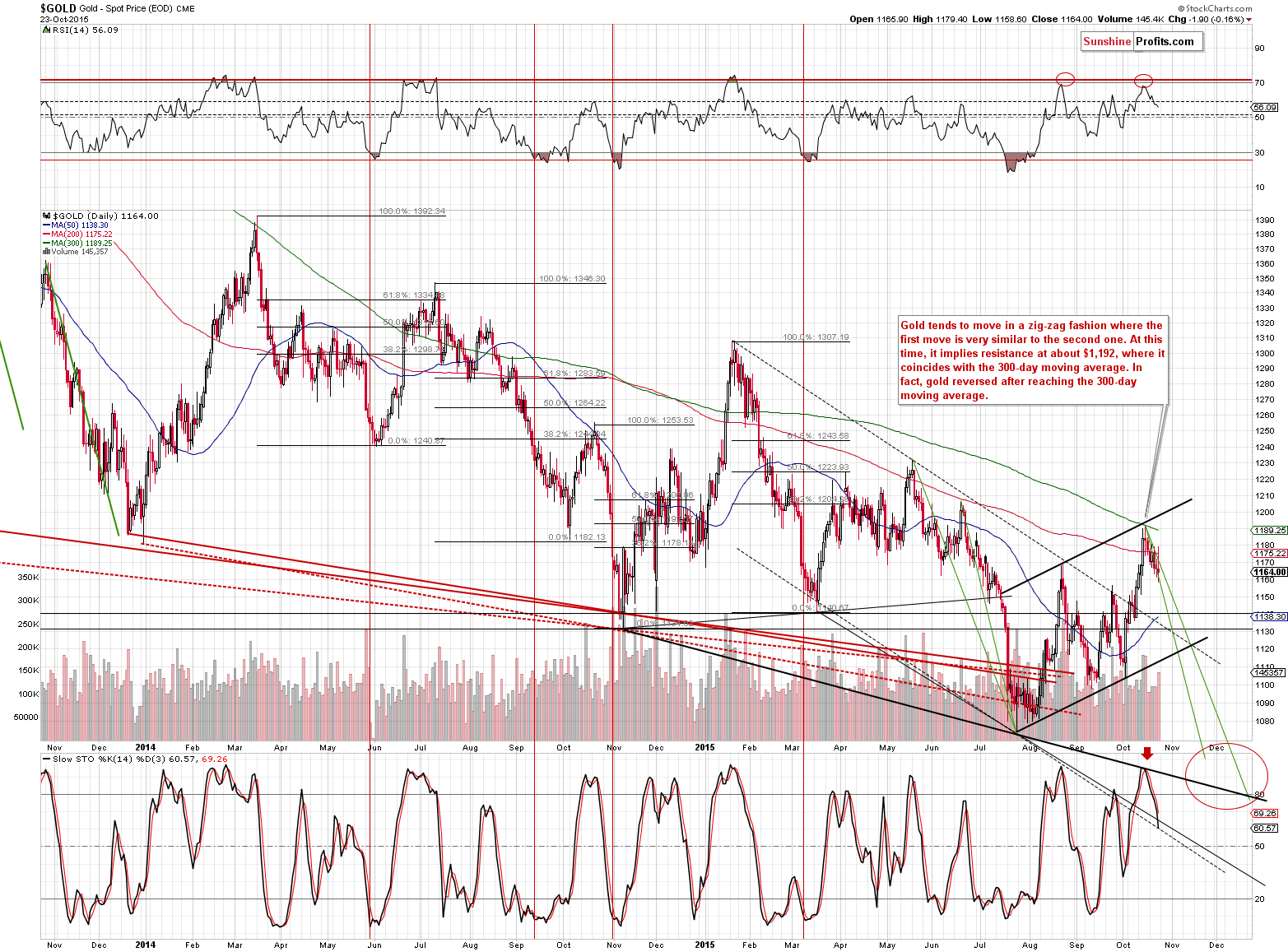

From the long-term perspective, we see that gold moved to its major resistance and declined once again. Without a breakout, the outlook and trend remain bearish.

From the short-term perspective, the outlook doesn’t look bullish either. Gold tried to move higher on Friday, but reversed and ultimately declined before the session was over. The intra-day reversal took place on strong volume, which is a bearish sign.

The sell signal from the Stochastic indicator is now more than confirmed and the implications are bearish.

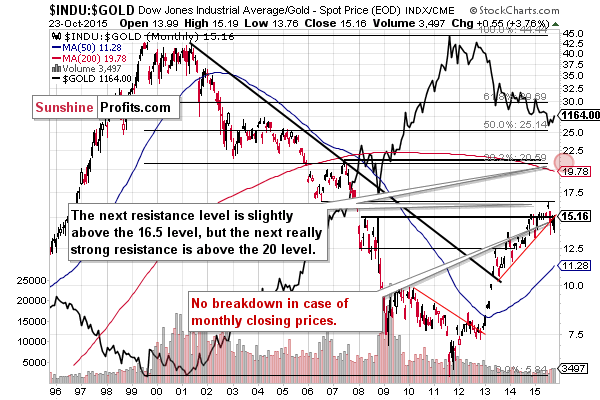

From the Dow-to-gold perspective, the outlook for the ratio remains bullish and the outlook for gold remains bearish. The reason is that the temporary breakdown below the rising red support line was invalidated. As the ratio moves higher, the price of gold is likely to move lower.

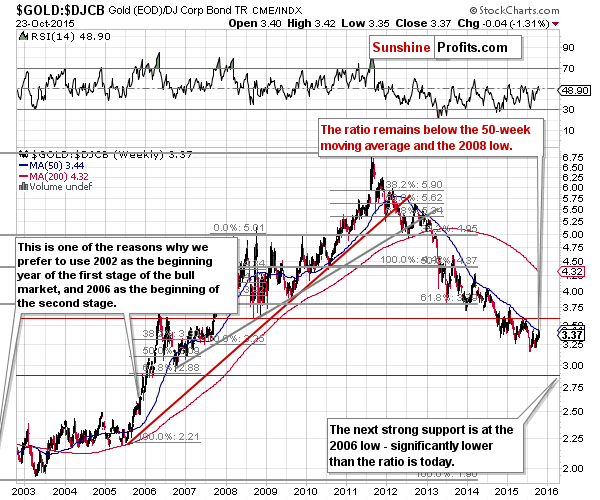

Speaking of ratios, the gold to bonds ratio remains below the all-important 50-week moving average. This means that gold is still likely to move lower in the coming weeks and – quite likely – days.

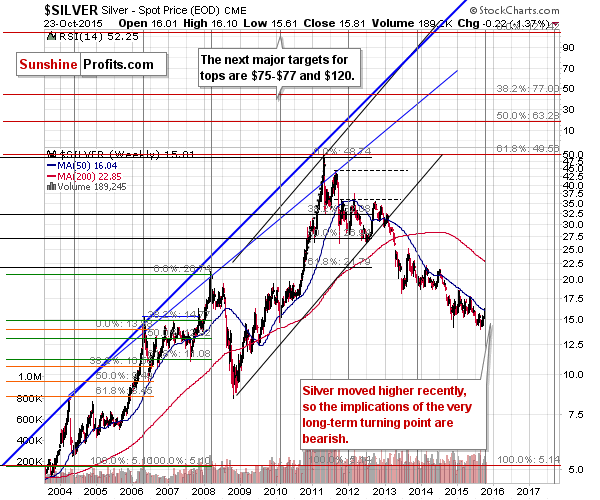

Having discussed gold from several angles, let’s take a look at silver. This time, we would like to show you the really big picture.

The very long-term chart of silver shows 2 things:

- The long-term price targets are a lot higher than the current price.

- Silver’s short-term rally is likely over.

The first point is based on the Fibonacci extensions and previous highs, and the second point is based on the very long-term turning points. Please note how precise these important points were in the past – the last move was definitely to the upside, so the implications are bearish.

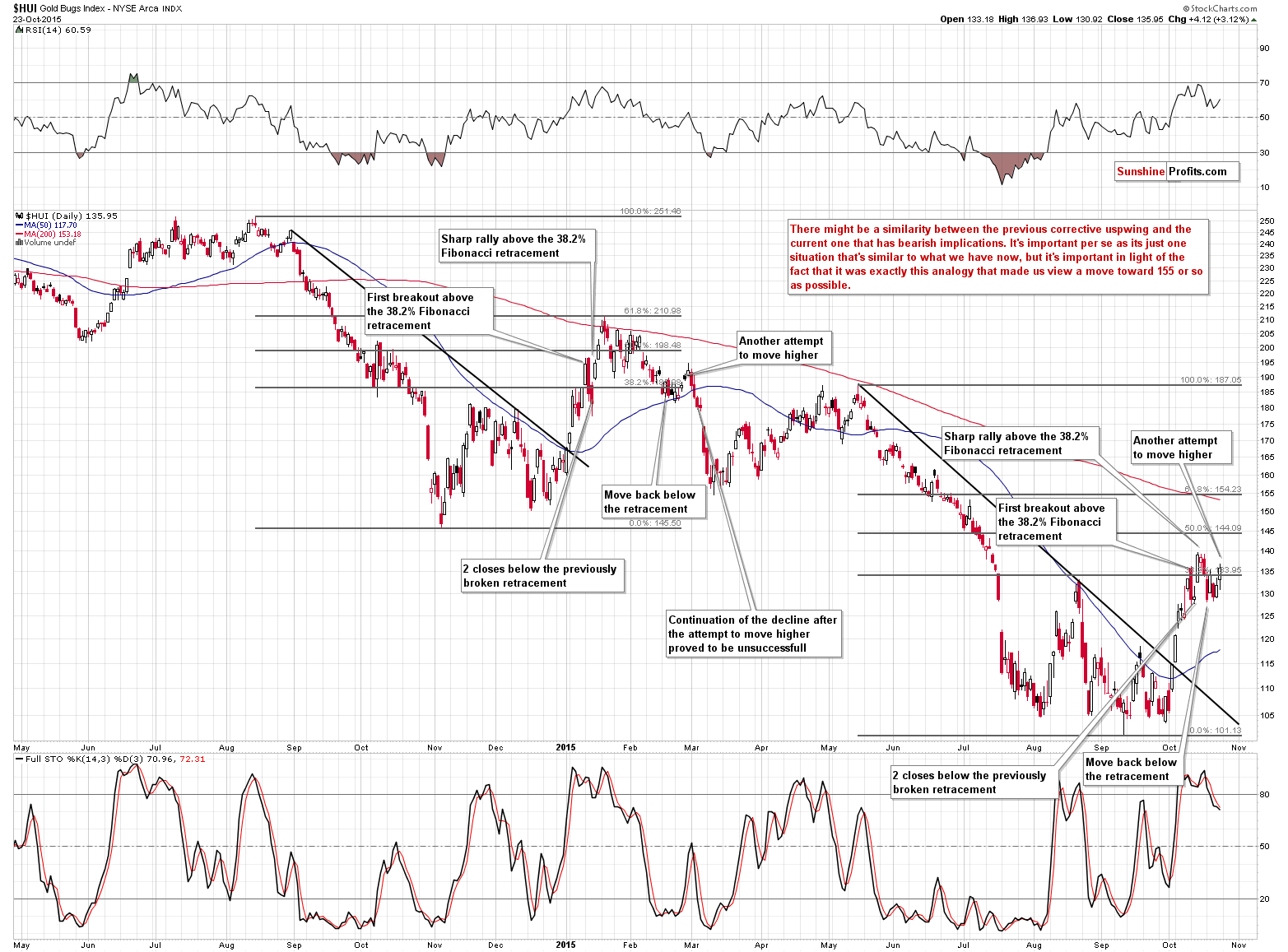

On Friday, we commented on the self-similar pattern in the HUI Index. As of today, it seems that the self-similarity is still present and the implications remain bearish. Based on Friday’s rally, it seems that we are still ahead of the final decline, not within it. Based on this pattern, we are not likely to see substantial strength shortly, but rather a reversal followed by continued weakness.

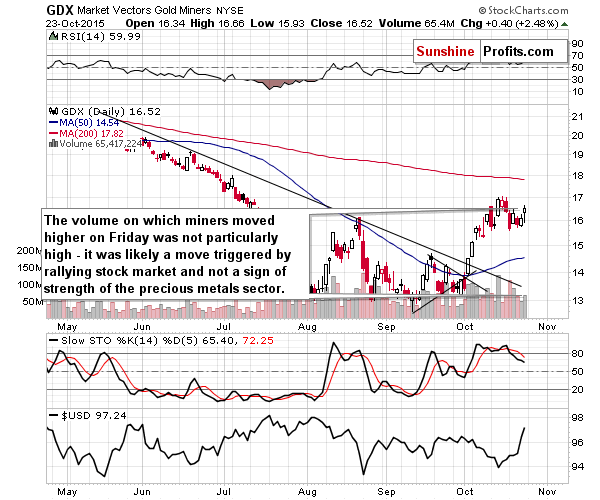

On a short-term basis, it seems that mining stocks moved higher once again, but the volume that accompanied this move was relatively low. It was higher than on the previous trading day, but on that that day miners moved only insignificantly higher and on Friday they ended over 2% higher. Overall, the price-volume implications are bearish. The fact that mining stocks moved higher might have been due to the strongly rallying general stock market.

The interesting thing is that the general stock market rallied on strong volume, while miners moved higher on only limited volume. Consequently, the relative performance of mining stocks is not as bullish as it seems – miners had a very good reason to move even more higher and do so on strong volume, but they didn’t. The fact that miners moved higher while gold didn’t is bullish at the first sight, but in light of the above, it’s not really the case.

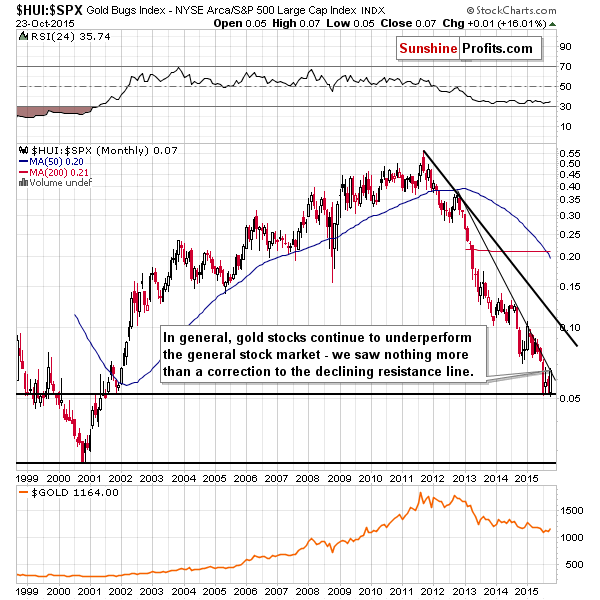

Comparing the miners’ performance to the general stock market from the long-term perspective reveals that there was no significant strength in the former after all. The trend of the miners to other stocks ratio simply remains bearish.

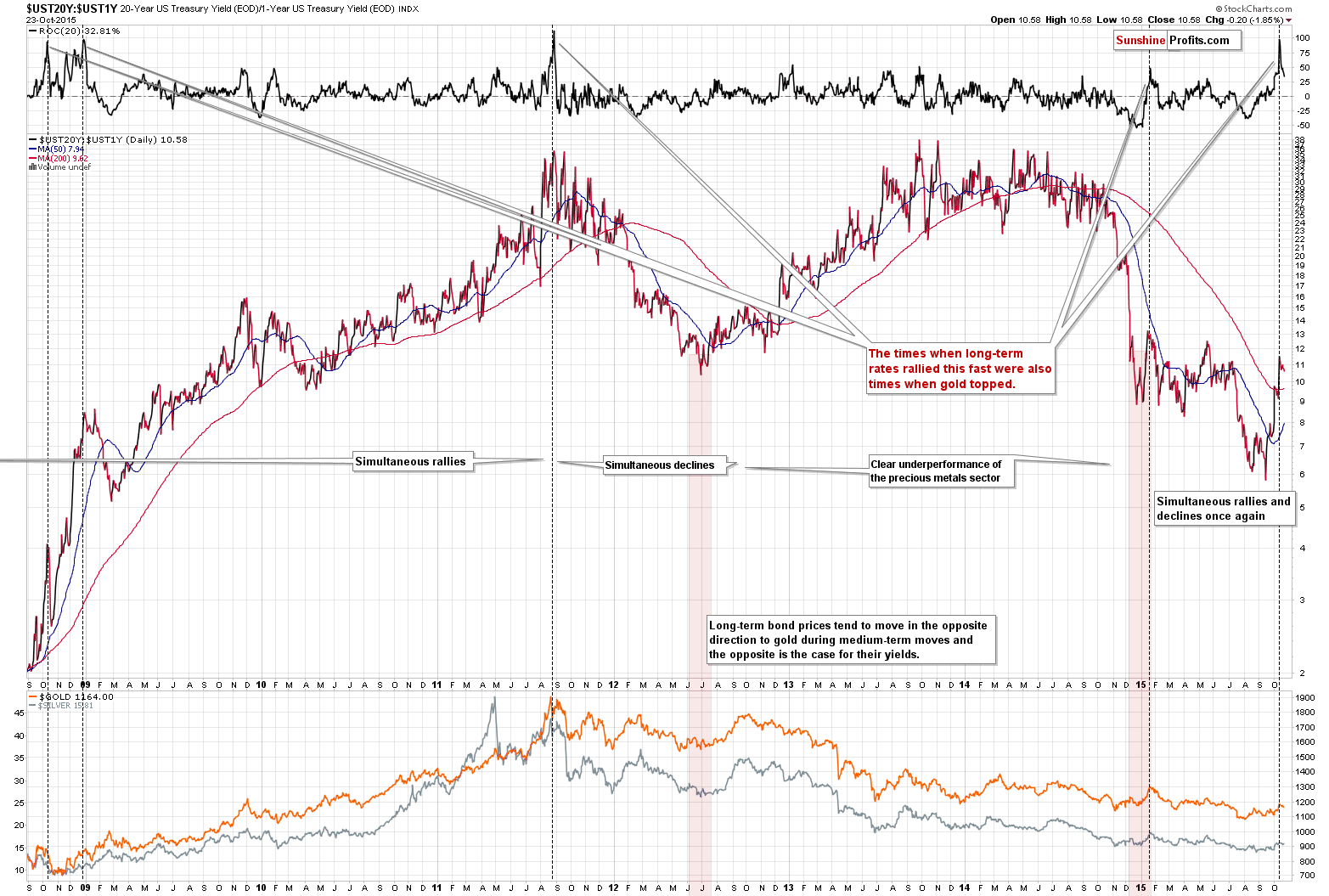

The sign coming from the bond market remains up-to-date and bearish. We commented on it previously, but we wanted to remind you about its importance.

The above chart features the ratio between the yield on the 20-year bonds and the 1-year ones. It’s designed to emphasize the moves in long-term bonds.

Why analyze bonds at all while it is the precious metals market that we want to invest in? Besides the fact that all markets are somehow connected and it’s good to have an overview of more of them in order to make decisions regarding only one, there is an additional link between gold and bonds. Namely, both can be viewed as a hedge against risks – both bonds and gold are viewed as hedges against various risks. Consequently, there can be – and in fact are – similarities between both markets and at times one market can say something about the other.

We haven’t commented on the above chart in many months as there was nothing to report, but that’s one of the approximately 100 things (charts, tools etc.) that we examine each day.

The interesting thing that we can observe now in the bond market is the sharp increase in long-term yields. In the upper part of the above chart we plotted the ROC (Rate of Change) indicator to have a more detailed look at the sharpness of the move. As you can see it has indeed been significant. In the past 7 years there were 4 cases, when we saw such sharp increases. They were all (!) accompanied by tops in gold (and silver as well, but its clearer in the case of the yellow metal). Please note that the scale on the lower part of the chart is linear (not logarithmic), so the tops in 2008 were actually more significant than they appear based on the above chart alone. Moreover, please note that the 2011 high was also indicated by this signal.

We just saw it again – the ROC is almost at the 100 level, which has bearish implications for the precious metals market.

Summing up, the situation in the precious metals described in Friday's market alert remains up-to-date and Friday’s move higher in mining stocks doesn’t have bullish implications despite the lack of a move higher in gold and a rally in the USD Index. The key thing is that multiple bearish signals that we’ve described in the recent alerts remain in place and continue to have very bearish implications for the medium term. While the situation and outlook for the next few days is still rather unclear (although more bearish than not), the medium-term outlook remains clearly bearish. Again, based on multiple signals that we have right now, it seems that the next big move will be to the downside and being positioned to take advantage of it remains justified from the risk/reward point of view. The next big downswing in PMs may be triggered by a breakout in the USD Index, which seems to be just around the corner.

As always, we will keep you – our subscribers – updated.

To summarize:

Trading capital (our opinion): Short position (full) position in gold, silver and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and initial (! – this means that reaching them doesn’t automatically close the position) target prices:

- Gold: initial target price: $1,050; stop-loss: $1,223, initial target price for the DGLD ETN: $98.37; stop loss for the DGLD ETN $62.34

- Silver: initial target price: $12.60; stop-loss: $16.73, initial target price for the DSLV ETN: $96.67; stop loss for DSLV ETN $40.28

- Mining stocks (price levels for the GDX ETF): initial target price: $11.57; stop-loss: $18.13, initial target price for the DUST ETF: $26.61; stop loss for the DUST ETF $9.22

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $16.27; stop-loss: $25.23

- JDST ETF: initial target price: $46.47; stop-loss: $15.58

Long-term capital (our opinion): No positions

Insurance capital (our opinion): Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the sings pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Just a day after the European Central Bank hinted at more quantitative easing in the nearest future, the People Bank of China surprisingly cut its interest rates. What does it imply for the global economy and the gold market?

=====

Hand-picked precious-metals-related links:

India’s gold monetisation scheme may be ready in weeks – Modi

Gold demand in China may gain to record bullion bourse says

Gold befuddling hedge fund managers as Fed decision looms

Platinum price back to triple digits

=====

In other news:

European shares slip as easing expectations fade

IMF set for green light on China's yuan joining currency basket-sources

PBOC: Our big easing nothing like ECB's, Fed's QE

Chinese leaders drawing up new long-range growth plan

Watch out for this kind of China stimulus

Saudi Arabia to run out of cash in less than 5 years

Gray Hairs Needn't Be a Deflation Headache for Central Bankers

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts