Briefly: In our opinion, no speculative positions in gold, silver and mining stocks are justified from the risk/reward perspective. However, we expect this to change shortly.

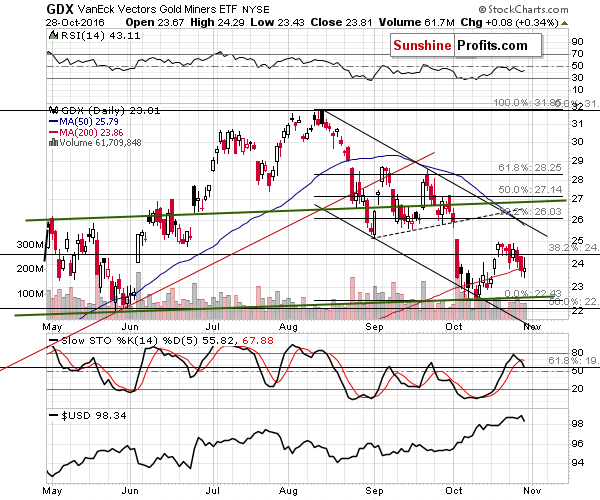

On Friday, gold moved about $15 higher on an intra-day basis and – to the surprise of many gold traders – it didn’t trigger a sustained rally in precious metals mining stocks. Conversely, miners didn’t even move close to their October highs and they finally ended Friday’s session almost unchanged. That’s a clear bearish sign – will the decline follow immediately?

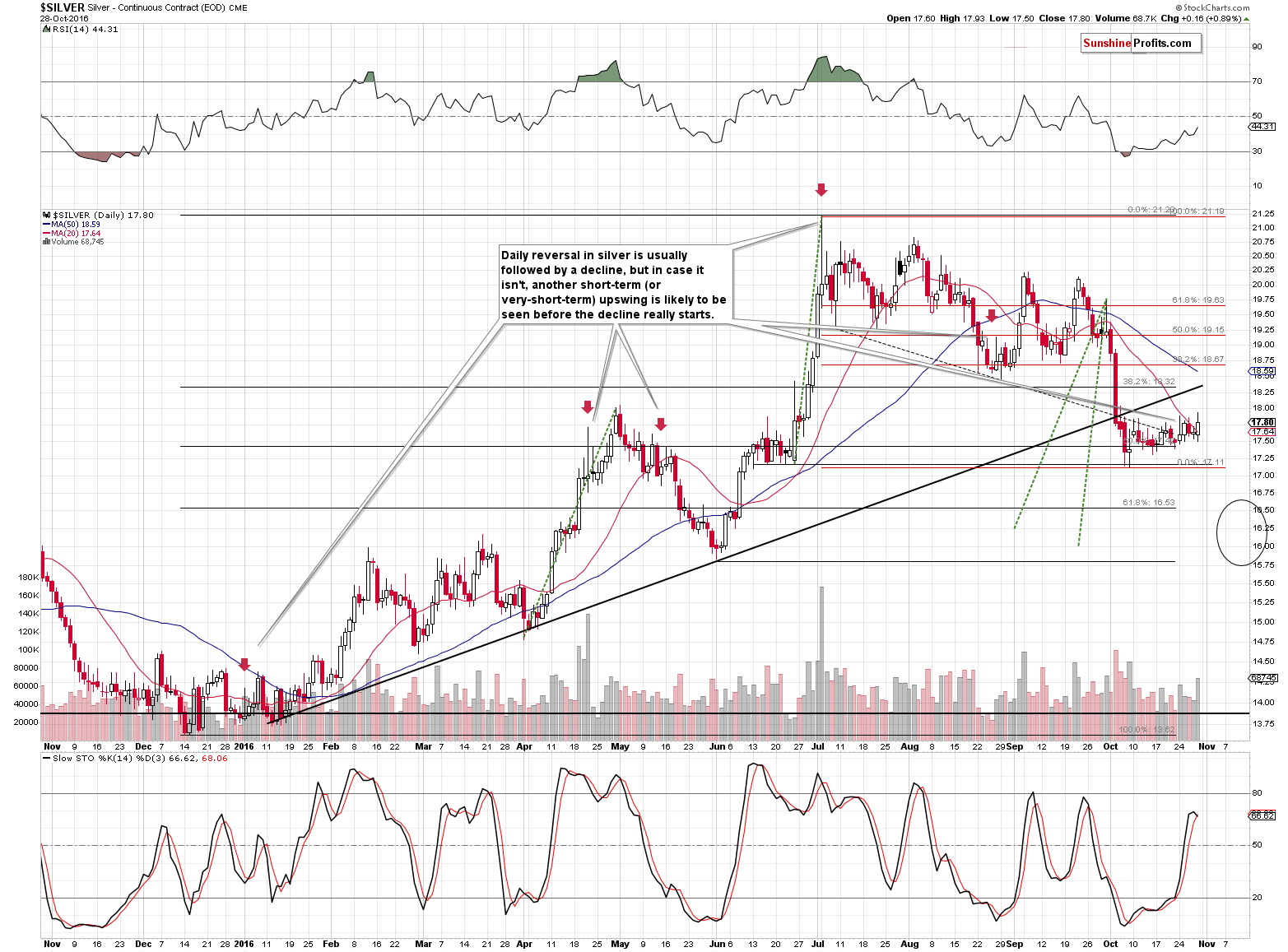

In short, it’s likely that a decline will follow, but not necessarily immediately. We still haven’t seen the bearish confirmation from the white metal – gold was leading the way on Friday, not silver. Let’s take a closer look at the charts (charts courtesy of http://stockcharts.com).

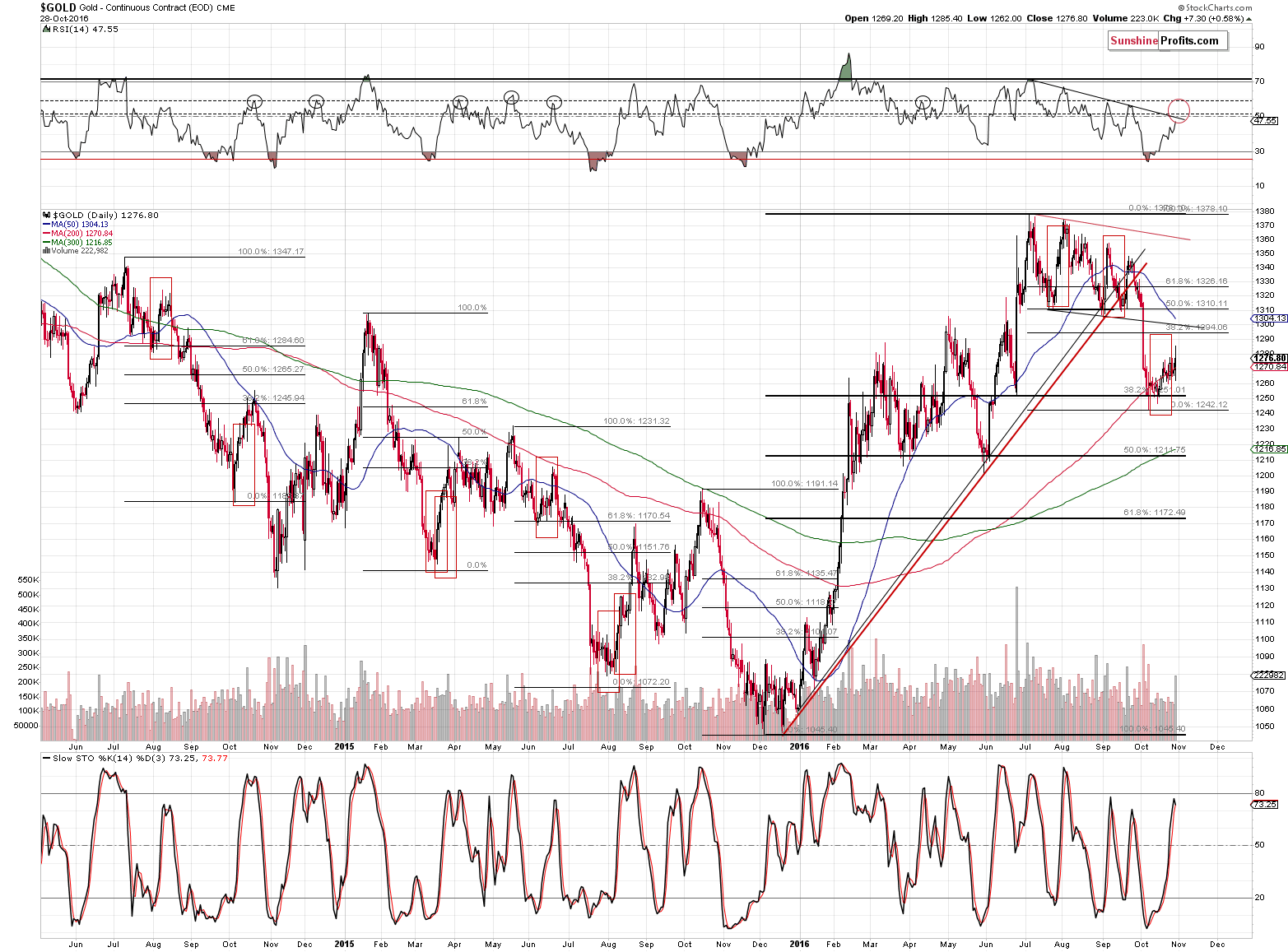

Gold rallied on strong volume on Friday, which is generally a bullish sign, but it’s important to keep in mind that gold ultimately erased half of its gains before the session was over, even though the USD Index didn’t move back up (thus gold underperformed the USD Index on an intra-day basis).

The Stochastic indicator just flashed a small sell signal and the RSI indicator is approaching our target area for the current upswing.

Overall, the above chart has some bullish implications, but only for the very short term.

As discussed above, silver hasn’t outperformed gold yet, so we have not seen a clear confirmation that the local top is in.

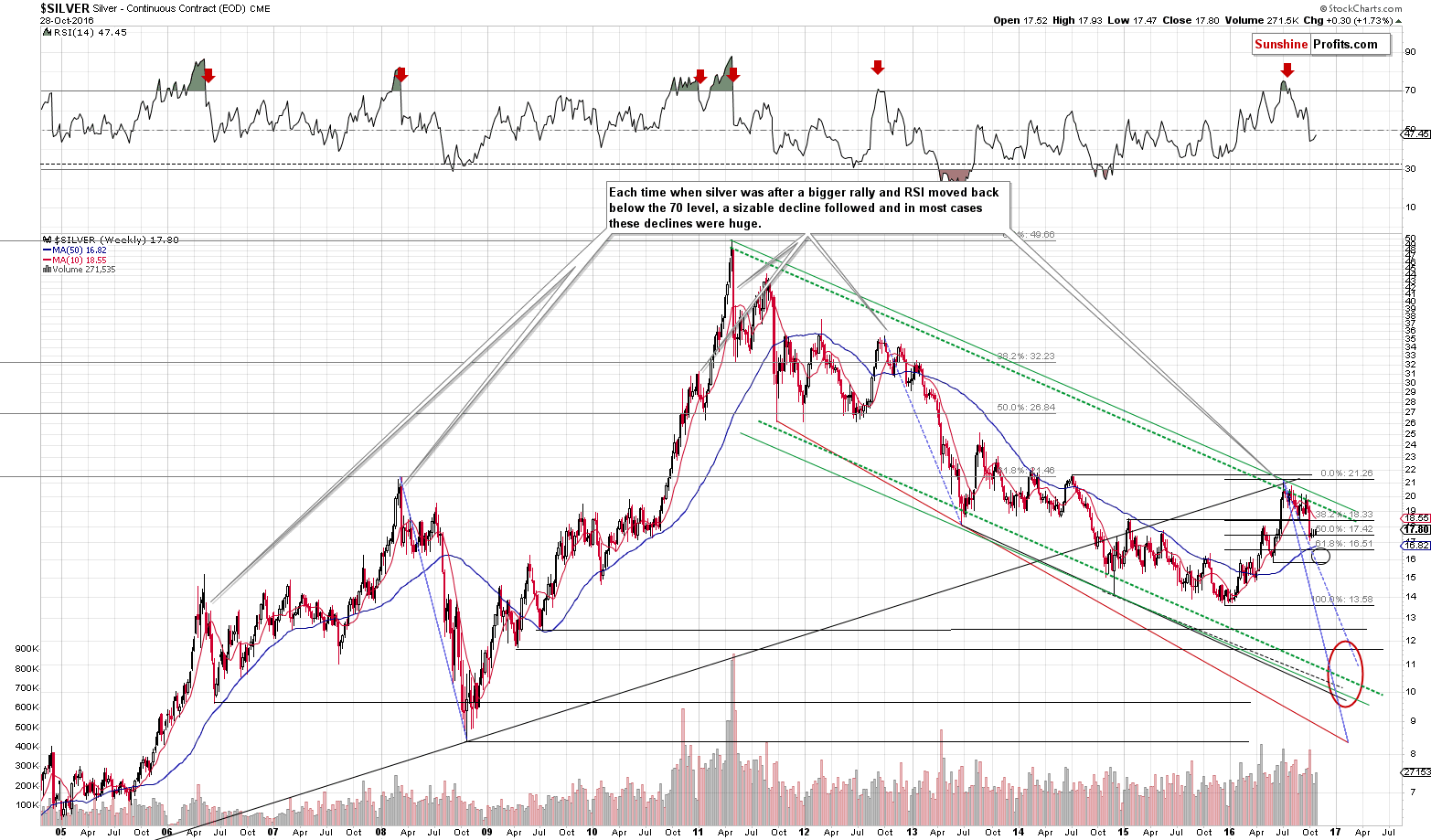

In the case of the long-term silver chart, we have a small clue suggesting that we’ll indeed see a small rally before the decline continues. The clue is the position of the RSI indicator. The 2012-2013 decline appears to be similar to the current one (the only 2 moves that started with the RSI above 70 in the past 5 years). About 3 months after the decline started, the RSI moved below 50 only to move back to it before the decline really started and accelerated. The rally that we saw in early 2013 was much more visible than what we’ve seen in the past few weeks, so it’s quite natural to expect some kind of upswing before the decline accelerates.

Mining stocks have been pointing to lower values of precious metals for several days now and Friday’s (lack of) action is another confirmation of the signal. The sell signal from the Stochastic indicator makes the outlook even more bearish.

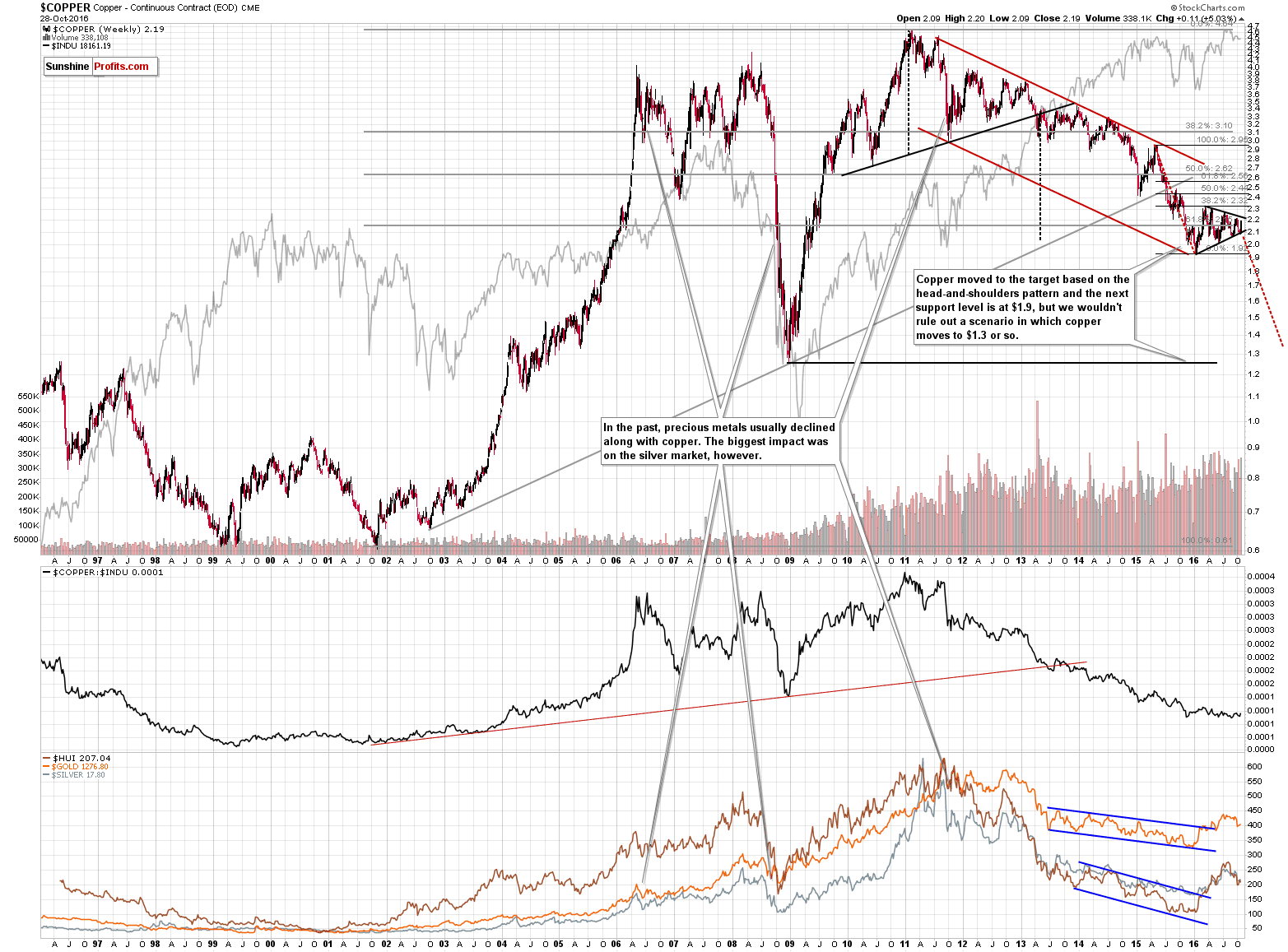

Several days ago we discussed the outlook for the copper market in the following way:

First of all, please note how the 2010 – 2013 head-and-shoulders pattern worked. That’s a good illustration of what we wrote on Friday about the USD Index and its big reverse-head-and-shoulders pattern. The height of the head (dashed black line) plotted on the breakdown provided the price target (close to the 2.0 level) even though it was reached over 2 years after the breakdown.

The mentioned bottom formed at the end of 2015, just like the bottom in the precious metals sector. However, the similarity doesn’t end there. The 2011 top was quite aligned with the one seen in the HUI Index and so was the 2008 bottom. There are more examples, but to make a long story short, let’s just say that major moves are in tune in copper and the PM sector.

Why is the above significant? Because the copper market declined substantially in 2015 and spend this year consolidating. The shape of the consolidation is a triangle, which is generally a continuation pattern. As it is the case with many other consolidation patterns, the size of the move that preceded the consolidation is likely to be similar to the size of the move that follows it. Based on the above, we created the red dashed lines and based on this technique, copper is likely to slide all the way down to the 1.3 level. That’s nothing new for those who have been following our analyses for years, but since we have a lot of new subscribers as well, we thought that it would be useful to remind about this situation.

The 1.3 level is also very close to the 2008 bottom, so if copper indeed gets that low, it’s likely that we’ll see a big reversal from there (which would be a very bullish sign for PMs as well). However, the thing that is most important at this time, is the likely proximity of the decline’s start. Copper is on the verge of breaking below the lower border of the triangle pattern and once it does (and the breakdown is confirmed), the huge slide will most likely be underway. In light of the mentioned link between copper and PMs, that’s likely to have a very bearish impact on the prices of gold, silver and mining stocks.

Will copper slide immediately? We have seen a breakdown below the triangle pattern if it is based on daily closing prices and we haven’t seen one if it is based on intra-day lows. All in all, the breakdown is not confirmed so far. If the USD Index declines, it could give copper additional several days (or a few weeks, but we don’t expect to see much beyond that) of strength, which would postpone the breakdown and the subsequent decline.

What does the above imply? That copper is very close to providing us with a very bearish medium-term sell signal. If it doesn’t happen right away, it’s still likely to happen sooner rather than later (after the USD corrects and moves back up). The implications for the current moment are rather non-existent, but the implications for the coming months are very bearish.

The above remains up-to-date – copper moved higher, but it remains within the triangle pattern and it’s still likely to break below it relatively soon. However, since it hasn’t done so yet, we shouldn’t be surprised to see copper move back to the upper border of the triangle (it’s already close to it) before the decline resumes. We have yet another market that appears to be ready to move much lower, but not before moving a little higher.

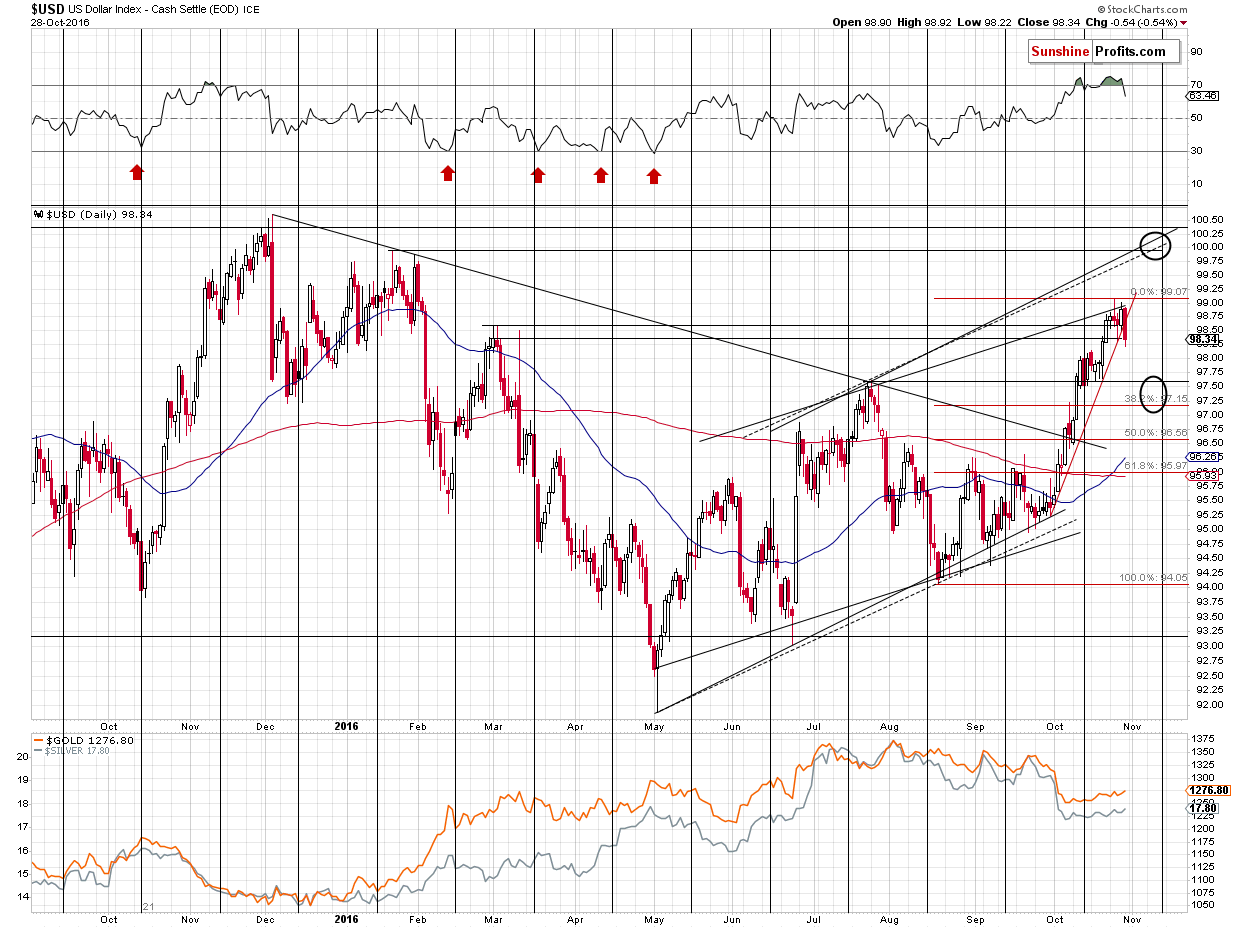

The USD Index declined on Friday, moving below the March highs and the rising red support line. The breakdowns were not confirmed, but they are already bearish for the short term. Consequently, we added an alternative target area – if the USD Index is indeed starting to move lower, then we may see the bottom close to the 97.25 – 97.50 area. Please note that the cyclical turning point is about 2 weeks away and it’s quite likely to correspond to a reversal. The short-term implications for the precious metals sector are bullish.

Let’s keep in mind that the turning points work on a near-to basis and given the major news that’s going to be released in early November (we’ll know who’s going to be the next U.S. President), it could be the case that the turnaround takes place close to the announcement – perhaps shortly before it, if the polls clearly point to a certain outcome.

The above could also be the reason due to which precious metals will not decline right away – uncertainty fuels the PMs and there’s no doubt that it will remain in place before the next U.S. President is chosen. When would the turnaround be seen? Probably soon – and it could be seen before the elections due to the way polls could shape – but we’ll wait for additional confirmations (for instance from silver) before opening another speculative position.

Summing up, it still seems that a big decline is relatively close, but that a short-term move higher will be seen sooner. Once we get additional bearish confirmations we’ll likely open another speculative short position (or if the bearish indications are invalidated and we get a lot of new bullish signals, we’ll open a long one), but it’s too early to do so now. As always – we will keep you – our subscribers – updated.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): No positions

Long-term capital (core part of the portfolio; our opinion): No positions

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

There is (fortunately) only one week left before the U.S. presidential election. What are the current odds of both candidates and what do they mean for the gold market?

Gold One Week before U.S. Presidential Election

S&P 500 index extends its short-term fluctuations below resistance level of 2,150. Is this some bottoming pattern or just flat correction before another leg down? Is holding short position still justified?

Stock Trading Alert: More Fluctuations Following Earnings Releases - Which Direction Is Next?

=====

Hand-picked precious-metals-related links:

Gold Holds Gains From Last Week as U.S. Election Polls Tighten

South Africa's AMCU union to sign wage deals with platinum trio

=====

In other news:

Dollar shakes off Clinton FBI scare, global stocks stay spooked

Euro zone third-quarter growth steady as expected, October inflation picks up

Central Banks Weigh Different Policies Under Similar Constraints

FBI’s Clinton probe is the black swan that could throw election off course, Citi says

Tired of Counting Piles of Cash, Venezuelans Start Weighing Them

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts