Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective. This position was originally featured on Jan. 12, 2017 at 3:49PM.

In the past few months, gold has been closely reflecting the changes in the USD Index. It is therefore reasonable to expect the major moves in the yellow metal (and thus in silver and miners) to depend on the major moves in the USD Index. The above provides key context for all other charts and it will continue to do so until gold starts moving higher along with the USD (we have not seen clues thereof recently). Consequently, before we move to gold, silver and mining stocks, let’s discuss the big picture for the USD Index (charts courtesy of http://stockcharts.com).

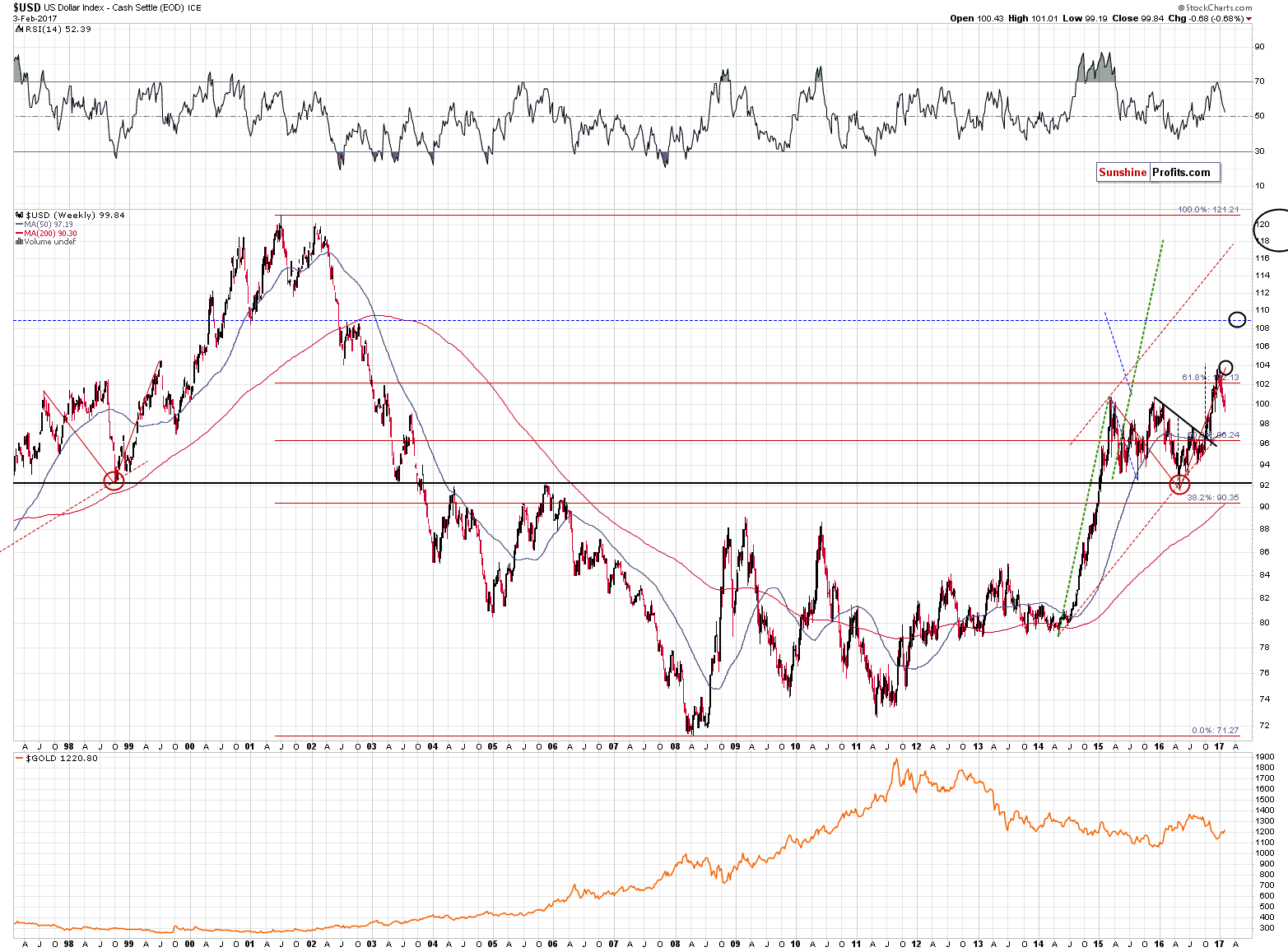

Several months ago, we discussed one self-similar pattern in the USD Index and several weeks later, we featured another one. The first one was the analogy to the 1998 – 1999 rally – something that was likely to correspond to the USD’s rally to the 104 level in the area marked with the lowest black ellipse.

We had also written on several occasions that the self-similar patterns are becoming less efficient as we move more into the future with the projections. They need to be monitored and when the pattern deviates too much, it shouldn’t be viewed as very important anymore. The USD Index indeed rallied as we had expected it to and it moved close to the 104 level, but the move happened sooner than the analogy had suggested and thus it is no longer as similar as it was previously. Consequently, it could be the case that the pattern will no longer repeat itself – especially that another self-similar pattern appears to be in place and the implications thereof are different than those of the first pattern.

The second self-similar pattern is the mirror nature of the 2009 – now bull market and the pre-2009 bear market. The move below 100 in 2003 was corrected only once and in a rather sharp way. After the correction, the decline resumed and continued until the level of 92 was reached. The pre-correction (which was about 4 index points – just like the current one at this time) decline in the USD Index started a bit above 108.

Back in 2016, the USD Index rallied from about 92 to about 104 and corrected about 4 index points in a rather sharp (from the long-term point of view) manner. If the history rhymes and the “reflection” continues, the USD Index is about to quickly rally to the 108 level or slightly higher (adding the size of the 2015 – 2016 correction to the 2015 highs provides us with 110 as the target).

What are the implications of the above? Naturally, they are bearish for gold and the rest of the precious metals sectors and there are 2 direct reasons for it:

- The potential size of the rally in the USD (and thus the potential size of the decline in gold) is huge.

- The corrective downswing is very similar to the 2003 correction, which suggests that it’s either over (which would be in tune with the short-term USD chart) or extremely close to being over.

Even if we didn’t pay attention to the reflective nature of the USD Index, its medium-term outlook would still be bullish.

The key fundamental reason is the situation in interest rates – they are moving higher in the U.S., while the rest of the world (here: the key currencies in the USD Index: the euro and the yen) is still in favor of dovish monetary policy and it doesn’t seem likely that this is going to change anytime soon.

The key technical fact is the USD’s breakout above the 2015 highs and the verification thereof. The breakout was not invalidated in any visible or meaningful way, so it’s very bullish implications for the following months remain in place.

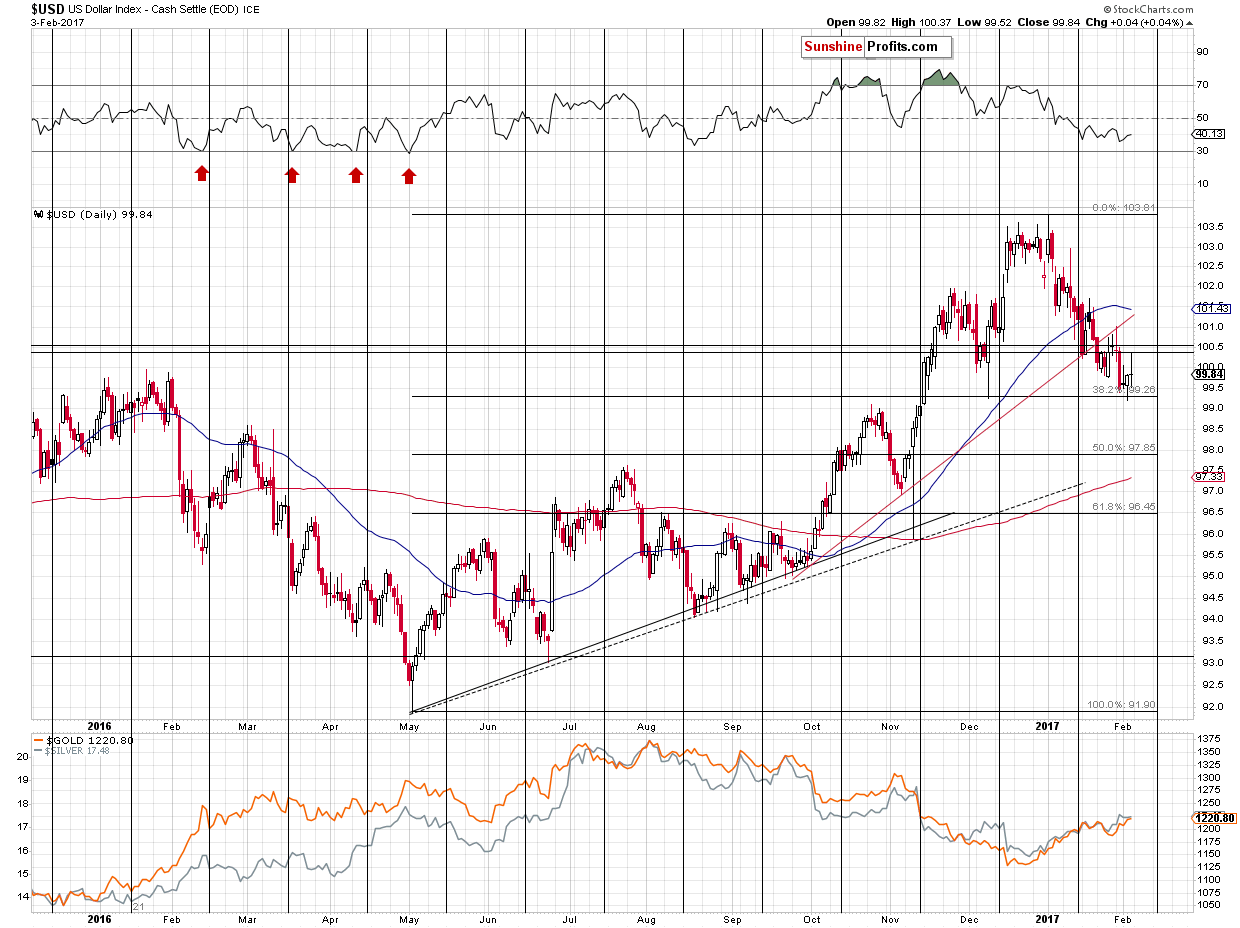

Speaking of the short-term USD Index chart, practically nothing changed on Friday, so the bullish implications of Thursday’s reversal (hammer candlestick) remain in place. The reversal’s bullish implications are strengthened by the fact that USD reached its 38.2% Fibonacci retracement and the December low.

Keeping the above in mind, let’s take a look at gold.

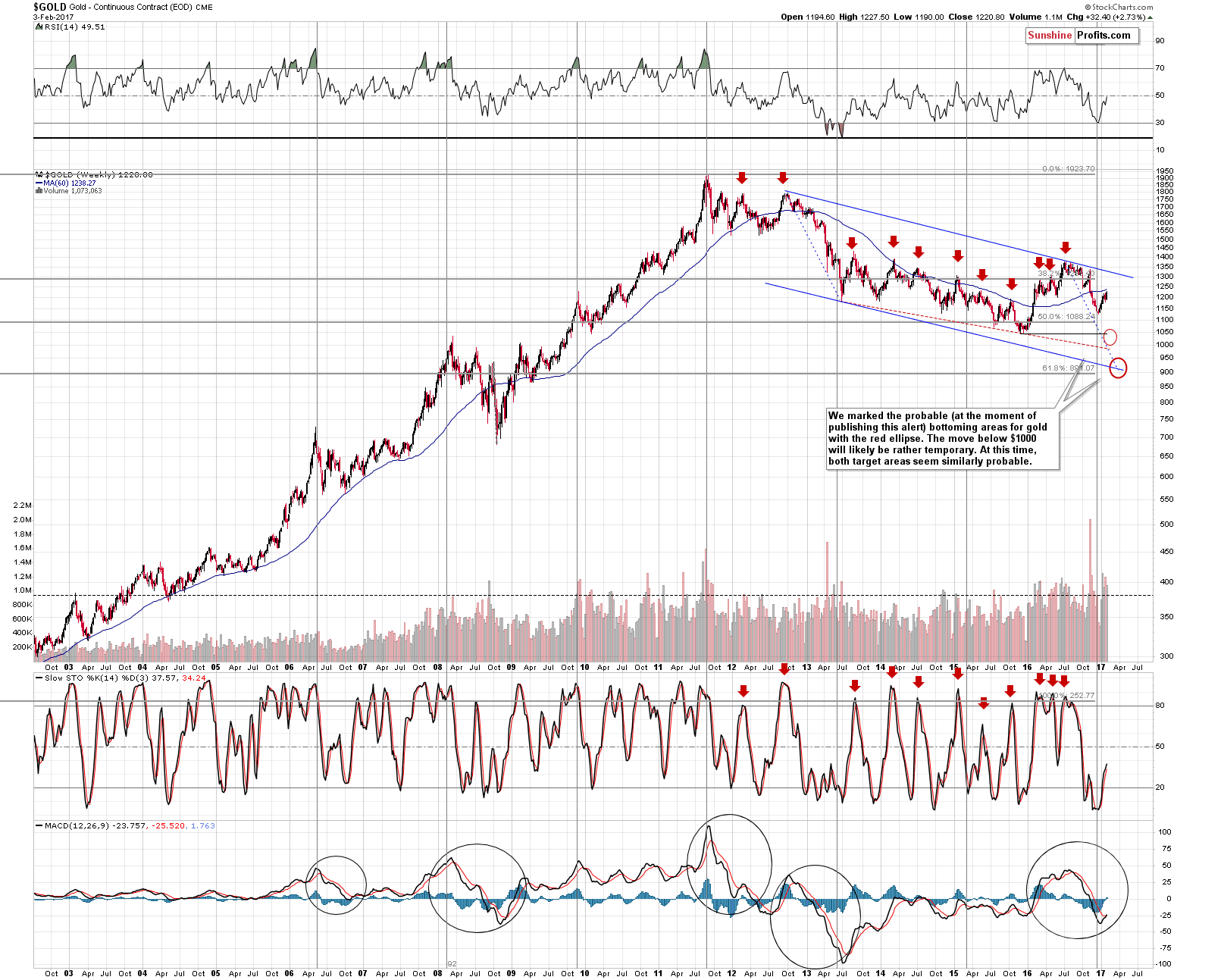

The first thing that we see on gold’s long-term chart is the yellow metal’s position relative to the 50-week moving average. Gold moved below it several months ago and it now moved more or less back to it. The average was not touched (gold topped $10 below it), but that it was close enough to notice the similarity between this situation and what we saw in the case of the last 2 tops (marked with red arrows) of 2015.

The RSI indicator is very close to the 50 level, which is also in tune with the past 2013 - 2015 tops – some of them were formed with the RSI above 50 and some with RSI a bit below 50, but on average, this was the value to look for at the top.

There’s also the issue of the buy signal in the MACD indicator. It proved quite effective several times in the past, so we would like to discuss whether it has important bullish implications at this time. The key question is: what is the current situation similar to? We marked the current situation and other 4 similar situations with black ellipses. In the past, the buy / “buy” signals in similar situations had the following implications: rally in 2006, decline in 2008, decline in 2012, rally in 2013 (however, the latter is least important as the MACD was already after a huge decline and so was the price of gold – this is not the case right now). Overall, was the signal bullish? Not really. Can we say that it serves as a bearish confirmation? No – that would be an exaggeration. It seems that the buy signal from the MACD indicator should simply be viewed as important at this time – it’s definitely not something that could invalidate the points made when analyzing the long-term USD Index chart.

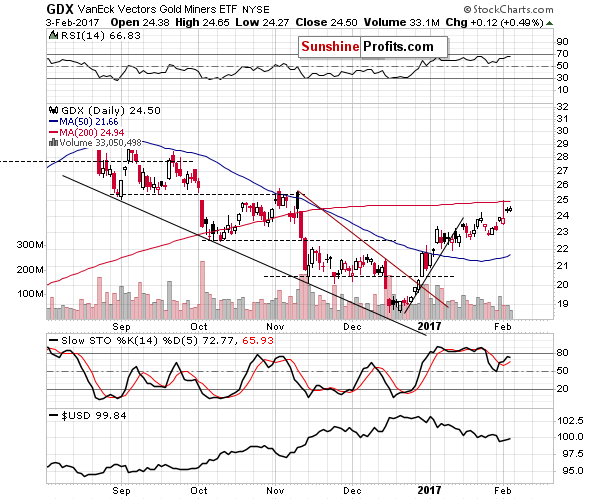

As far as the short-term charts are concerned, there is very little to comment on today as gold, silver and mining stocks closed Friday’s session very close to where they had closed Thursday’s session. One thing that we can say though, is that mining stocks moved 0.12% higher (next to nothing, but still) on very tiny volume.

Higher prices along with very low volume are generally a bearish sign as they show that the market was only moving higher because there were not many sellers on a given day – not because buyers showed exceptional strength.

Summing up, the medium-term picture for the USD Index is clearly bullish and even without considering other factors, it makes the outlook for the precious metals sector very bearish. It seems that the corrective downswing in the USD Index is over or very close to being over and it suggests that short positions, not long ones, should be focused on in the case of the precious metals sector.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,243; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $48.78

- Silver: initial target price: $13.12; stop-loss: $18.07; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $22.24

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.23; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.87

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $41.31

- JDST ETF: initial target price: $104.26; stop-loss: $14.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The U.S. economy added 227,000 jobs in January. What does it mean for the gold market?

S&P 500 index gained 0.7% on Friday, following better-than-expected jobs data release. Will it continue higher? Or is this just a topping pattern along record highs? Is holding short position still justified?

Stock Trading Alert: S&P 500 Index Got Closer To Record High - Will The Uptrend Continue?

=====

Hand-picked precious-metals-related links:

WGC:Gold Demand Trends Full Year 2016

Gold demand in India fell 21% in 2016: WGC

CHARTS: Gold price propped up (only) by Western investors

UPDATE 1-Randgold Q4 profit jumps; raises FY dividend by 52 pct

=====

In other news:

Clarity on Fed policy sought - stocks, dollar up in meantime

The Mortgage-Bond Whale That Everyone Is Suddenly Worried About

The race is on: Le Pen and Macron launch their bids to run France

China’s forex reserves may beat expectations: Analyst

Philippines 'unfit for mining' because of nation’s unique ecosystem: minister

US mulls scaling back ‘conflict minerals’ rule

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts