tools spotlight

-

Silver’s and Miners’ Recent Performance Relative to Gold

December 8, 2020, 9:28 AMSilver is like gold’s cheaper and more volatile little brother. The smaller market size of the white metal relative to gold makes it susceptible to wilder price swings. So how has it been performing relative to gold’s corrective actions since November? And finally, where do the miners stand in all this?

The entire precious metals sector moved higher yesterday (Dec 7), and one might wonder if this changes anything regarding the outlook. In short, it doesn’t. The move higher was in line with what I previously described as a likely outcome.

It was quite possible for gold to rally up to its September lows, and the low in gold futures in terms of the closing prices was $1,866.30. Yesterday’s closing price for gold futures was exactly $1,866.

So, did anything unusual happen? Not really.

Looking briefly at gold, can it move even higher from here? As discouraging (or encouraging, depending on one’s perspective) as this answer may be, it’s a “yes”. The US Dollar Index is currently trading at about 90.8, and its downside target is at about 90, so there is room for another short-term slide. Such a slide would be likely to trigger a rally in the yellow metal. How high could the rally go during this final part of the counter-trend corrective upswing?

Perhaps to the mid-November high of about $1,900. Even though gold might theoretically rally all the way up to the early-November high, I don’t see this as being likely.

At the moment of writing these words, gold has corrected more or less half of its November decline. Did silver correct as much?

Actually, silver corrected visibly more. Its already at its mid-November highs and relatively close to its early-November top. This means two things:

- If gold rallies to its mid-November high, silver could rally to its early-November high – to about $26.

- Silver is definitely outperforming gold , which is something that we tend to see before sizable declines – that’s one of the key silver and gold trading tips .

Moreover, please note that silver has a triangle-vertex-based reversal point in the final part of the month, which could imply that this is where silver forms a final, or temporary bottom. This could have implications also for the rest of the precious metals sector, as its parts tend to move together in the short and medium term.

Given the bearish post-Thanksgiving seasonality in the case of PMs and the tendency for them to form local bottoms in the middle or second half of December, it seems likely that the above is likely to be some kind of bottom.

Let’s get back to issue of the relative performance. While silver tends to show strength relative to gold before bigger declines, gold stocks tend to be relatively weak. Are they?

Of course they are! Even taking into account yesterday’s quite visible upswing, gold miners have clearly not corrected half of their November decline

Miners are not even close to their mid-November highs, let alone the early-November highs.

So, yes, miners did move higher yesterday, but examining their recent rebound and comparing it to what happened in gold and – especially – silver, provides us with very bearish implications.

What we see in the PMs is just a correction, not the start of a new, powerful upleg. If it was, miners would have been leading the way higher. We currently see the opposite.

Over a week ago, I wrote that miners could move to the previous lows and by moving to them, they could verify them as resistance. The previous – October – low is at $36.01 in intraday terms and at $36.52 in terms of the daily closing prices. Yesterday, miners closed at $36.50.

So, while gold closed at its September low (in terms of the daily closing prices), gold miners closed at their October low.

If the USD Index declines one more time before bottoming, and gold rallies, miners could also mover temporarily higher. How high could they move? I think that the mid-November high of about $38 (intraday high: $38.35, daily close: $38.01) would provide the kind of strong resistance that miners might not be able to breach.

Still, this upside is based on two big IFs.

The first “if” is if the USD Index declines to 90 or slightly lower – it’s extremely oversold, and the CoT reports confirm it.

The second “if” is if the precious metals sector really reacts to USD’s decline with a visible rally. In the past few weeks, gold shrugged off quite a few USDX declines. And miners shrugged off even more positive news.

Consequently, it seems that trying to take a profit from the possible, but not very likely, immediate-term upswing is not the best idea from the risk to reward point of view.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold: Have We Seen the Bottom Yet ?

December 7, 2020, 12:09 PMAs we dive into December, everything seems to hinge on an ever-changing daily news cycle. Coronavirus cases surging? Gold goes up, oil goes down. Another positive vaccine trial? Stocks go up, gold goes down. As the rollercoaster ride continues, there are various tools and indicators that one can examine to gain some sense of what’s happening in the fundamentals. The Gold Miners Bullish Percent Index ($BPGDM) and the The VanEck Vectors Gold Miners ETF (GDX) are two barometers that may be useful.

Last week we examined the similarities in the performance of the Gold Miners Bullish Percent Index ($BPGDM) in 2016 and 2020. We noted that in 2016 the $BPGDM had an additional upswing before the slide and that the same pattern was evident in the middle of 2020. We also highlighted that in 2016 and 2020, the buying opportunity in the miners didn’t present itself until the $BPGDM was below 10, whereas it currently sits above 30. The conclusion was that the miners are likely to move even lower.

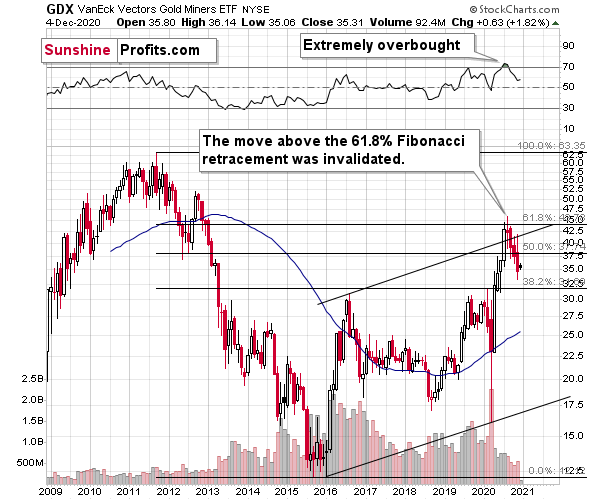

The GDX ETF was the first ETF in the U.S. to allow investors and traders exposure to gold mining companies. Let’s briefly look at what has occurred in the GDX ETF in the first week of December.

On December 1, I wrote the following about the likely upside target for the mining stocks during the recent correction:

How high could miners go? Perhaps only to the previous lows and by moving to them, they could verify them as resistance. The previous – October – low is at $36.01 in intraday terms and at $36.52 in terms of the daily closing prices. No matter which level we take, it’s not significantly above the pre-market price of $35.76, thus it seems that adjusting the trading position in order to limit the exposure for the relatively small part of the correction is not a good idea from the risk to reward perspective – one might miss the sharp drop that follows. Please note how sharp the mid-November decline was initially.

That’s exactly what happened – the GDX ETF rallied to $36.14 and then it started moving back down. Is the corrective upswing over? This is quite likely, however, I wouldn’t rule out another move higher, if the USD Index declines to, or slightly below, the 90 level. Still, such a move higher in the miners is not likely to be anything significant.

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there is just more than one month left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold on Course to Repeat Previous Patterns

December 3, 2020, 10:10 AMAvailable to premium subscribers only.

-

Gold & the USDX: Correlations

December 2, 2020, 11:31 AMIt’s crunch time for gold and the U.S. Dollar Index (USDX), as they find themselves at a crossroads. As of Wednesday, the USDX is holding its lows but wants to move up, thus invalidating its breakdown. And gold? Well, gold did gain a bit today, but it’s essentially jumping up in an elevator that’s moving down – it just doesn’t have enough steam to break out.

While it’s been the traditional view that when the US Dollar declines, gold increases in price, we find that's not always the case when comparing historical patterns. And just to watch the price of gold itself when making a buying decision is not enough. One needs to pay attention to the price of gold in relation to moves in the USDX – that helps to indicate the bottom.

Let’s pay attention to and examine what gold does when the USDX moves either up or down.

Yesterday we saw the first daily close below the September low. This means that the breakdown is not confirmed, and if the USDX closes below this level also today and tomorrow, it will be. However, at the moment of writing these words, the USDX is trying to rally back up – if it is successful, gold would be likely to plunge.

Still, to be precise, since gold just managed to rally above the declining resistance line, it might have enough momentum to reach the September low (at about $1,850) before turning south once again.

The breakdown in the USDX is not confirmed and it could be invalidated any hour now, but… What if it’s not? What if – despite invalidation being likely and the USDX moving up – what we’ve seen in the last couple of months was not the broad bottom in the USD Index, and the latter is going to decline from here?

These are important questions. First of all, if the above is indeed the case, it won’t mean that technical analysis became useless or less useful. It would mean that a different part of history is likely to be repeated to a certain extent, and not the ones that I featured and referred to previously.

The above wouldn’t invalidate the very bullish implications of the long-term breakout in the USDX in 2015.

So, what would be likely to happen if the USDX declines in the next few days?

In this case, it seems likely to me that the USDX would repeat its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the correction was now smaller than it was in 2017.

Since back in 2018, the USDX’s bottom was at about 1.618 Fibonacci extension of the size of the correction, we could expect something similar to happen this time. Applying the above to the current situation would give us the proximity of the 90 level as the downside target.

But would gold soar in this case? Well, if the early 2018 pattern was being repeated, then let’s check what happened to precious metals and gold stocks at that time.

In short, they moved just a little higher after the USDX’s breakdown. We marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in case of the miners.

Consequently, even if the USD Index is to decline further from here (and – again – the breakdown could be invalidated shortly), then the implications are not particularly bullish for the precious metals market.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM