tools spotlight

-

Where Will Gold Go After the Elections?

November 3, 2020, 9:49 AMIn yesterday’s analysis, I wrote that the market situation is likely to become more specific right before, during, and perhaps shortly after the U.S. presidential elections. And by “specific”, I mean that the markets could begin moving against their previous trends.

That’s precisely what we’re witnessing right now.

Yesterday, I commented on the chart above in the following manner:

(…)

In fact, I wouldn’t be surprised to see a corrective move lower that would trigger a brief move higher in the precious metals and mining stocks. However, that would only be temporary, and not likely to last more than several days.

That’s what we see right now – it’s not a game-changer, but instead, it’s a relatively normal uncertainty-based phenomenon.

Gold is moving higher, but not dramatically so. This is in perfect tune with yesterday’s comments.

And what about gold miners?

Miners rallied – which is also in tune with what I wrote previously in my analyses. On Thursday, after gold had declined significantly (on Wednesday), I’ve indicated the following:

Miners have been undermining gold, which is bearish, and they have also broken below the recent lows, which is also bearish. Moreover, miners have just declined on strong volume after opening the day with a price gap, which at first sight, is bearish.

The theory is that such sessions are particularly bearish, as they supposedly show the bears' strength. But, before applying any trading tip into practice, it’s important to check if it had indeed worked on a given market, especially in the recent past. And the aforementioned did work… In the opposite way!

For the third time, miners are declining substantially during one day on a strong volume. We saw the same thing happening in mid-August and late-September. None of them were followed by lower miner prices. Instead, we’ve witnessed corrective upswings that didn’t change the overall downtrend.

So, from here on in, will miners rally or decline? Overall, the very near term (until the elections in the U.S. and a day-two after that) is unclear. At this point, a temporary rebound here would not surprise me at all, and if we see one, I expect it to be followed by a major slide. That’s precisely what happened right before and after the elections in 2016.

The summary above remains 100% up-to-date. Miners moved a bit higher, and given today’s pre-market upswing in gold, they might also rally during today’s session. Still, the aforementioned is likely nothing more than a pre-election uncertainty that drives the prices and will most probably subside shortly.

Finally, let’s look at how gold performed after the previous U.S. presidential elections in 2016.

It turns out that on average (the thick red line is the average) based on the elections, nothing really happened. However, if we look at the individual price paths, it is evident that gold reversed its course on election day in 2008 and 2004. The link to 2004 and 2008 might not be as important, due to the fundamental similarities in both years including massive stock price plunges, and precious metals.

Furthermore, since the chart above is based on closing prices only, it misses one major point – the huge 2016 intraday (actually, overnight) reversal, when gold moved over $50 higher only, to slide shortly thereafter.

So, what does all the above mean for gold? Well, it means that my previous comments are completely justified and legitimate. The trend (which right now is down in the short term) is likely to remain intact. But, a counter-trend pop-up is quite possible, and if it is visible, we shouldn’t attribute any major implications to it.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Stocks and the Dollar Weigh In

November 2, 2020, 10:20 AMIt’s evident that stocks have once again invalidated the breakout above their early-2020 high. They have also closed the week below the lowest weekly September close. Back in September, the S&P 500 index reversed on a weekly basis and rallied once again. This is similar to what happened in 2018 (August) when stocks first broke to new highs. Back then, the volatility was lower, and therefore it’s no wonder that the breakout held and this time (in September) it was temporarily invalidated.

Back in 2018, stocks moved to a new high (not significantly higher), and this time they didn’t manage to do so, but were quite close (the rally seems to have burned itself out in August).

The key take-away from this similarity is that once stocks slide below the September lows in intraday terms, they are likely to decline further. Perhaps much lower.

Back in 2018, stocks consolidated around the previous lows, and then they declined even more profoundly in the final part of the year. Could the same happen this time as well? Well, it could happen, but with so much money being injected into the system from various directions, we don’t want to say that it's inevitable.

What is very likely in my view, however, is that stocks will slide, and when they do, they will take the precious metals sector with it. Especially silver, and mining stocks.

Moreover, let’s keep in mind that the situation continues to be excessive on the forex market.

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone “knew” that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it’s exactly the same right now.

The USD Index was at a powerful combination of support levels. One of them is the rising, long-term, black support line based on the 2011 and 2014 bottoms. The other major support level and a long-term factor is the proximity to the 92 level – that’s when gold topped in 2004, 2005, and where it – approximately – bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, broke slightly below them, and now it has clearly invalidated this breakdown. For many weeks, we’ve been warning about the likely USD Index rally, and we finally saw it.

Quoting my previous comments:

The USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

Before moving to the short-term chart, please note that the major bottoms in the USD Index that formed in the middle of the previous years often took the form of broad bottoms.

Consequently, the current back and forth trading is not that surprising. This includes the 2008, 2011, and 2018 bottoms.

A crucial aspect is that the rally that we’ve witnessed so far is just the tip of the bullish iceberg. The breakdown below the key support levels was invalidated, which is a strong bullish indicator. Since it happened on a long-term chart and the temporarily broken lines were critical, the implications are incredibly important as well– and they should be visible from the long-term perspective.

So, how high could the USD Index rally now be? At least to the 100 level (approximately). This way, the upcoming rally would almost match the rally that started after the previous major invalidation – the 2018 one.

Still, we wouldn’t rule out a scenario in which the USD Index rallies above its 2020 highs before another major top. After all, the USD Index is after a very long-term breakout that was already verified several times.

There isn’t a market that moves on its own in today’s globalized world economy. Most recently, gold has been correlated negatively with the USD Index and positively with the stock market. Right now, the implications of the general stock market and the USDX movements remain bearish for the next several weeks. However, precious metals could move higher in the next few hours or days.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Slide Continues Right Before the Elections

October 30, 2020, 11:33 AMAvailable to premium subscribers only.

-

Gold Stocks’ Bullish Decline

October 29, 2020, 10:10 AMI previously wrote that practically nothing happened on the gold market, which is bearish since gold should be rallying or trading at higher levels, given the pre-election uncertainty. However, gold didn’t wait for the elections to begin with its decline – it plunged yesterday, taking silver and mining stocks along with it.

To be more precise, it was the mining stocks sector that brought down the rest. Miners moved and closed the day below their previous September and October lows, and therefore anyone who joined us recently is now gaining profits.

But, is every factor truly bearish for the miners? It is not the case!

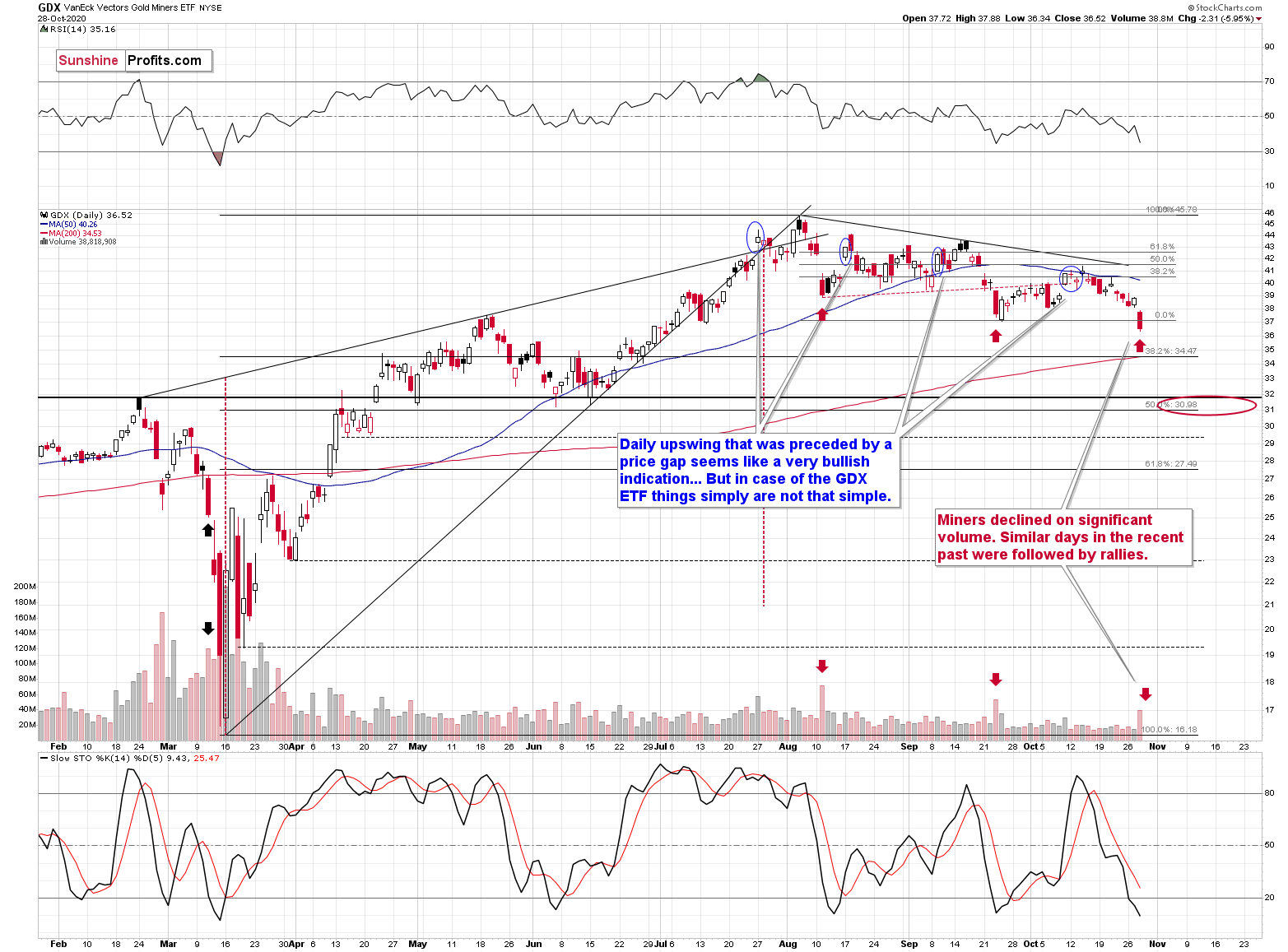

Miners have been undermining gold, which is bearish, and they have also broken below the recent lows, which is also bearish. Moreover, miners have just declined on strong volume after opening the day with a price gap, which at first sight, is bearish.

The theory is that such sessions are particularly bearish, as they supposedly show the bears' strength. But, before applying any trading tip into practice, it’s important to check if it had indeed worked on a given market, especially in the recent past. And the aforementioned did work… In the opposite way!

For the third time, miners are declining substantially during one day on a strong volume. We saw the same thing happening in mid-August and late-September. None of them were followed by lower miner prices. Instead, we’ve witnessed corrective upswings that didn’t change the overall downtrend.

So, from here on in, will miners rally or decline? Overall, the very near term (until the elections in the U.S. and a day-two after that) is unclear. At this point, a temporary rebound here would not surprise me at all, and if we see one, I expect it to be followed by a major slide. That’s precisely what happened right before and after the elections in 2016.

The precious metals sector (miners included) moved higher right before the elections only to slide profoundly in the following days.

The post-election decline started from above the 38.2% Fibonacci retracement based on the preceding big upswing and the 50-day moving average. It ended once miners declined below the 61.8% Fibonacci retracement.

Could that happen again? It seems quite possible – the history might repeat itself to a considerable degree. The GDX ETF is above its 38.2% Fibonacci retracement, and if it moves a bit higher, it will be relatively close to its 50-day moving average.

Moving below the 61.8% Fibonacci retracement – just like in 2016 – it would imply a move below $27.5, which could very well happen if gold declines significantly from here. And it is quite likely to do so, as I emphasized in my previous analyses.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Run-of-the-Mill Performance Amid U.S Elections Uncertainty

October 28, 2020, 11:38 AMIn my previous analyses, I’ve made quite a few comments on the factors that support the current precious metals market outlook, and there’s little to add on top of that, as nothing significant happened so far this week. But, whatever happened, was in tune with what we’ve predicted earlier, and the current silence of gold actually provides us with several insights.

We are aware that gold sustains its momentum for a fourth day in a row – that is, at least based on what’s happening in today’s pre-market trading.

So, does that seems boring to you? Certainly, since the everything remains evidently the same. How about informative? Well, it does tell us more than it meets the eye.

As I’ve discussed in one of the previous analyses, due to the looming presidential elections in the U.S, we’re living in ambiguous times. Because of that, gold should get a significant boost. After all, it’s a safe-haven metal. Or, at least it’s perceived as one.

Despite this theoretical tendency, gold is either unwilling to move higher, or the current prices are already the “boosted” ones. Nevertheless, both are bearish pieces of information as they indicate that once the post-election dust settles, gold is likely to lose its current boost. Perhaps the additional decline will be triggered due to the lack of uncertainty.

In the meantime, by being weak relative to gold, miners continue with their bearish indications. Gold did pretty much nothing over the last three days (not counting yesterday’s upswing). And how did miners respond?

Overall, miners declined. Yes, they moved higher yesterday, but they are still visibly below their October 22nd closing price, whereas gold closed practically at the same level yesterday.

To make the apples-to-apples comparison, let’s focus on the way GDX reacted to GLD’s movement. The former ETF represents the gold miners, and the latter – of course – gold. The useful characteristic of the GLD ETF here is that its closing time is exactly the same as the closing time for the GDX ETF. This is not the case with gold’s continuous futures contracts.

The GLD ETF closed at $178.83 on October 22nd, and it closed at $179.02 yesterday. In other words, it moved higher very insignificantly (about 0.11%).

During the same time, the GDX ETF moved from $39.19 to $38.83 – it declined by about 0.92%. This move is not gargantuan either, but it’s notable, and most importantly the direction of both moves is opposite.

This means that miners continue to be weak relative to gold, which means the bearish implications of this link remains intact.

Moreover, given today’s pre-market move lower in gold, it seems likely that miners’ yesterday’s upswing will soon be erased as well.

Thank you for reading our free analysis today. Please note that the following is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM