tools spotlight

-

The Key Nothing in Mining Stocks

July 17, 2020, 8:53 AMOnce again nothing major happened in the precious metals market and once again this "nothing" was quite important. Especially for the mining stocks. Still, let's start today's analysis with a look at the USD Index as that's where the clearest short-term clue is visible.

In yesterday's analysis, we wrote the following:

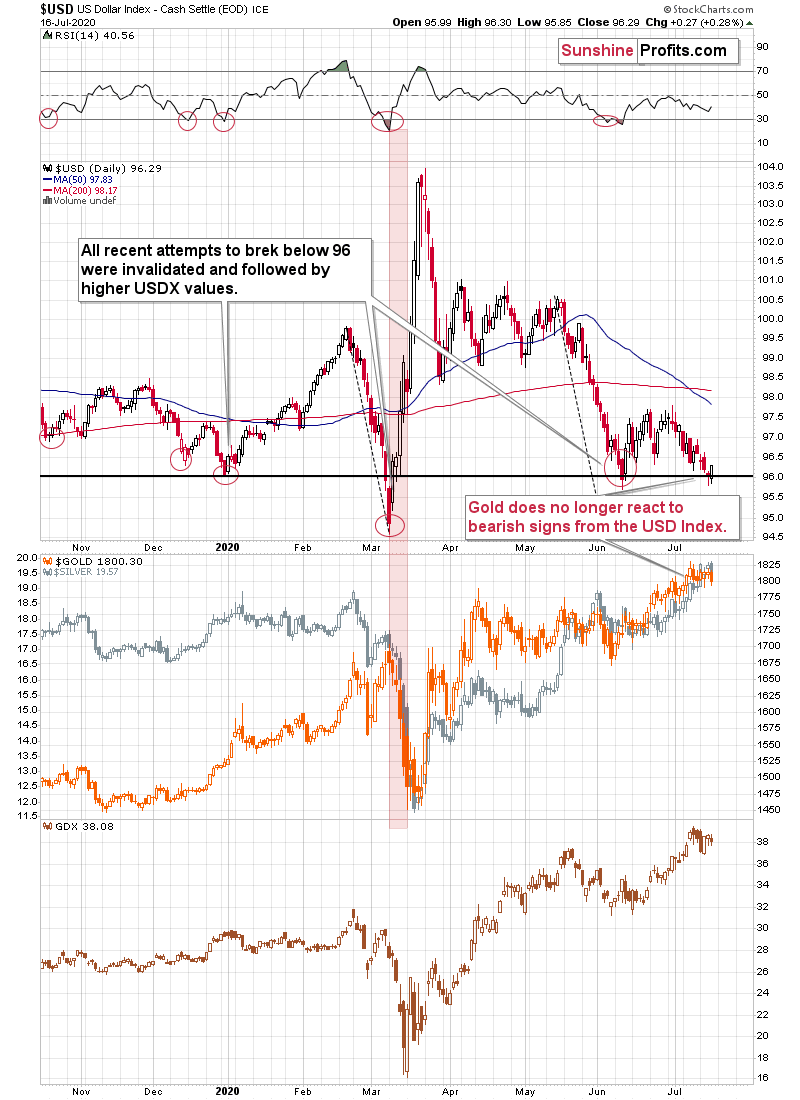

The USD Index moved visibly lower this week - also yesterday - and gold has barely reacted. As you can see on the lower chart, gold miners have also simply moved somewhat up, but not to - let alone above - their recent highs.

This "nothing" means that the precious metals market doesn't want to move higher without a decline first. And based on the multiple factors that we covered previously, especially in Monday's flagship Gold & Silver Trading Alert, it's likely that this decline is going to be major.

The lack of reaction to bullish indications from the USD Index also suggest that PMs might be vulnerable to strong reaction given a bearish lead from the USDX. And since the USDX just moved below 96, it seems that we're likely to see another USD upswing shortly. In fact, it might already be underway. After all, all recent attempts to break below the 96 level were followed by invalidations and rallies. That's how the huge March rally in the USDX and the huge downswing in the PMs started.

The USD Index has indeed invalidated the breakdown below the 96 level. This time, the breakdown was not significant, so the comeback was not clearly visible either. Just like if you put a ball underwater - it shoots back up, but if you put it just a bit below the surface, it will still go back, but not as quickly and that's perfectly normal.

The important thing is that it comes back at all and the same thing is with the USD Index right now. In March, the initial move back up was sharp, but that was not when gold rallied the most. After moving back above 96, it then paused for a bit and moved higher shortly thereafter. It was this post-pause move that wreaked the greatest havoc in gold, silver, and mining stocks.

And you know what the USD Index has been doing in the last several hours?

It's been consolidating around the 96 level. The moves are not as big as they were in mid-March, which is in tune with the current volatility and the fact that the USDX didn't move much below the 96 level previously.

At the same time, the USD Index is moving around the neck level of the previous head-and-shoulders formation. Since the breakdown below this line was already invalidated, we view this action as neutral-to-bullish - definitely not bearish.

On Monday, we wrote the following:

The USD Index did move lower and right now it's in the situation where it could still move slightly lower before soaring. The reason is the incomplete head-and-shoulders formation. Theoretically, this formation is bearish once its completed, but based on what we wrote with regard to USD's long-term picture, it seems more likely that the USD Index will attempt to break lower and then invalidate this breakdown. We saw this kind of performance multiple times and invalidated H&S pattern is a very bullish phenomenon. In fact, all invalidations are strong signs to the opposite direction, but the signals coming from invalidated H&S patterns appear particularly strong.

That's exactly what's taking place. The overall implications are bullish for the USD Index and bearish for the precious metals market.

Thank you for reading today's free analysis. Its full version - today's Gold & Silver Trading Alert includes also analysis of what happened in gold and how it relates to the critical developments in the USD Index. Gold might move higher briefly before plunging and today's Alert includes the specific upside target that we think will keep gold's rally in check. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The USDX Weighs In

July 16, 2020, 6:01 AMNot much happened in the precious metals market yesterday. This was an important "nothing", though.

The USD Index moved visibly lower this week - also yesterday - and gold has barely reacted. As you can see on the lower chart, gold miners have also simply moved somewhat up, but not to - let alone above - their recent highs.

This "nothing" means that the precious metals market doesn't want to move higher without a decline first. And based on the multiple factors that we covered previously, especially in Monday's flagship Gold & Silver Trading Alert, it's likely that this decline is going to be major.

The lack of reaction to bullish indications from the USD Index also suggest that PMs might be vulnerable to strong reaction given a bearish lead from the USDX. And since the USDX just moved below 96, it seems that we're likely to see another USD upswing shortly. In fact, it might already be underway. After all, all recent attempts to break below the 96 level were followed by invalidations and rallies. That's how the huge March rally in the USDX and the huge downswing in the PMs started.

There's also a more short-term-oriented indication pointing to the same outcome.

The neck level of the head and shoulders pattern that we've been commenting on in the previous days, was broken and then the breakdown invalidated just several minutes ago (I'm writing it well before the markets open in the U.S

On Monday, we wrote the following:

The USD Index did move lower and right now it's in the situation where it could still move slightly lower before soaring. The reason is the incomplete head-and-shoulders formation. Theoretically, this formation is bearish once its completed, but based on what we wrote with regard to USD's long-term picture, it seems more likely that the USD Index will attempt to break lower and then invalidate this breakdown. We saw this kind of performance multiple times and invalidated H&S pattern is a very bullish phenomenon. In fact, all invalidations are strong signs to the opposite direction, but the signals coming from invalidated H&S patterns appear particularly strong.

That's exactly what happened. The implications are bullish for the USD Index and bearish for the precious metals market.

Thank you for reading today's free analysis. Its full version - today's Gold & Silver Trading Alert includes also analysis of what happened in gold and how it relates to the critical developments in the USD Index. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Curious Story of the Miners' Breakdown

July 15, 2020, 6:11 AMWhat we previously wrote about mining stocks' breakdown and yesterday's upswing, might seem like something that invalidates it or something that's just nonsense. In reality, it's one of the common patterns that we see after breakdowns - the price comes back to the previously broken level or line in order to check whether it's able to get back above it. If it's not, the breakdown holds, and it becomes verified. This increases the odds for decline's continuation. Conversely, if the move higher takes the price above the certain level or line, the breakdown becomes invalidated and the signal for the opposite side (here: bullish) is created.

What if both: verification and invalidation take place at the same time? This can't happen with regard to the same line, but if a given line or level is considered based on different perspectives or different prices (intraday, daily closes, weekly closes, monthly closes, quarterly closes), the "same" line might actually be slightly different. Which indication should one trust more in this case?

Of course, there are no certainties in any market, but in general, the more long-term-oriented a picture is, the more important the signals coming from it. Consequently, ceteris paribus (all other things being equal), the more long-term-oriented indications are likely more important.

With the above in mind, let's take a look at what happened in the gold and silver stocks yesterday.

The GDX ETF invalidated its breakdown below the rising intraday support line, which could be viewed as a bullish sign, but...

GDX's daily chart (which is twice as long-term as daily candlesticks include two 4-hour candlesticks from the previous chart) shows that the line that's based on more long-term price extremes actually held. This means that the breakdown wasn't invalidated - it's being verified.

The above chart also shows that a pause and a small comeback is relatively normal after the major tops and initial declines. Please note what happened after the February top, after the March top, and after the May top. The same thing - a daily pause. This perfectly fits yesterday's comeback to the previously broken rising support line, which now turned into resistance.

Thank you for reading today's free analysis. Its full version - today's Gold & Silver Trading Alert includes also analysis of what happened in gold and how it relates to the critical developments in the USD Index. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Gold Index Consequences Are Starting to Arrive

July 14, 2020, 7:18 AMIn yesterday's analysis, we wrote that miners have likely formed an island top and that the final confirmation thereof will come when they break below their rising support line.

We didn't have to wait long for the above-mentioned confirmation - miners broke decisively and close yesterday's session below the rising support line.

We described the above chart in the following way:

GDX's 4-hour candlestick chart shows that they were just very overbought also from the short-term point of view as the RSI indicator moved above 70. While it was in this sell-signal territory, miners were moving back and forth after a bullish price gap. Combination of both suggests that what we saw was an island top formation. At this time, it's just a "potential" formation, because we won't know for certain until miners decline more and move below the $37.5 level. This level is important because it corresponds not only to the lower border of the price gap, but it's also where the rising support line currently is.

As the breakdown has already happened, the very short-term outlook for the mining stocks has deteriorated significantly.

The strength of the support line - and thus importance of the breakdown below it - is further increased by what we see on GDX's daily chart.

The above-mentioned line is actually the line that starts all the way at the March bottom. Breakdown below this line opened the door wide open to strong declines. Given the Gold Miners Bullish Percent Index's extreme overbought reading, the fall should be substantial.

Last Monday, we described the above chart in the following way:

Remember when we wrote that the situation right now is similar to what happened in March, but this time it takes longer for everything to develop due to the change in market's perception of risk? To make a long story short, the March coronavirus panic was because the entire world was dealing with the unknown, which exacerbated the fear. Right now, the situation is worse, and it goes worse almost on a daily basis, but people are not as afraid. The economic implications don't appear so dire either. And it's definitely nothing unknown - we more or less know what to expect.

This means that we're likely to see a repeat of what we saw in March, we're likely to see it in "slow motion", at least for some time. Please note that even slow-motion mode of the mid-March plunge would still be very volatile.

The areas that we marked with red rectangles are similar in terms of shape, but the current one is about 4x longer. The previous pattern was characterized by a decline and a correction that took more or less the same time to complete. If we're about to see something similar also this time, then we can expect the top to be formed this week.

As of yesterday, the June - July upswing took as much time as the May - June decline did. This time, the second high was higher, but the timing between the highs and the low is analogous to what we saw in February and March.

Given that the RSI that just touched the 70 level, the sell signal from the Stochastic indicator, the Gold Miners Bullish Percent Index that just hit the extreme 100 mark, and the above-mentioned symmetry, it seems that the top in the mining stocks is finally in.

The next strong support is provided by the June lows, but if gold is to move to $1,700 next week, we doubt that this level would hold.

Thank you for reading today's free analysis. Its full version - today's Gold & Silver Trading Alert includes also details for other parts of the precious metals sector (the signal from silver is also very important) and the explanation of the different in performance in DUST and HUI. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Little Known Gold Index Signal and Its Dramatic Consequences

July 13, 2020, 7:55 AMGiven how little it's used, Gold Miners Bullish Percent Index is an almost secret indicator, but that doesn't mean it's of little value to gold investors. Quite to the contrary.

As you can see, the miners just flashed an "extremely overbought" signal, which they had only flashed once in the past - almost right at the 2016 top.

The Gold Miners Bullish Percent Index recently moved to the highest level that it could reach - 100.

The only other case when the index was at 100, was in mid-2016.

We marked this situation with a vertical dashed line. Did miners continue to move higher for a long time, or did they move much higher? No.

Precisely, the index reached 100 on July 1st 2016, and gold mining stocks moved higher for two additional trading days. Then they topped. This was not the final top, but the second top took miners only about 5% above the initial July high.

This year, the index reached the 100 level on July 2nd - almost exactly 4 years later, and once again practically exactly in the middle of the year. Miners seemed to have formed the intraday high on July 9th - four trading days later.

It's not justified to assume that the delay in the exact top would be 100% identical, but it seems justified to view it as similar. Two-day delay then, and four-day delay now seem quite in tune, and this similarity supports a bearish forecast for gold.

There's also one additional point that we would like to emphasize and it's the previous high that the index made on November 9, 2010. That was the intraday top, so there was no additional delay. There was one additional high about a month later, in December, but miners moved only about 1.5% above the initial high then.

One might ask if mining stocks are really overbought right now given the unprecedented quantitative easing, and the answer is yes. Please note that in 2016 the world was also after three rounds of QE, which was also unprecedented, and it didn't prevent the miners to slide after becoming extremely overbought (with the index at the 100 level). The 100 level in the index reflects the excessive optimism, and markets will move from being extremely overbought to extremely oversold and vice versa regardless of how many QEs there are. People tend to go from the extreme fear to extreme greed and then the other way around, and no fundamental piece of news will change that in general. The economic circumstances change, but fear and greed remain embedded in human (and thus markets') behavior. Taking advantage of this cyclicality is the basis for most (if not all) trading tips for gold and other markets.

GDX's 4-hour candlestick chart shows that they were just very overbought also from the short-term point of view as the RSI indicator moved above 70. While it was in this sell-signal territory, miners were moving back and forth after a bullish price gap. Combination of both suggests that what we saw, was an island top formation. At this time, it's just a "potential" formation, because we won't know for certain until miners decline more and move below the $37.5 level. This level is important because it corresponds not only to the lower border of the price gap, but it's also where the rising support line currently is.

The strength of the support line - and thus importance of the potential breakdown below it - is further increased by what we see on GDX's daily chart.

That's actually the line that starts all the way at the March bottom. Breakdown below this line would open the door wide open to strong declines. Given the Gold Miners Bullish Percent Index's extreme overbought reading, the fall should be substantial.

Finally, we would like to show you something interesting that you almost certainly won't see anywhere else. The comparison between the performance of the Uber stock and the junior miners. Why would be compare them? Because they are both very highly correlated with the general stock market, but the shape in which they move relative to the general stock market (and to each other) is very specific. It can tell us in what stage of the move the market really is.

Uber is particularly interesting, because it's directly related to the current pandemic. When people are afraid of the coronavirus, they will think twice before using Uber's services. First, because they will prefer to stay home, and second because they will prefer to travel using more solitary means than by taking a cab, which was likely just used by someone else.

The thing is that Uber was early to disappoint and lag the market in March (underperforming the general stock market - please note how the final high in the S&P 500 didn't trigger an analogous move in the Uber stock), while the junior miners performed particularly well right before the top. The late-February spike was clearly visible.

Now, what's been taking place recently? The Uber stock is lagging, and it just failed to move to a new short-term high, while the S&P 500 did exactly that, and at the same time we see a sizable spike in the prices of junior miners. That's exactly what happened in February right before the slide.

This time, we also have bearish support from gold's long-term turning point, and we have miners which just showed an extremely overbought reading. The implications are very bearish.

Today's Gold & Silver Trading Alert includes multiple additional details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM