tools spotlight

-

Black Gold Is Gently Pointing the PMs Way

July 10, 2020, 8:57 AMAvailable to premium subscribers only.

-

The Remarkable Gold Index Sign Vs. the Miners' Strength

July 9, 2020, 7:37 AMWe started yesterday's Gold & Silver Trading Alert with the Gold Miners Bullish Percent Index, and we'll start today's analysis in the same way. We'll do so, because we received a question about whether gold miners stayed overbought for a long time, while they kept pushing to new highs - just like what markets sometimes do (especially the general stock market) when a given indicator (say, RSI) is already overbought.

In short, no.

The only other case when the index was at 100, was in mid-2016. We marked this situation with a vertical dashed line. Did miners continue to move higher for a long time, or did they move much higher? No.

Precisely, the index reached 100 on July 1st 2016, and gold mining stocks moved higher for two additional trading days. Then they topped. This was not the final top, but the second top took miners only about 5% above the initial July high.

This year, the index reached the 100 level on July 2nd - almost exactly 4 years later, and once again practically exactly in the middle of the year. Yesterday was the third day after this move. It's not justified to assume that the delay in the exact top would be 100% identical, but it seems justified to view it as similar. Two-day delay then, and three-day delay now seem quite in tune.

There's also one additional case that we would like to emphasize and it's the previous high that the index made on November 9, 2010. That was the intraday top, so there was no additional delay. There was one additional high about a month later, in December, but miners moved only about 1.5% above the initial high then.

One might ask if mining stocks are really overbought right now given the unprecedented quantitative easing, and the answer is yes. Please note that in 2016 the world was also after three rounds of QE, which was also unprecedented, and it didn't prevent the miners to slide after becoming extremely overbought (with the index at the 100 level). The 100 level in the index reflects the excessive optimism, and markets will move from being extremely overbought to extremely oversold and vice versa regardless of how many QEs there are. People tend to go from the extreme fear to extreme greed and then in the other way around, and no fundamental piece of news will change that in general. The economic circumstances change, but fear and greed remain embedded in human (and thus markets') behavior.

It's unlikely that gold miners would wait as long before declining profoundly, or that there would be another move higher before the bigger decline. Why? We already wrote about that this week - for instance, because of gold's long-term turning point and because of USD's mid-year turning point:

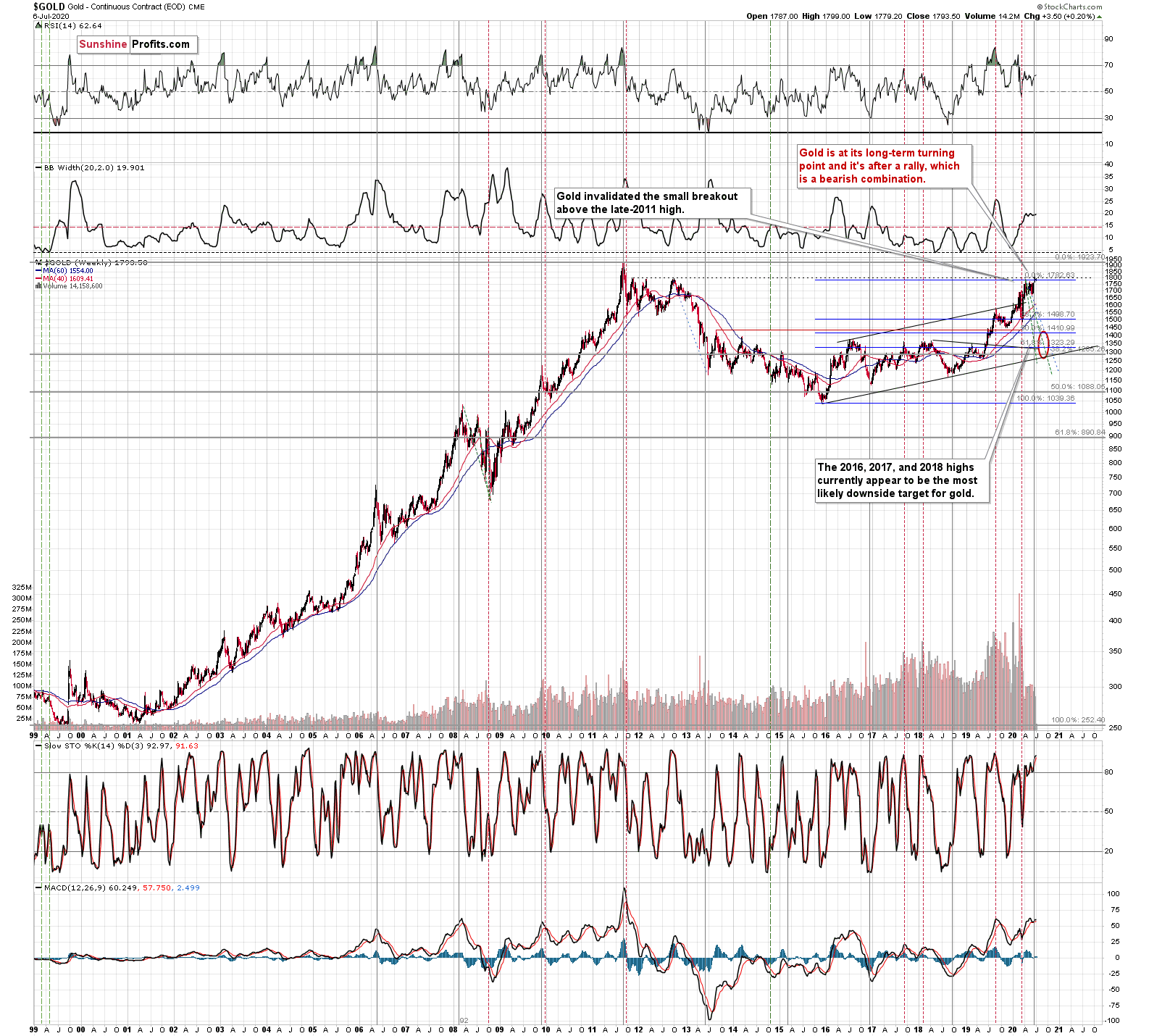

Gold's very long-term turning point is here and since the most recent move was to the upside, the implications are bearish. They are particularly bearish since gold just invalidated the tiny breakout above its November 2011 high.

Naturally, everyone's trading falls within their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound (buying miners on March 13th), and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The take-away is that the long-term turning point is a big deal, and that gold could fall significantly before it soars due to its extremely positive fundamental outlook. This also means that the downside target of $1,400 or slightly lower (the 2016 - 2018 highs) is well within the range of the possible moves.

Today's Gold & Silver Trading Alert includes multiple additional details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Diving into the Remarkable Gold Index Sign

July 8, 2020, 7:12 AMIn yesterday's analysis, we featured a gargantuan sign pointing to a very likely precious metals' turnaround. It's the extremely overbought Gold Miners Bullish Percent Index. What is truly remarkable is that we've seen its maximum reading this time, while the HUI Index is still close to 300.

It shows that the time for the rally is practically up. Yesterday, miners moved even higher, which might appear to invalidate this point, but it absolutely isn't the case. The situation in the mining stocks continues to be extremely overbought from the short-term point of view, and a day of higher prices doesn't change anything. In fact, the extremely overbought indication doesn't tell us that the market has to decline right now - it tells us that it's very likely to decline now or shortly.

Such were our words on Monday:

This could mean that the top is already in, however, if the USD Index is to decline here, gold might be forced to move higher, nonetheless. We wouldn't rule out an attempt to move to or above the most recent high, but we doubt that gold futures would move above $1,820 even on a very temporary basis.

Gold is indeed making an attempt to move higher, and - as we wrote previously - we think that this attempt will not be successful. This is especially the case given gold's specific intraday price pattern in which it tops. After a sharp intraday rally (the above chart features 30-minute candlesticks), gold tops, corrects, and then makes an attempt to move slightly higher in the following hours. We marked the recent cases with green and red, and we copied them to the current situation. If gold repeats its recent topping patterns, its likely to top at about $1,815 or so. At the moment of writing these words, gold futures are trading at $1,813.75, which means that this level was practically reached.

This means that gold is likely to reverse any hour now - perhaps before the markets open in the U.S.. This means that miners are likely to invalidate their tiny breakout, thus flashing a major sell signal.

The above perfectly fits the long-term reversal signs from gold and the USD Index, and the bearish narrative for the next 1-6 weeks for the precious metals sector.

Today's Gold & Silver Trading Alert includes multiple additional details such as the current gold futures performance - but most importantly, it includes the clear discussion of the upcoming moves' details, which we think you might enjoy, want, and need right now.

Subscribe at a discount today and read today's issue ASAP.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Little-known Gold Index: From the Abyss of Boredom to Exciting Pedestal

July 7, 2020, 10:05 AMWe just saw another gargantuan sign pointing to precious metals' very likely turnaround. And once again, most investors are either not aware of it, or are choosing to ignore it (gold can only go up, right?). The signal came from the Gold Miners Bullish Percent Index. It's been months... or perhaps even years since we covered this index and the reason is simple. It was not providing any major indications, and it was plain boring.

The index rose from the abyss of boredom to an exciting pedestal as it moved to the 100 level - the highest level that it can achieve. Why is this important? Let's recall what this index means:

The Gold Miners Bullish Percent Index ($BPGDM) is a gauge of overbought and oversold conditions for the gold mining sector. It is a breadth indicator based on the number of stocks with Point & Figure buy signals (a Point & Figure chart emphasizes strong moves while ignoring small ones) within this index.

The index can take value between 0 and 100, 0 meaning extremely oversold conditions and 100 meaning extremely overbought conditions. There were only a few times when the index moved to 0 and there was only one time when it moved to 100 (before the current situation).

Practically in all previous cases, the signals were very meaningful. The first time the index moved to 0, was when gold stocks hit the rock bottom in 2008. The next time was in 2013, when the gold miners were already after a huge decline, and while it didn't mark the final bottom, it did mean that the biggest part of the move was already over and that the bottom is going to be in shortly. Then, we saw two more times when the index moved to 0: in late 2014 and in mid-2015. On both occasions, gold miners formed major bottoms.

The only previous case when the index moved to 100, was at the 2016 top, when the index was topping close to the current price levels.

And... That's it. There were no more extreme signals since this index was introduced in 2008.

With only 5 extreme cases in the past and a near-100% efficiency in timing the major turning points, the fact that the Gold Miners Bullish Percent Index just hit the 100 level is a screaming sell signal for the precious metals sector.

It perfectly fits the tendency for the USD Index to start huge rallies close to the middle of the year, and gold's long-term turning point.

In yesterday's gold trading analysis, we emphasized the following major facts:

- In mid 2008, the USDX first moved lower before truly soaring.

- In Q3 2011 (close to the middle of the year), the USDX also moved lower, forming a broad bottom, before soaring sharply.

- In mid 2014, the USD Index also dipped while being between the 50-day moving average (marked with blue) and the 200-day moving average (marked with red) - exactly where they are right now.

- In 2016, the USD Index moved a bit lower and reversed (at about 93) before the middle of the year. That was also when gold topped.

The biggest rallies in the USD Index of the previous years started in the middle of the year. But this specific pattern goes beyond that. There were numerous smaller rallies that started in the middle of the year or close to it. There were also tops, which would indicate that mid-year is actually an important turning point for the U.S. currency, but most of them were bottoms, especially in recent years. Since the most recent move was down, the implications are bullish for the USDX and bearish for gold.

Gold's very long-term turning point is here and since the most recent move was to the upside, the implications are bearish. They are particularly bearish since gold just invalidated the tiny breakout above its November 2011 high.

Naturally, everyone's trading falls within their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

Today's Gold & Silver Trading Alert includes multiple details such as the current gold futures performance or a dig into the miners - but most importantly, it includes the clear discussion of the upcoming moves' details, which we think you might enjoy, want, and need right now.

Subscribe at a discount today and read today's issue ASAP.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Bearish Combination of Soaring Silver and Lagging Miners

July 6, 2020, 10:12 AMSilver is moving up quite shortly today, which sounds bullish, until one realizes that silver tends to be particularly strong right before the precious metals market tops. And you know what's the other thing that quite often happens at the tops, in addition to silver's temporary strength? Miners tend to underperform. What did gold miners do on the last trading day of the previous week?

Miners reversed and ended the day over 1% lower, even though the GLD ETF ended the day slightly higher. Consequently, this piece of the puzzle seems to be in.

Remember when we wrote that the situation right now is similar to what happened in March, but this time it takes longer for everything to develop due to the change in market's perception of risk? To make a long story short, the March coronavirus panic was because the entire world was dealing with the unknown, which exacerbated the fear. Right now, the situation is worse, and it goes worse almost on a daily basis, but people are not as afraid. The economic implications don't appear so dire either. And it's definitely nothing unknown - we more or less know what to expect.

This means that we're likely to see a repeat of what we saw in March, we're likely to see it in "slow motion", at least for some time. Please note that even slow-motion mode of the mid-March plunge would still be very volatile.

The areas that we marked with red rectangles are similar in terms of shape, but the current one is about 4x longer. The previous pattern was characterized by a decline and a correction that took more or less the same time to complete. If we're about to see something similar also this time, then we can expect the top to be formed this week.

If the March decline took 5 trading days and the price moves are taking 4x as long this time, then perhaps we would see a monthly decline to the final lows instead of a weekly one. This would serve as a perfect "handle" for the massive, long-term "cup and handle" pattern in gold.

Today's relatively weak performance of the mining stocks seems to confirm the above. The implications for the next 1-6 weeks are bearish.

Today's flagship Gold & Silver Trading Alert includes multiple details, but most importantly, it includes the clear discussion of what will be the sign telling one that gold's move lower is almost certainly completely over. That's the detail, we think you might enjoy, want, and need right now.

Subscribe at a discount today and read today's issue ASAP.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM