tools spotlight

-

Gold's Major Invalidation Serves as a Major Sign

July 2, 2020, 5:07 AMIn yesterday's analysis, we wrote that we didn't trust gold's breakout above the November 2011 high and that we thought that it will be invalidated shortly. We didn't have to wait for long. Gold invalidated this breakout several hours after we posted the above.

Invalidation of a major breakout is a major bearish development and a confirmation of the outlook that we outlined previously. In particular it indicates that gold has just topped or that it will top shortly. Quoting yesterday's analysis:

Gold just moved to the November 2011 high and in today's pre-market trading it even moved above it. The volume on which gold moved up last month was relatively small, which doesn't support the bullish case, but a confirmed breakout above the November 2011 high would be an important technical development, nonetheless.

The key word here is "confirmed". The November 2011 high was $1,804.40, and at the moment of writing these words, gold futures are trading at $1,805.15 - that's less than $1 above the above-mentioned high.

The way in which gold moved between 2012 and 2020 created a near-perfect cup from the cup-and-handle formation. Generally, the bigger the base, the stronger the move, and this time the base is huge. Still, the "handle" of the pattern is still missing, and it could take form of a volatile plunge. This would be in tune with how gold reacted to the first wave of coronavirus.

The breakout above the November 2011 high is far from being confirmed, and in our view it's unlikely to be confirmed. Why?

There are multiple reasons for it, but the most precise and technical ones are gold's likelihood to reverse its direction based on the triangle-vertex-based reversal and the long-term cyclical turning point.

The resistance line, above which gold tried to break and the rising support line based on the March and June lows cross more or less in the first days of July. The triangle-vertex-based reversals have pointed to many important tops and bottoms in the recent weeks and months.

We previously wrote that the above-mentioned reversal might correspond to a bottom in gold, but as of today, it's clear that if any reversal is to take place, it's going to be a top, not a bottom, as gold's most recent short-term move has been up.

Yesterday's top took place very close to the reversal, but at the same time it was not reached precisely. Consequently, we wouldn't be surprised to see one final pop up before the slide. This doesn't have to take form of a move to or above yesterday's high - it could be a smaller move up, just like the one that we saw in the first half of March - the final move higher on the right side of the area marked with a blue ellipse.

Let's keep in mind that gold's long-term turning point is here (the vertical gray line on the chart below), which further emphasizes the likelihood of seeing a major turnaround right now.

We already wrote this previously, but it's worth restating that the rising coronavirus cases have initially (!) triggered a precious metals sell-off in March and something similar is likely to take place shortly. The sell-off started when people started really considering the economic implications of the pandemic and the lockdown, so this kind of thinking is likely to be back once the pandemic prevention mechanisms are going to be re-introduced on a bigger scale.

Please remember that the longer the authorities wait with re-introducing the social distancing measures, the worse the situation is likely to be. And it's getting worse quite fast.

We just saw a fresh high in new daily Covid-19 cases both: globally, and in the U.S..

With no new social distancing measures, this trend is likely to stay in place and the longer we wait, the worse it will be, and likely the more severe the measures will have to be taken.

And, in my view, once those measures are finally taken, the stock market and the precious metals market (initially) are likely to slide.

Summary

Summing up, gold stole the spotlight, trying to break above the $1,800 barrier and the November 2011 high, but this move was quickly invalidated, which served as a bearish confirmation. Gold did end the previous month and quarter at exceptionally high level, but the monthly volume was low, and it was the only part of the precious metals market that showed this kind of strength. Silver is just a few dollars above its 2015 low and over $30 below its 2011 high, while miners are trying to get above their 2016 high - well below their 2011 high. Given the above and gold's looming reversals, I think that a big decline is in the cards for the entire precious metals sector.

If you enjoyed today's analysis and would like to get details of our trading positions and then receive follow-ups (including the intraday ones when things get hot on the market), we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Gold's Major Reversal to Create the "Handle"

July 1, 2020, 7:29 AMGold just closed the month and quarter and its performance on the final day of both was very encouraging for the bulls. What's going on and what changed?

Let's start with the big picture.

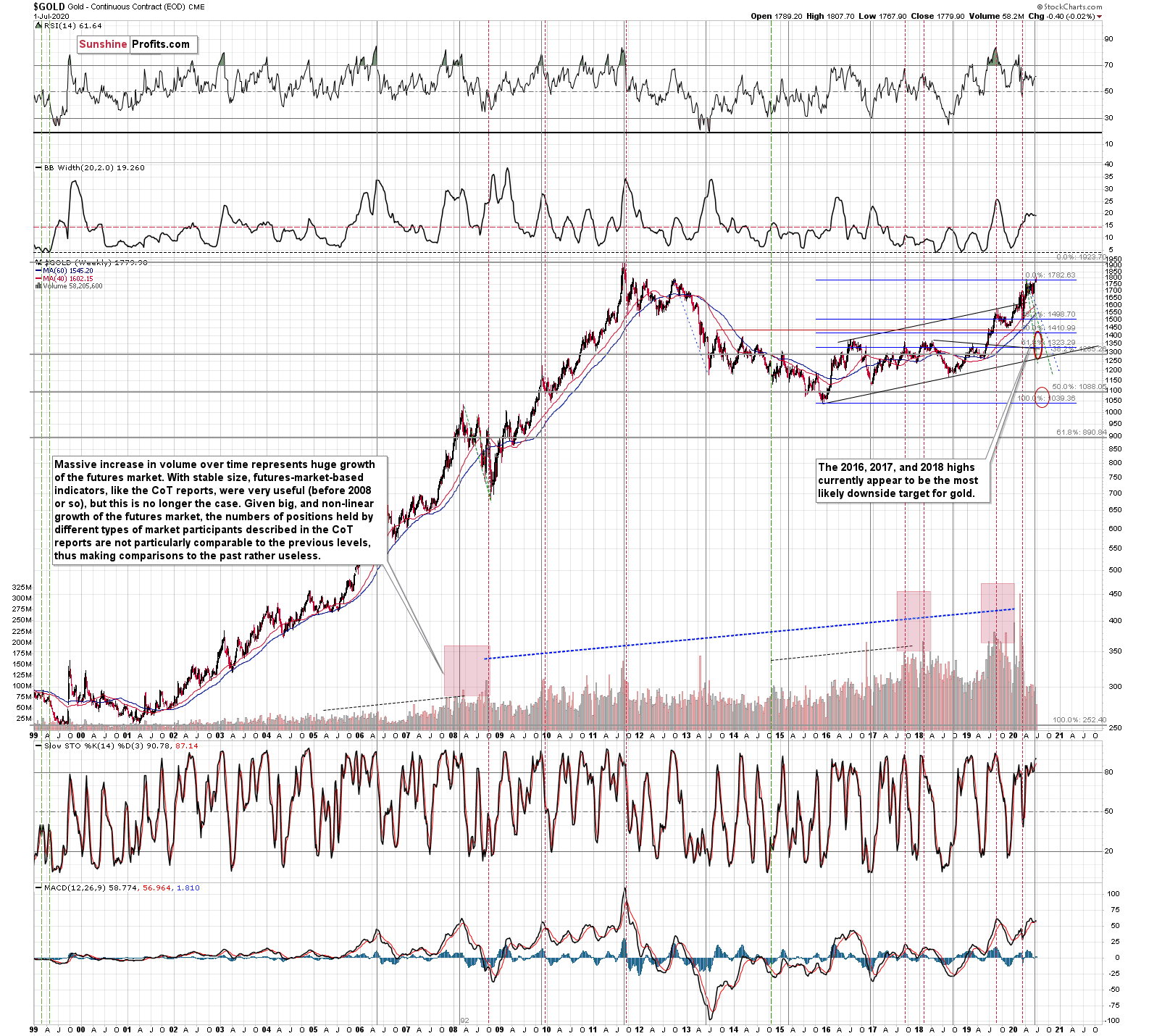

Gold just moved to the November 2011 high and in today's pre-market trading it even moved above it. The volume on which gold moved up last month was relatively small, which doesn't support the bullish case, but a confirmed breakout above the November 2011 high would be an important technical development, nonetheless.

The key word here is "confirmed". The November 2011 high was $1,804.40, and at the moment of writing these words, gold futures are trading at $1,805.15 - that's less than $1 above the above-mentioned high.

The way in which gold moved between 2012 and 2020 created a near-perfect cup from the cup-and-handle formation. Generally, the bigger the base, the stronger the move, and this time the base is huge. Still, the "handle" of the pattern is still missing, and it could take form of a volatile plunge. This would be in tune with how gold reacted to the first wave of coronavirus.

The breakout above the November 2011 high is far from being confirmed, and in our view it's unlikely to be confirmed. Why?

There are multiple reasons for it, but the most precise and technical ones are gold's likelihood to reverse its direction based on the triangle-vertex-based reversal and the long-term cyclical turning point.

The resistance line, above which gold tried to break and the rising support line based on the March and June lows cross more or less in the first days of July. The triangle-vertex-based reversals have pointed to many important tops and bottoms in the recent weeks and months.

We previously wrote that the above-mentioned reversal might correspond to a bottom in gold, but as of today, it's clear that if any reversal is to take place, it's going to be a top, not a bottom, as gold's most recent short-term move has been up.

Let's keep in mind that gold's long-term turning point is here (the vertical gray line on the chart below), which further emphasizes the likelihood of seeing a major turnaround right now.

The reversals provided by the above-mentioned techniques are actually relatively close to each other given that this is already the first week of July, and that the second week of the month starts in just 2 trading days (the markets are closed in the U.S. this Friday).

The implications here is clear - don't count on gold's breakout's success.

The HUI Index is once again trying to break above the 2016 high. Although it might move higher today, we doubt that it would be able to hold its gains for a long time, in light of gold's looming reversal. Instead, another invalidation of the reversal is likely.

And silver?

The white metal showed strength as well, rallying almost to the previous 2020 highs. As dramatic as it may sound, please note that silver just a few dollars above its 2015 low and over $30 below its 2011 high. Miners are disappointing too - it is only gold that is stealing the spotlight. And it's doing so on relatively low volume, making its entire "strength" doubtful.

Silver broke above its declining green resistance line... Once again. This line is based on the 2011 high and the 2019 high. There were three previous attempts of the white metal to break above this line and they all failed. Is this time any different? We doubt that, especially given gold's reversal indications.

And in particular, given the rising coronavirus cases that initially (!) triggered a precious metals sell-off in March. The sell-off started when people started really considering the economic implications of the pandemic and the lockdown, so this kind of thinking is likely to be back once the pandemic prevention mechanisms are going to be re-introduced on a bigger scale.

Summary

Summing up, gold is stealing the spotlight, trying to break above the $1,800 barrier and the November 2011 high, but it's unlikely to be able to confirm this move. Gold did end the previous month and quarter at exceptionally high level, but the monthly volume was low and it was the only part of the precious metals market that showed this kind of strength. Silver is just a few dollars above its 2015 low and over $30 below its 2011 high, while miners are trying to get above their 2016 high - well below their 2011 high. Given the above and gold's looming reversals, I think that a big decline is in the cards for the entire precious metals sector.

If you enjoyed today's analysis and would like to get details of our trading positions and then receive follow-ups (including the intraday ones when things get hot on the market), we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Technical or Fundamental Trigger for Gold

June 30, 2020, 4:53 AMVery little happened on the precious metals market yesterday and the related markets, but it seems that we might see something more interesting today.

The USD Index (third from the bottom) reversed and at the moment of writing these words, it's testing the previous June highs. A clear breakout above these highs might prove to traders that what we've been seeing in the past few weeks is not just a zig-zag correction, but a beginning of a new major rally.

This could trigger - technically - the bigger moves in all markets, not only the USD Index. As the USDX soars, stocks would be likely to slide, and the same fate would be likely for PMs and miners.

There could be - and likely will be eventually - a fundamental trigger for these moves anyway, which is why we are forecasting gold at much higher levels in the following years but not in the following weeks.

The new coronavirus cases are growing quickly and now only 16 states have the Rt number below 1. In other words, the number of new cases is declining in 16 states, and its growing in the remaining states. The snowball of new cases is growing, and the authorities will have to deal with it in one way or another. The social distancing procedures are being reintroduced only a little, and let's keep in mind that the longer the delay, the more severe the consequences will ultimately be. At some point more serious measures will have to be taken, and they will likely impact the economy to a degree that's much greater than what people are currently expecting. It was when people focused on the dire economic implications of the pandemic and lockdown that the markets really moved, and PMs plunged. We are still before this move.

There's not much more that we can add today as far as chart analysis is concerned, but we would like to reply to the questions that we received recently.

Q: First of all, in 2008, the Fed did not start an aggressive bond buying programs until after the PM and the stock markets tanked. The Fed is now all in and will prevent the market and PM to decline significantly as it did in March.

A: The Fed didn't start the bond buying programs until after the PMs and stock markets tanked in 2008, but it was supposed to be the new shocker back then. What the markets were used to previously were rate cuts, and the Fed had cut those previously - as the prices declined. The markets are now used to both: rate cuts and QEs. And each QE worked less effectively than the previous one.

If the Fed is already all-in, then how will they prevent further shock the market to prevent declines? What new shocker would they provide? By definition, being all in, means that one can't add anything more.

And stocks are likely to slide anyway, because the Fed can't fix the broken supply chains, nor can it make people go out, conduct businesses in the regular way and convince people that "nothing is really going on, you don't have to save your cash for hard times". In 2008, we had liquidity crisis, and the Fed injected liquidity - it helped, but the economic damage was substantial anyway. Right now, we have a different type of crisis. It's not the lack of liquidity that's the problem, but rather the pandemic, which can't be treated with dollars only. The market seems to have assumed that what we saw in March was a one-time event and a bad dream and that all will now be good. And it will be - in a few years. In the meantime, there will be a severe economic slump - much worse than what had already hit the markets, and much worse than what we saw in 2008.

Yet, the stock market didn't decline as low as it did in 2008, while the USD Index didn't rally as high. And gold didn't plunge as low - initially.

The Fed is already all in, while we are not in the situation in which it can really help much, as the problem is not with liquidity. Even though the situation is now much worse than in 2008, the markets have not moved as much as they did back then. This suggests that the markets are still likely to move more (in the directions in which they moved in March), while the Fed won't be able to do much about it. This doesn't bode well for stocks in my opinion. It does bode well for gold, but not initially. During both: 2008 and March 2020 slides, gold showed that it's likely to initially decline along with stocks and along with rising USD Index, and rally only after the decline. The above is very positive for gold, but not initially.

Q: GS now upped its forecast to 2000 and BAC has a 3000 target. Why are you so aggressive in you down side targets? PMs might will touch their march lows, but even that seems impossible given the current circumstances. Why not include some possible interim target prices above your profit-take exit prices in GDXJ and GDX. Will there not be stops along the way.

A: The profit-take exit prices are based on what is really likely to happen in the precious metals sector. It's taking more time than I had originally expected it to, but the stock market is likely to move much lower in my opinion and it's likely to take mining stocks along with them.

As far as interim price targets are concerned, each support level (based on the previous lows and the Fibonacci retracements) could trigger a quick rebound during the decline.

However, the two most important things details are not visible on the above chart.

The first is that we will likely get the opportunity to move from mining stocks to silver as the latter tends to outperform in the final part of a given move. We don't know at what prices it would take place, but we are monitoring the situation for the day (or days) when miners slide very profoundly while silver declines only somewhat. This would likely be the "switch" day. At that time - if we spot this occasion - we would close the position in miners and open one in silver. If it's too unclear, we would likely ride the decline in the miners.

The second thing is the day when gold reverses and moves back up while the USD Index continues to rally. This is what happened in 2008, and what happened in March 2020. It served as a major buy signal, and we expect it to mark the end of the decline also this time. This signal will be more important than the price that gold, silver, or mining stocks have at that time.

Summary

Summing up, the outlook for the precious metals market is extremely bearish for the next 1-3 weeks due to the huge number of bearish signs (and their strength) that we have right now, and how likely PMs are to repeat their March slide to a significant extent). The sharply rising new Covid-19 cases numbers as well as gold's long-term cyclical turning point both suggest that gold's one final slide is just around the corner.

If you enjoyed today's analysis and would like to get details of our trading positions and then receive follow-ups (including the intraday ones when things get hot on the market), we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

New Covid-19 Highs, New Major Price Moves

June 29, 2020, 8:02 AMThe second wave of Covid-19 is here and while it makes gold's potential even better in the long run, it's likely to mean a sharp decline beforehand.

It might be tempting to focus on something else, to look the other way, or to limit testing, but the difficult fact is that the Covid-19 pandemic is developing after a several-week-long pause. There are new highs in the number of new daily cases both: globally, and in the U.S.

The second wave is not yet present in Europe, but please keep in mind that it could become a severe problem very fast. As the entire world has more and more coronavirus cases, and the economies are being reopened, it will be very hard to avoid the second wave in Europe.

The new daily cases in Israel clearly show how a supposedly contained situation can easily get much worse in a relatively short period.

Why is this important from the gold investment and gold trading point of view? Because the markets appear to have viewed the March price moves as a one-time event triggered by also a one-time event. And the markets are just starting to wake up to the fact that it doesn't work this way at all.

The number of searches for the "coronavirus cases" phrase in the U.S. is on the rise again, but it's not yet significantly higher than what we saw in mid-March. People are not yet panicking once again, but the trend is already in place.

The re-opening schedules are being canceled and some small lockdown measures are being introduced but their extent is not yet significant. People are already starting to get that they were way too optimistic regarding the recovery, but we are early in this process. The above search chart from Google Trends indicates that and performance of the general stock market confirms it.

The huge volume on which the S&P 500 reversed on Friday was likely an indication of the change in the market sentiment, which is still remarkably positive compared to what's going on. It's as if we were not in the early part of the biggest economic disaster of the last several decades.

It seems that the markets will soon catch up to the (unfortunately - grim) reality and decline much more. In the early part of the move, the precious metals market is likely to decline, just like it had declined in the first half of March. It's likely to then rally more profoundly, and soar well above the 2011 highs, but it's unlikely to happen without a slide first.

The situation in the USD Index continues to support the bearish case in the next 1-3 weeks, but at the same time it also explains why gold hasn't plunge just yet.

From the short-term point of view, the situation in the USD Index was very similar to what we saw in early March. At this time, it's clear that it's not 100% similar, but that there's a significant difference when it comes to timing and volatility. The situation is now developing less dynamically, as the authorities are reluctant to impose new lockdown measures, knowing how big declines in stocks followed, and gold was reacting primarily to the economic changes - people ran for the hills and then craved the safety of the U.S. dollar - at least initially. Right now, the situation is not yet critical in people's view, which is most likely why the USD Index is moving up in a steady manner instead of moving up sharply.

What is key here is that the situation can change quickly, just as it changed in March. Now the states are looking at each other and nobody wants to be the first to seriously limit the economic activity let alone force people to stay home. But as the cases grow to new highs, and as the number of deaths grow, people will likely get scared once again, and the more severe lockdown measures are likely to be re-introduced. That's when the USDX would be likely to soar with vengeance, and gold would be likely to slide - at least initially.

Technically, the USD index didn't manage to break above its mid-June highs and instead it reversed on both: Thursday and Friday. Consequently, many traders are likely viewing the June rally as a zigzag - a correction within a decline. We disagree with this interpretation, because of the favorable long-term chart, the similarity to what happened in February and March, and the way in which the new Covid-19 cases are growing in the U.S..

Summing up, the precious metals market is likely to decline in the short term (and only in the short term! gold is likely to soar in the following months!) along with the big decline in the stock prices and the decisive upswing in the USD Index. This is quite likely to correspond to renewed lockdown orders, which are just starting to emerge. Given how quickly the pandemic is developing, the above actions and price moves are likely just around the corner.

Today's flagship Gold & Silver Trading Alert includes multiple details, but most importantly, it includes the clear discussion of what will be the sign telling one that gold's move lower is almost certainly completely over. That's the detail, we think you might enjoy, want, and need right now.

Subscribe at a discount today and read today's issue ASAP.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Gold and New High in U.S. Corona Cases

June 26, 2020, 6:12 AMAvailable to subscribers only.

Today's Gold & Silver Trading Alert includes multiple details, but most importantly, it includes the clear details of our current trading position and our long-term investment positions. We think you might enjoy, want, and need them right now.

Subscribe at a discount today and read today's issue ASAP.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM