tools spotlight

-

Juniors' Decline Might Surprise Even the Bears

October 25, 2019, 7:01 AMYesterday's analysis featured the price target for the junior miners, and we used GDXJ as a proxy for the sector. That's not the only proxy out there though, and looking at a different one - Toronto Stock Exchange Venture Index - provides us with an enormously important confirmation. Before moving to the chart, a few words why this index is a proxy for juniors, and why it's not as perfect. It can be used as a proxy for juniors because literally hundreds of junior mining companies are listed on this exchange. It's not a perfect proxy, because there are also other companies listed there that are not even close to the mining business such as tech stocks.

So... What's going on in this proxy for junior miners?

It's declining - that's what's happening. In particular, it declined below the rising medium-term support line that's based on two profound and clear bottoms: the 2016 and 2018 lows. And it's not something that happened just yesterday. It happened about 3 weeks ago and unless the TSX Venture Index rallies today, this week's close will mark the third consecutive weekly close below this line. That's important, because this means that the breakdown - even though it's tiny - was just confirmed. And confirmed breakdowns are likely to be followed by further declines.

Now, the more significant the support that was broken, the bigger decline one can expect, and the line that was just broken is definitely significant.

But maybe the tech stocks just underperformed?

Fat chance - the Nasdaq is very close to its all time highs, so the odds are that it was not the technology sector that dragged the index lower.

Please note how closely did the TSX Venture Index follow precious metals sector (lower part of the chart includes gold, silver, and HUI - proxy for gold stocks) higher in 2016 and how the subsequent decline happened at the same time. The 2018 decline was also more or less in tune. The sizes of the moves were different, but overall, prices moved in the same direction on average in the medium term.

This means that the confirmed breakdown in the TSX Venture sends a huge warning to the gold, silver, and mining stock bulls. It's not an immediate-term or even a short-term sign (we have plenty of them coming from other places), but it is a powerful sign pointing to sector-wide decline in the following months. We have been warned by yet another market. Those who refuse to listen will have to face the costly consequences.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Gold & Silver Trading Alert - this analysis' full version. There, we discuss gold outlook in more detail, yesterday's platinum developments or the very short-term PMs situation. Finally, we've also included a helpful summary of the gold move's determinants at play. Taken together, these paint a coherent picture of what's likely to come in the following months. The full Alert includes detailed price targets for gold, silver, and the GDX ETF as well as related leveraged ETNs. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Platinum's Confirmation and Price Target for Juniors

October 24, 2019, 7:27 AMIn yesterday's analysis we wrote about platinum's recent strength, and how it should not be taken at its face value. The reason is that platinum has been the weakest part of the precious metals sector in the previous months (and years), which means that the recent show of strength was likely a strong indication that the investment public has entered the precious metals market. That's something that happens at the tops, so one should be prepared for lower, not higher prices.

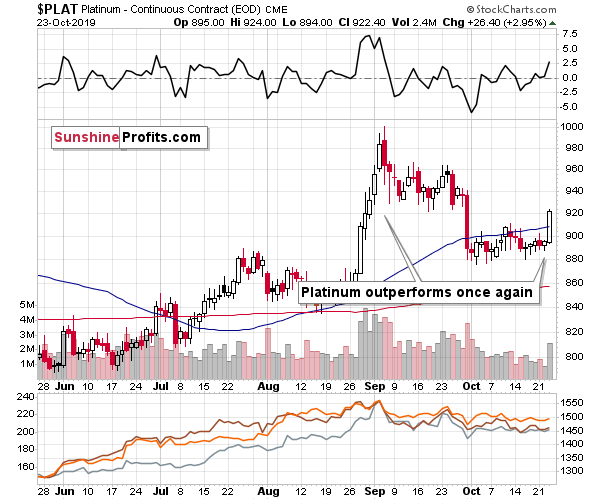

We didn't have to wait long for the same kind of signal to be repeated on a smaller scale - it happened yesterday.

The rally that we saw yesterday was not as big as what we saw in late August as it was just one day. But, this one day amounted to more than platinum rallied in all previous days of October and it was the biggest daily gain since the beginning of September. Just as we wrote yesterday, this doesn't bode well for the entire precious metals market, for two reasons:

The first detail is that any market that is generally weak, but then acts strong at a certain time, might simply be rallying just because everything is rallying as the investment public (that enters the market last and buys close to the top) is buying everything without looking at its potential. And in particular if something looks cheaper than something else (e.g. because it was declining previously or precisely because it has unfavorable fundamentals). This means that just by looking at the performance of the weak parts of a given market one can detect the moment, when the investment public is entering the fray, and thus that the top is being formed.

The second detail is that platinum is currently the weakest part of the precious metals sector and this perfectly fits the above-mentioned type of reaction. The size of the platinum market is also relatively small. The fundamental situation for platinum is rather grim as it's being used as a catalyst for diesel car engines that are no longer as often produced as in the past. Gasoline engines are growing in popularity relative to the former and in their case, palladium is used. Both could be hit when electric cars start to take over the market, but that's something that will take many years. The fundamental outlook is one source of information and the technical situation is another one [and the decline in the platinum to gold ratio confirms the above].

The rally that we saw in platinum in August confirmed the end of a multi-week rally in the precious metals sector. Yesterday's upswing in la platina may not seem significant enough to matter, but let's keep in mind that gold, silver, and mining stocks are currently after a small rally that took several days, not after a several-month-long one. Consequently, just a daily - but significant - show of strength from platinum may be enough to confirm that the top is in, or very close to being in.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Gold & Silver Trading Alert - this analysis' full version. There, we dive deep into the miners, both seniors and juniors, and the very short-term PMs situation. Finally, we've also included a helpful summary of the gold move's determinants at play. Taken together, these paint a coherent picture of what's likely to come in the following months. The full Alert includes detailed price targets for gold, silver, and the GDX ETF as well as related leveraged ETNs. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

Little Silver's Big Signal

October 23, 2019, 8:56 AMWould you like to invest in platinum?

"What? Why platinum?" - you'd probably ask back. And correctly so, this shiny metal has been declining in the previous years and only recently did it show some decent strength. And this may not sound important at all if you're only considering investing in gold, silver, or mining stocks (like most precious metals investors) or are already holding them, but it actually is.

In the interconnected and globalized economy there are very few (if any) assets that can move totally on their own. In particular, we can see similarities in movement of assets from the same sector. Like gold and silver. And - in some cases - platinum.

This means that at times, looking at platinum can tell us something not only about the little silver (that's what platina actually means), but about the rest of the precious metals sector. This appears to be the case right now.

What does the platinum chart say in general?

It's emphasizing how strongly platinum rallied in previous months... After being so weak in the previous years. The long-term trend remains down as platinum didn't break above the rising red resistance lines - the attempt to move above the lower one was invalidated. On a short-term basis, the rally was noticeable to say the least. What does it suggest?

It doesn't suggest anything per se, but once we combine it with two details, it becomes important.

The first detail is that any market that is generally weak, but then acts strong at a certain time, might simply be rallying just because everything is rallying as the investment public (that enters the market last and buys close to the top) is buying everything without looking at its potential. And in particular if something looks cheaper than something else (e.g. because it was declining previously or precisely because it has unfavorable fundamentals). This means that just by looking at the performance of the weak parts of a given market one can detect the moment, when the investment public is entering the fray, and thus that the top is being formed.

The second detail is that platinum is currently the weakest part of the precious metals sector and this perfectly fits the above-mentioned type of reaction. The size of the platinum market is also relatively small. The fundamental situation for platinum is rather grim as it's being used as a catalyst for diesel car engines that are no longer as often produced as in the past. Gasoline engines are growing in popularity relative to the former and in their case, palladium is used. Both could be hit when electric cars start to take over the market, but that's something that will take many years. The fundamental outlook is one source of information and the technical situation is another one.

The technicals perfectly confirm the fundamentals. Platinum has been continuously underperforming gold despite local rallies. There were attempts to break above the declining long-term resistance line, but they all failed. The value of the ROC indicator in the upper part of the chart just reached its resistance line, which suggests that another downturn is likely. Simply put, the outlook for the platinum to gold ratio and platinum itself looks very unfavorable.

This, plus the simple fact that platinum seems cheap compared to gold makes it perfectly fit the situation described previously. Platinum is the weakest part of the precious metals sector and it had recently rallied.

This means that the precious metals investment public has likely entered the market in August - when platinum outperformed and topped. And what does it signal for gold and the rest of the PMs? This means that the major top was most likely formed not just in platinum, but in the entire precious metals market, as that's the market most closely related to platinum.

All in all, even if you're not interested in investing in platinum (and likely rightfully so), it's worth paying attention to what this white metal is doing. It recently suggested that a medium-term top formed and that lower prices across the precious metals board are to be expected. This is yet another warning sign for the precious metals bulls. Surely, there will most likely be times when gold and silver are trading well above their 2011 highs, but it's unlikely to take place before we see a big decline first.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Gold & Silver Trading Alert - this analysis' full version. In the full version we discuss also silver outlook in detail, or the very short-term PMs situation. Finally, we’ve also included a helpful summary of the gold move’s determinants at play. Taken together, these paint a coherent picture of what's likely to come in the following months. The full Alert includes detailed price targets for gold, silver, and the GDX ETF as well as related leveraged ETNs. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

The Notable Silver Signal

October 22, 2019, 7:36 AMYesterday, we wrote that the Brexit saga continues with no clear and irreversible decisions and we can say exactly the same thing today. We also wrote that this didn't mean that we hadn't had any new signals. Actually, we did have them. And we can say the same thing today. The way silver soared, stopped and erased almost the entire daily gain only to close back below the declining resistance line - that is all very informative. Let's take a closer look.

Silver seems to have broken above the declining resistance line, but all it really did was catching many silver bulls by surprise. As silver quite often does. Just look at the late-September rally. Seemed encouraging at that time but it was just another of the white metal's fake-outs. The invalidation of a breakout is a bearish phenomenon as it emphasizes how artificial and inconsequential the very recent "strength" was. This goes double for the silver market as it's known for this type of behavior. That's why silver's breakouts should be raising eyebrows instead of generating an immediate jump into the market with both feet. Especially, if neither gold, nor mining stocks confirm the move.

All in all, silver's yesterday's action has bearish implications for the short run.

That's far from the only interesting thing about the current silver price, though.

Despite the recent quick upswing, the white metal remains below the 2018 high. This might not be obvious at first sight, because the May - August rally makes everything appear more bullish than it should. We added a horizontal line on the chart (please feel free to click it to expand it) to make it clear that the current price and the price of the 2018 high are practically the same. And the late-September decline invalidated the earlier breakout above it. This is another bearish indication - not a very strong one, but still one, nonetheless.

The 50-day moving average (red) just declined below the 200-day moving average (blue), which is a classic sell sign, known as the "death cross". It sounds quite scary, but in reality both: the death cross and its opposite - the golden cross, are patterns that are ineffective in case of gold and silver. The above links provide explanations for gold, but just looking at the above chart can tell you that quite often these indications work in the opposite to how one might think. The classic example would be buying silver in April 2018, when the red line rallied above the blue line when silver soared. And that was practically the top. In March 2019, the red line moved below the blue line which marked the end of a short-term decline - meaning that the death cross actually had bullish implications in the short run. In July 2019, the golden cross meant... a local top and a short-term decline in the following days.

We saw the death cross several days ago and... Silver rallied shortly thereafter. What does it mean right now? It means that silver is likely to decline anyway, but not because of the death cross. And the rally that the death cross might have actually (falsely) indicated seems to be already over given yesterday's reversal.

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Gold & Silver Trading Alert - this analysis' full version. In the full version we discuss also gold, mining stocks, and the USD Index movement, which - taken together - paint a coherent picture of what's likely to come in the following months. The full Alert includes detailed price targets for gold, silver, and the GDX ETF as well as related leveraged ETNs. We also include two time targets where the short-term reversals could take place. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to subscribe today.

-

What Will It Take to Make Gold Rally?

October 21, 2019, 7:52 AMThe Brexit saga continues with no clear and irreversible decisions. Over the weekend, the can was kicked down the road again (and again appears on the menu today), but we doubt that anything major will change. What may be surprising to some, this doesn't mean that we don't have any new signals. Actually, we do. The way gold (hasn't) reacted to sharply lower USD values and the UK turmoil in general, tells a lot about the next big move brewing.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM