tools spotlight

-

Mining Stocks: The Signs of Weakness

May 28, 2021, 9:51 AMWhen gold rallies, mining stocks should follow suit. If they don’t do that, bears probably lurk somewhere near – are we seeing alarming signs?

In the previous analyses, I wrote about the reversals in gold and the USD Index, and I emphasized that the weakness in mining stocks (which refused to follow gold to new highs) was a strong confirmation of the bearish scenario for the near term. And that’s what seems to be taking place right now.

Let’s take a look at the charts, starting with the USD Index.

USDX – Is Bottom Finally In?

In terms of daily closing prices, the USD Index moved lower yesterday – by 0.07. However, it’s up by more than that, so overall we can say that the move higher in the USDX continues.

From the very short-term point of view, this move higher is encouraging because it took the USDX above both: the declining resistance line based on May’s highs, and the declining resistance line that started with the late-March high.

This is important not only (and not primarily) because of the double-breakout. It’s important and particularly bullish, as it emphasizes that the third – and quite likely the final – short-term bottom in a row is already in. Consequently, my previous comments on the above chart remain more than up-to-date (as they are being validated by current market action):

This week’s move lower is a continuation, and most likely the final part, of a specific multi-bottom pattern that the USD Index exhibited recently.

I marked those situations with green. The thing is that the U.S. currency first declined practically without any corrections, but at some point it started to move back and forth while making new lows. The third distinctive bottom was the final one. Interestingly, the continuous decline took place for about a month, and the back-and-forth declines took another month (approximately). In July 2020, the USDX fell like a rock, and in August it moved back and forth while still declining. In November 2020, the USDX fell like a rock (there was one exception), and in December it moved back and forth while still declining.

Ever since the final days of March, we’ve seen the same thing all over again. The USD Index fell like a rock in April, and in May we’ve seen back-and-forth movement with lower lows and lower highs.

What we see right now is the third of the distinctive lows that previously marked the end of the declines.

And what did gold do when the USD Index rallied then?

In August, gold topped without waiting for USD’s final bottom – which is natural, given how extremely overbought it was in the short term.

In early January, gold topped (which was much more similar to the current situation given the preceding price action) when the USDX formed its third, final distinctive bottom.

The USD Index is after a two-month decline, half of which was the back-and-forth kind of decline. It’s forming the third – and likely the final – bottom, and gold just refused to react positively to this situation in today’s pre-market trading.

This might be “it” – the markets might be forming their final reversals here, starting to follow the most bearish (in the case of gold) part of the analogy to the price action in 2008 and 2012.

I received a few questions recently asking what would need to happen for me to change my mind on the precious metals sector’s outlook. There are multiple reasons, and it’s impossible to list all of them. However, one of the reasons that would make me strongly consider that the outlook has indeed changed (at least for the short term) would be a confirmed breakdown in the USD Index below the 2021 lows to which gold would actually react.

History Rhymes

At the moment of writing these words, gold is already back below the $1,900 mark – at about $1,890, which means that the breakout above this psychologically important level was invalidated. Moreover, it happened very close to the gold triangle-vertex-based reversal point, with RSI well above 70 (extremely overbought) and – most importantly – in near-perfect tune with how the final pre-slide tops formed in 2008 and 2012. Needless to say, the implications are very bearish.

My previous comments on gold charts remain up-to-date:

Gold seems to be insisting on repeating – to some extent – its 2012 performance, and – to some extent – its 2008 performance. Either way, it seems that gold is about to slide.

The initial reversal in gold took place after gold moved very close to its mid-January highs and the 50% Fibonacci retracement based on the August 2020 – March 2021 decline. Yesterday’s close was the first close above this important resistance, so the breakout was not confirmed.

The sizes of the current rally (taking the second March bottom as the starting point) and the rally that ended at the beginning of this year are practically identical at the moment. The current move is only a little bigger.

Just as the rallies from early 2012 and late 2012 (marked with blue) were almost identical, the same could happen now.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher gold prices here doesn’t seem to be justified based on the historical analogies.

The thing I would like to emphasize here is that gold didn’t form the final top at the huge-volume reversal on Sep. 13, 2012. It moved back and forth for a while and moved a bit above that high-volume top, and only then the final top took place (in early October 2012).

The same happened in September and in October 2008. Gold reversed on huge volume in mid-September, and it was approximately the end of the rally. The final top, however, formed after some back-and-forth trading and a move slightly above the previous high.

Consequently, the fact that gold moved a bit above its own high-volume reversal (May 19, 2021) is not an invalidation of the analogy, but rather its continuation.

There’s one more thing I would like to add, and it’s that back in 2012, gold corrected to approximately the 61.8% Fibonacci retracement level – furthermore, the same happened in 2008 as you can see in the below chart. Consequently, the fact that gold moved above its 50% Fibonacci retracement doesn’t break the analogy either. And even if gold moves to $1,940 or so, it will not break it. It’s not likely that it is going to move that high, as in both cases –in 2008 and 2012 – gold moved only somewhat above its high-volume reversal before forming the final top. So, as this year’s huge-volume reversal took place close to the 50% retracement and not the 61.8% retracement, it seems that we’ll likely see a temporary move above it, which will create the final top. And that’s exactly what we see happening so far this week.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline. This time the rally was not as volatile, so the lower – 50% Fibonacci retracement level will hold the rally in check.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

What would change my mind with regard to gold itself? Perhaps if it broke above its January 2021 highs and confirmed this breakout. This would be an important technical indication on its own, but it would also be something very different from what happened in 2008 and 2012. If that happened along with strength in mining stocks, it would be very bullish. Still, if the above happened, and miners didn’t react at all or they declined, it would not be bullish despite the gains in the gold price itself.

Gold Stocks Refuse to Follow Gold

Gold stocks moved slightly lower yesterday, but the important thing is what happened in the previous days. And more precisely, what didn’t happen.

And what didn’t happen was that gold stocks didn’t move to new highs, while gold did. In other words, gold stocks refused to follow gold higher, which is a very strong bearish indication.

Another thing that would most likely make me bullish on the precious metals sector would be seeing strength in gold stocks despite declines in gold or back-and-forth action in it. In other words, exactly the opposite of what we’re seeing right now.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Too Much Cash – Why Abundant Liquidity May Hurt the Markets

May 27, 2021, 8:03 AMExcess liquidity caused by low interest rates is backfiring. Banks are hurriedly flooding the FED with cash. Are investors ignoring the warning signs?

Alive Once Again

With negativity coming from all corners, Mr. Market would like to make you believe that the USD Index is heading back to 75. However, after bouncing above 90 on May 26, the greenback remains undervalued and likely has plenty of room to run. Case in point: I highlighted on May 25/26 that the U.S. Federal Reserve’s (FED) daily reverse repo transactions are mirroring the volatility that we witnessed in December 2015. And while investors have ignored the unsettling behavior, with sold repos’ value spiking above $450 billion on May 26, the USD Index may be sensing that something is amiss.

Please see below:

A reverse repurchase agreement (repo) occurs when an institution offloads cash to the FED in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the FED at an alarming rate.

The green line above tracks the daily reverse repo transactions executed by the FED, while the red line above tracks the federal funds rate. Moreover, notice what happened the last time reverse repos moved above 400 billion? If you focus your attention on the red line, you can see that after the $400 billion level was breached in December 2015, the FED’s rate-hike cycle began. Thus, with current inflation dwarfing 2015 levels and U.S. banks practically throwing cash at the FED, is this time really different?

To that point, while it may not be visible on the surface, global central banks are already tightening financial conditions. Following in the footsteps of the Bank of Canada (BOC), the Reserve Bank of New Zealand (RBNZ) announced on May 26 that “we believe it is appropriate to return to our long-standing practice of publishing an OCR projection.” And while the RBNZ labeled its forecast as “conditional” and subject to “the economic outlook,” it’s clear that we’re past the point of peak liquidity.

Please see below:

To explain, the blue line above tracks the RBNZ’s Official Cash Rate (OCR). If you analyze the right side of the chart, you can see that the central bank is already projecting liftoff by mid-2022. However, with most central banks initially expecting to hold off until sometime in 2023, if rampant inflation persists, another revision could happen sooner rather than later.

Shadow Rates

Case in point: “shadow rates” signal that a major shift is already underway. To explain, economists normally use the federal funds rate to construct their economic models. However, after the initiation of quantitative easing (QE) sent some overnight lending rates below zero (like the European Central Bank’s), shadow rates became a substitute for the federal funds rate. For example, when Jing Cynthia Wu and Fan Dora Xia created the metric, the relationship meant that when the FED increased its asset purchases by 1%, the shadow rate decreased by 0.0183%. More importantly, though, with the script now flipped, reduced liquidity is leading to a rise in global shadow rates.

Please see below:

To explain, the chart above tracks the rolling one-year change across various economies’ GDP-weighted shadow rates. If you analyze the right side of the chart, not only are all regions moving higher, but some have already moved into positive territory. Moreover, with central bankers akin to private-market investors, when one animal moves the herd often follows.

As further evidence, while emerging market currencies continue to elicit strength versus the U.S. dollar, real money flows signal that a sharp reversal could be forthcoming.

Please see below:

To explain, the red and blue bars above track the real money debt and equity flows into emerging markets (excluding China). If you analyze the right side of the chart, you can see that total flows have turned negative (the black line) and equity flows (the blue bars) remain extremely negative. More importantly, though, when similar shifts occurred, the USD Index rallied from roughly 78 to 85 in 2013, from roughly 88 to north of 100 in 2015, from roughly 92 to north of 102 in 2016 and from roughly 88 to north of 97 in 2018. For context, I’m excluding the coronavirus-induced spike in 2020 because the sharp drop in real money flows is a material outlier.

What’s more, while inflationary pressures stoke fears of the greenback’s demise – based on the premise that the FED will print the dollar into oblivion – for one, the FED is likely to reduce liquidity in the coming months. Two, it’s important to remember that narratives often foster weakness in the U.S. dollar. For example, data from Morgan Stanley reveals that when the U.S. Consumer Price Index (CPI) outperforms the rest of the world, the USD Index often suffers mightily.

Please see below:

To explain, the blue line above tracks the U.S.-world CPI-spread, while the gold line above tracks the inverted year-over-year (YoY) percentage change in the USD Index. For context, inverted means that the latter’s scale is flipped upside down and that a rising gold line represents a falling USD Index, while a falling gold line represents a rising USD Index. If you analyze the relationship, you can see that when the U.S.-world CPI-spread rises, the USD Index often heads in the opposite direction.

The Euro – A Commodity-Linked Currency in Disguise

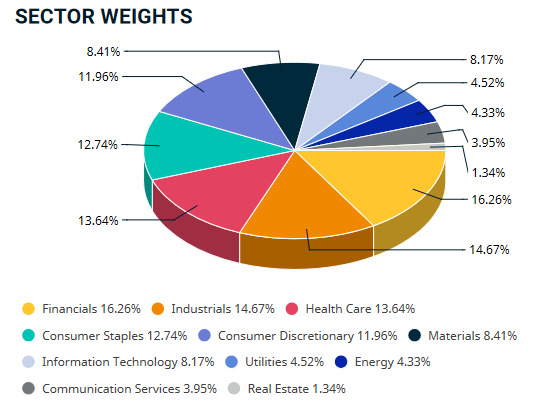

However, it’s important to remember that reflation is a boon for commodities and – in turn – commodity-linked currencies. To explain, with the Canadian dollar catching a bid during inflationary environments, rising oil prices can weigh on the USD Index. Likewise, while the euro is not considered a commodity-linked currency, the MSCI Europe Index – which represents roughly 85% of developed-market European equities – influences financials at 16.26%, industrials at 14.67%, consumer staples at 12.74% and materials at 8.41%.

Please see below:

Conversely, the S&P 500 influences financials at 11.82% industrials at 8.83%, consumer staples at 6.11% and materials at 2.82%. The key takeaway? With European bourses highly leveraged to sectors that benefit from reflation, the euro is essentially a commodity-linked currency in disguise. Thus, with investors positioning for commodities Renaissance, the euro has been a significant beneficiary. And with inflation expectations often the bearer of bad news for the USD Index, the greenback has been on the defensive in recent weeks.

Please see below:

To explain, when inflation expectations rise, notice how the U.S. dollar, the Japanese yen, and to a lesser extent, the Swiss franc (risk-off currencies) suffer the most? Conversely, when reflation is universally projected, the euro, the Canadian dollar and the pound sterling are often strong performers.

However, when expectations ease and investors are left to deal with actual inflation, notice how the roles often reverse?

The U.S. 3-Month Treasury Bill and the Core PCE Index

In addition, with the Personal Consumption Expenditures (PCE) Index scheduled for release on May 28, another sizzling print could be on the horizon.

The green line above tracks the year-over-year (YoY) percentage change in the Commodity Producer Price Index (PPI), while the red line above tracks the YoY percentage change in the headline PCE Index (which includes the inflationary effects of food and energy). If you analyze the right side of the chart, you can see that a material gap is clearly visible. And while the headline PCE Index tends to undershoot the commodity PPI, reconnecting with the green line implies a headline PCE Index of roughly 5.50%. For context, the last time the PCE Index jumped above 5% was November 1990.

More importantly, though, when the spread between the U.S. 3-month Treasury Bill and the core PCE Index (which excludes the inflationary effects of food and energy) is positive or turns extremely negative, the USD Index is often a major beneficiary.

Please see below:

To explain, the blue bars above depict the quarterly performance of the USD Index when the spread between the U.S. 3-month Treasury Bill and the core PCE Index ranges between 6% and below -2%. As you should expect, the more positive the spread, the stronger the USD Index. However, if you analyze the left side of the chart, you can see that when the spread turns deeply negative, the USD Index – likely driven by safe-haven demand due to inflationary uncertainty – often rallies by 2%. Thus, with the commodity PPI signaling that the headline PCE Index should move meaningfully higher, the USD Index could receive some near-term support.

Finally, with the European Central Bank (ECB) holding its next monetary policy meeting on Jun. 10, the EUR/USD remains in Neverland.

Please see below

Weighing four scenarios, Vanda Research believes that a 65% chance (combined) of a delay in normalization or a slight reduction in the ECB’s weekly PEPP purchases will result in a 2% or 1% decline in the EUR/USD. Conversely, no dovish pushback (25%) or a hawkish policy mistake (10%) are expected to result in a flat ratio or a 1% rally in the EUR/USD.

However, with the Eurozone slipping back into recession in Q1 and inflation (released on May 19) up by only 1.60% YoY in April (and still below the ECB’s 2% target), the reading is paltry relative to the sizzle that we’re witnessing in the U.S.

Please see below:

To that point, ECB President Christine Lagarde said the following on May 21:

The bottom line?

If the FED resists tapering when the headline CPI is up by 4.15% YoY, is the ECB likely to do so with annual inflation rising by only 1.60%?

In conclusion, the USD Index recorded a meaningful bounce on May 26 and the FED’s reverse repo debacle may have already ruffled a few feathers. With excess liquidity becoming a hot potato that no one wants to hold, the overabundance is doing more harm than good. And with investors largely ignoring the signs of stress, as the old saying goes, ignorance is bliss. However, with the ground shifting below our feet, a reversal of fortunes is likely to occur in the coming months. And with the USD Index and the U.S. 10-Year Treasury yield topping the list of major beneficiaries, it’s only a matter of time before the PMs’ inaction turns into a negative reaction.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold: The Rainy Season Is Coming

May 26, 2021, 9:37 AMExact weather is hard to predict, even with forecasts, but we can look for clouds on the horizon to prepare ahead of time.

During the dry season, people near the equator feel like the sun is getting closer each day, making the heat unbearable at some point. The weather needs to periodically correct itself, allowing for some torrential downpours – this way life can survive. The same happens on the market; we can’t try to reach the sun by rallying incessantly. Patience is key. One thing is certain – a major storm front is moving closer, taking into account how the PMs behave.

Gold just moved higher once again, but mining stocks refused to follow. This is one of the most reliable indications that a top is being formed.

Before moving to the precious metals sector, let’s take a look at the USD Index.

When I described the above chart yesterday (May 25), I wrote that the USD Index had been trading at about 89.6. Since this is the level at which the USD Index closed the day (approximately), practically everything that I wrote about its chart remains up-to-date:

This week’s move lower is a continuation, and most likely the final part, of a specific multi-bottom pattern that the USD Index exhibited recently.

I marked those situations with green. The thing is that the U.S. currency first declined practically without any corrections, but at some point it started to move back and forth while making new lows. The third distinctive bottom was the final one. Interestingly, the continuous decline took place for about a month, and the back-and-forth declines took another month (approximately). In July 2020, the USDX fell like a rock, and in August it moved back and forth while still declining. In November 2020, the USDX fell like a rock (there was one exception), and in December it moved back and forth while still declining.

Ever since the final days of March, we’ve seen the same thing all over again. The USD Index fell like a rock in April, and in May we’ve seen back-and-forth movement with lower lows and lower highs.

What we see right now is the third of the distinctive lows that previously marked the end of the declines.

And what did gold do when the USD Index rallied then?

In August, gold topped without waiting for USD’s final bottom – which is natural, given how extremely overbought it was in the short term.

In early January, gold topped (which was much more similar to the current situation given the preceding price action) when the USDX formed its third, final distinctive bottom.

The USD Index is after a two-month decline, half of which was the back-and-forth kind of decline. It’s forming the third – and likely the final – bottom, and gold just refused to react positively to this situation in today’s pre-market trading.

This might be “it” – the markets might be forming their final reversals here, starting to follow the most bearish (in the case of gold) part of the analogy to the price action in 2008 and 2012.

The Repeating Pattern

Gold has now moved higher, and it even moved slightly above $1,900 in today’s pre-market trading, which seems positive. But it doesn’t change anything with regard to gold’s analogies to how it performed in 2008 and 2012 right before the slide.

Gold seems to be insisting on repeating – to some extent – its 2012 performance, and – to some extent – its 2008 performance. Either way, it seems that gold is about to slide.

The initial reversal in gold took place after gold moved very close to its mid-January highs and the 50% Fibonacci retracement based on the August 2020 – March 2021 decline. Yesterday’s close was the first close above this important resistance, so the breakout was not confirmed.

The sizes of the current rally (taking the second March bottom as the starting point) and the rally that ended at the beginning of this year are practically identical at the moment. The current move is only a little bigger.

Just as the rallies from early 2012 and late 2012 (marked with blue) were almost identical, the same could happen now.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher gold prices here doesn’t seem to be justified based on the historical analogies.

The thing I would like to emphasize here is that gold didn’t form the final top at the huge-volume reversal on Sep. 13, 2012. It moved back and forth for a while and moved a bit above that high-volume top, and only then the final top took place (in early October 2012).

The same happened in September and in October 2008. Gold reversed on huge volume in mid-September, and it was approximately the end of the rally. The final top, however, formed after some back-and-forth trading and a move slightly above the previous high.

Consequently, the fact that gold moved a bit above its own high-volume reversal (May 19, 2021) is not an invalidation of the analogy, but rather its continuation.

There’s one more thing I would like to add, and it’s that back in 2012, gold corrected to approximately the 61.8% Fibonacci retracement level – furthermore, the same happened in 2008 as you can see in the below chart. Consequently, the fact that gold moved above its 50% Fibonacci retracement doesn’t break the analogy either. And even if gold moves to $1,940 or so, it will not break it. It’s not likely that it is going to move that high, as in both cases –in 2008 and 2012 – gold moved only somewhat above its high-volume reversal before forming the final top. So, as this year’s huge-volume reversal took place close to the 50% retracement and not the 61.8% retracement, it seems that we’ll likely see a temporary move above it, which will create the final top. And that’s exactly what we see happening so far this week.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline. This time the rally was not as volatile, so the lower – 50% Fibonacci retracement level will hold the rally in check.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

While gold moved to new highs, the GDX ETF didn’t (and neither did silver).

It moved mere nine cents higher and this move took place on relatively low volume – making that a bearish indication, not a bullish one.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

USDX, Gold: We May Have Reached the Top of the Mountain

May 25, 2021, 8:57 AMGiven the negative correlation between gold and the USDX, the former should have rallied today, but it didn’t. Have we reached the top with only one way out?

Let’s start today’s (May 25) analysis with something that’s happening right now, at the moment of writing these words. The USD Index is moving lower, below the recent lows. It’s currently trading at about 89.6, which means that after a few days of back-and-forth trading, it moved down once again – and (from the short-term point of view) quite visibly so.

What did gold do in response? It slid by 0.04%, which is a way of saying that it didn’t do anything. It should have rallied and broken above the recent highs. It didn’t, which indicates that the rally is likely over or about to be over. But let’s get back to the USD Index.

The Fight Between Gold and the USDX

Today’s move lower is a continuation, and most likely the final part, of a specific multi-bottom pattern that the USD Index exhibited recently.

I marked those situations with green. The thing is that the U.S. currency first declined practically without any corrections, but at some point it started to move back and forth while making new lows. The third distinctive bottom was the final one. Interestingly, the continuous decline took place for about a month, and the back-and-forth declines took another month (approximately). In July 2020, the USDX fell like a rock, and in August it moved back and forth while still declining. In November 2020, the USDX fell like a rock (there was one exception), and in December it moved back and forth while still declining.

Ever since the final days of March, we’ve seen the same thing all over again. The USD Index fell like a rock in April, and in May we’ve seen back-and-forth movement with lower lows and lower highs.

What we see right now is the third of the distinctive lows that previously marked the end of the declines.

And what did gold do when the USD Index rallied then?

In August, gold topped without waiting for USD’s final bottom – which is natural, given how extremely overbought it was in the short term.

In early January, gold topped (which was much more similar to the current situation given the preceding price action) when the USDX formed its third, final distinctive bottom.

The USD Index is after a two-month decline, half of which was the back-and-forth kind of decline. It’s forming the third – and likely the final – bottom, and gold just refused to react positively to this situation in today’s pre-market trading.

This might be “it” – the markets might be forming their final reversals here, starting to follow the most bearish (in the case of gold) part of the analogy to the price action in 2008 and 2012.

Gold seems to be insisting on repeating – to some extent – its 2012 performance, and – to some extent – its 2008 performance. Either way, it seems that gold is about to slide.

The reversal in gold took place after gold moved very close to its mid-January highs and the 50% Fibonacci retracement based on the August 2020 – March 2021 decline.

The sizes of the current rally (taking the second March bottom as the starting point) and the rally that ended at the beginning of this year are practically identical at the moment.

Just as the rallies from early 2012 and late 2012 (marked with blue) were almost identical, the same could happen now.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher gold prices here doesn’t seem to be justified based on the historical analogies.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline. This time the rally was not as volatile, so the lower – 50% Fibonacci retracement level will hold the rally in check.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold: The Past Years Are Often the Best Guides

May 24, 2021, 9:06 AMAs we know, history tends to rhyme. It’s never the same, but when you zoom out, the bigger picture often looks very similar. What does it mean for gold?

Short-term implications

With gold’s back-and-forth price action mirroring its behavior from 2012, the yellow metal is likely destined for devaluation.

Back then, gold zigzagged with anxiety before suffering a material drawdown. In fact, in early October 2012, it moved slightly above the initial highs right before sliding.

Moreover, while the yellow metal has bounced above its declining resistance line (the black line below), the price action mirrors gold’s behavior from early January. If you analyze the blue line below, you can see that investors’ optimism regarding gold’s short-term breakout quickly faded and the yellow metal sunk like a stone. In addition, with gold’s RSI (Relative Strength Index) moving slightly above 70 before the January swoon occurred, an identical development is already playing out in real time.

Gold seems to be insisting on repeating – to some extent – its 2012 performance, and – to some extent – its 2008 performance. Either way, it seems that gold is about to slide.

The reversal in gold took place after gold moved very close to its mid-January highs and the 50% Fibonacci retracement based on the August 2020 – March 2021 decline.

The sizes of the current rally (taking the second March bottom as the starting point) and the rally that ended at the beginning of this year are practically identical at the moment.

Just as the rallies from early 2012 and late 2012 (marked with blue) were almost identical, the same could happen now.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher gold prices here doesn’t seem to be justified based on the historical analogies.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline. This time the rally was not as volatile, so the lower – 50% Fibonacci retracement level will hold the rally in check.

Taking into consideration that the general stock market has probably just topped and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

MACD and the Long Term

Approaching the subject from a different side, remember the huge gap between the U.S. 10-Year Treasury yield and the U.S. 10-Year breakeven inflation rate? The situation in the very long-term MACD indicator is yet another confirmation that what we saw recently is similar to what we saw before the huge 2012 – 2013 slide. We get the same confirmation from the gold to bonds ratio, and I’ll move to that a bit later.

With February’s monthly close the last piece of the puzzle, the MACD indicator’s sell-signal is now perfectly clear. If you analyze the chart below (at the bottom right), you can see that the MACD line has crossed the signal line from above – a development that preceded significant drawdowns in 2008 and 2011.

Based on gold’s previous performance after the major sell signals from the MACD indicator, one could now expect gold to bottom in the ~$1,200 to ~1,350 range. Given the price moves that we witnessed in 1988, 2008 and 2011, historical precedent implies gold forming a bottom in this range. However, due to the competing impact of several different variables, it’s possible that the yellow metal could receive the key support at a higher level.

Only a shade below the 2011 high, today’s MACD reading is still the second-highest reading in the last 40 years. More importantly though, if you analyze the chart below (the red arrows at the bottom), the last four times the black line cut through the red line from above, a significant drawdown occurred.

Also ominous is that the magnitude of the drawdowns in price tend to coincide with the magnitude of the preceding upswings in MACD. And with today’s reading only surpassed by 2011, a climactic move to the $1,250/$1,450 range isn’t out of the question for gold. The above is based on how low gold had previously declined after a similarly important sell signal from the MACD

Now, the month is not over yet, so one might say that it’s too early to consider the sell signal that’s based on monthly closing prices, but it seems that given the level that the MACD had previously reached and the shape of the top in the black line, it makes the situation so similar to 2011/2012 that the sell signal itself is just a cherry on the bearish analytical cake.

Considering the reliability of the MACD indicator a sell signal for major declines, the reading also implies that gold’s downtrend could last longer and be more severe than originally thought. As a result, $1,500 remains the most likely outcome, with $1,350 still in the cards.

As further evidence, if you focus your attention on the monthly price action in 2008, you can see that gold is behaving exactly as it did before it suffered a significant decline.

Please see below:

To explain, after making a new all-time high in 2008 (that was a breakout above the 1980 tops), gold declined back to its rising support line before recording a short-term corrective upswing. This upswing ended approximately at gold’s previous monthly closing price. I marked it with a horizontal, blue, dashed line.

Similarly, if you analyze the right side of the chart, you can see that an identical pattern has emerged. With gold’s corrective upswing following a reconnection with its rising support line, history implies that a sharp decline should occur in the coming months and that the reversal is at hand or already behind us. After all, the thing that triggered the decline almost a year ago was the fact that gold made a new all-time high. Moreover, the recent high was very close to the previous high in terms of the monthly closing prices (Dec. 2020 - $1,895.10 vs. the recent intraday high of $1,891.30).

What about the HUI Index?

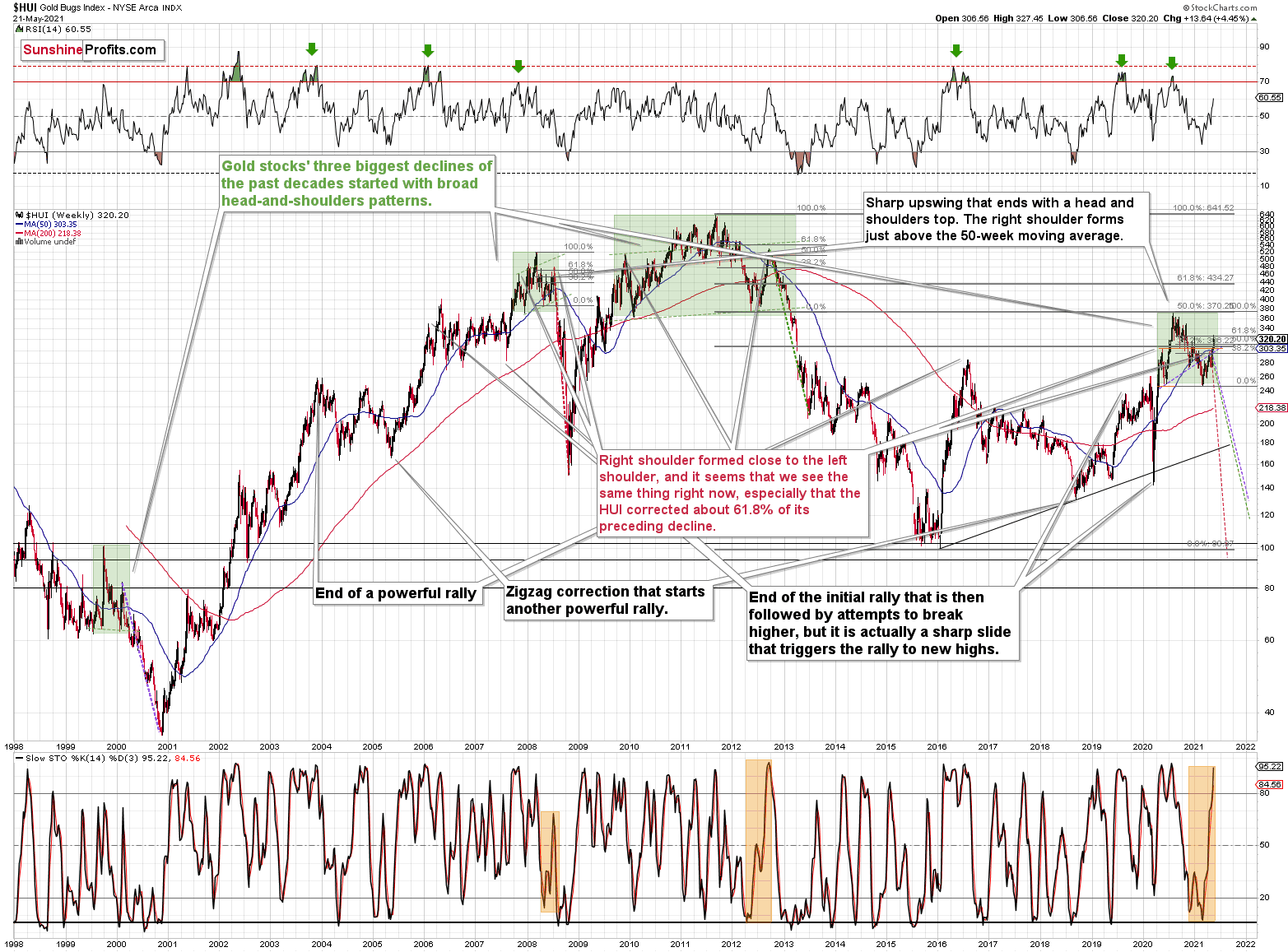

Not only are ominous signs emerging from gold’s medium-and-long-term charts, but beneath the surface, the gold miners are also folding their hands. If you analyze the chart below, you can see that the HUI Index back-and-forth price action mirrors its behavior from 2008 and 2012 and its bearish head & shoulders pattern is also gaining similarity. In addition, the BUGS (after all, HUI is called the Gold Bugs Index) stochastic oscillator has moved all-in like the 2012 analogue (depicted at the bottom part of the chart below), and thus, it seems to be only a matter of time before the HUI Index completely blows its bankroll.

Please see below:

To explain, the HUI Index retraced a bit more than 61.8% of its downswing in 2008 and in between 50% and 61.8% of its downswing in 2012 before eventually rolling over. And with investors rejecting the HUI’s recent attempt to break above the 61.8% level, the house of cards is slowly coming down.

The bottom line?

If the HUI Index hasn’t already peaked, history implies that a top is increasingly imminent. As a result, in my opinion, now is the time to enter short positions and not exit them.

Now, in both (2008 and 2012) cases, the final top – the right shoulder – formed close to the price where the left shoulder topped. And in early 2020, the left shoulder topped at 303.02.

That’s why I previously wrote that “it wouldn’t be surprising to see a move to about 300 in the HUI Index”. And that’s exactly what we saw (a move above 320 is still close to 300 from the long-term point of view). To clarify, one head-and-shoulders pattern – with a rising neckline – was already completed, and one head-and-shoulders pattern – with a horizontal neckline – is being completed, but we’ll have the confirmation once miners break to new yearly lows.

In addition, the recent rally is not a game-changer, but rather a part of a long-term pattern that’s not visible when one focuses on the short term only.

The thing is that the vast majority of individual investors and – sadly – quite many analysts focus on the trees while forgetting about the forest. During the walk, this might result in getting lost, and the implications are no different in the investment landscape.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM