tools spotlight

-

3 Price Drivers in a Globalized World

January 13, 2021, 9:00 AMDo you want to know how gold will be doing soon? Or the USDX? You have to look at the German and French economies. You may ask “What? How can they be tied together?” Well, the globalization of markets is one of the core foundations of the modern world. With everything interrelated, nothing in economics can be examined in a vacuum state. That includes the three precious metals price drivers: stocks, yields and currencies.

The EUR/USD currency pair is a perfect example of this interconnectivity. Being the most popular and most traded currency pair in the world, the EUR/USD is influenced by many factors, including the price action in the USD Index as well as the strength of the European and American economies at any given time. The same level of interconnectedness can be applied to the other price drivers.

Let’s take a fundamental look at stocks, yields and currencies.

As you can see in our Correlation Matrix, the 30-trading-day correlation values are strongly negative in the case of all key parts of the precious metals market (gold, silver, senior miners, junior miners) and the USD Index, while they remain generally positive in case of the link with the stock market. Both links are most visible when we take the 250 trading days into account (effectively about 1 year).

Figure 1

The closer to -1 the number gets, the more negatively correlated given assets are, and the closer to 1 it gets, the stronger the positive correlation. Numbers close to zero imply no correlation.

So, what do these markets tell us about future movements in the price of gold?

Future History

Yesterday, I highlighted the record excess that’s building up across U.S. equities. And as we approach the middle of January, investors are giving new meaning to Paul Engemann’s Push It to the Limit.

Last week, the S&P 500’s option Gamma (21-day moving average) reached the top 0.37% of all-time readings. And on Monday (Jan. 11), the 10-day MA set a new record.

Please see the chart below:

Figure 2

Keep in mind, Monday’s record was set on an absolute basis (by analyzing the number of outstanding options contracts). However, relative to the S&P 500’s market cap (which biases the reading lower as stocks move higher), it’s the fourth-highest since 2011. More importantly though, the last three times Gamma exposure reached the current level, the S&P 500 fell by 7.9%, 7.3% and 31.0% over the following two months (the vertical red lines above).

From a valuation perspective, the derivatives frenzy has also helped push the NASDAQ (4.17x), S&P 500 (2.85x) and Russell 2000’s (1.49x) price-to-sales (P/S) ratios to their highest levels ever.

Please see below:

Figure 3 – (Source: Bloomberg/ Liz Ann Sonders)

And a day after the milestones were set, U.S. small business confidence (the NFIB Small Business Optimism Index) fell to a seven-month low (Jan. 12).

Figure 4 - (Source: Bloomberg/Daniel Lacalle)

In addition, while economists expected a print of 100.2 (the red box on the left), the reading came in at 95.9 (the red box on the right), more than two points below the index’s historical average. Furthermore, nine out of 10 survey categories indicated that economic conditions are worse than they were in November.

Figure 5

As another wonder to marvel at, U.S. Treasury yields are also surging (which I’ve mentioned during previous editions). And because corporate profits are still on life support (due to the lack of real economic activity), the spread between the S&P 500’s earnings yield and the U.S. 10-Year Treasury yield just hit its lowest level in over two years.

Please see below:

Figure 6 – (Source: Bloomberg/ Lisa Abramowicz

To explain, the earnings yield is the inverse of the S&P 500’s price-to-earnings (P/E) ratio (calculated as earnings divided by price). The percentage is often compared to the yield on the U.S. 10-Year Treasury to gauge the relative value of stocks versus bonds. If you look at the middle of the chart, you can see that the spread between the two peaked at more than 6% in 2019 (as companies’ EPS rose and bond yields fell). However, with the opposite occurring today, the spread between the two has fallen below 2.23%.

Thus, with bond yields beginning to breathe new life, Jerome Powell’s (Chairman of the U.S. Federal Reserve) argument that P/E multiples are “not as relevant” in a world of low interest rates is starting to lose its luster.

EUR/USD Struggles with Reality

Despite bouncing yesterday (as declines rarely happen linearly), the EUR/USD is still treading fundamental water.

Over the last few weeks, I’ve been highlighting the increased economic divergence – as a weak U.S. economy is overshadowed only by an even-weaker Eurozone economy (Remember, currencies trade on a relative basis.)

And as another data point of validation, yesterday, Bloomberg Economics reduced its first-quarter GDP forecast (for Europe) from a rise of 1.3% to a decline of 4.0%. Furthermore, the team also reduced their full-year GDP growth forecast from 4.8% to 2.9%.

Please see below:

Figure 7

If you analyze the red box, you can see the massive drop in economic activity that’s expected during the first three months of 2021. And even more pessimistic, Peter Vanden Houte, ING’s Chief Economist wrote (on Jan. 7) that he believes “it will take until the summer of 2023 for the Eurozone to regain its pre-crisis activity level.”

Also plaguing Europe, please have a look at the sharp decline in the Eurozone household savings rate:

Figure 8 – (Source: Refinitiv/ING)

To explain, the huge spike in 2020 was a function of government programs to replace lost wages at the onset of the pandemic. However, as the crisis unfolded and the level of government spending became unsustainable, the household savings rate in Germany and France (Europe’s two largest economies) sunk like a stone.

Moreover, with Eurozone retail sales plunging by 6.1% in November, and assuming the household savings rate followed suit, you can infer that households are allocating resources to necessities and not discretionary items that boost GDP.

The bottom line?

The European economy is underperforming the U.S. economy and the deluge of bad data is slowly chipping away at the euro. And as the fundamental damage continues, the EUR/USD should come under pressure and help propel the USD Index higher.

As part of the fallout, gold will likely drop below its rising support line and then decline further. Once it bottoms, we’ll have a very attractive entry point to go long in the precious metals and mining stocks.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

A Strategy for the Buy Low, Sell High Mantra

January 12, 2021, 9:51 AM“Buy low, sell high!” Bada-bing, bada-boom and the money rolls in. If only it were that simple, we’d all be rich fairly quickly. However, after looking past the myths, there are strategies that can help in determining a bottom or a top, and one of them is to look for reversals.

Gold and silver both reversed yesterday (Jan. 11), which might seem bullish at first sight, but it isn’t.

Reversals are the key moments in any market, because they often mark tops and bottoms. And – of course – everyone wants to buy at the bottom and sell at the top. That’s much easier said than done though, because tops form exactly at the moment when the urge to buy is at its peak, and the opposite is true for bottoms. So, in order to make money, one needs to decide on not following what they “feel” is going to happen, but what the objective tools that have proven effective in the past suggest. If enough of them suggest the same thing, the odds are that the market is going to do something – regardless of how one “feels” about the market at a given time.

Reversals are particularly interesting, because they allow one to enter the market almost right at the bottom and exit right at the top. And they work over and over again. They’re easy to spot too – the price was going up for days and now it moved up and then back down. Easy as that… Or is it?

You already know the answer. No, it’s not that easy. It may look simple, especially at first glance, but it’s not easy, and the emotional factors are not the only obstacle in determining whether or not a reversal was really important.

The thing about reversals that’s hidden in plain sight is that they are not only about the price. The key thing to look for during these reversals is volume.

We should see a fierce battle between bulls and bears, leaving one side overpowered – in the case of bottoms, bulls should overpower bears. Low or average volume means that the battle was not fierce, or that there was very little fighting done on a given day. The implications would likely be nonexistent.

So, what happened yesterday in gold and silver with regard to volume?

Figure 1 – COMEX Gold Futures

Figure 2 – COMEX Silver Futures

The volume was notable, but it was not huge. So, did gold form a critical reversal? Not really. It corrected some of its declines and took form of a reversal, but it didn’t have the reversal’s “spirit”. The bulls didn’t seem to have overpowered the bears. What seems to have happened instead, is that bears took a break after a massive daily victory.

You can see a good example of a clear reversal in silver, on Sep. 24, 2020. The volume was the second biggest in a month and slightly bigger than what accompanied the previous day’s decline. And indeed, that was a bottom for months.

Gold doesn’t feature any crystal-clear reversal example in recent history, but the closest to it would be the Aug. 12, 2020 session. Back then, gold reversed, but the rally was over in a week. So, did the reversal really work? It did, but only to some extent. And what kind of volume preceded it? It was big, but not huge. It was big enough to show a bull’s strength, but it was not truly groundbreaking. Thus, a limited reaction was perfectly justified – and that’s what we saw.

Getting back to the current situation on Monday, the volume was relatively average, so I don’t think one should focus on the “default, bullish” implications, because this is not a “default bullish” reversal. It’s a suspicious reversal that might have actually been a breather, so forecasting gold’s rally here would likely be a mistake. The volume doesn’t indicate that it was an important reversal – it’s only the price that indicates that.

So, will gold and silver plunge immediately? Perhaps, and perhaps not. Friday’s (Jan. 8) decline was quite profound, so a few extra days of back-and-forth movement or even a small rally, wouldn’t be surprising. The overall trend is down, and since the USD Index has already (most likely) bottomed, more downside should be expected for the precious metals.

Speaking of the USD Index, it’s breaking above increasingly more resistance lines.

Figure 3 - USD Index, USD, GOLD and CORR Comparison

After confirming the breakout above the very short-term declining resistance line, the USD Index has now broken above the declining dashed line that’s based on the March 2020 and September 2020 tops.

With the correlation between the USD index and gold (bottom part of the chart) being strongly negative, the USD’s breakouts are bullish for gold. Namely, they tell us that after a breather, the USD Index is likely to continue its rally, while precious metals are likely to fall.

The next big move in the PMs is likely to take place once gold breaks below its rising support line, and that’s likely to happen relatively soon. Moreover, please note that the existence of the support line is – by itself – a reason for gold to correct before sliding. This makes the theory of yesterday’s (Jan. 11) reversal not being a true reversal even more valid.

All in all, it seems that the precious metals sector is about to decline once again, if not immediately, then shortly.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

What Underperforms Gold and Heralds More Declines?

January 11, 2021, 9:13 AMWith the gold miners underperforming gold, and gold underperforming the USDX, it was only a matter of time before the house of cards came crashing down.

The writing has been on the wall all along with signs for all to see. On Jan. 5, I warned that the GDX was approaching an inflection point in the following way:

The GDX ETF managed to rally above its 50-day moving average – just as it did at its November top. Moreover, please take note of the spike in volume that we saw yesterday. There were very few cases when we saw something similar in the previous months, which was at the November high and at the July high, right before the final 2020 top. The implications are bearish.

And despite Friday’s (Jan. 8) 4.82% sell-off, the GDX’s last hurrah is likely to end with even more fireworks.

Please see the chart below:

Figure 1 - VanEck Vectors Gold Miners ETF (GDX), GDX and Slow Stochastic Oscillator Chart Comparison – 2020

With technicals foretelling the decline, many bullion bulls closed their eyes to the plethora of warnings signs that you can find in the previous Gold & Silver Trading Alerts.

For example:

- A huge volume spike in the first session of 2021 was very similar to what we saw at the November 2020 and July 2020 tops – this heralded declines.

- The GDX’s stochastic oscillator bounced above 80, mirroring similar readings that preceded five pullbacks since September.

- Arguably the most important indication that keeps on flashing the very bearish signals , the GDX’s underperformance relative to gold remained intact.

In addition, the GDX is on the cusp of forming a head and shoulders pattern. If you analyze the chart above, the area on the left (marked S) represents the first shoulder, while the area in the middle (H) represents the head and the area on the right (second S) represents the potential second shoulder.

Right now, $33.7-$34 is the do-or-die area. If the GDX breaks below this (where the right shoulder forms) it could trigger a decline back to the $24 to $23 range (measured by the spread between the head and the neckline; marked with green).

Since there’s a significant support at about $31 in the form of the 50% retracement based on the 2020 rally, and the February 2020 high, it seems that we might see the miners pause there. In fact, it wouldn’t be surprising to see a pullback from these levels to about $33, which could serve as the verification of the completion of the head-and-shoulder pattern. This might take place at the same time, when gold corrects the decline to $1,700, but it’s too early to say with certainty.

Also, let’s not forget that the GDX ETF has recently invalidated the breakout above the 61.8% Fibonacci retracement based on the 2011 – 2016 decline.

Figure 2 - GDX VanEck Vectors Gold Miners ETF (2009 – 2020)

When GDX approached its 38.2% Fibonacci retracement, it declined sharply – it was right after the 2016 top. Are we seeing the 2020 top right now? This is quite possible – PMs are likely to decline after the sharp upswing, and since there is just more than one month left before the year ends, it might be the case that they move north of the recent highs only in 2021.

Either way, miners’ inability to move above the 61.8% Fibonacci retracement level and their invalidation of the tiny breakout is a bearish sign.

The same goes for miners’ inability to stay above the rising support line – the line that’s parallel to the line based on the 2016 and 2020 lows.

In summary, the GDX’s train has likely gone off the rails, with silver in the front car and gold in the back. And as the technical derailment unfolds, a resurgent U.S. dollar is likely to accelerate the impact. Furthermore, if the S&P 500 hops on board – and declines from its current state of euphoria – damage to the precious metals mining stocks could be particularly violent.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold’s Moves Prove That Technical Analysis is Still Cool

January 8, 2021, 9:35 AMAvailable to premium subscribers only.

-

Impending USD Bottom Means Gold’s Plummet is Close at Hand

January 7, 2021, 8:32 AMGold prices eased on Thursday (Jan. 7), the first time they did so after experiencing a strong start to the year, and the dollar remains firm for the moment. In the first days of January 2021, gold was likely to top at its triangle-vertex-based reversal, similarly to what it did in November, and that’s exactly what happened.

Figure 1 - COMEX Gold Futures

The daily slide was not as big as the one we saw in early November, but the rally in the USD Index was also not as big as the one in early November.

Figure 2 - USD Index

In fact, the USD Index closed yesterday’s (Jan. 6) session just slightly higher in terms of the futures prices, and it actually closed slightly lower in ETF terms (UUP ETF in this case).

Figure 3 - SPDR Gold Shares (GLD) and Invesco DB US Dollar Index Bullish Fund (UUP)

Comparing both ETFs with identical opening and closing hours, we see how closely gold was reacting to moves in the U.S. currency, but at the same time how it was magnifying the USD’s rallies (by declining more) and how it was mostly ignoring the USD’s declines (by rallying less).

Ultimately, the UUP ETF ended yesterday’s session slightly below the Jan. 5 closing price, and the GLD ETF didn’t end above its Jan. 5 closing price. Conversely, it didn’t even manage to erase half of the intraday decline before the closing bell.

The above tells us that if the USD Index rallies more visibly here and breaks above the declining resistance line in a decisive manner, gold would be likely to truly plunge.

And that’s exactly what’s likely to happen! The USD Index is extremely oversold and just a little strength here will allow it to break above the steep resistance line.

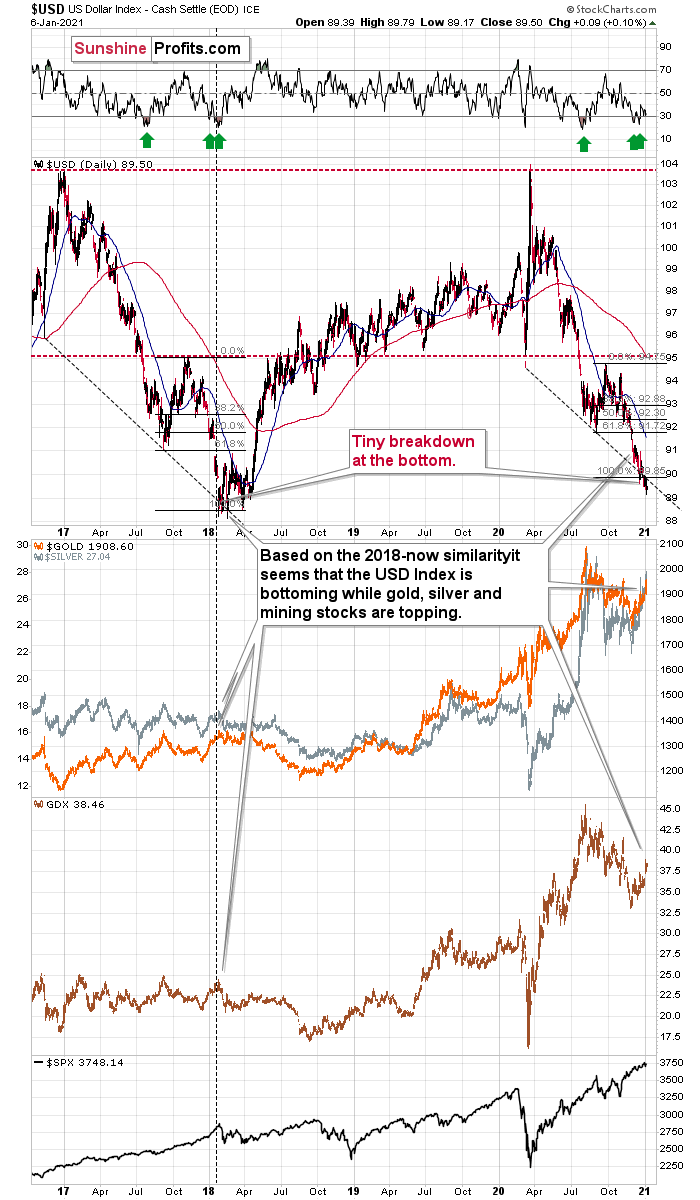

Figure 4 -USD Index (ICE), USD, GOLD, GDX, and SPX Comparison

With the situation looking just like it did in early 2018, it seems that the USD index is bottoming, and the precious metals sector is topping.

The USD Index is slightly below the Fibonacci-extension-based target based on the size of the most recent corrective upswing and the declining dashed resistance line. The same situation in 2018 (also please note that cryptocurrencies are in a price bubble now just like they were in early 2018) meant that the final bottom was already in. The situation in the RSI indicator is similar as well.

Let’s get back to gold.

Figure 5 - COMEX Gold Futures

Please note that after topping at its triangle-vertex-based reversal, gold then declined but stopped at its rising support line.

Figure 6 - COMEX Silver Futures

Silver did pretty much the same thing.

They both stopped where they were likely to stop, which is quite normal. The USD Index didn’t rally yet in a particularly visible way and the UUP ETF even declined somewhat yesterday. But the day when the PMs are going to get a significant push lower is coming. It’s likely very, very close. And then, once gold and silver break below their rising support lines, we’ll see significantly lower prices.

Figure 7 - VanEck Vectors Gold Miners ETF (GDX) and Slow Stochastic Oscillator (Slow STO) comparison

Mining stocks moved somewhat lower yesterday, but the decline was relatively small at first sight. Are miners showing strength here?

Let’s take one more look at the GDX while comparing it with the GLD ETF so that they both have the same opening and closing hours.

Figure 8 - GDX and GLD ETFs comparison

As you can see, both ETFs have actually moved to their mid-December highs and then moved back up yesterday. The GDX corrected a bit more of the daily decline, but nothing more.

What seems like a show of strength is more of an intraday price noise. If this persists and miners hold up well despite gold’s declines, it might be a bullish indication, but it’s way too early to draw bullish conclusions from miners’ performance.

The spike in volume in the GDX ETF that we saw recently continues to emphasize the similarity between the recent top, the November top, and the late-July top. The implications remain bearish.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM