tools spotlight

-

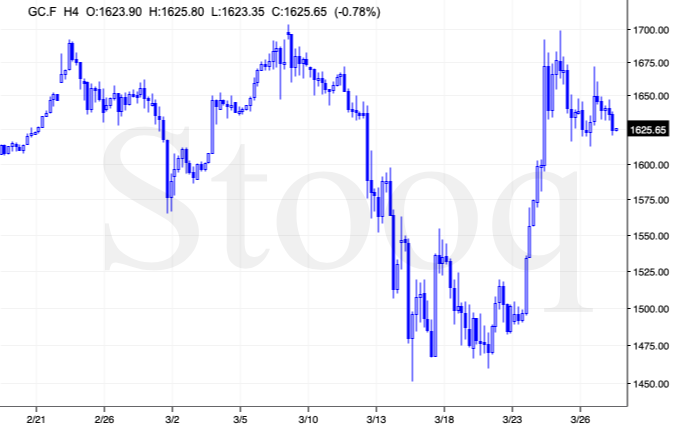

So Much for the Miners' Rally...

March 27, 2020, 10:44 AMIn the summary of last Friday's Gold & Silver Trading Alert, we wrote the following:

This rally might make one feel bullish - after all, the prices of miners are likely to soar soon. Please be sure to keep in mind that what we saw was the first big wave down of a much bigger move lower, also in the stock market. The coronavirus stock-market decline has likely just begun and once it continues - and as the rally in the USD Index resumes - the precious metals market is likely to be hit. Silver and miners are likely to be hit particularly hard.

The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. We hate to be right on this prediction, but we expect the number of the total confirmed cases in the US to be greater than the analogous number in China. At the moment of writing these words, the number of total confirmed cases in the US is 14,250, which is sixth in the world, just behind Germany (15,320 cases).

A week later, we see that indeed the total number of confirmed cases in the US is greater (86k) than the analogous number in China (82k). The death toll is not yet the biggest worldwide, but it's only a matter of time. Either slowly, or suddenly, the investors will start to realize that the stimulus money is not going to keep the economy running. The people are necessary for everything to work (both figuratively, and literally). And people will be quarantined, or self-quarantined in fear for their lives due to Covid-19 pandemic.

But we already elaborated on this in this week's flagship Gold & Silver Trading Alert, so we don't want to go into details once again today. We have very interesting technical things to tell you instead.

One actionable thing that we will tell you right away, is that in the final part of Wednesday's session, we took enormous profits from our long positions in GDX and GDXJ (entered at about $17 in GDX on March 13). We also opened another trading position, but we'll leave the details to our subscribers.

In Wednesday's analysis, we described the very specific time link with 2008 in case of gold, silver and mining stocks. Based on it, we explained why the mining stocks are likely to top on that day (and they did - in terms of the daily closing prices), why silver is unlikely to rally significantly as it was already in its topping zone (indeed, silver seems to have topped on Wednesday in terms of the daily closing prices), and we also let you know that it will likely take longer before gold tops. We wrote that gold would be likely to form its final top either on Thursday or today.

About Those Tops

The above was based on how prices moved in 2008 and how similar these moves were to what we saw recently (their shape and the intermarket relations that accompanied them).

Some of you may remember what was the general "feel" in the second part of September and in early October of 2008. It was that the worst is over, gold held it's purchasing power quite well, and that in general, it was all a bad dream. Gold seemed ready to resume its bull market and the same seemed likely for silver and miners. Neither silver, nor mining stocks moved as high as gold, but people were not paying attention to that.

What happened next? Blood-bath for the bulls.

So, did gold top yesterday, or not?

It's not perfectly clear, but the odds are that it has indeed topped.

Two distinct tops, then a decline and then another quick rally - that failed. Then a move lower back to the most recent lows and a quick consolidation.

That's exactly what preceded the 2008 slide, so the odds are that we are looking at the beginning of another slide also this time.

Gold didn't manage to move to or above the previous highs during the most recent intraday run-up, which is not what happened in 2008, but overall, we think that the similarity in terms of shape of the moves is more important than the price level that was reached.

Besides, gold failed to rally despite a move lower in the USD Index, which showed that the buying power for the yellow metal is probably drying up for now. This is an important bearish confirmation for gold and the rest of the precious metals sector.

Meanwhile in the USDX and S&P 500

Speaking of the USD Index, in yesterday's analysis, we wrote the following:

The USD Index just broke below its 38.2% Fibonacci retracement level, which means that it's now likely to head toward the 50% retracement. This approximately corresponds to the March 18 low. It seems that the USDX could bottom at this retracement while gold tests its yearly highs.

We can't rule out a situation in which the USDX declines all the way down to the 61.8% Fibonacci retracement level at about 98, but this level seems less likely to stop the decline than the 50% level - the latter is more in tune with how the situation developed in 2008.

Indeed, the USDX corrected half of its previous powerful upswing and started to move back up.

And the stock market?

The S&P 500 futures are moving lower in today's pre-market trading (having declined about 3% at the moment of writing these words) after having moved very close to the 38.2% Fibonacci retracement level, which we previously described as our upside target for this counter-trend rally.

Back in 2008, we saw another corrective upswing after stocks moved to their most recent lows, which could also take place sometime next week, but we wouldn't bet the farm on this rebound. The Covid-19 death toll is going to start to climb at an accelerated pace and it won't stop its pace of rise just because stocks move to their previous lows. The Fed and Trump might come up with another rescue plan, but it seems they already did most (almost anything?) of what they could do. The only thing better would be to go back in time and order a near-total lockdown a few weeks ago, but this option is unavailable.

All in all, it seems that the price moves that we had been predicting previously, have all taken place and the downtrend in stocks and PMs is now likely to continue, while the USD Index moves higher.

With declining stock market and declining gold, mining stocks are likely to move considerably lower today. In fact, if the general stock market continues to decline, miners would be likely to decline (or at least not rally visibly) even if gold would still manage to soar to $1,700 later today.

As far as gold is concerned, making detailed target price predictions right now is very difficult due to its safe-haven nature, which might come into play. It is, however, likely that it will decline shortly.

Thank you for reading today's free analysis. Silver and mining stocks are likely to decline much more than gold, and in their case, the profit-take targets are much easier to estimate. We provide details in the full version of today's analysis.

-

Yesterday was THE Day

March 26, 2020, 9:50 AMAvailable to premium subscribers only.

Yesterday was a critical day on the precious metals market, and our subscribers received a timely intraday Alert. Today's analysis explains the details behind it.

-

Today is THE Day

March 25, 2020, 8:24 AMAvailable to premium subscribers only.

Today is likely to be an epic day in many markets.

In today's Gold & Silver Trading Alert we explain why, and how to use this to increase one's profits. As a reminder, we entered our current long position in the mining stocks in the final 25 minutes of the March 13 session, with GDX at about $17. That (March 13) was also when we completely closed our short positions in the precious metals sector - the ones that we had opened on February 21st - one day before the final 2020 top.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM