tools spotlight

-

Gold Seeks Direction as USDX Slips

December 30, 2020, 10:39 AMAs of Wednesday (Dec. 30) morning, gold is range trading and remains more or less flat as it seeks momentum. As we wait for the precious metals to act on a catalyst, let’s also take a look at the Euro’s relation to the U.S. Dollar and how both impact gold.

Over the last 24 hours, the precious metals market did more or less nothing, despite the new daily decline in the USD Index. The latter is now testing its monthly and yearly lows, while the PMs are not. PMs – as a group – are not reacting to what should make them rally, and this is yet another bearish sign for the precious metals market.

Figure 1 - USD Index (Sept – Dec 2020)

The USDX is at its monthly and yearly lows and at the same time…

Figure 2 - COMEX Gold Futures (Jan – Dec 2020)

Gold is about $30 below its monthly high, and about $200 below the yearly low.

After a temporary breakout, gold is back below its 2011 high. The breakout above the latter was clearly invalidated.

Figure 3 - COMEX Silver Futures (Jan – Dec 2020)

Silver is not even close to its 2011 high, and while it’s relatively strong compared to gold and miners on a short-term basis, it’s not at its December high right now. It’s also a few dollars below its yearly high.

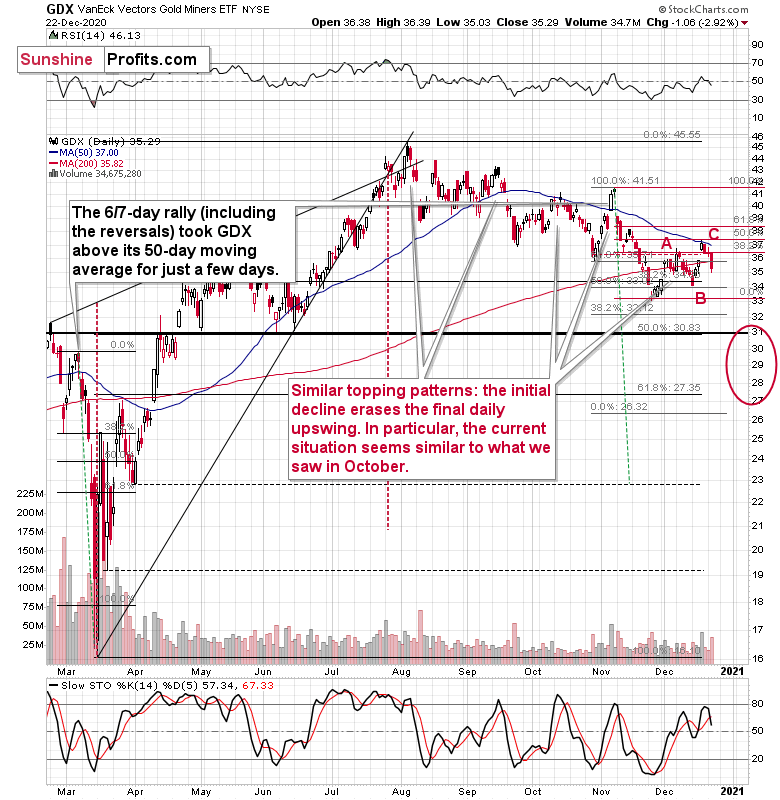

Figure 4 - GDX VanEck Vectors Gold Miners ETF (Feb – Dec 2020)

Miners remained relatively quiet on Tuesday (Dec. 29).

We see that the GDX ETF moved lower once again despite the intraday attempt to rally. During Monday’s (Dec. 28) session, miners once again moved back to their 50-day moving average and… Once again verified it as resistance. The implications are bearish.

Let’s get back to silver once again. On its chart, you can see a triangle-vertex-based reversal at the end of the year. Before the price moves close to the reversal, it’s relatively unclear what kind of implications a given reversal is likely to have. Well, including today’s (Dec. 30) session, there remain only two sessions until the end of the year, so we’re likely to see the reversal shortly.

Based on the likelihood that the next big move is going to be to the downside, it would fit the overall picture more if the upcoming reversal was a top, not a bottom. A bottom would imply a rally in the following days or weeks, and the relative performance (as described above) along with other factors continues to favor a bigger decline.

This means that we might not see a meaningful decline for a few more days, and we might even see one final move higher before the top is formed. This could be something that takes place in silver only, or something that we see in gold and miners as well. Still, I don’t expect it to be really significant in case of the latter. They are underperforming the metals, after all.

Before summarizing, let’s discuss the USD Index’s main part – the EUR/USD currency pair in greater detail. After all, this pair often moves in tandem with gold.

EUR/USD Decouples from Fundamentals

John Maynard Keynes once said, “Markets can remain irrational longer than you can remain solvent.”

And right now, EUR/USD is putting his theory to the test.

Because the euro accounts for nearly 58% of the movement in the USD Index, its rise (and likely fall) will determine if/when the war is won.

But brimming with confidence and unwilling to wave the white flag, the EUR/USD has been green for five straight days and has rallied during nine of the last 12 trading days. And while sentiment and momentum are warriors that don’t die easy, the euro is losing fundamental soldiers left and right.

Please see the chart below:

Figure 5 - European Central Bank (ECB) Balance Sheet

Another weekly update shows the European Central Bank’s (ECB) money printer continues to work overtime. And as I mentioned on Monday (Dec. 28), the ECB’s total assets now equal 69% of Eurozone GDP – nearly double the U.S. Federal Reserve’s (FED) 35%.

And why is this necessary?

Because the Eurozone economy is in free-fall.

Remember, currencies trade on a relative basis. Thus, a less-bad U.S. economy is good news for the U.S. dollar.

Please see below:

Figure 6 - 2020 Economic Indicators for Germany, France, Italy, Spain

Across Europe’s largest economies – Germany, France, Italy and Spain – economic activity is rolling over (To explain the chart, alternative economic indicators are high-frequency data like credit card spending, indoor dining traffic, travel activity and location information.)

And underpinning the irrationality, the deceleration is happening as the euro is strengthening.

Makes sense?

Well, considering Spain’s retail sales dipped further into negative territory on Monday (Dec. 28) – coming in at – 5.8% vs. – 5.3% expected – the data speaks for itself.

Figure 7 - Spain Retail Sales Constant Prices (Source: Bloomberg/Daniel Lacalle)

The bottom line is: the euro bulls are fighting a war they’re unlikely to win. And as the fundamental data worsens, it’s analogous to a platoon losing more and more soldiers. Eventually, the infantry runs out of reserves and it’s time to wave the white flag.

And then what happens?

Well, then history tries to explain how it all went wrong.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Relative Signs Remain Bearish for Gold, Silver and Miners

December 29, 2020, 9:50 AMIn yesterday’s extensive analysis, I elaborated on multiple factors due to which the precious metals sector is likely to move lower in the following weeks/months. I emphasized that with each passing day we see additional bearish confirmations as gold stocks continue to be weak relative to gold and silver is either strong relative to gold or performs relatively normally. Gold is also not reacting to the indications from the USD Index that “should have” caused it to rally strongly.

And today we once again see more of the same – more bearish confirmations from the relative front.

Figure 1 – USD Index

Yesterday, the USDX moved down and then back up, so the fact that gold did the opposite is relatively normal.

However, today, the USDX moved close to its yesterday’s intraday lows while at the same time…

Figure 2 – COMEX Gold Futures

Gold didn’t move close to its yesterday’s intraday high.

While the USD Index is clearly and visibly below its early-December low, gold is just slightly above its early-December high.

Overall, from both the short-term and very-short-term perspective, the gold-USD link has bearish implications for the yellow metal.

Figure 3 – COMEX Silver Futures

Silver is not only above its early-December high, it’s also above its October and November highs. The white metal is clearly outperforming gold. This combined with gold miners’ underperformance is something that we’ve seen over and over again before bigger declines. The implications are clearly bearish.

And speaking of mining stocks…

Figure 4 – GDX VanEck Vectors Gold Miners ETF

We see that the GDX ETF moved lower again despite the intraday attempt to rally. During yesterday’s session, miners moved back to their 50-day moving average once more, again verifying it as resistance. The implications are bearish.

Let’s get back to silver. On its chart (figure 3), you can see a triangle-vertex-based reversal at the end of the year. Before the price moves close to the reversal, it’s relatively unclear what kind of implications a given reversal is likely to have. Well, including today’s session, there remain only three sessions until the end of the year, so we’re likely to see the reversal shortly.

Based on the likelihood that the next big move is going to be to the downside, it would fit the overall picture more if the upcoming reversal was a top, not a bottom. A bottom would imply a rally in the following days or weeks, and the relative performance (as described above and yesterday) along with other factors (as described yesterday) continues to favor a bigger decline.

This means that we might not see a meaningful decline for a few more days, and we might even see one final move higher before the top is formed. This could be something that takes place in silver only or something that we see in gold and miners as well. Still, I don’t expect a move higher to be really significant in the case of the latter. The miners are underperforming the metals, after all.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

As USDX is Poised to Pop, What Happens to Gold?

December 28, 2020, 9:52 AMAfter awakening from its slumber last week, the USD Index may be in the early innings of a short-term breakout. Bursting with energy, the dollar basket closed (on Dec. 22) above its declining resistance line (although more data is needed to confirm a larger move).

And to quote Francis Bacon, because “we rise to great heights by a winding staircase of small steps,” Tuesday’s ‘small step’ may be the beginning of an epic comeback.

Please see below:

In this week’s early trading, the USDX moved lower and then rallied back up, after touching its previous resistance line, which now appears to have turned into support. Despite the initial decline, the USDX is now more or less where it had started this week’s trading. Its ability to reverse the initial decline appears bullish.

While the USDX traded lower-to-flat from Dec. 23 – 25, the price action still follows a familiar playbook: In 2018, the USDX dipped below the 1.618 Fibonacci extension level before circling back with a vengeance (The initial bottom occurred in early 2018, with the final bottom not far behind.) Moreover, the 2018 USDX bottom also marked the 2018 top in gold, silver and the gold miners (depicted in charts 2 and 3 below).

I previously wrote that the USDX was repeating its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the recent correction was smaller than it was in 2017.

Since back in 2018, the USDX’s bottom was at about 1.618 Fibonacci extension of the size of the correction, we could expect something similar to happen this time. Applying the above to the current situation would give us the proximity of the 90-level as the downside target.

“So, shouldn’t gold soar in this case?” – would be a valid question to ask.

Well, if the early 2018 pattern was being repeated, then let’s check what happened to precious metals and gold stocks at that time.

In short, they moved just a little higher after the USDX’s breakdown. I marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX (proxy for mining stocks) were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in the case of the miners.

Consequently, even if the USD Index is to decline further from here, then the implications are not particularly bullish for the precious metals market.

And as we approach the New Year and beyond, I expect a similar pattern to emerge.

Why so?

First, the USDX is after a long-term, more-than-confirmed breakout. This means that the long-term trend for the U.S. currency is up.

Second, the amount of capital that was shorting the USDX was excessive even before the most recent decline. This means that the USD Index is not likely to keep declining for much longer.

In addition, after last week’s drawdown in gold and the gold miners, the sun appears to be setting on the yellow metal. As ‘buy the dip’ morphs into ‘sell the rally,’ gold’s downtrend is likely to resume. Furthermore, the 2018 analogue signals that the SPX’s (S&P 500 Index) days are also numbered (If you analyze the chart above, you can see that the USDX bottom coincided with the SPX top.)

Fundamentally, the USDX is also poised to pop.

On Tuesday (Dec. 22), I highlighted the misguided narrative plaguing the U.S. dollar. In short:

With liquidity spigots on full blast around the world, the U.S. isn’t the only region expanding its money supply (And remember, currencies trade on a relative basis.) In fact, the European Central Bank (ECB) has more assets on its balance sheet than the U.S. Federal Reserve (FED).

And after another update, the ECB’s spending spree has now reached a record €7 trillion (As a point of reference, the Dec. 22 ECB chart was relative to the FED, so both balance sheets were presented in U.S. dollars. The chart below depicts the ECB’s balance sheet in euros).

Week-over-week, the ECB’s balance sheet increased by €59 billion. But the real story? The ECB’s total assets now equal 69% of Eurozone GDP – nearly double the FED’s 35%. So while EUR/USD clawed back some of its early-week losses (after the EU and the U.K. reached a Brexit agreement), its prior three-day downtrend (Dec. 18 – 22) is likely to continue (Remember, movement in the euro accounts for nearly 58% of the movement in the USDX.)

Consequently, the implications for the precious metals market are not as bullish as everyone and their brother seems to tell you. Conversely, the forex market could provide the PMs and mining stocks with a substantial bearish push in the coming weeks – or even days.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks.We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFAFounder, Editor-in-chief -

Gold’s and Miners’ Relative Weakness = Big Downswing Ahead

December 23, 2020, 9:40 AMHere is a simple formula to follow, which perfectly encapsulates the current market situation: gold’s relative weakness to the USDX + miners’ relative weakness to gold = bearish days ahead.

Yesterday’s trading confirmed my previous comments – gold, silver, and mining stocks declined. They all moved back up in today’s pre-market trading, but the relative performance of these markets have also confirmed the bearish outlook. Let’s take a look at the details, starting with gold stocks.

The GDX ETF declined visibly yesterday and it did so on volume that was a bit below the volume on which the GDX topped at its 50-day moving average last week. At the same time, we saw a new sell signal in the Stochastic indicator. This is exactly what we saw in early November, before the approximately $8 decline. An $8 decline from the recent top would imply a move to about $31, which is the upper border of the target area that I’ve been featuring for some time. And since history tends to repeat itself to a considerable degree, the above became more likely based on the above analogy.

In today’s trading that’s taking place on the London Stock Exchange, the GDX is barely up. It hasn’t corrected almost anything from yesterday’s decline, even though gold is up more visibly. This is bearish.

If we consider how much gold and the GDX changed this week, it’s clear that miners continue to underperform gold, magnifying it’s declines and mostly ignoring its upswings.

Why does it matter? Because one of the key gold trading tips is that gold stocks tend to outperform gold in the early stages of big upswings, and they tend to underperform gold in the early stages of big downswings. Gold miners’ relative performance has been providing us with bearish indications for weeks, even during rallies. The implications are bearish. It seems that we will see a major decline before seeing a breakout to new highs in gold.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Gold Set to Decline as USDX Poised for Resurgence

December 22, 2020, 9:12 AMGold prices fell in Tuesday’s trading, on fears of a new and faster spreading strain of the coronavirus in the U.K. Meanwhile, the U.S. dollar strengthened and appears to be poised for a resurgence, which does not bode well for the price of gold in the coming weeks. Is the top in for gold and has the final downward trend begun? Can the U.S. dollar only rise from here?

Gold remains in a downtrend and yesterday it moved to the very upper border of the declining trend channel. It seems that the next move lower can start any day now. In fact, it might have started yesterday.

This is especially the case if the USD Index is about to move higher, and this does seem to be the case, as it moved back above my previous Fibonacci-extension based target.

When the same thing happened in 2018, it meant that the decline was practically over for the USDX, and that the top is in for the precious metals sector.

So, it appears that after bouncing off my initial downside target (89.8 – 90) on Thursday (Dec. 17), the USDX seems poised for a resurgence.

But what are the direct catalysts?

Well, as I already mentioned, the positioning is beyond bearish. And if sentiment reverses, we could see a wave of short-covering (investors have to buy the U.S. dollar to cover their shorts). Last week, USD sentiment hit one of its lowest points in the last 30 years (roughly 11,000 trading days), with negativity only exceeding today’s levels 2.5% of the time.

Please have a look at the chart:

When bearish positioning becomes this crowded, it often ends with a sharp reversal. Focus on the data: Notice how extremes (in either direction) don’t age well?

In addition, traders are ignoring the dichotomy between speculators (those that gamble on currency moves) and commercial traders (hedgers that buy/sell the currency on behalf of actual businesses).

Please look at the following chart:

Source: Bloomberg/Santiago Capital

Please note that commercial traders are actually net-buyers of USD futures. More importantly, the last seven times commercial positioning was this high, it preceded a U.S. dollar rally.

So where is all the negativity coming from?

Well, the narrative from financial pundits includes: 1) QE (money printing). 2) Debt/GDP (fiscal overspending). 3) A climactic debasement of the U.S. dollar.

However, the story is more of a fairy tale.

With liquidity spigots on full blast around the world, the U.S. isn’t the only region expanding its money supply (And remember, currencies trade on a relative basis.) In fact, the European Central Bank (ECB) has more assets on its balance sheet than the U.S. Federal Reserve (FED). All other things being equal (in Economese: ceteris paribus), if things are bad in the U.S. but are worse in other parts of the world, in particular in the Eurozone and in Japan, then the USD Index would likely rally because the USD would seem like a better currency in comparison to the euro and the yen.

Please take a look below:

As of Wednesday (Dec. 16), the ECB has purchased more than $8 trillion in financial assets, while the FED lags behind, at more than $7 trillion. So, while the financial media claims the dollar is being printed into oblivion – on a relative basis, Europe actually takes the cake.

Another important factor is that investors have forgotten their history lessons. Past precedent shows that QE doesn’t debase the U.S. dollar in the really long run. In fact, the greenback actually appreciated (from its early 2008 value) during the first three bouts of money printing (QE1 – QE3).

We are over 10 years after the first QE was announced, after three rounds plus some extra operations, and right now we are in an open-ended QE with the Fed determined to keep providing liquidity as needed. And where is the USD Index? Above its 2008 high.

So …Is this time really different?

Source: Bloomberg/Santiago Capital

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim target for gold that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM