tools spotlight

-

A Slightly Weaker Dollar Tempering Gold's Decline

October 6, 2020, 7:41 AMVery little has changed on the precious metals market since yesterday, and practically everything that we wrote in yesterday's extensive analysis remains valid. For that reason, our Gold & Silver Trading Alert for today will be relatively brief.

What we want to emphasize today are yesterday's price moves that didn't manage to make a significant change in the marketplace. Let's begin with one of the key precious metals price drivers - the USD Index.

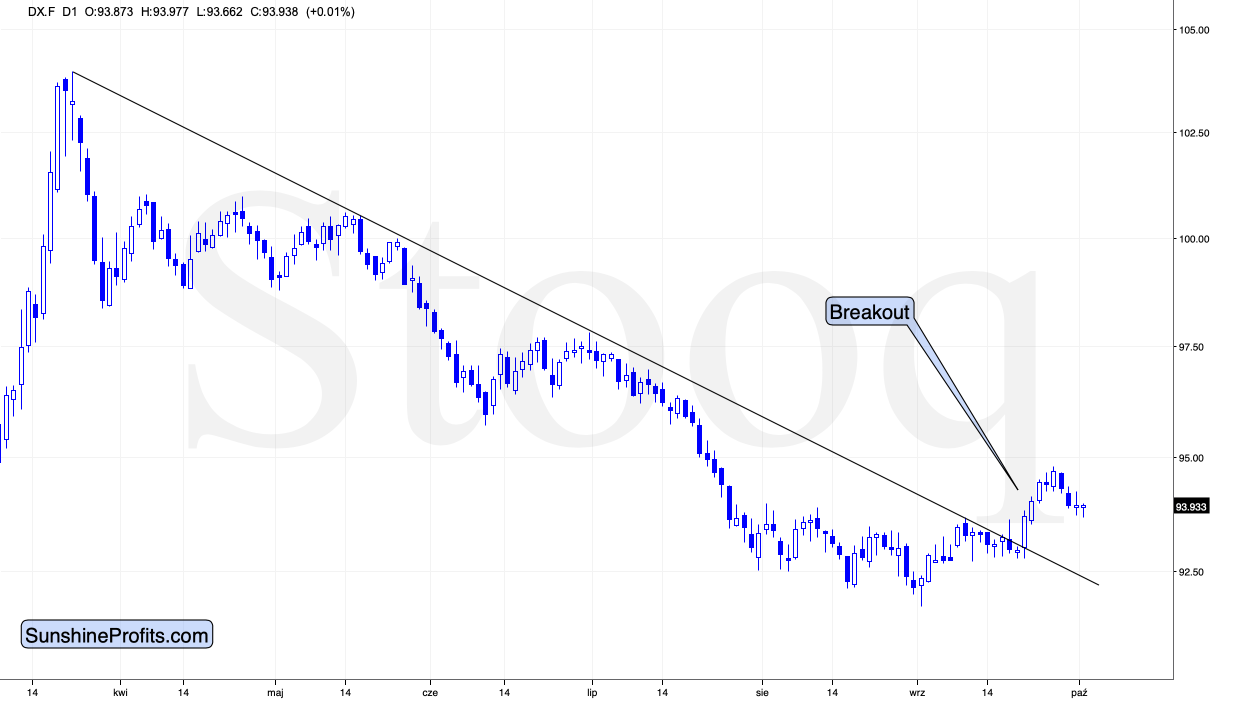

In yesterday's analysis, we emphasized that the breakout above the declining, medium-term resistance line was more than confirmed. The implications of this remain bullish today as well. The fact that yesterday the USDX moved slightly lower and that nothing changed in today's pre-market trading due to the really tiny price moves is a normal and natural part of the breather that the market is currently in.

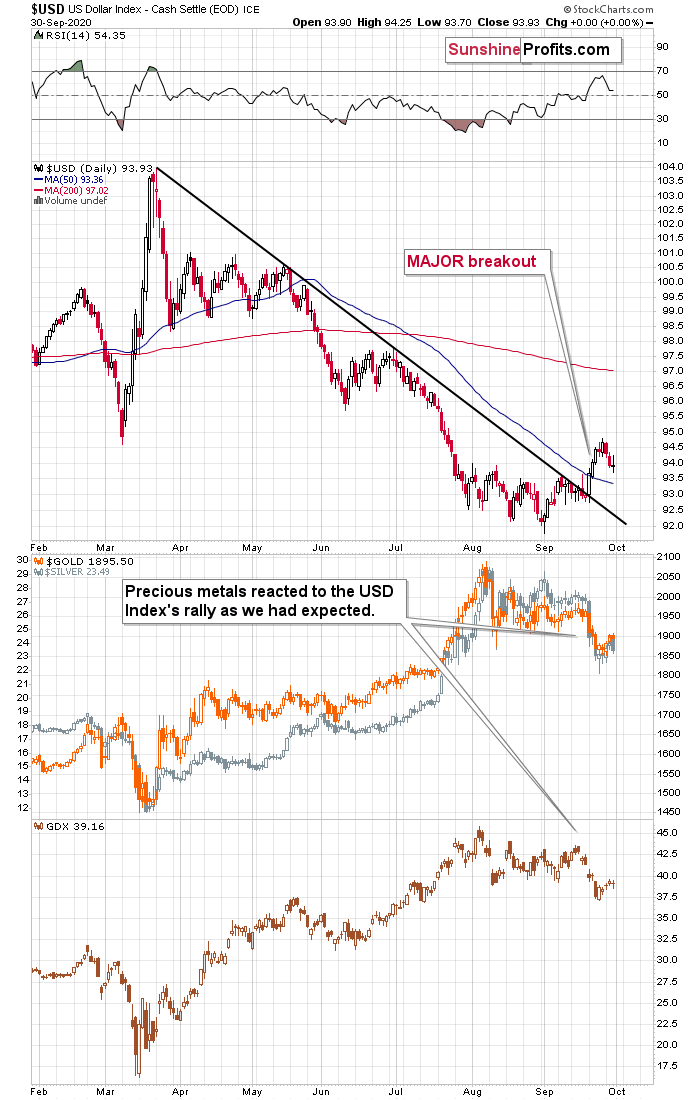

The pause in the precious metals sector continued in the same manner as the ongoing USD Index breather.

On Friday, we've commented on the gold chart above in the following manner:

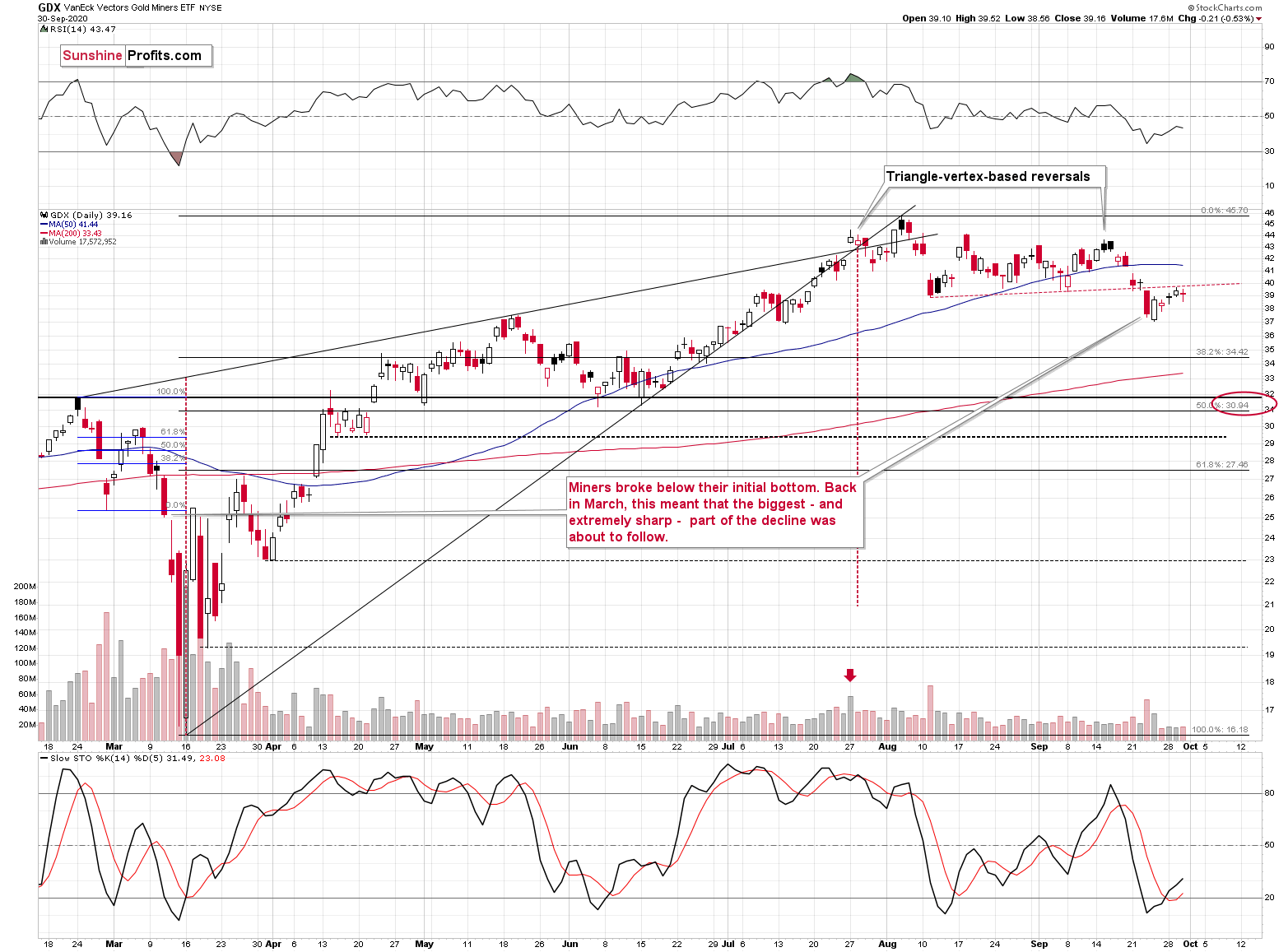

The short-term triangle-vertex-based reversals were quite useful in timing the final moments of the given short-term moves in the past few weeks. Please keep in mind that the early and late September lows developed when the support and resistance lines were crossed.

We can see the same thing happening once more. Based on the recent highs and lows, yesterday, the support and resistance lines both crossed again. And indeed, gold is trading below yesterday's closing price in today's pre-market trading.

Now, this technique might not work on a precise basis, but rather on a near-to basis, and given the highly political character of the current month (before the U.S. presidential elections), things might move in a somewhat chaotic manner... But still, this technique worked multiple times in the previous months and years, and it has worked recently as well. It seems quite likely that the days of this corrective upswing are numbered.

While gold didn't start with its decline right after the most recent triangle-vertex-based reversal, please note that it hasn't happened previously either. What happened was that it ended the decline, instead of starting a corrective upswing. The move higher took place several days later, after witnessing a pause beforehand.

Hence, it's absolutely normal that gold didn't decline yet, and that it appears to have ended the rally instead. The current pause is very much in tune with what happened previously - in late September. The implications were not invalidated, and therefore, they remain bearish.

-

Focusing on Gold's Strength Against the Ongoing USDX Rally

October 5, 2020, 10:08 AMOn Friday, we commented on the above gold chart in the following manner:

The short-term triangle-vertex-based reversals were quite useful in timing the final moments of the given short-term moves in the past few weeks. Please keep in mind that the early and late September lows developed when the support and resistance lines were crossed.

We can see the same thing happening once more. Based on the recent highs and lows, yesterday, the support and resistance lines both crossed again. And indeed, gold is trading below yesterday's closing price in today's pre-market trading.

Now, this technique might not work on a precise basis, but rather on a near-to basis, and given the highly political character of the current month (before the U.S. presidential elections), things might move in a somewhat chaotic manner... But still, this technique worked multiple times in the previous months and years, and it has worked recently as well. It seems quite likely that the days of this corrective upswing are numbered.

Indeed, gold moved lower in this week's pre-market trading. Therefore, what we've analyzed above remains valid, and the outlook continues to be bearish for the next several weeks - next few months.

Based on the chart above, the likely downside target for gold is at about $1,700, predicated on the previous lows and the 61.8% Fibonacci retracement, based on the recent 2020 rally.

As far as the white metal is concerned, previously, we've indicated the following:

Silver is also after a major breakdown and it just moved slightly below the recent intraday lows, which could serve as short-term support. This support is not significant enough to trigger any major rally, but it could be enough to trigger a dead-cat bounce, especially if gold does the same thing.

Once again, that's exactly what happened.

At this point one might ask how do we know if that really just a dead-cat bounce, and not a beginning of a new strong upleg in the precious metals sector. The reply would be that while nobody can say anything for sure in any market, the dead-cat-bounce scenario is very likely because of multiple factors, and the clearest of them are the confirmed breakdowns in gold and silver, and - most importantly - the confirmed breakout in the USD Index. The invalidation of the breakout above the previous 2020 highs in case of the general stock market is also a bearish factor, especially for mining stocks (and silver).

-

Trump Tests COVID-19 Positive - How will The Markets Respond?

October 2, 2020, 9:12 AMThe big news of the day is that the U.S. President - Donald Trump, and the First Lady - Melania Trump, had both tested positive for Covid-19. If the markets were waiting on any trigger that the situation is about to worsen - this might be it. In the last several hours, crude oil and stocks have declined, making the entire situation more and more similar to what we have witnessed in March.

And what followed in March? A massive slide in the precious metals market that was then followed by a robust rebound afterward. In the present case, we expect history to repeat itself one more time again.

As far as price action is concerned, it's in tune with the news mentioned above and the technical indications that we had seen previously.

Regarding the USD Index's short-term chart, previously, we've indicated the following:

Last week, the USD Index was just starting to break above the declining resistance line. We wrote that the situation doesn't become crystal-bullish, unless we see a confirmation of the breakout in the form of either a significant move above the resistance (it's not significant so far), or three consecutive daily closes above it.

That's exactly what we saw. The breakout is more than confirmed. We didn't saw a corrective decline, but rather, we've witnessed a pause. So, will we see a pullback soon? That's quite possible, but definitely not inevitable. Such a decline could trigger a rally in gold, but we don't think that any of these moves would be significant.

As it turns out, that's precisely what we've witnessed this week.

The USDX moved slightly lower, while gold, silver, and mining stocks moved marginally higher. And then we saw a pause in all of them. However, the sizes of these moves were not particularly significant.

Just as the USD Index paused, the same happened in gold, silver, and mining stocks. Gold moved a bit above its very recent highs yesterday, but the move was tiny. The same happened when it comes to miners. Silver didn't manage to move above its very short-term highs. All in all, after a substantial short-term decline, the markets took a breather, appearing to be ready to move lower once again.

The above GDX ETF chart points out that miners still closed the day below the red resistance line despite gold's move higher. So, did the most recent upswing made the outlook bullish even for the short term? Not really.

In other words, practically everything that I wrote yesterday and in Monday's extensive analysis still applies - for the next several weeks, the outlook for the precious metals market remains bearish.

Before summarizing, let's answer the question that you're likely wondering about the most - when will this correction end?

The simple answer is that it's relatively unclear, but also, it could be the case that it has already ended.

The short-term triangle-vertex-based reversals were quite useful in timing the final moments of the given short-term moves in the past few weeks. Please keep in mind that the early and late September lows developed when the support and resistance lines were crossed.

We can see the same thing happening once more. Based on the recent highs and lows, yesterday, the support and resistance lines both crossed again. And indeed, gold is trading below yesterday's closing price in today's pre-market trading.

Now, this technique might not work on a precise basis, but rather on a near-to basis, and given the highly political character of the current month (before the U.S. presidential elections), things might move in a somewhat chaotic manner... But still, this technique worked multiple times in the previous months and years, and it has worked recently as well. It seems quite likely that the days of this corrective upswing are numbered.

Thank you for reading our free analysis today. Please note that it's just a small fraction of today's all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the detail to look for as a confirmation that the final bottom in gold is in Subscribe now and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

USDX Rebounds Keep Countervailing the PM Market

October 1, 2020, 7:27 AMToday's analysis will be relatively short, as the precious metals market hasn't done much in the past 24 hours, and the same goes for the USD Index. Therefore, my previous comments on the precious metals market remain up-to-date.

Regarding the USD Index's short-term chart, we've indicated the following:

Last week, the USD Index was just starting to break above the declining resistance line. We wrote that the situation doesn't become crystal-bullish, unless we see a confirmation of the breakout in the form of either a significant move above the resistance (it's not significant so far), or three consecutive daily closes above it.

That's exactly what we saw. The breakout is more than confirmed. We didn't saw a corrective decline, but rather, we've witnessed a pause. So, will we see a pullback soon? That's quite possible, but definitely not inevitable. Such a decline could trigger a rally in gold, but we don't think that any of these moves would be significant.

As it turns out, that's precisely what we've witnessed this week.

The USDX moved a bit lower, while gold, silver, and mining stocks moved slightly higher. After that, we saw a pause in all of them. However, the magnitudes of these moves were not particularly significant.

In an equal manner as the USD Index, gold, silver, and mining stocks paused as well. After a sizable short-term decline, the markets took a breather, and now they appear to be ready to move lower once again.

The GDX ETF closed slightly above its August low, but it did so below the red resistance line. At this point, we must ask ourselves - did the most recent upswing made the outlook bullish, even at short notice? Not really.

In other words, practically everything that I wrote yesterday and in Monday's extensive analysis still applies - the outlook for the precious metals market remains bearish for the next several weeks.

Note Regarding Trading Vehicles

We've been asked to mention some ETF / ETN symbols that one could use for precious metals trading in this environment, so we would like to share our comments on them below. Please note that the "trading" section within the "Summary" already includes examples of trading vehicles for mining stocks (GDX; DUST) and junior miners (GDXJ; JDST).

In my opinion, the ProShares instruments are the ones worth looking at. By that, I don't mean that they are appropriate for everyone, and this should not be treated as investment advice. However, these investment vehicles are liquid, and they provide significant exposure to the underlying metals' prices.

The symbols are the following:

- UGL - 2x long gold

- GLL - 2x short gold

- AGQ - 2x long silver

- ZSL - 2x short silver

Thank you for reading our free analysis today. Please note that it's just a small fraction of today's all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the detail to look for as a confirmation that the final bottom in gold is in Subscribe now and read today's issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Staying Engulfed in Bearish Bias Amid U.S Presidential Debate

September 30, 2020, 6:45 AMThe USD Index declined yesterday, while the precious metals market moved higher, possibly due to the relatively "turbulent" pre-election debate in the U.S. But still, did anything actually change regarding the outlook?

Not really.

As we have stated in our previous analyses, while gold and the rest of the precious metals market will probably decline significantly in the following weeks, and that a short-term correction would not be surprising at all. The same holds true for the USD Index, except that the direction of any possible moves could be considered the opposite.

Regarding the USD Index's short-term chart, we've indicated the following:

Last week, the USD Index was just starting to break above the declining resistance line. We wrote that the situation doesn't become crystal-bullish, unless we see a confirmation of the breakout in the form of either a significant move above the resistance (it's not significant so far), or three consecutive daily closes above it.

That's exactly what we saw. The breakout is more than confirmed. We didn't saw a corrective decline, but rather, we've witnessed a pause. So, will we see a pullback soon? That's quite possible, but definitely not inevitable. Such a decline could trigger a rally in gold, but we don't think that any of these moves would be significant.

As it turns out, that's precisely what we've witnessed this week.

The USDX moved a bit lower, while gold, silver, and mining stocks moved slightly higher. However, the sizes of these moves were not particularly significant.

In the chart above, we see that the USDX has barely moved to the August highs, and then moved back up again (in today's pre-market trading) - above these highs. What does that mean? It means that the pullback might already be over.

At the moment of writing, we can see that gold erased most of yesterday's upswing (during the pre-market trading), which would support the theory above about the corrective move being over.

If we take the intraday prices into account, gold moved slightly above its August low, but that would not be the case if we consider the daily closing prices. In the latter case, we could even speak of a breakdown's verification below the August low.

Silver corrected based on a relatively weak support level created by the local August lows. We've predicted that this move is not likely to be anything significant, and indeed, it wasn't. Silver corrected a smaller part of the downswing, and it didn't even manage to move back to the rising support line that it had broken earlier this month. Therefore, the outlook remains bearish.

But, did it become bullish in the case of the mining stocks? After all, they just closed above their August low...

In short, we're not buying the bullish narrative because of the following three reasons:

- It doesn't fit the indications from the USD Index, gold, or silver.

- GDX corrected to the rising resistance line, based on the previous lows (red, dashed line) without breaking it.

- Gold is already back to where it was 24 hours earlier, and since miners closed above their August low for just one day, it seems that this was somewhat accidental and that they will follow gold's bearish lead that we've already detected in the pre-market trading.

In other words, practically everything that I wrote yesterday and in Monday's extensive analysis still applies - the outlook for the precious metals market remains bearish for the next several weeks.

Thank you for reading our free analysis today. Please note that it’s just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the detail to look for as a confirmation that the final bottom in gold is in Subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM