tools spotlight

-

Gold to Slide Along With Interest Rates - It's 2008 All Over Again

March 3, 2020, 6:54 AMThere is the political quote "There are decades when nothing happens, and there are weeks when decades happen.

Similarly in the markets, the times of dramatic developments give way to periods of relative calm.

That's exactly what we could say looking at the action in precious metals yesterday. But let's make additional comments on the interest rates and the analogy to 2008 and 2000.

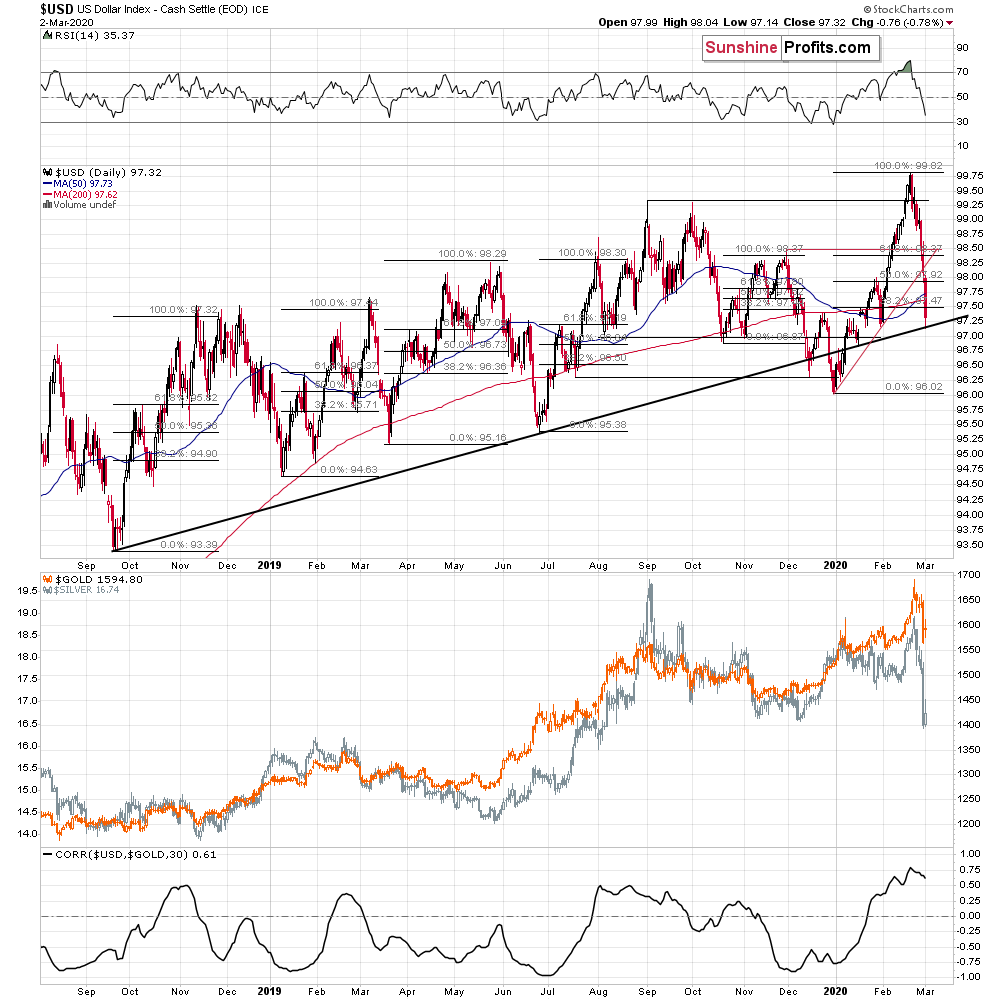

The technical thing that did change, was the USD Index chart, which shows USD's yet another powerful slide. And that happened regardless of the greenback having already reached a combination of support levels previously. What does it mean?

The USDX Reflection on PMs

The less important thing is that the USDX might have finally reached the bottom yesterday, as it visited the rising, medium-term support line and the late-January lows. The RSI indicator close to 30 is where the USDX used to reach its previous short-term bottoms. It's at 35 right now, suggesting that the downside here is very limited.

The more important thing is how did the precious metals sector respond to the big show of weakness (-0.76 index point slide in one day is quite something). It barely moved.

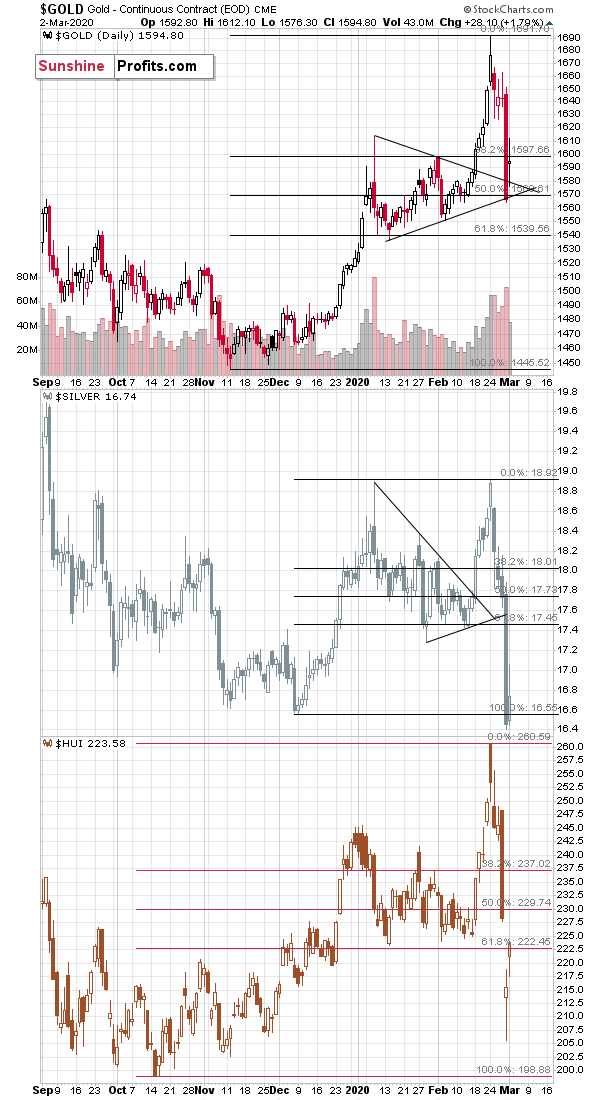

The move higher in silver was almost nonexistent compared to the huge slide on Friday, and the move in gold was a regular rebound - a breather.

In many cases, gold's $28 upswing would be viewed as something significant. But not yesterday, as such moves should be considered on a relative basis. Compared to how volatile gold was on Friday, and how much it dropped, it "should have" erased at least half of the preceding decline, preferably more. And it should have done away with a sizable portion of our profits (we entered the short positions in gold, silver, and mining stocks on Feb 21st). Gold was unable to do that.

This tells us that yesterday's move was most likely just a breather within a decline, not the profound comeback after a major bottom. And it tells us that one should at least consider postponing their gold investments right now.

The upswing that we see in mining stocks might seem more encouraging, but we don't trust it either. Miners didn't erase their Friday's decline, even though the other stocks (S&P 500) did. In fact, S&P 500 almost erased Friday's and Thursday's decline with yesterday's rebound. Miners were not even close to doing the same thing as the general stock market.

What miners did, was actually a comeback to the previously broken levels - the previous 2020 lows. The breakdown below them seems to be verified. Once this process is completed, the decline is likely to resume.

Please note that the market is expecting at least a 0.5% rate cut in March. Based on CME's FedWatch tool, the probability of at least a 0.5% cut is 100%. This means that a 0.5% cut might even be viewed as hawkish and thus not trigger a rally in PMs, or cause further decline in the USDX. The markets expect (73.9%) the Fed to then cut rates once again in April (or to cut it by 0.75% in March and not to cut in April).

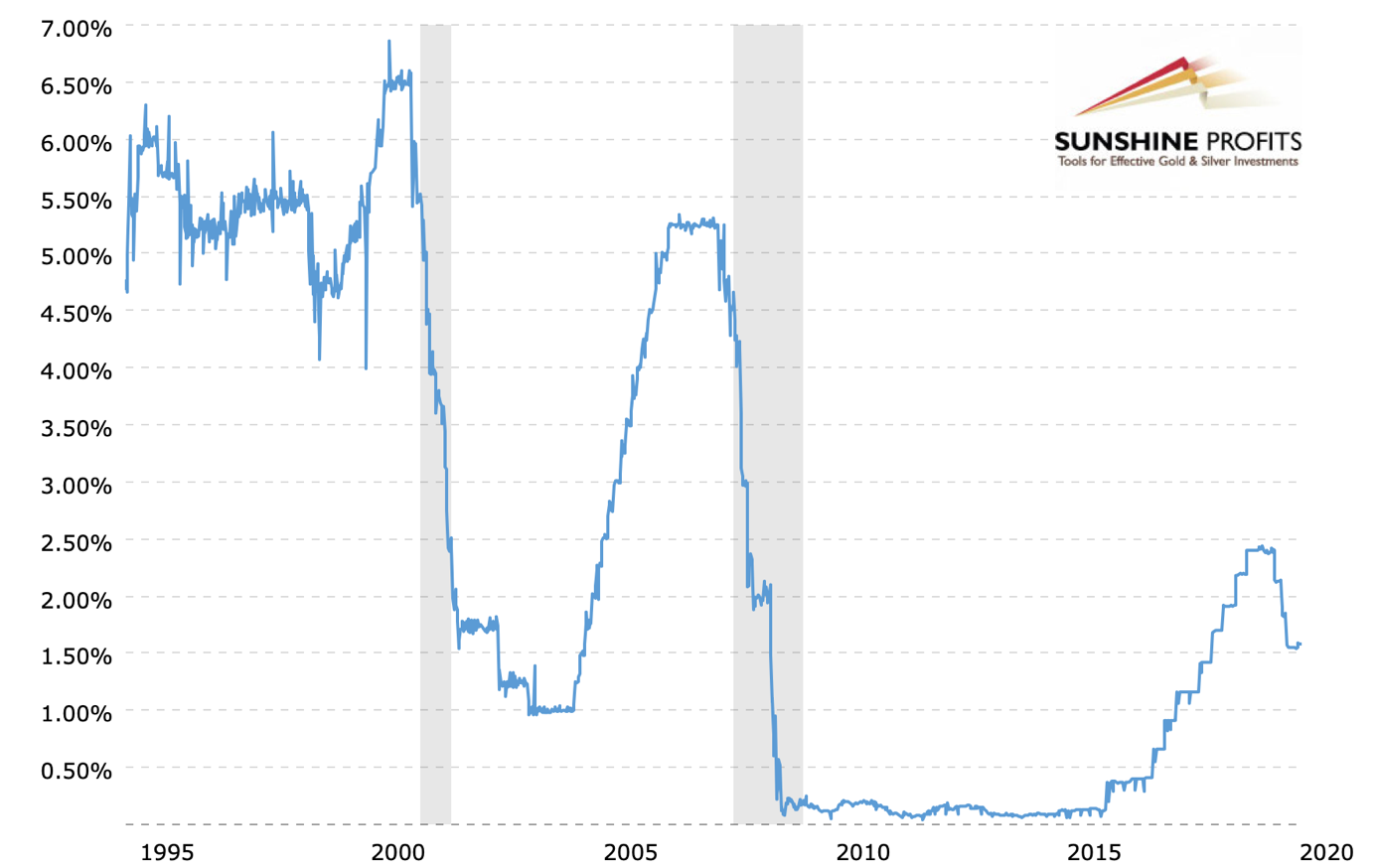

The rates are likely to decline and yet PMs are still declining. Doesn't that remind you of something?

The Fed Cutting Rates

The Fed started to cut rates in mid-2007. Gold moved higher and topped in early 2008. Then it started one of the biggest and sharpest declines of the previous decades. And it did so despite the rates declining at a faster pace. The rates bottomed at the end of 2008, but gold bottomed earlier. Also, the USD Index declined at first (between mid-2007 and early 2008) but then it soared by about 16 index points in just a few months (despite the downtrend in interest rates). And we've been writing about dollar's upside potential for months.

Now, the Fed started to cut rates in mid-2019. Gold moved higher and topped in early 2008. The rates were not cut once again yet, but it's almost certain that they will be cut given the market's expectations, so we practically know that the decline in rates is likely to accelerate. And yet, gold is not reacting by rallying anymore.

The similarity to 2008 is present not only from the technical point of view (which we elaborated on yesterday), but also from the fundamental point of view.

Oh, and there was only one additional analogous situation in case of interest rates. It was between late-2000 and late-2001. Gold bottomed then, but not before declining first. Silver underperformed gold, and it bottomed in late 2001. This analogy is not perfect, though, and is worse than the one to 2008, because of the obvious difference in the performance of gold stocks. In 2008, they magnified gold's declines, while in 2001, they showed great strength. Well, miners are definitely not showing great strength here, so the link to 2008 is much stronger. And the implications are very bearish for the following months.

Thank you for reading today's free analysis. If you'd like to supplement the above with details regarding our current approach to trading positions (and the upcoming ones), we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The 2020 Top in Gold Is In

March 2, 2020, 6:33 AMAvailable to premium subscribers only. The speculative short positions that we entered on Friday, February 21st are already profoundly profitable. In case of mining stocks, we are moving all our stop-loss levels lower - below our entry prices, which means that we are effectively securing profits on this trade, while at the same time allowing it to grow further.

-

Gold Really Doesn't Seem to Be All That Steady

February 28, 2020, 5:36 AMAvailable to premium subscribers only. The speculative short positions that we entered one week ago are already profoundly profitable.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM