tools spotlight

-

The Countdown to the Gold & Silver Move

April 30, 2020, 6:52 AMSilver is attracting more than its fair share of attention, and we're reflecting on that. How far do the similarity lessons go in the white metal actually?

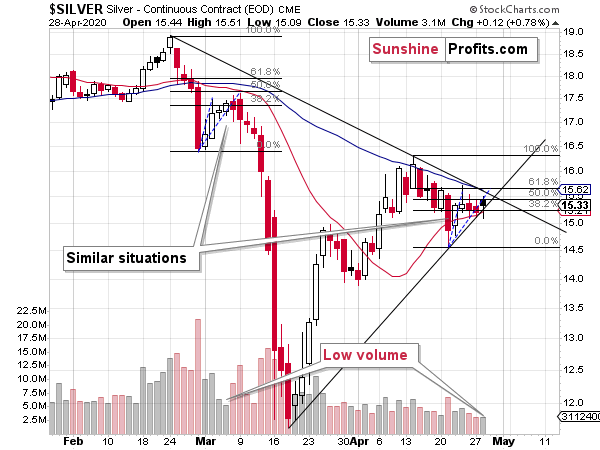

As far as the SLV ETF is concerned, we also continue to see similarity between both periods: early March and late April.

The SLV ETF closed yesterday's session 2 cents above the upper border of its previous price gap, which might be bullish, if the breakout is confirmed. It doesn't seem likely because silver just rallied and reversed in the overnight trading, and it happened at the vertex of the triangle based on the important support and resistance lines.

This suggests that the small breakout above the price gap in SLV, and above the declining resistance line in silver, is likely to be invalidated shortly.

Such an invalidation would likely lead to sizable declines, even without taking into account the similarity to what happened in early March.

Speaking of the similarity to early March - the red dashed lines show when and how far silver rallied before plunging at that time. The initial rallies are practically identical, while the final upswing is very similar in terms of price, and as far as time is concerned, it still similar as it seems to be taking silver only an extra day to complete the same pattern.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and the miners.

-

Gold & Silver: Just Like in March 2020, Before The Slide

April 29, 2020, 5:32 AMIn our yesterday's free article, we discussed i.a. the situation in silver and we emphasized that it might be repeating its early-March performance. In fact, we wrote about many other markets and signs pointing to this kind of self-similarity. What happened after we wrote it?

In short, silver is acting exactly as we outlined yesterday, so it seems justified to start today's essay with a quote:

On the short-term note, we see that silver is more or less repeating its early-March performance. The price moves are not identical in terms of the Fibonacci retracement levels, but comparing the size and shape of the initial rallies (blue dashed lines) we get almost identical results. After rallying sharply initially, silver started to do... pretty much nothing. That was the same in early March. It was after a few additional days, when silver's corrective upswing had really ended, and the big slide started.

If the similarity to the early-March continues, we can expect the decline to start on Wednesday or very close to it. Please note that silver's first few days of the decline were noticeable, but not huge. However, once silver broke below its previous lows, it took only three sessions for the white metal to slide below $12. Let's keep in mind that previously silver started from higher price levels.

The implications are bearish for the following few weeks and rather neutral for the next few days.

Silver declined below $15 in yesterday's pre-market trading and it seems to be analogical to what it did on March 9 - declining profoundly before the US markets open and then coming back only to level off in the next 2 days.

Please note that back in March, the day when silver declined was accompanied by high volume and yesterday's session wasn't. This might seem like an invalidation of the analogy, but it really isn't. The reason is that ultimately silver ended yesterday's session higher, while it ended the March 9th session lower. This means that in a way, lower volume now than on March 9th is normal and bearish.

While both situations are not identical, history does seem to be rhyming.

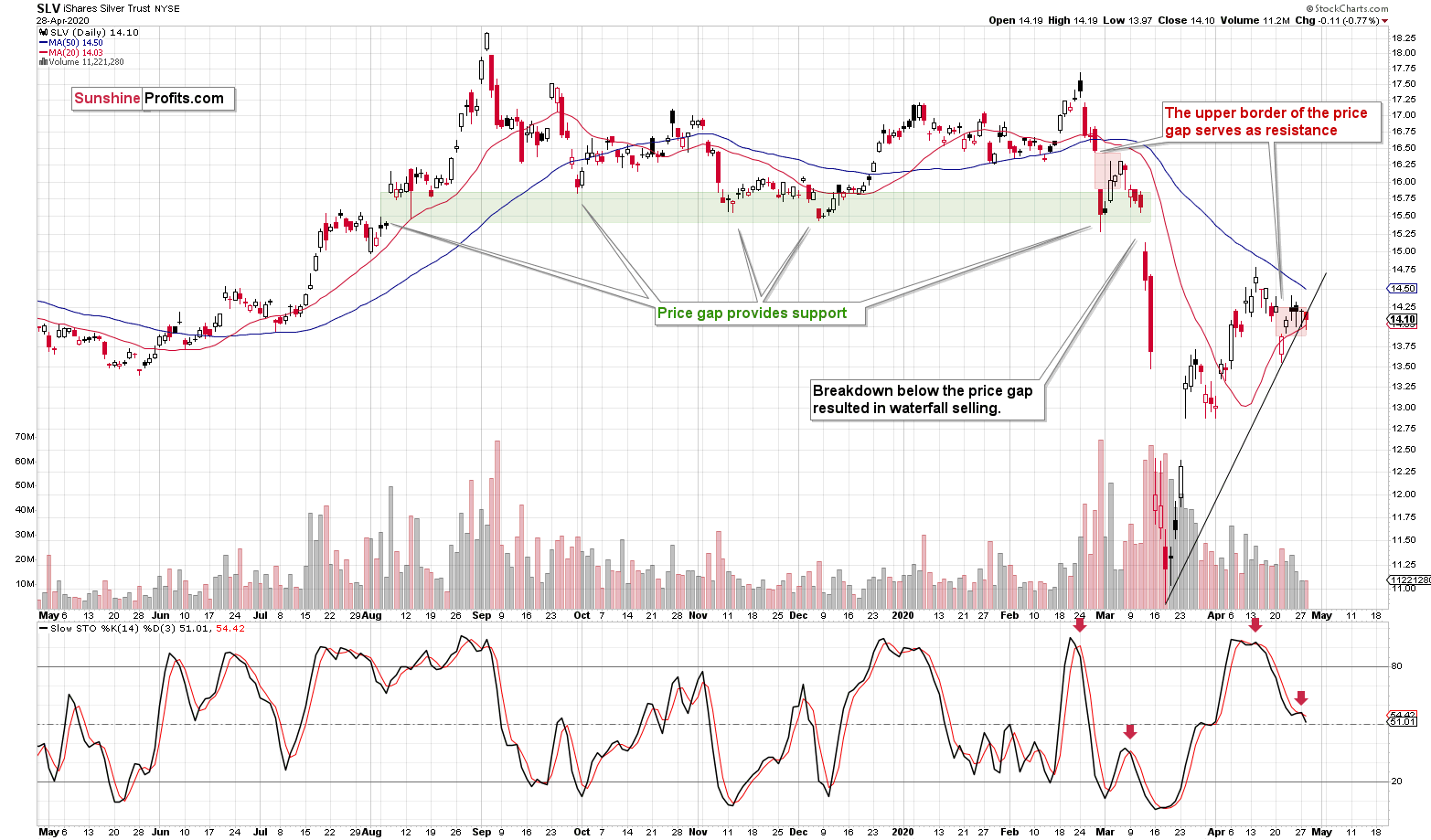

Having said that, let's look at silver from the ETF point of view. After all, at times comparing signals generated during only the US trading hours could provide more precious metals trading tips than the signals coming from the futures market.

The important details that SLV show clearly that silver futures don't, are the price gaps and the volume levels.

The volume in the SLV ETF is now very low. It was relatively low also during the early-March correction and it was the calm before the storm. By itself, it wouldn't mean much, but since it's just one of the factors pointing to similarity between early March and the current situation, it's worth paying attention to it.

The price gaps are also important. The green rectangle shows just how important they can be. The price gap that formed in early August 2019 served as support several times. It was so important that when it was finally broken in March, the waterfall selling followed.

At this time, we also have a price gap in play, but it works in a different way. Namely, it's based on the Apr 20-21 price gap, and its upper border serves as resistance. This is important, because during the early-March correction, the upper border of the recent (Feb 27-28) price gap also served as resistance. This makes the two situations even more similar.

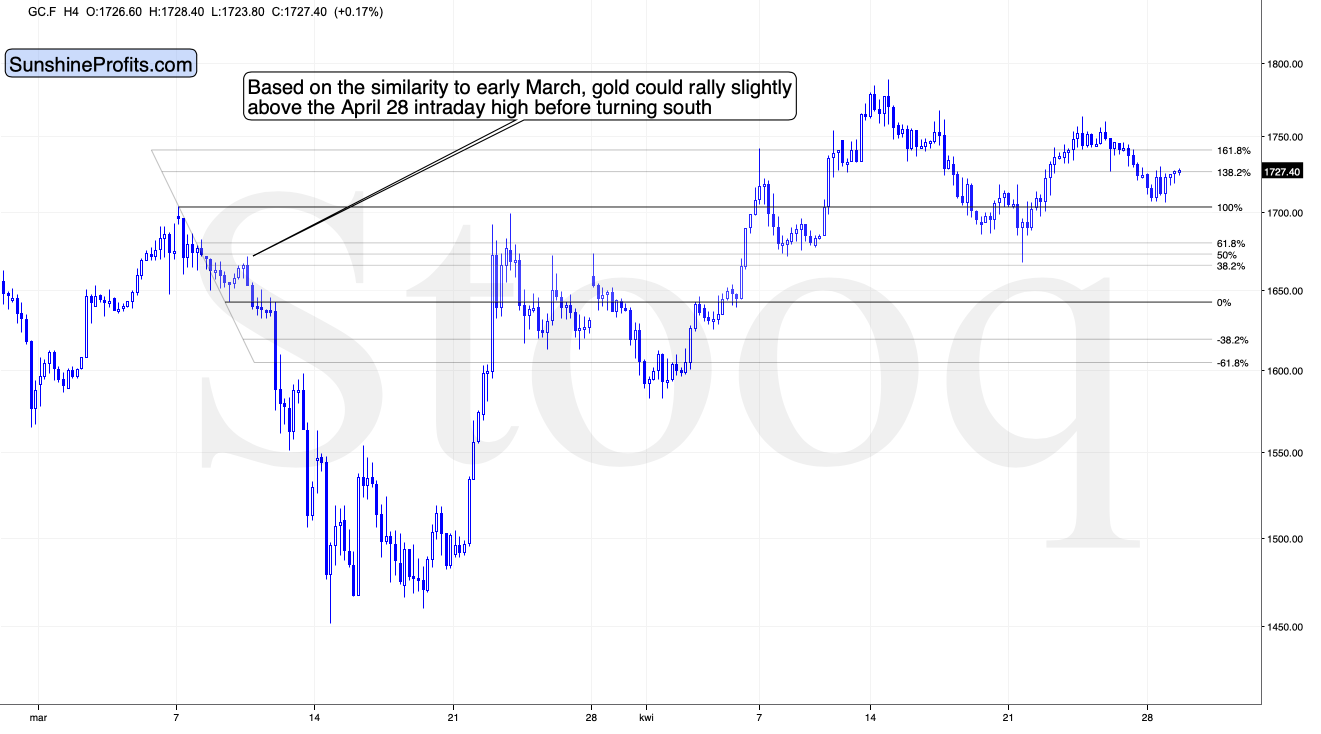

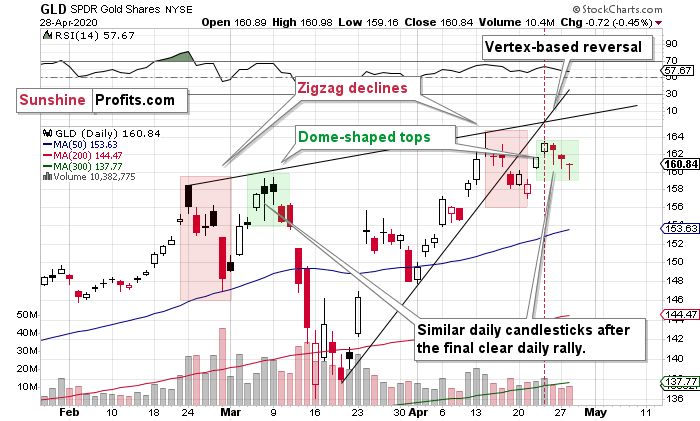

And what does gold report at this time?

Gold futures point to a situation in which the most recent April high was well below the mid-April high.

However, in case of the GLD ETF those highs are relatively similar. And actually, taking daily closes into account, we saw a new high just a few days ago.

This makes that situation even more similar to what happened in early March. Back then, the GLD ETF also made a new high in terms of the closing prices... And it was the final time to exit any remaining long positions and enter short ones.

Please note that the double-top itself is not the only similar thing. The shape of the decline from the first top (zigzag marked with red) and the shape of the second top (dome) also confirm the similarity.

This, plus the fact that based on the last few days, it seems that gold topped right at its vertex-based reversal, makes the outlook very bearish.

Overall, the short-term outlook for the precious metals sector is bearish, even though it moved higher this month. To clarify, we think that the fundamental case for gold is excellent, but at the same time we think that gold and silver still need to decline one final time before the true bottom is formed. Being long gold, silver, or mining stocks right now is - in our opinion - dangerous.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and the miners.

-

The Price Targets for Gold

April 28, 2020, 6:59 AMPractically everything that we wrote yesterday, remains up-to-date today. Consequently, we will quote some parts of the analysis, and we'll supplement them with additional discussion of the relative performance of various sectors, as we saw interesting details yesterday that further confirmed our earlier writings.

USDX in Focus

In short, the USD Index is after a huge rally and a correction. In late March, the USD Index corrected the previous rally in terms of price moves, but not in terms of time. The latter is what it seems to have been doing for the past month. The USD Index did move higher in April, but the moves were relatively boring - somewhat similar to how it rallied in January and February. And what did gold do at that time? It moved higher, and then declined at some point once it got too high too fast - practically regardless of what the USD Index was doing. That was in the final part of February.

Please check what silver did in January and February. It moved mostly higher, only to decline in the final part of the month. Overall the initial action was positive but rather nothing to call home about. Gold's rebound in early March was accompanied by rather weak action in silver.

What's happening now? Gold declined in mid-April, similar to how it declined in late February. The USD Index initially triggered the move, but then gold declined for a few days regardless of what the USDX was doing. And the rebound that we saw last week? Silver's upswing was nothing to call home about - just like what we saw in early March.

Back in March, gold's rally ended after the first clear intraday decline. Interestingly, the very first day of gold's March slide - March 9th - took place when the USD Index also declined. That daily decline, however, was actually the start of a powerful rally.

That USD Index rally was not only powerful, but it was also volatile. It was volatile not only in general, but also in terms of each individual trading day.

Guess what - Friday was the day when gold clearly declined on an intraday basis, and that was also when the USD Index declined a bit. Silver hasn't done much.

What is even more interesting is that today, gold is also declining (about $10 at the moment of writing these words) along with the decline in the USD Index (about 0.26 decline at the moment of writing these words).

Just like it wasn't clear that gold was topping in the first half of March, it's far from being clear now - at least for most market participants.

Neither we would bet the farm on the scenario in which gold topped on Thursday, but it does seem quite likely.

Gold ended the day lower and so did the USD Index, confirming the indications from the previous day.

Today, gold is also lower while the USD Index is virtually flat (lower by 0.02). Based on the similarity to how the situation developed in early March, gold might be moving very close to the cliff, from which it would fall. In other words, yesterday's session could be similar to what happened on March 9th.

"Ok, but if so, then why aren't the miners declining? That's exactly what they did on March 9th!"

It's true that they declined and were the first to drop profoundly at that time. However, it's also true that back then, it was the decline in the stock market that helped them plunge first. On March 9th, the general stock market was already in the full decline mode. That's not what's going on right now.

The Lessons from Stocks

Conversely, the stock market is moving higher in the short term. That's pointless compared to the fundamental situation, but that's exactly what's taking place right now.

Quoting our yesterday's analysis:

In general, the above chart shows that the S&P 500 lost its momentum and broke below the rising trend channel. It moved higher since that time, but the breakdown was not invalidated. This has bearish implications going forward. In reality, it's just a confirmation of what we wrote with regard to how the situation is developing from the fundamental point of view and how it's likely to develop in the future.

Stocks are too high given what's likely ahead as investors don't seem to realize the long-term implications of what's happening right now, still counting on the V-shaped economic recovery. The market is forward looking and once more people start to realize what's going on, the stock market is likely to fall.

You know that UBER's stock price just moved to new April high on Friday? It makes little sense given that the restrictions are likely to be in place longer, not shorter than initially expected. Instead of looking at data, investors seem to be focusing on the fact that the re-opening talks are taking place - which "seems to suggest" that re-opening the economy is somewhat close or that it would be the first step toward getting quickly to how things were before. It's not quick, and it might even require a step back first, if the second wave of the virus hits first - which seems quite likely given how the protests are taking place.

It's very likely that stocks will decline over the next several weeks, but the question is when will investors start to - massively - realize that the worst is yet to come?

The vertical dashed lines provide interesting details from the precious metals investors' and traders' point of view. Namely, they show that in late February and early March, the PMs and miners were lagging the stock market. The declines in stocks started earlier. In fact, when the first serious daily decline in the stock market took place (February 24th), the PMs and miners topped. We marked this day with the red vertical line.

Then the stock market declined, and when it bottomed, gold, silver and miners also formed a daily bottom. That was on February 28th and we marked it with a green line. What happened next is that we saw a corrective rebound, which lasted longer in case of the precious metals market than it did in case of the general stock market. Once again stocks topped first, and the precious metals market topped approximately on the day when the stock market declined quite visibly (red line - March 6th).

We're seeing something similar also this month. The initial top in stocks formed on April 14th (red line) and that was also the top in the precious metals market. Then stocks bottomed on April 21st, which was also the day when the precious metals market bottomed (more or less).

The late-February - early March performance seems to be repeating.

The difference is in the performance of the mining stocks, which used to lag, and now they leap gold and the general stock market. What gives? Well, during the analogous period in March (around March 6th), stocks moved higher, but they didn't even manage to correct half of the decline from the February high. Right now, the stock market (taking the overnight futures into account) is slightly above the April 14th high. Mining stocks, being more correlated with the general stock market are moving higher relative to gold as they take their strength from the general stock market. Moreover, if the general stock market is about to top shortly, it's quite likely to expect the previously worst performing stocks, to shine now (that's what tends to happen at the market tops).

All the above suggests that the general stock market is likely to top any day now, and when the first sizable daily slide takes place, we'll have a good indication that the next huge decline in the precious metals market is about to start or that it has just started.

When could that take place? Quite possibly as early as this week. Please note that the spacing between the horizontal lines that we saw in late February and early March was approximately symmetrical. Plus, they were about a week apart.

Based on the above symmetry and the week analogy (which remains intact as the initial top and the most recent bottom were exactly one week apart) it seems that the next top or the significant daily slide could take place tomorrow - on Tuesday. Of course, there's no guarantee that it would happen, but it does seem quite likely.

This means that the next local top in the precious metals sector - including the mining stocks - might be at hand, quite possibly today or tomorrow.

The first sizable decline in the stock market will serve as an indication and the sizable daily decline in gold, silver, and mining stocks that follows - likely on the next day - will serve as a confirmation.

Given the price level to which stocks rallied yesterday and the proximity of a combination of very strong resistance levels it seems that they will move even higher before topping. It still seems relatively likely that it will happen this week - perhaps today or tomorrow.

The strong resistance levels are: the 61.8% Fibonacci retracement, the rising resistance line, and the upper border of the early-March price gap. There's also the 200-day moving average.

This means that while stocks might attempt to break above the 3000 level, they are unlikely to do so, and if they do manage to do so, this move is likely to be invalidated shortly.

Is it any wonder that in this environment mining stocks are not leading gold and silver lower? Absolutely not. But the above is also a reason to expect miners to slide with vengeance once stocks finally do decline.

Silver in the Spotlight

Meanwhile, silver is acting exactly as we outlined yesterday:

On the short-term note, we see that silver is more or less repeating its early-March performance. The price moves are not identical in terms of the Fibonacci retracement levels, but comparing the size and shape of the initial rallies (blue dashed lines) we get almost identical results. After rallying sharply initially, silver started to do... pretty much nothing. That was the same in early March. It was after a few additional days, when silver's corrective upswing had really ended, and the big slide started.

If the similarity to the early-March continues, we can expect the decline to start on Wednesday or very close to it. Please note that silver's first few days of the decline were noticeable, but not huge. However, once silver broke below its previous lows, it took only three sessions for the white metal to slide below $12. Let's keep in mind that previously silver started from higher price levels.

The implications are bearish for the following few weeks and rather neutral for the next few days.

Silver declined below $15 in today's pre-market trading - it could be the case that it's the beginning of the final slide, but it could also be the case that silver is doing what it did on March 9 - declining profoundly before the US markets open and then coming back only to level off in the next 2 days. Either way, the implications are bearish, the only difference is when the big move lower is going to take place: shortly, or almost immediately.

And what about the miners? Once again, the situation is just as we've described it yesterday.

Mining Stocks

The HUI Index declined significantly, and then it rebounded significantly.

Both are likely linked. Miners first declined more sharply than they did in 2008, so the rebound was also sharper. Based on the stimulus and gold reaching new yearly highs, miners also rallied and tried to move to new yearly highs. It's not surprising.

However, if the general stock market is going to decline significantly one more time, and so will gold - and as you have read above, it is very likely - then miners are likely to slide once again as well. This would be in tune with what happened in 2008.

At this time, it may seem impossible or ridiculous that miners could slide below their 2015 lows, but that's exactly what could take place in the following weeks. With gold below their recent lows and the general stock market at new lows, we would be surprised not to see miners even below their 2020 lows. And once they break below those, their next strong resistance is at the 2016 low. However, please note that miners didn't bottom at their previous lows in 2008 - they moved slightly lower before soaring back up.

Please note that the HUI Index just moved to its 2016 high which serves as a very strong resistance. Given the likelihood of a very short-term (1-2 days?) upswing in stocks and perhaps also in gold (to a rather small extent, but still), it could be the case that gold miners attempt to rally above their 2016 high and... Spectacularly fail, invalidating the move. This would be a great way to start the next huge move lower.

The GDX ETF managed to break above the previous 2020 highs and confirm this breakout in terms of three consecutive daily closes, and a weekly close. The above chart is now bullish for the mining stocks.

However, given how close the powerful long-term resistance (as presented on the previous HUI Index chart) is, and what's likely ahead for the GLD ETF and the general stock market, we doubt that this breakout would be able to generate anything more than a 1-2 day upswing.

It seems that those who are more short-term oriented (or the more advanced traders) might want to limit their exposure to the mining stocks or the precious metals sector until the situation clarifies, while those who aren't might prefer to keep the short positions intact as it seems that within the next 1-3 weeks, gold miners will be much (!) lower.

The full version of today's analysis includes details of our currently open position as well as supports and targets of the upcoming sizable moves in gold, silver and the miners.

-

Precious Metals, Lockdowns and Reopening

April 27, 2020, 9:21 AMThe action in silver is really interesting. Let's check the prospects for volatile white metal, and the relevant historical analogy it offers. Is the major 2008 - 2020 analogy in terms of price moves remains intact? In short, yes.

Silver Shares Its Two Cents

Silver plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we forecasted silver below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Note: Silver at or slightly below $8 seems most probable at this time.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Now, some may say that back in 2008, silver rallied only to about $14 and since now it rallied to about $16, so the situation is now completely different and that the link between both years is broken. But that's simply not true.

The nominal price levels are just one of the ways that one should look at the analogy - far from being the perfect or most important one.

Please note that back in 2008, there were two smaller bottoms in silver, and this time we saw just one. The decline before the bottom was sharper, so is it really that surprising that the rebound was sharper as well? Silver ended the 2008 corrective upswing once it moved visibly above the declining orange line and that's exactly what happened recently. It also topped once it reached its 10-week moving average (red line). That's exactly what just happened.

This MA is at $15.48 and at the moment of writing these words, silver is back below it, trading at $15.35.

The situations are not perfectly identical in terms of nominal prices, but they remain remarkably similar given how different fundamental reasons are behind these price moves (in reality, what's behind both declines is fear that - itself - doesn't change).

The technique used for predicting silver price is clearer than the one that we applied for gold, so it seems useful to look not only at the USD Index for signs, but also at the white metal itself. Once silver moves to $8 or below it, it will likely serve as a strong buy sign for gold, regardless of the price at which gold will be trading at that time.

Also, please note that silver formed a big shooting star candlestick during the previous week, which is a topping sign. The volume was low, but it was not low just during the formation of this candlestick, but it's been low during this month's upswing as well. It's relatively unclear whether the volume is confirming or invalidating the shooting star. Consequently, we view it as a bearish confirmation, and we wouldn't open a position based just on it. However, since it's just one of the factors pointing to much lower silver prices in the next few weeks, we view the very bearish outlook as justified.

On the short-term note, we see that silver is more or less repeating its early-March performance. The price moves are not identical in terms of the Fibonacci retracement levels, but comparing the size and shape of the initial rallies (blue dashed lines) we get almost identical results. After rallying sharply initially, silver started to do... pretty much nothing. That was the same in early March. It was after a few additional days, when silver's corrective upswing had really ended, and the big slide started.

If the similarity to the early-March continues, we can expect the decline to start on Wednesday or very close to it. Please note that silver's first few days of the decline were noticeable, but not huge. However, once silver broke below its previous lows, it took only three sessions for the white metal to slide below $12. Let's keep in mind that previously silver started from higher price levels.

The implications are bearish for the following few weeks and rather neutral for the next few days.

The full version of today's analysis includes details of our currently open position as well as targets of the upcoming sizable moves in gold, silver and the miners.

-

Gold Upswing Goes On - What Has Changed and What Has Not

April 24, 2020, 8:38 AMAvailable to subscribers only.

The full version of today's analysis includes details of our currently open position as well as targets of the upcoming sizable moves in gold, silver and the miners.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM