tools spotlight

-

PMs on the Move - a New Trading Call

April 3, 2020, 6:04 AMTwo important things happened yesterday. And no, the ridiculous rally in crude oil wasn't one of them. Yes, it was ridiculous, because it was clearly based on just one indication from Trump that was not backed by anything, and in the crude oil market, it is rather common to hear about the possibility to cut production, and then nothing happens.

Anyway, the particularly important things happening, were the rally in gold, and the rally in the USD Index.

Let's start with the latter.

The USDX and Gold Rallies

The USD Index just posted a daily rally and it was a second daily rally in a row. This may not seem significant at first sight, but it is significant, because that was what confirmed that the downward correction was already over in case of both similar price moves: the 2008 and 2011 one. As we described these analogies on Tuesday, we don't want to do so again today, but the key takeaway is that the USD Index is now very likely to continue its upward move, likely rallying to new 2020 highs shortly.

The good news is that since we know that the correction is most likely over, we can use Fibonacci extension tools based on the previous rally and the correction to estimate how high the USD Index is likely to move before this significant, yet short-term rally is over. Once the short-term rally is over, it would probably be followed by a more meaningful correction and then another wave up, but that's not the key information from the precious metals investor's and trader's point of view, because PMs and miners are likely to bottom even before the USD Index tops.

So, how high would the USD Index be likely to rally in the near term?

Back in 2008, the USD Index topped after it slightly exceeded the level that one would get by doubling the size of the initial sharp upswing. The first, initial top formed slightly above the level that one would get by multiplying the size of the initial sharp correction by 2.618.

Based on these techniques and the analogy to 2008, the USD Index is likely to soar to about 113 before correcting in a more meaningful manner. This level is just above the rising, long-term resistance line that's based on the 2009 and 2015 highs, which is at about 112, so conservatively we will view 112 as our upside target.

The USD Index is at about 100 at the moment of writing these words, so the upside potential is substantial.

And as we wrote in many flagship Gold & Silver Trading Alerts, big moves higher in the USD Index almost always translate into big declines in gold. One of the reasons that yesterday's session was important, is because it provided us with a confirmation that this big move higher in the USD Index has just started.

The second reason why it was important, is more of a short-term nature. Gold rallied and it rallied back up above the previously broken lows. This is important, because it changes the way we are looking at the 2008 - 2020 analogy. It now (based on yesterday's move) seems most likely that we have not yet completed the topping formation, but that we saw the initial fake move lower, after which gold could even move to new highs (not significantly, but still).

We previously wrote that it became less likely that gold would move higher once again, but that it could still happen. Based on what we saw yesterday, the odds for that significantly increased.

Furthermore, this means that our very short-term analogy in terms of time, would definitely need to be adjusted as it's no longer likely that we will see a major bottom in the precious metals market on Tuesday or close to it. Instead, it might be the case that it will be when we'll see the next local top.

Sounds disappointing? Why would it? We're adjusting our analysis to the information the market gives us and we're making sure that we are positioned correctly given all the clues, taking into account both what was available previously, and what is available now.

The key thing was that the precious metals sector was about to slide, and miners were likely to decline the most - and both forecasts remain intact. The only thing that changed, is the likely timing for this upcoming bottom. If we're about to make a gazillion dollars (of course, we can't promise any kind of performance, nor can anyone else) on that decline, does it really matter that we have to wait an extra week or two for that, especially while sitting on huge profits from the previous decline and the subsequent rebound? Exactly - we can definitely afford to wait it out. It doesn't seem that we will have to wait for long, anyway.

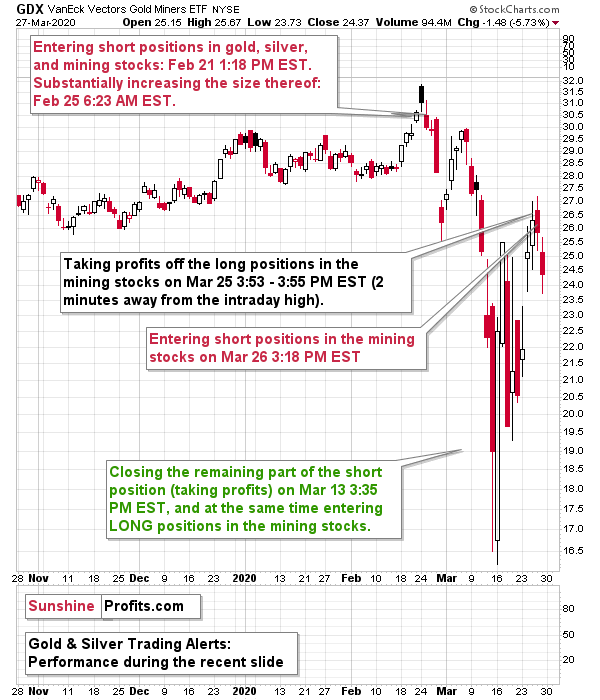

Thank you for reading today's free analysis. We had taken profits from the previous long positions in mining stocks on March 25th, and we entered new short positions in the miners on March 26th. Even despite the recent move higher in the miners, it seems that we took profits from our previous long positions exactly on the day that the miners topped in terms of the closing prices, and that we entered the new short positions exactly on the day that the miners topped in intraday terms. This assumes using GDX as a proxy. If we use GDXJ, we entered the short position on the day when they made the second intraday top of their double-top formation.

In today's Gold & Silver Trading Alert, we are letting our subscribers know how we aim to make the most of this complex situation (and it's not just about waiting it out). We also provide details regarding our profitable short position in the mining stocks.

Subscribe at a discount today and read today's issue ASAP.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Curious Case of the Miners' Rally

April 2, 2020, 7:47 AMThe miners moved higher instead of moving lower yesterday, which might make one concerned about our current positions. And rightfully so - one should be on a constant lookout for the things that might invalidate one's current position (that's the opposite of confirmation bias). That's definitely our aim.

So, what exactly happened in the miners?

In the Miners Yesterday

Miners moved higher on VERY low volume. The volume was the lowest of any session since the final part of the February.

That's exactly what a breather within a decline - a one that doesn't change the trend - should look like.

But miners didn't rally visibly - even just one day - before the mid-March plunge!

Didn't they? Please take a look at what happened on March 10th. The candlestick is black, because GDX declined on an intraday basis, but the closing price is higher than the March 9th closing price. Small, but still, it was a daily rally.

In yesterday's analysis, we explained that the bases (steady parts of the decline) are getting bigger, which likely indicates that the real moves (volatile parts of the decline) are also getting bigger.

If this is the case, then it's only natural to expect the corrective upswings to be more visible during this "base". And, well, it was more visible. The volume was still very low, so yesterday's session appears not to invalidate anything.

But let's double check, by looking at details from the 4-hour candlestick chart.

This chart does not only tell us that what we saw yesterday was normal - it actually provides us with bearish confirmations.

The 4-hour candlesticks mean that each session is effectively broken into two candlesticks, instead of one. While it is relatively normal for the volume to be relatively low during the first half of the day, it is usually the case that the volume during the second half of the session is bigger.

Now, the point is that the volume during the second half of yesterday's session was very low. This emphasizes how weak the bulls are and how little buying power there is right now. But let's compare it to the recent past.

The green rectangles on the above chart represent the second halves of the sessions when the volume was approximately as low as it was yesterday. This was the case on March 4th, and on February 26th. In the latter case, the decline accelerated on the next day. In the former case, it was exactly one daily close away from the top. Based on these similarities, the implications of yesterday's session are actually bearish.

Since we saw an additional day of the "base", we need to update the analogy (in italics just below) in terms of time that we described yesterday:

In late February, GDX declined steadily for 5 candlesticks (the above chart is based on 4-hourly candlesticks). Then it declined quickly for 3-4 candlesticks (there was a double bottom).

In mid-March, GDX declined steadily for 6 candlesticks. Then it declined quickly for 4-5 candlesticks (there was a double bottom).

Please note that there is a specific tendency for both: the base (steady decline) and the real move (quick decline). They were both slightly longer in the second case - each by 1 day. It's also interesting that we saw a double bottom at the end of each.

Now, GDX has been declining steadily for 8 candlesticks, which still seems to fit the above pattern quite well. If the more volatile part starts today - and this seems quite likely - then based on the above analogy, we can expect it to continue for about 5-7 trading days. This means that the bottom would be likely to form on April 8th (Wednesday) or April 9th (Thursday), or April 10th (Friday).

Based on yet another technique (the previous ones are the analogy between 2008 and 2020 in gold, and the one about miners' reaching their declining support line that we outlined on Monday) it seems that we'll see a major bottom in the precious metals market next week.

It could be the case we'll once again see a double bottom formation in the, but we have only one indication for it, so we wouldn't bet the farm on this particular scenario.

Please note that the above time prediction is very far from being written in stone. Conversely, we will be updating it as more details become available. Remember how it was with the recent long position in the miners? We've been changing the upside target for them multiple times, and we ended up closing the long position at the top, anyway.

Thank you for reading today's free analysis. We had taken profits from the previous long positions in mining stocks on March 25th, and we entered new short positions in the miners on March 26th. Given yesterday's weakness in the mining stocks, it seems that we took profits from our previous long positions exactly on the day that the miners topped in terms of the closing prices, and that we entered the new short positions exactly on the day that the miners topped in intraday terms. This assumes using GDX as a proxy. If we use GDXJ, we entered the short position on the day when they made the second intraday top of their double-top formation.

We provide details regarding our profitable short position in the mining stocks in the full version of today's analysis.

Subscribe at a discount today and read today's issue ASAP.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

Miners Are Not Lagging. They Are Preparing.

April 1, 2020, 6:54 AMIt's 2008 all over again, only much worse. And just like back then, PMs are likely to slide very fast, very far and then recover in a big way. A lot of money is likely to be made by those, who are positioned correctly.

The precious metals market has been providing us with myriads of signs recently. Some come from gold, some come from silver, and quite many come from the analysis of the mining stock sector. Those that we will show you in just a minute, will probably make you first think "No way!", then "What if?", and finally "I hope I still have the time".

Still not convinced whether it's worth reading? What if we told you that the final bottom for the precious metals sector (but not for the stock market) could be seen as early as... next week?

We prepared just one chart for you today (and also a supplementary one which explains why you should treat the first chart seriously), but it's of very big importance.

Let's start with something relatively uninteresting, but still important. You might be wondering why didn't the GDX ETF slide further yesterday, even though gold moved lower very visibly. The above chart provides two reasons for it.

The first reason is the rising support line that's based on the previous closing prices. That's where the GDX closed yesterday. This alone is a good reason for GDX not to decline more during yesterday's session. Of course, when gold declines again, miners are likely to break below this support line and decline much more visibly.

The second reason is that a relatively steady decline should have been expected right now. That's exactly how the two previous declines started. The important thing is that the steady part of the downswing is not likely to persist for much longer.

This brings us to the most interesting part of the above chart - examination of the previous declines with regard to their shape.

In late February, GDX declined steadily for 5 candlesticks (the above chart is based on 4-hourly candlesticks). Then it declined quickly for 3-4 candlesticks (there was a double bottom).

In mid-March, GDX declined steadily for 6 candlesticks. Then it declined quickly for 4-5 candlesticks (there was a double bottom).

Please note that there is a specific tendency for both: the base (steady decline) and the real move (quick decline). They both took slightly longer in the second case - each by 1 day. It's also interesting that we saw a double bottom at the end of each.

Now, GDX has been declining steadily for 7 candlesticks, which seems to fit the above pattern very well. If the more volatile part starts today - and this seems quite likely - then based on the above analogy, we can expect it to continue for about 5-6 trading days. This means that the bottom would be likely to form on April 7th (Tuesday) or April 8th (Wednesday).

Based on yet another technique (the previous ones are based on the analogy between 2008 and 2020 in gold, and the one about miners' reaching their declining support line that we outlined on Monday) it seems that we'll see a major bottom in the precious metals market next week, likely close to April 7th.

It could be the case we'll once again see a double bottom formation with one bottom on Tuesday, and one on Wednesday, but we have only one indication for it, so we wouldn't bet the farm on this particular scenario.

We realize that these are very bold statements that we are making, and they might appear unrealistic, crazy or one might just want to laugh them off (especially while holding a long position in the precious metals market). Please remember that one of our "crazy" predictions about silver breaking below its 2015 lows was realized very recently. These are crazy times, and "crazy" could indeed take place. To confirm that we might actually know a thing or two about timing this extremely volatile market, we are providing you with a quick look at our recent performance.

What? This can't be real! Where's the proof?

Here it is: links to all above-mentioned Alerts posted on our website - exactly as our subscribers have read them - available for everyone to review:

- Gold & Silver Trading Alert - March 26, 2020, 3:18 PM EST

- Gold & Silver Trading Alert - March 25, 2020, 3:44 PM EST

- Gold & Silver Trading Alert - March 13, 2020, 3:35 PM EST

- Gold & Silver Trading Alert - February 25, 2020, 6:23 AM EST

- Gold & Silver Trading Alert - February 21, 2020, 1:18 PM EST

Also, our Gold & Silver Trading Alerts didn't feature any other trades since late February.

Miners have already showed exceptional weakness by declining in the last few days despite a move higher in gold and in the general stock market - a combination that previously triggered substantial gains. It happened on March 26, when we were entering short positions in the miners. Miners didn't move much recently, but it was relatively normal at this stage of the decline - we wouldn't count on this pace of decline to continue. Conversely, it's likely to accelerate shortly.

On February 19, we posted a free article entitled "Warning - That's Not a Buying Opportunity in Gold" and we summarized it by writing "You have been warned.".

Today, we are telling you:

You have been warned. Again.

Of course, we can't guarantee any kind of performance as all trading is risky, but hopefully, this move will generate you substantial gains.

We provide details regarding our (already profitable) short position in the mining stocks in the full version of today's analysis.

Subscribe at a discount today and read today's issue ASAP.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

The Calm Before the Storm

March 31, 2020, 8:20 AMToday is the final trading day of the first quarter of 2020. Seems irrelevant, right? But it's not. Various types of performance are often calculated on a monthly basis, and quarterly calculations are used for a more broader overview. This includes the stock market performance, and it also is relevant for us, precious metals investors and traders.

The monthly and quarterly performance numbers are what is then automatically written about, what's shown on TV and what people use to then make decisions on regarding the future. One might say "my investment fund is based on a very sound strategy that's based on meticulous research, combines sector-specific indicators, is based on strategically changing exposures to various parts of the sector it specializes in, has special algorithms for individual stock selection, carefully handles leverage, and is very adaptable, should the circumstances change", but it would most likely not get the same kind of attention as "it seems that my investment fund is going to end this quarter over 140% higher after all fees".

The odds are that you yawned while reading the long sentence describing the approach, but the quarterly performance estimate generated a "whoa!" reaction. The next thought would probably be something along the lines of "hey, maybe I should invest in it". If that was a big negative number, you might think the opposite.

The Fed knows very well how it works. Trump knows how it works, and so does his administration.

Ok, so what? Everyone knows that quarterly numbers are important - what makes it something worth keeping in mind right now?

The thing that makes the difference is that while most people don't have the ability to impact the quarterly closing prices, the Powers That Be - do. We don't want to elaborate on the mechanisms through which this goal might be achieved, and whether or not they are legal (It's not market manipulation if it's done officially, right? Like interest rate management...), we just want to emphasize that it is something that we should expect. Of course, that is if the Powers That Be really want to prevent further declines on the stock market. And they definitely and desperately want to prevent them.

In our view, they don't stand a chance against the entire market that is slowly, but surely getting frozen by fear. Well, maybe not so slowly. The initial reaction was substantial, but the worst is yet to come. And it's going to be much, much worse than it is. But we already elaborated on that matter yesterday. What we wanted to emphasize today, is the very quick possibility of seeing higher stock market prices today, and perhaps some turbulence (in terms of intraday market volatility) in general. If that happens - please keep in mind that it's most likely only temporary and the market are likely to move lower (except for the USD Index) soon, anyway.

Also, if the Powers That Be are going to intervene and try to push the markets higher, you know which market is the one least likely to get support? The precious metals market. Gold could get some temporary boost (after all, in 2008 there was a third high that exceeded the previous two and we have seen that so far), but we wouldn't expect one in case of silver or miners.

Having said that, let's move over to the greenback.

Is the short-term correction in the USD Index over, and has it already resumed its rally? Another wave up in the USD Index would likely correspond to another wave down in gold, silver, and miners. It's getting more likely with each passing hour.

The USD Index already broke above the declining resistance line, and while the breakout is not yet confirmed, it's already a positive sign.

The second positive sign will be, if the USDX is able to close the day higher than it closed yesterday. Why? We compared the corrections in similar times and here's what we found.

Based on the above chart, we see that there were two similar cases - one in 2008 and the other in 2011. These years are also similar due to the fact that in both cases we saw major tops in gold.

Given the size of the most recent rally, the 2014-2015 rally might appear similar, but the correction that we saw back then, was not big enough and the preceding rally was not sharp enough to be really comparable. That's why we're focusing on 2008 and 2011.

In 2008, the USDX corrected a bit below its 50% retracement, but not to its 61.8% retracement - just like it did recently. There were moves both up and down during the corrective downswing, and the thing that confirmed its end, was the second daily gain.

And in 2011?

Exactly the same thing was the case. The shape of the decline was different, and the decline was deeper (it moved below the 61.8% retracement but the USDX stayed there for just 2 trading days), but once we saw two daily gains in a row, it served as a confirmation that the decline was over.

The USD Index just posted the biggest daily gain in the last 7 trading days and it's moving higher also today. Unless it slides later today, it seems that we'll get the above-mentioned bullish confirmation today. This means that gold would be to likely to slide well below $1,600 soon, and... The "storm" would really begin.

Thank you for reading today's free analysis. We had taken profits from the previous long positions in mining stocks on March 25th, and we entered new short positions in the miners on March 26th. Given yesterday's weakness in the mining stocks, it seems that we took profits from our previous long positions exactly on the day that the miners topped in terms of the closing prices, and that we entered the new short positions exactly on the day that the miners topped in intraday terms. This assumes using GDX as a proxy. If we use GDXJ, we entered the short position on the day when they made the second intraday top of their double-top formation.

We provide details regarding our profitable short position in the mining stocks in the full version of today's analysis.

-

The Powerful 2008 Lessons That Apply to Gold Today

March 30, 2020, 8:41 AMMark Twain said that history does not repeat itself, but it rhymes. It's certainly true in both life and financial markets. Let's explore how the recent history lessons apply to the precious metals.

The 2008 - Now Link

Let's recount the similarities. We already had gold reversing on huge volume, and we saw it decline very strongly in the first week after the top. We already had another attempt to break above that high and we saw it fail. We also saw rhodium at about $10,000. We already saw silver and miners plunging much more severely than gold did. In fact, silver just plunged almost exactly as it did in 2008 during the analogous part of the slide.

All these factors make the current situation similar to how it was in 2008, at the beginning of one of the biggest declines in the precious metals sector of the past decades.

But the very specific confirmation came from the link between gold and the stock market. Stocks plunged along with gold, silver, and mining stocks. That's exactly what was taking place in 2008. The drop in 2008 was very sharp, and silver and miners were hit particularly hard. We expect this to be the case this time as well.

In 2008, the temporary rallies were particularly visible in case of gold, not that much in case of silver, mining stocks, or the general stock market. Gold declined particularly hard only after the USD Index started its powerful rally.

The 2008 decline in the PMs ended only after a substantial (about 20%) rally in the USD Index.

The USDX has just corrected almost 61.8% of its previous decline, and it could be the case that it's now ready to soar much higher. Last week, we wrote that the USD Index could correct based on the 2T stimulus and other monetary, and fiscal steps taken by the US officials.

That's exactly what happened. Yet, it's not likely that these steps will prevent people from raising cash when their fear reaches extreme levels. We're getting there. And we're getting there fast.

As the situation is more severe, the USD Index might rally even more than 20%, and the 120 level in the USD Index (comeback to the 2001 high) has become a quite likely scenario.

Let's keep in mind that it was not only the 2008 drop that was sharp - it was also the case with the post-bottom rebound, so if there ever was a time, when one needed to stay alert and updated on how things are developing in the precious metals market - it's right now.

Last week we supplemented the above with description of the 2008 analogy in terms of the shape of the price moves. On Wednesday, we supplemented it with a more detailed time analysis. It's very important today (and for the rest of the week), so we're quoting our Wednesday's comments:

It took 9 trading days for gold to decline from its top to the final intraday bottom, before starting the powerful comeback.

In 2008, it took 41 days. It seems that things are developing about 4.5 times faster now, than they were developing in 2008. More precisely: 41/9 = 4.56 times.

Please note that the decline that preceded the sharp upswing in gold, is also somewhat similar to what we saw recently. There was an initial slide in gold that ended in mid-August 2008, then we saw a correction and then another slide and a bottom in early September. This year, we saw an initial bottom in mid-March, and the final one a few days ago.

Back in 2008, it took 23 trading days for gold to reach its initial bottom and it then took another 18 days for the final short-term bottom to form. 56.1% of the downswing was to the initial bottom, and the 43.9% of the downswing was between the initial and final bottom.

And now? It took 5 out of 9 trading days for gold to reach the initial bottom, and the remaining 4 days were the time between the bottoms. That's 55.6% and 44.4% respectively.

This is very important, because it shows that the shape of the move is indeed very similar now.

This means that we can most likely draw meaningful conclusions for the current situation based on how the situation developed back in 2008.

Back then, gold moved back and forth close to the initial top. That's what gold has been doing so far today - which serves as another confirmation for the analogy.

Back in 2008, gold topped over the period of 16 trading days. Dividing this by 4.56 provides us with 3.5 days as the target for the end of the topping pattern since its start. The pattern started yesterday, which suggests that gold could top tomorrow [Thursday, March 26th] or on Friday.

EDIT: That's exactly what happened - in terms of the daily closing prices, gold has indeed topped on Thursday.

The situation gets more interesting as we dig in more thoroughly...

There are 24 hours in a day. Dividing this by the factor of 4.56 provides us with 5.26. This means that if we could create a chart with 5.26 hour candlesticks, the price moves in gold should be analogous (in terms of how we see them on the chart) to their daily performance from 2008. The closest that we have available are the 4-hour candlesticks.

Let's check how gold performed recently from this perspective, and compare it to its daily performance from 2008.

The price moves are remarkably similar.

Even the March 17, 2020 upswing took gold to analogous price level! Gold temporarily topped very close to the previous (Feb 28) low. That's in perfect analogy to how high gold corrected in late August 2008 - it moved up to the early May 2008 high.

The link to 2008 truly is the key right now.

Ok, so when are silver and miners likely to top?

Sooner than gold.

Please note that both: silver and mining stocks topped more or less in the middle of gold's topping formation... Which suggests that they should be topping today.

And for the final confirmation - please take a look at what the stock market and the USD Index have been doing at that time. The USD Index was within a pullback while the stock market formed a very short-term upswing. Silver and miners topped along with the stock market.

Silver just moved to its previous short-term high (a small high, but the one that preceded the final part of the decline) and it's approximately at its 38.2% Fibonacci retracement.

That's exactly where silver topped in 2008. Back then the analogous high was the late-August high, and it also topped close to its 38.2% Fibonacci retracement.

We are probably looking at a top in silver right now.

This means that miners are likely to top today as well.

EDIT: That's exactly what happened in terms of the daily closing prices. Both: silver and GDX formed the highest daily closing prices on Wednesday - the same day we had published the above.

Please keep in mind that after the 2008 bottom in stocks, it took only two days before they formed an intraday top. Given that this time, the price moves are more volatile, it seems that we could (far from certain) see a powerful reversal (top) as early as tomorrow. This estimate is in perfect tune with the triangle-vertex-based reversal that we see on the GDX and GDXJ charts.

EDIT: Again, that's exactly what happened. The GDX index formed the intraday high on Thursday, one day after we wrote the above. The GDXJ formed the intraday high on Wednesday.

How much clearer could it get that the precious metals market is re-creating its 2008 slide?

Ok, so what does it tell us going forward?

It tells us that the precious metals market is likely going to slide very profoundly, and very quickly. And it might happen as early as this, or the next week.

Thank you for reading today's free analysis. Silver and mining stocks are likely to decline much more than gold, and in their case, the profit-take targets are much easier to estimate. We provide details in the full version of today's analysis.

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM