tools spotlight

-

Why Gold Erasing Half of Yesterday's Losses Isn't Really Bullish

March 11, 2020, 6:40 AMAvailable to premium subscribers only.

-

Miners Slide Once Again

March 10, 2020, 10:30 AMIn yesterday's extensive Alert, we wrote about multiple factors that are likely to drive the precious metals market in the future. In particular, we emphasized why the next several months are likely to be very disappointing for gold bulls. The last few years have likely been disappointing to silver and mining stock bulls already (with exception of early 2016) - it is only gold that is up considerably. Silver and miners are visibly below their 2016 highs. In fact, silver is only a few dollars above its 2015 bottom. That's not a bull market in the precious metals sector.

We already saw silver slide yesterday, but when we were writing yesterday's analysis, miners' were not yet trading. We wrote that the outlook for them was bearish, but did they really respond with declines?

PMs in the Short-Term

Yes, that's exactly what they did. Yesterday's close in the HUI Index was the second lowest close of 2020. And that happened on the same day that gold was trying to break above its previous yearly high. That's a clear sign of weakness of both the miners and the precious metals sector in general.

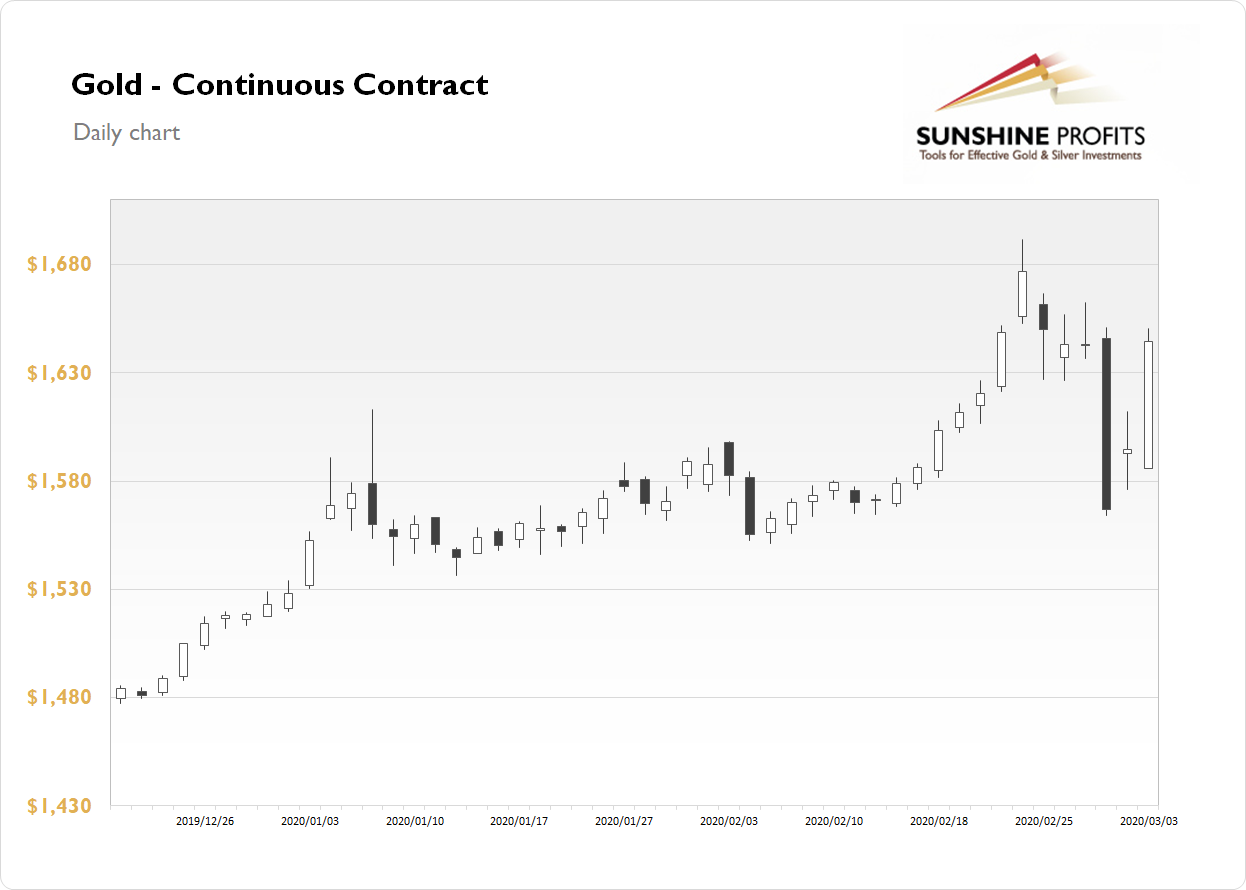

And what about the aftermath of gold's failed attempt to break above the February high?

Gold invalidated the breakout in terms of the closing prices, which means that in those terms, there was no new yearly high. The yearly high - in terms of the closing prices - formed on February 24 - one day after we had opened our short positions, and one day before we increased their size. This position is practically flat at this time, but the ones in silver and miners are very profitable, which emphasizes the benefits of being diversified among more than one market.

The invalidation of gold's breakout in intraday terms is a very bearish phenomenon for the short term. No wonder that gold is declining today.

The history tends to repeat itself to a considerable degree. Do you remember how gold topped in 2011?

Lessons from the 2011 Gold Top

Gold plunged significantly initially - by about 11% - after which it rallied back up and topped about $8 above the previous high. It declined on the day that it reached this new intraday high, and it also declined on the following day.

What happened this year?

Gold plunged significantly initially - by about 7.5% - after which it rallied back up and topped $12.60 above the previous high. It declined on the day it reached this new intraday high (yesterday), and it's also declining on the following day (today).

Identical cases? No. Very similar? Definitely - and the implications are very bearish for the following weeks and months.

But there's more.

But it's reserved to our (Gold & Silver Trading Alert) subscribers. If you'd like to supplement the above with more details, also ones our current trading positions (and the upcoming ones), we encourage you to subscribe to our Gold & Silver Trading Alerts. You might also be interested in our new service - weekly Gold Investment Updates, which we have recently introduced, and which we provide at promotional terms. Try them out today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

So Many Bullish Factors... That Gold is Ignoring

March 9, 2020, 10:08 AMGold is testing its previous 2020 highs, but silver plunged anyway, which created a very special situation. Namely, the gold to silver ratio just jumped to the 100 level.

This may not seem like a big deal, because ultimately people buy metals, not their ratio, but it actually is a huge deal. This ratio is observed by investors and traders alike, as it tends to peak at the market extremes. Moving to the 100 level might indicate that we are at a price extreme. But what kind of extreme would that be if silver is declining while gold moved up?

Let's take a closer look at the gold to silver ratio chart for details.

In early July 2019, the gold to silver ratio topped after breaking above the previous highs and now it's after the verification of this breakout. Despite the sharp pullback, the ratio moved back below the 2008 high only very briefly. It stabilized above the 2008 high shortly thereafter and now it's moving up once again.

It previously moved up relatively slowly, but it jumped to new highs last week and today.

Anything after a breakout is vulnerable to a quick correction to the previously broken levels. On the other hand, anything after a breakout that was already confirmed, is ready to move higher and the risk of another corrective decline is much lower.

The most important thing about the gold and silver ratio chart to keep in mind is that it's after a breakout above the 2008 high and this breakout was already verified. This means that the ratio is likely to rally further. It's not likely to decline based on being "high" relative to its historical average. That's not how breakouts work.

The breakout above the previous highs was verified by a pullback to them and now the ratio moved even higher, just as we've been expecting it to.

The true, long-term resistance in the gold to silver ratio is at about 100 level. This level was not yet reached, which means that as long as the trend remains intact (and it does remain intact), the 100 level will continue to be the likely target.

We've been writing the above for weeks (hence we formatted it with italics), despite numerous calls for a lower gold to silver ratio from many of our colleagues. And our target of 100 was just hit today. It was only hit on an intraday basis, not in terms of the daily closing prices, but it's still notable.

We had been expecting the gold to silver ratio to hit this extreme close or at the very bottom and the end of the medium-term decline in the precious metals sector - similarly to what happened in 2008. Obviously, that's not what happened.

Instead, the ratio moved to 100 in the situation where gold rallied, likely based on its safe-haven status, and silver plunged based on its industrial uses.

Despite numerous similarities to 2008, the ratio didn't rally as much as it did back then. If the decline in the PMs is just starting - and that does appear to be the case - then the very strong long-term resistance of 100 might not be able to trigger a rebound.

It might also be the case that for some time gold declines faster than silver, which would make the ratio move back down from the 100 level. The 100 level could then be re-tested at the final bottom.

Or... which seems more realistic, silver and mining stocks could slide to the level that we originally expected them to while gold ultimately bottoms higher than at $890. Perhaps even higher than $1,000. With gold at $1,100 or so, and silver at about $9, the gold to silver ratio would be a bit over 120.

If the rally in the gold to silver ratio is similar to the one that we saw in 2008, the 118 level or so could really be in the cards. This means that the combination of the above-mentioned price levels would not be out of the question.

At this time it's too early to say what combination of price levels will be seen at the final bottom, but we can say that the way gold reacted recently and how it relates to everything else in the world, makes gold likely to decline in the following months. Silver is likely to fall as well and its unlikely that a local top in the gold to silver ratio will prevent further declines.

Thank you for reading today's free analysis. If you'd like to supplement the above with details regarding the details of our current trading positions (and the upcoming ones), we encourage you to subscribe to our Gold & Silver Trading Alerts. You might also be interested in our new service - weekly Gold Investment Updates, which we have recently introduced, and which we provide at promotional terms. Try them out today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager -

PMs: First to Rally and First to Stall

March 5, 2020, 3:22 AMAvailable to premium subscribers only.

-

Gold Rallies, but Stock Slide Despite a Rate Cut - It's 2008 All Over Again

March 4, 2020, 6:09 AMIt was only yesterday (and Monday), when we emphasized that it seems that it's 2008 all over again, and that the interest rate cuts as well as possibility of QE4 are not likely to prevent markets from declining. The next regular interest rate decision is on March 18, but the Fed decided to cut the rates by 0.5% yesterday in a surprising move. And... stocks declined (and we profited both on their move higher in anticipation of that cut, and also on the intraday decline in its aftermath in our Stock Trading Alerts), just like they did in 2008, when the rates were cut.

And gold?

Yes, a rate cut, as a response to the coronavirus threat, is a theoretically bullish development, as it's positive for the economy in the short run, but it seems that the market viewed this decision as an act of desperation, and a confirmation that things might be much worse than they are being reported. This is a very dangerous kind of reaction, because the fact that the market declined, only reinforced the belief that the Fed can't stop a move down with lower rates. At least not before the market declines a lot.

Markets are forward-looking, which means that if people expect lower prices, they will sell right away, at prices that they still view as relatively high. It really does look like the 2008 decline.

So why did gold rally so much, yesterday? Doesn't that invalidate the analogy to 2008?

First of all, did gold really show a lot of bullishness yesterday? The rates were just cut by 0.5% in a surprising move, and gold is not at new highs, while miners reversed a large part of their gains before the closing bell.

Second, a single day event rarely invalidates or confirms anything. Quick moves can be accidental, or based on extremely short-term trends that are predicted using other means.

Third, it was not just a decrease in the interest rates. It was a surprising decrease in the interest rates. Gold, and the rest of the precious metals sector seems to have reacted not as much to the rates themselves, but to the surprise. Investors looked for safe haven, and they found it in gold. But, just as such rallies didn't last long in 2008, they are unlikely to last for long this year.

The Fedwatch tool didn't update yet after yesterday's decision from the Fed, which means that we don't know what kind of probabilities the market is assigning to further rate cuts this month (and how big they are likely to be).

However, we know that since the Fed cut the rates and surprised the market now, it has one fewer surprise-ace up its sleeve. This suggests that as the prices decline, it will take longer time, before another surprising move takes place (note: it's just likely that it works this way, it's far from certain - the Fed could have so many surprise-aces up its sleeve that using one now doesn't change much). This means that perhaps one of the corrective upswings that was supposed to happen in the future, has already happened in a surprising manner yesterday, and the decline that follows is likely to move lower in straighter fashion.

Yesterday's PMs Moves Examined

Gold corrected about 61.8% of the preceding decline.

Gold stocks corrected about 61.8% of the preceding decline, but ended the day at the 50% Fibonacci retracement.

Silver initially corrected a bit above 38.2% of the preceding decline, but wasn't able to hold this level, and ended the day visibly below this retracement.

These are all classic levels to which prices can retrace (correct) during a move without changing the trend. We saw the most strength in gold, and the least in silver, which is business-as-usual - that's what's been taking place in the previous days as well.

The point is that nothing particularly exceptional happened. Yes, the volatility was big, but it was in tune with what we saw previously. Volatile declines could be corrected with volatile rallies. And they can then be followed by additional volatile declines. Predicting that gold ended its decline just because we saw a 61.8% correction (and smaller moves in miners and silver) is likely a mistake.

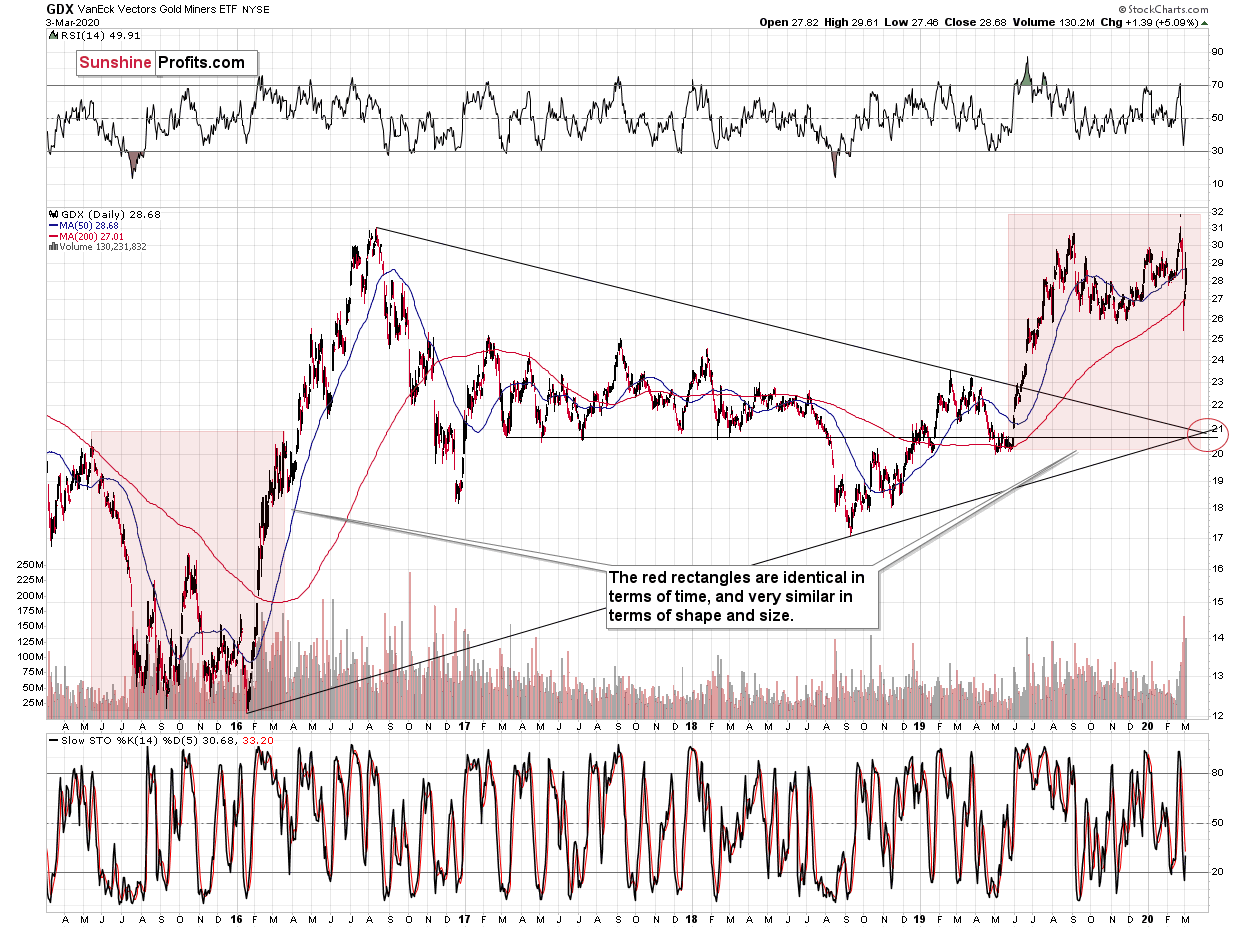

Another indication that the upswing was a relatively normal part of the bigger decline comes from the GDX ETF.

The mid-2016 decline started from very similar levels, and after GDX dropped to about $25, it rallied approximately to its 50-day moving average, which was at about $28 at that time. Approximately the same thing took place today. The GDX jumped from about $25 to its 50-day moving average (GDX closed at it yesterday) and it was relatively close to $28. Back in 2016, the decline then resumed after a few weeks of sideways trading. The volatility is bigger this time, so we might not have to wait that long before the decline returns and miners move to new yearly lows.

Thank you for reading today's free analysis. If you'd like to supplement the above with details regarding the details of our current trading positions (and the upcoming ones), we encourage you to subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM