tools spotlight

-

Today's Gold Upswing and Lessons from Gold Tops

December 23, 2019, 8:17 AMWhat a classic day Friday was! Gold moved a bit lower, miners moved significantly lower, and silver rallied. Truly classic and outstanding performance if one enjoys seeing topping patterns that are playing out according to their usual and likely characteristics. And Monday's early session seems to be an encore. Let's start today's analysis with examination of the Friday's "play".

Friday's Gold Action in Perspective

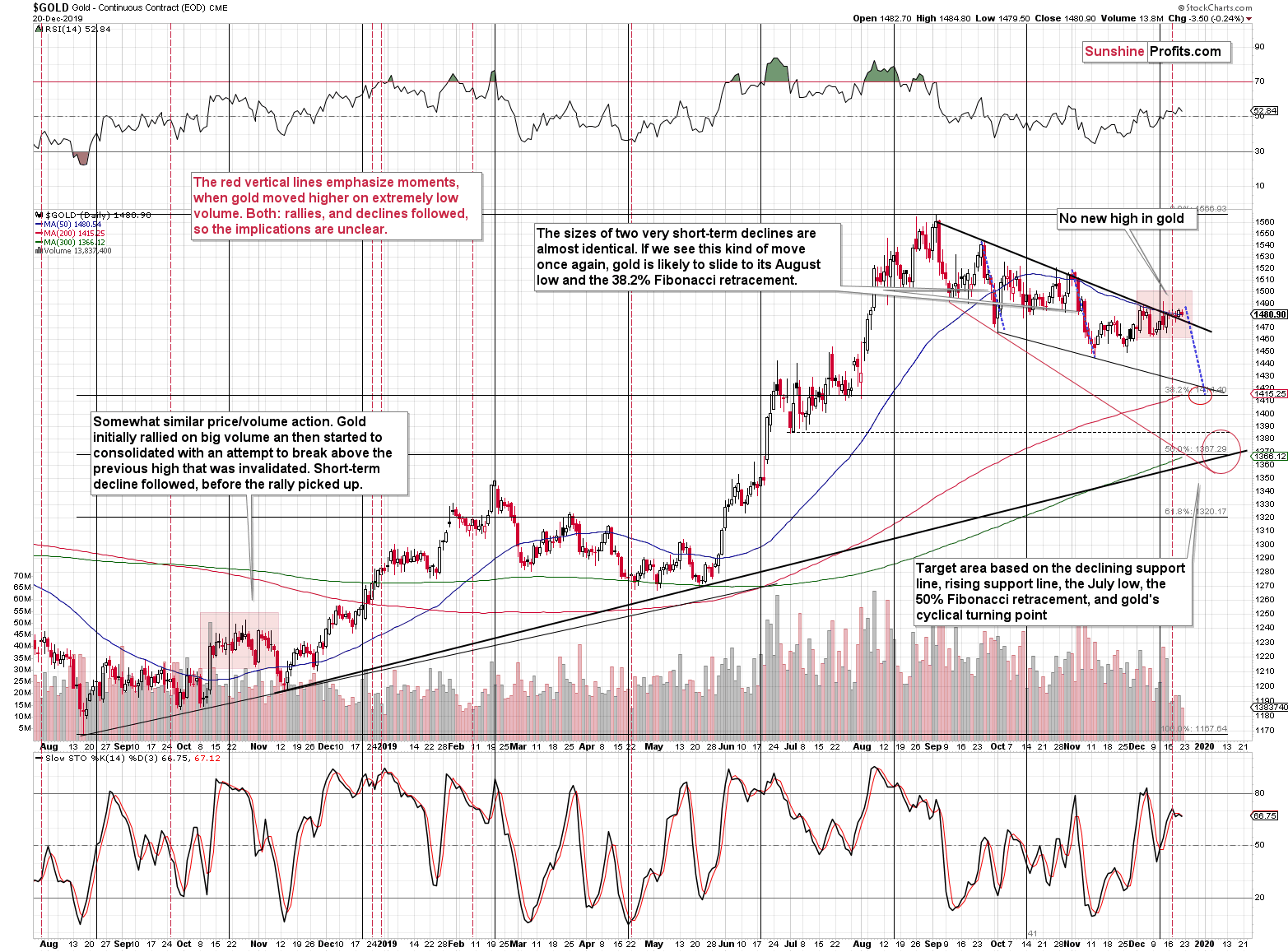

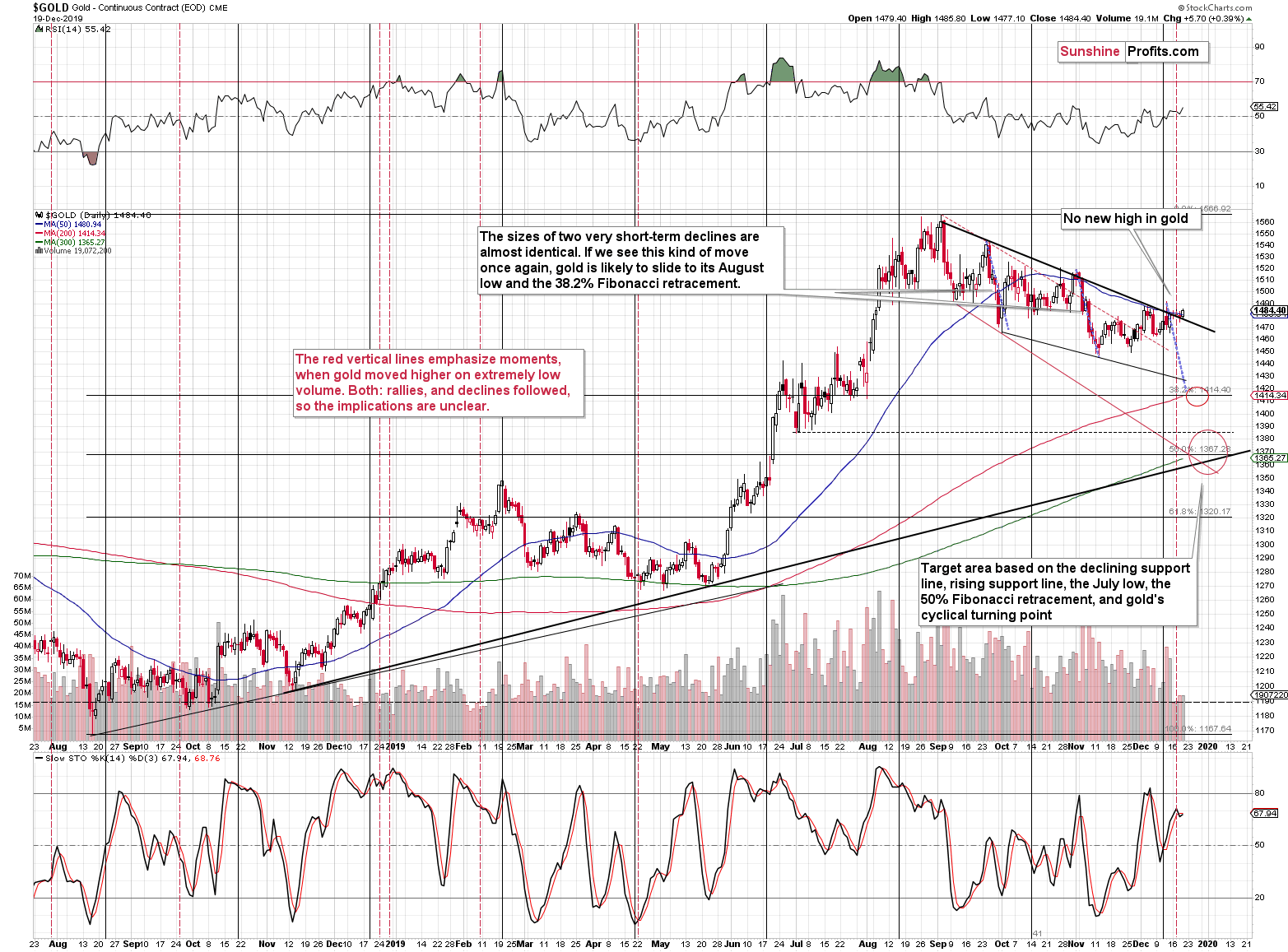

Gold once again managed to close the day above the declining resistance line that's based on daily closing prices. This seems very bullish until one examines the volume at which the breakout and it's supposed verification took place. It was very low. This is exactly the opposite of what one wants to see as a breakout's confirmation. So why did gold rally?

Well, one reason could be a delayed reaction to U.S. President's impeachment news, but if so, then what caused the delay? That's where the technicals come in and there is one specific thing that causes this price action to make sense.

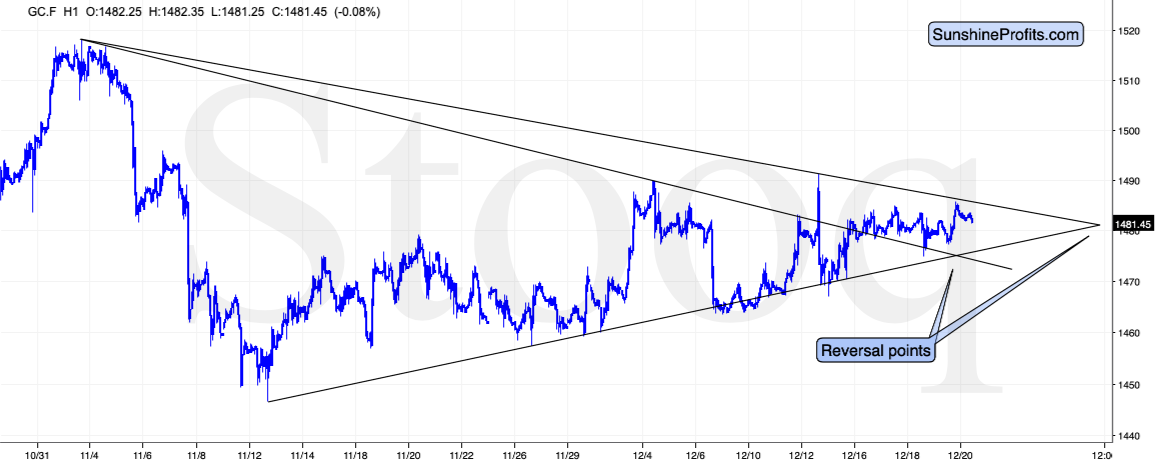

In Friday's analysis, we showed you that one of the nearby triangle-vertex-based reversals might have been the technical factor that was at least partially responsible for the recent upswing. There is, however, another analogical reversal that is due today, which means that the implications of what we wrote on Friday remain up-to-date even though gold moved a few dollars higher.

If gold didn't rally before the reversal, it would have bullish implications. And the situation being what it is, we actually have bearish implications of what happened.

The existence of the reversal point, along with very weak volume on which gold moved higher recently, make it very likely that the move higher will be invalidated and followed by lower gold prices, not higher ones.

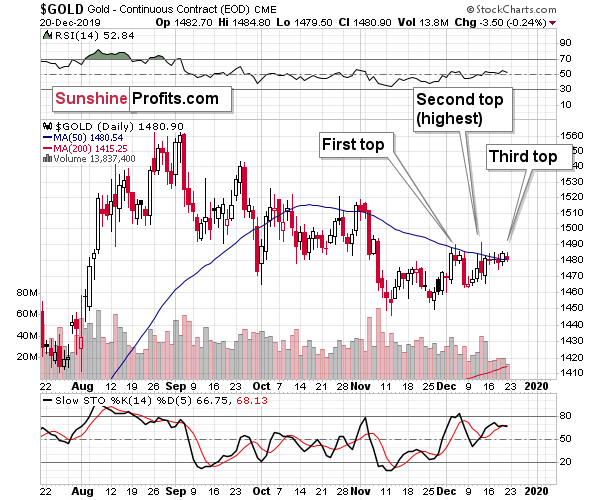

At the moment of writing these words, today's pre-market high in gold was $1,488.95. That's below the December 4th high ($1,489.85) and the December 12th high ($1,491.25). This means that all our comments on the shape of gold's recent price movement with regard to this month's seasonality, remain up-to-date:

Gold tends to move higher in the final quarter of the year, and if we consider the fact that gold closed September at $1,472.90, we see that it's been true at least so far. Based on the seasonal tendencies, the yellow metal was supposed to decline in November, and that's exactly what happened. Gold was supposed to then move higher and it did. It didn't move above the November high, though. That doesn't mean that the seasonality is useless - it simply means that since gold is now in a medium-term downtrend (considering highs, lows, and for instance the declining 50-day moving average), the implications might have a bit shifted, but they aren't necessarily totally absent.

The above chart suggests three tops in the head-and-shoulders form and that is indeed what gold formed.

What we just saw could have been the final of the three tops that is then likely (based on seasonality alone) to be followed by the biggest decline of the quarter.

Now, taking seasonality at its face value, this is the time of the year when gold should be bottoming and preparing for its year-end rally. However, it seems that the patterns were delayed and since we have indications of upcoming reversals at the end of the year, it seems that we are still likely to see quite a volatile move lower before the next short-term corrective rally starts.

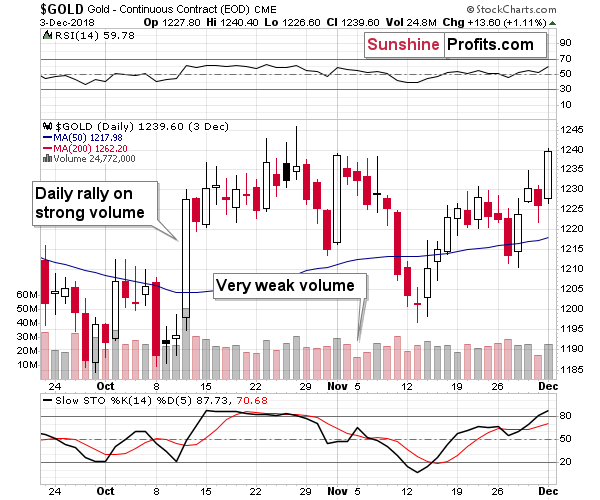

There's one more thing about the first gold chart that we would like to comment on. We mean the two areas that we marked with red rectangles. The above chart features in greater detail what happened recently, and the one below features the past - late-2018 price performance.

Lessons From Gold a Year Ago

Both patterns started with a sizable daily rally in gold that took place on big volume (October 2018 and early December 2019). Then gold entered consolidation with a small breakout that was then invalidated. Gold recovered and went on to make the third attempt to break higher, but failed. What's notable about these final attempts is that we saw a day with very low volume (early November 2018, and the last few days). Back in 2018, this pattern was followed by several days of visibly lower prices before gold rallied.

Something similar could - and is likely to - take place also this time. The end of the year is likely to mark a reversal, which means that gold could bottom at that time and start a corrective upswing. The difference this time is that the follow-up rally that would take place in January is not likely to be as sustainable as the one that started in mid-November 2018.

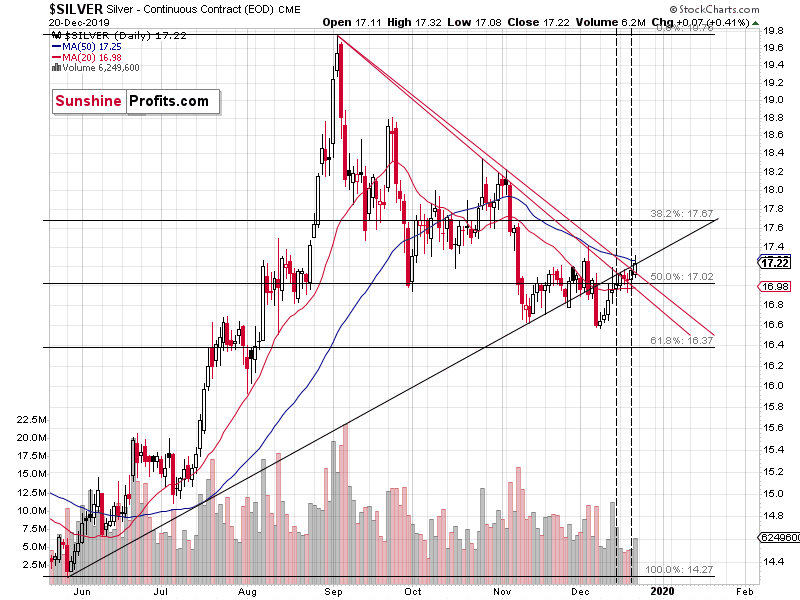

Having said that, let's take a look at the silver market.

Turning to Silver

The white metal has indeed shown strength by rallying back to the rising resistance line and the 50-day moving average. It almost moved above the early-December high on Friday. It finally managed to break above it in Monday's pre-market trading.

Silver has shown exceptional strength and soared to new monthly highs. This means that it also broke above its 50-day moving average and the rising resistance line. This would have been a very important and bullish development if...

If it wasn't silver. The white metal can be counted on to provide fake signals over and over again, and one of the ways to tell if silver is likely lying is to look at what the rest of the precious metals market is doing. If gold is not breaking higher and if miners are underperforming, it's very likely a fake move on silver's part. The above is one of the most important trading tips for the gold market. There are many techniques that are universal, but this one is specific - and highly useful - in case of the PMs.

We already know what happened in gold - it didn't break above the previous highs, at least at the moment of writing these words. And what about the gold miners?

The Miners' Turn

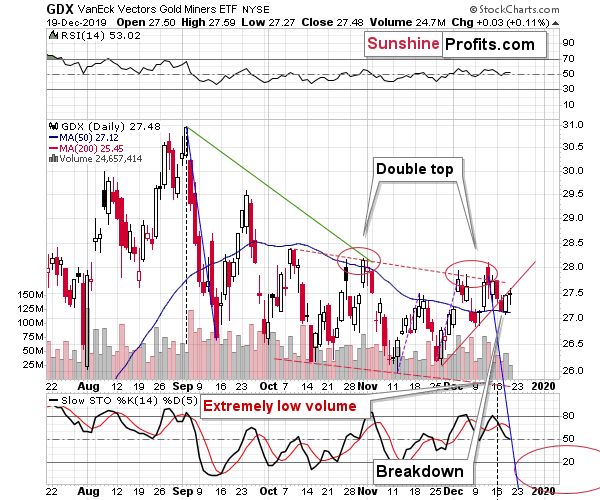

On Friday, miners confirmed their breakdown below the rising support line. It's hard to imagine a clearer sign that silver's breakout should not be trusted.

Remember the two, three tops in gold? In miners we can only see two of them, right? You know why? Because miners are already in the decline mode.

Just as it's usually the case, miners were the first to rally and silver was catching up. Again, that's a classic topping performance in the precious metals market.

The dynamics of other precious metals' sectors or the lessons from their seasonality are far from the only defining elements in gold price development. The USD Index moves and the key factors at play are another important pieces of the puzzle. This is what the full version of the analysis covers - plus the targets of our promising short position. We encourage you to join our subscribers and reap the rewards. Subscribe today!

-

The Anatomy of Yesterday's Gold Breakout

December 20, 2019, 9:09 AMOur yesterday's analysis delved into the gold path in non-U.S. currencies, the lessons learned and the implications ahead. But didn't gold just throw a spanner in the works with its yesterday's upswing?

Gold's Twists and Turns

Gold just managed to close the day above the declining resistance line that's based on daily closing prices. This seems very bullish until one examines the volume at which the breakout took place. It was very low. This is exactly the opposite of what one wants to see as a breakout's confirmation. So why did gold rally?

Well, one reason could be a delayed reaction to U.S. President's impeachment news, but if so, then what caused the delay? That's where the technicals come in and there is one specific thing that causes this price action to make sense.

We just had a short-term triangle-vertex-based turning point in gold. If gold didn't rally before the reversal, it would have bullish implications. And the situation being what it is, we actually have bearish implications of what happened.

The existence of the reversal point, along with very weak volume on which gold moved higher yesterday, make it very likely that the move higher will be invalidated and followed by lower gold prices, not higher ones.

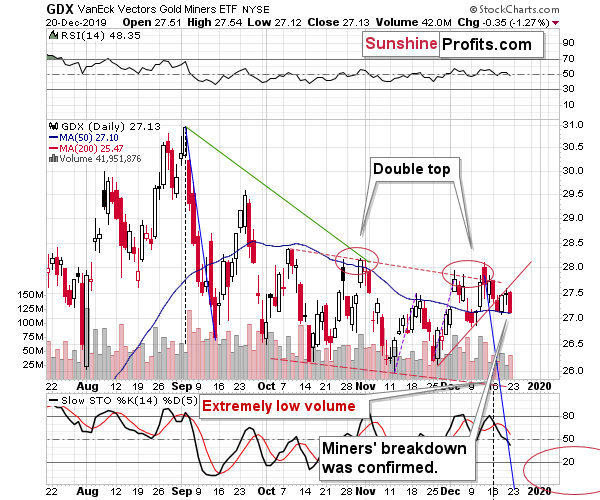

Speaking of low volume, let's take a look at the mining stocks.

The Miners' Moves

The volume was truly tiny. It was one of the lowest volume readings that we saw this year. And what did GDX do? It moved up by mere 3 cents. It was basically flat despite gold's breakout.

At the same time, GDX just confirmed its own breakdown by closing below the rising red support line for the third consecutive trading day. Miners are practically screaming here that gold's breakout was a fake move and that one shouldn't trust it.

The extremely low volume is also interesting on its own. The reason is that these sessions tend to imply that a lot of people are waiting on the sidelines, refusing to participate in the trading at all. This is important, because once the move - in any direction - starts, there are many people that can then join the trend as it matures. This means that the moves that follow the very low-volume sessions can be really sizable.

The full version of this analysis isn't just about the short-term in gold and the miners. The full version discusses yesterday's silver move, and the the message of gold's seasonality for the days ahead. Naturally, you'll find there the up-to-date key factors at play and the targets of our promising short position. We encourage you to join our subscribers and reap the rewards. Subscribe today!

-

Gold in Indian Rupees, the USD and the Many Non-USD Currencies

December 19, 2019, 8:11 AMWe started yesterday's analysis with the investigation of the Euro Index and gold price in this European currency. Today, we'll take a moment to analyze the gold market from the Indian point of view. Gold has a special place in the Indian history and culture, India is the second biggest "consumer" of gold (right after China). USA's gold consumption is third biggest in the world, but it's less than one fourth of the Indian gold consumption. This means that to a considerable extent, the Indian gold buyers can influence gold's fundamental situation.

Moreover, India is the second-largest English-speaking country (US comes in first with 268 million English speakers, while about 125 million people speak English in India). Since we're writing in English and about gold, it's only natural to discuss the Indian side of the gold market. And by that, we mean taking a closer look at gold's price in the Indian rupee.

In the recent years the value of the Indian currency has declined compared to the value of the U.S. dollar, and so did gold. This mean that if you live in India, you have yet another reason to be holding gold and one less reason to worry that gold is going to decline profoundly. Yet, the situation is not that simple. After all, the huge value increases in the USD Index translated into declines in gold that were even bigger. This means that from the non-USD point of view, for instance from the Indian point of view, gold price still declined. Where does that lead us to?

It leads us to checking what really happened with the price of gold in terms of Indian rupees during two situations that appear most similar to the current situation with regard to the USD Index movement (the 80s and mid-90s). In particular, the less distant from these situations - the mid-90s - is outstanding in terms of similarity, and looking at what happened to gold form the Indian perspective at that time should give us invaluable insight into what may be lurking just around the corner.

First things first - why should you care about some two situations from a rather distant past? We wrote about it, but it was already some time ago, so it seems appropriate to go over it once again.

Let's start with the fact that the USD Index is holding up extremely well. It's not plunging and it's moving in a rising trend channel despite Trump's - U.S. President's - numerous calls for lower USD values, the major shift in Fed's policy (moving from monetary tightening to loosening). If it happens for a day, or a week, or even a month, it could be accidental. But it's been taking place for many months. And it's not a coincidence either.

The USD Index is after an epic breakout and a huge verification thereof.

The Big Picture View of the USD Index

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Rises

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, one could report gold's decline as really fast.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

Let's get back to the topic of gold price in Indian rupees. If gold's trading in 2020 is going to resemble its mid-90s performance, then it would be a good idea to check what happened with gold in terms of Indian rupee at that time.

Gold from the Indian Perspective

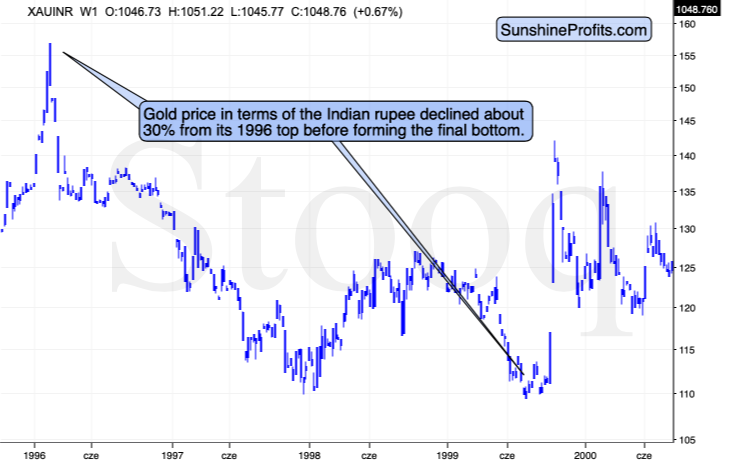

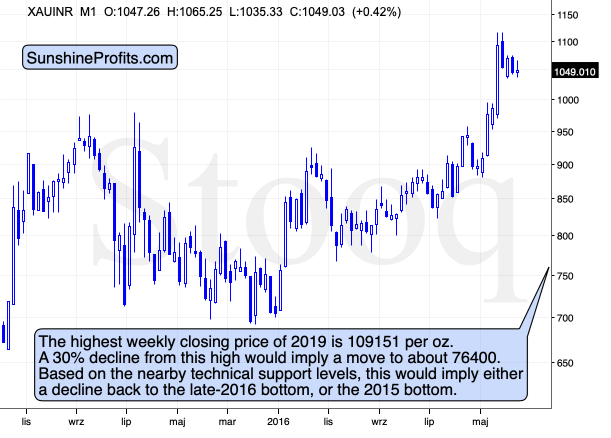

Gold price in terms of the Indian rupee declined about 30% from its 1996 top before forming the final bottom. That's not a small move - that's a move that could erase a large part of the buy-and-hold investors capital and it would take many months to just get back to the initial level. If one managed to get out close to the top, or even profit thanks to adjusting one's positions to the ones that profit from gold's decline, it would be entirely different and much more pleasant.

The highest weekly closing price of 2019 is 109151 per oz. A 30% decline from this high would imply a move to about 76400. Based on the nearby technical support levels, this would imply either a decline back to the late-2016 bottom, or the 2015 bottom. If we see a particularly bearish market news, gold could decline even below the 2015 bottom. Of course, we can't guarantee that this will indeed happen, but it seems that gold could decline quite a lot before the final bottom forms.

If it seems like it can't happen, because the price rallied so high so soon, please note that the times after sharp upswings were exactly the times when gold was starting the declines - especially in 2013 and 2016.

All the above might seem quite complex, so let's discuss it once again, this time using a brief Q&A:

Gold is likely to decline in the following months, also in terms of the Indian rupee.

- But why? It's been rallying so nicely in the recent years...

There are numerous reasons, but one of the key ones is the epic breakout in the USD Index that was more than confirmed. Big USD Index rallies follow such breakouts, and they sooner or later trigger big declines in gold.

- So what? If I live in India, why should I be concerned with the U.S. dollar? I'm not using it and I'm buying gold with rupees.

The big USD Index rallies trigger declines in gold that much bigger than the said rallies. This means that even if you never bought anything using U.S. dollars, the big increase in its value can still affect you, if you're investing or considering investing in gold.

- Really? Did it happen in this way when the USD was previously gaining value quickly?

It did. Back then - in mid-90s - gold priced in the Indian rupee declined by about 30%. It doesn't have to happen again, and nobody can guarantee any outcome, but that's exactly what happened.

- Ouch... So, is a decline in gold really likely in 2020?

Again, we can't guarantee anything with regard to performance, market movement, or individual stock picks, but in our view it's very likely that we'll see much lower gold values before we see much higher prices. A decline below $1000 in terms of the USD is likely in our view. Gold price in terms of the Indian rupee could move to its late-2016 bottom, the 2015 bottom or even below it. The $890 target in the USD terms seems to be the most precise one and it appears to be a good idea to monitor gold price movement and make gold price forecasts based on the USD perspective in order to determine the optimal entry point for big long positions and perhaps to exit the positions that would be aimed to profit from lower gold prices.

The full version of this analysis isn't just about gold in Indian rupee terms though. By the way, such a view is beneficial to the many non-U.S. currencies too. This analysis' full version discusses yesterday's strength in mining stocks and the key factors at play and the targets of our promising short position. We encourage you to join our subscribers and reap the rewards. Subscribe today!

-

Gold, USD and the Euro: the Signs Ahead

December 18, 2019, 10:08 AMBrexit has become very likely due to result of the UK vote. But so what (gold- and currency-wise)? The uncertainty dropped significantly, and markets were able to sign a breath of relief (bearish for gold), but on the other hand Brexit itself increases the geopolitical turmoil (bullish for gold). Gold didn't react decisively in the short run overall, but the European currencies: the euro, and the pound rallied. In the first part of today's analysis, we'll focus on what happened in the euro and how the forex situation fits the other gold price predictions.

Let's start with the long-term chart featuring gold price in terms of the euro.

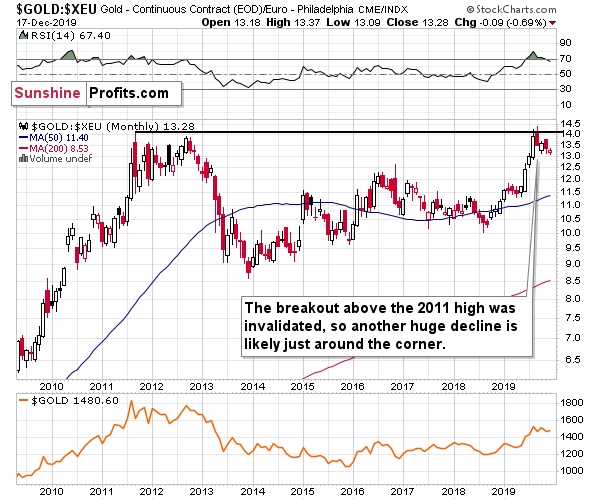

Gold in the Eyes of the Europeans

The most important thing about gold's performance is it's 2019 attempt to break above the 2011 highs. It succeeded but only for a short while. The breakout was invalidated almost instantly as it was clear that gold is not able to withstand the selling pressure. Invalidations of breakouts tend to be very bearish developments and this time was no exception. And just like that - gold declined.

It's been a few months since gold topped and gold - looking from the long-term perspective - is now only a little lower. Some may say that it's a proof that gold is just correcting after a big rally and that another big upswing is just around the corner. But that's not what the chart facts support. The fact is that gold failed to break above the previous high, which is bearish. Looking at the short-term performance, it might be both: correction or the early part of the decline, but so far nothing happened that would justify the bullish interpretation.

In particular, please note that back in 2012, when gold also tried to break above the previous high (and it actually succeeded in terms of the monthly highs), and failed, it also declined at a relatively slow pace initially. That didn't prevent gold from declining very rapidly in the following months.

This means that if you're using euro for your day-to-day transactions (for instance, because you live in the Western Europe), then you shouldn't count on the continuation in gold's rally in the following months. In fact, something exactly the opposite could take place.

If you're using U.S. dollars for your day-to-day purchases, the above is also very important to you. In this case, the above chart implies that the value of gold is likely to decline relative to what the EUR/USD currency pair will be doing.

And the EUR/USD pair...

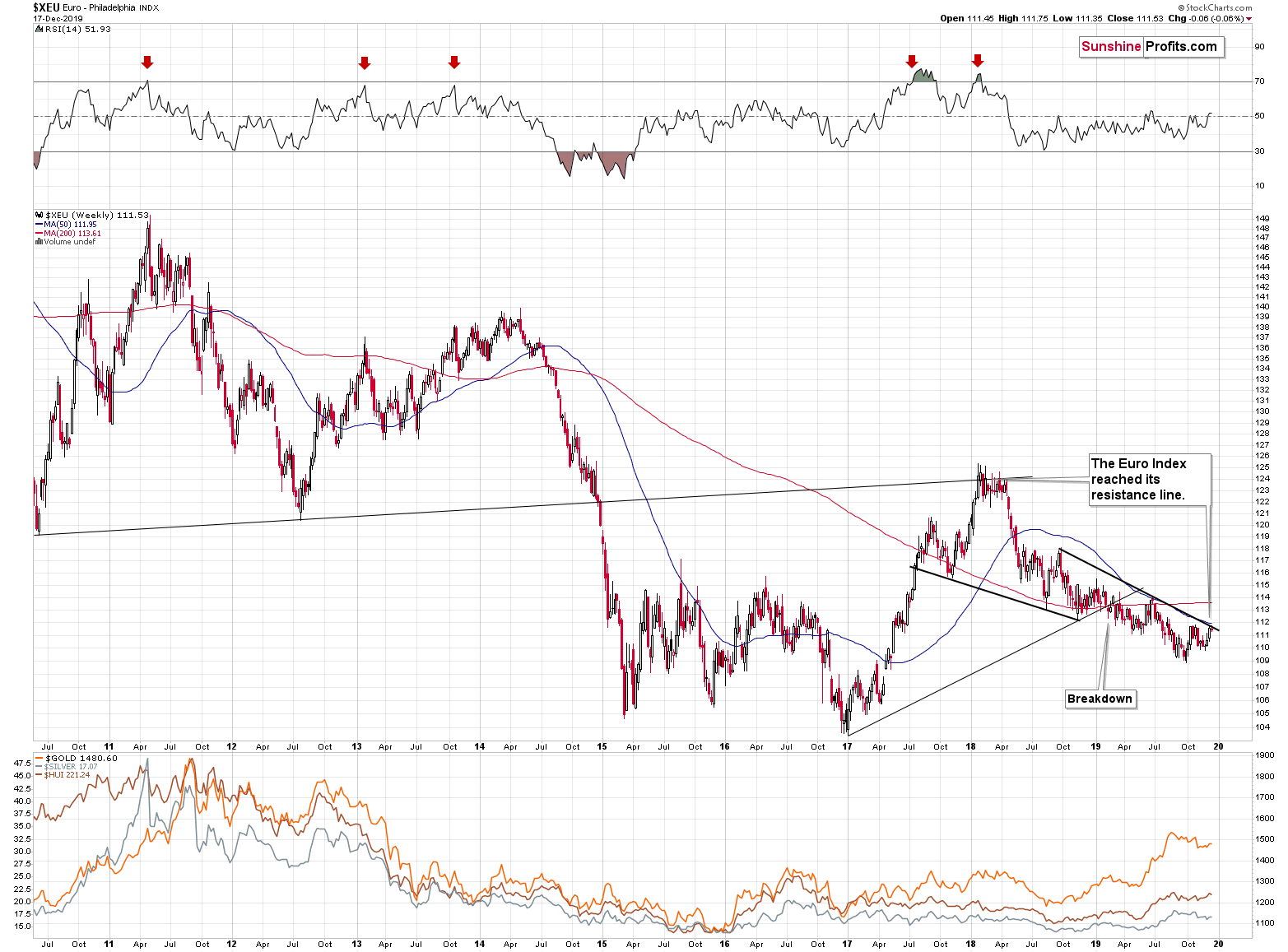

The Euro and the Dollar

The Euro Index - proxy for the above - is at its medium-term resistance. Being at an important resistance without breaking above it means that the price is likely to move down. That's how resistances work.

Moreover, please note that the entire September - today decline is one big prolonged shoulder of the bearish head-and-shoulders pattern (the early-2019 rally being the head). This means that once the Euro breaks significantly lower (perhaps triggered by one of the market news scheduled for this week) - below the previous 2019 lows, it's likely to fall particularly hard. The size of the decline that follows the breakdown below the head-and-shoulders pattern is likely to be similar to the size of the head, which in this case means a move below the 2017 low. Of course, this would have major repercussions for many other markets, including gold.

If the euro declines that significantly, breaking below its 2017 low, and at the same time - based on the previous chart - gold declines more than the euro, gold would likely truly plunge in terms of the USD. Of course that's not the only factor that points to this outcome, but it's something that confirms other, even more important factors.

The full version of this analysis isn't just about gold in euro terms though. There, we cover the immediate action in gold, silver and the miners in light of the USD Index twists and turns. Plus, we feature a little known sign that gold's low volume just flashed, and show you its reliability. And of course, you'll also find there the key factors at play and the targets of our promising short position. We encourage you to join our subscribers and reap the rewards. Subscribe today!

-

Platinum's Insightful Signal

December 17, 2019, 7:40 AMDo you remember about platinum? You know, the other white metal that has fallen behind gold and that is being outperformed by its smaller (?) brother - palladium. Platinum is special because it's the weakest part of the precious metals sector. And the weakest part of a given market tends to act quite specifically at tops, so it's analysis could be particularly useful at times. Especially at times like this, because it appears that the next local top is just around the corner, or that it's already in.

By "acting specifically" we mean that it catches up with the rest of the market and does so with exceptional strength. This is most likely due to inexperienced investors entering the market close to the top. They are likely to buy whatever seems cheap regardless of its fundamental situation - after all, there might be a good reason why it's cheap. In case of platinum, it's the decline in the use of diesel engines, which means lower demand for platinum as it is used in catalysts of diesel-powered cars.

Platinum's Attempts to Rally

In the last several months we saw two major short-term upswings in platinum price and now we see the third one. Both previous cases were platinum's attempts to break above the declining red resistance line and they both failed. In both cases, the volume was relatively big, but it was much bigger in the first case.

How did gold, silver and miners respond? With declines. The times when platinum showed exceptional short-term strength were good times to prepare for lower prices. The situation when platinum rallied on huge volume was the situation when the top in gold was most profound - that was THE 2019 top (most likely as the year is not over yet). That's important, because the volume was very big once again this time. This increases the odds that the precious metals market is forming a short-term top right now and that the next short-term move will be to the downside.

The full version of this analysis isn't merely about platinum though. There, we cover the immediate action in gold, silver and the miners. And of course, we update you also on the USD Index and the closest short-term turning point in gold. You'll also find there the key factors at play and the targets of our promising short position. We encourage you to join our subscribers and reap the rewards. Subscribe today!

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM