Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Today’s short-term analysis will once again be in video format. However, to make a long story short, the precious metals sector declined yesterday, and what we wrote previously remains up-to-date.

Having said that, let’s take a look at the markets from a more fundamental angle.

With the Consumer Price Index (CPI) scheduled for release today, the print will likely swing the pendulum to euphoria or depression. Moreover, with the release on Nov. 10 igniting a violent short squeeze, the S&P 500 rallied sharply on Dec. 12 as the bears wanted to avoid another manifestation.

In contrast, gold, silver and mining stocks declined on Dec. 12, and I’ve warned on numerous occasions that investors overreact to monthly economic data. In a nutshell: one month’s print does not change the medium-term trend, and the Fed’s inflation fight should be one of attrition.

Yet, with oil prices declining in November, they should put downward pressure on the headline CPI; and with investors’ emotional reactions poised to persist, the noise could be amplified. For example, Reuters reported on Dec. 12:

“Pricing in the U.S. options market on Monday implied investors were positioned for the S&P 500 to move 2.5% in either direction in the wake of Tuesday’s consumer price report, which covers November, data from options market-making firm Optiver showed.”

In addition:

“Options prices are projecting a 1.8% swing in either direction for the S&P 500 in the hour immediately following Wednesday's FOMC decision.”

So, with heightened volatility expected on Dec. 13 and 14, the PMs may get caught up in the manic moves. But, with the crowd highly reactive rather than proactive, their reflexivity should be their undoing in the months ahead.

To explain, the crowd believes that lower inflation is a linear process of positive results. However, the pessimism that confronted the financial markets from mid-August to mid-October lowered asset prices and helped calm today’s inflation metrics. Conversely, with that pessimism reversing recently and financial conditions loosening, the current optimism sets the stage for higher inflation over the medium term.

Furthermore, market participants don’t realize that the inflation merry-go-round will spin if they keep overreacting to relatively immaterial progress. In other words: investors’ hopes for a dovish pivot actually reduce the chances of one occurring.

To that point, the Wall Street Journal’s (WSJ) Nick Timiraos – the Fed whisperer – wrote on Dec. 12:

“Some investors think Mr. Powell will flinch on raising rates once unemployment rises, but former Fed governor Randal Quarles, who has known the Fed Chair since they worked in the Treasury Department in the early 1990s, said Mr. Powell is determined to avoid Mr. Burns’s mistakes of failing to control inflation.

“’People really misjudge the fact that Jay is a diplomat and a genuinely good guy to mean he’s a conciliator – which is absolutely not the case,’ said Mr. Quarles, who served at the Fed from 2017 to 2021. ‘He’ll have a very clear view, and he’s committed to doing what the law requires,’ which is to lower inflation.”

Consequently, while the crowd either doesn’t know or doesn’t care about history, the Fed understands the mistakes and embarrassment that occurred in the 1970s.

Please see below:

Remember, we warned previously that the crowd is misinformed in its belief that ignoring inflation (a dovish pivot) will solve all of the financial market’s problems. In reality, patience from the Fed will only make a bad situation worse. We wrote on Aug. 9:

Inflation is like termites; it eats away at the U.S. economy until it crumbles. Therefore, the greater risk is not curbing inflation. The [Fed’s Great Inflation] report [stated]:

“Once in the position of having unacceptably high inflation and high unemployment, policymakers faced an unhappy dilemma. Fighting high unemployment would almost certainly drive inflation higher still, while fighting inflation would just as certainly cause unemployment to spike even higher.”

However, with the destructive nature of inflation now obvious (we’re not there yet in 2022), the answer to the “trade-off” was clear, and the narrative shifted dramatically.

So, with its own autopsy of the 1970s warning the Fed against a dovish pivot, the U.S. federal funds rate (FFR) should continue its ascent. Furthermore, with the U.S. unemployment rate near a 50-year low, the “unhappy dilemma” from the 1970s hasn’t even started, which means the pivot crowd is buying hope and selling reality.

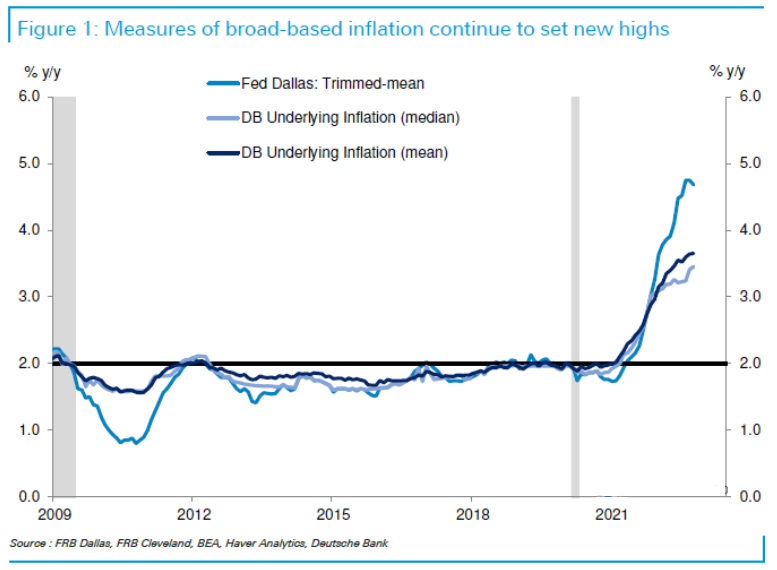

Likewise, while the headline CPI garners all of the attention, measures of broad-based inflation continue to rise. As a result, the pricing pressures are much more ingrained than the consensus realizes.

Please see below:

To explain, the royal blue line above tracks the year-over-year (YoY) percentage change in the Dallas Fed's Trimmed-mean CPI, while the dark and light blue lines above track the YoY percentage changes in Deutsche Bank's mean and median measures of underlying inflation.

If you analyze the right side of the chart, you can see that the latter two continue to hit new highs. Thus, with broad-based inflation still prevalent, the Fed's issues stretch far beyond supply chains.

On top of that, silver is repeating its bearish pattern from 2012-2013, where a sharp rally occurred before the white metal fell off a cliff; and with silver's outperformance often an ominous indicator for gold, the technical setup also supports much lower precious metals prices in 2023.

Overall, the crowd's misunderstanding of inflation has them assuming the pricing pressures will ease with little economic damage. But, history contrasts this sentiment, and one can argue that the pandemic-induced imbalances make this bout even worse. As such, pain should confront the believers when reality returns.

Silver

With the silver price struggling to eclipse $24, sellers have emerged when the white metal nears the psychological level; and while today’s CPI print could amplify the volatility, the medium-term backdrop is bearish, not bullish.

For example, sticky inflation supports higher interest rates and a stronger USD Index. Moreover, we’ve noted previously that the Bank of Canada (BoC) and the Fed often mirror each other’s monetary policy due to their region’s geographical proximity and trade relationship.

Therefore, after the BoC raised its overnight lending rate by 50 basis points on Dec. 7 and hinted at a pause, we wrote on Dec. 8:

While the BoC cited “excess demand” and “unemployment near historic lows,” and in the next breath, questioned “whether the policy interest rate needs to rise further,” the contradiction highlights the conundrum confronting North American central banks. With some areas of their economies running too hot, while others are too cold, they want to have their cake and eat it too.

However, the reality is that supporting growth encourages inflation, and history shows the gambit ends in a recession regardless of what they do; and while the BoC (and maybe the Fed next week) thinks the overnight lending rate could peak at 4.25%, we believe the central bank materially underestimates the challenges that lie ahead.

Yet, with BoC Governor Tiff Macklem (Canada’s Jerome Powell) sounding much different on Dec. 12, the about-face highlights the anxiety confronting North American central banks. In a nutshell: because they know about the difficulty of normalizing unanchored inflation, all that’s left is hope. He said:

“We are trying to balance the risks of over and under-tightening monetary policy. If we raise rates too much, we could drive the economy into an unnecessarily painful recession and undershoot the inflation target. If we don't raise them enough, inflation will remain elevated, and households and business will come to expect persistently high inflation.

“With inflation running well above target, this is the greater risk.”

Thus, while market participants have full faith in their central banks, they don’t realize that Powell and Macklem are driving blind. Not only were they woefully wrong about “transitory” inflation in 2021, but history shows they won’t pull off soft landings either.

As such, while Macklem admitted what we already knew, don’t be surprised if interest rates rise more than the consensus expects and economic growth is a major casualty.

Please see below:

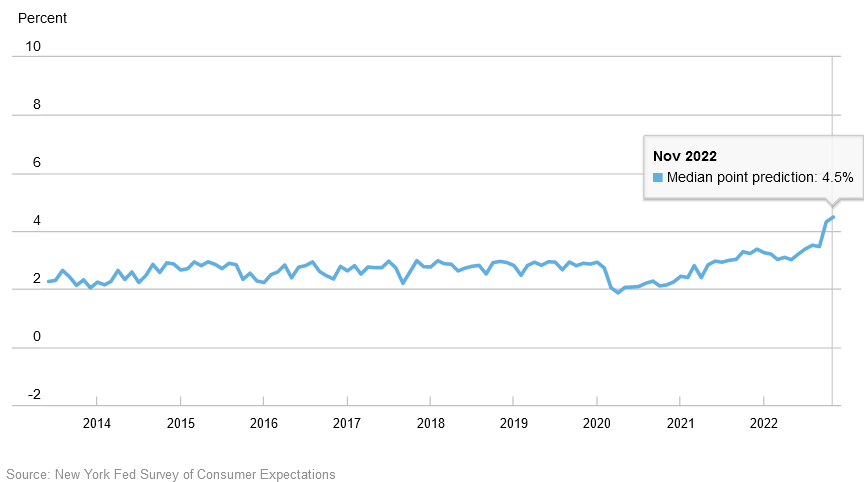

On top of that, we warned throughout 2021 and 2022 that demand was the primary driver of high inflation, and even as supply chains normalize, the pricing pressures will continue. But, the New York Fed released its Survey of Consumer Expectations (SCE) on Dec. 12, and the report stated:

“Median inflation expectations decreased at both the one and three-year-ahead horizons in November, by 0.7 percentage point (to 5.2%) and by 0.1 percentage point, to 3.0%, respectively.”

So, problem solved, right?

Well, the report added:

“The median expected growth in household income increased by 0.2 percentage point to 4.5% in November, a new series high.”

Please see below:

On top of that:

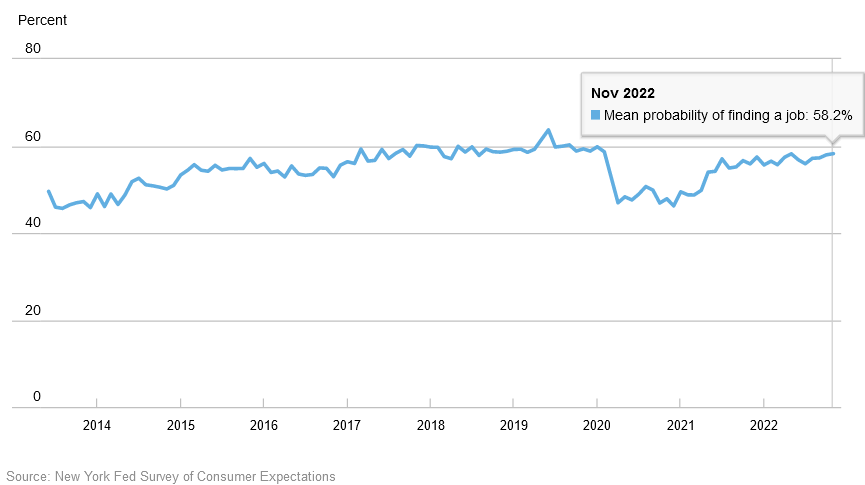

“The mean perceived probability of finding a job (if one’s current job was lost) increased by 0.2 percentage point to 58.2%, its fourth consecutive monthly increase and the highest reading since February 2020.”

Please see below:

Thus, with Americans expecting higher household income and more confidence in the U.S. labor market, demand should keep inflation elevated for much longer than the consensus expects. This means the fundamental backdrop is bullish for the FFR, real yields and the USD Index, and bearish for silver.

As further evidence, we warned on Dec. 23, 2021, that the crowd underestimated Americans’ ability and willingness to spend. We wrote:

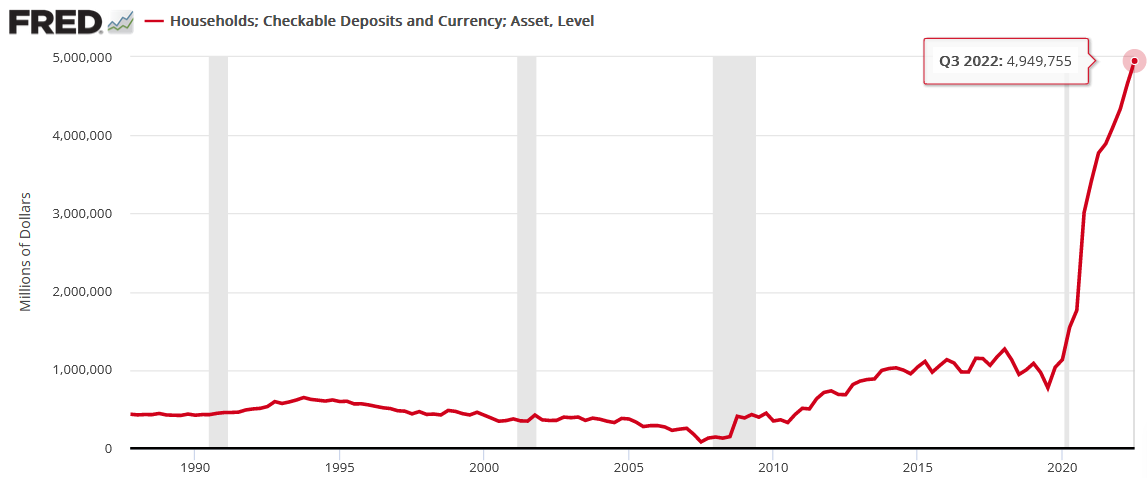

While “the Fed is trapped” crew cites these issues as reasons for an economic calamity, they often miss the forest through the trees. For example, while the fiscal spending spree may end, U.S. households are still flush with cash…. U.S. households have nearly $3.54 trillion in their checking accounts. For context, this is 253% more than Q4 2019 (pre-COVID-19).

Yet, while the FFR has surged in 2022 and the crowd still assumes that demand will collapse, the Fed revealed on Dec. 9 that U.S. households have a record ~$4.95 trillion (as of Q3 2022) in their checking and/or demand deposit accounts, which is 379% more than Q4 2019 and 6.3% more than Q2 2022.

Please see below:

Consequently, while investors wait for a destitute consumer to reduce inflation and allow the Fed to pivot, the vertical ascent on the right side of the chart above highlights the profound stimulus imbalance that materialized during the pandemic; and with wage growth also near an all-time high, investors are kidding themselves if they think monetary policy can return to its pre-pandemic state when Americans’ checking account balances have gone parabolic.

Overall, the silver price remains well above its fundamental value, as misguided inflation optimism has created hopes for a dovish pivot. Moreover, while today’s headline CPI print may be relatively weak due to the drop in oil prices, the underlying pressures remain.

Likewise, with Americans' cash balances at a record high, while the U.S. unemployment rate is near a record low, history shows that lower inflation occurs alongside economic distress and large spikes in unemployment.

Therefore, with job openings and Americans' employment expectations far from these levels, the U.S. economy, the S&P 500 and the silver price should suffer immense weakness before inflation is finally defeated.

The Bottom Line

Investors think they can wish outcomes into fruition, regardless of the fundamental backdrop. But, when it becomes clear that their desires are merely dreams, reality rains on the parade and liquidations unfold. So, while seasonality is bullish and lower commodity prices have increased investors’ inflation optimism, their exuberance is short-sighted and the resiliency of demand should put upward pressure on the FFR in the months ahead.

In conclusion, the PMs declined on Dec. 12, as the USD Index and the U.S. 10-Year real yield rallied; and while volatility could be amplified on Dec. 13 and 14 as the CPI and the FOMC dominate the headlines, the medium-term implications are unchanged: the technicals and the fundamentals are highly bearish, and they should showcase their might in 2023.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over (or about to be over) and that the next big move lower is already underway (or that it’s about to start).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

There are no new letters for today, but I wanted to keep the below reminder in place, just to make sure that everyone had the chance to see it:

Please note that this section is going to go away within the next 1-8 weeks, as you can add comments/questions below the article on Golden Meadow – the platform that we’re using to provide our analyses. Your notification e-mails include an invitation link that allows you to access the “Gold Trading Alerts” space.

The first premium analysis had over 30 comments below it, and once I finish writing this article, I’ll head over to the comments section and catch up on yesterday’s comments.

Also, if you haven’t had the chance to see the video, in which I’m talking about the new platform and why we essentially moved from Sunshine Profits to Golden Meadow, I strongly encourage you to do so:

Summary

Summing up, it seems that the major bottom in the USD Index is in, while the correction in stocks, gold, silver, and mining stocks is over.

The nature of the recent corrections was mostly technical. No market moves up or down in a straight line, and seeing market corrections is rather normal. The reason that markets corrected this time was an incorrect (in my opinion) expectation that the Fed would make a dovish U-turn. The fact that even the positive employment numbers were ignored as a bearish indication of further rate hikes shows the extent of the recent/current irrationality.

However, as the irrationality ends, the medium-term trend is likely to resume, and in the case of junior mining stocks, this trend is downward.. The latter are likely to decline profoundly based on declines in both: gold and the stock market.

In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. And while I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $27.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $74.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $18.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $46.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief