Briefly: in our opinion, full (100% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. We are lowering the exposure to the short side of the precious metals market, as the bearish outlook became less bearish.

There are multiple questions that one might be asking based on yesterday's price moves in gold, silver, and mining stocks, but most of them boil down to this: has anything changed regarding the outlook?

In short, our reply is that it might have, but the outlook still remains bearish overall. The economic outlook is still gloomy, stocks are likely to decline in the following weeks (we are making money on stocks' quick upswing, and we're doing the same in crude oil, though) and the USD Index remains in a long-term uptrend. However, if the technical signs start pointing to a different outcome in the short term, we won't argue that the long- or medium-term trends have to continue right away. After all, markets can be illogical in the short run. They can for instance just assume that there will be negative interest rates in the US without an indication thereof from the Fed. That's why examining technicals is so important - they allow us to detect if something really changed on the emotional side of the market or not. And to check whether what we saw, was rather a price noise or something profound.

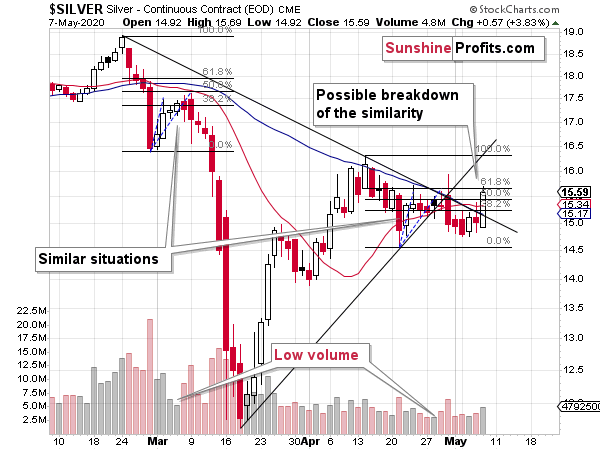

As in the previous days, let's start with silver.

In the previous Alerts, we wrote that the similarity to what happened in early March remained relatively clear and intact. Based on yesterday's upswing and today's pre-market move higher (silver futures are trading at $15.80 at the moment of writing these words, they are slightly above the late-April high), so it might be the similarity to March correction just broke down. They key word here is "might".

Even in late April, we saw that the back and forth movement since the mid-April bottom was taking longer than what we saw in March. Based on the shape of the late-April daily decline and how high silver moved on an intraday basis, we knew that the analogy in terms of price is not perfect either. So, perhaps this consolidation simply takes longer in general, just as the topping pattern is the stock market is broad, as opposed to the quick pause that we saw in the first half of March. It's probably too early to discard the March-May similarity in its entirety, and it's definitely too early to discard the bearish outlook in general.

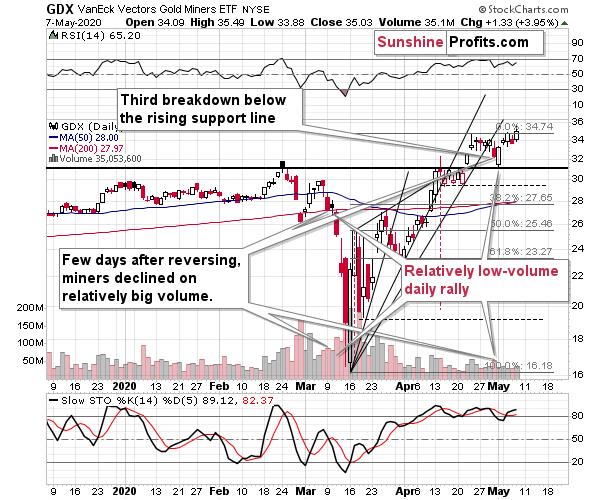

Both the mining stocks and silver tend to behave specifically during tops. Silver catches up, while miners don't perform as well as they did previously. Silver definitely caught up yesterday and is catching up today - what about the miners' performance?

Miners moved higher, but compared to silver, their upswing was not even similarly profound. Taking the last two trading days into account, miners are barely up, while silver is up significantly. This could mean that silver is up, precisely because it's the final part of the upswing.

As far as today's pre-market trading is concerned, at the moment of writing these words, gold is up by 0.24% and silver is up by 1.49% - the white metal is clearly outperforming in the very short term.

With decreased volatility, the times are becoming "more normal" and with this, "more normal" trading techniques become more useful. Looking at miners and silver's relative performance is one of them.

USDX in the Spotlight

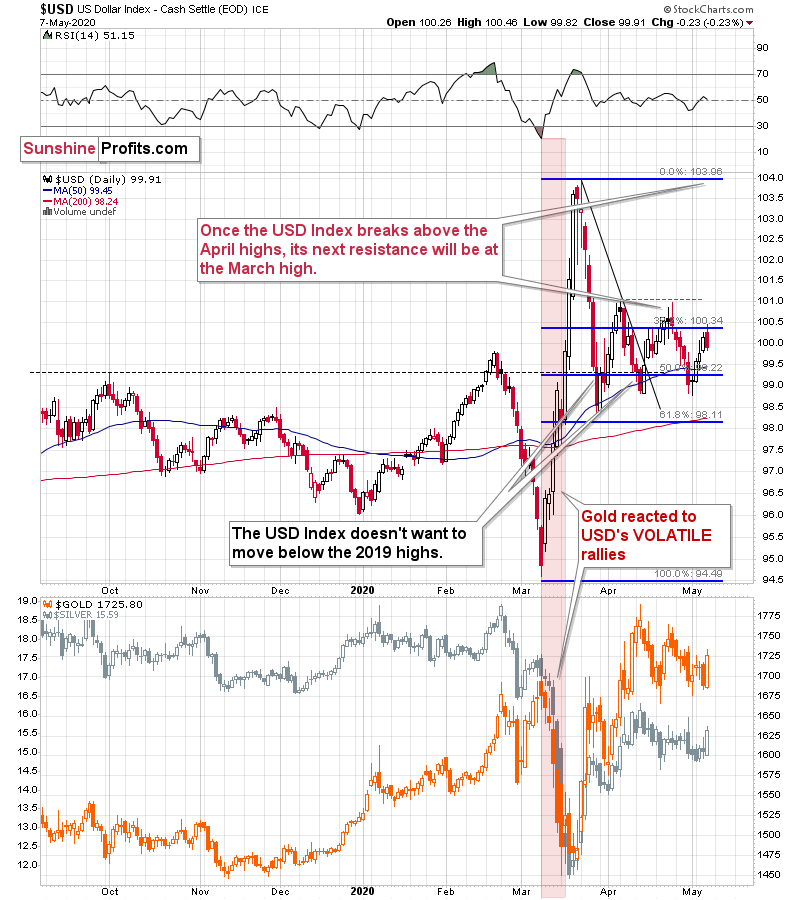

The above chart might (!) also indicate a change in the outlook. The USD index declined, and gold reacted strongly to this move. As a confirmation of the bearish case, we would prefer to see the opposite taking place - we would like to see gold ignore USD's daily weakness.

This daily show of strength could imply that more strength is just around the corner. Or, it could imply that it was just a daily pause within the broad consolidation. The USD Index has been consolidating since late March and gold has been consolidating since mid-April. If the USD Index breaks higher from its consolidation, gold would be likely to break below its consolidation. The opposite is also true - a breakdown below the consolidation in the USD Index would be likely to result in a breakout, and possibly a big move up - in gold.

It seems that yesterday's reversal and a daily decline in the USDX is caused by people assuming that the USD Index just topped and that it's on its way to new lows. We doubt that this would be the case - not only because of the very long-term technical breakout in the USD Index (we'll provide more long-term charts on Monday), but also because of the medium-term uptrend, and the likely demand for the safe-haven currency - the US dollar - from the BRIC / developing countries. The growth in new daily Covid-19 cases in Brazil, Russia and India is increasing. Taken together, they now match the US in terms of daily new cases, and it was just a fraction of the US daily cases just several days ago.

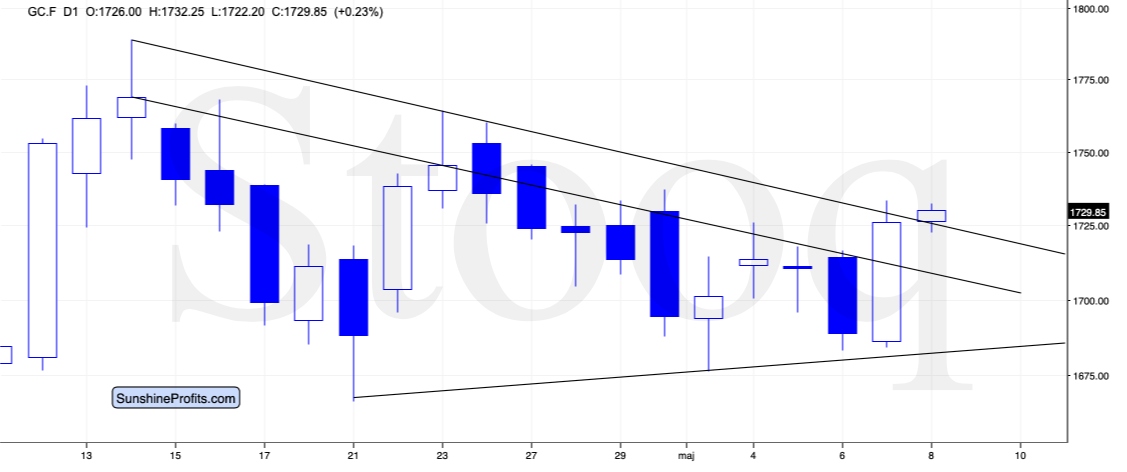

Let's zoom in on gold's price moves.

Focused on Gold

On the above daily chart, we see that yesterday, gold didn't break below the declining resistance line based on the intraday highs. Gold is making a small attempt to do that today, but so far it's tiny and very far from being confirmed.

In case of the declining resistance line that's based on the daily closing prices, it was broken yesterday, and right now gold is trying to verify it. We generally prefer to see three consecutive closes above a certain level before we view the breakout as confirmed - so far we saw just one.

On the 4-hour chart, we see that gold's breakout is very inconclusive. Gold theoretically already invalidated the breakout by moving slightly below the declining line, but then it moved back above it once again as if it was verifying the breakout.

What gold and silver could be doing right now is panicking right before today's jobs report, which we know that will be a disaster, but the scope of the disaster is still unknown. As the uncertainty fades away, so might the particular appeal of the precious metals.

The above is relatively unclear, though. What is quite clear, however, is the strong appeal of the US currency, to which gold is likely to respond with declines.

We have been recently asked out a stop-loss order and our take on that matter hasn't changed since we previously wrote about it, so we'll quote this text also below. Please note that today's decision to lower the exposure to the short side of the precious metals market confirms the points that we made in it:

Of course, the precious metals might show exceptional strength here and the outlook might prove to be bullish even without a big slide in the precious metals prices, but... We don't see strong evidence toward that just yet. And no, a daily rally or few days of higher prices is not enough of a proof.

The confirmations, verifications etc. are used for a reason. This reason is that there are multiple forces that aim to pull the market in their direction and sometimes they succeed in doing that for a short while, despite the real trend. This means that acting on the very initial signs could be misleading.

On the other hand, we (well, not just us - everyone) have the risk of being affected by the confirmation bias and myopic loss aversion - meaning ignoring the new information, especially if taking them into account would mean realizing a loss (either materially, or psychologically - the mind hates that in particular and will play many tricks on one, just to avoid it). Why would the myopic loss aversion be a big problem? Because from the financial point of view it's far better to take even five minor (say 1%) losses than just one huge (20%) one. However, that's not how the mind works - it will "understand" the above as five losses vs. one loss and will aim for the latter outcome - which is actually the worse outcome.

One of the ways one can protect themselves against the above biases in the markets is a stop-loss order. It's good for many cases, especially in case of day trading, when one is barely able to take into account anything more than the price itself. However, the more one zooms out to the long term, and the more non-direct-price factors are taken into account (and the more important they are), the less useful a stop-loss becomes.

If you bought a house with the aim to collecting rent payments and creating a semi-passive income, would you decide (upfront) on selling that house as soon as its value dropped by 5% below the purchase price? Or 10%? The odds are, you wouldn't, because the decision was made based on many other factors than just the price itself.

That's similar to our current outlook and trading positions. We are taking myriads of factors into account, not just the price of gold or the price of silver, or the prices of mining stocks. We're looking at their inter-market relationships, we're looking at how they perform combined with how they performed during situations that were most similar to what we see right now (2008), and we check how they react to details that should make them move in one way or another (USDX, general stock market).

The outlook is not determined by just the price of gold itself - it's determined by many of the above. If this is the case, why should a certain price by itself change the outlook? That's why in case of this trade, we don't have stop-loss levels in place. We could set it (say to $2,100 in gold), but it would be so ridiculously high that it would be useless. Actually, it would be counter-productive, because it gives the false impression that we would actually wait until gold moved that high to change the outlook, whereas the point is that it is not the price itself that we will be looking at, at least not only at it. If gold declined or rallied by $1, while the USD Index soared by 4 index points, our outlook would change immediately. Not because of the price, but because of the relative strength. If silver declined to $8, while gold moved just $50 lower, we would probably change the outlook as well as it would imply a major target being (almost) reached while gold was showing strength.

We moved to always providing the stop-loss orders against our approach (described above) as it was requested by our subscribers. And it turned out that our profitability was much better when our approach toward exiting trades matched our approach to the market in general. It was requested, as most trading strategies are based only on the price and as such, price would be something that invalidates a given outlook. In our case, it's not like that, as our approach is more sophisticated. That's why we will use the stop-loss orders when breaking them would really invalidate the outlook and when it's close enough to be useful instead of being misleading. At this time, it would be misleading, not helpful. Of course, one is free to use these techniques in their trades, especially if one combines our research with some other techniques.

For now, the USD Index is likely to rally, and the stock market is likely to decline. The way gold, silver, and mining stocks respond to the decisive moves in these markets will tell us a lot about the outlook. If PMs and miners' respond in a bullish way (by not declining significantly, or even rallying), the outlook might become bullish. If PMs and miners' respond like they responded in March, or similarly, it will be clear that the outlook has been bearish all along.

For now, the technical signs don't point to strength in the precious metals sector that would be decisive enough to tell us that the situation is bullish, and at the same time we see signs that point to a high probability of situation in which the PMs and miners will have the chance to either plunge, or show their strength by declining just a little. In both cases, exiting short positions now, seems pre-mature.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks, but since the self-similar (to March) pattern in the precious metals market might have just been broken, the outlook is not as bearish as it used to be in the previous days. Consequently, we are decreasing the size of our trading position at this time. If we see more bearish signals, we're likely to increase the position (which we view as likely). If, on the other hand, we see strong bullish signals, we might close or even reverse the position. We are very far from "getting married to the short position" or the bearish outlook in general, especially that we emphasized it many times that we view the fundamental picture for gold as excellent.

Don't get us wrong - we still have many bearish signs for the precious metals market, it's just that we don't have as many today, as we had previously, and therefore, adjusting our current position seems justified. And yes, this is the case regardless of the profitability of the position. The decision whether a position should be kept or not, depends on the outlook, and not on the entry price (and therefore on profitability) - at times it means taking smaller profits off the table that one's mind would prefer, and at times it means exiting an unprofitable position (which the mind hates). However, overtime, such hard decisions pay off, as long as they are done in tune with the objective changes in the outlook. In fact, the difficulty in the above and acting as objectively as possible is probably the main reason why investing is simple, but not easy (well, this, and the position size management).

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (100% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager