Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

The pause in the miners continued for one more day, and there was no decisive move in either direction. But that doesn't really matter - just like one swallow doesn't make a summer, an additional daily pause doesn't change the overall picture. What really matters today, is the closing price we get. That would be the weekly, monthly, and quarterly closing price. And gold moved over $1,400 just several days ago. Will it manage to hold these gains this day, this week, and this month?

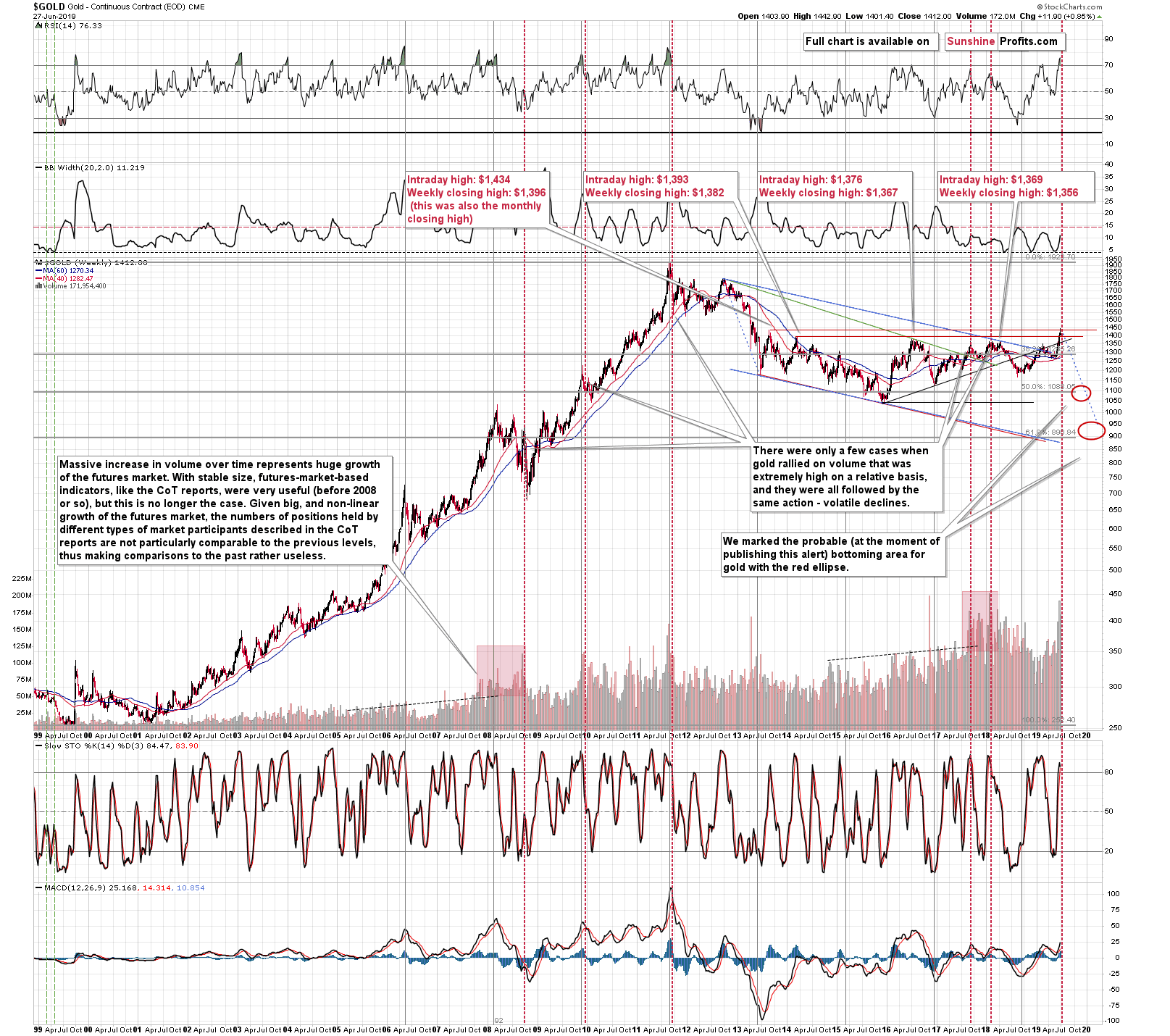

Very little changed on the short-term charts yesterday, so in today's analysis, we will focus on the key chart that matters the most - gold's long-term chart. Let's get right into it.

First of all, let us emphasize that what we previously wrote about the above chart remains up-to-date. Impossible not to highlight enough - especially so and in particular, the implications of huge weekly volume that we saw last week. All similar huge volume spikes marked key tops in gold. This was also the case with the 2011 top. The implications are clear - gold is likely topping here, especially given the overbought reading from the weekly RSI indicator.

While the emphasis is on the importance of today's closing price, let's add in some context first. Gold continuous futures contract ended the previous week ten cents above $1,400, which was a tiny breakout that was in no way confirmed. Since that time, gold managed to move as high as $1,442.90 only to decline to $1,401.40 yesterday. At the moment of writing these words, it's at about $1,415. With this kind of volatility, anything can happen today.

If gold rallies back above the $1,434 and closes the day, week, and month there, the implications will be bullish, and gold could continue its rally for a while longer before correcting. If gold however declines and ends the week below $1,396 (which is the highest weekly and monthly closing price that we saw in the second half of 2013), the implications will be extremely bearish. This would be an invalidation of the breakout in weekly and monthly closing price terms and at the same time, the entire week would become a huge-volume shooting star reversal candlestick.

Let's keep in mind that gold's rally was practically the only bullish thing that we saw recently. Sure, miners moved higher but the medium-term underperformance relative to gold remained intact, and silver has moved higher very little compared to gold. The above-mentioned price moves would make gold chart extremely bearish instead of being bullish.

What if gold closes between $1,396 and $1,434? In this case, the implications will not be crystal clear, and they will depend on the overall shape of the weekly candlestick as well as on signals from other markets. For instance, a close at around $1,405 would still create a bearish reversal candlestick, while a close at about $1,430 would make the candlestick look more like a regular weekly move during an upswing. The interpretation would depend on what miners, silver, and the USD Index would do.

The most likely outcome in our view is the one in which gold moves lower today, ending the week on a bearish note.

Before summarizing, we would like to reply two questions that we received yesterday. The first one is about the fundamental outlook:

Q: We are in a situation where growth may get slower, Recession may set in, and Interest rates may be dropped. In the face of all this do you still see that Gold will drop to less than 1200 before shooting above 1500??

A: Yes. Do you know that interest rates climbed higher in the 1970s as gold soared? And that when they declined in the 1980s and 1990s gold didn't soar back to the previous highs? It actually reached a low in 1999. Do lower interest rates really have to translate into higher gold prices if the analogy to the two most important historical periods suggests the opposite?

In the short run, the effect of lower interest rates may indeed be positive for gold, but only to the extent that the market is surprised by this decrease. The markets can and do move on emotionality in the short and medium term - while the fundamental outlook for gold remains positive, I'm expecting to see lower gold prices nonetheless. Gold simply hasn't fallen enough in 2015 - people did not hate gold at that time, they were optimistic. That's not what should accompany major bottoms, which means that gold has probably some more declining to do, just as the gold to silver ratio suggests.

Q: Secondly, you always quote about different phases in the past like 2011, 2013 etc. Why this time it cannot be different? And does Gold always have to follow the historical events that have occurred in the past?

Can this time be different? Of course it can be different. However, even though it can be different, the history is likely to repeat to some extent. This is one of the foundations of the technical analysis. The economic environments change, but the perennial emotions of fear and greed don't. People still get excited by rising prices and they get scared by lower prices. And when the price and volume indicate that something from the past is being repeated, the odds are that the follow-up action will be repeated as well. That's practically the only thing that we can use (the details are complicated, but the underlying rule is simple) to detect the likely price moves in the short- and medium term. The fundamental information will not be of much help as it tells one what gold is going to do "eventually" - which could mean in several years.

Summary

Summing up, today's closing price is going to be very important for gold's outlook and based on the signals that we get from other markets, it seems that we will get a bearish confirmation from gold instead of everything else aligning to tune of gold's recent rally. The gold-silver ratio, silver itself, gold stocks to gold ratio, the size of the upswing in the gold stocks, the situation in the USD Index, and gold's invalidation of the breakout above the mid-2013 high all suggest that the most recent move higher in the precious metals sector is nothing more than just a corrective upswing within a bigger trend.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,452; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $31.67

- Silver: profit-take exit price: $13.81; stop-loss: $16.32; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $23.87

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $26.47; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $9.87

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $37.17

- JDST ETF: profit-take exit price: $78.21 stop-loss: $22.47

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Once upon a time there was a Goldilocks (economy)... Would like to know the end of this story? So let's read our today's article - and find out whether it will have a happy end for gold!

Once Upon a Time There Was a Goldilocks Economy. Will This Story End Well for Gold?

The series of higher oil prices appears to be over as today, we might see the bulls' power tested. Where can the bears aim realistically and what is most likely to happen next? These are certainly valid questions as the oil price has reached an important resistance and appears hesitating today. Will some geopolitical news come to the rescue? High time to dive in...

Can the Oil Bulls Extend the Sputtering Rally?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager