Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Some might consider an additional (short) position in the FCX.

In yesterday’s analysis, I wrote about how the time aspect supports the ongoing similarity to 2008, and in light of yesterday’s upswing… nothing changed.

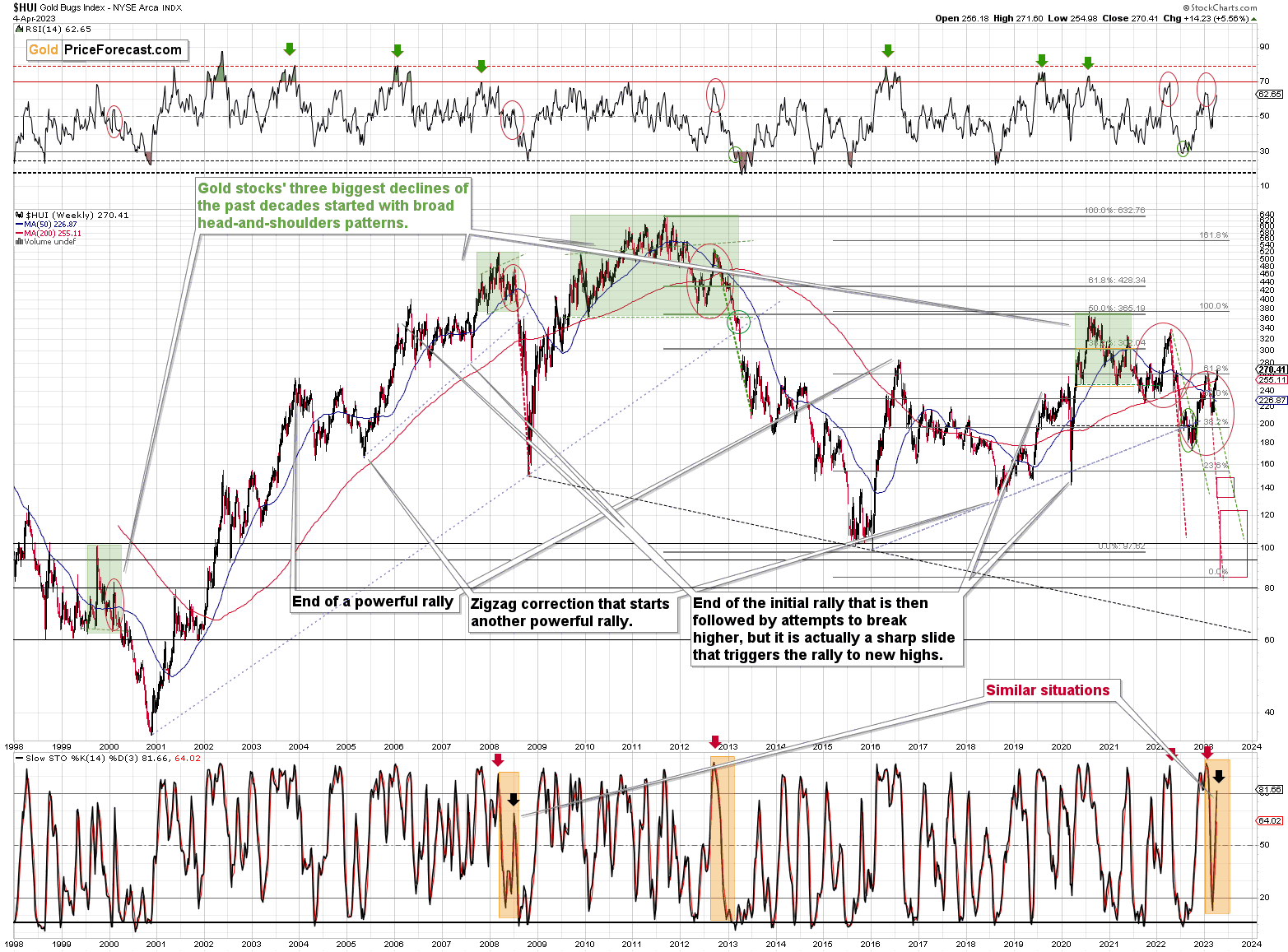

In fact, if we look at the HUI Index’s long-term chart, we’ll see that miners are doing exactly what they had been doing in 2008, during the USD Index’s bottom.

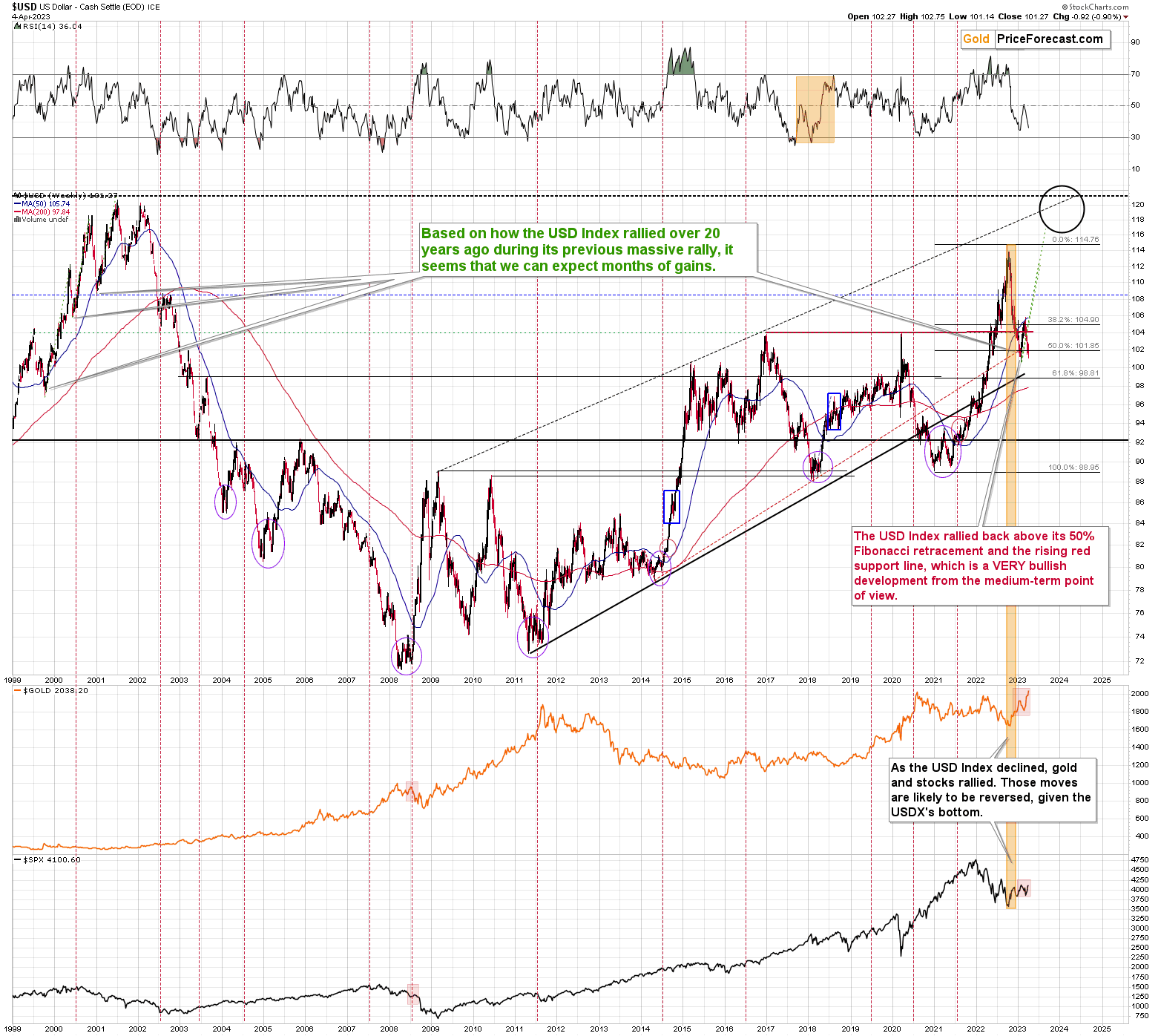

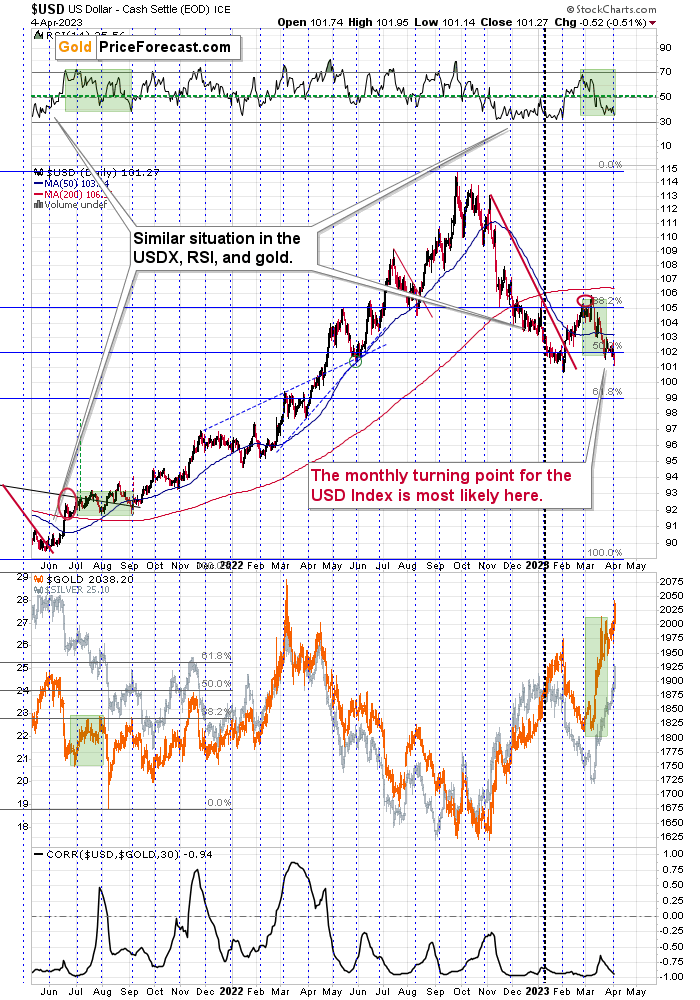

Let’s start with the latter. I already wrote about the situation in the U.S. currency, but it’s worth emphasizing it one more time as the implications for the precious metals sector remain in place.

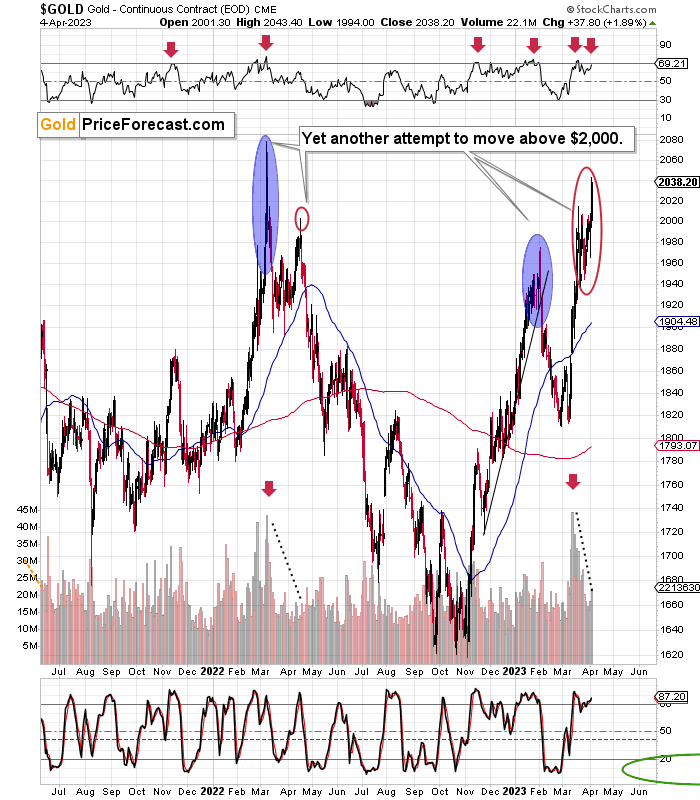

The sharp short-term decline after a sharp-short-term rally was typical before two of gold’s key tops. The final 2008 top and the 2011 top.

This is particularly important given all the other links to 2008.

Back then, the final bottom in the USDX was a bit (but not much) above the initial bottom. Well, guess what’s happening right now.

On a medium-term basis, the USD Index just moved very close to its 2023 low while remaining slightly above it.

This is as close to 2008 as it gets.

Let’s keep in mind that we’re just after two trading days of April, and the USD Index tends to reverse its course close to the turn of the month – or right at it. This means that we’re likely to see a turnaround any day – or hour – now.

This, in turn, means that the USDX is likely to rally at least somewhat. Based on the 2008 analogy, though, it’s likely to be much more than just “somewhat.” It seems more likely that we’re about to see a truly powerful move to the upside – perhaps similarly big to what we saw in 2008.

Speaking of 2008 and the moment when we saw the final bottom in the USDX, let’s see what happened in gold stocks at that time.

Well, as the USDX was bottoming, the HUI Index – proxy for gold stocks – was moving higher – quite visibly so. However, it’s important to note what accompanied this final pre-slide upswing in the HUI Index in the case of the indicators.

In particular, the stochastic indicator in the lower part of the above chart seems to be flashing a major “IT’S TIME” sign.

This time, the volatility is even bigger (which is not that odd given that more money is floating around this time), but we can see that the indicator is behaving very similarly.

After bottoming below 20, we saw a sharp upswing in stochastic. And it was this upswing that marked the last moment to enter short positions (and/or exit long ones) before the slide took gold stocks much lower. Is this THE TIME right now? I can’t make any guarantees (regarding outlook or performance), of course, and I’m not making one right now. However, in my opinion, it’s highly likely that we are in the same situation right now.

The sentiment is ridiculously positive, and it was just as positive back in 2008. Pretty much nobody was expecting what arrived next – the carnage.

Sure, gold moved higher today – above the initial high.

The RSI also moved above 69, and we saw a slight bump in volume levels – just like we saw it last year in early April – and that was what started a huge short-term decline back then.

What is different now is that gold has reached new highs.

But… since gold is also repeating its 2008 performance, that’s normal.

The final top in gold happened only after gold moved above the previous highs.

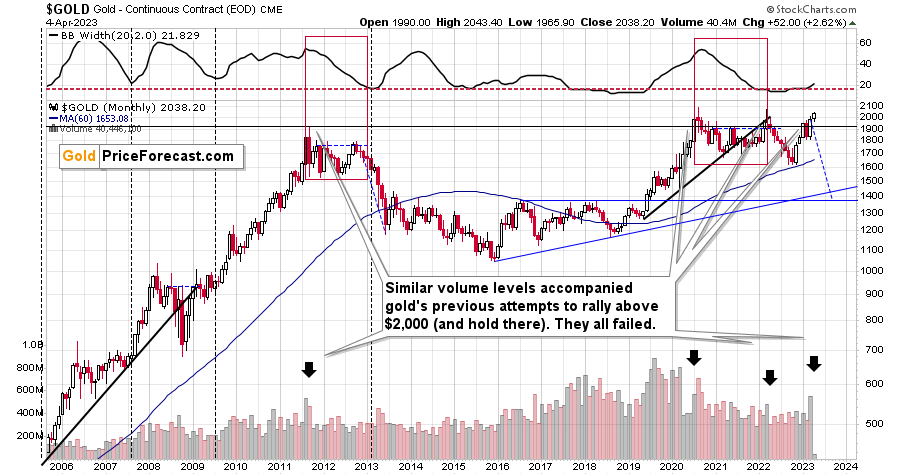

Also, let me remind you that this is yet another attempt to move above $2,000 and one that happened on strong monthly volume.

All three previous attempts that were accompanied by a similarly big volume failed. Sometimes they failed immediately, and sometimes there was an attempt to move higher in the following months, but they all failed.

This is likely where we are right now.

Given what just happened in the USD Index and the HUI Index, and given USDX’s tendency to reverse close to the turn of the month, it seems likely that the top is in or at hand.

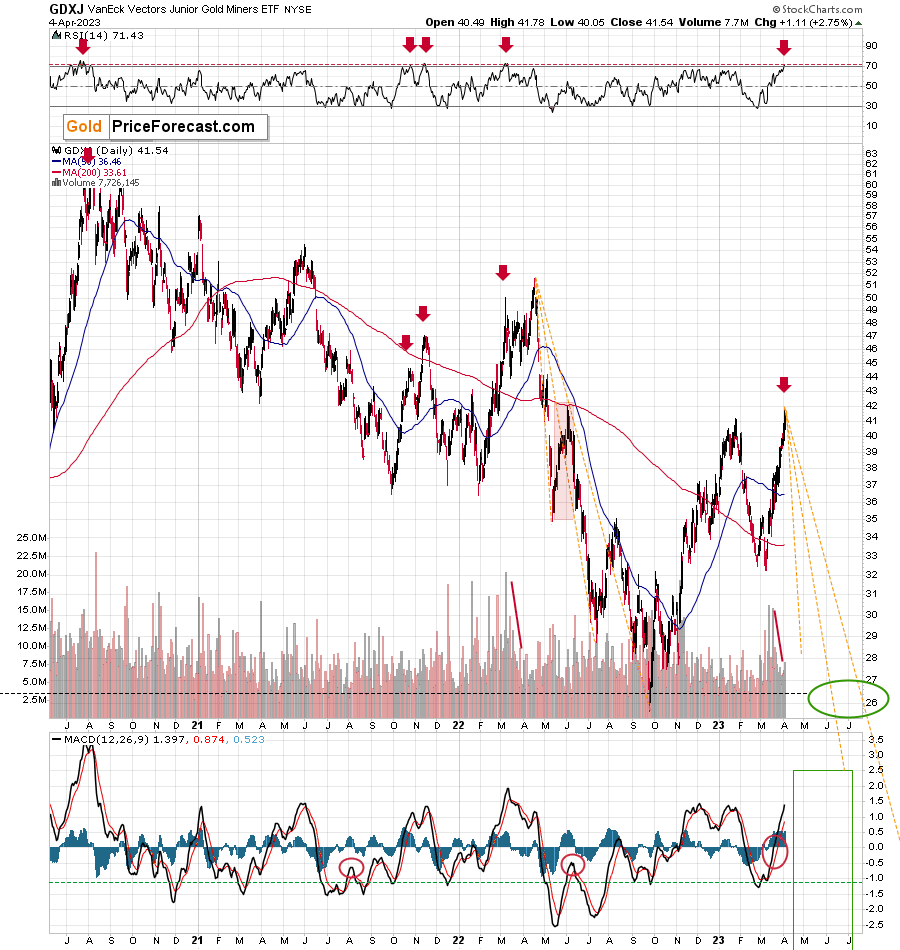

I already wrote about the GDXJ’s extremely bearish indication from its RSI indicator in yesterday’s intraday Gold Trading Alert, and here’s a graphical representation of what I wrote.

Quoting yesterday’s intraday Alert:

The GDXJ ETF moved higher today (as gold and silver did), and as a result, the RSI based on it moved above 70.

In the recent years, it was almost always the case (and has been the case since 2021) that when the GDXJ’s RSI moved above 70, a major top formed and the GDXJ was about to slide.

Meanwhile, the USD Index moved lower, and it’s now just a bit above its previous yearly low. Based on the analogy to 2008 (and also 2011), it seems that the bottom is in or that it’s so close that any potential downside here is likely negligible.

Consequently, the odds are that the junior miners are topping here. Even though one might “feel” that this is the time to drop the towel, and maybe even go long, the history shows that exactly the opposite is justified from the risk to reward point of view. If I didn’t have a short position in junior mining stocks right now, I would be opening one right now.

The above simply remains up-to-date.

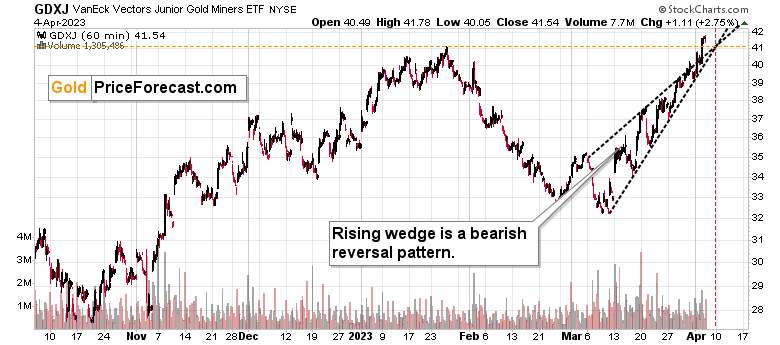

On the above hourly GDXJ chart, we see that it moved slightly above its previous 2023 high, and we see a small move above the rising wedge pattern.

Both moves were not confirmed yet, and given the situation in the USD Index, the HUI Index, and gold, it seems likely that those breakouts won’t be confirmed. And once they are invalidated, they will be a very strong sell signal for the short term.

The lines creating the rising wedge will cross approximately on April 10 – next Monday. Since there is no trading in the U.S. this Friday, we have only two full sessions left (including today). Consequently, it could be the case that we see some sideways movement or a move lower and then a final attempt to move higher on Monday, only to see a massive failure and the start of a truly powerful decline at that time.

Patience here is likely to be extremely well rewarded.

Just as the night is darkest before the dawn, it “seems most bullish” right before the biggest slides.

Stay strong.

===

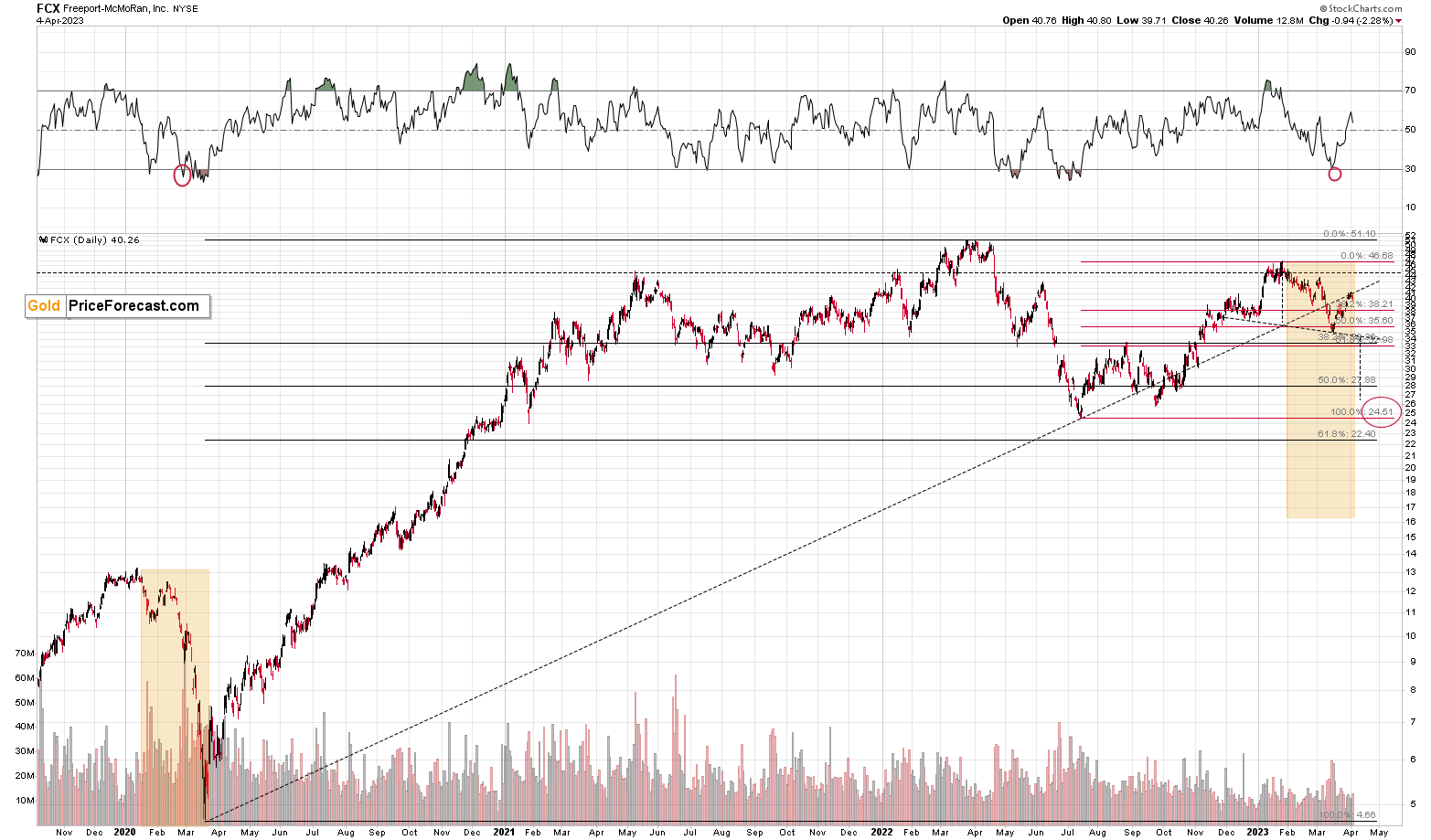

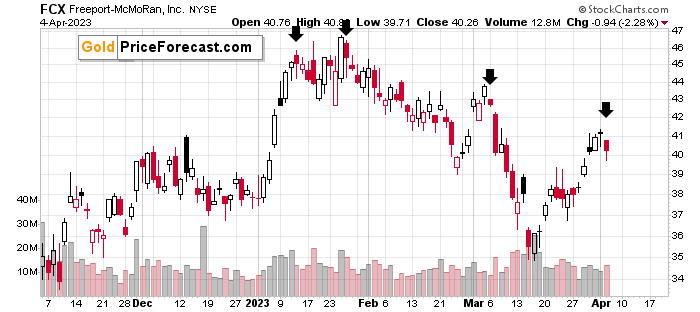

It seems that we have another trading opportunity in the FCX – another shorting opportunity.

I already wrote about FCX’s medium-term outlook (which is terrible) based on the situations in stocks, copper, and – to some extent – gold, and based on the analogy to 2008. It’s already getting late as I’m writing this (just 1.5h before the markets open in the U.S.), I won’t get into those details today, but you can find them in the analysis that I posted about a month ago.

Today, I would like to emphasize that the FCX seems to have verified an important long-term breakdown by moving to the rising resistance line and then moving back down.

And on the short-term side of things, we see that the FCX did what it had done twice right after tops.

After topping, the FCX’s price has been doing this specific initial decline that is then followed by a slight intraday corrective upswing. I marked three previous cases with black arrows. And we just saw the same thing once again.

Given all the background information that I’m not discussing today but that I have discussed previously, and given those above-mentioned short-term signs, I think that a short position in the FCX is now justified from the risk-to-reward point of view.

How low can the FCX fall this time? Quite possibly to the $24-$27 area. I’ll fine-tune the target as we move closer to it, but for now, I’m treating the upper border of the above as the target.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

On another – and final – side note, the number of messages, comments etc. that I’m receiving is enormous, and while I’m grateful for such engagement and feedback, I’m also starting to realize that there’s no way in which I’m going to be able to provide replies to everyone that I would like to, while keeping any sort of work-life balance and sanity ;) Not to mention peace of mind and calmness required to approach the markets with maximum objectivity and to provide you with the service of the highest quality – and best of my abilities.

Consequently, please keep in mind that I will not be able to react / reply to all messages. It will be my priority to reply to messages/comments that adhere to the Pillars of the Community (I wrote them, by the way) and are based on kindness, compassion and on helping others grow themselves and their capital in the most objective manner possible (and to messages that are supportive in general). I noticed that whatever one puts their attention to – grows, and that’s what I think all communities need more of.

Sometimes, Golden Meadow’s support team forwards me a message from someone, who assumed that I might not be able to see a message on Golden Meadow, but that I would notice it in my e-mail account. However, since it’s the point here to create a supportive community, I will specifically not be providing any replies over email, and I will be providing them over here (to the extent time permits). Everyone’s best option is to communicate here, on Golden Meadow, ideally not in private messages (there are exceptions, of course!) but in specific spaces or below articles, because even if I’m not able to reply, the odds are that there will be someone else with insights on a given matter that might provide helpful details. And since we are all on the same side (aiming to grow ourselves and our capital), a to of value can be created through this kind of collaboration :).

Overview of the Upcoming Part of the Decline

- It seems that we’re seeing another – and probably final – corrective upswing in gold, which is likely to be less visible in the case of silver and mining stocks.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, we recently took profits from the additional FCX trade (right before the trend reversed!) and the current short position in junior mining stocks is – in my view – poised to become very profitable in the following weeks and perhaps days. Based on the information that we have today, it seems like it might be a good moment to enter another short position in the FCX for another round of extra profits.

Things might appear chaotic in the precious metals market right now, but based on the analogy to the previous crises (2020 and 2008), it’s clear that gold, miners, and other markets are pretty much doing the same thing all over again.

The implications of this “all over” are extremely bearish for junior mining stocks. Back in 2008, at a similar juncture, GDX’s price was about to be cut in half in about a month! In my opinion, while the decline might not be as sharp this time, it’s likely to be enormous anyway and very, very, very profitable.

===

On an administrative note, there will be no regular Gold Trading Alerts posted on Friday (the U.S. markets are closed, anyway) and on Monday. The first regular Gold Trading Alert of the next week will be posted on Tuesday. And we’ll post the big, flagship analysis tomorrow. If anything changes regarding the outlook / positions, I’ll send out an intraday Gold Trading Alert anyway.

===

As a reminder, we still have a “promotion” that allows you to extend your subscription for up to three (!) years at the current prices… with a 20% discount! And it would apply to all those years, so the savings could be substantial. Given inflation this high, it’s practically certain that we will be raising our prices, and the above would not only protect you from it (at least on our end), but it would also be a perfect way to re-invest some of the profits that you just made.

The savings can be even bigger if you apply it to our All-inclusive Package (Stock- and Oil- Trading Alerts are also included). Actually, in this case, a 25% discount (even up to three years!) applies, so the savings are huge!

If you’d like to extend your subscription (and perhaps also upgrade your plan while doing so), please contact us – our support staff will be happy to help and make sure that your subscription is set up perfectly. If anything about the above is unclear, but you’d like to proceed – please contact us anyway :).

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.13; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $13.87; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.83 (stop-loss: none)

SLV profit-take exit price: $16.73 (stop-loss: none)

ZSL profit-take exit price: $32.97 (stop-loss: none)

Gold futures downside profit-take exit price: $1,743 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $10.97 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $25.47 (stop-loss: none)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $27.13 as the short-term profit-take level.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief