Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

In yesterday’s alert, we wrote that the previous days’ gains were likely just a pause and not a major turnaround and we didn’t have to wait long for the confirmation - gold, silver and mining stocks declined during yesterday’s session. The important thing is that the month is now over, which means that we can analyze the monthly price moves and the monthly volume levels. What do these major factors suggest?

Let’s take a look at the chart for details (chart courtesy of http://stockcharts.com).

The most important observation is that the analogy to the 2012 – 2013 decline remains in place. On October 2nd, we wrote the following:

What’s particularly interesting about the gold market right now is that the bigger the perspective, the more profound and more bearish signals we get.

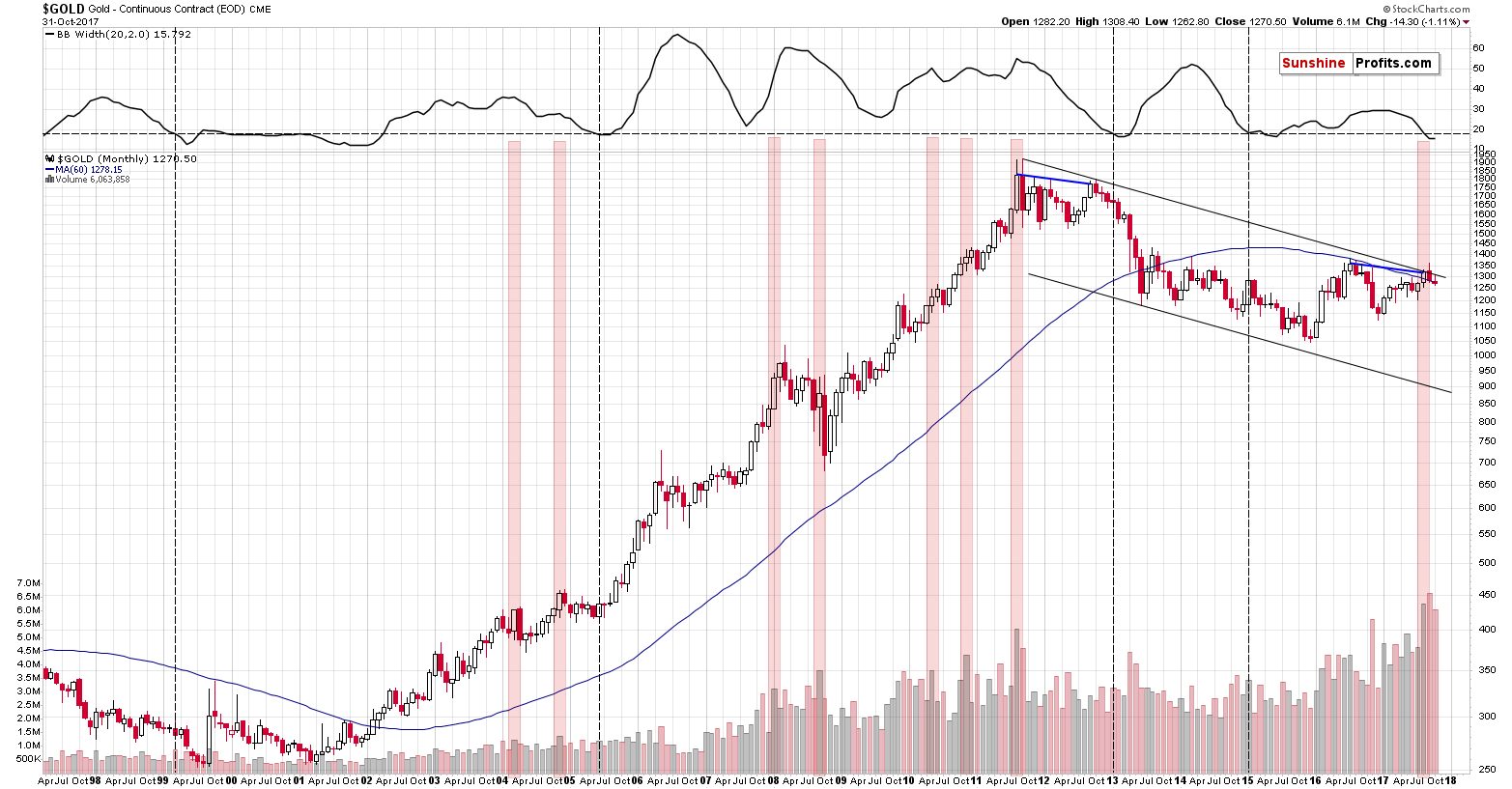

The above chart based on the monthly candlesticks confirms the above thesis. We discussed the above chart thoroughly in the September 1 Gold & Silver Trading Alert. Back then, we wrote the following:

There are 2 important signals that we would like to discuss: the size of the monthly volume and the decline in the monthly volatility as measured by the Bollinger Band’s width (indicator in the upper part of the chart). There’s also one additional analogy that we’ll discuss later on. Let’s start with the former.

The August volume on which gold rallied in August was huge and it’s directly comparable to only one case from the past – the 2011 top. That’s the only case when gold’s monthly upswing was accompanied by volume that was similarly big. Since that was THE top, the implications here are naturally bearish.

However, there are more analogies that are also important. Considering other monthly volume readings, when gold moved higher on volume that was visibly bigger than the previous values, we get the same implication. We marked the similar cases with red rectangles. Two 2004 declines, the final part of the 2008 decline and – approximately – the 2008 top, the two 2010 corrective downswings, and finally the 2011 top were all accompanied by or preceded by huge monthly volume readings. In 3 cases (the 2008 top, both 2010 corrections) the signal was not precise as the decline started in 2 months not in the next month, but still, the efficiency of this signal in a strong bull market where gold rallied in the vast majority of months, is still remarkable.

The signal that we’re seeing right now is not a minor one – the volume was truly huge and thus the implications are not vague, but clearly bearish at this time.

The width of the Bollinger Bands – a proxy for volatility – confirms the above, by strongly suggesting that a huge move is just around the corner. We added a horizontal line on the BB width chart to better compare its current value to the previous cases when it was seen after a downswing. We marked those cases with vertical dashed lines. There were 4 similar cases: in early 1999 (right before the final downswing of the previous bear market), in mid-2005 (before one of the biggest and sharpest rallies started), in early 2013 (before the biggest and sharpest decline started), and in early 2015 (when the most recent huge decline started). Most of the signals were followed by very important declines even though gold was moving higher for most of the past 2 decades - the implications are once again bearish.

Finally, there’s an interesting analogy between the 2011/2012 tops and the 2016/2017 tops. We marked the link between them with the blue lines. Actually, that’s only one line – between the 2011 and 2012 tops, which is then copied into the current situation. Surprisingly – it fits, which means that in case of the monthly closing prices, the 2017 rally could be just as significant as the 2012 rally. In other words, it could indicate that this year’s move is just a fake rally that’s here to fool the gold bulls, just like the 2012 rally did. Of course, it could be the case that the current rally is a beginning of a new long-term uptrend, but the signals – including the long-term ones - and the way the precious metals sector responded to USD’s decline in the past few months strongly suggest otherwise.

Let’s discuss the last paragraph. The analogy regarding the blue line connecting both (2012 and 2017) tops just got much stronger and so did the bearish implications. The reason is that the similarity now is even stronger. The month that followed both tops (that is tops in terms of monthly closing prices) featured both a temporary move to new short-term highs (above the previous month’s intraday high), and a decline to more or less the beginning of the previous month. In other words, in both cases gold first tried to break above last month’s high and ended up erasing last month’s price gains. This was indeed the case in both October 2012 and September 2017. Based on the above similarity, the analogy is more complete and the link and implications are stronger. The latter are bearish as a huge decline followed the mentioned 2012 developments.

Moving to the analysis of volume, we already wrote about the similarity to the 2011 top, but based on the above chart, we would like to add another comment. Namely, the volume accompanying September’s decline was even higher than the one that we saw in August (we have a new record). This is extremely bearish for three separate, yet connected, reasons:

- The volume that accompanied the decline was bigger than the one that accompanied the decline.

- September’s price action in gold is one big monthly reversal (shooting star) candlestick which was confirmed by extremely high volume.

- Gold’s breakout above the declining long-term resistance line was invalidated and the invalidation took place on huge volume.

No matter how you slice it, what we saw last month in gold was extremely bearish, even though so many investors welcomed gold’s move above $1,300 with thundering ovation.

Let’s stay for a minute with the analogy to 2012-2013 and move the focus to the mentioned Bollinger Bands’ width – a proxy for volatility. It moved below the dashed line and when we saw a similar development back in early 2013 it was shortly before the dramatic plunge. Consequently, it might be a good idea for one to be prepared for an analogous outcome in the following weeks also this time.

Last month gold moved temporarily higher, but ultimately ended the month almost $15 lower. The overall shape of the monthly candlestick is almost just like what we saw in 2012 after the final top. Back then the decline continued almost immediately, but it was not very sharp initially – does it mean that the decline will also be steady also this time?

Not necessarily. The Bollinger Bands’ width stopped narrowing/declining while being below 20 and back in 2013 it meant that a sharp decline was just around the corner. Gold moved about $500 lower in the next few months, so betting on continuation of back and forth movement in gold in the following months is not a good idea.

Moreover, please note that the last 3 months are very similar to the 3 months in mid-2016 when gold topped. Back then gold’s pace of decline accelerated in the following months, so this seems likely also this time.

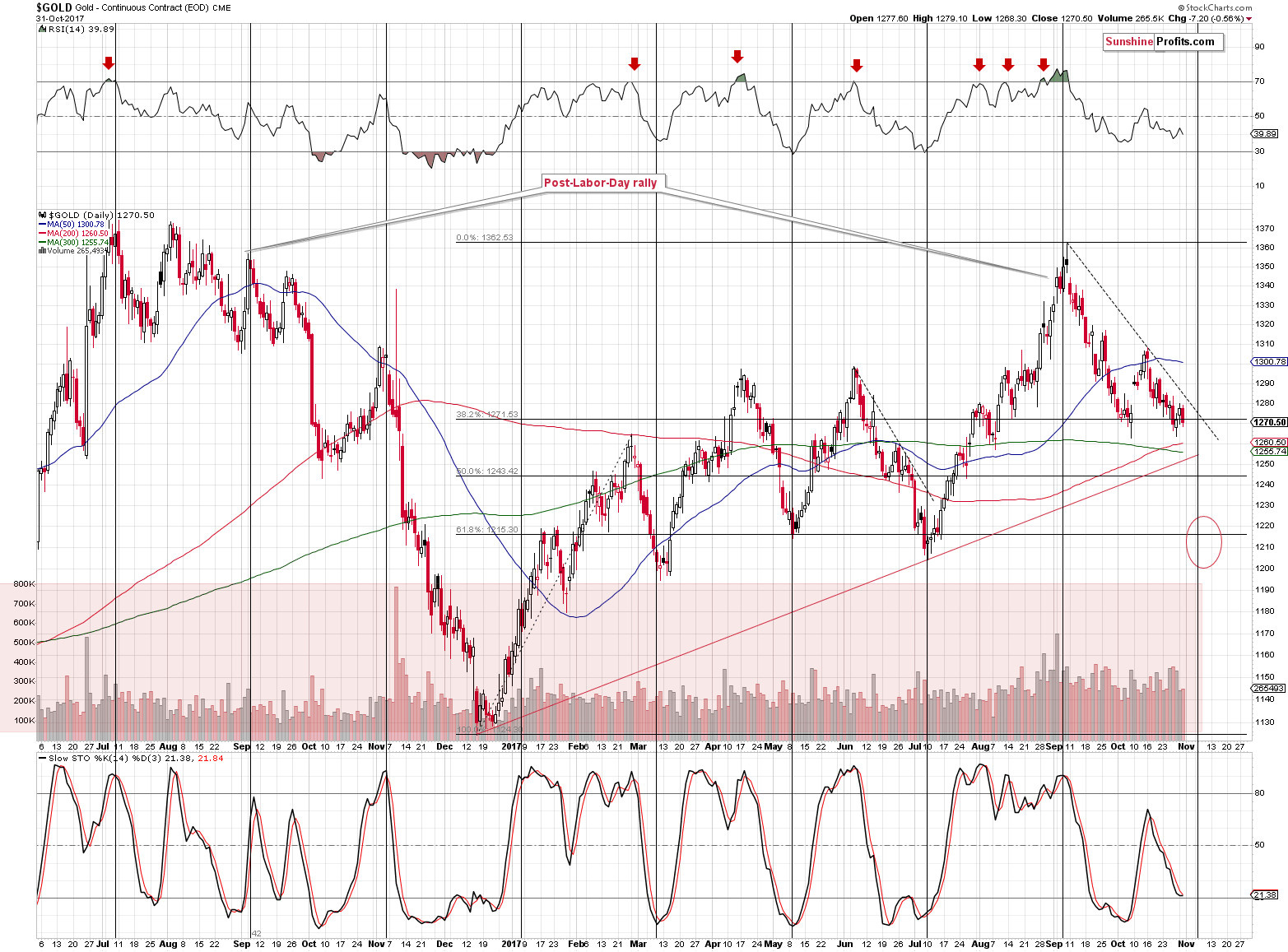

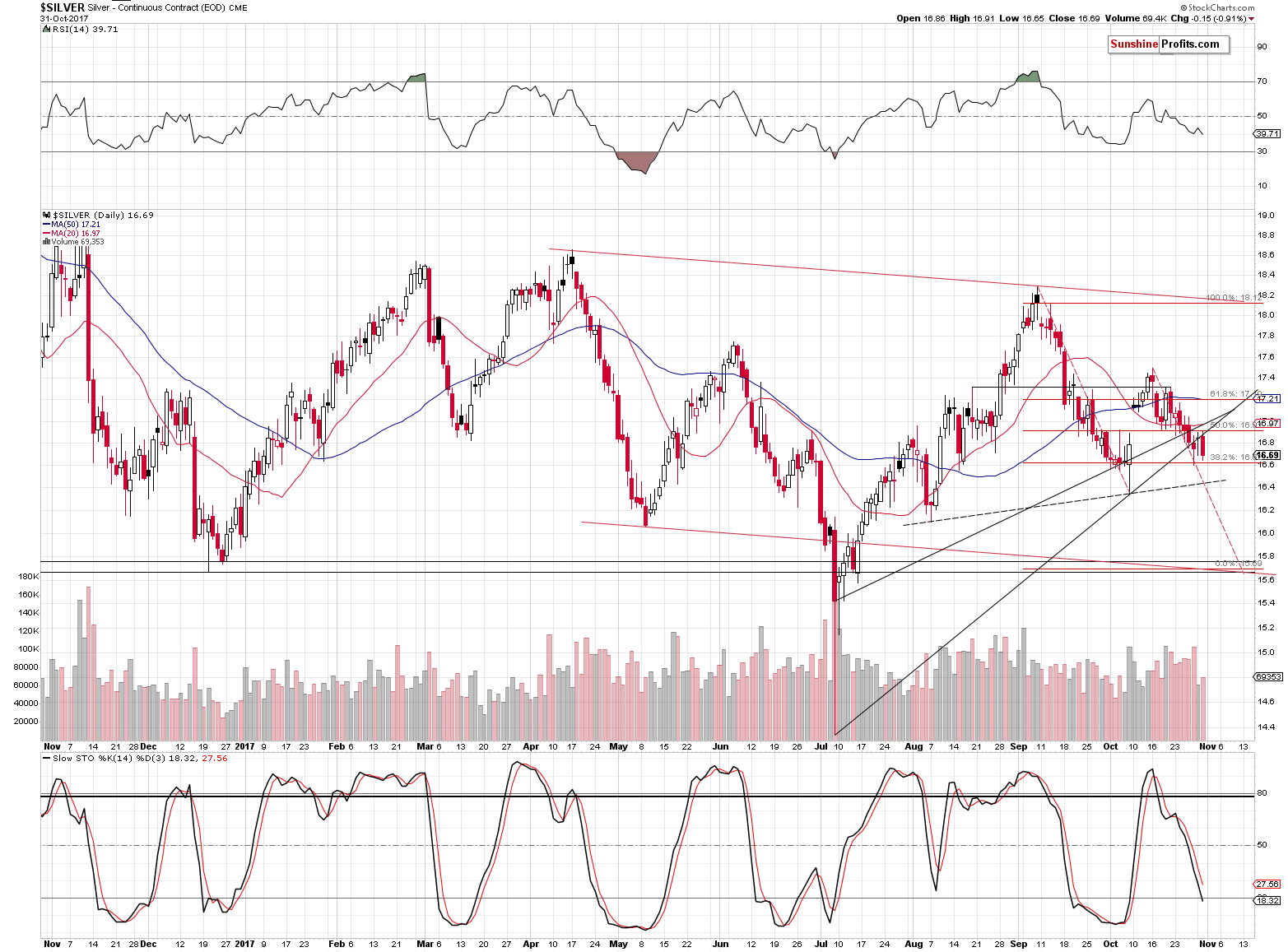

From the short-term point of view, we see that gold, silver and mining stocks moved lower once again but that there was nothing extraordinary about this move. It wasn’t huge or accompanied by huge volume. It was a rather regular the-decline-simply-continues-after-the-pause day. Today’s small pre-market move higher doesn’t seem to change it either. However, what seems normal and perhaps boring from the short-term point of view, isn’t such when we consider the big picture.

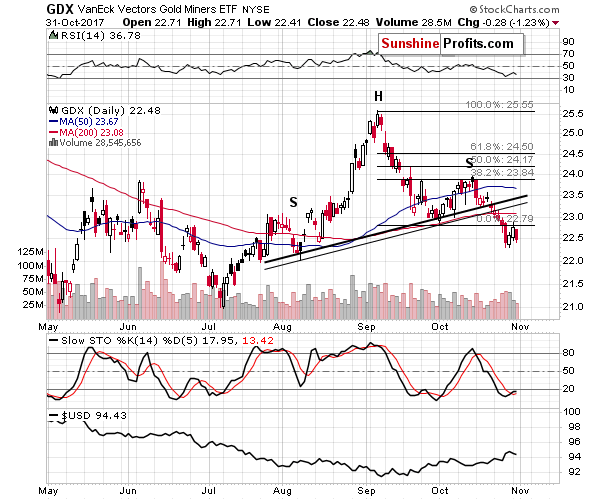

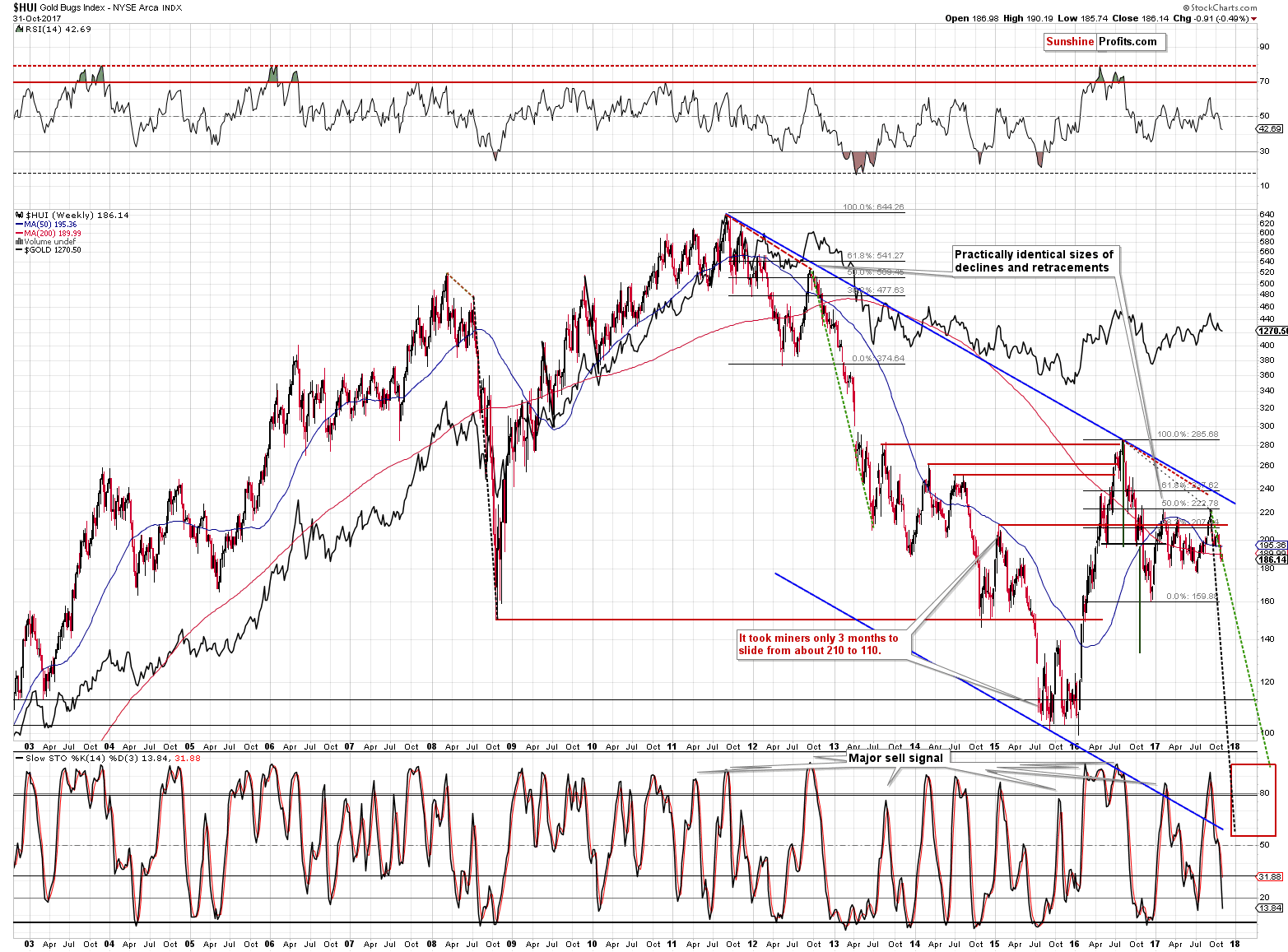

Gold stocks chart shows that the precious metals sector is indeed declining just as it did in 2012, before the decline accelerated. Consequently, while things are bearish but not overly exciting on a short-term basis, they are likely to become much more interesting in the following weeks.

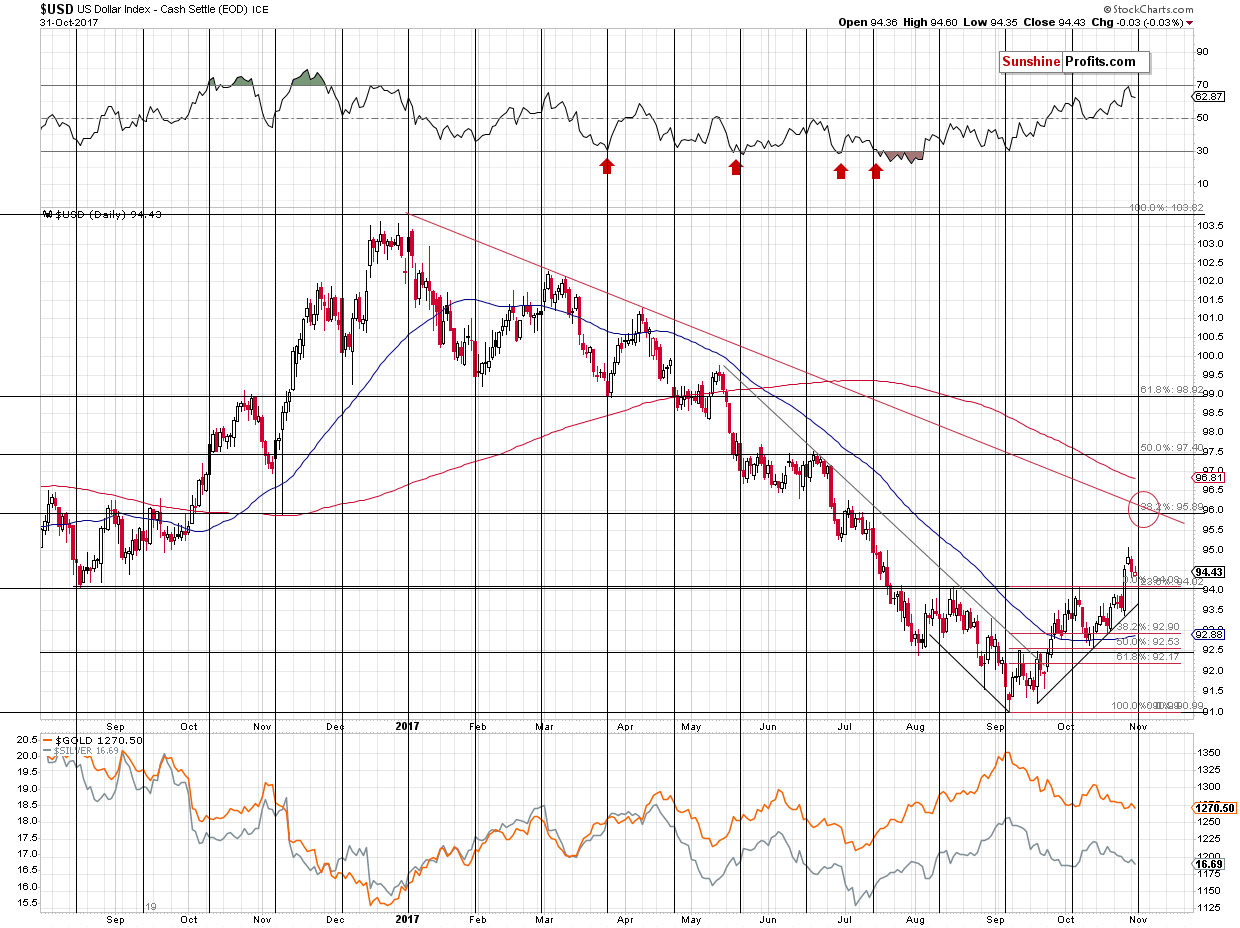

Speaking of interesting developments, yesterday’s decline in the precious metals sector took place without USD’s help, so the decline has more bearish implications than it appears at the first sight.

The USD’s turning point is here, but please note that we are still a few days before gold’s turning point and since the latter appears more accurate, it seems that the turnaround is more likely at the end of this week or at the beginning of the next week than today.

Summing up, the analogy to the 2012-2013 decline remains in place as latest developments continue to support it and the previously discussed long-term signals remain in place: gold’s huge monthly volume, the analogy in the HUI Index, the analogy between the two most recent series of interest rate hikes, and the RSI signal from gold priced in the Japanese yen.

As far as the following weeks are concerned, it seems that we could see another rebound during the decline, but not likely until gold moves to the $1,200 - $1,220 range, which is likely to take place in the first half of November (likely at the end of this week or in the first part of the next week). The analogous range for the USD Index is 95.5 – 96.5 with the 96 level being the most likely target.

We understand that it may not seem believable that gold could decline in the near future or that the decline is going to be really huge, but please keep in mind that this is the generally the case with big moves (and the same was the case with the 2013 slide) – they don’t appear believable until they are over and it’s too late to take action at that time. We will continue to monitor the market and strive to keep you informed and prepared for what’s coming.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit price levels / profit-take orders:

- Gold: exit price: $1,218; stop-loss: $1,366; exit price for the DGLD ETN: $51.98; stop-loss for the DGLD ETN $38.74

- Silver: exit price: $15.82; stop-loss: $19.22; exit price for the DSLV ETN: $28.88; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): exit price: $21.23; stop-loss: $26.34; exit price for the DUST ETF: $29.97; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and exit prices:

- GDXJ ETF: exit price: $30.28; stop-loss: $45.31

- JDST ETF: exit price: $66.27; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the Bank of Japan released its most recent monetary policy statement. What does it say about the BoJ’s stance and what does it imply for the gold market?

BoJ Meeting in October 2017 and Gold

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold edges higher; Fed statement in focus

COMMENT: Someone is counterfeiting the Mint’s gold bars

South Africa's Sibanye confirms over 2,000 layoffs at gold mines

=====

In other news:

Deadly Halloween attack in New York branded 'terrorism' by authorities

Fed Chair Drama Steals Spotlight From FOMC: Decision Day Guide

Stocks in Europe Hit Two-Year High as Metals Surge: Markets Wrap

Wall Street Learns to Dance Bitcoin's Tune

Bitcoin blasts to new all-time high of $6,450

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts