Briefly: in our opinion, small (50% of the regular size of the position) speculative long positions in gold, silver, and mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

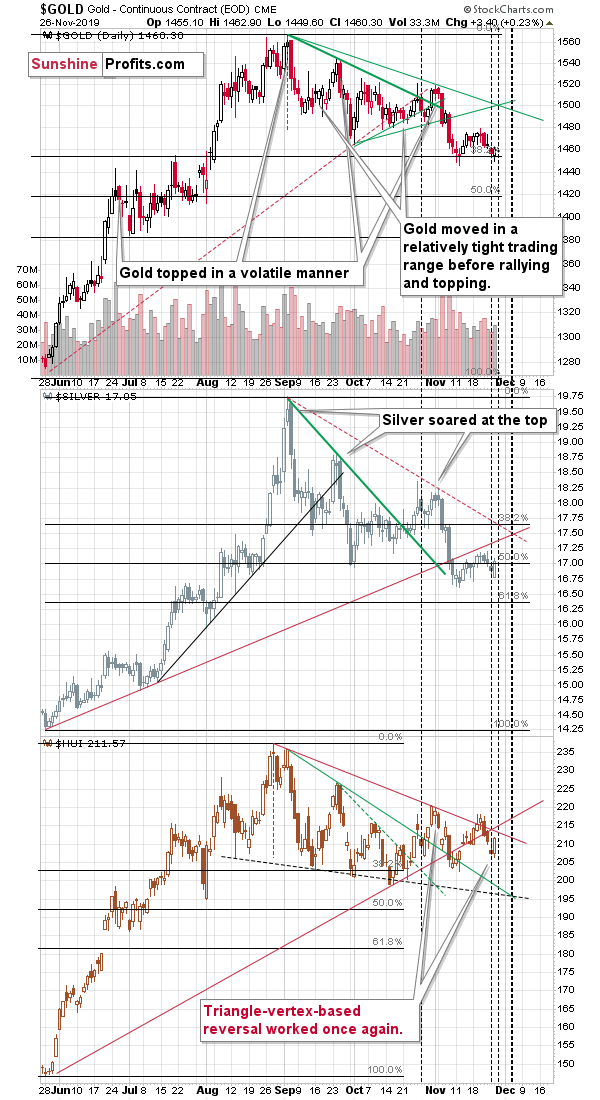

Gold reversed yesterday, and so did the rest of the precious metal sector. Mining stocks and - what's important - silver showed strength relative to gold and rallied even more than gold. Silver's strength is important because it indicates that we are already in the second half of the short-term upswing in the precious metals market. If there only was a tool that would provide us with a more precise time prediction... Oh wait, there is one. And it just worked perfectly yesterday.

Precious Metals' Upcoming Reversal

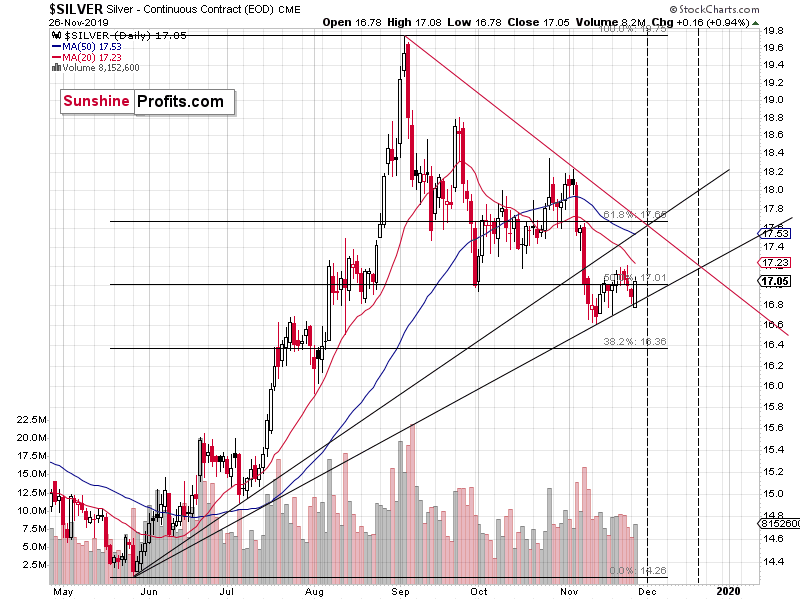

The technique is called the triangle-vertex-based reversal, but let's just call it triangle reversals. When the rising support line crosses the declining resistance line, we have a vertex of a triangle. This vertex marks a moment when we are likely to see some kind of reversal. Sometimes it's relatively clear in advance what sort of reversal we are likely to see, and at times it becomes clear only right before the reversal.

It wasn't 100% clear recently, but after prices declined on Monday, we wrote that the turnaround is very likely. It was confirmed by the pre-market price action as well. However, what happened during the session made it even more obvious that we saw the start of yet another quick upswing. What's not to like about such a bullish set of circumstances?

What we saw yesterday was not the only triangle reversal on the horizon. In fact, there's one today and one early next week. Since this is the Thanksgiving weekend, the odds are that the particularly significant market action will be pushed off until the next week. But, once we're there, things could get very hot very soon.

The True Seasonality of gold confirms the above.

On average, gold price has been spiking around late November and early December. November 26 is marked right on the gold chart. That's the last pause before the final spike high in gold that is then followed by a decline to mid-December. This seasonality perfectly confirms what we can see based on the triangle reversals and what we can infer from silver's relative strength.

Please note that while on average gold performs best in late November, the accuracy reading actually rises strongly in the next several days. This means that while the biggest price moves usually happened sooner, some of them were a bit late. In case of the times when gold soared sooner, it didn't decline immediately. The take-away here is that even if the above forecast for gold is not 100% correct, and price spike doesn't happen right away, it means that it's still likely to arrive shortly.

Based on the triangle reversals, gold's True Seasonality, and other factors, the following week is likely to include an important top in gold, silver, and mining stocks.

Turning to Mining Stocks

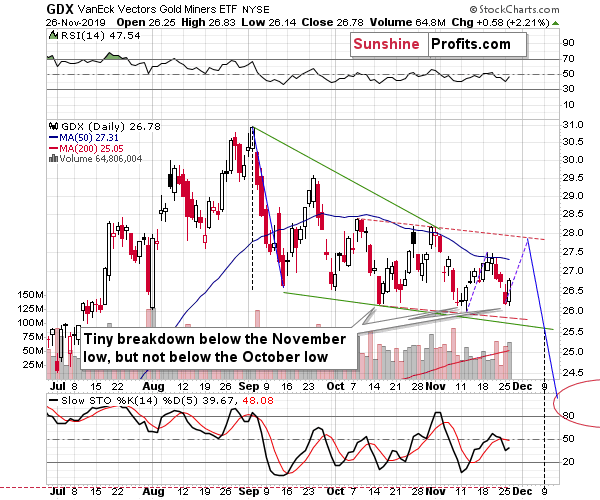

Looking at the GDX ETF, we see that it rallied strongly on volume that was the highest this month. This is a very bullish sign for the following days. It doesn't change anything from the medium-term point of view, though.

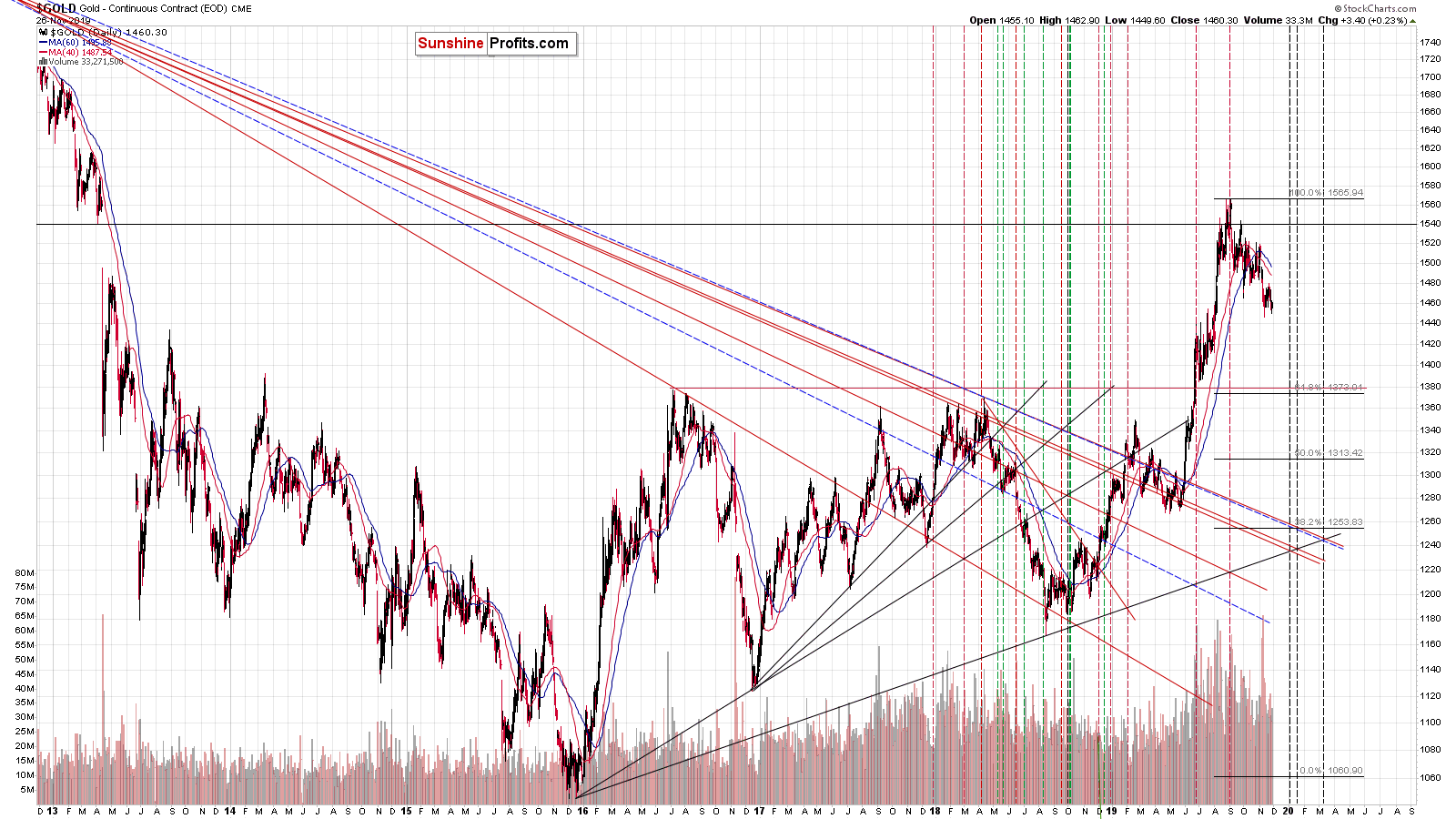

Before summarizing, we would like to discuss one more thing. Since you just saw how well the triangle reversal worked, you might be wondering if there are also some other, more distant reversals that this technique is pointing to. And that is indeed the case. Let's start with gold's long-term chart.

The Overview of Upcoming PMs Reversals

There are three looming long-term triangle reversals. The first one is at the end of this year / beginning of the next year. The second one is slated for mid-January, and the third one comes in early March.

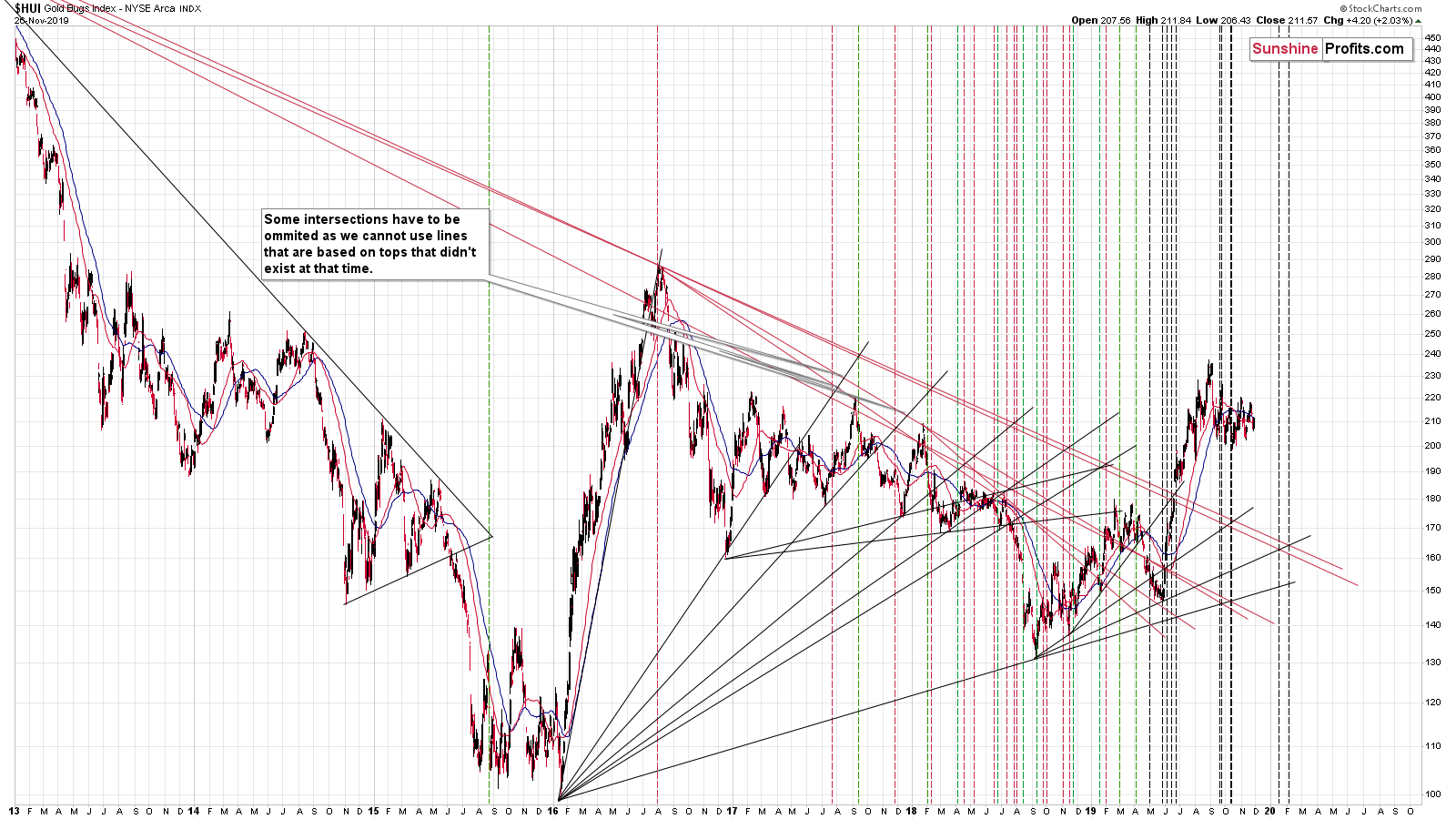

In case of gold stocks, we see some similarities to the above, but also some differences.

There's one triangle reversal "scheduled" for mid-January and there's also one for early February.

In case of silver, there are no looming long-term reversals as silver didn't rally significantly enough in the recent years to create a reliable rising medium-term support line that could be used for this technique. We'll take a more detailed look at the short-term silver chart, though.

You already know the first upcoming triangle reversal from the first chart of today's analysis. The second triangle reversal is "scheduled" for mid-December. This is in perfect tune with what we wrote about gold's True Seasonality. The silver True Seasonality is a bit different, but similar.

Silver's December bottom tends to take place a bit later than the one in the gold market. This means that silver's triangle reversal being slightly after the middle of December is perfectly normal. It also means that gold might bottom sooner also this year (perhaps in mid-December and silver just afterwards).

The implications of the more distant triangle reversals will become clearer as the price moves closer to them. Naturally, we'll keep you - our subscribers - informed.

Key Factors to Keep in Mind

Critical factors:

- The USD Index broke above the very long-term resistance line and verified the breakout above it. Its huge upswing is already underway.

- The USD's long-term upswing is an extremely important and bearish factor for gold. There were only two similar cases in the past few decades, when USD Index was starting profound, long-term bull markets, and they were both accompanied by huge declines in gold and the rest of the precious metals market

- Out of these two similar cases, only one is very similar - the case when gold topped in February 1996. The similarity extends beyond gold's about a yearly delay in reaction to the USD's rally. Also the shape of gold price moves prior to the 1996 high and what we saw in the last couple of years is very similar, which confirm the analysis of the gold-USD link and the above-mentioned implications of USD Index's long-term breakout.

- The similarity between now and 1996 extends to silver and mining stocks - in other words, it goes beyond USD, gold-USD link, and gold itself. The white metal and its miners appear to be in a similar position as well, and the implications are particularly bearish for the miners. After their 1996 top, they erased more than 2/3rds of their prices.

- Many investors got excited by the gold-is-soaring theme in the last few months, but looking beyond the short-term moves, reveals that most of the precious metals sector didn't show substantial strength that would be really visible from the long-term perspective. Gold doesn't appear to be starting a new bull market here, but rather to be an exception from the rule.

- Gold stocks appear to be repeating their performance from 20 years ago, which means that a bottom in the entire precious metals sector is quite likely to form at much lower prices, in about a year

Very important, but not as critical factors:

- Long-term technical signs for silver, i.a. the analogy in terms of price to what we saw in 2008, shows that silver could slide even below $10.

- Silver's very long-term cycles point to a major reversal taking place right now and since the most recent move was up, the implications are bearish (this is also silver's technical sign, but it's so important that it deserves its own point)

- Long-term technical signs for gold stocks point to this not being a new gold bull market beginning. Among others, it's their long-term underperformance relative to gold that hint this is rather a corrective upswing within a bear market that is not over yet.

- Record-breaking weekly volume in gold is a strong sign pointing to lower gold prices

Important factors:

- Extreme volume reading in the SIL ETF (proxy for silver stocks) is an effective indication that lower values of silver miners are to be expected

- Silver's short-term outperformance of gold, and gold stocks' short-term underperformance of gold both confirm that the precious metals sector is topping here

- Gold topped almost right at its cyclical turning point, which makes the trend reversal more likely

- Copper broke below its head-and-shoulders pattern and confirmed the breakdown. The last time we saw something similar was in April 2013, when the entire precious metals sector was on the verge of plunging lower.

Moreover, please note that while there may be a recession threat, it doesn't mean that gold has to rally immediately. Both: recession and gold's multi-year rally could be many months away - comparing what happened to bond yields in the 90s confirms that.

Summary

Summing up, the outlook for the precious metals sector remains very bearish for the following months (also because of the record open interest in gold), but it seems that we will first see a short-term upswing before the decline continues. Based on what we saw in the last few days, the bullish outlook remains justified. It seems that the profits on our long positions will become bigger before we close it. We expect to close the long position this or (likely early) next week. Then, we plan to open a short position shortly thereafter.

On an administrative note, the US markets are closed tomorrow and the due to the long Thanksgiving weekend, the trading is likely to be limited on Friday as well. Consequently, there will be no regular Alerts on Thursday and Friday. We will post the next regular Alert on Monday. Still, since the top and change in positions is likely just around the corner, we will be keeping our eyes on the market anyway, and if something major happens, we will send you a quick intraday message.

Also, please keep in mind that the exit profit-take levels for gold, silver, and GDX that we feature below are binding, which means that if they are hit, the position should be closed without additional confirmation from us. Before we manage to write, test, and send you a message, and you are able to receive it, the prices might no longer be as favorable.

We will send a confirmation anyway, but having the orders ready will help execute the trade and secure profits at the right prices.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Small speculative long position (50% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Gold: profit-take exit price: $1,489.80; stop-loss: $1,437; initial target price for the UGLD ETN: $135.88; stop-loss for the UGLD ETN: $122.10

- Silver: profit-take exit price: $17.47; stop-loss: $16.27; initial target price for the USLV ETN: $89.33; stop-loss for the USLV ETN: $72.44

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $27.88; stop-loss: $25.47; initial target price for the NUGT ETF: $30.27; stop-loss for the NUGT ETF $23.08

In case one wants to bet on junior mining stocks' prices, here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $39.27; stop-loss: $35.38

- JNUG ETF: profit-take exit price: $67.97; stop-loss: $49.83

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager