Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Here we go again! Another rumor about a dovish Fed. Another fake rally based on it. And yet, the key factors that are contributing to the real trends remain the same.

Let’s start with a look at the situation from a fundamental point of view.

Pivot Drama

With risk assets staging a material rally on Oct. 21, gold, silver, mining stocks and the S&P 500 were back in the bullish limelight; and with the USD Index and the U.S. 10-Year real yield heading in the opposite direction, the optimism fueled the bear market laggards and upended the outperformers.

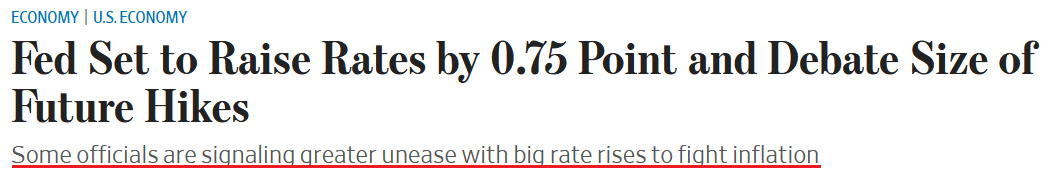

To explain, the drama began when the Wall Street Journal’s (WSJ) Nick Timiraos, who serves as the Fed’s unofficial mouthpiece, tweeted that the central bank could slow the pace of its rate hikes in the months ahead.

Furthermore, since Timiraos is considered an informed source regarding Fed policy, his assertion that officials are getting “aligned on [the] next steps” was perceived as bullish.

Please see below:

Likewise, his WSJ article portrayed an environment where Fed officials are more open to smaller rate hikes during the fall and winter months.

Please see below:

As such, with his words breathing new life into the dovish pivot predictors, they were eager to front-run the action. Conversely, the USD Index suffered because a cautious Fed means fewer rate hikes and less fundamental support for the greenback.

Please see below:

Source: Bloomberg/ZeroHedge

To explain, the red line above tracks the peak U.S. federal funds rate (FFR) implied by the futures market, while the green line above tracks the inverted (down means up) rate cuts projected thereafter.

If you analyze the right side of the chart, you can see that the red line declined sharply on Oct. 21, as Timiraos’ rhetoric had investors pricing in a more dovish Fed. Also, rate cut expectations declined slightly, as a lower terminal rate was perceived as implementing a hike-and-hold strategy.

However, the important point is that peak FFR expectations decreased from north of 5% to under 4.9%; and since the FFR, real yields, and the USD Index often move in the same direction, investors' misguided optimism hurt the dollar basket.

In addition, the performance of the U.S. 2-Year Treasury yield – which is often a leading indicator of the FFR – highlights how Timiraos moved the market on Oct. 21.

Please see below:

To explain, the candlestick chart above tracks the five-minute movement of the U.S. 2-Year Treasury yield. If you analyze the vertical gray line, you can see that sentiment materially shifted after 8:30 a.m. ET. To that point, Timiraos sent out his tweet at 8:54 a.m. ET, and it’s no coincidence that the U.S. 2-Year Treasury yield slumped soon after.

As a result, Lawrence McDonald of The Bear Traps Report summed it up perfectly:

Now, is the pivot drama material, or is it just another example of daily noise?

Well, the critical point is that hope doesn't create reality. Remember, investors are forward-looking, and they aim to price in future events today. Moreover, their returns are driven by the accuracy of these predictions.

However, investors have been reaching for a dovish pivot throughout 2022, and their many failures have culminated in higher highs for the USD Index and the U.S. 10-Year real yield. Likewise, they have also resulted in new lows for the GDXJ ETF.

Therefore, the moves on Oct. 21 were another example of sentiment overpowering fundamentals. For example, the crowd took solace in the idea of the Fed reducing its rate hike pace to 50 basis points in December.

Yet, the FFR is already at 3.25%, and a 75 basis point rate hike is likely a done deal on Nov. 3; and if the Fed hikes rates by 50 basis points in December, the FFR will end 2022 at 4.5%.

So while the consensus assumes that a step down is bullish, who believed the Fed would hike by 75 basis points in perpetuity? In contrast, Fed policy has unfolded as I expected. To explain, I wrote on Aug. 12:

The FFR has either eclipsed the year-over-year (YoY) headline CPI or come within ~50 basis points of its peak in every inflation fight since 1954. Therefore, please see the unprecedented gap on the right side of the chart. With the YoY headline CPI peaking (for now) at 9.1% and the FFR at 2.5% (the high end of the Fed's 2.25% to 2.5% range), the difference is 6.6%.

As a result, history implies the FFR needs to hit at least 8.6% (which marks ~50 basis points below the current CPI peak). Moreover, while we don't expect the FFR to hit this level, the purpose is to show just how laughable a 3% FFR and 9%+ inflation is from a historical perspective. In reality, a 4.5%+ FFR is much more realistic, and the prospect is far from priced in.

In addition, notice how every inflation spike leads to a higher FFR and then a recession (the gray bars)? As such, do you really think this time is different?

Thus, while our 4.5% FFR projection was in the major minority in August, it’s now the consensus; and with our upper estimate of 5.5% in 2023 still plausible, the pace of the Fed’s FFR increases implies nothing about its peak.

Furthermore, while investors hope that the worst is in the rearview, history shows that every inflation fight since 1954 has ended with a recession, so a higher FFR is only one part of a two-part story.

All in all, while the PMs rallied and the USD Index and the U.S. 10-Year real yield fell, the fundamentals didn’t change: the Fed has plenty of work to do to suppress inflation, and the liquidity drain is bearish for risk assets.

Consumers and Inflation

While the consensus assumed that inflation would abate when supply chains normalized, I warned throughout 2021 and 2022 that demand was much stronger than the crowd realized; and with resilient consumer spending poised to keep inflation uplifted, Americans’ ability and willingness to spend are bullish for the FFR, real yields, and the USD Index.

For example, American Express – one of the largest credit card companies in the U.S. – released its third-quarter earnings on Oct. 21. CEO Steve Squeri said during the Q3 earnings call:

“Card member spending remained at near-record levels in the quarter. Billed business was up 24% on an FX-adjusted basis over the record growth we delivered a year earlier, led by the continued strength in goods and services spending and the ongoing strong rebound in travel and entertainment.

“As we said earlier this year, we expected the recovery in travel spending to be a tailwind for us. But the strength of the rebound has exceeded our expectations throughout the year. In the quarter, total T&E spending was up 57% from a year earlier on an FX-adjusted basis, driven by the continued strong demand from consumers and small business customers.

“Particularly noteworthy is the strength we're seeing in T&E spending in our international markets, which exceeded pre-pandemic levels for the first time this quarter on FX-adjusted basis.”

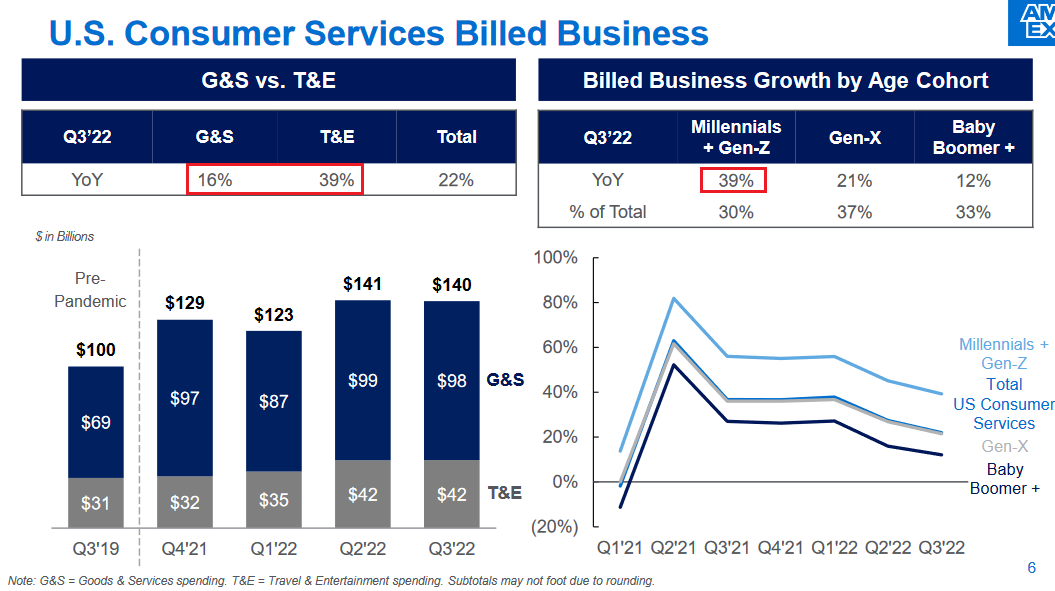

Please see below:

To explain, the visual above is from American Express' Q3 earnings presentation. If you analyze the red rectangle on the left, you can see that consumers' G&E (goods & services) and T&E (travel & entertainment) spending increased by 16% and 39% YoY in Q3, while the red rectangle on the right shows that combined Millennial and Gen-Z spending was up by 39% YoY.

Thus, investors underestimated (and still do) the resiliency of demand-driven inflation. Also, with Bank of America noting how consumers' deposit balances are multiples above their pre-pandemic levels, I've warned repeatedly that the Fed's inflation fight will be one of attrition. I wrote on Oct. 18:

The visual above is from Bank of America’s earnings presentation. If you analyze the blue bars at the top left, you can see that YTD consumer spending is up by 12%. Moreover, while the figure is less than the 21% realized in 2021, it’s still materially above the 1% and 6% recorded in 2020 and 2019. So despite the Fed’s 12 25 basis point rate hikes in 2022, Americans are spending more than they did pre-pandemic.

In addition, the dark blue, gold and light blue lines on the chart at the bottom right are also critical. Supporting the data I presented in December 2021, the dark blue line highlights how Americans that had less than $2,000 in their bank accounts pre-pandemic have 5x that amount now. Likewise, those that had $2,000 to $10,000 have 3x, while those that had $10,000 to $20,000 have 2x. Thus, U.S. consumers are in a healthy position.

As further evidence, Target CEO Brian Cornell – who heads the seventh largest retailer in the U.S. – said on Oct. 17 that “healthy” consumer spending remains evident.

Please see below:

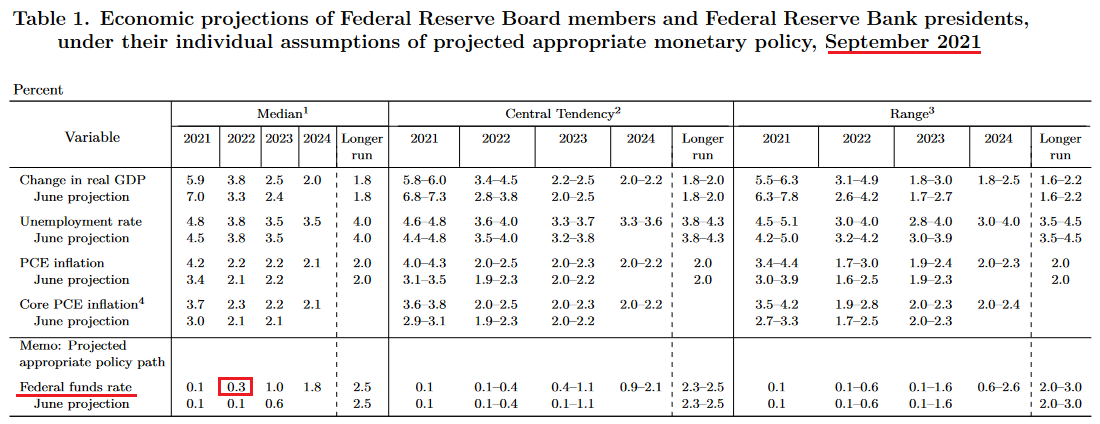

So while investors assume that a 50 basis point rate hike in December is bullish, it’s not. Moreover, they’re focused on the Fed’s rhetoric, not the data. Remember, Fed officials’ median 2022 FFR estimate in their September 2021 Summary of Economic Projections (SEP) was 0.3% (roughly one rate hike), yet here we are on track for 4.5%. As a result, American consumers are a better indicator of inflation, and their spending prowess supports tighter monetary policy.

The Bottom Line

The pivot drama on Oct. 21 was no different than the previous iterations throughout 2022. In a nutshell: something creates hope for a dovish shift, and investors run with the narrative. However, when the fundamentals signal the opposite, and it becomes evident later on, the optimism evaporates. Therefore, this time should be no different.

In conclusion, the PMs rallied on Oct. 21, as risk-on sentiment dominated; and with the USD Index and the U.S. 10-Year real yield declining, the PMs' optimism was rational. However, since the price action was built on a false narrative, a reversal of fortunes should occur over the medium term. Quite likely over the short term as well. As such, I continue to expect gold, silver, mining stocks, and the S&P 500 to hit lower lows in the months ahead. And it seems we won’t have to wait too long for those declines.

In fact, gold is already down $11 in today’s overnight trading (at the moment of writing these words). Let’s take a closer look.

Technically Speaking

Gold bounced from the previous low, and part of this daily rally was already erased.

Is there anything special about a rebound from the previous lows? No. That’s a normal thing for any market to do. When it encounters support, a rebound is quite possible and normal. Unless you’re a daytrader, it’s not really important if that rebound happens or not, as long as the previous trend remains intact.

A rebound, two rebounds, or even a few rebounds are relatively unimportant as long as the trend remains in place, because the support is still likely to be broken eventually. That’s what the “trend remains intact” part implies.

Did anything change fundamentally based on Friday’s events?

No.

Did anything change technically based on Friday’s events?

No.

Gold didn’t even rally above its declining resistance line, breaking above which triggered reversals in August and October.

We see more of the same on the USD Index chart.

Namely, nothing really changed. The USD Index continues to trade sideways, just like what we saw in mid-September.

Back then, a similar pattern preceded a sharp upswing, and it seems quite likely that we’ll see something similar again in the near future. How “near” is this future likely to be? It’s impossible to tell with certainty, but I would say that days are more likely than weeks in the case of this question.

The GDXJ ETF moved higher on Friday, but – just like in the case of gold – it didn’t change the downtrend, and it didn’t cause our profitable short position to become unprofitable. As a reminder, we opened it (right after taking profits from the long position) on August 3, when the GDXJ was well above $30.

The downtrend has continued since that time, but in a rather back-and-forth manner. The markets are still susceptible to dovish rumors, but at some point, the “hope” for a dovish U-turn is likely to turn into despair as people realize that higher rates and hawkish operations overall are the “new normal”.

This will remain the case as long as inflation is the main concern of the voters. That’s unlikely to change anytime soon.

Therefore, the support levels in gold and mining stocks are likely to be broken, and they are likely to fall. That’s simply how those markets react to higher real interest rates.

Given the technical position in which the precious metals market is, and the 2013 analogy that remains fully intact, it seems that we won’t have to wait for the breakdown much longer.

Any potential (!) rally in the main stock indices is unlikely to have a lasting impact on the precious metals sector – if it happens at all.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over, and that the next big move lower is already underway.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500-$1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems that the biggest part of the 2013-like decline is taking place right now, and – while I can’t make any promises regarding performance - it seems likely to me that our big profits are about to become huge, and then ridiculously big in the relatively near future.

As far as this quick corrective upswing is concerned, it seems that it might already be over.

The current quick upswing most likely doesn’t change anything. Fundamentals and technicals continue to point to lower precious metals values in the coming weeks / months. The current geopolitical news-based rally is likely to serve as nothing more than just a verification of the breakdown below the previous lows in gold.

Things might happen very fast in the coming days, and if I plan to make any adjustments, I’ll keep you informed. Still, if the targets that I’m mentioning in the “Trading” part of the summary are reached, I think that profits should be taken off the table without an additional confirmation from me. I will probably get on the long side of the market at that time, but I’ll send a confirmation if I decide to do so.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $27.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $74.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $18.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $46.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief