Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

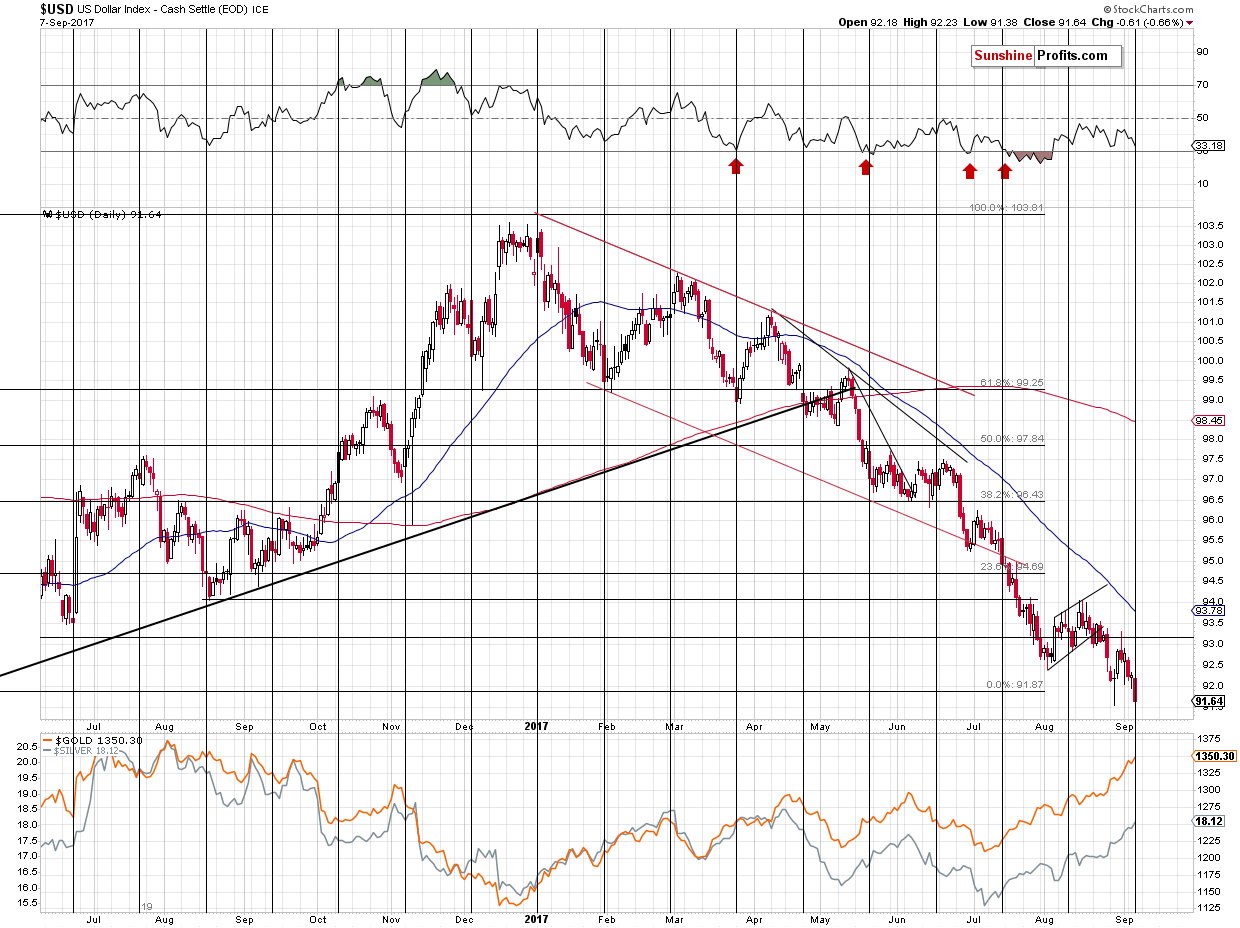

The USD Index once again moved lower yesterday and it declined below several important extremes. Gold moved a bit above the previous highs and the same goes for silver and mining stocks. What changes do these breakdowns and breakouts imply?

For now, they imply little. If the USD Index closes this week below the previous extremes, it will still be the first weekly close with such a breakdown – not a confirmation thereof. Let’s take a look at the chart for details (chart courtesy of http://stockcharts.com).

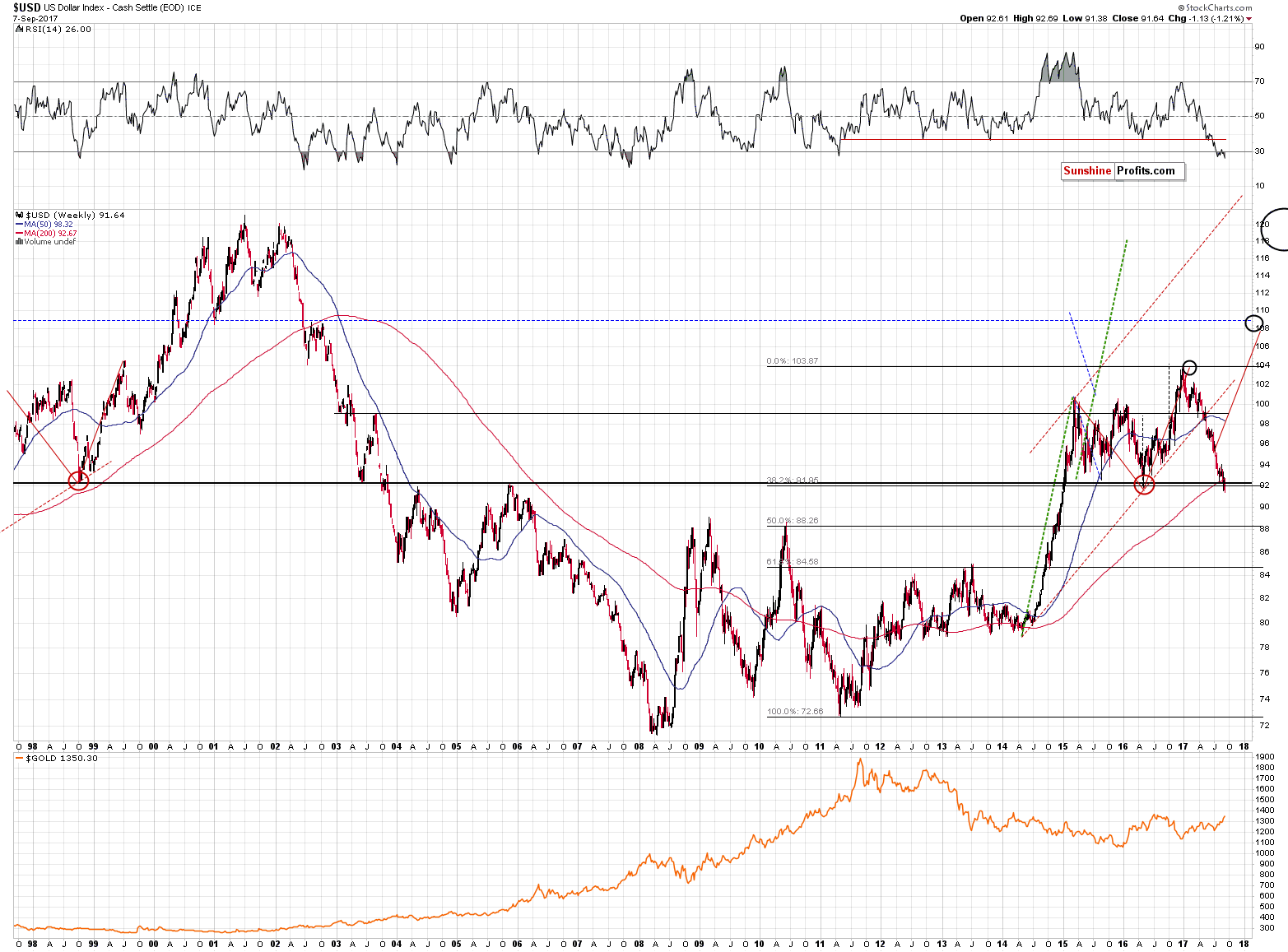

The USD Index moved below the 1998 weekly low, the 2003 weekly low, the 2004 weekly high, the 2005 weekly high and both: 2014 and 2015 weekly lows, which is bearish. However, the breakdown was not confirmed even by this week’s closing price and in case of a breakdown of this importance, it seems that at least another weekly close below them (or a move visibly below them) would be required to confirm the breakdown. This seems doubtful given that yesterday was the daily turning point for the USD Index and the weekly RSI indicator has been suggesting extremely oversold conditions for several days.

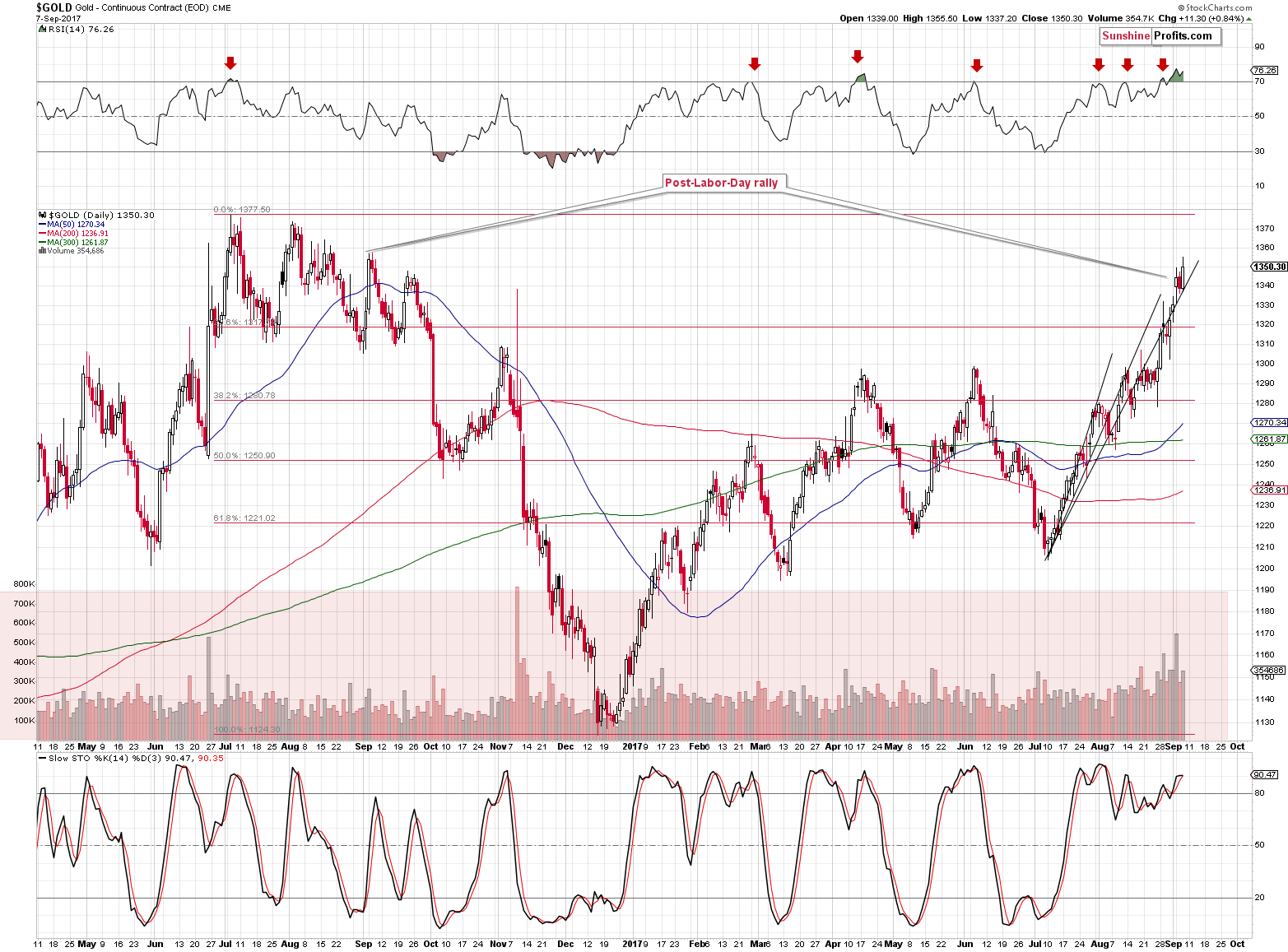

Can gold’s move above Tuesday’s high be trusted? The breakout was not significant (in both: closing price terms and intraday highs) and not accompanied by huge volume. It seems that gold rallied only because it virtually had to given the decline in the USD. Without such action, gold would become much cheaper in terms of other currencies. In other words, gold didn’t rally yesterday in terms of most important currencies, almost only in case of the USD. Consequently, it doesn’t seem that the very bearish post-Labor-Day implications were invalidated.

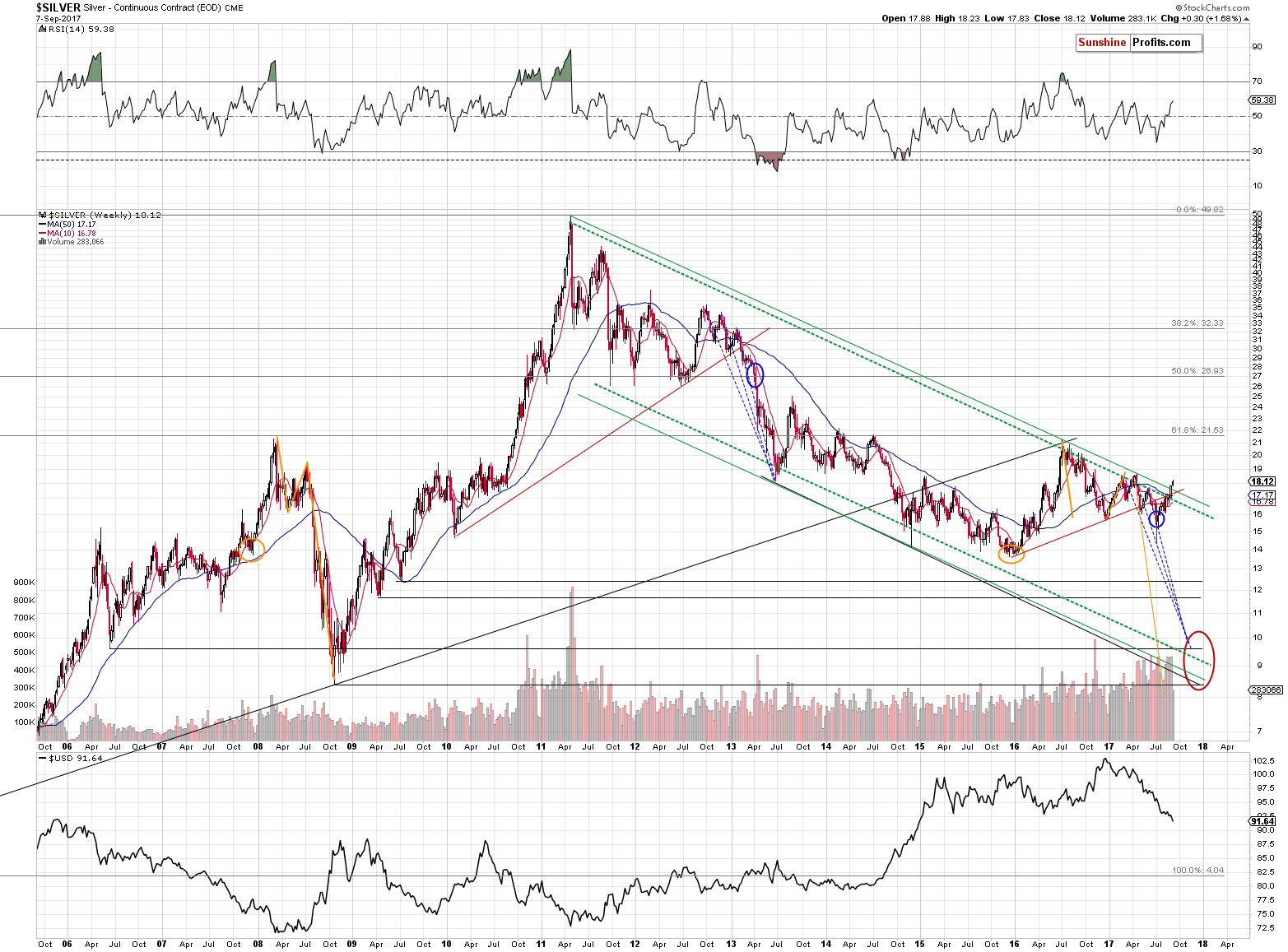

Silver’s breakout is still relatively small compared to the size of the declining line that it broke above and given silver’s frequency of breaking out just to decline even more, it doesn’t serve as a real bullish indication.

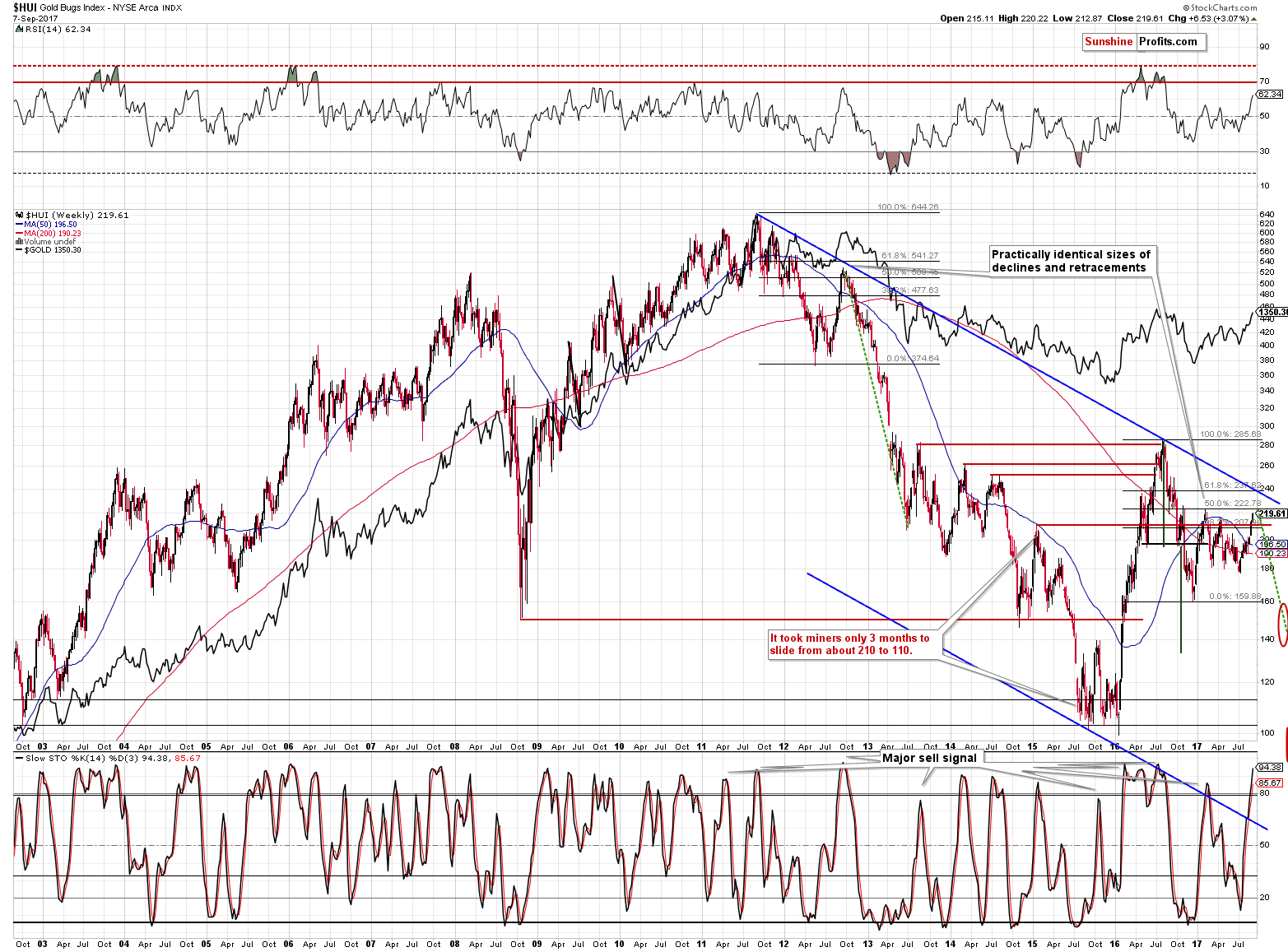

The above is especially the case that the long-term declining resistance line in case of the gold stocks is far from being reached. Conversely, the HUI Index is testing the previous 2017 high and the 50% Fibonacci retracement level based on the late 2016 decline. The same retracement stopped the counter-trend rally in 2012 and the same could be the case this time. On a side note, the 2012 correction was much bigger than the rally that started in July and yet – it was nothing more than just the final pause before the real slide started. When it starts, it could be very volatile. Please note that in 2015 it took only about 3 months for the HUI Index to slide from about 210 to 110.

There are more and more evidence that the interest for buying gold is spiking – just as one would expect it to at an important top. We have more reports of people that are generally not interested in the capital markets start to get really interested in gold. Additionally, the inflows to the gold ETFs are surging, which confirms that recent spike in volume. In the early stages of a huge rally – the one that will follow the final bottom – gold is mostly ignored and now many people are acting like $1,300 was the new $1,900.

Even if (again, this is not likely) gold is starting a big rally here, it’s still likely to decline in the short term as no market can move up or down without periodic corrections. The USD and gold markets are not exempt from this rule. Based on the way they perform after their turnaround, we’ll likely see what kind of big move is likely next. For now, it continues to be much more likely that the next big (!) move will be to the downside, not to the upside.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,366; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $38.74

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Wednesday, the Bank of Canada raised its interest rates for the second time in 2017. What does it imply for the gold market?

BoC Second Hike in 2017 and Gold

Since July 11, gold has been in a short-term upward trend, jumping above $1,300 at the end of August. We invite you to read our today’s article about the recent fundamental developments in the gold market and find out whether gold is likely to break out of sideway trading based on the fundamental factors.

Will Gold Break Out of Sideway Trading?

=====

Hand-picked precious-metals-related links:

Gold Rises As Hurricane Pushes U.S. Jobless Claims Up 62,000 To 298,000

BRIEF-CME raises September margins for gold futures

Watch Gold to Figure Out Where Yen Is Going, Says UniCredit

Gold Just Got Cheaper - New ETF Hits The Block As Demand Soars

Australia state raises gold royalty, other mining fees to repair budget

=====

In other news:

Dollar Tumbles as Yen, Euro Rally on Irma, ECB: Markets Wrap

ECB to Study QE Options That Don't Need Tweak to Rules

Why Europe's Central Bank Shouldn't Worry About the Euro

In World of Supposed Bubbles Here's What Fund Managers Fear Most

Giant Equifax data breach: 143 million people could be affected

LME to slash some fees to win back volumes as rivals circle

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts