Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

Gold rallied and it rallied significantly. Most of the move took place overnight, when the Asian markets reacted to the latest monetary news. The Fed delivered a dovish surprise and a decisive end to its rate hike series. They now openly discuss the possibility of rate cuts and how fast they can execute them. Even though the Fed left the rates intact, the markets - being forward-looking - acted as if the rates were already lowered. What does it mean going forward?

This means that we are already in a situation where surprisingly huge amount of positive factors for gold have already happened. Gold reacted even on what didn't happen yet. And if all the bullish surprises are behind us, then what can the market do now? It can fall. Let's see if the technical picture supports this.

Positive Surprises Force Gold Higher

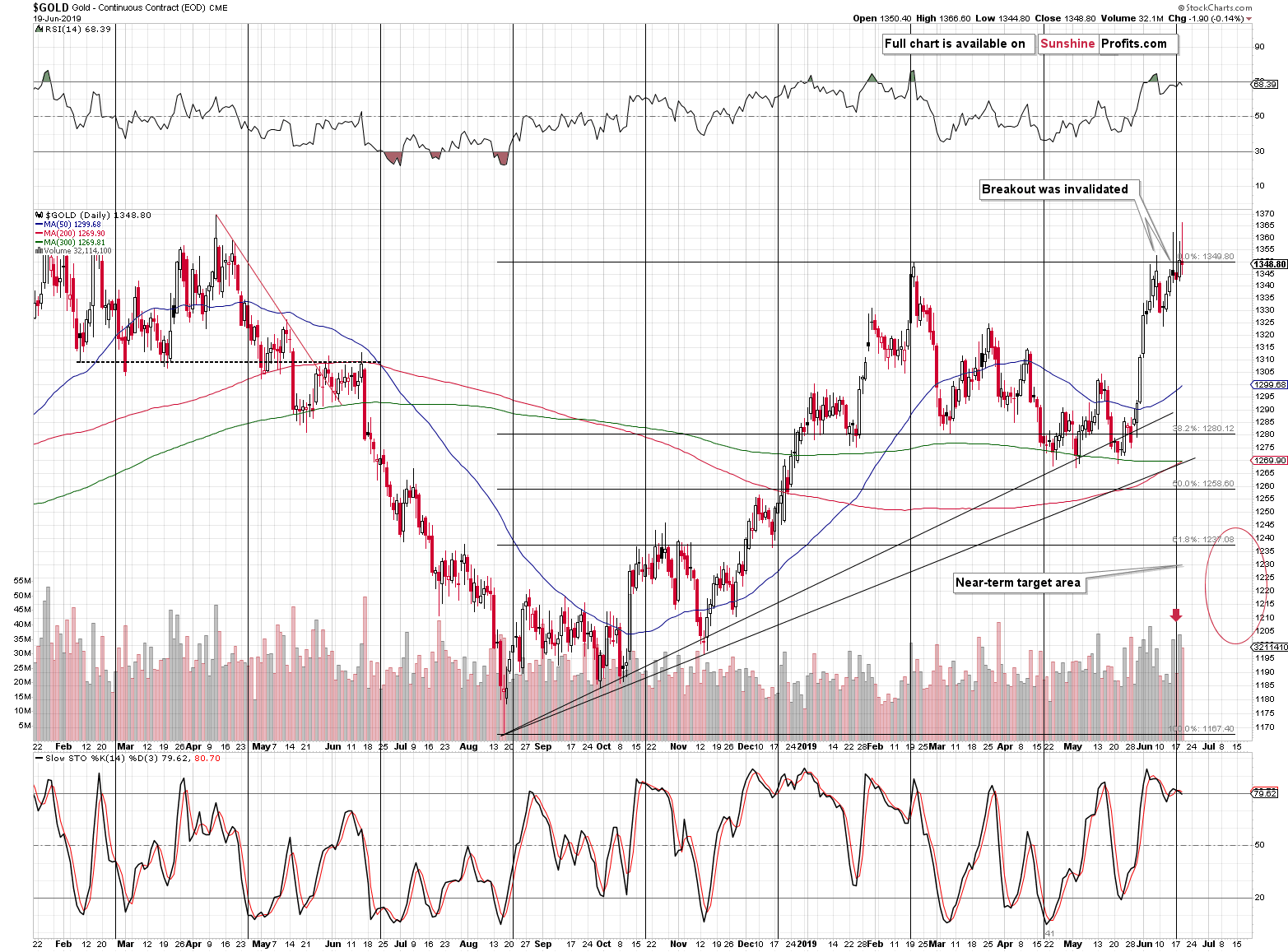

The above chart shows that gold closed yesterday's session more or less unchanged, but we saw a bigger move overnight. Based on finance.yahoo.com prices, the gold continuous futures contract spiked as high as $1,397.70 only to fall to $1,382 shortly thereafter. This means that - even though it's not yet visible on the above chart - gold moved a few dollars above the 2014 high and then invalidated the move. Given the immediate-term behavior and trend, the very recent upswing could be invalidated even before the end of the day.

Let's keep in mind that in the previous days, we already saw several daily reversals, which shows that gold is actually in the topping process. The increased intraday volatility and the reversal-shaped daily candlesticks show that the market is forced to react to unexpected news, but that it really doesn't want to go higher.

It's all taking place around the cyclical turning point, which further confirms the reversal nature of all these moves and makes the outlook bearish, even though we saw higher gold prices in the last 24 hours.

Of course, it's possible that the gold market will show substantial strength and soar, breaking above all nearby resistance levels and confirming the breakout. In this case, a much bigger - multi-month rally - will become likely. It would take a confirmed breakout above the highest of the previous tops (the late-2013 high) to do that. And gold is still far from it.

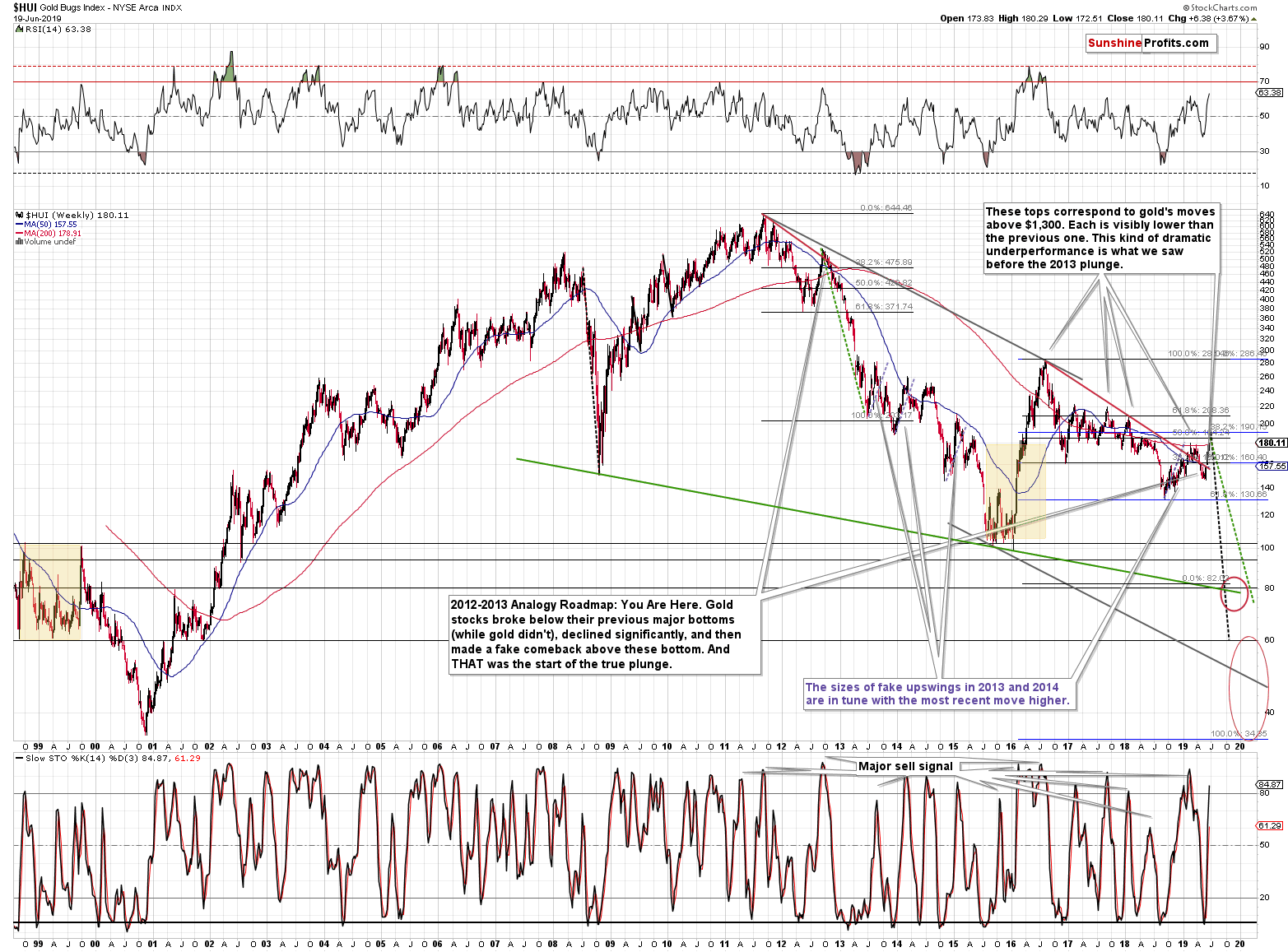

You know what else would indicate a major change in the medium-term outlook? Massive, medium-term strength in the gold stocks. Do we see it?

Gold Stocks and Gold-to-Silver Ratio Aren't Confirming

Absolutely not. The gold miners are barely at the levels they reached when gold had been trading tens of dollars lower. Since 2016, gold made several attempts to break above $1,300 and hold this level and each attempt to move to similar levels in gold was accompanied by lower highs in the HUI Index.

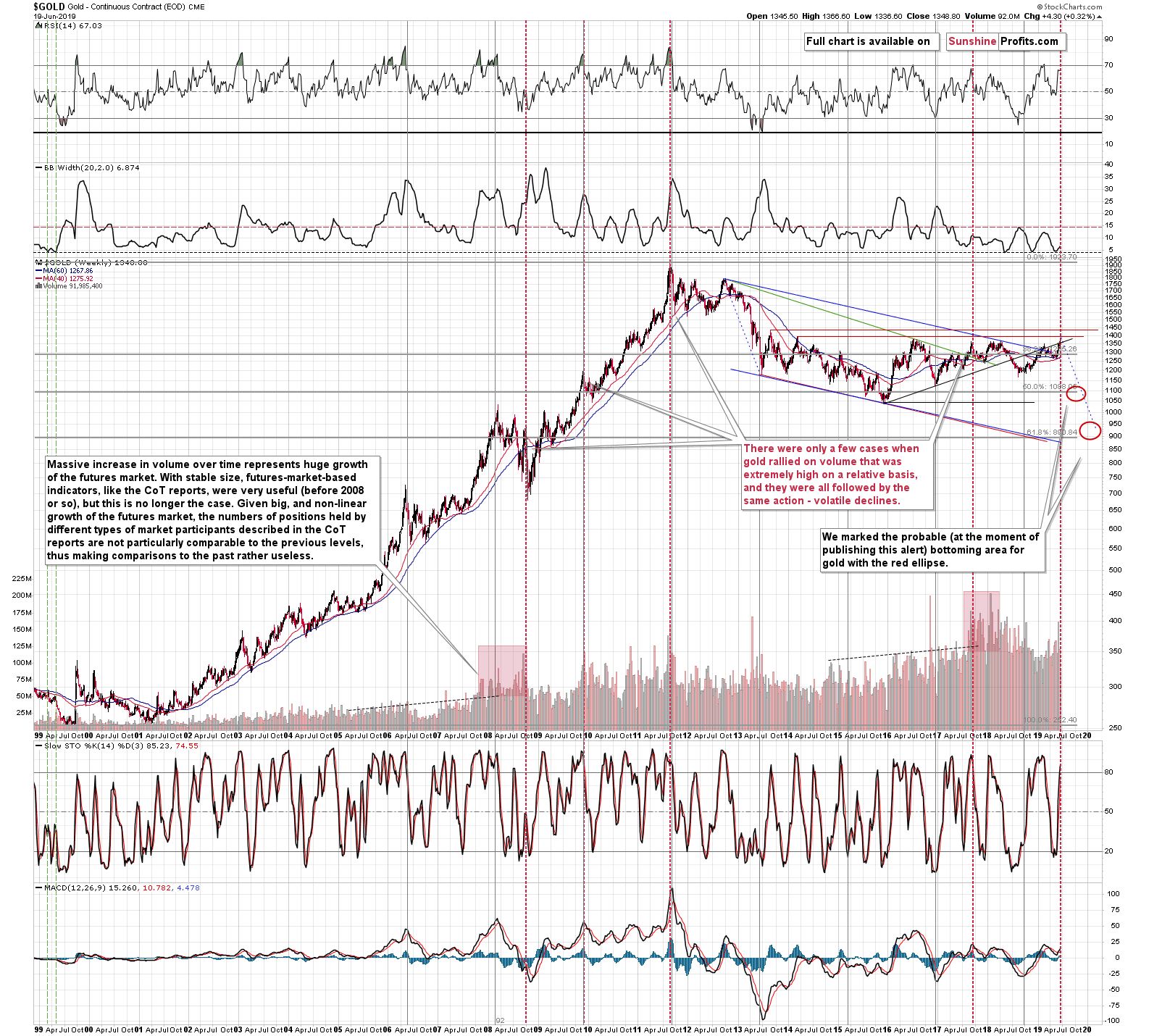

Finally, please note that the entire 2018-2019 upswing is practically as big as all the corrections during the 2011 - 2016 slide. This all points to the conclusion that the current upswing - even though it appears encouraging - is yet another counter-trend rally within a bigger downtrend. It's not obvious when looking at the gold chart, but it's quite clear when looking at gold stocks' big picture.

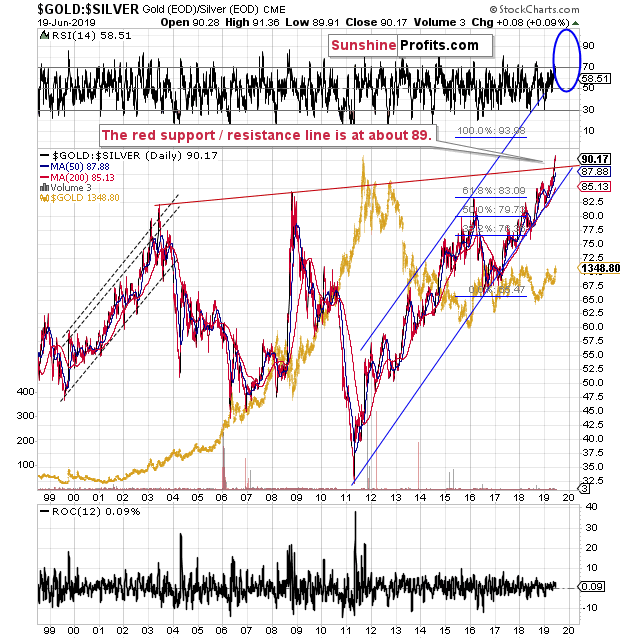

And the gold to silver ratio? Why isn't it declining sharply, just like it did in 2011, and soars instead, more or less as it did in 2008?

Because the big trend still remains down and the current upswing should be viewed as something temporary, not as the beginning of a new massive uptrend.

It's About the USD

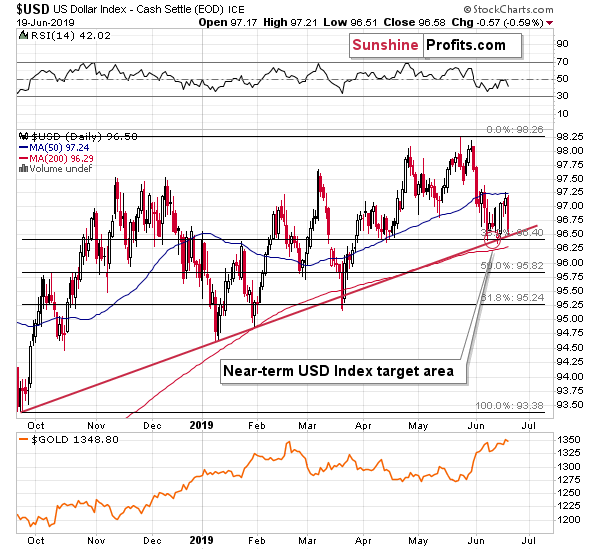

All or almost all of what happened in the news in the last couple of weeks likely had taken aim at the U.S. dollar. And it did move lower... Temporarily. The U.S. currency moved down in today's pre-market trading, but it didn't decline below the previous June low. What we saw appears to be very similar to the March situation. Then, the Fed surprised the market with dovish approach, and we saw the same thing yesterday. And what happened? The USD Index formed a bottom a bit below the rising red support line. What's happening right now? The USD Index moved slightly below the rising red support line - but not significantly so - and it even rallied back a bit.

Despite much more dovish comments from the Fed, increased trade tensions and even despite Iran accusations, the U.S. dollar is not below the March low. It's about a full index point higher.

The dollar is not as "toast" as many would have you believe. It may have been attacked, but it showed great resilience to these attacks and once they subside (the Fed had already turned dovish and yesterday's second dovish surprise in a row didn't even manage to take USD to new lows), the USD is likely to soar. The PMs will very likely react with a substantial plunge.

Summary

Summing up, gold moved to a very strong long-term resistance in today's pre-market trading, and gold's performance relative to silver and the big picture for mining stocks suggest that what we saw was nothing more than a - bigger than it was likely, but still - correction, not a game-changer. Gold rallied recently, but we are already in a situation where whatever positive surprise for gold could have happened, already had happened. On top, gold reacted even to what didn't materialize yet. And if all the bullish news are behind us, then what can the market do now? It should decline, just as the USD Index managed not to break below the previous June low.

We know the last few weeks, months, and years have been exhausting because not that much happened on the precious metals market - but it is exactly this kind of boring action that usually precedes the biggest price moves and biggest opportunities. This was even made into a trading technique. Bollinger bands become narrow when a given market is calm and seasoned traders know that when they are narrow, it's time to prepare for a huge move. Most people don't know that, and they get caught by surprise and only join the move once it's mostly over. It seems that we have this kind of situation in the precious metals right now. The patience will be well rewarded, especially that our medium-term downside target for gold remain intact.

Gold moved above our stop-loss level, but since the outlook didn't change, we are re-opening the short position with a higher stop-loss level. We are also moving the stop-loss level higher in case of mining stocks.

As always, we'll keep you - our subscribers - informed.

On a side note, there would be no regular Alert tomorrow due to Your Editor’s travel schedule. We apologize for possible inconvenience and we’ll be back on Monday.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,452; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $31.67

- Silver: profit-take exit price: $13.81; stop-loss: $15.72; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $25.37; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $11.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Super Mario delivered a surprisingly dovish speech. But he was shortly outshined by Super Jerome. Both key central banks have sent new signals to the markets for interpretation. Let's read the tea leaves and make sense of the initial reaction in the gold market.

Gold Scores Gains as Draghi and Powel Grow Concerned

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager