Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

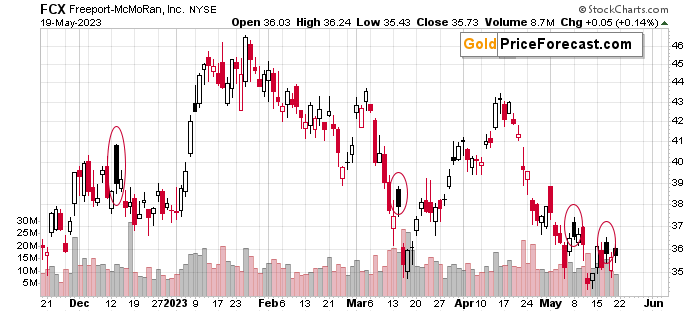

Some might consider an additional (short) position in the FCX. Last week, gold price moved sharply lower but rallied back up on Friday. Which direction is the real one?

It’s often difficult to solve problems (especially important ones) on the same level that those problems were created.

While possible, it’s quite often not the most efficient way to proceed, and sometimes one can waste a lot of energy on sub-optimal solutions. Or one can miss a great deal of benefits that would be available if one approached this situation from a different angle.

Take dieting, for example. Some people (most?) would like to get rid of some extra pounds (or kilograms). Some have quite many of those “extras”. And what do they usually focus on? On eating less or eating better quality foods. And it works.

However, in many cases, it works for just a while, it takes a lot of willpower and is inconvenient in all sorts of ways. There are ways to minimize the inconvenience and maximize efficiency (I used and think very highly of Tim Ferriss’ slow carb diet, by the way. You can read about it in this book “4 Hour Body”), but again, there’s the issue of getting stable and not just initial successes.

In this case, achieving success is possible, but it’s difficult, and the stability of that success is a different matter.

In this case, looking at the challenge at hand from a different point of view, could be examining why does one tend to overeat in the first place. Stress eating? Not enough enjoyment of life in other areas?

There could be quite many reasons, but the point is that addressing whatever the real reason is, can make the changes in one’s body composition stable. Why? Because without the real reason, everything that one “fighting” like the urge to eat more or sweeter foods will simply no longer be there. And it would happen easily and lightly.

Of course, there’s much more to the above, but I won’t go into details here, as that’s not the point of this analysis.

Why did I mention the above at all? To show you how looking at something from just the basic level can be a sub-optimal way of doing things.

In our case, the gold price rallied on Friday – that’s a fact. But what is the context? What happened in other markets? What is the overall market tendency right now? Knowing the above, can change the rally from “perplexing” to “obvious”.

As far as the overall tendency is concerned, I already covered it in Friday’s huge Gold Trading Alert, but to make a long story short, the odds are that we’re now in the “return to normalcy” stage of the bear market, which is particularly tricky, as that’s when investors still think that it’s a bull market’s return.

I’m applying this to the stock market, but it has consequences for other markets as well. In particular, this makes investors particularly vulnerable to emotional price swings to the upside that have little fundamental merit.

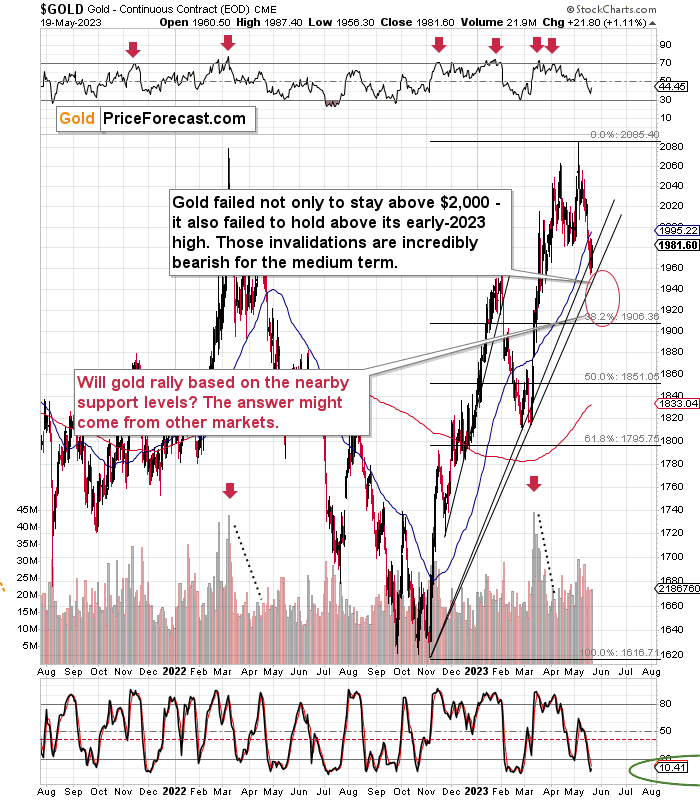

Looking at gold price only, we see the following:

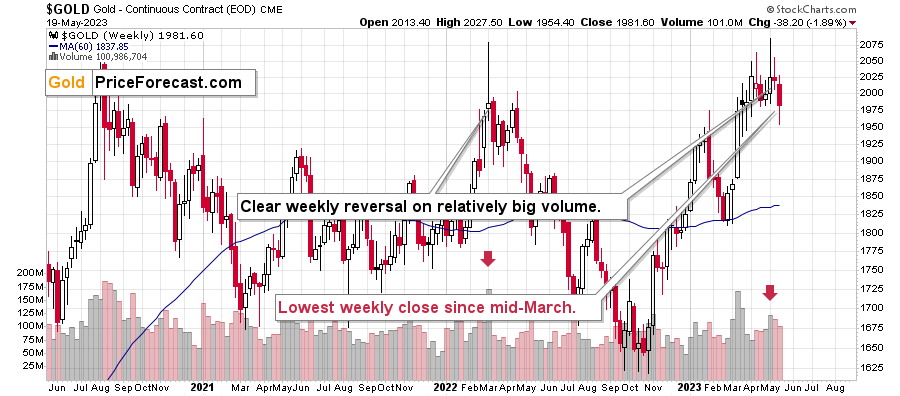

Gold declined by almost $40 last week, and it was the lowest weekly closing price since mid-March. Both are bearish indications, especially the latter as it implies that last week’s move was indeed important.

What about Friday’s comeback?

Markets are emotional in the very near term, and they easily focus on what was the most recent news out there. If it sounds scary, people can flock to gold, even if it’s pointless.

On Friday, Powell spoke about interest rates, and he said pretty much nothing new. They will assess the risks on a meeting-by-meeting basis – nothing new.

What caught public’s attention was the pause in the negotiations about the debt ceiling.

“Oh no, the U.S. can default on its debt obligations!” – that pesky thought entered anxious investors’ minds once again.

Pointlessly so because it’s practically impossible for anyone to willingly take blame for nation’s default. Especially when the U.S. needs to be fully credible. I’m not talking jut about the war in Europe, but also about tensions regarding China.

That’s why I wrote the following in Friday’s intraday Gold Trading Alert:

Powell just spoke about rates, and he said very little new. They (the Fed) will make the interest rate decisions on a meeting-by-meeting basis depending on the data. That’s what they already said before, so it changes nothing – also with regard to the fact that the markets are most likely overestimating the odds for the rate decreases in the coming months. But I already wrote a lot about it this week, so I don’t want to go into details once again.

What I would like to comment on is the debt-ceiling debate. The debt limit talks came to an abrupt standstill. The Republican House Speaker said it's time to “pause” negotiations.

What does it change?

Absolutely nothing.

They will practically certainly (I’d give it 100% chance, but since there are no certainties on any market, I’m not saying that it’s certain) increase the debt limit, because nobody will want to be the person responsible for the U.S. default. Especially given the war in Europe, and tensions regarding China. Can the U.S. afford to be viewed as weak now? Come on…

Then again, they can’t just state the obvious and say, “you know, we really have no way out of this debt spiral and when we do try to implement something, it will already be after you have already suffered losses from your stock investments that will be so huge, that you’ll accept just about any solution”. That would be a form of weakness, too, right?

So, no. I can’t happen like that.

Consequently, instead, we have smoke and mirrors. A dance. A fake argument. Nothing more. And nothing that impacts our positions as whatever the market does based on the fake disagreements, will be undone once it’s clear that the debt ceiling will indeed be raised.

Zooming in, allows one to see that the move higher was nothing to write home about compared to the size of the preceding decline.

I provided the fundamental context, so we looked at the situation from a “higher level” than by focusing on the price moves alone. Now, let’s do the same from the technical point of view.

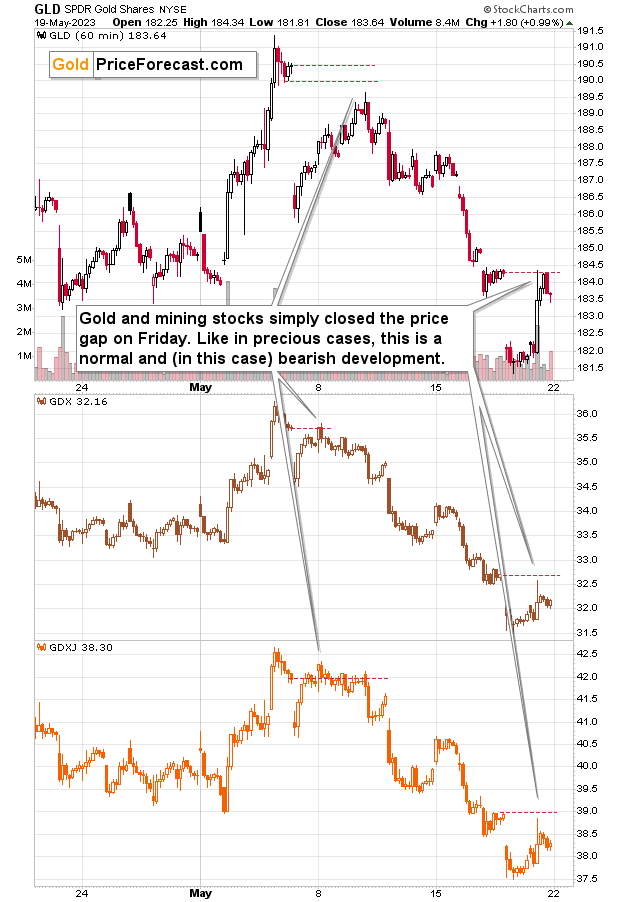

This time, the critical context is provided by the mining stocks. And more precisely, by the fact that miners were weak relative to gold.

While the GLD ETF (proxy for gold, which I’m using to have an apples-to-apples comparison with GDX and GDXJ) moved above its early-May lows, that didn’t happen in case of GDX or GDXJ – proxies for senior and junior mining stocks, respectively.

Miners tend to be weaker than gold during declines, and they tend to be stronger than gold during upswings, especially in upswings’ early parts.

This is the extra angle that one wouldn’t get while looking at gold price alone. Thanks to knowing how miners performed relative to gold (poorly), one can estimate, what’s the most likely outcome with greater accuracy than without this information.

Given what miners just did, the odds are that Friday’s upswing was just a correction and not the beginning of another bigger rally.

Moreover, please note that GLD, GDX, and GDXJ tend to either “close the gaps” or correct in the “gap’s territory”. And that’s what we saw once again on Friday.

A price gap is created, when a given market opens well below or above the closing price from the previous session. The space between the previous days’ close and the new open is a “gap”. It’s essentially a group of price levels at which there was no trading as the markets were closed.

Gold and gold miners tend to then – after such a price gap is formed – to move back to the previous closing price and then continue the trend.

We saw something like that earlier this month, and we saw it on Friday.

What does it mean? It means that since the gap was closed / almost closed, the precious metals sector can now decline once again – quite possibly in a profound manner.

Also, here’s more “extra context”.

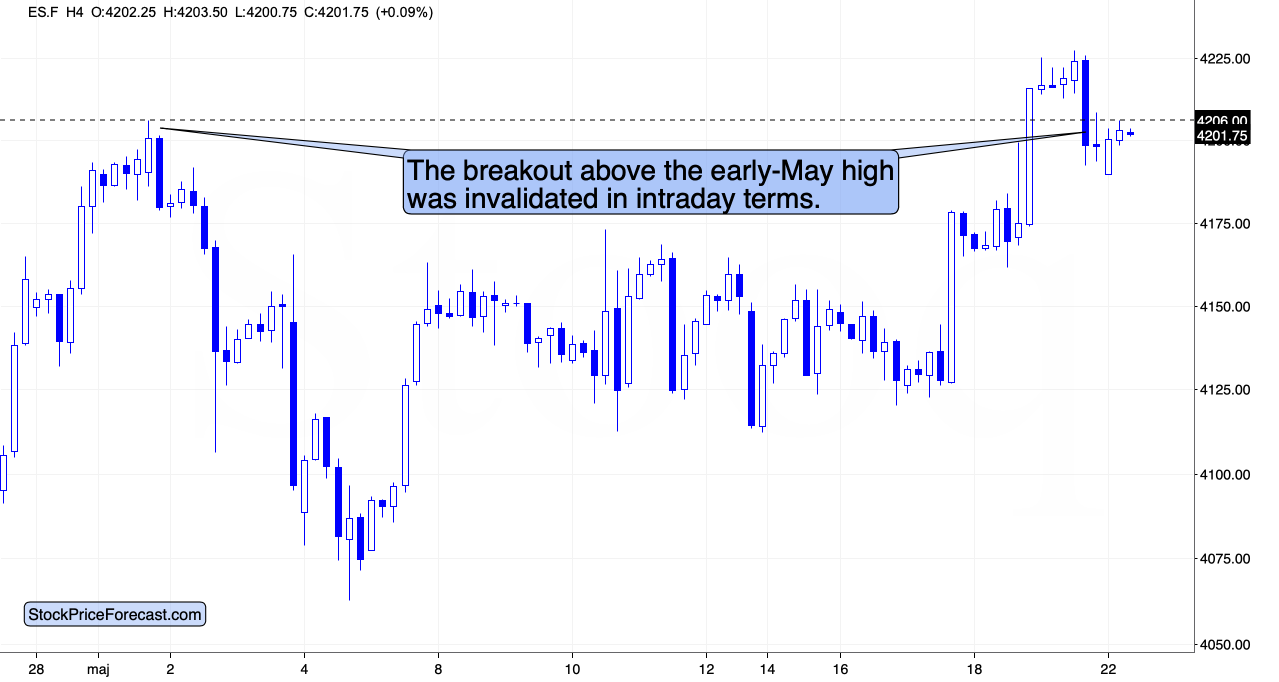

In Friday’s flagship Gold Trading Alert (if you just joined and haven’t had the chance to read it, I encourage you to do so), I wrote that I don’t really trust S&P 500’s breakout above its previous May highs.

Indeed, that move was quickly invalidated in intraday terms. During the overnight trading S&P 500 moved back to the previous high once again but failed to rally above it. This could be the end of the rally in stocks and the beginning of another huge move lower. The world stocks provide most context for this, but I just wrote about it on Friday.

This is important, because in the preceding months, stocks rallied together with the precious metals sector, and the link between stocks and junior miners is particularly strong.

Recently, it seems like the precious metals sector (in particular junior miners) really wanted to move lower and they declined even without stock market’s help, but when they finally do get this bearish help, junior mining stock prices are likely to truly slide.

The same goes for the FCX, in which we continue to hold profitable short positions (entered in early April) – those profits are likely to increase substantially soon. And profits from a short position in the GDXJ is likely to join in as well.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

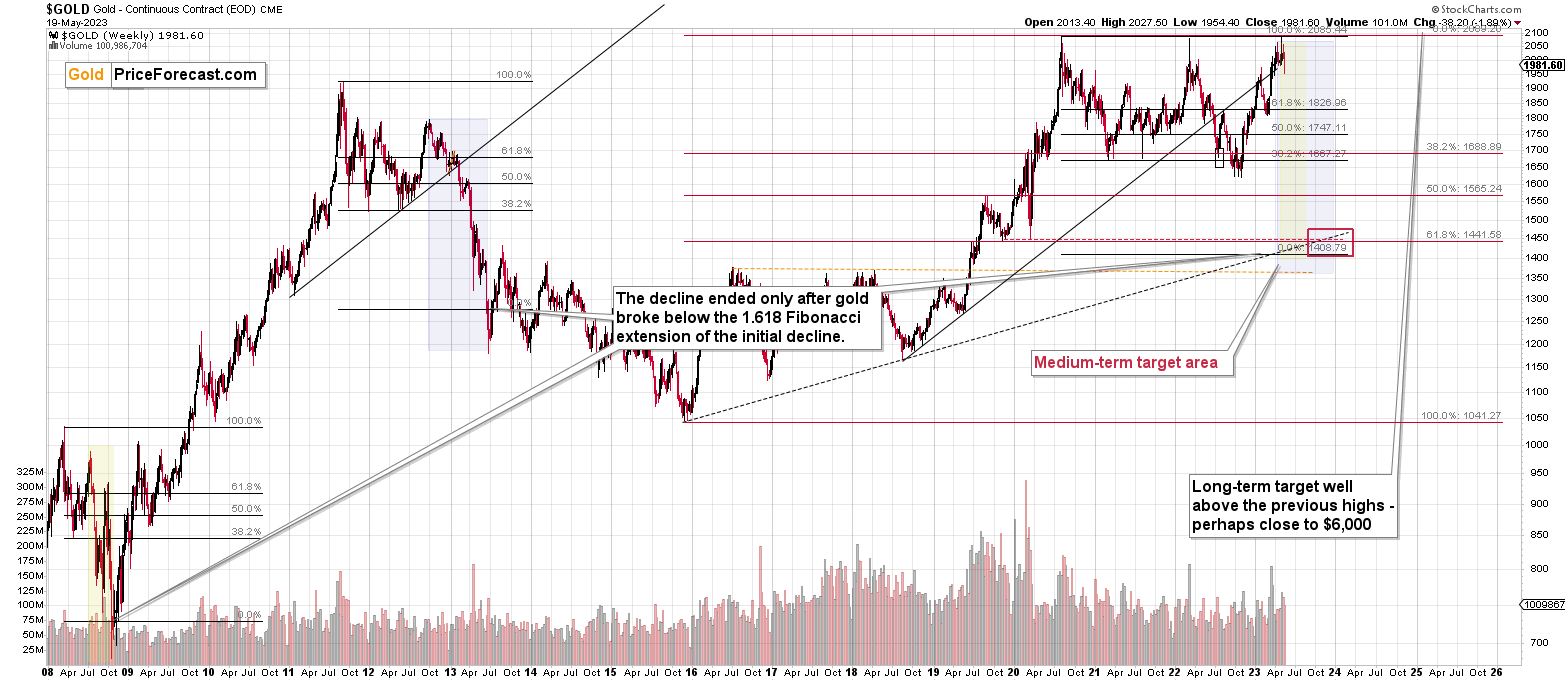

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, we recently took profits from the additional FCX trade (right before the trend reversed!) and the current short position in it is VERY profitable as well.

The short position in junior mining stocks is – in my view – poised to become very profitable in the following weeks.

Things might appear chaotic in the precious metals market right now, but based on the analogy to the previous crises (2020 and 2008), it’s clear that gold, miners, and other markets are pretty much doing the same thing all over again.

The implications of this “all over” are extremely bearish for junior mining stocks. Back in 2008, at a similar juncture, GDX’s price was about to be cut in half in about a month! In my opinion, while the decline might not be as sharp this time, it’s likely to be enormous anyway and very, very, very profitable.

If I didn’t have a short position in junior mining stocks, I would be entering it now.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.13; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $13.87; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.83 (stop-loss: none)

SLV profit-take exit price: $16.73 (stop-loss: none)

ZSL profit-take exit price: $32.97 (stop-loss: none)

Gold futures downside profit-take exit price: $1,743 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $10.97 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $25.47 (stop-loss: none)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $27.13 as the short-term profit-take level.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

On another – and final – side note, the number of messages, comments etc. that I’m receiving is enormous, and while I’m grateful for such engagement and feedback, I’m also starting to realize that there’s no way in which I’m going to be able to provide replies to everyone that I would like to, while keeping any sort of work-life balance and sanity ;) Not to mention peace of mind and calmness required to approach the markets with maximum objectivity and to provide you with the service of the highest quality – and best of my abilities.

Consequently, please keep in mind that I will not be able to react / reply to all messages. It will be my priority to reply to messages/comments that adhere to the Pillars of the Community (I wrote them, by the way) and are based on kindness, compassion and on helping others grow themselves and their capital in the most objective manner possible (and to messages that are supportive in general). I noticed that whatever one puts their attention to – grows, and that’s what I think all communities need more of.

Sometimes, Golden Meadow’s support team forwards me a message from someone, who assumed that I might not be able to see a message on Golden Meadow, but that I would notice it in my e-mail account. However, since it’s the point here to create a supportive community, I will specifically not be providing any replies over email, and I will be providing them over here (to the extent time permits). Everyone’s best option is to communicate here, on Golden Meadow, ideally not in private messages (there are exceptions, of course!) but in specific spaces or below articles, because even if I’m not able to reply, the odds are that there will be someone else with insights on a given matter that might provide helpful details. And since we are all on the same side (aiming to grow ourselves and our capital), a ton of value can be created through this kind of collaboration :).

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief