Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

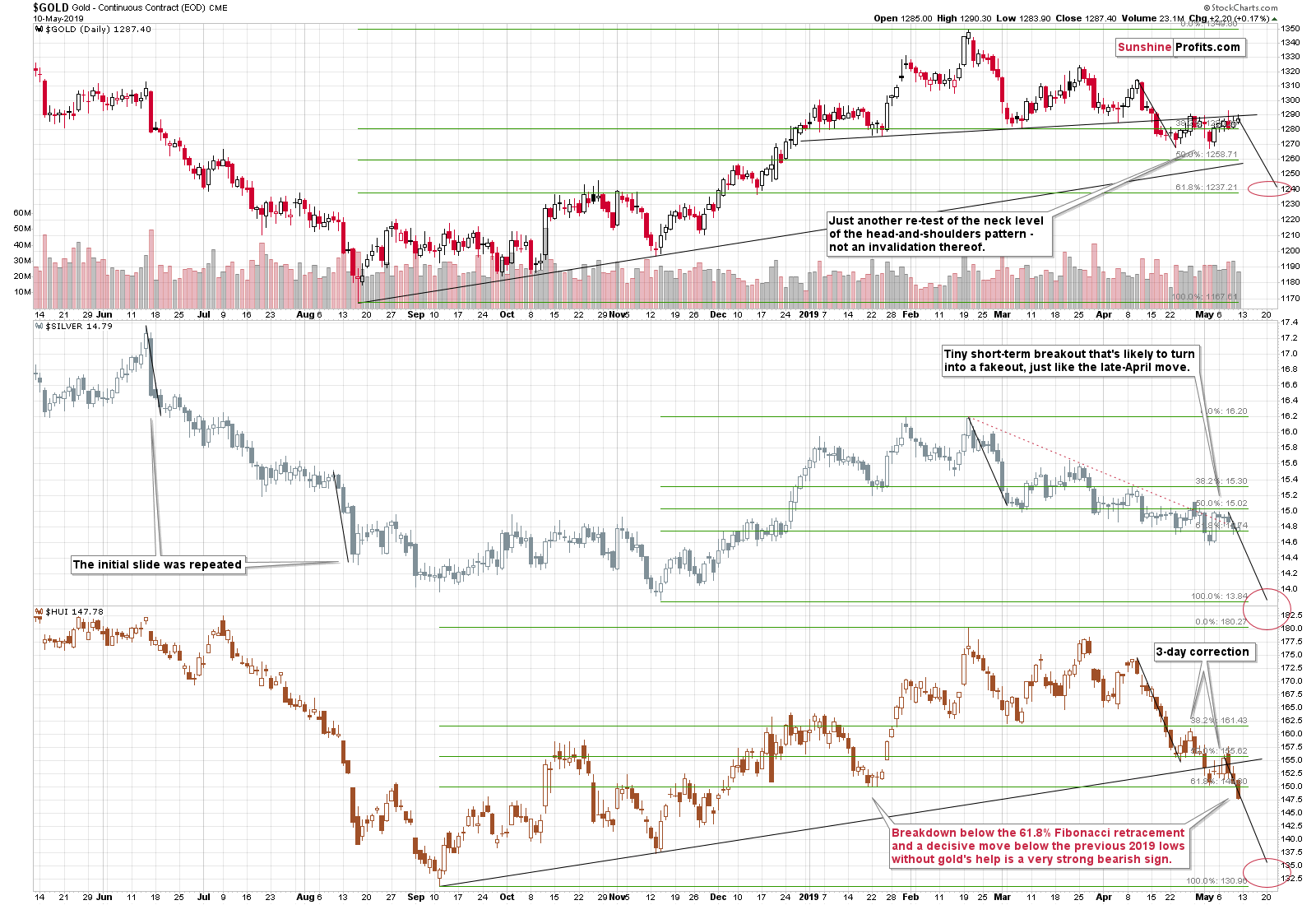

We had warned you about the miners' bluff and we hope that you heeded it. Gold is still testing the neck level of the head-and-shoulders pattern, but silver is already back at its 2019 lows, while miners broke decisively below them. It may seem that the miners have declined enough and that a rebound is imminent from these levels. Should you hold your breath? Are we on a doorstep of a tradable rebound, or it ain't here just yet?

To answer that, let's turn to two analytical gems that have served us so well in the past. Not once, but many times.

Let's start by taking a look at what happened across the precious metals on Friday.

A Comparative Look at the PMs Sector

Gold did practically nothing. It moved insignificantly higher as a response to a relatively small move lower in the USD Index. Gold didn't move above the neck level of the previously completed head-and-shoulders pattern, so Friday's small upswing didn't change anything. The previously bearish implications remain bearish.

Silver was basically flat on Friday, but it's already declining in today's pre-market trading.

In fact, the white metal is trading close to its previous 2019 lows. It didn't break below them yet, but it's just cents above them, so the breakdown could take place any minute. The previous medium-term breakout in the gold to silver ratio continues to have great impact on the relative prices of both metals and it's likely to do so for weeks and months. As a reminder, the true long-term resistance of the ratio is at about 100, and the current gold to silver ratio value is not even 90. Silver's underperformance is far from being over and the above-mentioned pre-market action is one of the multiple confirmations thereof that we have.

Gold stocks moved decisively lower and this is one of the most profound things that happened on Friday. In Friday's Gold & Silver Trading Alert, we wrote the following:

It's difficult to imagine a more bearish set-up than what we have in gold stocks right now. We saw a breakdown below a rising support line, then it was confirmed and an attempt to break back above it quickly failed. We now saw a move to new yearly lows that took place despite a move higher in gold and a move lower in the USD Index.

The situation is definitely not like what we saw in late January, so we shouldn't expect to see a rally based on just the price level. Instead, the situation is similar to what we saw in August 2018, when gold miners were already after a sizable downswing. Last year, the next turnaround materialized at about 140 level in the HUI. We expect something similar also this time. Back then, it took only two days for the miners to rise from about 140 to above 150, so please keep in mind that this kind of volatility is quite likely also this time.

The above remains up-to-date, with a slight change. The situation is even more bearish in the short run than we had expected previously, because of how low the HUI Index has fallen already without gold's help. The underperformance will not always be as extreme as it's been recently. However, even if it is only average, it's difficult to expect the HUI to decline by just another 8 index points while gold declines by more than $40. After all, the last $40 move in gold (from the late-March highs to Friday's session) corresponded to a 30-index-point decline in the HUI.

This means that when gold slides to $1,240, HUI is likely to slide below 140. The next strong support level is the September 2018 low of 131.12. Going forward, let's use 130 for simplicity - we'll be actively monitoring the market and adjusting the final target based on how the markets move relative to each other anyway.

But, it might also be the case that the HUI Index actually moves lower than that.

Focus on the Miners

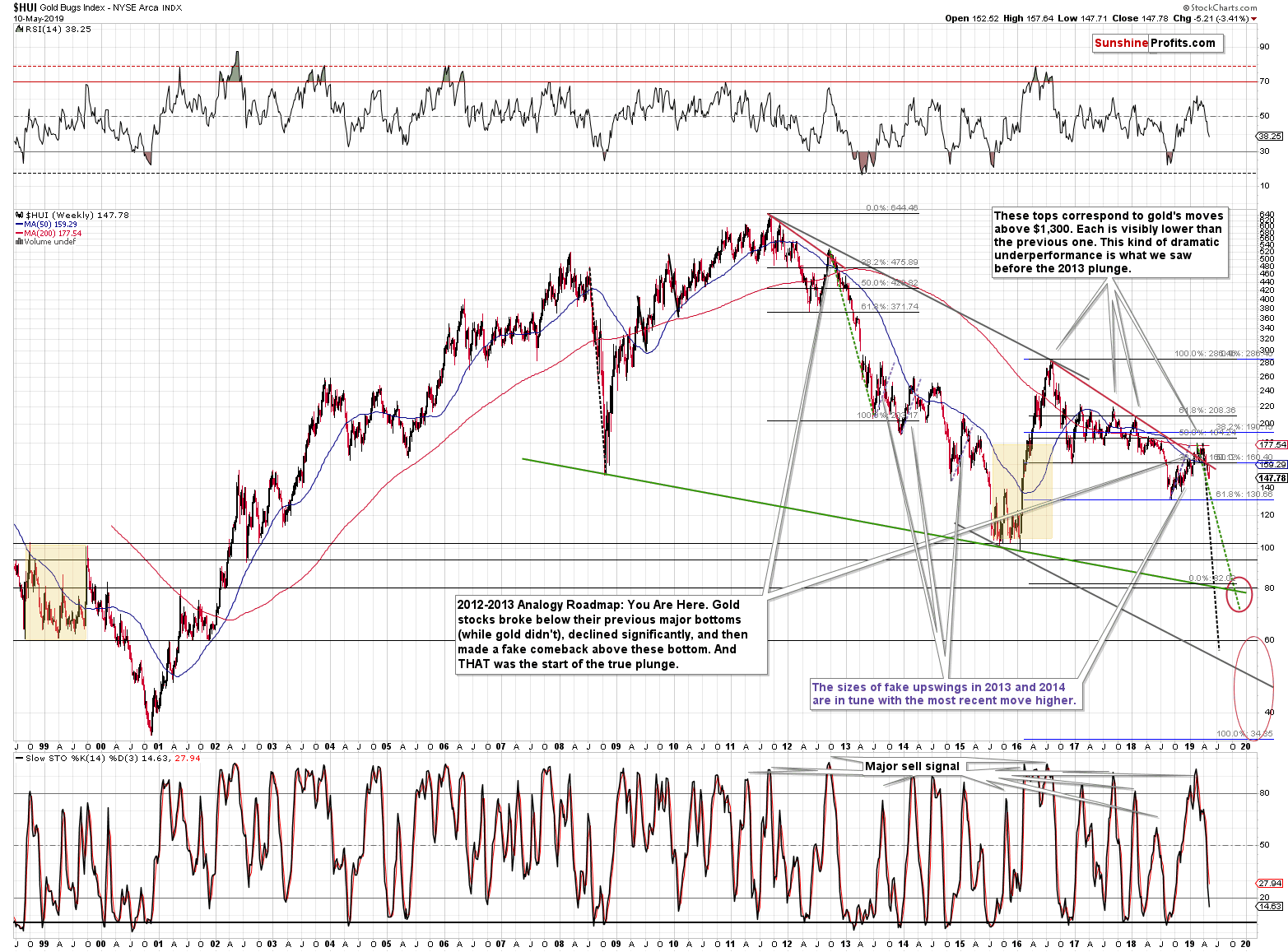

You see, if the current situation continues to develop as it did in late 2012 and early 2013, then we might see the next visible correction only after HUI breaks below its most recent medium-term lows.

That's exactly what happened in early 2013 - HUI bounced only after breaking below the 2012 low and this bounce was in fact the verification of the breakdown. There had also been one more visible move higher earlier, in December 2012, when HUI had just erased half of the preceding (second half of 2012) rally. The small December rally was stopped by the 50-week moving average.

Now, the HUI Index was and still is relatively close to the middle of the previous (late 2018 - early 2019) rally, and the most recent move higher (the "bluff") took HUI to 157.64, while the 50-week moving average is at about 159. Both above-mentioned cases are very similar.

This means that instead of the next bottom at about 140, we may actually get the next bottom at about 120-125 that is followed by a corrective bounce to about 131. The $1,240 target for gold is much more precise than the above-mentioned HUI Index targets, so we will likely continue to adjust the target for miners based on what gold does. At this time, the 140 level seems to be the highest of the possible near-term targets, while 120 seems to be the lowest. Which one provides the most favorable risk/reward ratio for adjusting the trading positions? At this time, it seems that it's the 125 level, but at the same time it seems to be a good idea to watch gold for the clue regarding timing and use the above-mentioned HUI target more as a guideline than as set in stone.

Before summarizing, we would like to point your attention to two factors that confirm that the next move lower is going to be significant. Yes, we know that you already know that as we provided myriads of details beforehand, but looking at the situation from a fresh perspective and seeing new signals makes it easier to be patient before the move gathers real momentum.

The first of them is the analysis of the silver stocks, and the second is the analysis of the popularity of 2 key search phrases for the gold market. Let's start with the former.

Factors That Point to the Slide

We have extensively commented on the silver stocks on April 3, when we emphasized that their daily decline on huge volume was the harbinger of something very bearish to happen. Let's quote what we wrote back then - it will also serve as a brief introduction to those, who haven't read the early-April analysis. We will make only small adjustments within the quote, because almost everything that we wrote remains up-to-date and continues to have important impact on the following weeks and months.

Gold price usually moves in tune with the silver price, and silver stocks usually move in tune with silver. The sizes of the moves are not identical, but the turnarounds often take place at the same time. The price moves are similar enough to say that the big moves will take place at the same time, but they are different enough for the markets to provide different signals. At times, one market might lead the other. There may also be other specific features and in today's analysis, we'll focus on one of them.

Namely, we're going to discuss the huge daily volume spikes. And in particular, we're going to focus on days when the silver miners (were using the SIL ETF as a proxy for the sector) declined on big volume. There were quite a few such days since early 2016 and they were almost all characterized by analogous price action - not only in the case of silver miners, but also in the case of gold.

To put it simply, gold usually took a dive after silver miners declined on huge volume.

The above doesn't reveal the efficiency, nor the severity of the signal, though.

As far as efficiency is concerned [note: we are leaving the numbers as they were in early April - we will comment on the update later in a few paragraphs], there were 19 signals and 15 of them were good (or excellent) shorting opportunities. In two cases, it was unclear if it was a good shorting opportunity or not. There were only two cases when the signal clearly failed: in December 2016 and in December 2018.

[None of the failed signals is similar to the current case as silver stocks are neither after a breakout, nor after several-month long decline, so let's consider the neutral signals]

One of them was mid-July 2016 case where the market moved higher one more time before forming the final top, and the other one was the September 2018 situation, when the market moved lower in the near term, but that was actually the start of a bigger upleg. One case was a good shorting opportunity in the medium term, but a bad one in the near term, and the other case was the opposite. None of them clearly invalidated the signal, but to be conservative, we can say that only one additional case confirmed the signal, while the other one didn't. This means that [based on information that was available in early April] we get the ultimate efficiency of 84.2% (16 out of 19). That's an extremely high efficiency and...

That's not everything.

You see, the very recent price/volume action in silver stocks was not average. It was special.

There are two reasons for it:

- The daily volume was higher than what we saw previously. In fact, it was the highest daily volume that we ever saw in case of the SIL ETF.

- The volume spike took place right after a major breakdown.

The April 1st volume in the silver miners was no April Fools' Day joke. It exceeded the previous record by about 30%. Out of the recent years, we saw the biggest daily volume during a decline in silver in 2016: in August and September. That was the beginning of the biggest decline in gold of the recent years. In other words, the only analogy that we have based on the size of the volume points to the biggest decline in the recent history. And the volume was even bigger this time - it broke the previous record. Will the decline be bigger than the late-2016 one? That's what is very likely based on many other techniques and what the above silver chart is confirming.

Moving to the second point, silver miners are right after a major breakdown. There were two similar breakdowns in the recent past that were then followed by the huge-volume signal. That was in August 2016 and in June 2018. In both cases, silver miners and gold continued to decline for many weeks.

Both the above-mentioned factors suggest that 84.2% efficiency is likely understated and should in reality be higher. In particular, both links point to analogy between the current situation and what we saw in August 2016. It then took gold less than 4 months to decline over $200. And let's keep in mind that the volume was much higher this time, so the move - based on the above chart alone - could also be bigger this time.

Basically, everything about the above signal remains up-to-date. The only thing that changed is the efficiency. It's now even better.

The huge-volume decline in early April was indeed followed by visible declines in the entire precious metals sector and this adds to the credibility of the technique. There was one more case in late April when we saw a relatively big volume during a daily decline and this was also a great shorting opportunity in the silver stocks. It was relatively neutral in case of gold and silver, but it was clearly a great shorting opportunity in case of the mining stocks. Overall, it seems that both cases confirmed the previous bearish implications and the efficiency of the technique.

The reason we are mentioning all this is not only to show you that the bearish implications that we described in early April haven't yet fully developed as the volume was bigger than the previous record and the decline - so far - isn't bigger than the past slide. We are mentioning all this, because we have once again seen a daily decline on relatively big volume.

Consequently, the above-mentioned 84.2% efficiency is definitely understated. If it wasn't clear what the precious metals sector is likely to do next based on what gold stocks have been doing, the silver stocks' bearish scream should get more than one's attention. It should result in action. The opportunity in the mining stocks is decreasing on a daily basis, but there's still are still plenty profits that remain on the table, especially from the medium-term point of view.

Having said that let's take a look at the really big picture.

Wait, that's not a price chart.

It isn't. It's a sentiment chart. However, if you've been monitoring the gold market for some time, you should immediately recognize its immense value for all precious metals investors. There are two clear spikes in the more distant past. It's clear that both differ from other parts of the chart and that the only case that's - very - similar to them is what happened several months ago.

The chart is based on monthly values, and the first spike is based on March 2008 data, while the second spike is based on August 2011 data. The seasoned gold investors know very well what happened on those occasions. Something very different from what had happened any other time. These were the final tops before the blood-letting precious metals carnages started.

Think about it. Two key tops in gold. Two ultimate shorting opportunities. And two clearly visible spikes on the above chart. There were no other cases that were similar to them, just as there were no declines that were similarly epic. And if anyone argues that the declines were not epic, ask them to look at the long-term HUI Index chart. Better yet, ask them to talk to someone who was invested in mining stocks at that time. Have them ask these investors how much would they pay to be able to travel back in time for just a few seconds to scream at themselves GET OUT OF THE MINERS, GET OUT NOW! RUN!

How many times can you relive a given situation and make a good decision instead of making the one that you would regret for years? It's extremely rare. In fact, it's on the border of being a miracle. And yet, that's exactly what the above chart does. Several months ago, we saw the third spike - it was once again crystal clear that it happened. In the last 15 years, there were not 2 critical situations, but 3. The blessing here is that the implications of the third signal have not yet played out. We're running out of time, but we still have it.

After the March 2008 top, gold declined about 34%.

After the August 2011 top, gold declined about 20% initially, but since there were no new tops since, it seems that it's more appropriate to focus on how much it declined before the medium-term decline ended and became the multi-year consolidation. From August 2011 top to the June 2013 bottom, gold declined about 38%.

The most recent medium-term top in gold formed at about $1,350. And you know where it would decline if it was to repeat the smaller of the above-mentioned declines and slide by 34%? To about $890 - which is exactly our final target for the current medium-term decline in gold based on other factors (i.a. the 61.8% Fibonacci retracement based on the entire previous bull market).

Making money on both: the decline (over 30% in gold alone) and the rebound (once again over 30% in gold alone) is a huge opportunity, not only because of the sizes of the moves, but because the target for gold is confirmed by multiple technical tools; and because these profits might be further increased by applying more sophisticated techniques that go beyond the simple use of leverage (which also has its merits, when applied correctly). For instance, miners and silver are likely to magnify what gold does. There's a tremendous difference in taking advantage of it all compared to simply waiting for gold to slide and then to come back to the current price levels, which wouldn't result in any return. The sleepless nights during gold's decline would be included in such profitless package at no extra charge, though.

It's incredible that we received such a clear confirmation of what's to come. The only more incredible thing will be when someone knows all this and then still chooses to ignore it, losing the opportunity. You have been warned.

Summary

Summing up, gold miners' extremely weak performance, strong volume on which silver miners declined on Friday, and the long-term sentiment indications confirm that the big decline in the precious metals sector is most likely underway. The next short-term bottom might be reached as early as this or the next week - in a volatile manner. This upcoming bottom might be a good opportunity to go long, but we are definitely not in this kind of situation right now. Conversely, in our view, short positions in the PMs are likely to generate sizable profits.

The short-term profit potential for mining stocks seems bigger than we initially expected, so we are moving the profit-take exit levels lower for GDX and GDXJ. The targets for leveraged ETNs remain unchanged, though, due to the time factor and most recent leverage data. Still, it will be most important to look at gold for guidance with regard to timing the exact exit moment.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $13.81; stop-loss: $15.72; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks were gaining on Friday following a lower opening of the trading session and the morning sell-off. The S&P 500 index extended its downtrend before bouncing off and closing 0.4% higher. So was it an upward reversal or just correction within a downtrend?

S&P 500: Negative Expectations Again

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager