Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert. We are increasing the size of our trading short position (from 200% to 250%).

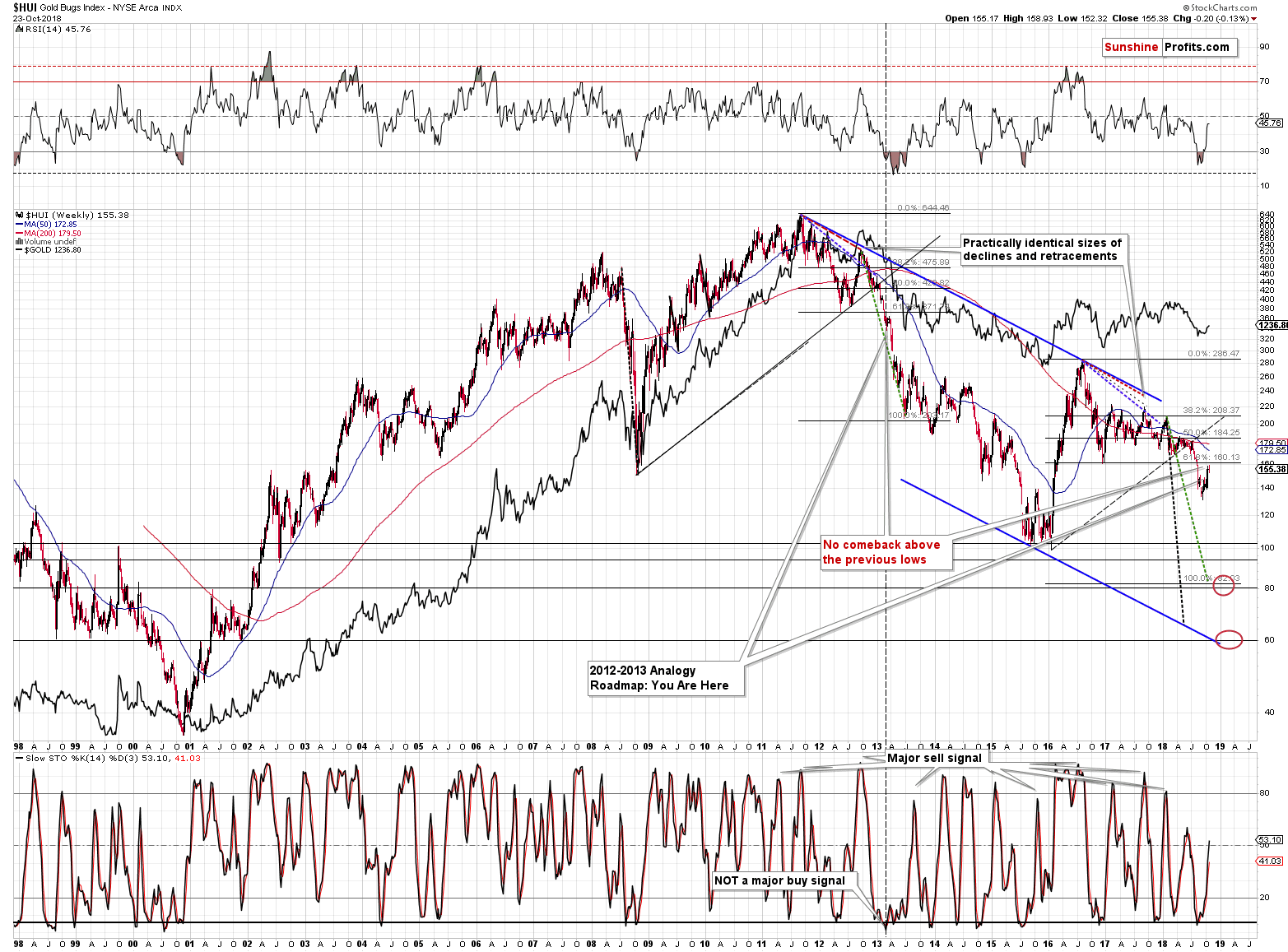

Gold rallied yesterday, right before its turning point, and reversed its course before the end of the session. Precisely, even before the US session started. Miners reversed as well, after failing to move back above the late-2016 bottom. With the critical situation in the USD Index, and gold miners’ short-term underperformance (so far this week gold is up by $8.10, while the HUI Index is down by 0.2), it appears that things will get very hot for the precious metals market shortly.

Before discussing the above, let’s take a closer look at what happened yesterday and what’s happening in today’s pre-market trading in the USD Index.

Forex Implications

In yesterday’s analysis, we wrote the following:

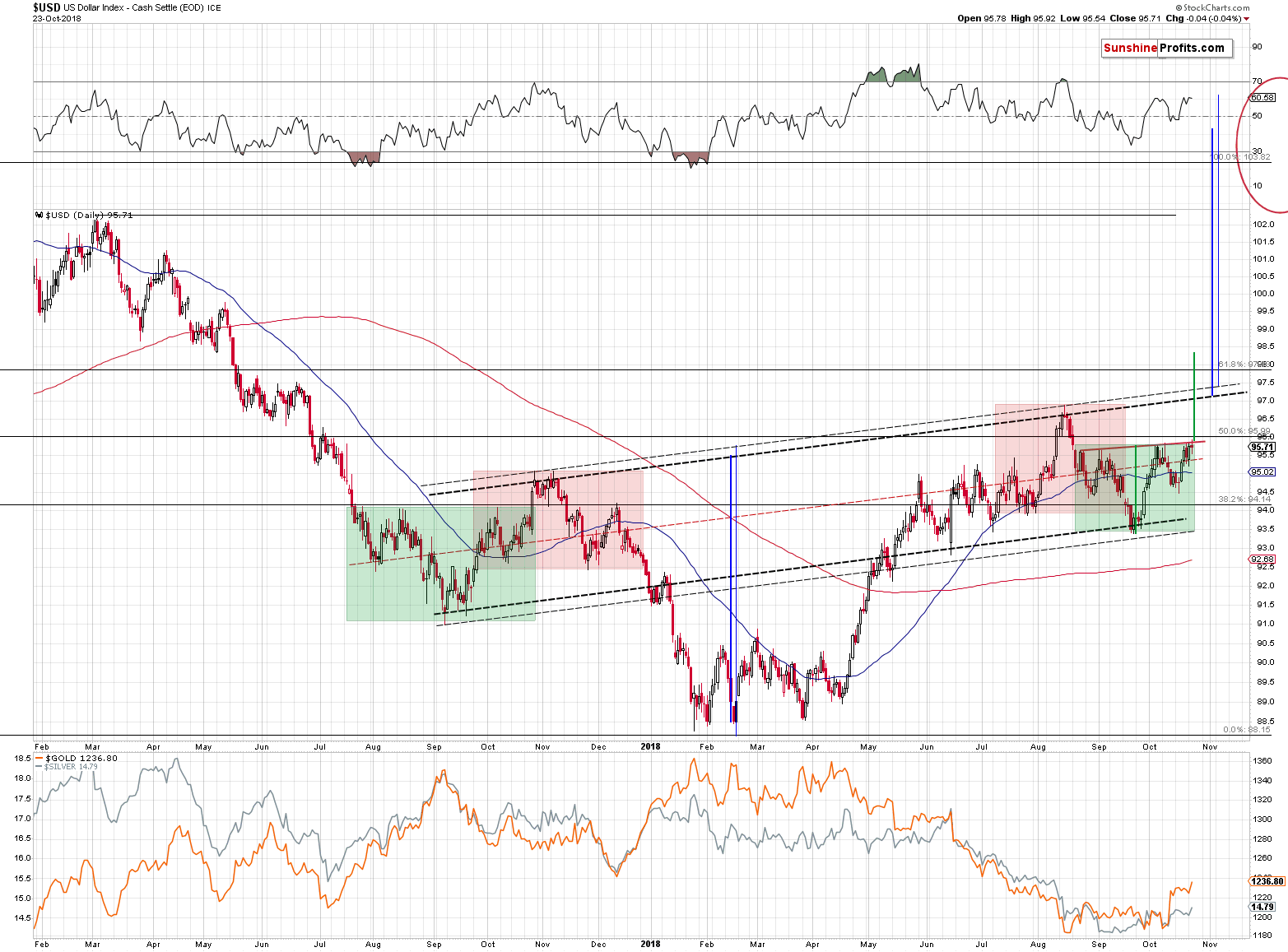

We already discussed the existence of the reflective pattern in the USD Index in the previous Alerts, but there’s one thing that we would like to add. Namely, we would like to address the potential (! – not completed) inverse head-and-shoulders pattern that is probably being formed.

But, first things first. The remarkable thing about the reflective nature of the recent price movement is that it is so similar. The October / November 2017 top is like the August 2018 top as they both took form of head-and-shoulders tops. We marked them with red. What’s even more profound is that outside shoulders of the top above-mentioned formations (left in 2017 and right in 2018) were the inside shoulders of the inverse head-and-shoulders patterns. We marked them with green. The reflective nature of the pattern is even clearer than we thought.

Now, the current inverse head-and-shoulders pattern has no direct implications yet as the price has not yet broken above its neck level, let alone confirmed such breakout. But, in light of the striking similarity between the 2017 decline and this year’s upswing, it’s likely that this formation will be completed.

The completion of the local (green) inverse head-and-shoulders pattern would provide us with the target at about 98.4, which means that it would likely result in a breakout above the medium-term inverse head-and-shoulders pattern that has its own target well above 100 – at about 103. In other words, based on the above-mentioned patterns, a move to the 2017 high in the USDX appears likely.

The above rally would perfectly fit the long-term analogies in the USD Index.

As you can see on the above chart, not much happened yesterday. But, in today’s pre-market trading, the USDX moved above 96.30, which means that we are seeing a breakout above the local inverse head-and-shoulders pattern – the one that points to a target of 98.4 and that is likely to lead to the completion of the bigger inverse H&S and even bigger rallies.

The move above 96 materialized only a few hours ago, so it’s far from being confirmed. Therefore, the implications are not yet strongly bullish, but they are definitely present. The implications for the USDX are already bullish even though they are not very strong for the short term just yet. The opposite is the case for the precious metals sector – the PMs are likely to decline along with the rally in the USD Index.

Speaking of the precious metals sector, let’s see what happened in it yesterday..

Gold’s Clear Reversal and Relative Performance

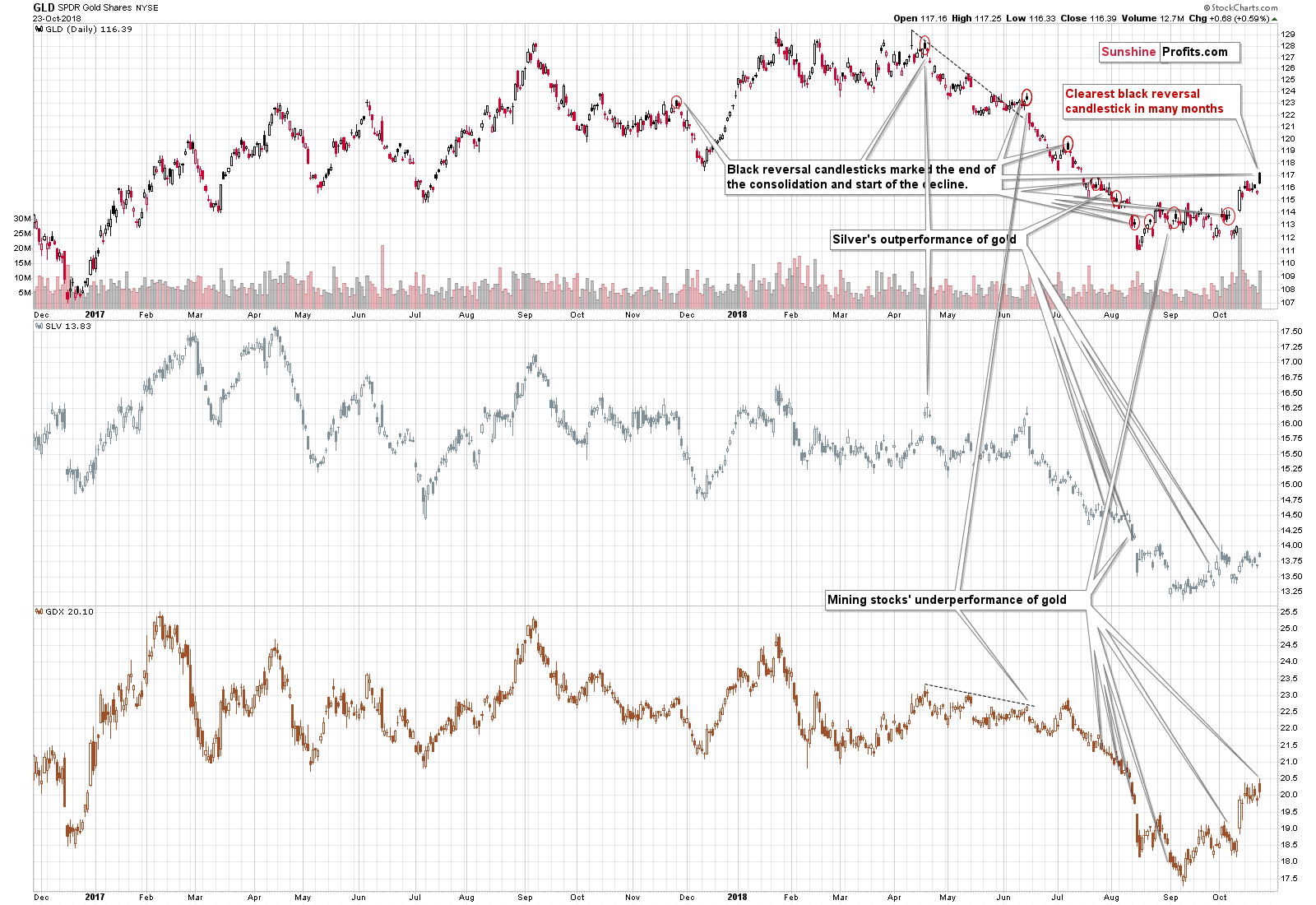

Gold, silver, and mining stocks all ended yesterday’s session higher, but at the same time, they all declined on an intraday basis, during the US session. This is particularly visible in case of the GLD ETF, where we see a clearly visible black reversal candlestick. In fact, that’s the clearest black reversal that we’ve seen in many months. There’s not one case on the above chart where the signal would be more apparent.

Why should one care? Because this is what preceded the short-term declines in the entire precious metals sector in many cases. In fact, practically all short-term downswings of the April resulted in August decline.. The clarity of this sell signal adds to its credibility and we can say the same thing about the corresponding short-term indications.

There are two key short-term signs that we want to see before a decline. One thing is that we want to see silver outperform on a very short-term basis, and the other thing is that we want to see mining stocks underperform gold – either on a very short-term basis, or on a short-term basis. In case of medium-term moves, the underperformance could even take the form of weekly or monthly weaknesses.

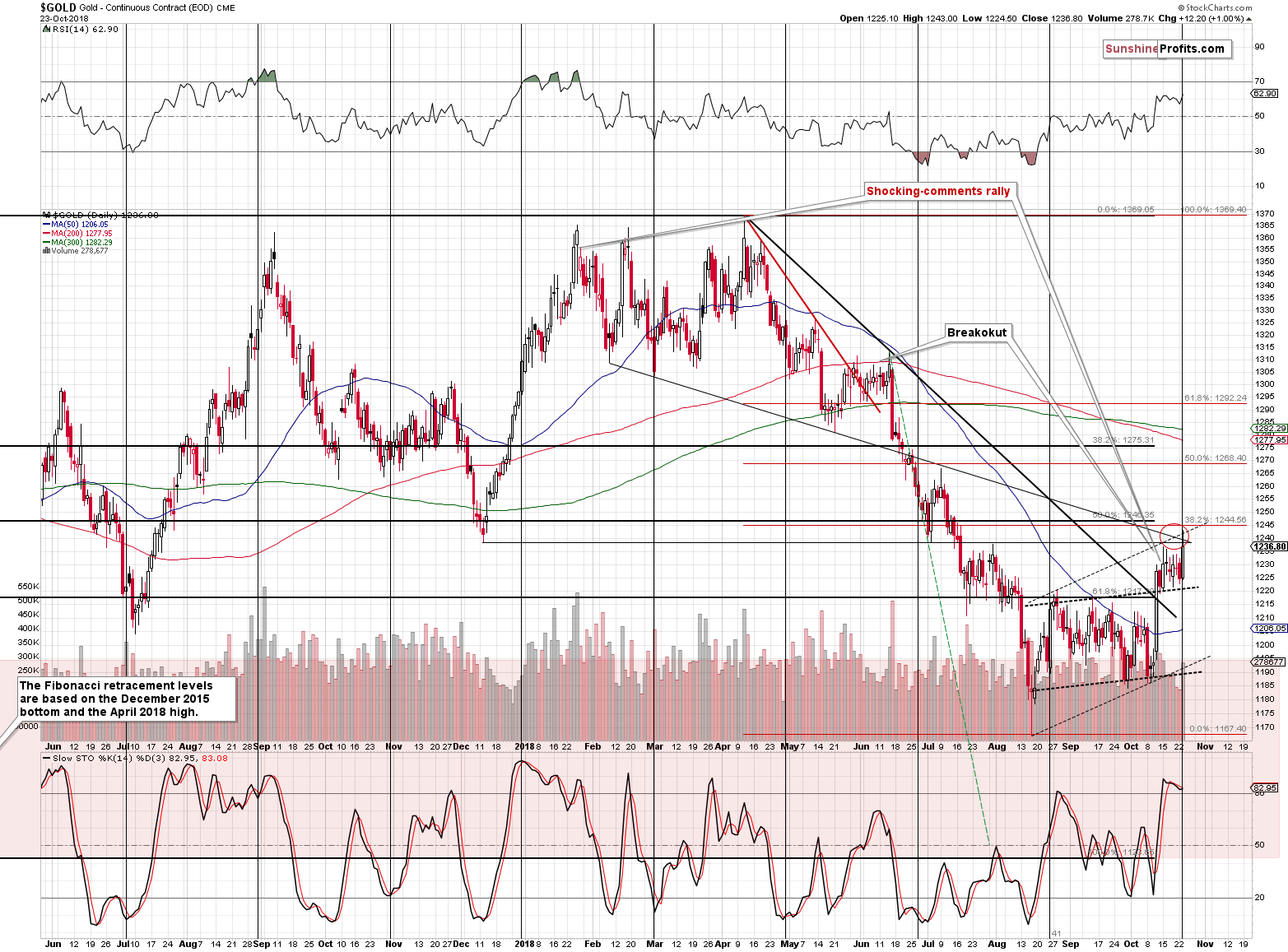

Silver already outperformed in early October. That was most likely the true end of this consolidation and the decline should have been resumed at that time. And that would have most likely happened if the market wasn’t surprised by Trump’s comments, in which he called the Fed action regarding interest rates “crazy”. After the above happened and the entire PM sector rallied, we emphasized that the effect thereof was likely only temporary as it didn’t change anything materially – it was just a temporary news-driven upswing. Such upswings can distort the short-term technical picture for a moment but are unlikely to change anything of medium- or long-term importance. And it seems that what happened recently perfectly confirmed the above general rule.

What about miners’ underperformance? It’s not apparent based on the above chart, but let’s consider 2 simple numbers. Gold is up by $8.10 this week, while the HUI Index (proxy for gold stocks) is down by 0.20. Gold stocks clearly underperform, and the implications are bearish.

Moreover, from the broad perspective, we see that despite gold’s yesterday’s strength, the gold miners were unable to break back above the December 2016 low. This means that the current price pattern remains similar to what took place in 2013 before the biggest part of the decline, even though the corrective upswing was bigger in this case. Truth be told, the current rally is likely so big most likely because of the surprising “crazy comments” that we discussed above. If it wasn’t for them, the two situations would have likely been even more alike.

In our previous analyses, we wrote that gold might move a bit higher right before its reversal date (which is today – October 24th) and it seems that we have just seen exactly that. Gold touched the upper part of our target area on an intraday basis, but declined shortly thereafter. Since gold’s turning points tend to work on a near-to basis, it seems quite likely that the top is already in. If not, it’s likely to be formed this week anyway.

Trump vs. Fed – New Details

Interestingly, we just got a big confirmation of Trump’s approach. As we can read on finance.yahoo.com:

In an interview Tuesday with The Wall Street Journal, Mr. Trump acknowledged the independence the Fed has long enjoyed in setting economic policy, while also making clear he was intentionally sending a direct message to Mr. Powell that he wanted lower interest rates.

The article quotes a number of comments that raise the question of Fed’s independence and coherent strategy for the entire country. The US President being in an open conflict with the Fed’s head is a major concern for the USD and for gold, especially that Trump said the following about Powell:

He was supposed to be a low-interest-rate guy. It’s turned out that he’s not.

Our interpretation (opinion) of the above is that since the general stock market declined, Trump wants to make sure that he’s not the one to blame by the voters and he’s pushing the blame onto somebody else. The Fed is an easy target. Trump assumes that it’s better to be viewed as reckless (Powell was supposed to be a low-interest-rate guy? Come on.) than to be the one that’s held responsible for the stock market decline. And he might be right from the political marketing point of view – after all, people are likely to forget about individual political decisions that don’t affect them directly but are not going to forget about the amount of capital they have on their brokerage and retirement accounts.

What would this interpretation imply? That once the stock market’s correction is over, Trump will either cease commenting on the Fed’s role, or he might say that they are doing a good job after all, and that he’ll be watching them to make sure that they don’t damage the economy etc. This also means that the USD Index would soar and that PMs would take a dive as the factor that was already priced-in, would cease to exist, or its importance would be minimal.

But, the above already has bullish implications for the USDX and bearish implications for gold.

The trust in the US currency should be declining based on the above-mentioned comments, while gold should be soaring. But it’s not. The market seems to have already discounted this conflict in the prices and currency values. This is very bullish for the USDX and bearish for gold. Why? Because the situation really can’t get worse on this front. Trump can’t be any more straightforward with regard to his opinion on Fed’s interest rate moves, and there’s not much more that he can do about it. And we doubt that he plans to. As discussed above, in our opinion it’s just a political theater. Fortunately, between this smoke and mirrors, we can find signals and opportunities. The fact that USDX and gold are not reacting in the way they should be reacting, tells us that these markets really want to move in the opposite way. The USDX is rallying in today’s pre-market trading.

Important Analyses

Before summarizing, we would like to emphasize that we have recently posted several analyses that are very important and that one should keep in mind, especially in the next several weeks. If you haven’t had the chance of reading them previously, we encourage you to do so today:

- Dear Gold Investor - Letters from 2013 - Analogy to 2013, which should make it easier to trade the upcoming sizable upswing (if enough factors point to it, that is) and to enter the market close to the final bottom.

- Gold to Soar Above $6,000 - discussion of gold’s long-term upside target of $6,000.

- Preparing for THE Bottom in Gold: Part 6 – What to Buy - extremely important analysis of the portfolio structure for the next huge, multi-year rally in the precious metals.

- Preparing for THE Bottom in Gold: Part 7 – Buy-and-hold on Steroids - description of a strategy dedicated to significantly boosting one’s long-term investment returns while staying invested in the PM sector.

- Gold’s Downside Target, Upcoming Rebound, and Miners’ Buy Plan - details regarding the shape of the following price moves, a buying plan for mining stocks, and a brief discussion of the final price targets for the current decline.

- Gold: What Happened vs. What Changed - discussion of the latest extreme readings from gold’s CoT report

- Key Factors for Gold & Silver Investors - discussion of key, long-term factors that support the bearish outlook for PMs. We are often asked what makes us so bearish – this article is a reply to this question.

- The Upcoming Silver Surprise - two sets of price targets for gold, silver and mining stocks: the initial and the final one.

- Precious Metals Sector: It’s 2013 All Over Again - comparison between 2013 and 2018 throughout the precious metals sector, the general stock market and the USD Index. Multiple similarities point to the repeat of a 2013-style volatile decline in the PMs.

- Changing One's Mind - Why, When, and How – discussing the way of analyzing the market that helps to stay focused on the growing one’s capital while not being influenced by the loss aversion bias. This essay might be particularly useful in light of the recent upswing in the PMs.

Summary

Summing up,based on yesterday’s reversal in gold (and its shape in case of the GLD ETF), mining stocks’ underperformance, and previous outperformance of silver, it seems that the local top in the precious metal sector is in or at hand. The reversal was likely to take place this week and it seems to have taken place yesterday. If not, then it’s likely to be seen this week, anyway. The very important bearish signal came from market’s reaction and lack of reaction to Trump’s new criticism of Fed’s interest rate actions. The USDX should be declining and gold should be rallying, but nothing like that is taking place, which is a very strong indication that these markets want to and are about to move in the opposite ways.

In light of the new confirmation with regard to USDX and gold’s performance in light of Trump’s recent comments along with other short-term technical confirmations, we are increasing the size of our speculative short position.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,257; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $49.27

- Silver: profit-take exit price: $12.72; stop-loss: $15.76; initial target price for the DSLV ETN: $46.97; stop-loss for the DSLV ETN $27.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $20.83; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $27.67

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Only one digit has changed. But it may have profound consequences, sending the country closer to junk status. Meanwhile, Rome and Brussels clash over budget plan. Will that duel benefit or harm the yellow metal?

Rome vs Brussels. Will That Battle Benefit Gold?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts