Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Gold soared. The banking system seems to be collapsing, and people are buying gold for safety. Will the crisis spread like wildfire? What will gold do next?

Well, that’s not the first crisis that we’ve seen in this millennium. There were COVID-based lockdowns, and there was the infamous 2008 slide in practically all asset prices.

It’s easy to follow the emotion in the markets. It’s easy to follow the herd.

It’s difficult to make profits.

Why?

Because it takes resilience and courage to ignore the commotion and ask good questions. For example: all right, but what’s really going on and what happened when the same thing happened previously? Were there some typical reactions? Can I apply it now? What else happened, and what else is happening now? What’s the context?

In our case and in the current situation, the key questions are:

How did those crises really work for gold? For stocks? For mining stocks?

Let’s start with the more recent crisis – the 2020 one.

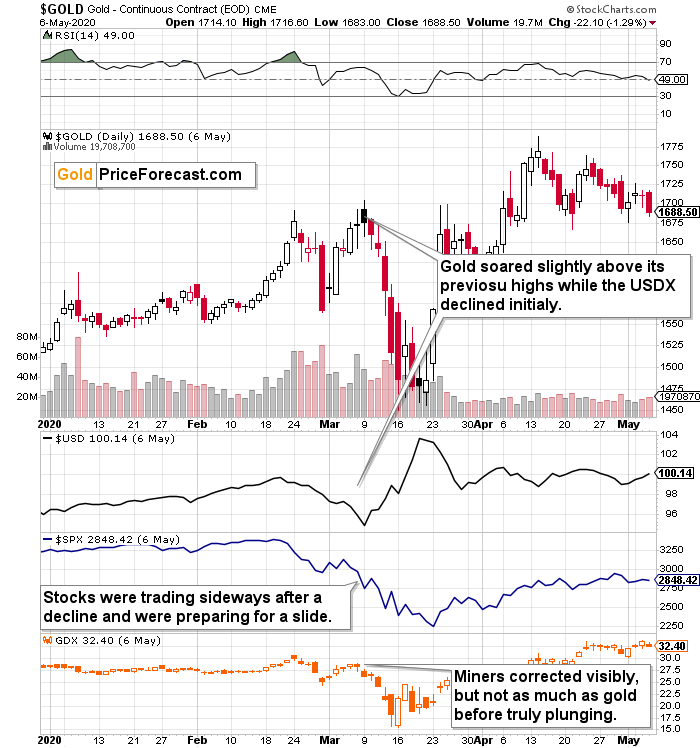

At first, gold soared while the USD Index declined. People ran for the hills, took their gold bars and coins with them, and rushed to buy more while on the way. And I’m only half joking.

There was an initial top and an initial decline, and it was followed by a corrective upswing – a sizable one – which took about a week.

Gold soared initially (late-February – early March 2020), and it moved slightly above its previous high. People were very bullish at that time as it seemed that the world was ending. The world came to a standstill almost overnight! The job numbers were horrible and unprecedented. It made sense to buy gold, right?

Well, gold soared in huge volume, so many people thought that it was a good idea.

Yet, that was the worst moment to buy gold from a short-term point of view, as that was when gold topped, and it then declined several hundred dollars in about a week.

What happened?

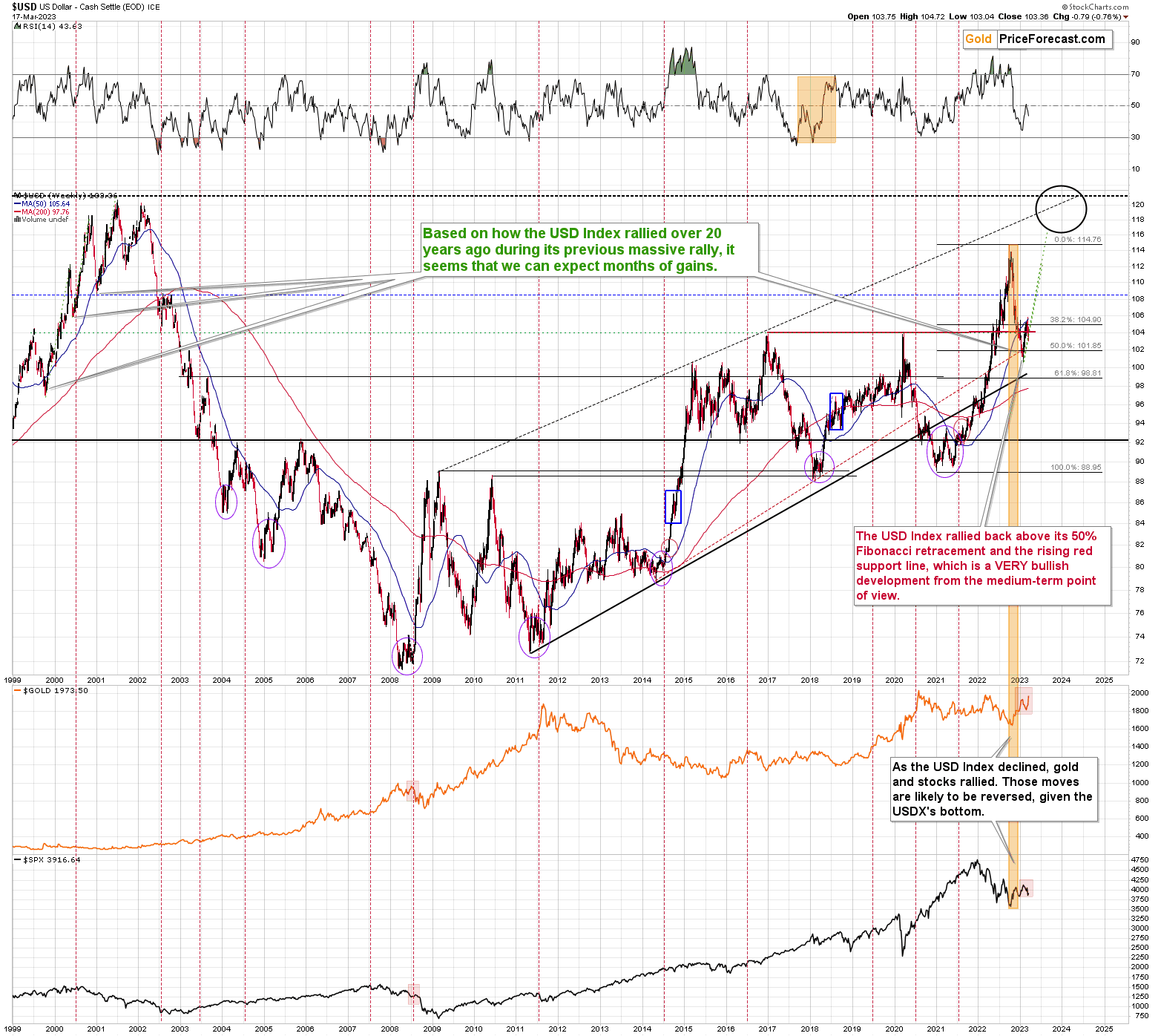

The gold price peaked along with uncertainty. As people moved to the currency that they can and want to actually use in day-to-day transactions – USD – gold plunged and the USD Index soared.

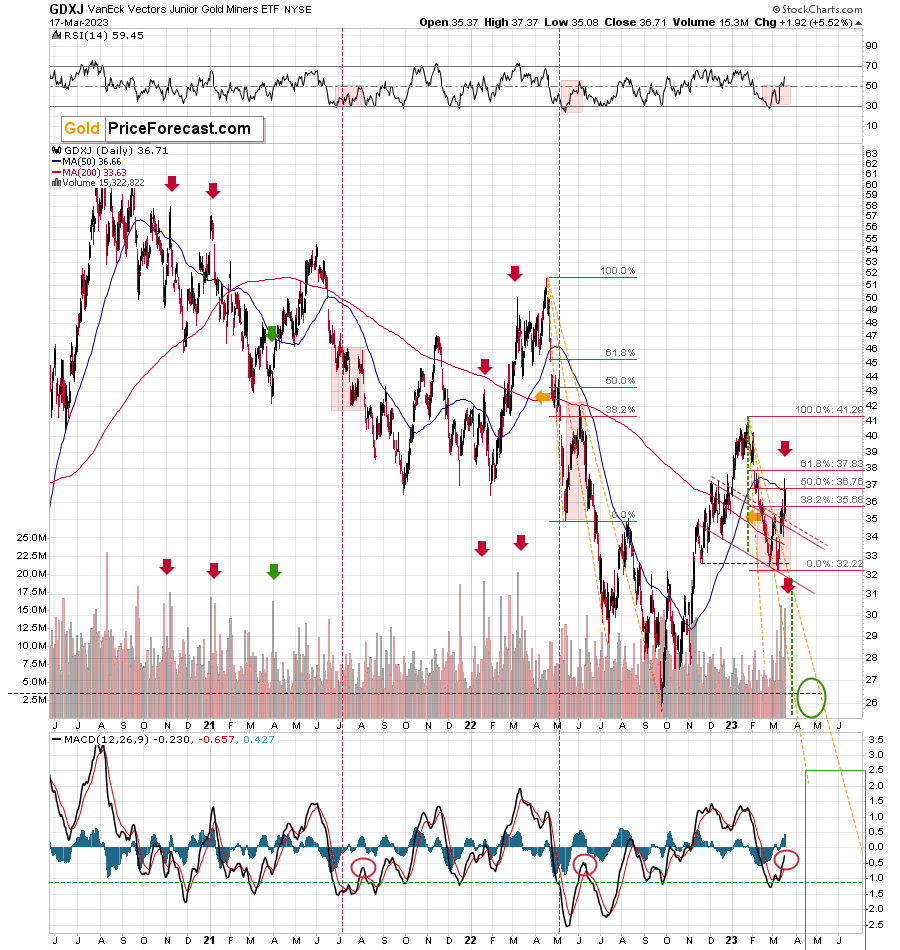

While the gold was still soaring and the USDX was moving lower, we also saw a consolidation on the stock market (that happened after a short-term decline) and a rebound in mining stocks. The rebound in miners (early March 2020) was notable, but it wasn’t nearly as big as the rally in gold.

Then, as gold and stocks declined, mining stocks (in particular junior mining stocks) truly plunged. The value of the GDXJ was pretty much cut in half in about a week.

Please keep in mind the parts that I put in bold while we move to the next crisis – the 2008 one.

Well, what happened?

There was an initial (July 2008) top and an initial decline, and it was followed by a corrective upswing – a sizable one – which took about a week.

While gold was moving sharply higher in September 2008 (on huge volume), the USD Index declined. Also, stocks were moving back and forth after a decline, and mining stocks moved higher in a notable manner but not as visibly as gold did.

In 2008, gold didn’t rally back to its previous highs, but everything else was remarkably similar, even though the two crises were over a decade apart!

It’s simply normal for people to first “run for the hills” and buy gold, and then switch to the USD while selling stocks (and – most of all – silver and mining stocks).

With this context in mind, let’s see where we are now.

People are very concerned about the health of the banking sector – it looks like a severe banking crisis. Is the world ending? It might seem so, but is the fear really as big as it was when the entire globe was in lockdown back in 2008? Not really – the current situation is not as severe as the previous one.

What is gold price doing right now?

Exactly. The. Same. Thing.

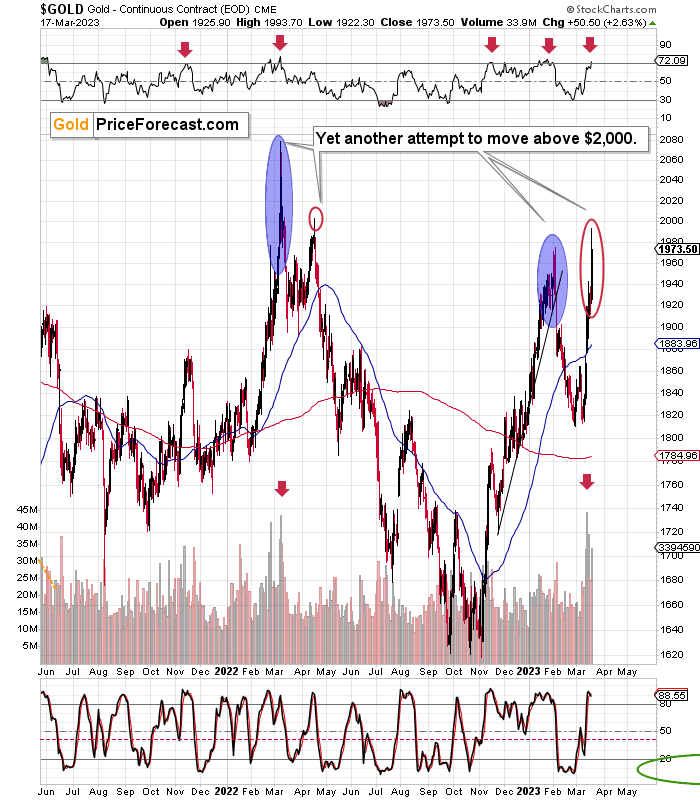

Gold was after an initial decline and downswing and now it’s been rallying for about a week now. This rally was accompanied by huge volume.

Do you see the link already?

Gold moved slightly above its previous high. In fact, in today’s pre-market trading, gold even moved somewhat above $2,000. This doesn’t invalidate the analogy, because the ultimate top for gold relative to the previous high was the only thing that wasn’t very similar in case of both previous crises.

What about the rest? The other markets?

The USD Index dipped (main part of the above chart) just like in mid-2008, right before its sharpest rally in many years.

Stocks (bottom of the above chart) moved sideways after a decline.

And mining stocks?

Miners moved higher, but the size of the move was much smaller than what we saw in gold.

All this means that while it might be difficult to believe (as it’s natural for everyone to focus on what happened recently), what’s happening on the markets right now is a typical reaction to the early stages of crisis-based declines.

The implications are extremely bearish for junior mining stocks.

They are also bearish for the rest of the precious metals sector. However, it’s least unclear how high gold might move in the immediate term.

Still, do you know the saying that time is more important than price – when the time is up, the price will reverse?

The “weekly move” analogy was surprisingly accurate – gold’s final pre-slide rally took about a week. And that’s how much time the current rally took. This means that it’s likely to end today or shortly, anyway.

In fact, we see it even more clearly in the case of the HUI Index and its hourly chart.

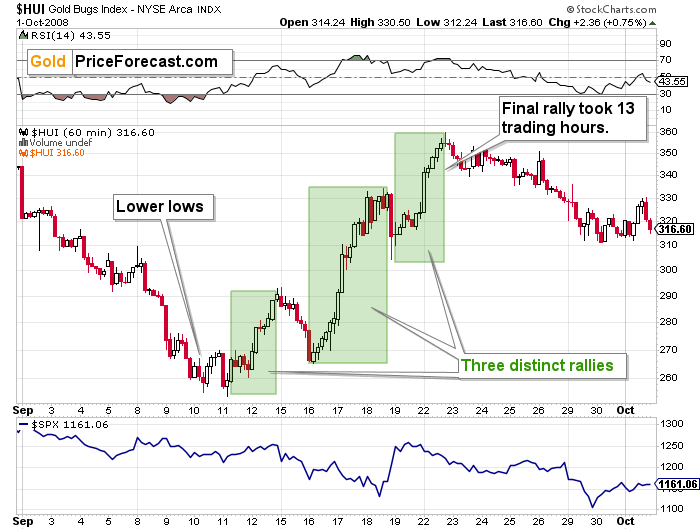

Here’s what the HUI Index (proxy for gold stocks) did back in 2008 before sliding.

The decline ended with lower lows, and there were three distinct rallies. The final one took about 13 trading hours.

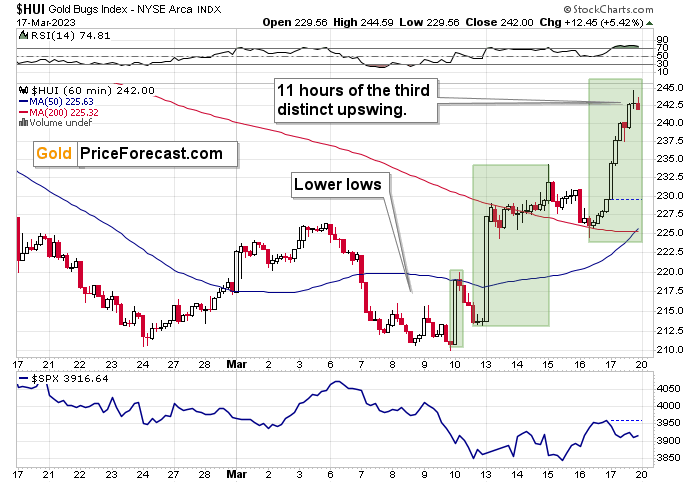

Here’s the current situation.

The decline ended with lower lows, and there were three distinct rallies. The final one took about 11 trading hours SO FAR.

That’s definitely “close enough” for the top to be in at this very moment. However, let’s keep in mind that history might not repeat itself to the letter but rather rhyme, so it could be the case that gold stocks move higher for several more hours before topping. Of course, I can’t rule out a situation in which miners move even higher even for several additional days, but this seems rather unlikely at this point.

Based on the historical analogies to two major crises, it seems that we are very close to the top in mining stocks, or we have already seen it.

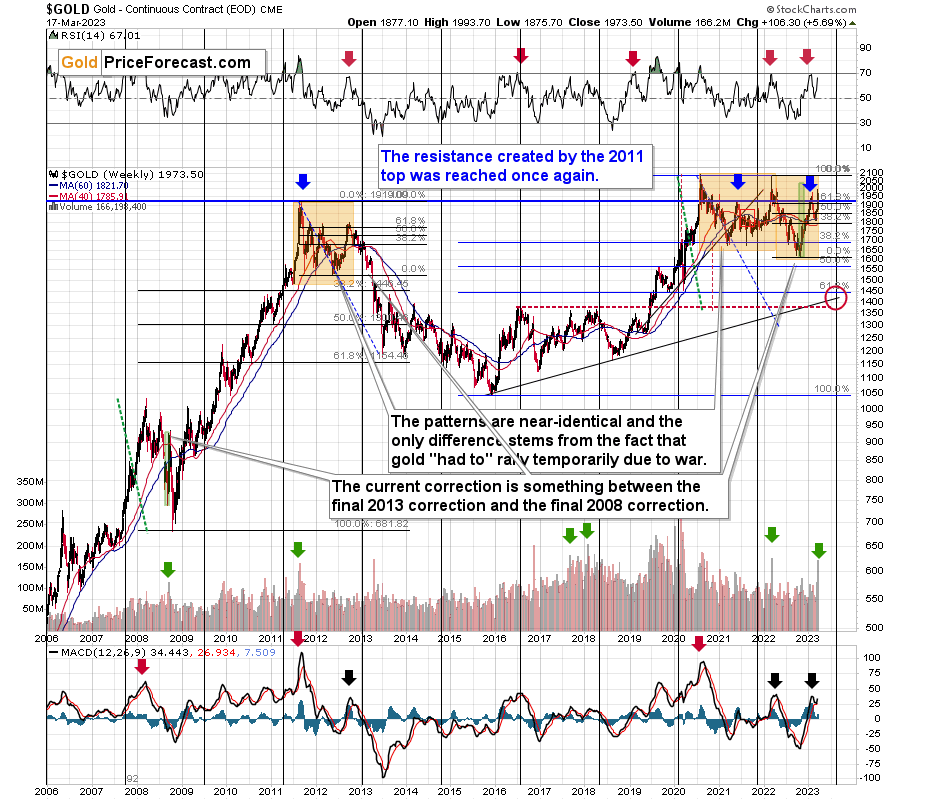

I already wrote a lot about gold’s volume (and how bearish it is given analogies to previous similar situations) on Friday, but here’s a very quick reminder:

The green arrows on the above chart show weeks when gold soared on huge volume. This includes the final pre-slide top in 2008, the 2011 top, as well as the 2022 top. In short, this is generally a bearish indication, not a bullish one.

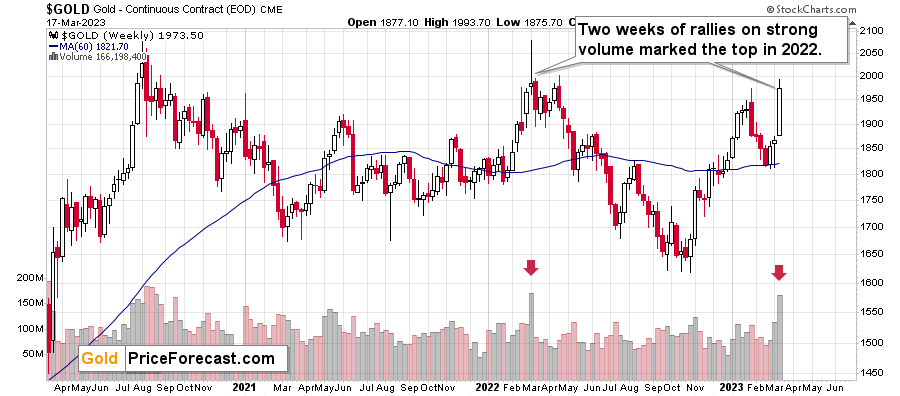

If we zoom in a bit, we see that last year, gold topped exactly on the day of the spike in the volume readings. In fact, the volume was similar.

Last year, the Russian invasion was the source of concern; this year, it's the banking crisis. And just like it was the case back then, it seems that gold has topped along with peak uncertainty/concern, or is about to do so.

On a side note, when you look at the above chart and compare the trend in gold (horizontal) to the one that is visible in the GDXJ ETF chart (a clear downtrend), it’s easy to understand why we haven’t been shorting gold in years, but we have been profitably shorting junior mining stocks many times.

And yes, even though it might appear unlikely, in my opinion this is the perfect moment to enter (not close!) short positions in junior mining stocks if one doesn’t have them yet. (Don’t have a position that’s too big for you, though! If you have a position that you want to have – that’s enough.) In fact, it might be one of the final days when this opportunity is still available.

Again, I know that the “overall feeling out there” might not support this, but please focus on the charts from 2008 and 2020 – what kind of action followed in miners. Yes – the ENORMOUS profit potential for those short positions is fully intact right now.

THIS is the time when victories are made.

When things get tough, and yet you decide to be even tougher.

The follow-up action, profits etc. are just that – a follow-up action.

The true victory comes from doing what is right (here: justified from the risk-to-reward point of view) despite the difficulties (here: current sentiment).

Stay objective.

Stay strong.

And the victory will be yours.

Overview of the Upcoming Part of the Decline

- It seems that we’re seeing another – and probably final – corrective upswing in gold, which is likely to be less visible in the case of silver and mining stocks.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

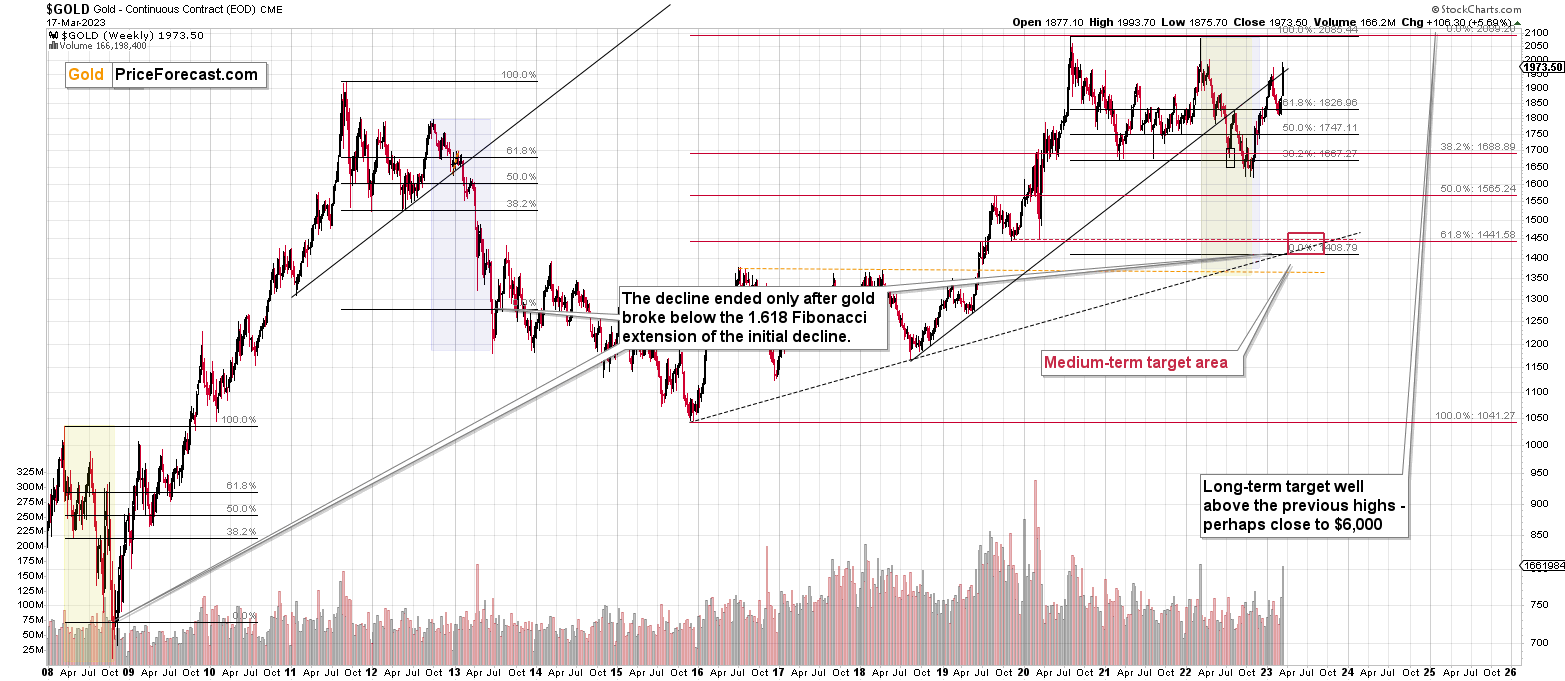

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues), and if they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community, after all), so that more people can contribute to the reply and then enjoy the answer. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, we just took profits from the additional FCX trade and the current short position in junior mining stocks is – in my view – poised to become very profitable in the following weeks, and perhaps days.

This might appear chaotic in the precious metals market right now, but based on the analogy to the previous crises (2020 and 2008), it’s clear that gold, miners, and other markets are pretty much doing the same thing all over again.

The implications of this “all over” are extremely bearish for the junior mining stocks. Back in 2008, at a similar juncture, GDXJ’s price was about to be cut in half in about a week! In my opinion, while the decline might not be as sharp this time, it’s likely to be enormous, anyway, and very, very, very profitable.

===

As a reminder, we still have a “promotion” that allows you to extend your subscription for up to three (!) years at the current prices… with a 20% discount! And it would apply to all those years, so the savings could be substantial. Given inflation this high, it’s practically certain that we will be raising our prices, and the above would not only protect you from it (at least on our end), but it would also be a perfect way to re-invest some of the profits that you just made.

The savings can be even bigger if you apply it to our All-inclusive Package (Stock- and Oil- Trading Alerts are also included). Actually, in this case, a 25% discount (even up to three years!) applies, so the savings are huge!

If you’d like to extend your subscription (and perhaps also upgrade your plan while doing so), please contact us – our support staff will be happy to help and make sure that your subscription is set up perfectly. If anything about the above is unclear, but you’d like to proceed – please contact us anyway :).

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.13; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $13.87; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.83 (stop-loss: none)

SLV profit-take exit price: $16.73 (stop-loss: none)

ZSL profit-take exit price: $32.97 (stop-loss: none)

Gold futures downside profit-take exit price: $1,743 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $10.97 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $25.47 (stop-loss: none)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief