Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

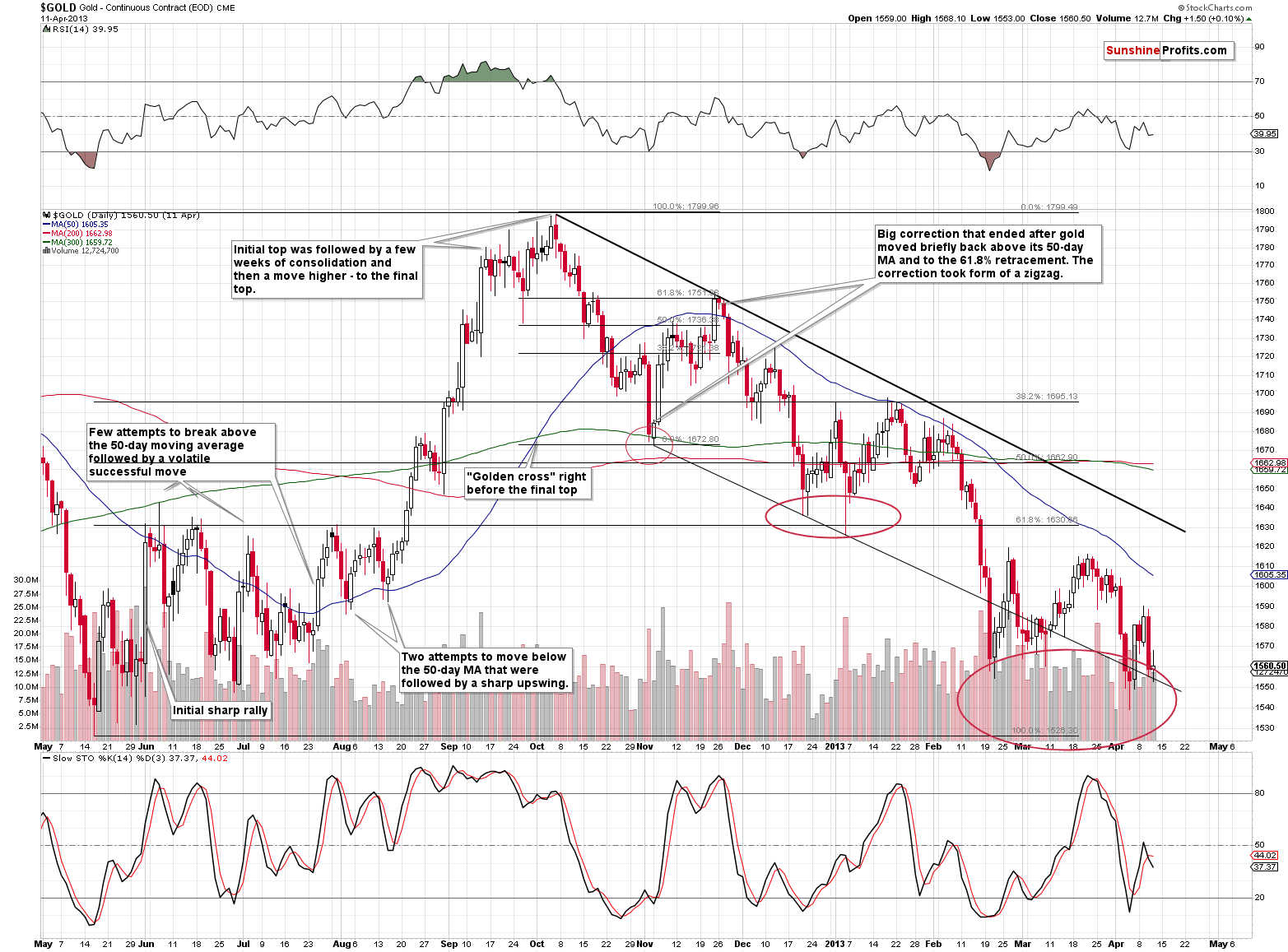

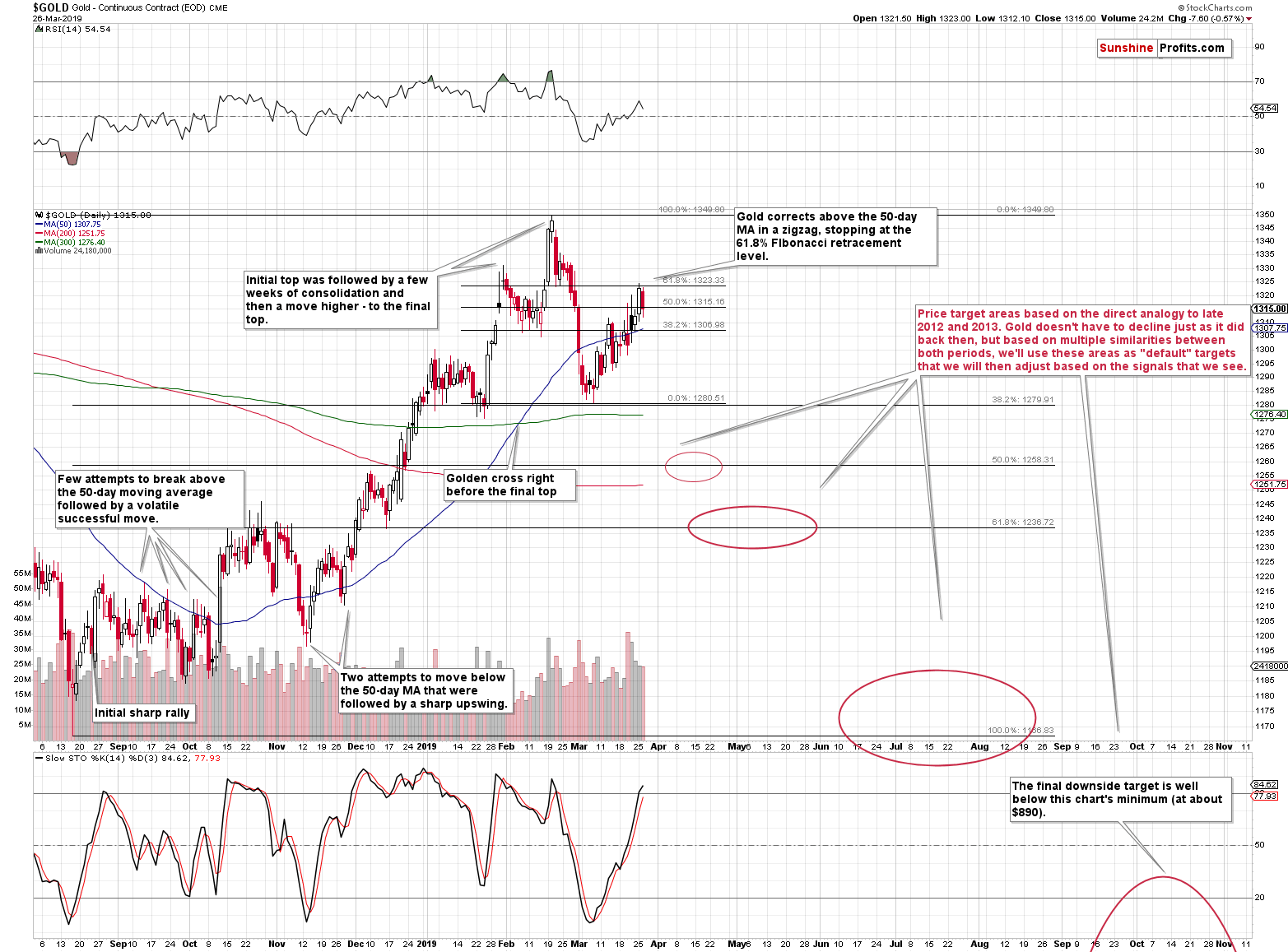

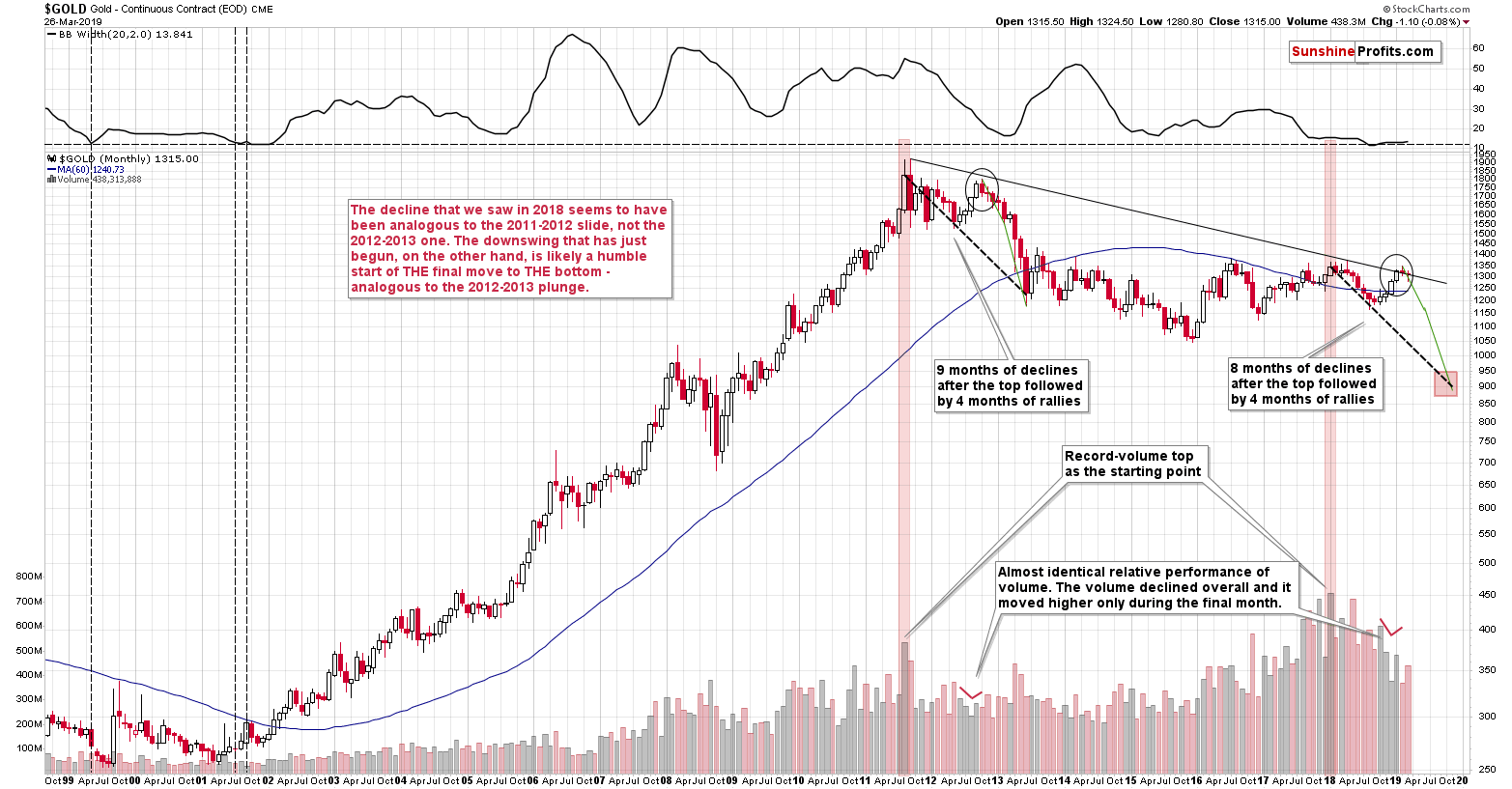

We previously wrote about the situation being similar to 2012 with regard to overall price movement in gold and in particular with regard to the 61.8% Fibonacci retracement that has been just reached. The yellow metal declined by a few dollars yesterday, just like it did after topping out in November 2012. Higher prices were never seen since that time, which means that there was no single day giving a better opportunity to sell gold. But… Gold miners just moved higher yesterday, even though gold declined, which is a classic buy sign.

The devil is in the details. The miners moved higher, but barely so. The move higher in the HUI Index was less than half of one percent and the GDX ETF was up by just 9 cents. It’s a rally, but a tiny rally. And… What happened right after the 2012 top in gold that we described previously?

The 2012-2013 – Now Link: The Topping Action in Gold and Gold Miners

The top that we described yesterday, formed precisely on November 23, 2012. On the following session – November 26, 2012, gold declined. But what did the mining stocks do on November 26, 2012?

They all declined initially but rallied before the end of the session. The HUI Index closed just 0.17% lower and the GDX ETF was up by 1 cent – a tiny rally. This post-top day in gold was very similar on both occasions. In case of the HUI Index, the November 23, 2012 session was the one that was the final top, and in case of the GDX ETF, the final top formed on November 26, 2012.

The link remains intact and the implications remain bearish.

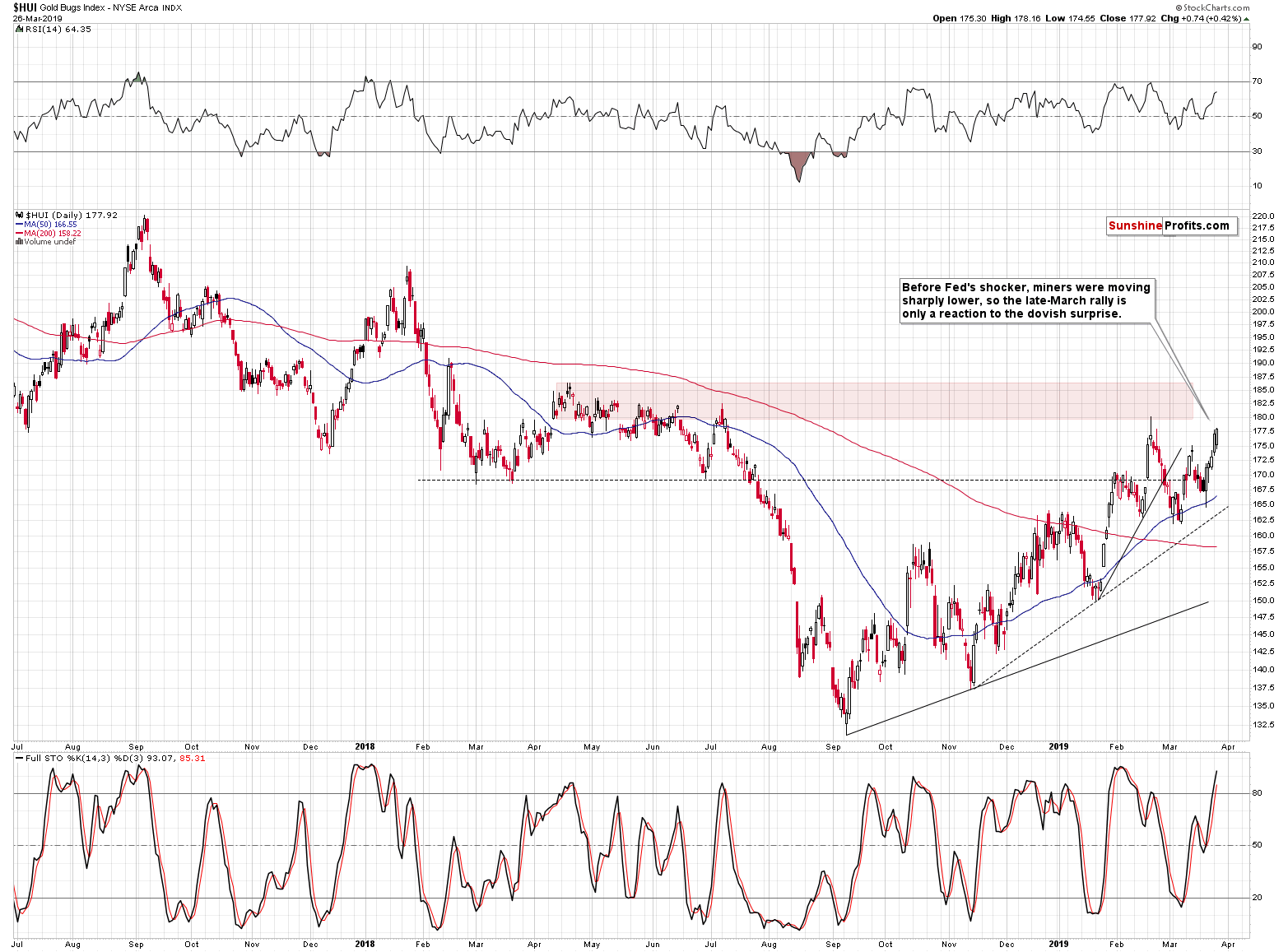

Gold Miners Review: The Cost of Capital Implications of the Fed U-Turn

The most notable development that took place recently was the dovish surprise from the Fed. Out of the entire precious metals market, miners were declining most profoundly right before the Fed surprised the markets. They really wanted to slide. The reaction of the entire precious metals sector to Fed’s announcement was weak, but the reaction of mining stocks appears stronger than the one of silver and gold. Is there any meaningful reason for that, or is this simply a sign of strength of the miners?

Let’s see… What is the one key benefit that is always mentioned when someone is advocating investing in physical metals? That it’s nobody else’s liability. And you know what companies – including mining stocks – have? Liabilities. Companies, including miners, finance their operations with debt. Of course, not only with debt, but also with shares, private placements and so on, but the debt is one of the instruments company’s management can – and does – use to raise capital.

More dovish Fed means better terms at which companies might finance their operations. The implications of the Fed’s surprising change in policy are more meaningful for mining stocks than they are for the underlying metals. Consequently, it’s normal for the miners to react in a more meaningful way to the prospect of a loosening monetary policy. Taking the above into account, miners’ reaction was still relatively weak.

Consequently, in light of both: strength of the miners’ reaction to the Fed’s interest rate announcement, and the analogy to what happened in late November 2012, it doesn’t seem that yesterday’s strength of the mining stocks relative to gold should be taken at its face value.

Gold stocks moved a bit above the highest closing price of February, but the breakout is definitely not confirmed so far, so it’s not really meaningful. And the odds are that it will be invalidated, instead of being confirmed.

Let’s check how much changed from the long-term point of view.

Practically nothing. The second month of declines in late 2012 was the one when there were moves up and down, but overall gold didn’t move much lower on a closing basis. We can say something similar about March. Gold is down just $1 this month, which fits the above analogy very well. If it wasn’t for the Fed’s shocker, we would have probably seen lower gold prices instead. In this way, gold would have caught up with the pace of decline from late 2012, when in the first one to two months of the decline, it erased its last month of gains. Then again, we still have four more sessions left in March, so gold might still move lower after all, catching up with the average monthly pace of the decline that we have witnessed in 2012.

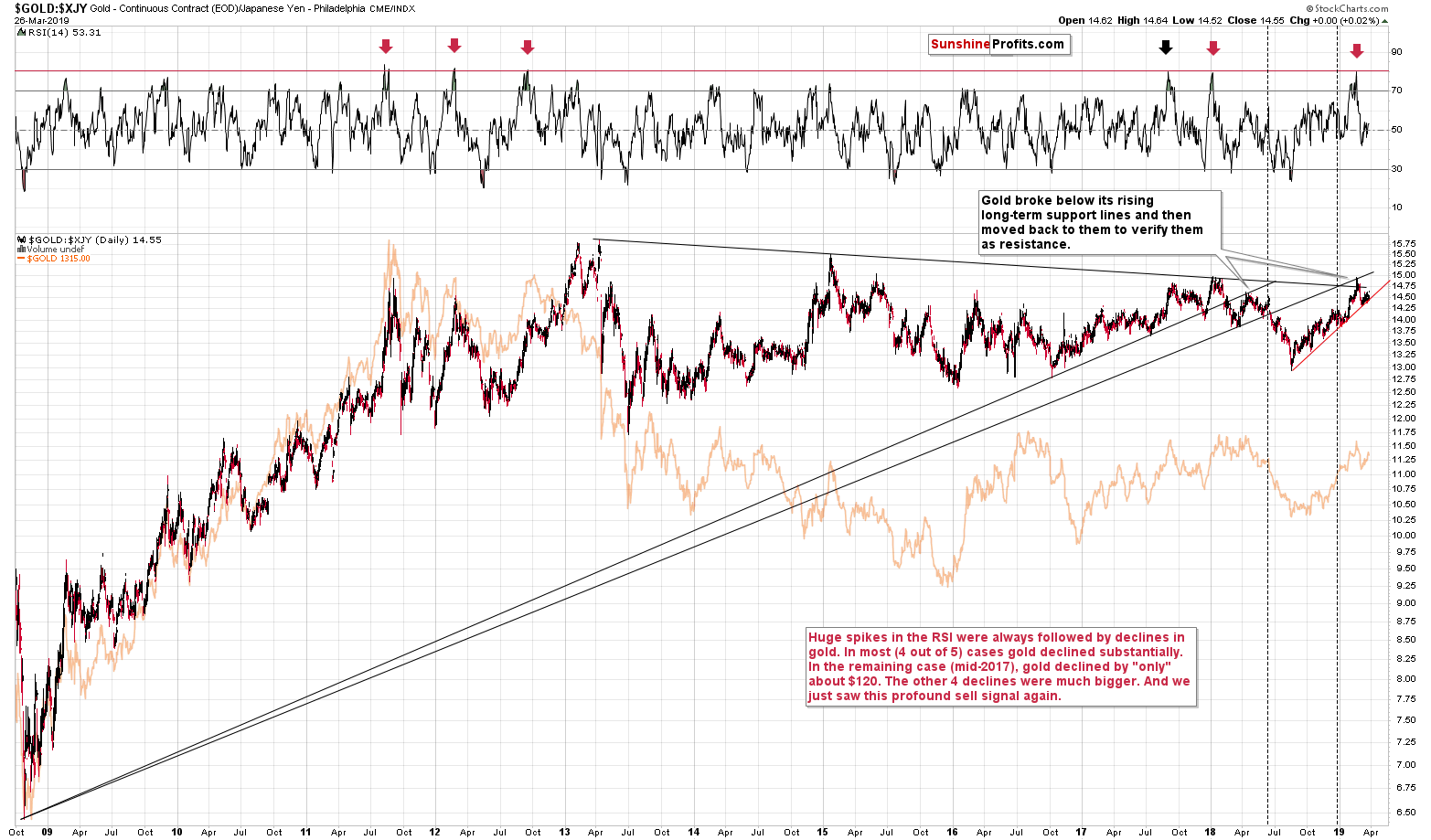

Gold, Japanese Yen and the USD Index

Looking at gold’s price in terms of the Japanese yen, we see that gold is currently trading very close to its rising red support line based on the previous lows. The lows are more aligned to the rising line in case of the yen perspective, than in the case of our regular USD view, so any breakdown here is likely to be quite meaningful.

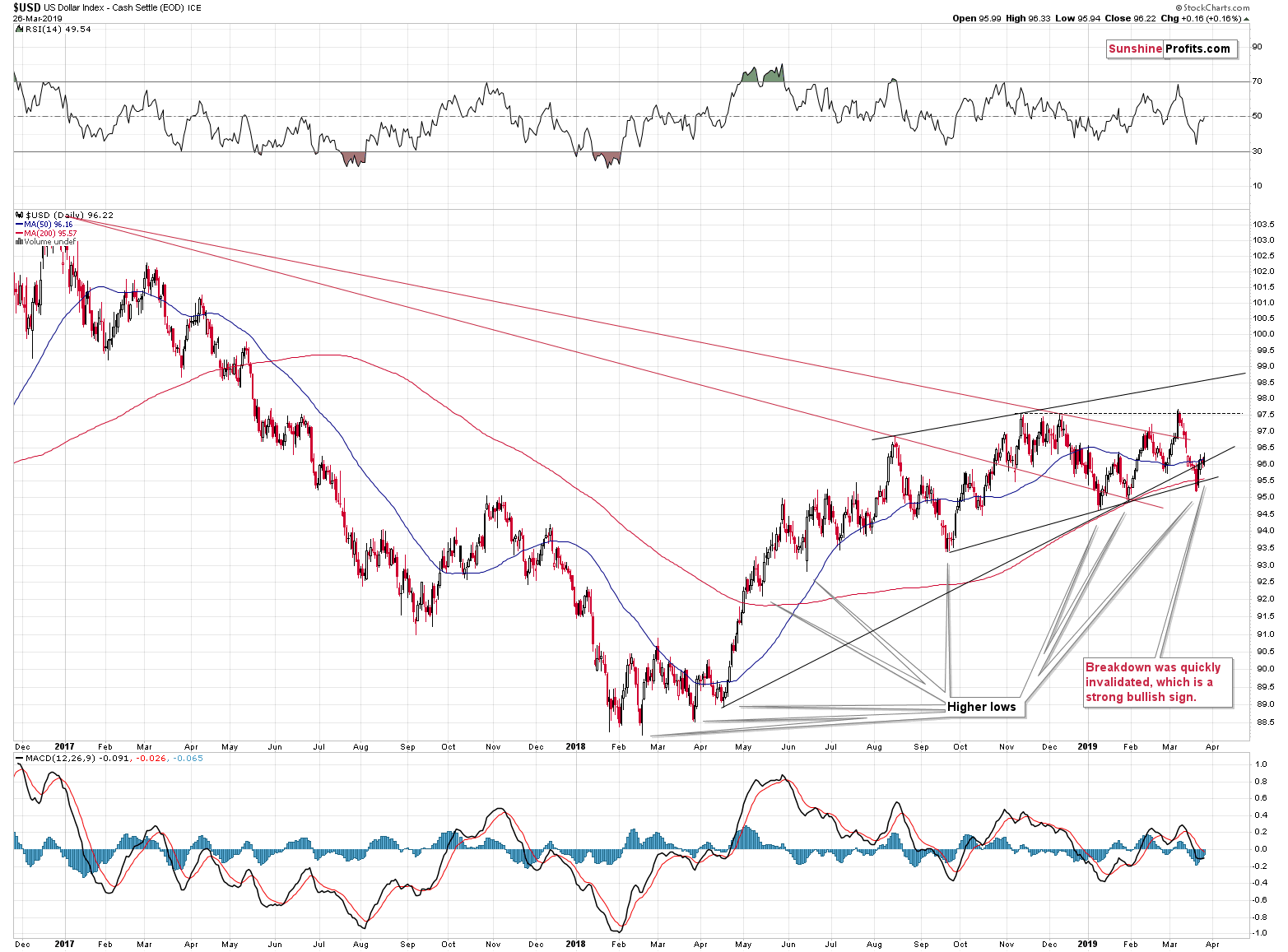

And we are likely to see one based on the factors that we are writing about today, and what we have discussed previously. In particular, please note that gold’s reaction to the moves in the USD Index may be delayed, but it’s extremely unlikely to be absent. And the USD Index has practically already told us what it’s about to do next.

The US currency is already higher than it was before the Fed announced the change in its policy. Such a change should have sent the USD much lower, just like it did very initially. If the USD Index resisted such a massively bearish signal, then what could really prevent its rally? It’s almost inevitable – like a coiled spring.

Technicals confirm it as well. Invalidations of breakdown are very strong bullish signs and we recently saw two of them. One support line was based on the April 2018 low and the late-January 2019 low, and the other one was based on the September 2018 low and the January 2019 lows. The USD Index moved below both of them and then rallied back up – despite the Fed’s announcement. This is a profoundly bullish sign for the US currency.

Summary

Summing up, it’s almost certain that the next big move lower has already begun and that the 2013-like slide is in its early stage. Based on the updated version of the 2013-now link, the implications are even more bearish than we had initially assumed. Even the tiny move higher in the mining stocks is in tune with what happened in late November 2012. The downside target for gold remains intact ($890), and the corrective upswing that we just saw seems to be rather natural part of the bigger move lower – not a beginning of an important move higher. And it seems that the corrective move higher in the PMs is either over or about to be over shortly.

Gold’s and miners’ very weak reaction to Fed’s surprisingly dovish remarks strongly confirms the bearish outlook for the following weeks. The outlook for the USDX is very bullish and it will almost certainly translate into lower PM prices. The analogy to 2012-2013 price moves suggests that the waiting for the PMs’ decline is practically over.

As we explained on Friday, if gold declines to $1,240, this might be an opportunity to go long, but it’s too early to say for sure at this time.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,357; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $23.68

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $24.17; initial target price for the DUST ETF: $76.87; stop-loss for the DUST ETF $15.47

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $35.67

- JDST ETF: initial target price: $143.87 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The yield curve followed suit of the Fed and also inverted. Inverted yield curve is a sign of an incoming recession, they say. However, what is the background of this yield inversion and how will gold react to its emerging story?

Yield Curve Has Inverted. Will Gold Rally Now?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager