Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Just when the price of gold was supposed to form an inverse head and shoulders pattern that would trigger a bigger rally, the yellow metal declined, making it clear that such a pattern does not exist at this time. However, there’s more to yesterday’s price moves than just the fact that the H&S pattern was not formed.

Let’s take a look at what happened (chart courtesy of http://stockcharts.com).

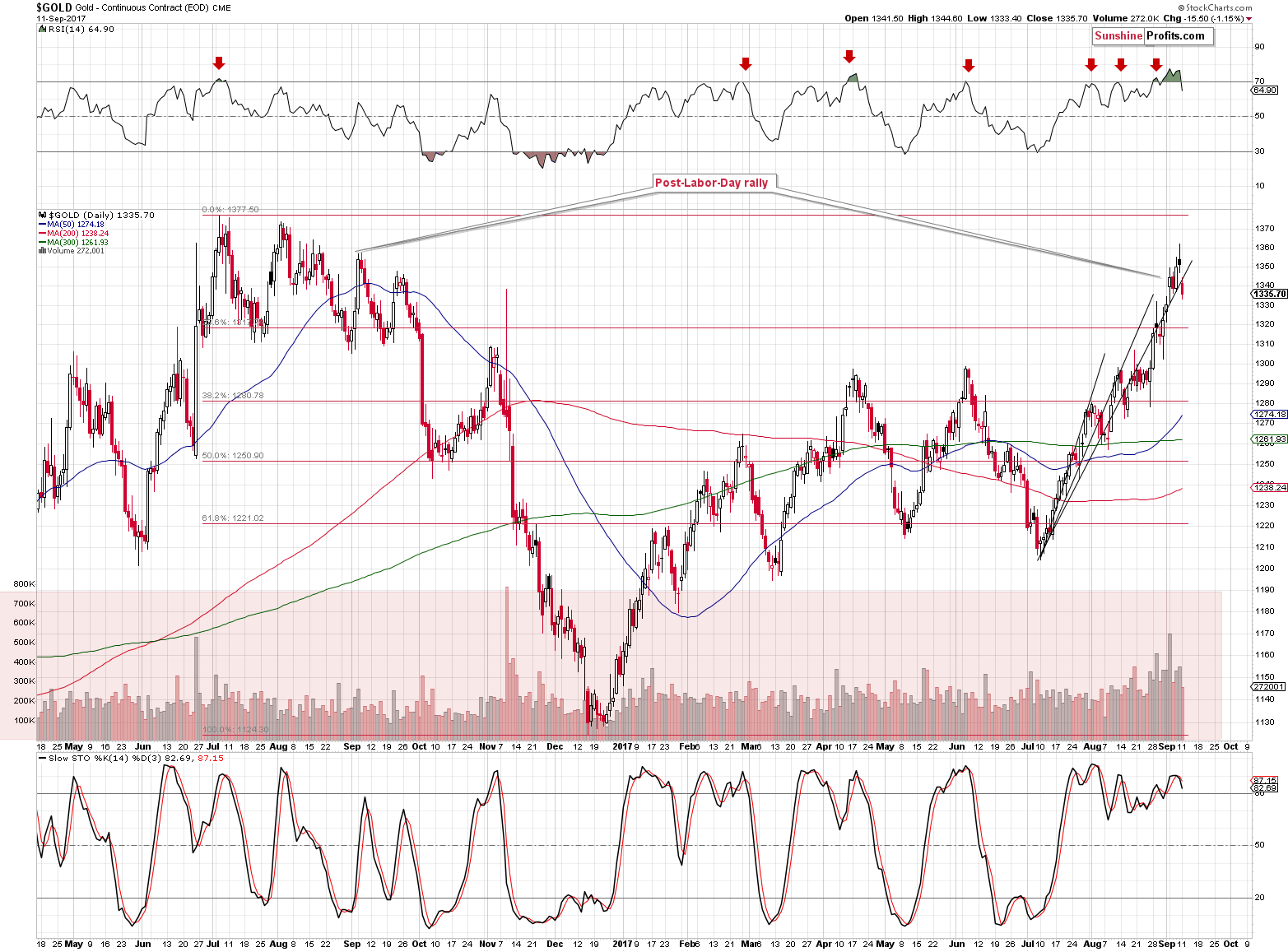

Gold declined erasing several days of gains, and the RSI and Stochastic indicators generated sell signals. The decline might finally be starting this time, however, the decline is not big enough to clearly confirm that. Once we see a move below $1,300, it will be clear that the time for the corrective upswing (with the main trend being still down) is over. What we’ve seen so far seems to be just the beginning.

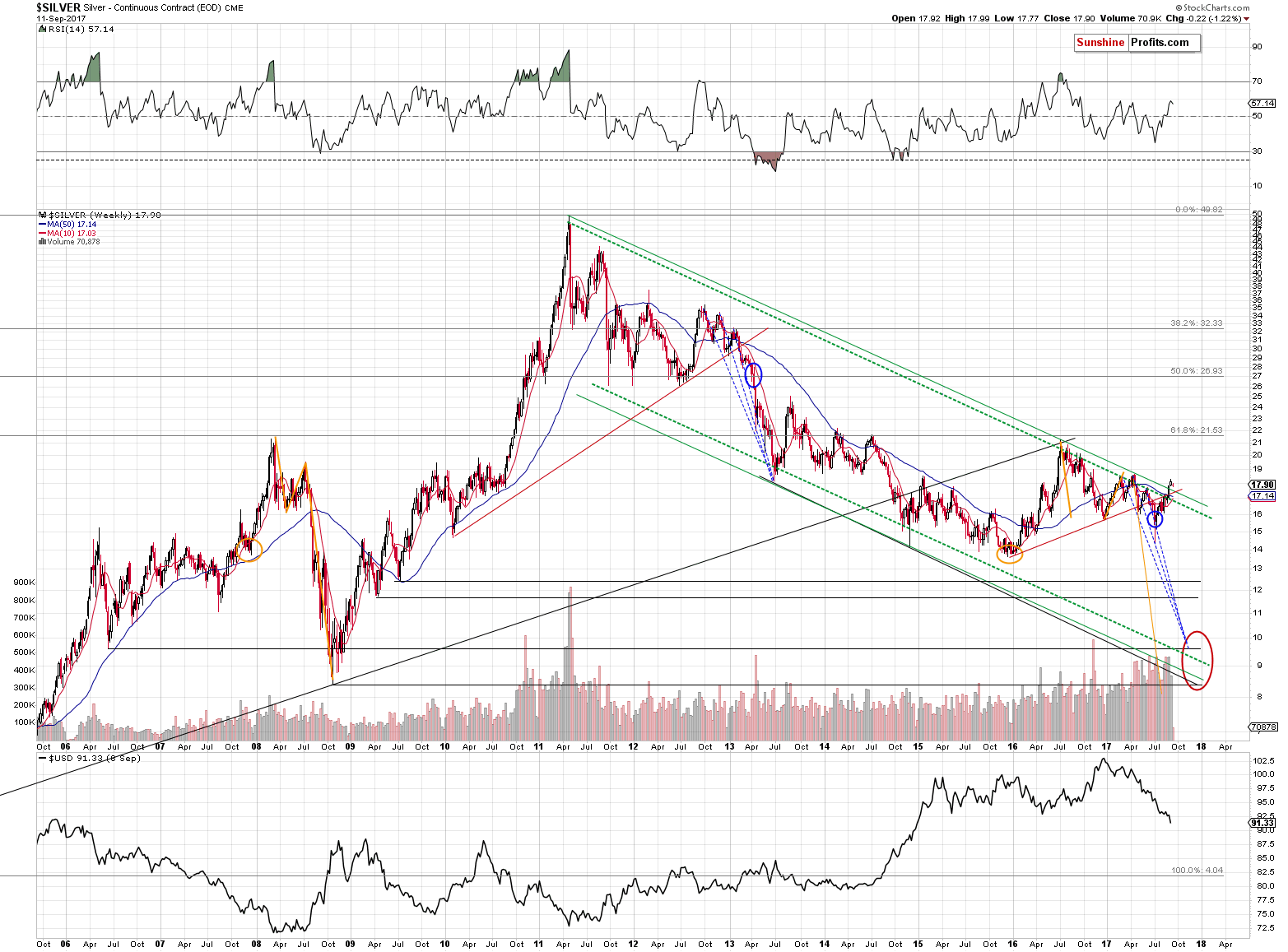

In the case of silver, the breakout above the declining long-term resistance line has not yet been invalidated, but we expect it to be invalidated shortly. Silver is known for its fake breakouts and breaking above the key resistance line just before the final downleg and the final bottom seems like a very “silver thing to do”.

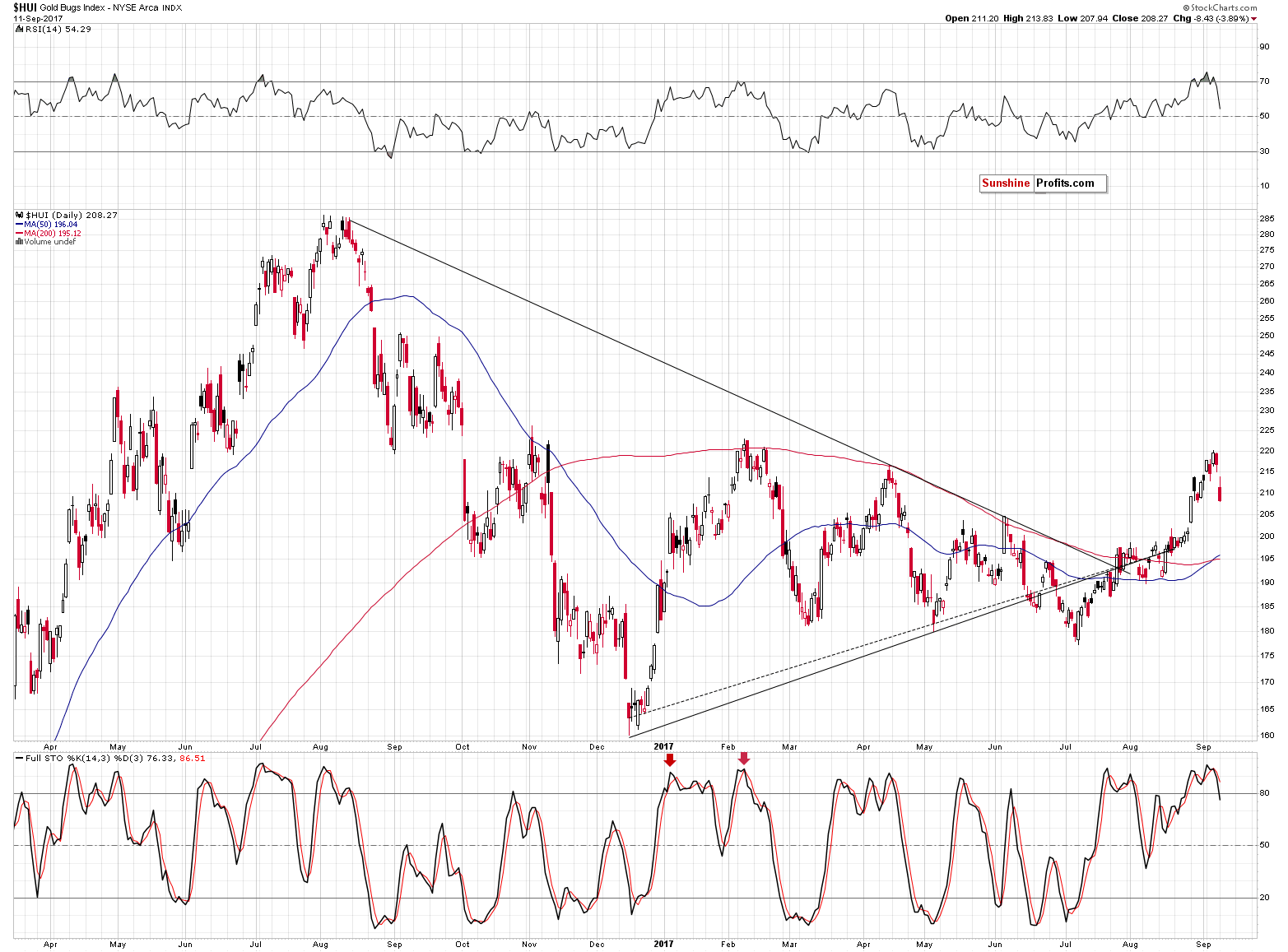

In the case of gold stocks, we finally have something clearer to report on. Namely, the decline showed that miners are underperforming gold once again. Yesterday’s decline alone was enough to push the HUI Index below the August 28 close. Gold is more or less halfway there (taking into account the move from the recent high to the August 28 close).

The miners’ underperformance is something that we often see before and during bigger declines, so it seems likely that what we saw yesterday is just the beginning. The sell signals from Stochastic and RSI seem to confirm it.

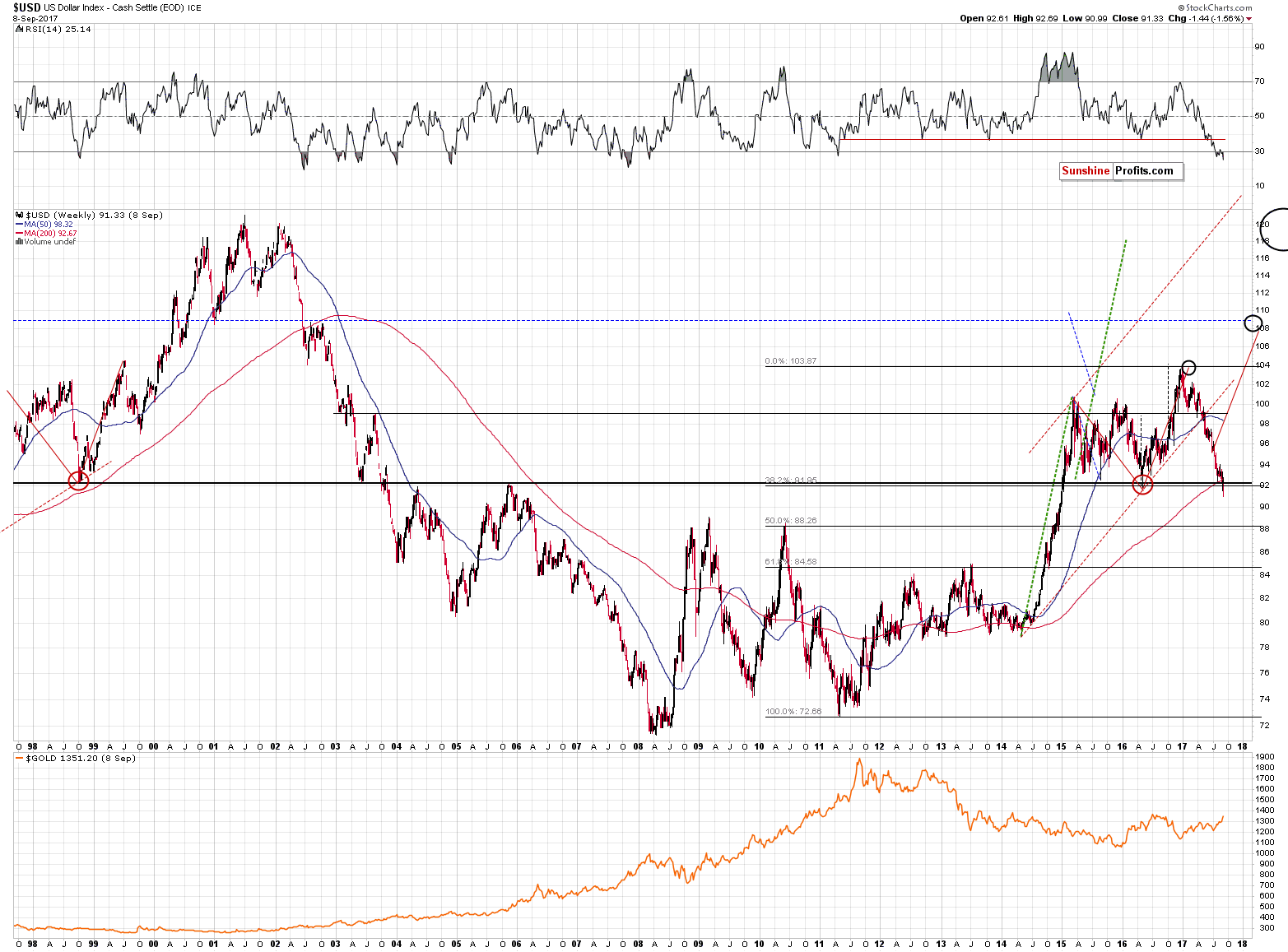

Finally, it’s very interesting to see how the situation is developing in the case of the USD Index. In Friday’s alert, we wrote the following:

The USD Index moved below the 1998 weekly low, the 2003 weekly low, the 2004 weekly high, the 2005 weekly high and both: 2014 and 2015 weekly lows, which is bearish. However, the breakdown was not confirmed even by this week’s closing price and in case of a breakdown of this importance, it seems that at least another weekly close below them (or a move visibly below them) would be required to confirm the breakdown. This seems doubtful given that yesterday was the daily turning point for the USD Index and the weekly RSI indicator has been suggesting extremely oversold conditions for several days.

The USD Index moved visibly higher yesterday and it doesn’t take much strength for the USD to invalidate the mentioned breakdowns. The key levels (weekly closing prices) that should be invalidated are: 91.66, 92.04, 92.22, 92.28, and 93.03. Yesterday’s close of 91.85 means that if the USD closed the week without any changes, it would already invalidate the lowest of the above levels. It’s something, but it doesn’t seem enough to convince most traders about the start of a new major rally in the USD. While the USD Index hasn’t rallied enough yet, it seems that it will rally enough shortly – its ridiculously oversold not only on a short-term, but also on a medium-term basis and it declined in a parabolic fashion – that’s not sustainable. Once we see the USD visibly above 93 (say, a close at 93.5), a much bigger rally is likely to follow.

Summing up, the interest in gold seems to have spiked recently, along with the Google searches for the phrase “gold trading”, gold’s volume (both daily and monthly) and with the price of gold itself. The latter reacted visibly to the USD’s daily strength and mining stocks reacted even more. It seems that the rally in gold is finally over and the USD’s close visibly above 93 and gold’s close below $1,310 and $1,300 will serve as a confirmation.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,366; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $38.74

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

On Sunday, hurricane Irma made landfall in Florida. What does it mean for the gold market?

=====

Hand-picked precious-metals-related links:

Gold eases as investors pile into equities

Money Managers' Bullish Gold Positioning Hits 2017 High

Bank of America Merrill Lynch maintains $1,400 an ounce outlook for Gold

Lonmin Woes Make Its Stock the Top Sell Call in Johannesburg

Tahoe shares surge after Guatemala ruling

Canada's Alamos Gold buys Richmont in a deal valued at Cdn$905 million

Centerra shares jump again on confirmation of Kyrgyz settlement

=====

In other news:

The dollar index bounces back from multiyear lows

World stocks hit record highs as Irma weakens

$150 Billion Misfire: How Forecasters Got Irma Damage So Wrong

Why American Workers Pay Twice as Much in Taxes as Wealthy Investors

Three Reasons the Global Rally Can Keep Going

UN Security Council unanimously votes to step up sanctions against North Korea

Goldman says so many investors are expecting a market correction that means it likely won't happen

U.K. Inflation Leaps To Four-Year High Ahead of Bank of England Rate Decision

Private Assets Are the New Hedge Funds

Job Hunting? The Employment Backdrop Is the Best Since 2008

Apple set to unveil anniversary iPhone in major product launch

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts