Briefly: in our opinion, full (100% of the regular position size) speculative long positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

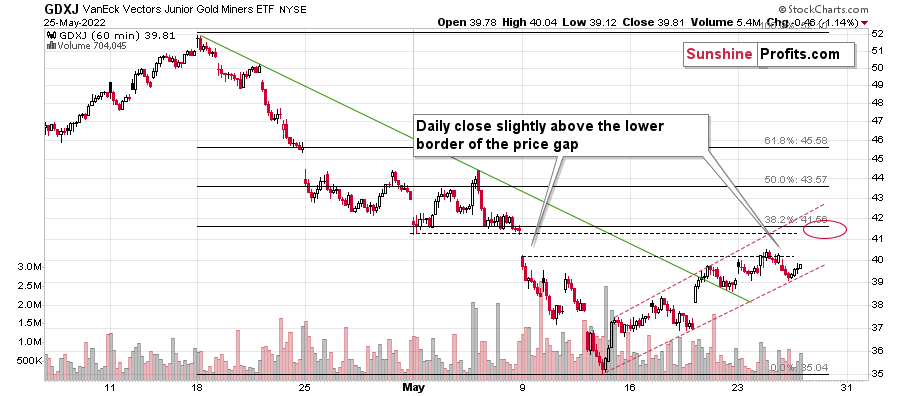

Let’s start today’s analysis with the very short-term GDXJ picture, as that’s the one that seems most informative given the current situation.

The GDXJ moved down by a bit over 1% yesterday, but as you can see on the above chart, this decline was well within the rising uptrend. The GDXJ stopped at its rising support line and then moved back up in the final part of the session.

Consequently, what happened wasn’t particularly bearish.

In fact, thanks to the last couple of days – and the consolidation that we’ve seen in them – it seems that junior miners are now ready to rally once again. After all, no market moves up or down in a straight line, there are corrections and consolidations along the way.

In other words, we can summarize the current outlook for the GDXJ ETF as “almost there”.

In fact, we see the same thing on other charts as well.

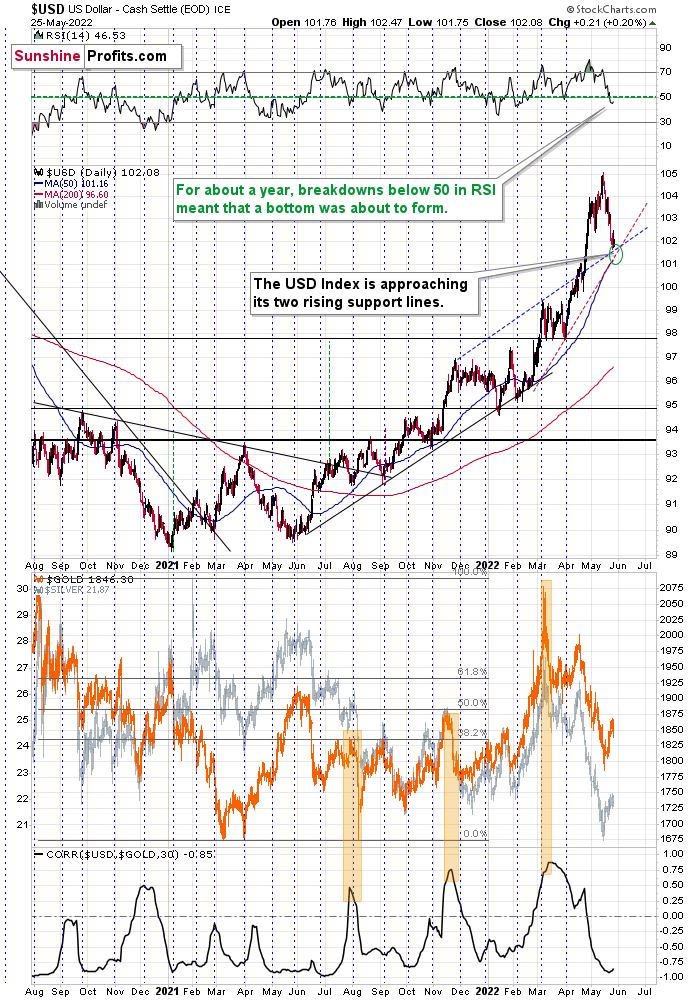

The USD Index is “almost there” with regard to its combination of support levels, which I marked with a green ellipse.

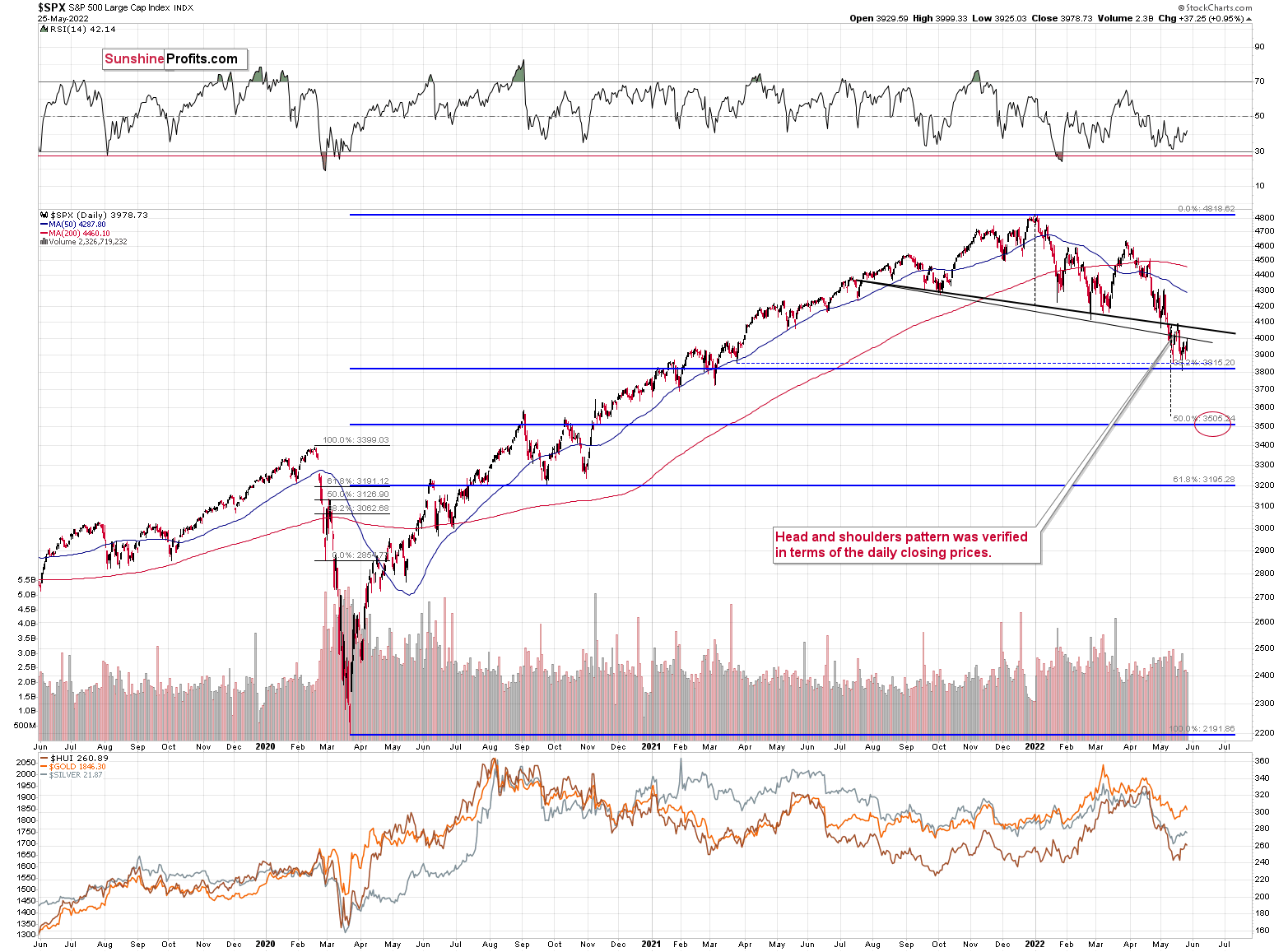

The S&P 500 has moved slightly higher recently, but a really strong resistance is still a bit higher. Namely, it’s the neck level of the previously broken head and shoulders pattern in terms of the daily closing prices. This resistance line already stopped a previous small rally, and it could be the case that it will be verified one last time – just like what we saw in the final part of the early-May consolidation.

This way, the very recent history (the above-mentioned early-May consolidation) would be repeated to a considerable extent, and that’s what the markets do very often – they rhyme.

If stocks are “almost there” and the USD Index is “almost there”, it’s quite natural for mining stocks to be “almost there” too.

What about gold? – one might ask, and it would definitely be a valid question.

Just like what junior miners did yesterday, gold has just moved to its rising support line. In fact, gold moved slightly below it and then it came back above it, invalidating the breakdown. The jury is still out as today’s session hasn’t even started (in the U.S.), let alone finished, but given the previous intraday move back above the support line, the odds are that the breakdown will be invalidated and that an immediate-term rally will follow.

I’m not married to this outlook, though. If we see confirmed signs of weakness, I might reverse the current long position, take profits off the table, and enter short positions even if our target is not reached. After all, this is a very strong medium-term downtrend that we’re (still) betting against, so it’s particularly important to be on the lookout for any signs of weakness.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Parallel Universe

While investors continue their countdown until the Fed pivots and resumes QE, in some alternative reality, it's perceived as bullish for risk assets. Sure, the short-term sugar high of more free money should uplift sentiment. However, I've noted on numerous occasions that the long-term consequences would be dire.

Thus, while investors await a superhero that's unlikely to arrive, the ramifications of unanchored inflation should prove troublesome over the medium term. To explain, the FOMC released the minutes from its May 3-4 monetary policy meeting on May 25. The report revealed:

“Participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook.”

In addition:

“Participants observed that inflation continued to run well above the Committee's longer-run goal and that inflation pressures were evident in a broad array of goods and services. Various participants remarked on the hardship caused by elevated inflation and heightened inflation uncertainty – including eroding American families' real incomes and wealth and making it more difficult for businesses to make production and investment plans. They also pointed out that high inflation could impede the achievement of maximum employment on a sustained basis.”

As a result, 50 basis point rate hikes are now the consensus for “the next couple of meetings.”

Please see below:

Likewise, Fed Vice Chair Lael Brainard conveyed a similar message on May 25. She said:

However, it's important to remember that Fed officials' primary objective is to calm inflation. They don't want to crash the stock, bond, or commodities markets; the latter outcomes are simply collateral damage of what must be done to curb the pricing pressures. To explain, I wrote on Dec. 23:

The Fed’s only hawkish goal is to calm inflation. When inflation was running hot and most Americans bought into the “transitory” narrative, Fed officials exuded confidence. However, when consumer confidence sunk to a 10-year low and inflation became political, the Fed changed its tune. As a result, Powell wants to reduce inflation while tightening as little as possible (3% to 4% inflation may be considered acceptable in 2022).

Thus, the Fed’s hawkish crusade has always been dependent on the path of inflation. Therefore, if inflation fades into the night, officials can turn dovish, and the bull market can resume on Wall Street. To that point, the FOMC minutes also stated:

“Most participants indicated that their business contacts had continued to report that substantial increases in wages and input prices were being passed through into higher prices to their customers. A few participants added that some of their contacts were starting to report that higher prices were hurting sales.

“A number of participants observed that recent monthly data might suggest that overall price pressures may no longer be worsening. These participants also emphasized that price pressures remained elevated and that it was too early to be confident that inflation had peaked.”

As a result, while it’s “too early to be confident,” Fed officials, like investors, continue to search for signs of positive momentum. Moreover, Atlanta Fed President Raphael Bostic said on May 23 that he supports 50 basis point rate hikes in June and July.

“I’m at 50 basis points as long as the economy proceeds as I think it’s going to,” said Bostic. “If inflation starts moving in a different direction than it is right now, I’d have to be open to us moving more aggressively….

“It’s hard to know exactly how far or how hard we are going to push. But I think getting us somewhere in the 2% to 2.5% range by year’s end would be a good place for us to get to.”

However, he also opined that a wait-and-see approach could prove prudent in the months that follow.

Please see below:

Thus, Fed officials are open to pausing their rate hike cycle. For context, Bostic’s expectation of a U.S. federal funds rate “somewhere in the 2% to 2.5% range by year’s end” still implies eight to 10 rate hikes in 2022. Therefore, it’s not dovish.

However, while investors will applaud Fed officials’ willingness to “observe and adapt,” nothing has changed. It was always about inflation, and it’s still about inflation.

For example, Fed officials were split about one rate hike when they made their projections in September. Moreover, in the months before that, they expected to taper their asset purchases in late 2022 and raise interest rates in late 2023. As a result, their read on inflation shouldn’t instill much confidence.

For context, I wrote on Nov. 4:

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

Therefore, while the potential for three-straight 50 basis point rate hikes is profoundly hawkish, the Fed still underestimates the challenges that lie ahead. For example, S&P Global released its U.S. Composite PMI on May 24. I noted on May 25:

And:

This data was collected from May 12-23. Therefore, inflation is still running away from the Fed, and three rate hikes (25 basis point increments) have done little to alleviate the pricing pressures.

Second, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on May 24. The headline index declined from 14 in April to −9 in May, which is bearish for Fed policy. However, the report also revealed that “The average growth rate of prices paid increased notably in May. Firms also reported higher average growth in prices received in May.”

On top of that: “The wage index also remained elevated, indicating that a large share of firms continue to report increasing wages.”

Please see below:

Likewise, the Richmond Fed also released its Fifth District Survey of Service Sector Activity on May 24. The headline index decreased from 24 in April to 10 in May. However, while the wage index declined, the price indexes remained materially elevated.

Please see below:

In addition, the U.S. Census Bureau released its residential home sales report on May 24. Moreover, while sales of new single‐family houses declined by 16.6% month-over-month (MoM) in April, the average and median selling prices hit new all-time highs.

Please see below:

Also, despite three rate hikes by the Fed, are these the kind of headlines that you see when inflation has calmed down?

Source: The Wall Street Journal Twitter

Source: The Wall Street Journal Twitter

Finally, Bain semiconductor analyst Peter Hanbury told CNBC on May 24 that the world’s largest foundries — including Taiwan Semiconductor, Samsung and Intel — are considering further price hikes. He said:

“Foundries have already increased prices 10%-20% in the past year. We expect a further round of price increases this year, but smaller (i.e. 5%-7%).”

He added: “The chemicals used in [chip] manufacturing have increased 10%-20%. Similarly, the labor required to build new semiconductor facilities has also seen shortages and increased wage rates.”

As a result, PCs, cars, toys, consumer electronics, appliances, and many other products could sell at higher price points in the near future.

Please see below:

The bottom line? While 50 basis point rate hikes are likely done deals in June and July, a realization will only put the U.S. federal funds rate at 1.83%. With annualized inflation at 8%+, calming the price pressures with such little action is completely unrealistic. In fact, it’s never happened.

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) nearly always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In conclusion, the PMs declined on May 25, and the GDXJ ETF gave back some of its recent gains. However, the short-term uptrend remains intact, and the rally should continue in the coming days. Conversely, with investors still underestimating the severity of the Fed’s inflation problem, more reality checks should emerge over the next few months. As a result, the PMs’ recent optimism should reverse sharply over the medium term (perhaps quite soon).

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over.

- After the above-mentioned correction, we’re likely to see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Would you kindly give your target after the turn for the junior gold miners on the next downside and the amount of time to reach that target in your opinion?

Also, is it possible to receive option advice on the miners?

A: I’m not yet sure what the target will be. I think that we’ll see the next pause when gold moves to its 2021 lows, but it’s not clear where the GDXJ will be at that time. At this time, my best guesstimate is that the GDXJ would move close to $28 (or $27), which would imply approximately repeating its recent decline (the moves to the 2021 lows in gold would imply the analogous thing for that market). This level is also very close to the support provided by the late-March 2020 low in the GDXJ.

I’m not going to provide details regarding any option plays. Options are a sophisticated instrument that shouldn’t be used by beginning investors, in my view. If someone requires details and direct help with regard to using options, it means that perhaps they would be better off without using options.

Moreover, I noticed (based on the analysis of my own analyses – yes) that I’m much better at forecasting price movements than I am at forecasting when those price levels will be reached. I’m patient myself, but this might not be the case with most subscribers, and it’s definitely something that affects the usefulness of options (not only you have to be right, you have to be right on time). I’m personally not using options, and I don’t feel comfortable describing my opinions on that market.

On the other hand, I do see the potential in using this instrument, and I have nothing against “options” on their own. I simply think that it’s something that should be reserved for more advanced traders, and I think that I may not be the best person to provide details with regard to selecting this particular instrument. I care a lot about what I’m providing my subscribers with, and I want to be sure that I provide only the very best.

Q: I have discovered your article on investing.com and I found it really assertive how you explained your market analyses regarding gold. That’s why I subscribed to your company in order to speculate on gold futures. I must say almost all trades are positive, and I am really very happy about it. As I am based in Europe I cannot trade the GDXJ ETF and as I work with futures, would there be any possibility for me to get more information/alerts about gold futures? You do speak a lot about the GDXJ but that does not always correlate with my investments. I hope you can help me further with this matter. All the best and my sincerest congratulations on your amazing work!

A: Thanks for the kind words, I appreciate them a lot!

Well, you’re already getting what I could provide in the case of the rest of the precious metals market – the target prices for a given trade. These are available for gold and silver futures. To clarify – I mean the “Trading” part in the “Summary” section (just below this reply). That’s where you find the details.

Within the technical analyses, I will provide the biggest exposure to the part of the precious metals market where I currently think a position is most useful, but please note that in almost all cases, the entire precious metals sector moves together (at least gold, silver and mining stocks) and the differences in timing of bottoms of particular parts of those markets are not that different.

Moreover, when the situation changes on a given market, I’m adjusting the target prices, even if a given market is not mentioned within the analysis. Today, gold is mentioned, and I am changing the target price for it in the “Trading” part of the “Summary”.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is relatively close to being over, and if not, then at least the easy part of the long trade is getting close to being over. While our profits on this long trade have grown quickly, it seems that after they grow a bit more and the GDXJ reaches our target ($40.96), it might be a good idea to take them off the table and return to the short positions (300% of the regular position size) in the junior mining stocks (GDXJ).

Please note that the exit targets were profitably reached on Tuesday in the case of SLV, HZU.TO and AGQ (intraday high was just 1 cent above target).

Also, because of the latest information, I’m adjusting the target price for gold futures (moving it lower).

The medium-term downtrend is likely to continue shortly (perhaps after a daily or a few-days long correction). As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months. And the profits from the current long position are likely to enhance them even further.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (100% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $40.96; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JNUG (2x leveraged). The binding profit-take level for the JNUG: $56.18; stop-loss for the JNUG: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: $22.28

SLV profit-take exit price: no position (target was profitably reached on May 24)

AGQ profit-take exit price: no position (target was profitably reached on May 24)

Gold futures downside profit-take exit price: $1,876

HGU.TO – alternative (Canadian) 2x leveraged gold stocks ETF – the upside profit-take exit price: $17.28

HZU.TO – alternative (Canadian) 2x leveraged silver ETF – the upside profit-take exit price: no position (target was profitably reached on May 24)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief