Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Several days ago, we wrote about the most important session of 2017 based on the level of volume in gold. It was indeed the most important session of the year up to that day, but this is no longer the case – yesterday’s volume and action in general were even more important and the implications are even more profound.

Yesterday, was the day of reversals. Gold, silver, miners, the USD Index and even crude oil – to some extent – reversed their early and pre-market price moves. The initial moves were significant and the same goes for their reversals. What are the implications of these volatile intraday price moves? The implications might be different in case of crude oil, but as far as currencies and precious metals are concerned, it seems very likely that the final turnarounds have just taken place.

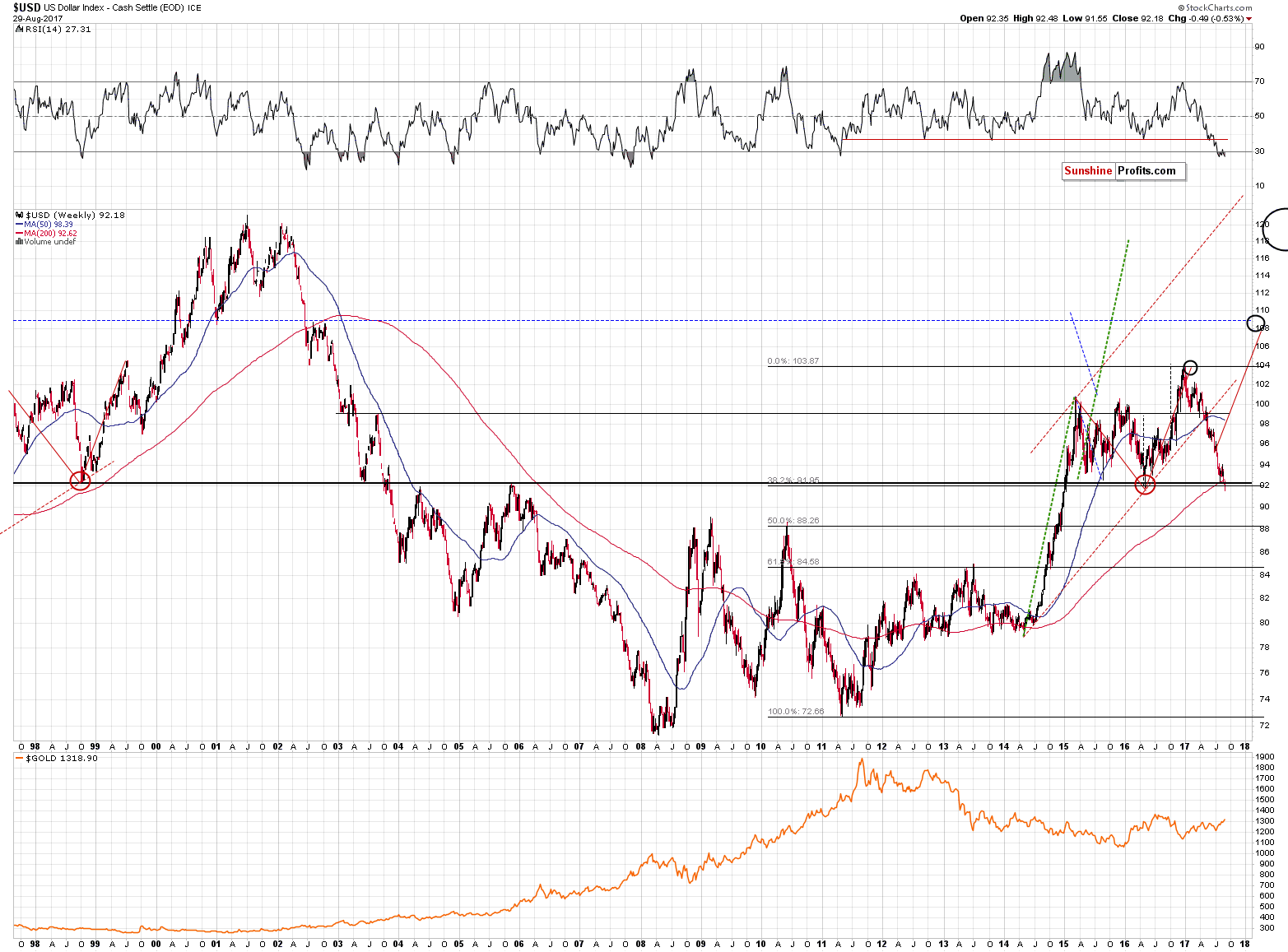

Let’s begin today’s analysis with the USD Index and quotes from our previous alerts (chart courtesy of http://stockcharts.com).

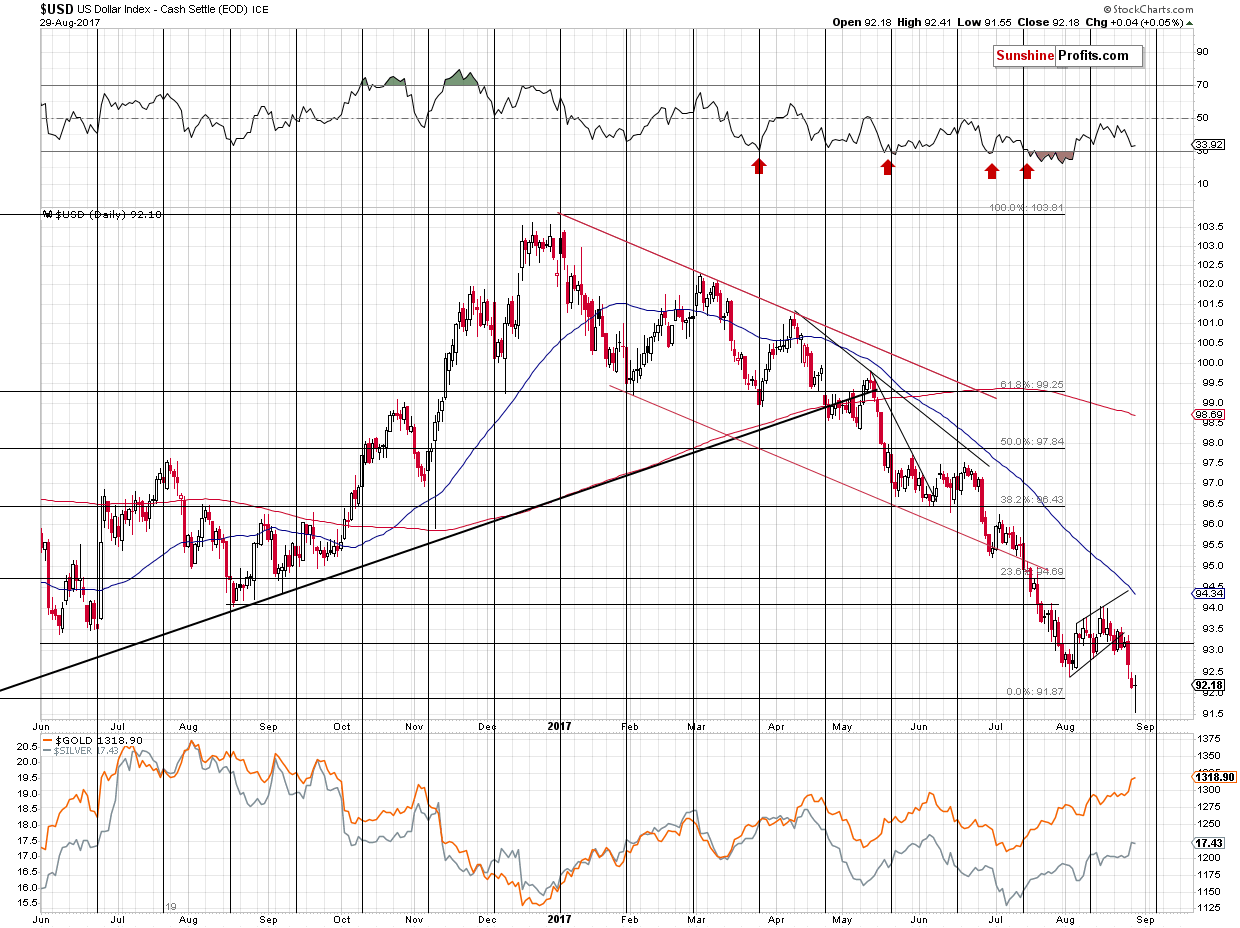

What about the USD Index? It’s below its major support level that’s based on the weekly closing prices. Consequently, even though the USD Index moved lower, it’s still likely to move back above it before the end of the week, thus forming a major reversal. As far as the intraday support is concerned, the lowest intraday price of the recent years was seen on May 3rd, 2016 at 91.88. Today’s intraday low for the USD Index is 92.251 - still above the above-mentioned low. The USD Index has NOT broken below the intraday low in intraday terms and below the weekly low in terms of weekly closing prices. There was no major breakdown and thus a reversal and a rally are likely to be seen this week.

The thing that changed yesterday was that we have finally seen a breakdown below the 2016 low (USD Index moved to 91.55), but what’s more important, we saw a quick invalidation of this breakdown. The USD Index ended the session visibly higher – back above 92. The USD Index is trading at about 92.5 at the moment of writing these words – about a full index point above yesterday’s intraday low.

In yesterday’s alert, we also wrote the following:

Earlier today, the USD Index moved to 91.621 and moved a bit higher shortly thereafter. Consequently, the key bottom of the recent years – the intraday 2016 bottom – was just reached (even breached, but it seems to be temporary phenomenon). At the same time the USD Index moved to the 38.2% Fibonacci retracement level based on the entire 2011 – 2017 rally. If there’s an important combination of support levels that’s likely to stop the decline – that’s it.

Profound reversal in the USD Index is likely to translate into a powerful reversal in gold and the rest of the precious metals market.

That’s exactly what we saw yesterday – the breakdown below the previous low was temporary, followed by a powerful reversal that translated into an analogous reversal in gold.

In yesterday’s alert, we wrote the following:

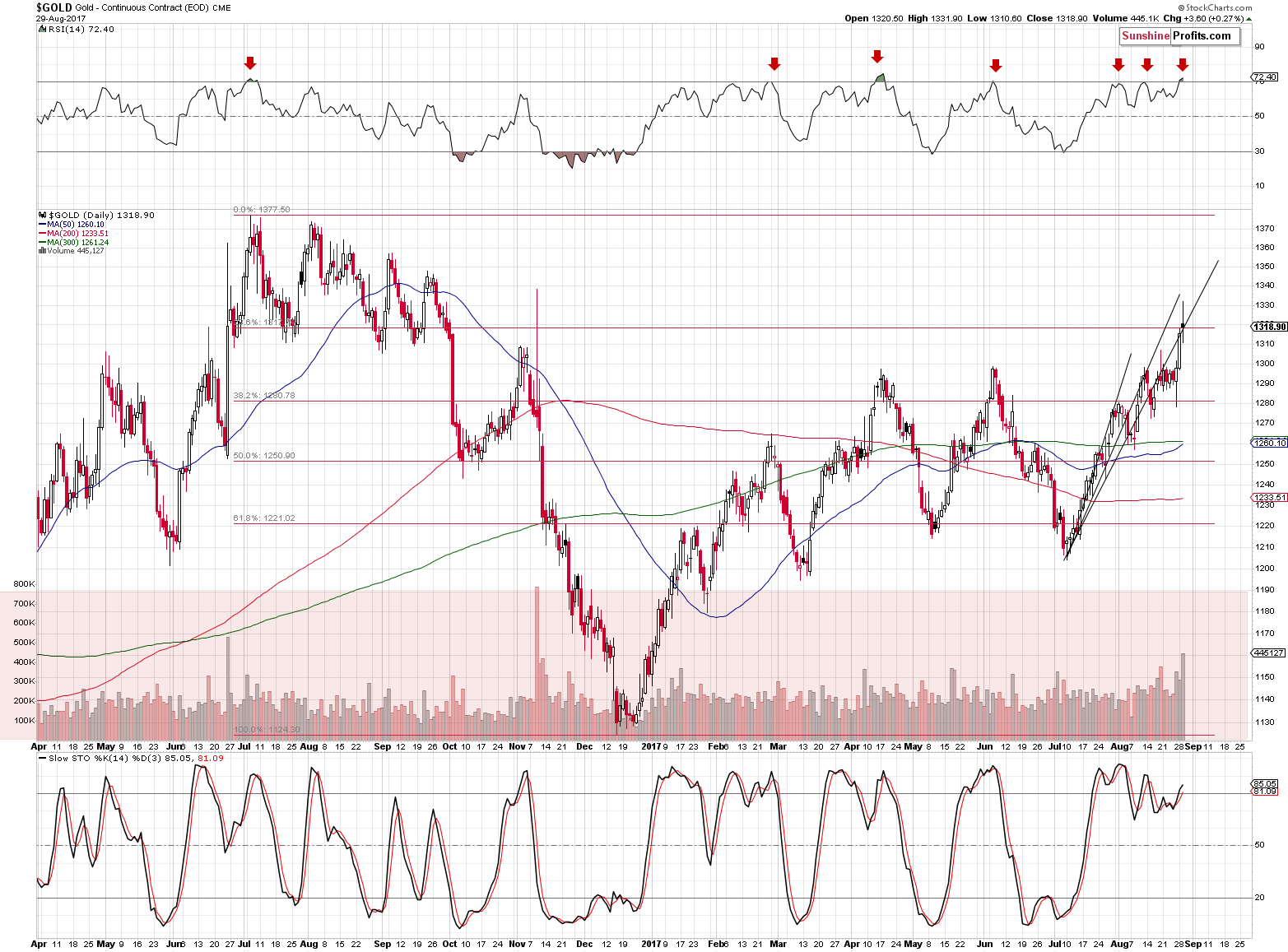

Gold finally responded to USD’s weakness (it’s trading close to $1,320 at the moment of writing these words) and moved to its 76.4% Fibonacci retracement – a little less important than the classic ones, but still something worth keeping in mind. What’s more important, is the fact that the RSI indicator moved above the 70 level, which is a classic sell signal. We marked the previous cases with red arrows on the above chart and the efficiency of this signal was particularly high.

In case of the GLD ETF, we saw a price gap (the ETF opened above the previous session’s closing price), but since that was the case multiple times in the past and was followed by: rallies, declines and consolidations, it doesn’t seem that it implies anything going forward.

The Fibonacci retracement seems to have stopped the rally, just as the RSI indicator had suggested. As you can see on the above chart, the volume that accompanied yesterday’s session was huge and this makes its implications critical.

Despite what we can see on the above chart, yesterday’s closing price (as reported by kitco.com) was below $1,309, which means that yesterday’s session ended below the previous closing price and that yesterday’s reversal was a clear, big shooting start candlestick that was confirmed by huge volume. It was also seen after a sizable rally. This is the perfect combination of factors that make the reversal very important and very likely to trigger declines in the following days and weeks. It turned out that the one that we’ve seen a week and a half ago was not the final reversal, just an intermediary one.

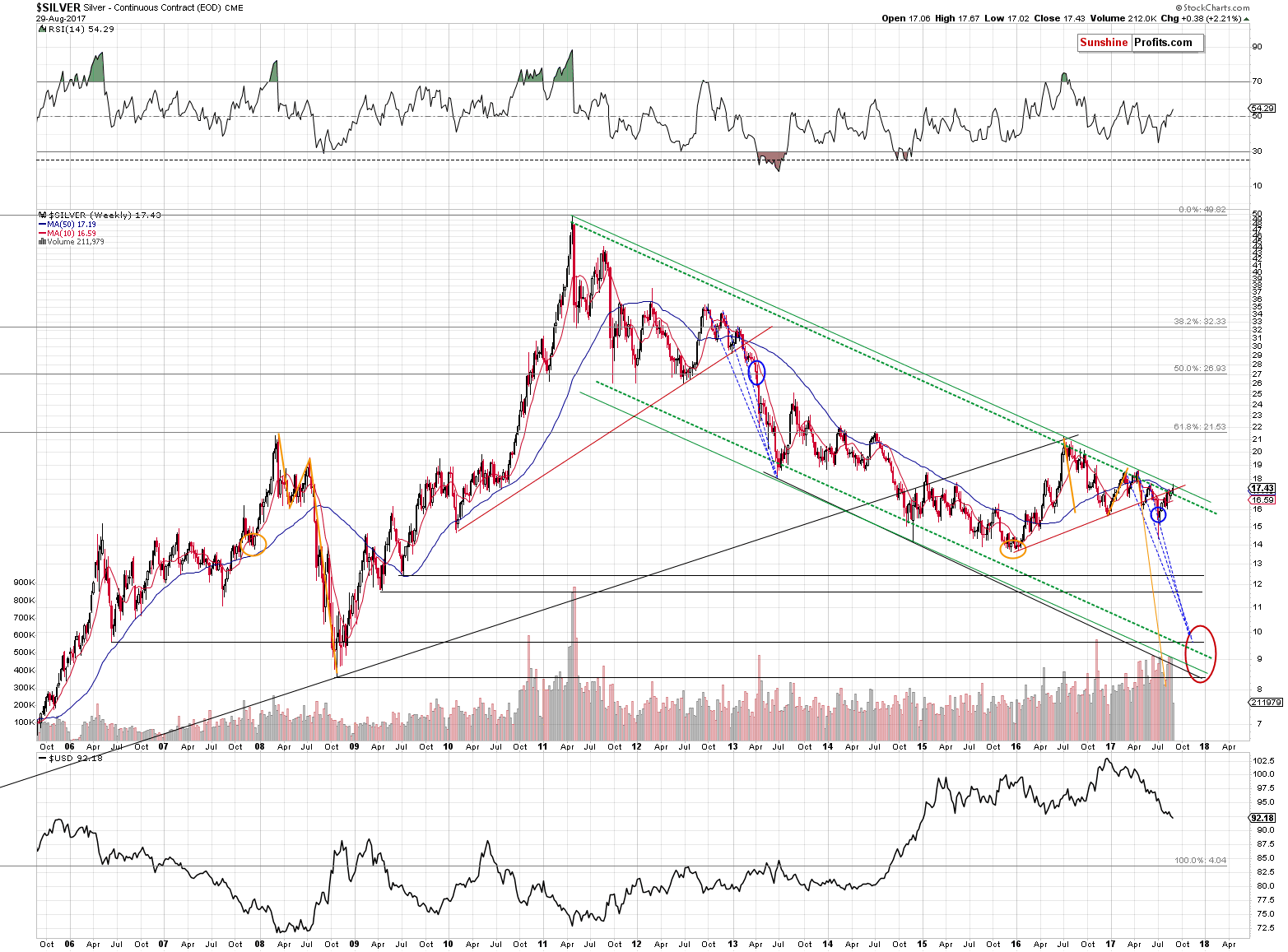

What makes it likely that this reversal was final? The most important reason is that it was accompanied by the epic reversal in the USD Index, while the previous one was not. The second reason is the sell signal from the RSI indicator and the third reason is the fact that this time, silver reached its final resistance line and reversed right at it.

In yesterday’s alert, we wrote the following:

Silver moved above the dashed, green line and close to the solid green line, without breaking it. The dashed line is based on the weekly closing prices, while the solid line is based on the intraday highs. The line based on the intraday highs is still likely to trigger a reversal even though silver moved above the dashed one. The week has just begun and silver has several days to move back and invalidate the so-far-inconsequential breakout – just like what we see in the USD Index.

That’s exactly what happened. Silver reversed after reaching the solid, green line. The week is far from being over and it seems likely that the intraweek breakout above the dashed, weekly resistance line will also be invalidated (with silver below $17) before the week is over.

The action in gold stocks and silver stocks was not as profound as it was in case of gold, but this could be attributed to the late-session upswing in the general stock market. The impact of the latter should be temporary, so if gold and silver slide in the coming days and weeks, mining stocks should follow.

Summing up, this week things got hot and – based on the price swings, size of the volume, and the level that was temporarily broken in case of the USD Index – very emotional, and it’s particularly important to keep calm in such times. The implications thereof that are of greatest important for us are for the precious metals market, but the key action has taken place in the USD Index.

In the summary of yesterday’s alert, we wrote that if USD confirms the breakdown below its long-term support, the big slide in the precious metals market could be delayed once again, but we stated that for now, this didn’t appear to be the likely outcome – the reversal was.

That’s exactly what we have just seen – powerful reversals in both: USD and gold. Each of them would be a strong signal on its own with profound bearish implications for the precious metals market, but since we saw them together, the strength of the signal increased even further. The outlook remains bearish.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,346; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $39.94

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Some analysts expect the stock market crash or even recession in the near future. Are they right? And how it would affect the gold market?

Forecasts of the Stock Market Correction and Gold

=====

Hand-picked precious-metals-related links:

Gold dips in Asia as investors note UN Security Council rap of NKorea

Why Gold Is Less of a Haven These Days

Morse Says Half of Gold's Rally Attributed to N. Korea

=====

In other news:

Stocks Rebound as Korean Fears Abate; Gold Steady: Markets Wrap

Europe Has Recovered Enough to Ease Off the Quantitative Easing

Draghi Seen Putting a Lid on Euro as Traders Test Pain Threshold

U.N. condemns 'outrageous' North Korea missile launch, Pyongyang says more to come

Hong Kong stocks top 28,000 points for first time in 12 years

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts