Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Yesterday’s session was quite uneventful in the case of the precious metals market and in the case of the USD Index. Nothing really changed regarding: prices, implications of the previously discussed signals, and the outlook. Consequently, today’s analysis could be very short – but it won’t be. The reason is that while we were once again going through the long-term charts of gold, silver and mining stocks and compared them to the performance of palladium, a very interesting – and likely effective – pattern emerged. We want to share it with you.

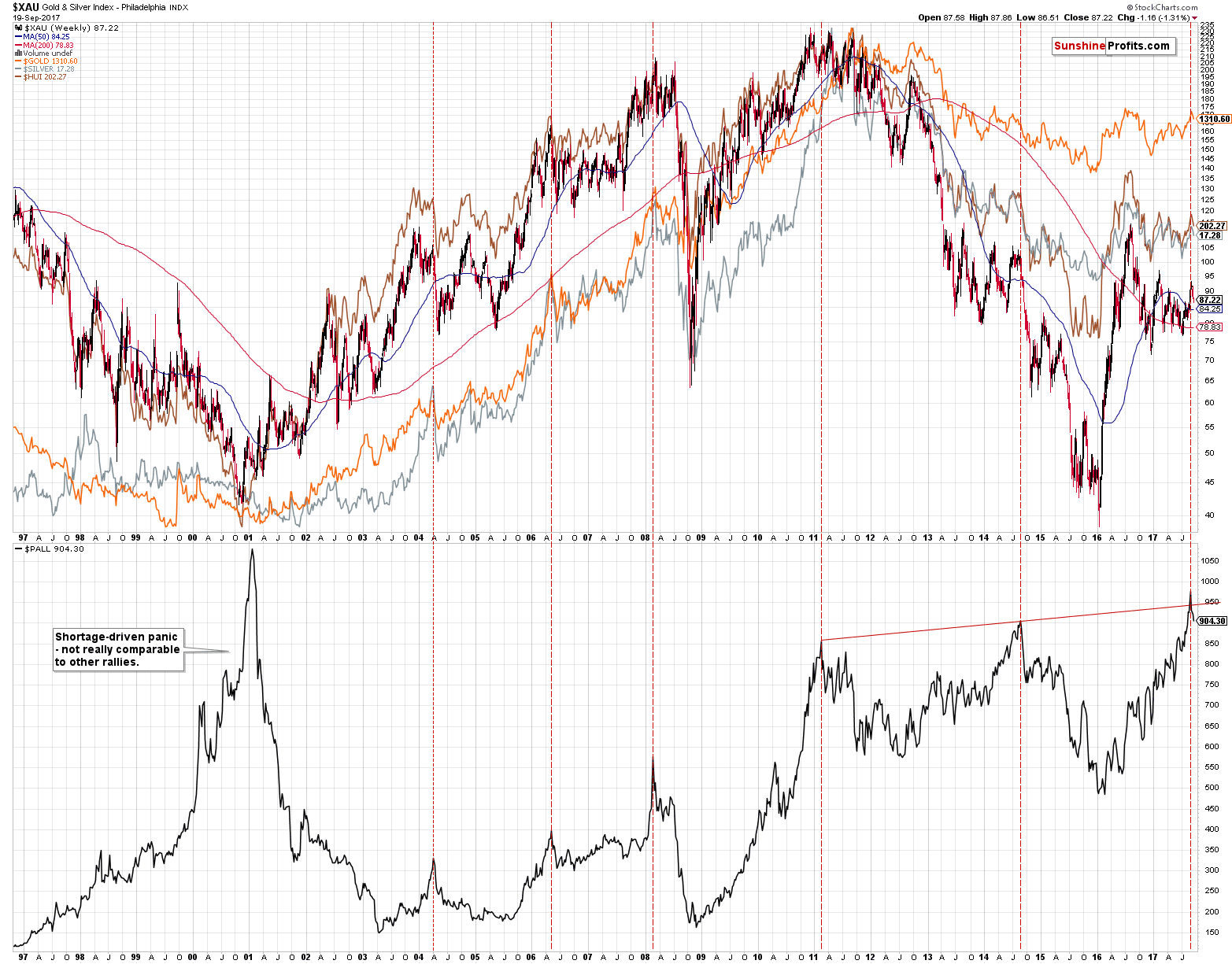

There are also other implications of the chart below and we will discuss them in the following issues of the “Preparing for the Bottom” article series, but for now, let’s focus on what we can infer from it for the following months. Please take a look below (chart courtesy of http://stockcharts.com).

In all cases after 2002, whenever palladium was after a significant (visible from the long-term perspective) and sharp rally and it then declined even in a rather insignificant way, it meant trouble for the precious metals sector. In all cases, it heralded a major top – either in the entire precious metals sector, or in a part thereof – and it meant that big declines were to be expected.

We marked these situations with vertical, red, dashed lines. There were five such cases after 2002 and they all corresponded to major tops. There was also one case when palladium rallied the most – in 2000 – but this was a shortage-driven upswing, which is not really comparable to other rallies and shouldn’t be treated as one of them.

We have just seen another substantial and sharp rally in palladium, which seems to have ended – the decline that we saw recently is significant enough to compare this situation to other tops. Moreover, palladium moved above the rising red resistance line based on the 2011 and 2014 tops and it invalidated this breakout, thus flashing a major sell signal.

Consequently, based on the extremely effective (at last so far) signal from the palladium market, precious metals investors should be preparing for a major downswing in the near future that will likely take metals and mining stocks much lower.

As far as the very-short-term outlook is concerned, we could see some intraday volatility today based on the comments from the Fed (it doesn’t seem that an interest rate change will be seen this time), but nothing major is likely to take place based on it.

Summing up, there are more and more long-term signs pointing to a big decline in the precious metals sector – even the palladium market provides us with a strong sell signal. The implications of the August record-breaking volume in gold, the analogies to 2013 and the short-term sell signals all confirm the bearish outlook.

Please note that if the USD Index does indeed start a major rally (and we expect it do to so), then gold’s decline could be sharper than the decline that we saw in 2012 and 2013, as back then the USD Index didn’t rally substantially. Consequently, the 1:1 analogy between them could work for prices, but not necessarily in terms of time.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,366; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $38.74

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The Federal Reserve is due to release the statement from their September meeting. What can we expect and how can it affect the gold market?

September 2017 FOMC Preview Gold

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold inches up ahead of Fed policy statement

Diwali, Lord Rama, and the Return of Gold from Exile

=====

In other news:

Fed to Pack Up Crisis Tool, Debate Next Hike: Decision-Day Guide

Fed conflicted by tepid U.S. inflation, global economic rebound

Traders Hold Back in Fed Countdown; Oil Advances: Markets Wrap

Police arrest high-ranking Catalan officials in raids

Ray Dalio Calls Bitcoin a Bubble and a Highly Speculative Market

The Most Crowded Trades Today: Assessing Gold’s Benefit

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts