Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold and silver are justified from the risk/reward perspective at the moment of publishing this Alert. The position in the mining stocks is temporarily closed.

Quite a few journalists wrote about gold's breakout in the previous days even though gold made an attempt to break above the key resistance - the mid-2013 high - only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, "gold people" have to be bullish on gold all the time, right? Wrong - those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

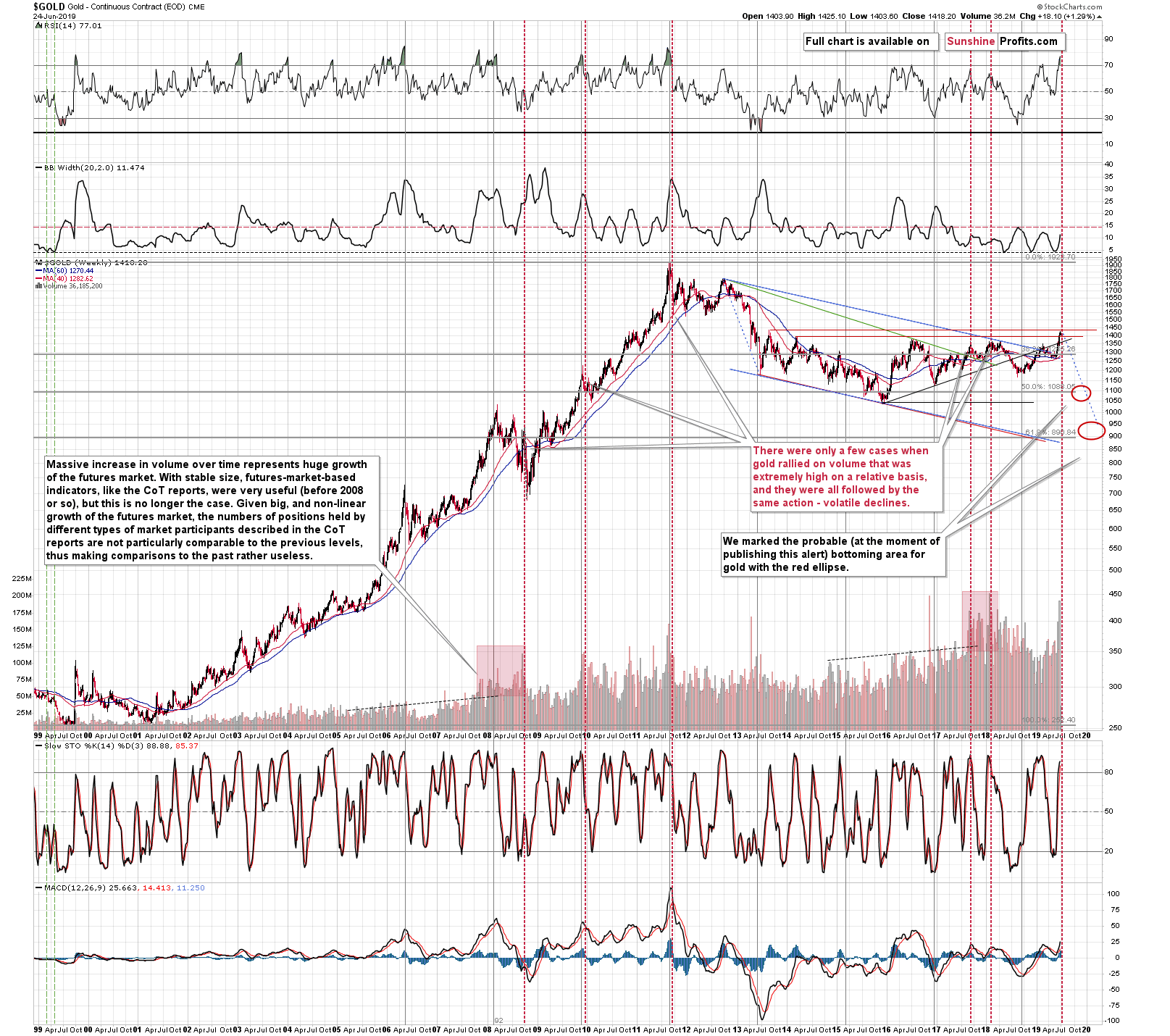

Today's overnight high for gold futures was $1,442. As shown below, gold declined to about $1,425 once reaching that high. The downswing was quite visible, and it could be what marked the end of gold's rally. Why is this level particularly important?

Because that's very close to the highest of the recent local tops during the current long-term consolidation.

The Gold High Put Into Perspective

You probably read in quite a few places that gold has broken out above certain highs. While that's true, people usually don't mention that the consolidation didn't just start last year, or in 2016. It started right after the profound 2013 decline and the highest high thereof is actually the mid-2013 high of $1,434. Consequently, what we saw in today's pre-market trading was an attempt to break above this most important of nearby highs. Gold moved slightly above this level and then declined. This invalidation is what might trigger the reversal, reasons for which we described yesterday.

Namely, the triangle-vertex-based reversals in gold, silver, and gold stocks, the extreme volume readings in gold, silver, and silver stocks, the long-term performance of gold miners (which is weak), the continuous strength in the gold to silver ratio, and other reasons continue to support gold's reversal. These are all major issues that point to lower precious metals prices in the following months.

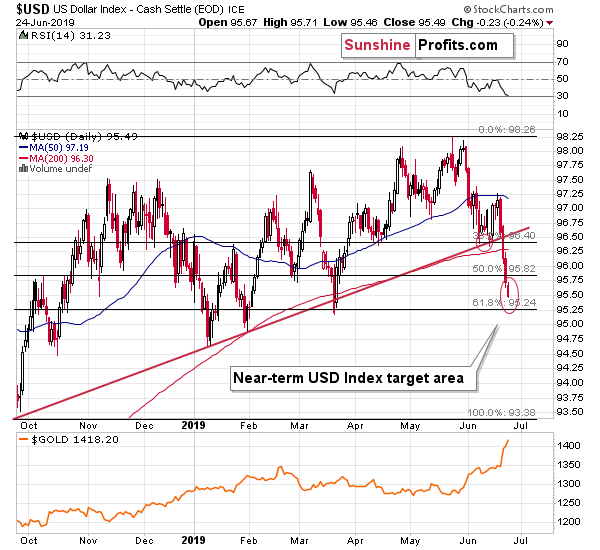

There is a specific fight in the precious metals market and we don't mean the fight between buyers and sellers. It's a fight between the signals. On one hand we have all the above and the likely bottoming USD Index. On the other hand, we have just one thing - gold's upswing that was triggered by geopolitical news. And this very upswing just reached its critical resistance. This is an uneven battle, in which the bearish side has many more signals on its side. That's why our money is (literally) on it.

Checking on the USD Index

Meanwhile, the USD Index closed right in the middle of our target area. Today's (so far) pre-market low was 0.15 below yesterday's close, while the 61.8% Fibonacci retracement level is 0.25 below yesterday's close, so the USDX was very close to it. Is the bottom in? It certainly could be the case, or we could see another 0.10 move below today's pre-market low, but that's a relatively small move. The proximity of the March low makes the support created by the Fibonacci retracement stronger and the bottom more likely.

The IFs

Did we just see a major reversal in gold today? That's quite likely. If we didn't, then the medium-term outlook for gold might change in the near future. The end of this week marks more than merely the week's finish. It's also the end of the month, and the end of the quarter. The closing price that we get this week will be critical.

If the week closes visibly above the mid-2013 high, a bigger rally could follow and in this case, mining stocks and - in particular - silver, could catch up with gold.

If we get a weekly closing price below $1,400, then the entire week will be one huge reversal and likely something that starts the true decline.

Gold's weekly close between $1,400 and the mid-2013 high of $1,434 would have mixed implications and other markets might provide more decisive signals.

We have four sessions left and given the increase in volatility, both scenarios could happen. We have multiple signs suggesting that the reversal and the bearish outlook are much more likely, though.

Speaking of volatility, it's the reason due to which we are not re-opening our speculative short positions in the mining stocks with a higher stop-loss at this time. If gold continues to soar and it breaks above the above-mentioned resistance levels, gold miners might catch up in the 2016 style. Those with a more long-term approach might prefer to keep the short position intact as long as the medium-term outlook remains bearish, but as far as our trading positions are concerned, we will wait for gold to give us the final sign later this week.

Before summarizing, we would like to publicly reply to one of the questions that we received recently. The question was if it's possible that gold to silver ratio would reach its top at 100 while both metals are rallying.

Our take is that there is only a slight chance that the gold to silver ratio would top at 100 and the precious metals sector would rally from that point without a $500 decline in gold from the current levels. We doubt that it would happen during an upswing, but it could happen during a smaller decline. For instance, gold could decline $50 and silver could decline a few dollars. This is not the most likely outcome, but it's more likely than the 100 level being reached during a rally. And the scenario in which both metals decline really profoundly remains the most probable one in our view, anyway.

Summary

Summing up, the gold-silver ratio, silver itself, gold stocks to gold ratio, the size of the upswing in the gold stocks, and the situation in the USD Index all suggest that the most recent move higher in the precious metals sector is nothing more than just a corrective upswing within a bigger trend. It is only the gold price itself that can make one wonder if gold has truly broken out and that it will now continue to soar. This is doubtful, because this strength is not confirmed, as it happened right after a series of rather chaotic and surprising news. Moreover, gold just invalidated the pre-market breakout above the key resistance provided by the mid-2013 high. Adding extremely positive sentiment as confirmed by volume across the precious metals board and the very strong triple vertex-based reversal indication, makes the outlook for gold much less bullish that everyone and their brother would have you believe. Please note that we are not "married" to the bearish outlook for gold and we will return to viewing the medium-term outlook as bullish, but not until the cold analytical facts suggest that the tables have indeed turned. This is not the case right now - please take a look at today's charts for details. In particular, it's a bad idea to adjust one's outlook just because many people got excited. The excitation itself is a sign of a turnaround, not something to take at the face value.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold and silver is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,452; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $31.67

- Silver: profit-take exit price: $13.81; stop-loss: $16.32; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $23.87

- Mining stocks (price levels for the GDX ETF): none, but we expect to get back on the short side of the market soon.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week was definitely hot. Both major central banks adopted a more dovish stance. Gold reacted positively, jumping above $1,400. What has changed, and what has not? How close are we to an actual rate cut, not only to the speculation of getting one for sure on the next Fed meeting? How will gold like it?

Gold Jumps Above $1,400 after Dovish Fed

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager