Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

We already presented the final target for gold's decline many months ago. Yesterday, we updated the short-term gold price target that might be reached within a week, and gold just moved toward it. Given that we already provided you with both: short- and long-term price targets, is there anything more than we can discuss to better prepare you for what's coming?

Yes. Today, we'll provide you with all the gold price targets in between.

Pretty bold, right? Of course, with this kind of forecast, it will be impossible to get 100% of them right and we don't claim that we will always have all the answers right - nobody ever will. However, the roadmap that we are about to present, is based on multiple techniques that we have found to be reliable over many years, and the analogies that stand behind the price paths have been confirmed over and over again, even in the most recent past. It may look like just a few colorful lines, but in reality, this is the essence and result of hundreds of hours of research just in one chart. Gold might deviate from the price path, especially if some unexpected news pops up, but it's thousandfold times better to have an approximate roadmap, than to have none at all.

Let's get right to it.

The Golden Roadmap

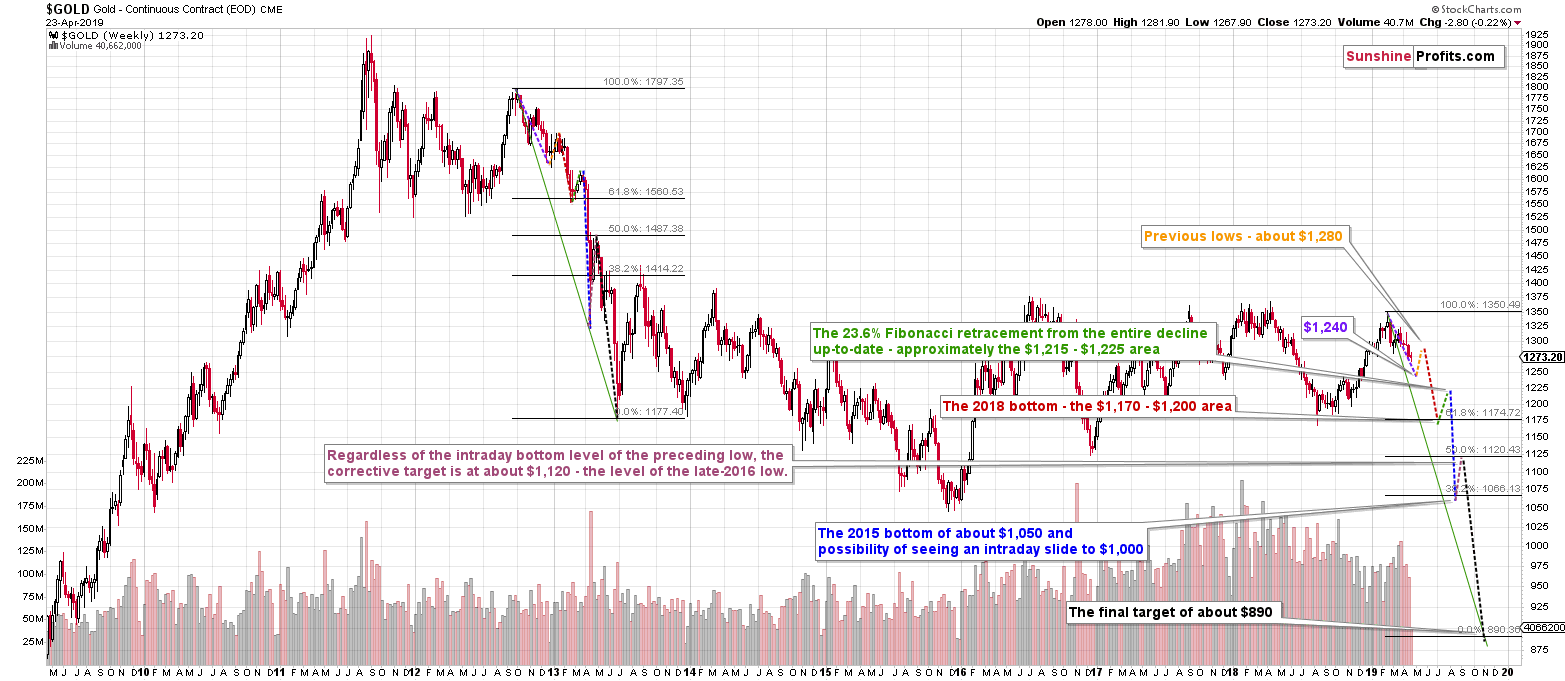

Based on the bullishness that accompanied gold's bottom in 2015, it was very unlikely that it was the final bottom for the decline. Consequently, it has been likely that gold will move below the 2015 low before the slide begins. Based i.a. on the 61.8% Fibonacci retracement based on the entire 2000 - 2011 bull market, the next strong support is at about $890, which makes it a natural long-term target.

Based on the long-term analogy between 2012-2013 and the current decline, the latter is likely to be very similar to the 2013 slide. In fact, it already is - the short-term price moves confirm it. We don't want to go into details today as it would take a lot of space to cover all the details once again - please visit the above links for more information.

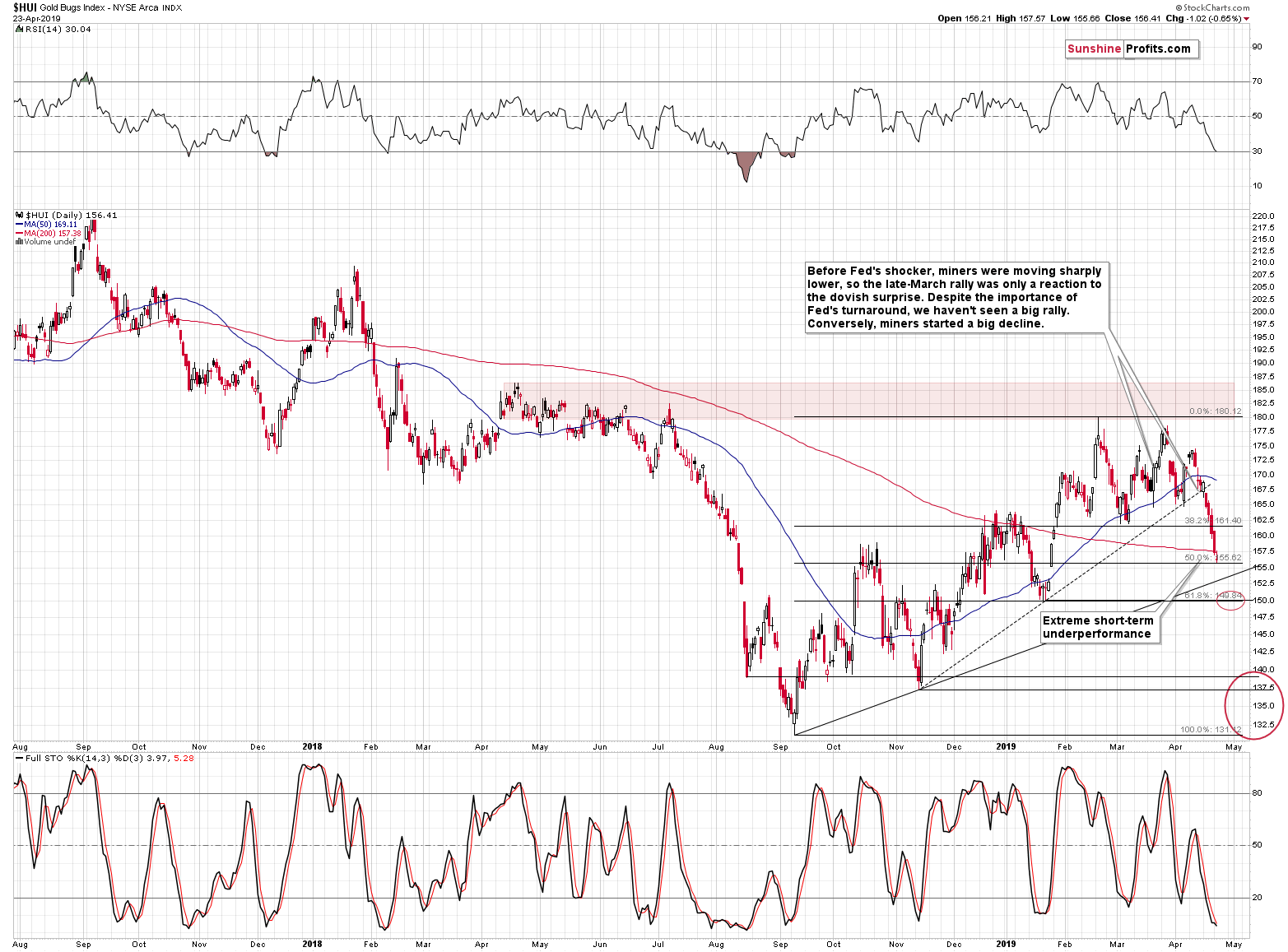

Based on the recent extremely weak reaction of the entire precious metals sector to the last month's Fed dovish surprise, it seems that the major decline has already started.

The third paragraph gives us the initial price of the decline, the first paragraph provides the final price, and the second paragraph tells us what the decline is more or less likely to look like.

We intentionally started these three paragraphs with "based", because all the above provides us with exactly that - a base. Base that needs to be adjusted to the current support levels. You see, the analogies work much better on a relative than absolute basis. One of the ways where we see this, is the popular Fibonacci retracement tool. It's not based on absolute, but relative (percentage) price moves. Think about it - back in 2013 gold didn't just end a given decline only because it declined by precisely $142. It ended the decline, because it reached a specific support level that was provided by previous lows, support lines and/or retracements. At least the latter is much more likely than a decline that ends based on its size in terms of dollars.

Replicating the individual lines in dollar terms might be misleading. Better, but still not ideal would be to apply the analogy in percentage terms. In case of logarithmic charts that we use, it simply means copying a line from one part of the chart to another part thereof. This is better than simple dollar terms, because it takes into account the similar level of excitement and it is ultimately emotionality that drives the markets in the short run.

For instance, a move from $300 to $450 in gold was just as exciting or important as the move from $1000 to $1500 - it provided the same profits. On a side note, this is one of the reasons why waiting to re-enter the market at lower prices is so important - $200 now is just as important as $1000 will be when gold will be trading close to $6,000 in the future.

In order to further improve the simple relativity, we took into account other techniques, i.a. True Seasonality, the current support levels and more short-term Fibonacci retracements. Based on them, we adjusted the "base" price targets and arrived at the final ones.

The best thing about this technique is that we didn't have to change the size of the decline - it almost perfectly aligns with the final $890 target. All that we had to do was to adjust the interim targets and we actually didn't need to make the huge adjustments either. The analogy to the 2013 slide fits the current situation quite well. Of course, being off $50 on both long- and short trades can result in major change in the overall profitability, so our adjustments are a critical improvement, even though they may not appear to be huge from the long-term point of view.

In our view, the most surprising thing that the 2013 - now analogy suggests is that the late-2016 low is not likely to stop the decline (it is likely to provide strong resistance, though). Of course, this might be the case after all, but it's not the most likely outcome. Without the analogy, we would view this level as strong support.

You already saw the details on the chart, but let's describe them once again for greater clarity:

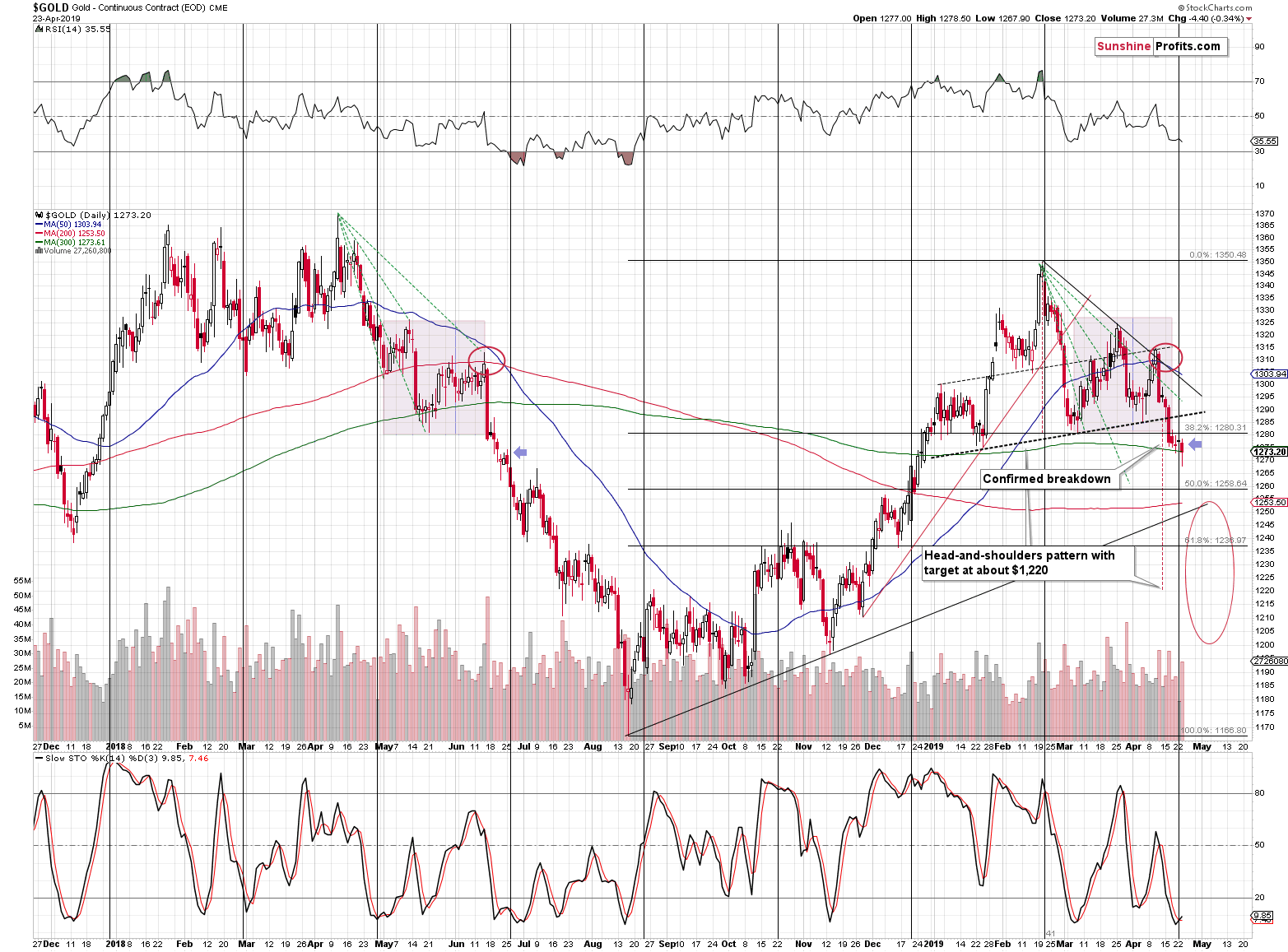

- The first projected bottom is the one that is likely to be reached within a week or so - at about $1,240.

- The second target is the next top that is likely to be reached close to the middle of May (around May 10th) at about $1,280 (the recent lows).

- The next target is the bottom at about $1,170 - $1,200 area. This target is based on the 2018 bottom an is likely to take place in the middle part of June (this timing is relatively unclear at this moment).

- The next target is the top at about $1,215 - $1,220. That's based on the (less popular, but still important) 23.6% Fibonacci retracement level. Time-wise, the target for this top is the middle part of July (this timing is relatively unclear at this moment).

- The next target is the bottom at about $1,050, with a good chance of seeing an intraday move to $1,000. This target is based on the 2015 bottom and the intraday possibility is based on the analogy to the April 2013 volatility. This is likely to take place in August, or at the beginning of September.

- The next target is the top at about $1,120, which means that the correction from the $2015 lows should be quite sizable. This will also very likely be accompanied by cheerful "the bottom is in!" comments in various gold forums and the final slide is likely to start amid them. This top is likely to form between late September and mid-October.

- The final target is the bottom at about $890, which is likely to take place in late October or early November.

In other words, this year is likely to be busy but very rewarding.

Before summarizing, we will briefly comment on yesterday's price moves. Briefly, because all our yesterday's comments remain up-to-date with regard to them.

Short-term Update

Gold declined by just 4 dollars, which is rather insignificant. At the same time however, it was the lowest close of 2019, which emphasizes what's really happening. Gold just broke below an important head-and-shoulders top formation and its decline is just starting.

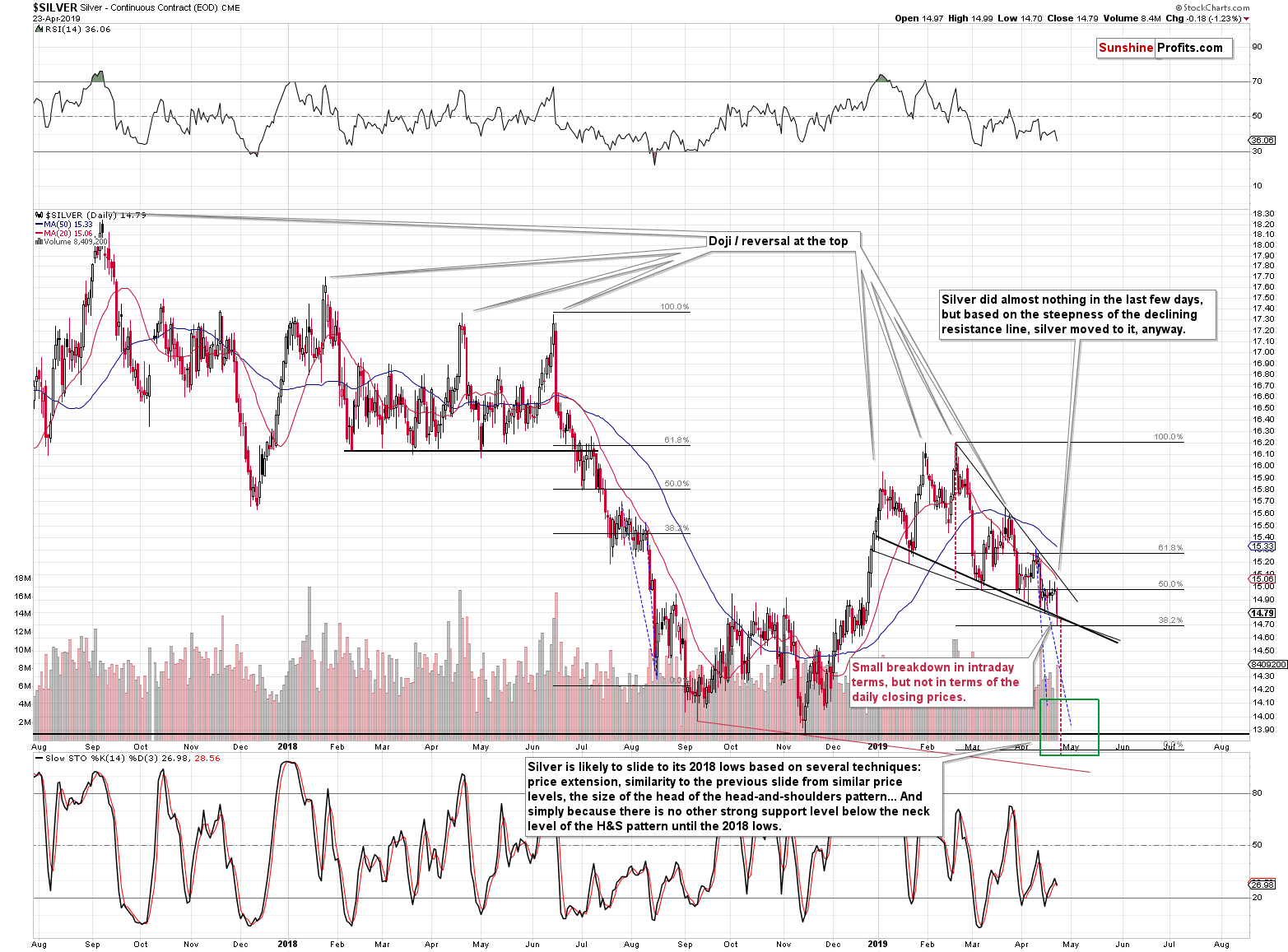

Silver declined more profoundly, and it also moved to a new 2019 low. The white metal didn't manage to break below the declining support line yet, but it seems that it's going to do that shortly. And when it does, silver is likely to drop sharply.

The slide in the mining stocks continues. The pace at which miners declined was lower yesterday, but this is not surprising after two daily slides without gold's help. One can view it as a breather, during which miners declined anyway.

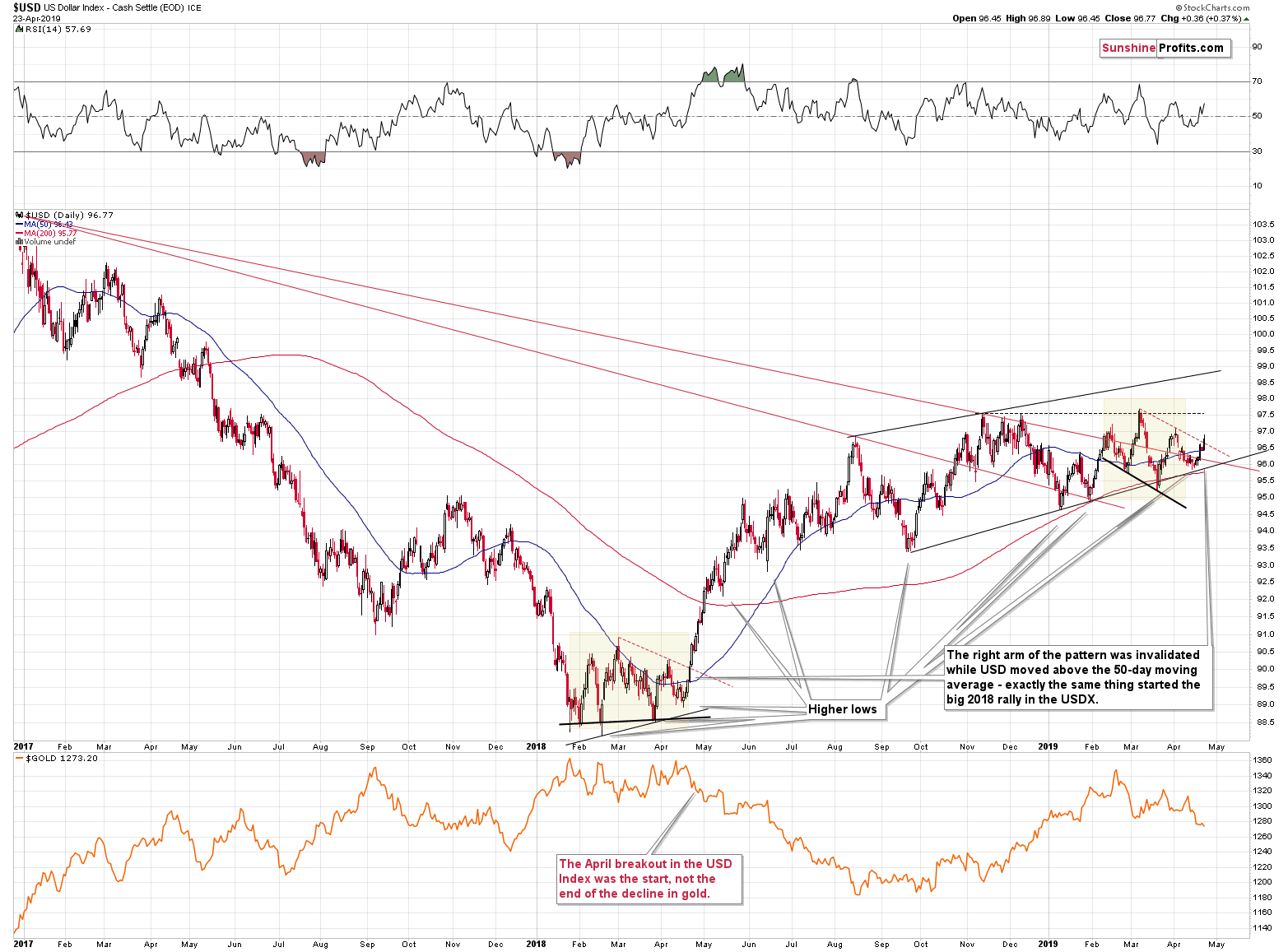

Meanwhile, the USD Index broke above the declining resistance line based on the previous highs. In the similar situation in April 2018, that was the final confirmation that the big rally in the USD has just begun.

Please note that when that happened, gold was still early in its decline. It fits perfectly the current gold picture.

Summary

Summing up, the breakdown in gold is confirmed from multiple angles, miners underperform to an extreme extent, while silver appears ready to slide any hour now - it's difficult to imagine a more bearish combination for the short term. If it wasn't enough, the USD Index seems to have bottomed. All the above creates an excellent shorting opportunity in the precious metals sector. There will likely come a time later this year when we will get in the back-up-the-truck territory with regard to precious metals, but we are not even close to these discounted price levels. However, it looks like the final slide towards them has already started. Based on the likelihood of seeing a temporary turnaround next week, we might have a good chance of exiting the current short position or even switching to a long one at that time.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $14.03; stop-loss: $15.72; initial target price for the DSLV ETN: $37.47; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $18.41; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $26.42; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Recent positive news suggest the US economy spring revival. But what about gold? Will it blossom? Will the gold love trade take reins from gold as a safe haven play?

Spring Has Arrived. Will Gold also Bloom?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager