Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

Drums please, we have the winner of the "chaotic month" award contest! June 2019 now has it all. We saw substantial trade escalations with China, we had a surprising - and relatively ridiculous in its justification - tariff threat against Mexico, and we enjoyed additional dovish comments from the supposedly hawkish Fed chief. Now, we're also presented with a supposed "proof" of Iran's involvement in an attack on a tanker. The video that was released is very far from being a real proof of anything, and in particular originating from any specific country, but the market's initial response was emotional and gold soared. More geopolitical news and more surprising price moves do suggest something, but it's not what it seems at first sight.

All the above-mentioned chaotic news were U.S.-centered. It was Iran that was accused of being involved in the attack on the tanker, but who suggested that? The Bloomberg news story's title explains it: "U.S. Says Video Shows Iran Was Involved in an Attack on Tanker". Theoretically anyone can claim anything about any damaged ship. Why did the "American officials release images they said show that Iran was involved in an attack on an oil tanker"? What's the common denominator among all the above?

It's the U.S. dollar. What did the U.S. currency do during - and most importantly - before the 2003 invasion of Iraq (the tensions rose gradually before the war)? The USD Index declined severely. In fact, it was the biggest multi-year decline of the recent history. On a side note, it turned out that there were no weapons of mass destruction found in Iraq, despite the supposed "solid proof" to the contrary. Doesn't the just-released "proof" of Iran's involvement look at least a bit suspicious?

President Trump likely doesn't want any wars - he said so many times - but he knows that words and threats can sometimes do a lot on their own. If a simple tweet can change a lot and move the markets, then a simple accusation that people will associate with "war with Iran" could do even more and cause the USD to decline without any military intervention whatsoever.

The problem is that in 2002 and 2003, the USD was after a powerful rally and significantly overvalued. This time, the technical and - especially - fundamental situation appears quite different. The U.S. dollar may be a bad (fiat) currency, but it's still best house in a bad neighborhood. Europe has quite a lot of structural problems and the Japanese money-printing machine is almost overheating. Which country has actually been raising interest rates and not only talking about it? The U.S.

The market can be tricked on a short- or medium-term basis, but in the long run, the market forces always win. We have already reached the point when surprising news is not something that triggers really big declines in the USD. The amount of people that wants to get into the USD Index at lower prices is growing, while the amount of people that takes the surprising news at its face value is declining. The result is weaker reaction to the downside.

The interesting fact is that because USD appears to be the fiat currency of choice, it acts as a safe haven for many investors. Sure, gold is the real hard currency, but since we live in the fiat world, many people simply prefer the world reserve currency backed by the world's most powerful economy and military. This means that in case of the geopolitical turmoil, especially if it's not directly related to the U.S. - like the just-released "story" about Iran, we could actually see increased demand for the U.S. dollar. The plan to lower the USD value may simply not work this time.

How could this be resolved? The Powers That Be will know that they can't keep the USD low for long, so they would do as much as they can to actually take advantage of it. They - or the companies they "are in association with" - would take aggressive bets on higher USD values before the major breakout. As they would no longer be trying to suppress the price, the rally following the breakout should be very significant. That's very much in tune with what we wrote yesterday while discussing USD's red resistance line visible on the long-term chart.

This means that our technical comments on the above chart are not only up-to-date, but they are justified also from the fundamental point of view:

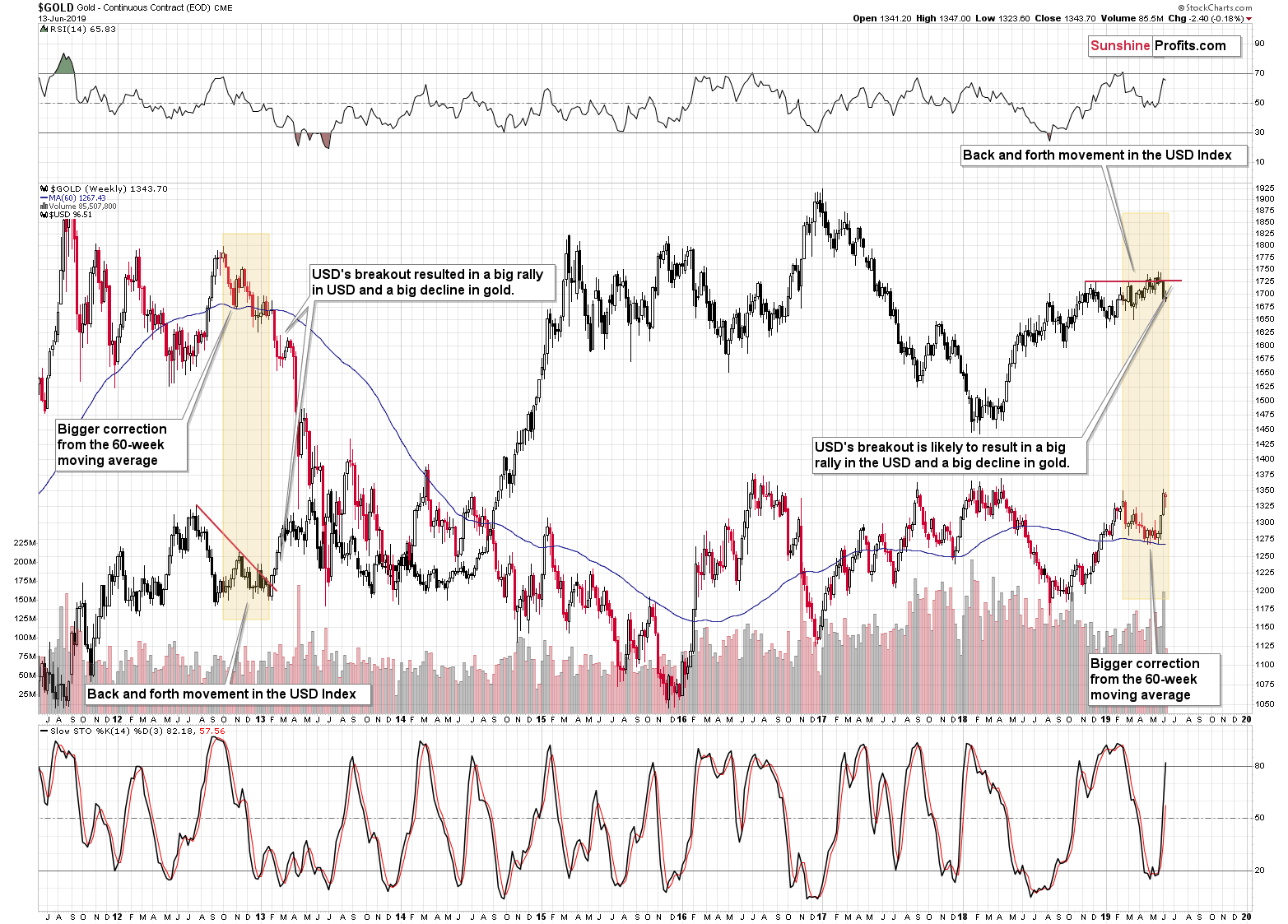

[Back in 2002] It went like this. After several months of back-and-forth trading, the USD Index broke above a medium-term resistance line and started several-week-long rally. That's when gold's decline accelerated. What's important is that this was not what started THE decline. It was the trigger that directly preceded THE decline. It was still quite early with regard to the entire downswing.

Right now, the USD Index is still in the back-and-forth movement pattern. If it wasn't for Trump's very surprising comments, the USD Index would have likely already successfully broken to new highs, with gold correspondingly being at new 2019 lows. Instead, gold moved to the previous highs, thus altering the previous similarity a bit. Please note that it was altered, not invalidated.

The upswing that we just saw is clearly similar to the first, and practically only big corrective upswing that we saw during the 2012-2012 decline (not counting the April correction). In 2012, gold moved visibly higher after reaching the 60-week moving average (blue line on the above chart). And that happened when this moving average was already declining.

We saw exactly the same thing recently. Back in 2012, the rally didn't reach the previous high but this time it did. No wonder since so many surprising news (trade tensions with both: Mexico and China, extremely bad jobs report, more dovish remarks from the Fed and mounting market bets on a July rate cut) popped up very close to each other.

Today's action in gold may not be over just yet - at the moment of writing these words ,it's over $10 higher, but we will probably see some kind of an angry tweet from President Trump that pushes gold even higher, perhaps resulting in a re-test of the pre-market high. Please keep in mind that this is all geopolitical stuff. The impact is likely temporary and whatever is gained based on it, is likely to be reversed.

On June 7, we wrote the following:

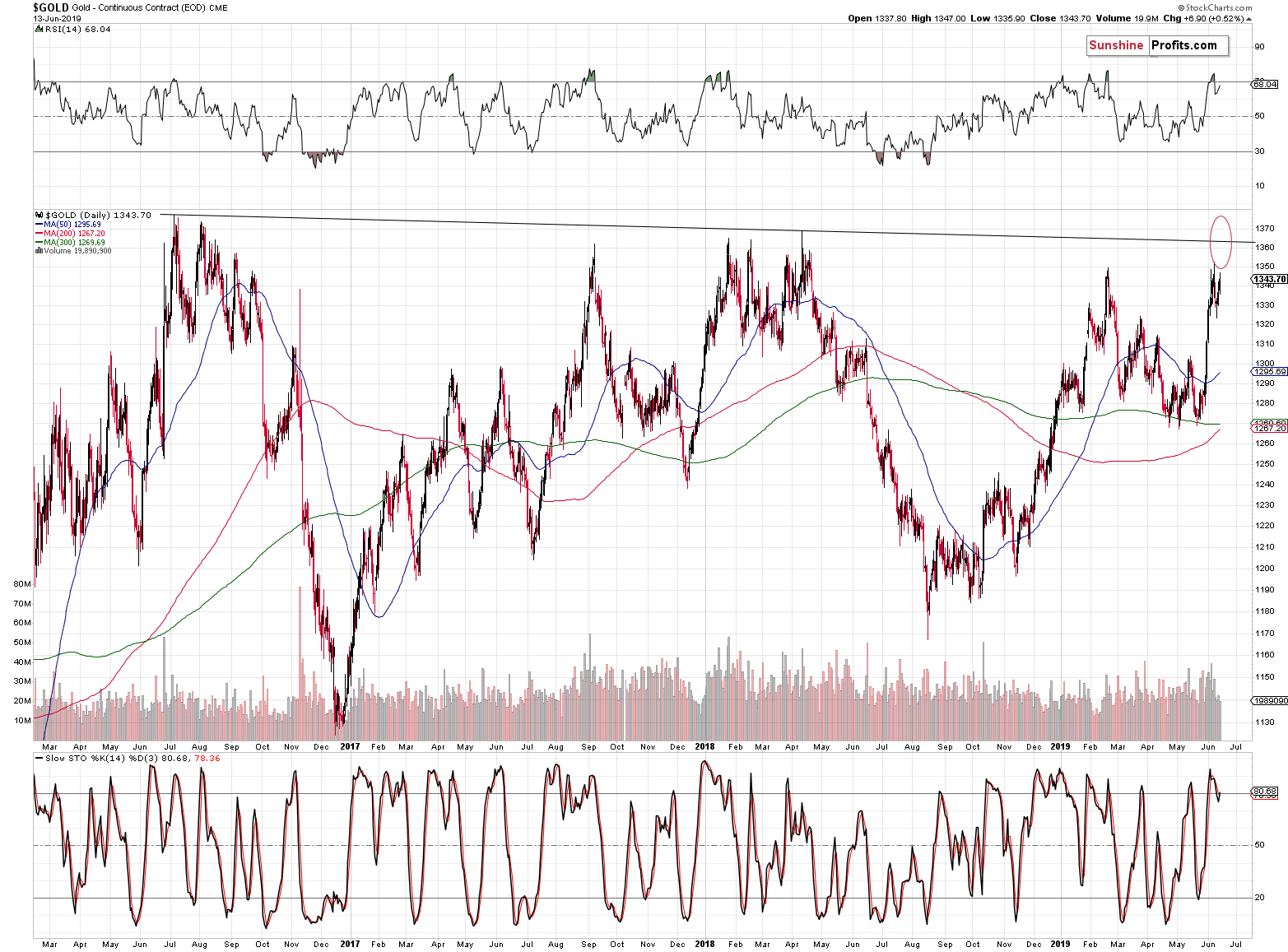

Breaking above the previous 2019 highs would likely result in another quick upswing that could push gold toward the long-term resistance line and previous highs. The slightly declining resistance line is at about $1,363, which is where gold might reverse. It could also move a bit higher, but it's unlikely that it would break above the 2016 highs.

The key thing would be to monitor the market for confirmations from silver and mining stocks. Ideally, we would like to see silver to soar and miners to somewhat disappoint. This would paint a perfectly bearish picture and we would most likely re-enter our short positions at that time.

Since the above-mentioned support line is declining, it moved a bit below the $1,363.

It's not visible on the above chart, but based on the Iran "revelations" gold's continuous futures contract (which the above chart represents) rallied to $1,362.20. The extremely strong resistance line was just reached, which means that the top for gold is likely in.

Today's pre-market high in silver was $15.05 and it was $15.15 on June 7th. This means that while it turns out that we have not shorted the market at the exact top in case of gold or mining stocks (relatively close to it, though), we most likely did short the silver market at its exact top.

The short-term charts don't feature today's pre-market price moves yet, so they would not be particularly useful today. However, given the nature of the most recent move in gold, you might be particularly interested in gold's performance during geopolitical turmoil. You can read the brief explanation in our Dictionary section and as far as the bigger picture is concerned, you will find details in the Market Overview from almost 5 years ago (we made sure that it's available for your review). Yes, it's up-to-date as the situation didn't change much - gold didn't soar despite multiple geopolitical events that happened in the meantime.

Summary

Summing up, gold moved higher once again based on yet another geopolitical event and it reached a very long-term resistance line right at the target that we mentioned last Friday. The odds are that the top in gold is in. Silver didn't move above its previous high (so even taking today's pre-market upswing into account, we did short the silver market at the exact top), but mining stocks have yet to react. Based on the price level that we saw today, they are likely to move higher in a sharp manner but since gold is likely topping today, the same is likely to be the case for the mining stocks. This is not a breakout in gold, but likely an even better (ultimate?) shorting opportunity than what we saw last week.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,382; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $38.67

- Silver: profit-take exit price: $13.81; stop-loss: $15.72; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $13.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The current economic expansion has just equaled with the longest boom in the US history. Is that not suspicious? We invite you to read our today's article, which provide you with the valuable lessons from the 1990s expansion for the gold market and find out whether the US economy will die of old age.

It looks like the calm in the currencies is drawing to a close and volatility is about to pick up. So far, so good. We're at a crossroads these days: after a recent string of declines, the USD appears to be catching a bid. This is not without repercussions and a move either way will be profoundly felt across the markets. But which way that move will be? Read on to find out - and also get positioned accordingly.

Profiting on the Increasing Momentum in the Currencies

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager