Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

How gold behaved yesterday, everyone knows. How it rallied before today’s opening bell, you probably already see as well. But can we assign this to some reasonable cause or rather just emotionality? Let’s look at the charts first.

Yesterday was one of “those” days and today’s pre-market trading ones one of those mornings. “Those” sessions that we all know take place every now and then, but we secretly wish they didn’t. Like one of those things that “happen to other people” but never to us. You don’t like it, and I don’t like it. “Those” days test our knowledge (what’s normal and what’s not?) and – most of all – patience. Something happened, markets reacted, and just when it was likely that after several more days (a few weeks at best) the junior miners would slide profoundly to new yearly lows, it started to seem much less likely. The keyword here, however, is “seem”, and in today’s analysis, I’ll show you why

That “something” yesterday that most likely triggered the rally in gold was the surprisingly positive employment numbers that resulted in temporary changes in the real yields (more on that later today; and yes, this does make the current situation look even more like 2013 …). And that “something” that likely triggered another rally was likely the exceptionally bad… employment numbers (different numbers, though, as yesterday’s report was about initial jobless claims and today’s report was the nonfarm payrolls for April. There were fewer jobless claims, but fewer jobs as well. It shouldn’t have been the case that gold rallied on both pieces of news, but it’s what we saw. Overall, yesterday’s and today’s rally seems to have much more to do with emotionality and, well, randomness than it does with cold logic (by the way, if you haven’t read Fooled by Randomness by Nassim Taleb, I highly recommend it).

And a great way to deal with emotionality and randomness is through charts, as far as the markets are concerned (and, well, through Stoic philosophy in general, but that’s a matter going well beyond the scope of this analysis). When looking at charts, we can apply tools designed to detect emotional peaks and breakthroughs that markets endure.

After all, it’s not important that a line or slope was broken by itself – it’s important because of what it all represents and how people interpret it. Times change, but the fact that people feel fear and greed doesn’t change, which is why even distant patterns and similarities to what we see on different occasions can be useful.

All right, all right, all right, it’s all nicely said, but when will I be making lots of money on this trade?

Likely a week – or so – longer than what seemed to be the most plausible scenario before yesterday’s session. I’m quite sure most people will agree that waiting an extra week for a truly massive price move doesn’t sound that bad after all, especially given that we’re already sitting on profits from the previous positions – everyone following my analyses to the letter profited from the last long trade in the miners, and many people profited handsomely by exiting the previous short position (GDX) on Feb. 26, 2021 and (GDXJ) on Mar. 4, 2021 – extremely close to the yearly bottom (at least so far).

While the market’s moves don’t depend on me, analyzing the market thoroughly, diligently and carefully, and then reporting my findings to you (and keeping you updated), does. Therefore, during yesterday’s session, I sent you the intraday Alert, in which I discussed the situation. Not much changed on the market since I posted/sent it, so today’s analysis is going to be an extension of what I wrote then.

Let’s jump right into charts, starting with the USD Index.

In yesterday’s regular analysis, I wrote the following about the above chart:

Yes, the USD Index soared on Friday, Apr. 30, and based on that it invalidated the breakdown below the 61.8% Fibonacci retracement level. It also broke above its declining resistance line, but it’s been trading sideways since that time. The rally didn’t continue, which likely makes traders question its validity.

What is really happening here is that the USD Index has been verifying the breakout – and it managed to do so. Consequently, the situation is bullish for the next several weeks (even if we see a very short-term move to somewhere around the recent lows).

This, in turn, means that gold is likely to fall in the following weeks (not necessarily in terms of days, though).

As traders had previously been unsure if the strength in the USD Index was indeed the beginning of a new trend, they just got a “confirmation” that the USD Index is not done with declining. In my view, that’s an incorrect interpretation of what’s happening, and while the traders might be right about this for the next several hours or days, they are likely very wrong about the overall direction of the trend over the course of the following months. This means precious metals and mining stocks have likely overreacted yesterday, and this will be reversed once the USD Index proves that last Friday’s rally was not accidental. A rally to new monthly highs might be enough proof.

In the near term, the USD Index could once again test the very recent lows and perhaps reach the rising medium-term support line – at about 90.4 – 90.5. In response, gold might even rally to $1,830 or so, which I already wrote yesterday.

[Edit: I wrote the above in advance, and I’m adding this paragraph at 9 AM EST – the USD Index just reached the above-mentioned target area, so the bottom might be in at this time or it might be extremely close.]

Quoting my yesterday’s thoughts on that matter:

How high could gold rally in the very near term? Perhaps by another $15, to about $1,830 as that’s where we have the 38.2% Fibonacci retracement level based on the August 2020 – March 2021 decline. However, even if gold does rally there (which is far from being certain – the top might form as early as today), it doesn’t seem likely to me that GDXJ would soar substantially. Please note that miners tend to be particularly weak relative to gold right at or before the top and GDXJ is already underperforming.

Also, a quick rally to this level would imply a move back to the previously broken support line – it could work as resistance right now.

Gold moved beyond the blue rectangle that I marked on the above chart (a copy of the 2020 consolidation) but it is not required for the two shoulders of a head-and-shoulders pattern to be 100% identical, so it didn’t invalidate the possibility of this pattern being formed in the following weeks.

Mining stocks have indeed underperformed yesterday. The GDX ETF moved to new intraday highs, but it closed the day below the highest closing price of April. The GDXJ ETF was unable to rally to new intraday highs – it underperformed once again. In fact, looking at the GDXJ ETF chart reveals that yesterday’s session wasn’t really that important in terms of price changes… As long as one is sticking to the selection of assets that I’m featuring in the analyses.

Still, yesterday’s session provides us with some interesting clues. The most interesting thing is the spike in volume that we’ve seen in both ETFs. It’s particularly notable in the case of the GDXJ ETF.

On both charts, it’s clear the spikes in volume during daily rallies are something that marks the end of the rally, not its beginning. On the GDXJ ETF chart, we see an additional layer of detail. Namely, the way the volume-spikes are positioned relative to each other and how it all compares to the late-2020 and early-2021 performance.

In early November 2020, we saw a spike in volume which marked a local top. Then the early-December spike marked the start of a rally. Then after– more or less – an equal amount of time, we saw another spike in volume, which once again marked a local top – that was the early-2021 high.

Now, we saw a spike in volume in late February 2021 (local top), then in late March (start of the rally), and now – in early May, after a more or less equal amount of time – we can see another spike in volume. Consequently, it seems quite likely that what we see right now is similar to what we saw at the beginning of the year. The difference is that if miners decline from here, then the slide is likely to be much bigger as a move to new yearly lows would confirm the broad head-and-shoulders pattern in the miners.

Now, given today’s pre-market move higher in gold – to $1,830s – miners are likely to rally as well. Perhaps the GDXJ ETF will make another attempt to move above its April highs. Please keep in mind that it’s just trading sideways and not a game-changing rally – the GDXJ already was at the very same levels slightly less than a month ago. Today’s rally is not likely to last.

Another, obvious, clue is that miners – unlike gold – didn’t soar to new highs, so one might say that they continue to underperform gold, which is bearish, especially when combined with outperforming silver.

And that’s exactly what silver is doing right now – it’s outperforming gold on a short-term basis. This is what has been preceding major tops for many years, and it seems that the same fate awaits the precious metals market shortly.

Having said that, let’s take a look at the markets from a more fundamental angle.

Taper Your Expectations

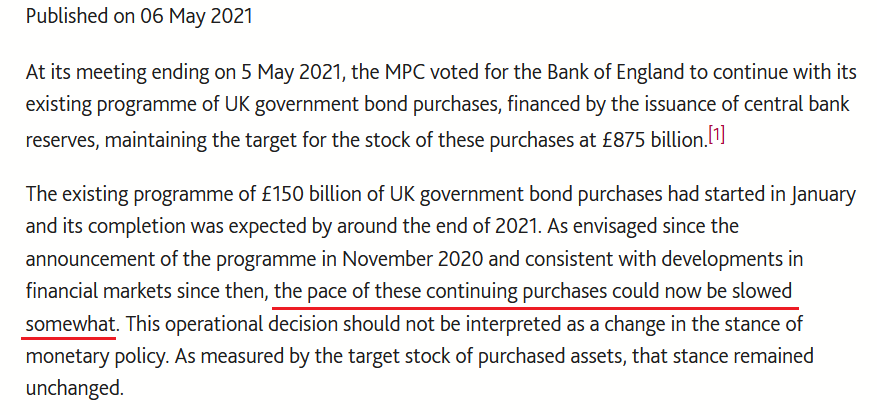

After the Bank of Canada (BOC) decided to scale back its asset purchases on Apr. 21, the Bank of England (BOE) announced on May 6th that it will reduce its bond purchases from £4.40 billion per week to £3.40 billion per week beginning some time in between May and August.

Please see below:

And why is this so important?

Well, with the BOE following in the BOC’s footsteps, the U.S. Federal Reserve (FED) is likely next in line. To explain, while the PMs enjoyed another strong rally on May 6th, their recent climb actually makes some fundamental sense: with inflation expectations surging and the U.S. 10-Year Treasury yield failing to participate, the U.S. 10-Year real yield has declined by 12 basis points since Apr. 30. However, with the U.S. 10-Year Treasury yield demonstrating an even wider divergence from the U.S. 10-Year breakeven inflation rate than before the taper tantrum in 2013, once the dam eventually breaks, the former’s flood will likely drown the PMs in the process. (You likely remember very well how fast gold plunged in 2013.)

Please see below:

To explain, the green line above tracks the U.S. 10-Year Treasury yield, while the red line above tracks the U.S. 10-Year breakeven inflation rate. If you analyze the left side of the chart, you can see that when the material gap finally filled in 2013, the U.S. 10-Year Treasury yield’s surge was fast and furious. Likewise, if you analyze the right side of the chart, you can see that the gap between the two is even larger now. As a result, with material divergences often reversing in a violent fashion, the next surge will likely be no different.

To that point, the FED released its semi-annual Financial Stability Report on May 6. An excerpt from the report read:

“High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields. In this setting, asset prices may be vulnerable to significant declines should risk appetite fall.”

On top of that, FED Governor Lael Brainard had this to say about the current state of affairs:

For context, a “re-pricing event” means that if the U.S. 10-Year Treasury yield reconnects with the U.S. 10-Year breakeven inflation rate above, we should prepare for an explosion.

If that wasn’t enough, Boston FED President Eric Rosengren told an audience at the Boston College Carroll School of Management on May 5th that the housing market remains on high alert. For context, the FED currently buys “at least” $40 billion worth of agency mortgage-backed securities (MBS) per month.

Please see below:

The bottom line?

With euphoric valuations and surging inflation on a collision course of destruction, even FED officials are sounding the alarm. And with the PMs’ recent rally underpinned by falling real yields and investors’ joyful exuberance, sentiment will sour rather quickly once the FED is forced to reduce liquidity. Case in point: following historical recessions since 1970, the U.S. 10-Year Treasury yield often rallies sharply, consolidates, and then continues its trek higher.

Please see below:

To explain, the orange line above tracks the average performance of the U.S. 10-Year Treasury yield during global recoveries since 1970, while the blue line above tracks the performance of the U.S. 10-Year Treasury yield since August 2020. If you analyze the middle of the chart, you can see that the U.S. 10-Year Treasury yield is likely exiting its consolidation phase and is poised to resume its uptrend.

Likewise, while the PMs have exuded confidence alongside a largely absent USD Index, history implies that another sharp move higher is approaching fast.

To explain, the orange line above tracks the average performance of the USD Index during global recoveries since 1970, while the blue line above tracks the performance of the USD Index since August 2020. If you analyze the middle of the chart, you can see that the greenback’s bounce off of the bottom nearly mirrors the average analogue. Moreover, while fits and starts were present along the way, the USD Index is approaching a period that culminates with further strength.

And why is this the case?

Well, because, like most things in life, you can’t have your cake and eat it too. With investors pricing in a future of record GDP growth, perpetual asset purchases by the FED and zero percent interest rates, the goldilocks environment has never occurred in history. For context, when economic growth is strong, increased demand for debt – as businesses increase their capital investments and expand alongside the growing economy – allows lenders to charge higher interest rates. Conversely, when economic growth is weak, decreased demand for debt – as businesses hunker down and preserve capital – forces lenders to offer lower interest rates.

Thus, with a strong economy supposedly around the corner, the U.S. 10-Year Treasury yield and the USD Index should rise in unison (because higher interest rates increase the fundamental value of the U.S. dollar). However, with “elevated risk appetite” (as Brainard puts it) threatening to swallow the financial system, FED officials are wary about reducing liquidity, rising interest rates and popping the stock market bubble.

Remember though: history has shown that no matter how hard they try, the house of cards always comes crashing down. Case in point: Lords of Finance: The Bankers Who Broke the World dissects the stock market crash of 1929 and The Great Depression.

And if you read the excerpt from the book below, notice a familiar policy?

“The quartet of central bankers did in fact succeed in keeping the world economy going but they were only able to do so by holding U.S. interest rates down and by keeping Germany afloat on borrowed money. It was a system that was bound to come to a crashing end. Indeed, it held the seeds of its own destruction. Eventually, the policy of keeping U.S. interest rates low to shore up the international exchanges precipitated a bubble in the U.S. stock market. By 1927, the Fed was thus torn between two conflicting objectives: to keep propping up Europe or to control speculation on Wall Street. It tried to do both and achieved neither.”

The bottom line?

With inflationary pressures akin to propping up Germany in the late 1920s, the FED is torn between rocking Wall Street – which occurred on May 4th when U.S. Treasury Secretary Janet Yellen hinted that interest rates should rise – and allowing inflationary pressures to persist in hopes that they’ll calm down on their own. However, with cost-push inflation born by speculation in the commodities market, a summertime surprise will likely force the FED’s hand.

As evidence of the European Central Bank’s (ECB) ‘hope-and-pray’ strategy, the ECB published a report on May 6th essentially outlining a myriad of reasons why it should not raise interest rates. And while the policy stance is bearish for the EUR/USD, and therefore, bullish for the USD Index, the reasoning is another example of why once the dam breaks, the flood will be fast and furious.

Please see below:

Translation?

As long as inflation expectations are confined to the financial markets and not mirrored by households and businesses, then inflation is synthetic, and raising interest rates will do more harm than good to the economy. However, with the argument flawed on so many levels, history implies that failing to taper creates even more problems down the road.

Case in point: the Institute for Supply Management (ISM) released its services PMI on May 5th. Quoting an excerpt from the report, I wrote on May 6th:

“The Prices Index figure of 76.8 percent is 2.8 percentage points higher than the March reading of 74 percent, indicating that prices increased in April, and at a faster rate. This is the index's highest reading since it reached 77.4 percent in July 2008 ….All 18 services industries reported an increase in prices paid during the month of April.”

And highlighting the significance, notice the strong correlation between the ISM Prices Index and the core Personal Consumption Expenditures (PCE) Index? For context, the core PCE Index is similar to the core Consumer Price Index (CPI). However, the former measures the prices that consumers and nonprofits pay for goods and services and excludes more than just the effects of food and energy.

Please see below:

To explain, the light blue line above tracks the year-over-year (YoY) percentage change in the ISM Prices Index, while the dark blue line above tracks the YoY percentage change in the core PCE Index. If you analyze the right side of the chart, you can see that reconnecting with the light blue line implies a core PCE Index reading of roughly 3% (using the scale on the right side of the chart). For context, the last time the core PCE Index hit 3% was January 1992. Thus, while the PMs continue to enjoy the speculative ride higher, once the FED realizes that reducing liquidity is not only the best, but the only course of action, the positivity will likely be short-lived.

In conclusion, plunging real yields have lit a fire under the PMs, but the rubber band can only stretch so far before it snaps. With inflation bubbling beneath the surface and central banks already diverging in their responses, it’s only a matter of time before long-term yields move meaningfully higher. To that point, with the U.S. 10-Year Treasury yield demonstrating its largest-ever divergence from the U.S. 10-Year breakeven inflation rate, history implies that the reconnection won’t be met with applause by the PMs. Thus, the medium-term outlook remains profoundly bearish, and the PMs often shine their brightest just before the sun sets.

Overview of the Upcoming Part of the Decline

- It seems likely to me that the corrective upswing was already completed (at least in the GDXJ ETF) or that it will be completed shortly – perhaps with gold rising temporarily to the $1830s .

- After miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-2 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,450 - $1,500 and the entire decline (from above $1,700 to about $1,475) would be likely to take place within 1-12 weeks, and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might happen with gold close to $1,475, but it’s too early to say with certainty at this time. In other words, the entire decline could take between 1 and 12 weeks, with silver declines occurring particularly fast in the final 1-2 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops. If the last week’s highs in the S&P 500 and NASDAQ were the final highs, then we might expect the precious metals sector to bottom in the middle of the year – in late July or in August.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the PMs’ medium-term decline is well underway and based on the recent performance of the USD Index, gold, and mining stocks, it seems that the corrective upswing is about to start soon. In fact, it might have already begun in the case of the GDXJ ETF. IF it moves to new intraday highs or even manages to close above the April highs, this move higher is not likely to last. Conversely, this emotionality-and-news-based rally is likely to be short-lived. The confirmed breakout in the USD Index is yet another confirmation of the bearish outlook for the precious metals market, even though it might move a bit lower in the near term, pushing gold (temporarily) higher.

After the sell-off (that takes gold to about $1,350 - $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with a possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now, while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $24.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $39.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $94.87; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,512.

Gold futures upside profit-take exit price: $1,512.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief