Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

Gold, mining stocks, and - especially - silver all declined last week, but the sizes of the downswings were not alike. Miners didn't break either above, or below their consolidation, gold didn't close the week below $1,400, but it was extremely close to doing so (the close was just 10 cents above this level) and silver broke below its rising support level in a decisive manner. What does such a mix tell us? Quite a lot.

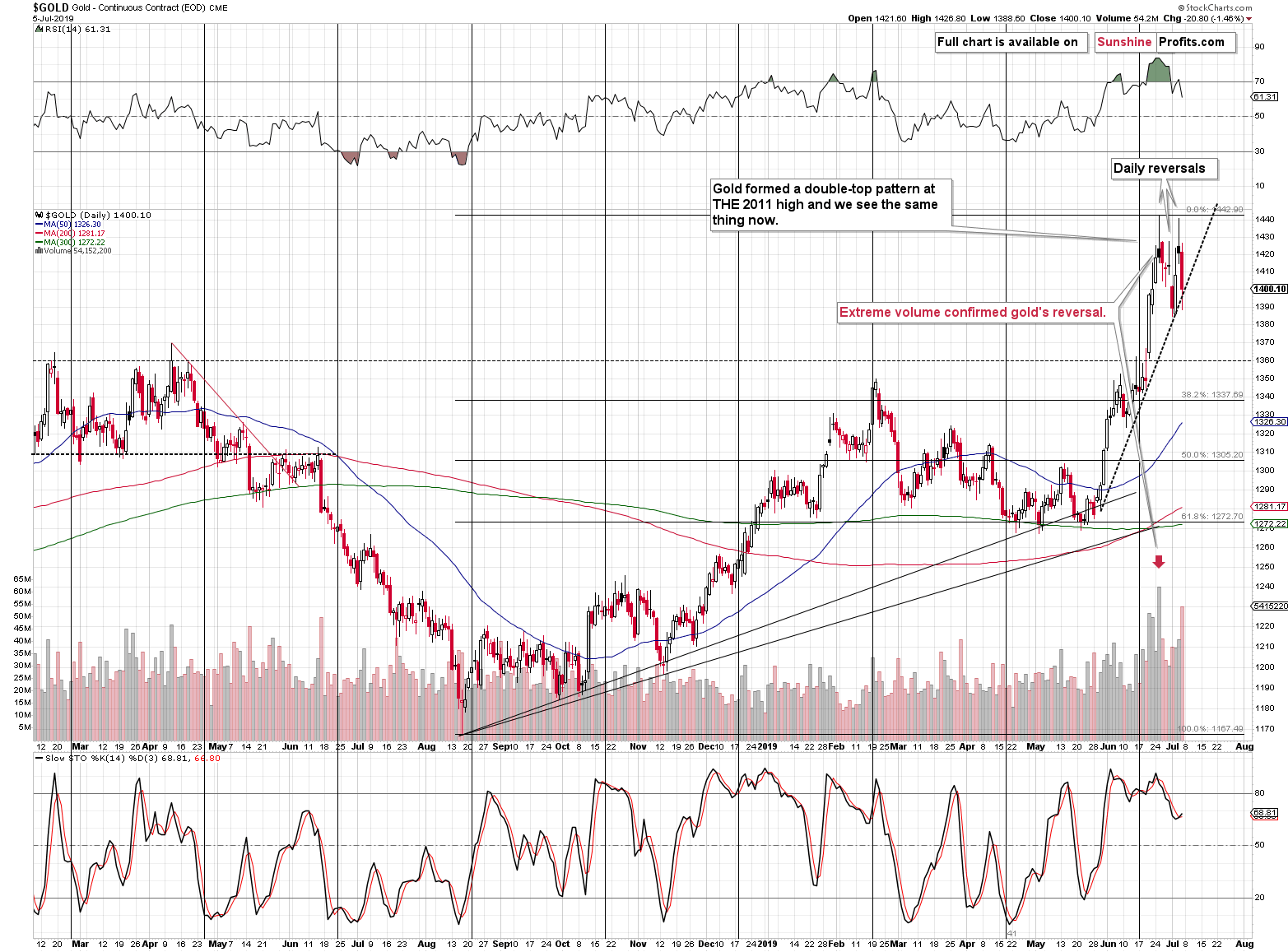

First of all, it tells us that gold's performance here (on its own) is quite similar to how it topped in 2011. Yes, we mean THE top. Back then, the key round resistance was $2,000 and the level that gold manage to break above was $1,900. Gold broke above $1,900, then declined below it and soared back above more or less to the previous high, but not above the $2,000 mark.

This time, the key round resistance is the $1,500 mark and gold managed to break above $1,400 instead. It managed to do so once, then it declined back below this level and then made another attempt. But, instead of rallying above $1,500, gold stopped at about the previous high and declined once again.

Double-topping Gold?

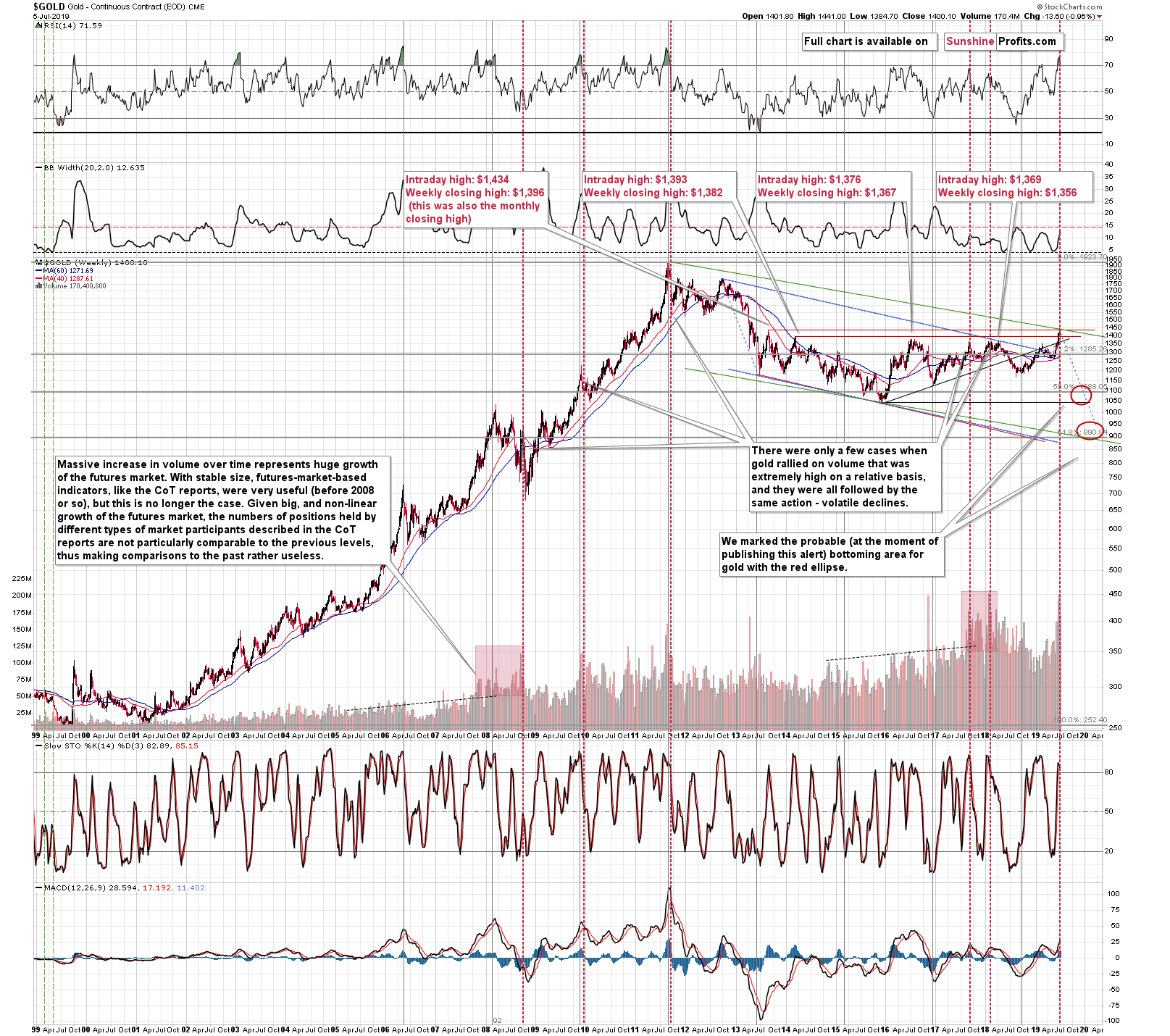

The decline materialized on big volume, while the second top formed on volume that was high in absolute terms, but average to - low on a relative basis. That's exactly what one would like to see as a confirmation of the double top pattern.

Gold didn't close below the rising support line, but the above price-volume link and the fact that we saw two major reversals and two failed attempts to break above the mid-2013 high, makes the outlook more bearish than a week ago.

What About Mining Stocks?

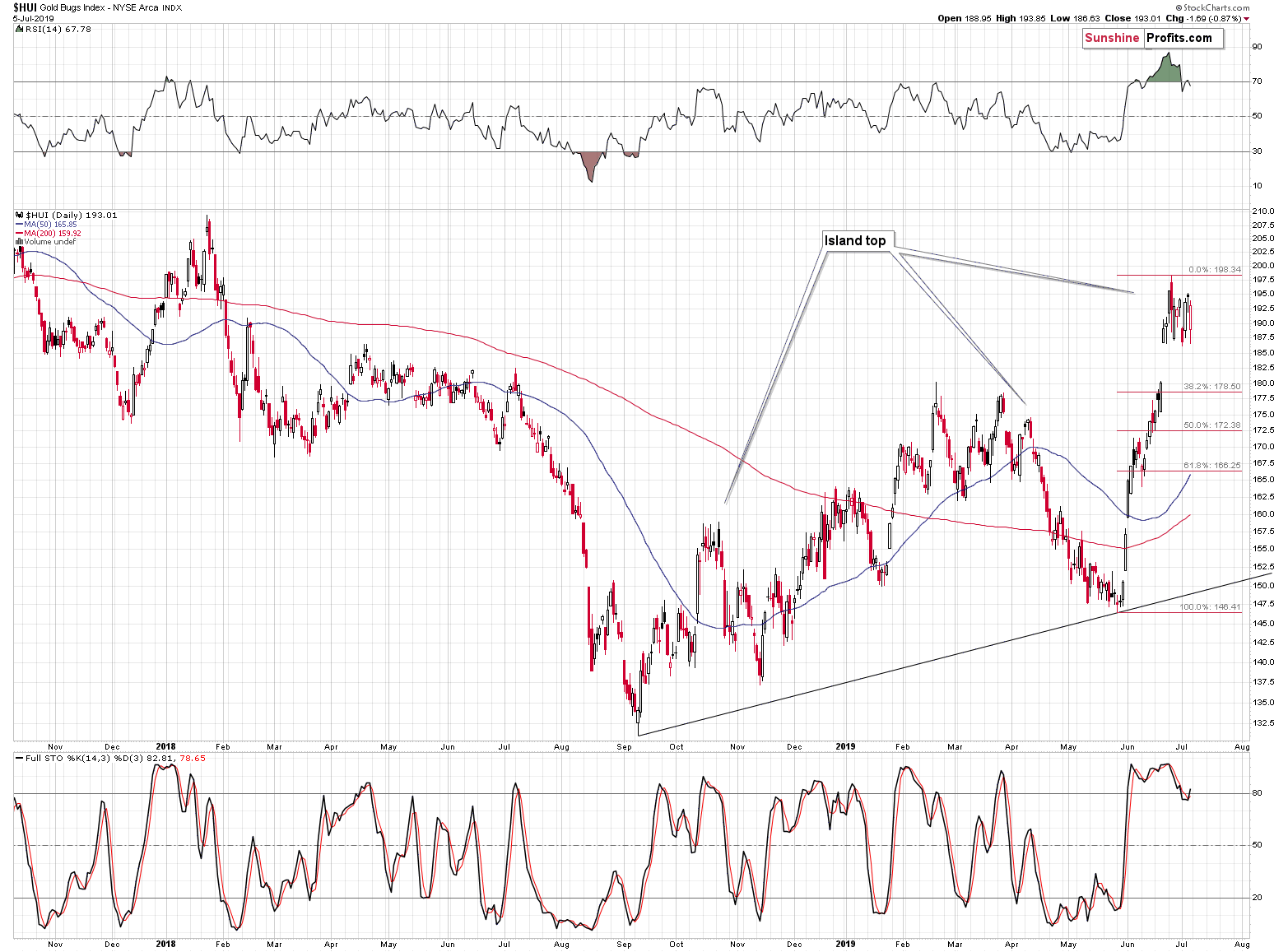

Gold stocks declined initially but given gold's turnaround before the end of the session, they didn't break below their recent lows and stayed within the consolidation pattern. It appears bullish but given the lack of breakdown in terms of closing prices in gold, this move is not surprising. When the declines in gold continue - just like they did in 2011, gold miners are likely to slide with vengeance, just like they did in October 2018. The likely difference is that the following decline is likely to be much bigger as the preceding rally was bigger. The declines that take place after the island tops - and that's the shape of the last several days of trading - usually erase the preceding rally in a manner that's just as fast as the rally itself. And since the rally was sharp, the following decline is likely to be either sharp or even sharper.

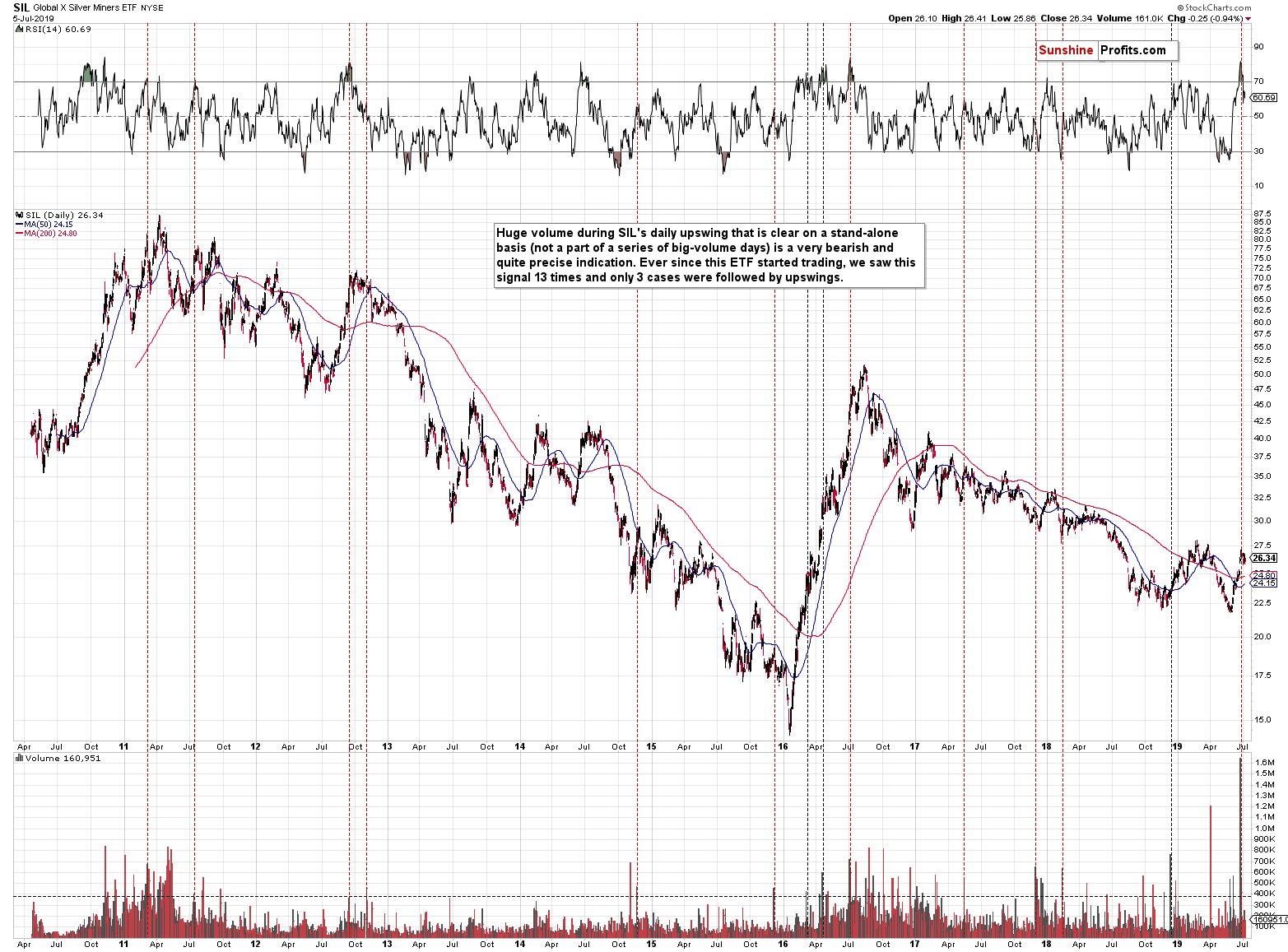

Silver stocks' picture shows something similar, only this time the size of the preceding rally appears smaller. That's mostly the case, because the scale is bigger and the 2016 rally as well as the preceding decline were larger. If anyone still had any doubts regarding the local and unsubstantial nature or the recent upswing, this chart should make them disappear.

We just saw a relatively small counter-trend rally that took RSI well above 80 (meaning that it was extremely overbought) and that ended with volume that we've literally never seen before - at least not in case of the SIL ETF that we use as a proxy for the silver miners.

Mining stocks are generally the first to soar after a major bottom is formed. And did they? They moved higher, but they are very far from being the extremely strong part of the precious metals sector.

What about the underlying metal - silver?

The White Metal in Focus

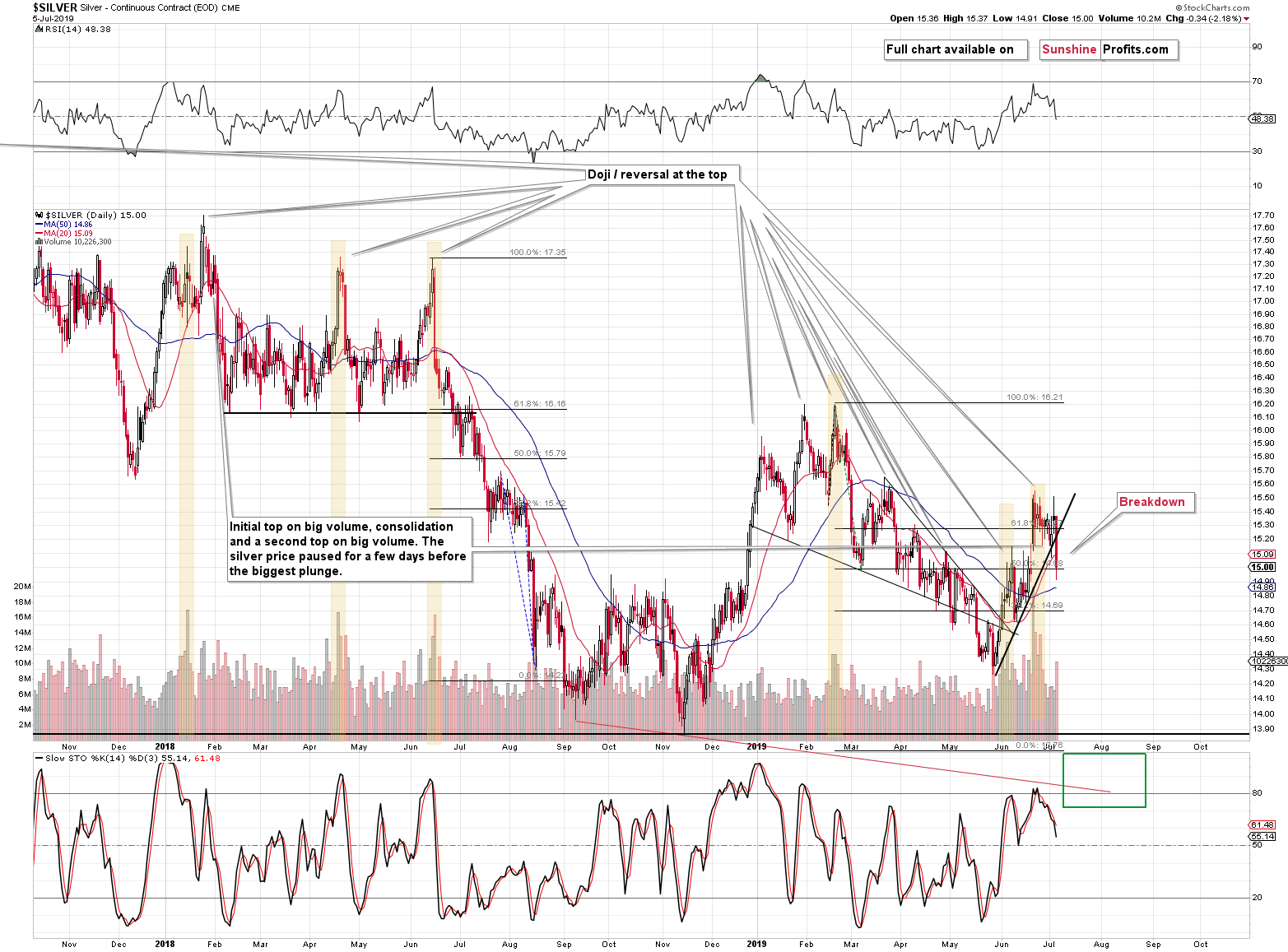

While gold was hesitating to break below its rising support line, silver had no second thoughts. The rally is over, and the white metal is back in the decline mode after topping on huge volume. The very short-term outperformance at the June top and huge volume that accompanied it was what clearly emphasized that the top was in and that's what we dutifully reported to you. It's not something that beginning investors realize as a technical analysis 101 manual would have one believe that a rally on huge volume is bullish. However, being in the precious metals market for well over a decade makes us know intricacies of the precious metals market that many people miss.

The implications of the above chart are clearly bearish.

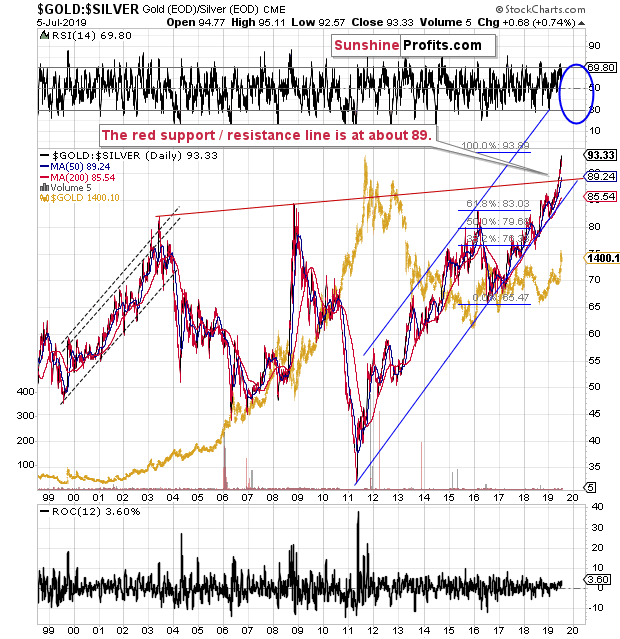

By the way, do you remember when everyone and their brother told you how the gold to silver ratio was topping, but we warned you about the breakout?

It's clear that the breakout has been more than confirmed and that the implications remain bearish for the precious metals market for the following months. Why would the latter be the case? Because major moves in the PM sector tend to happen in the opposite direction to the one in which the ratio is moving. By breaking above the 2016 high (as well as 2008 and 2003 highs), the ratio is practically screaming that new lows (below the 2015 and 2016 lows) are to be expected for gold and silver.

There's one more decisive move that we would like to discuss today.

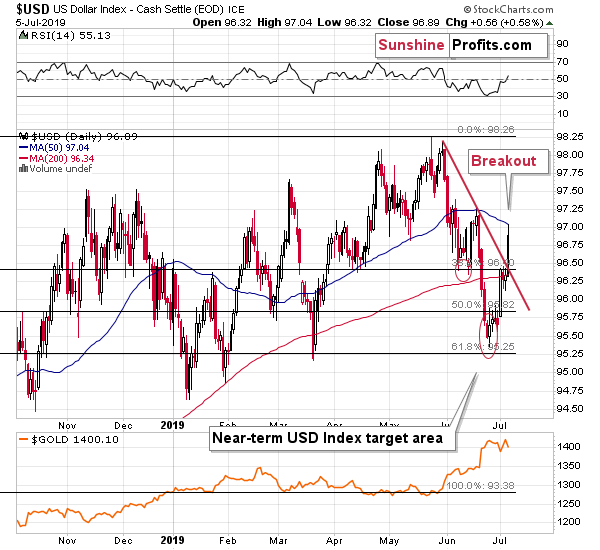

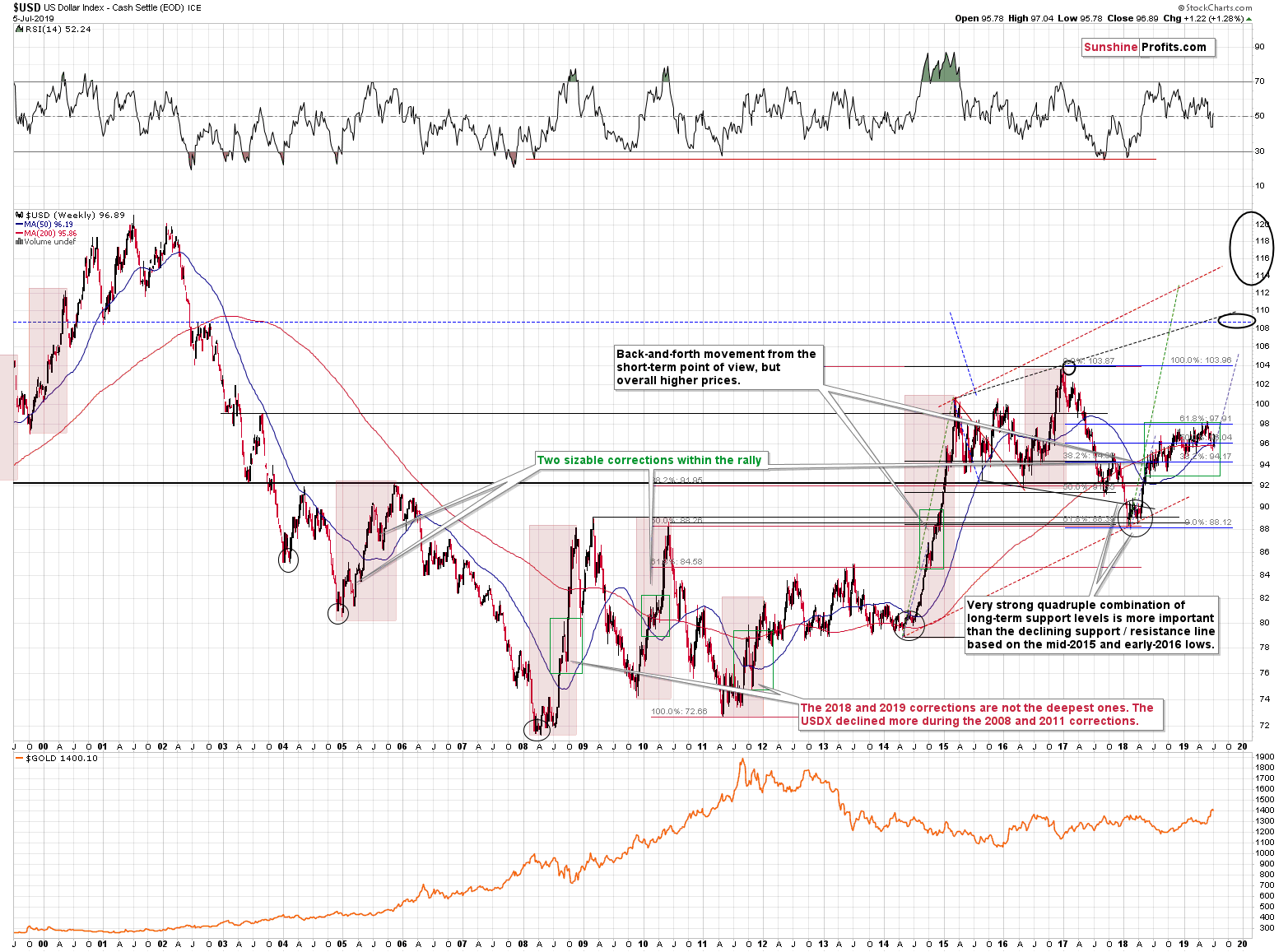

The USD Index Tips Its Hand

Namely, the USD Index soared on Friday and closed the week well above the declining resistance line. This is a meaningful breakout, especially in light of all the bearish news that recently hit this market. The Fed became surprisingly dovish, Trump has been officially calling for lower USD values multiple times and - what's likely connected with the above - U.S. engaged in several "political disagreements" to put it politely and midly. During this time, we emphasized that the most important thing was not to watch the decline itself, but to monitor if the strength of the decline is adequate to what had been happening. It has been of utmost importance how exactly is USD reacting - and it showed strength even through the declines. How? By not falling lower.

Everything that happened could have easily taken the USD below 90. But it didn't. The USD Index didn't even move to a new 2019 low. It didn't even move to the March 2019 low, when the Fed was less dovish than it is right now. This was and continues to be very bullish for the following weeks and months.

And where was the USD Index on Friday? The intraday high was 97.04, which is above the June 3 low. In other words, the USD Index was just higher than where it was just two days after the yearly top in terms of the closing prices. The USD continues to show strength and it has profound implications going forward.

Namely, it means that the U.S. currency is likely to finally break above its running correction and soar more intensively. Just a repeat of the rally that we saw before the correction (the early 2018 move) would take the USD Index above its 2017 and 2018 highs. The next strong resistance above them is the late-2002 high of about 108. And given the pace of the 2018 rally, we could see USD Index close to the 2017 - 2018 highs as early as in the final part of this year.

The Analytical Cherry: Gold Price Path

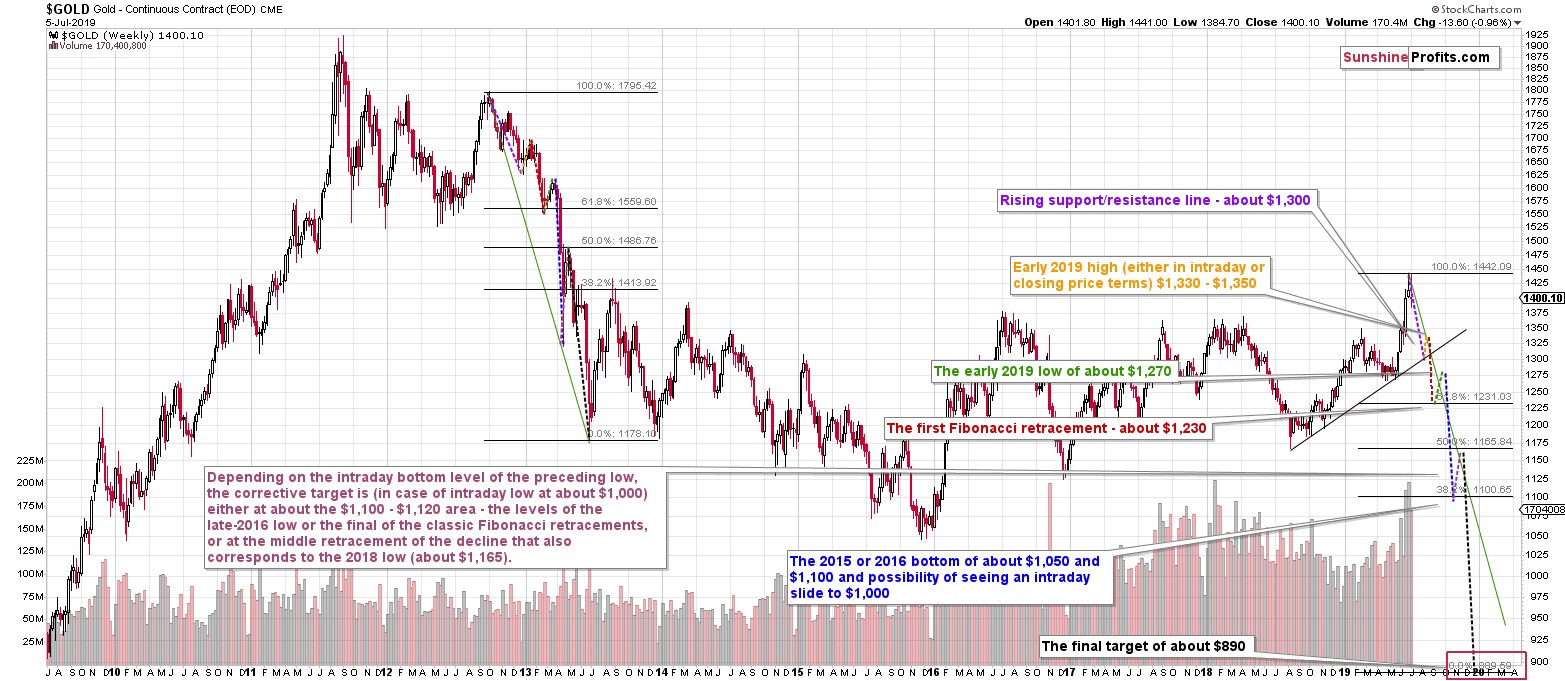

This has very important implications for what we promised to show you today. We promised to deliver the updated gold price path chart. When we originally featured it, we explained that all targets should be taken on an approximate (at least +/- 1 month basis in terms of time) and that we can't guarantee that gold will indeed move exactly as we outline. This remains up-to-date. It's simply not possible to predict the price path with the exact precision and definitely not when it comes to the long-term price moves. Nobody in this, or any other business, can claim to be able to do so, and neither do we. But, does it mean that the chart below is not valuable? Of course not. It shows you more or less what to expect and when certain moves could happen, so that they don't surprise you as they will surprise (and likely cause panic among) beginning investors and traders. It also shows you that big moves are likely relatively close and thanks to comparing them to what already happened a couple of years earlier, you see that expecting these moves is not as unrealistic as it may appear at first sight, especially if one is focused on the most-recent day-to-day trading. It's very easy to get all caught-up in the daily market movement and while gold is rallying, to forget that it declines as well, and while gold keeps on sliding, to forget that gold will also rally (in fact it is likely to rally greatly in the next several years).

So, without further introduction, here's the likely price path for gold for the following months.

The details are visible directly on the above chart (by the way, you can click it to enlarge it) and the most important takeaways are:

- Gold is still likely to slide below $1,000, most likely to about $890 and it's most likely to take place in the final part of this year, around the time of the USD Index top, however, we are not ruling out a situation in which these reversals take place early in 2020

- The sharp rally that we saw recently is likely to be reversed in a just as a sharp manner

- The support levels are provided by the previous lows, Fibonacci retracements (created using the $890 target), and the nearby rising support line

- There's not much clarity regarding the shape of the final part of the decline and the correction that precedes it, just as there was little clarity regarding the initial April 2013 slide. The implication here is not to trust the initial corrective upswing from about $1,100 when almost everyone will be writing about gold having bottomed.

Before summarizing, we would like to quickly show why $890 is such a likely target for the final bottom in gold. Those who have been with us for years know this very well, but since many people joined us recently, we would like to quickly show it once again.

In short, the $890 level is the combination of two critical support levels, the 2013 analogy, and one major fact. The support factor are:

- the 61.8% Fibonacci retracement level (the most classic retracement) based on the entire bull market

- the lower border of the declining trend channel based on the 2011 high, the most recent high and the 2015 low

The 2013 analogy currently suggests a move below $950, not necessarily to about $890, but the latter is still the most likely target given the above two points and the major fact that we mentioned above. And this fact is that back in 2015 gold was not hated enough for this to be THE bottom. People were relatively optimistic, we saw comments of gold analysts and gold promoters, we saw the outcome of the online polls, we saw our own e-mail inbox. There was neither major panic, nor hate toward gold. Gold was not loathed in the mass media. That's all what we should see at THE bottom and we didn't. Gold simply didn't get low enough. Now, gold breaking below $1,000 (which also means a visible breakdown below the 2015 bottom) is something that should trigger panic selling and make people hate it. That's the environment in which the true bottom is likely to form and the time to back up the truck with the precious metals. For now, in our opinion, the greatest opportunity continues to be in making the most of the upcoming slide.

Summary

Summing up, gold closed the previous week 10 cents above $1,400, but it did so after once again failing to break above the mid-2013 high, and shortly after silver broke below its own rising support line, which means that the overall outlook for the precious metals market deteriorated. The above happened after multiple long-term signs pointing to lower prices in the following months, i.a. the clear huge-volume-confirmed bearish shooting star candlestick in gold, huge volume topping signs from both: gold and silver, the triangle-vertex-based reversals, and epic volume from silver stocks. The next big move in the precious metals sector is most likely going to be down, not up.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,452; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $31.67

- Silver: profit-take exit price: $13.81; stop-loss: $16.32; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $23.87

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $26.47; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $9.87

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $37.17

- JDST ETF: profit-take exit price: $78.21 stop-loss: $22.47

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Ladies and Gentlemen, it has finally happened! The current expansion already goes on for 121 months, becoming the longest economic boom in the US history. Should we celebrate now? Or should we worry, as all good things come to an end, and whatever lasts long, ends up even faster? We invite you to read our today's article, which assesses the vitality of the current expansion, and find out whether the U.S. economy in a good shape or on the edge of collapse, and what all of this implies for the gold market.

Record-Long Expansion and Gold

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager