Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. Predicated on last week’s price moves, our most recently featured medium-term outlook remains the same as the price moves align with our expectations (or at least are not really against them). On that account, there are parts of the previous analysis that didn’t change at all in the earlier days and are written in italics.

This week we’re posting this bigger update one day ahead of regular schedule, due to PR’s travel plans.

The key thing that happened this week is the reversal and decline in silver and junior mining stocks (GDXJ; whereas the GDX and the HUI Index are basically flat) that happened despite a visible move lower in the USD Index and a move higher in the S&P 500. And gold futures are up by only $9.20 this week, meaning that junior miners are down despite both of its key price drives (gold and stocks) being up, which is extremely bearish for the following weeks.

Quite a lot will depend on today’s CPI reading, but only in the short run. You’ll find more details below.

Will the CPI Hype Help Gold Shine Bright?

The hype train has arrived, and investors are eager to ride the narrative as long as they can; and with gold’s 2023 strength driven by false hopes for a dovish pivot, the chorus could grow louder on Jan. 12.

For example, the U.S. Bureau of Labor Statistics (BLS) will release the Consumer Price Index (CPI). Moreover, with the crowd assuming that the long-term issues can be resolved with one print, they’re using hyperbole to justify their lack of historical knowledge about inflation.

Please see below:

So, while the narrative proclaims that this CPI print is significant, the reality is that the small declines in recent months have no bearing on the medium-term ramifications. For example, the decline in oil prices has driven the headline CPI’s weakness, even as core inflation remains uplifted. To explain, we wrote on Dec. 14:

The recent decline in oil prices was driven by investors’ misguided fears of an imminent recession. In a nutshell: if the global economy is on the brink of collapse, demand for oil should suffer mightily.

Please see below:

The various headlines above depict the recession sentiment confronting the oil market since late September. As you can see, “recession fears” have been making the rounds, and these fears helped reduce oil prices, which helped reduce the headline CPI.

To that point, with the crude oil price suffering in recent months, the headline CPI’s deceleration was far from unexpected.

Please see below:

To explain, the candlesticks above track the performance of the crude oil price since November. The data shows that crude futures have struggled recently, which supports lower headline inflation and fuels the bulls’ misguided optimism.

But, the crowd misses the forest through the trees. With core inflation – which excludes food and energy – still resilient, normalizing the metric to 2% should be much more challenging than the consensus realizes.

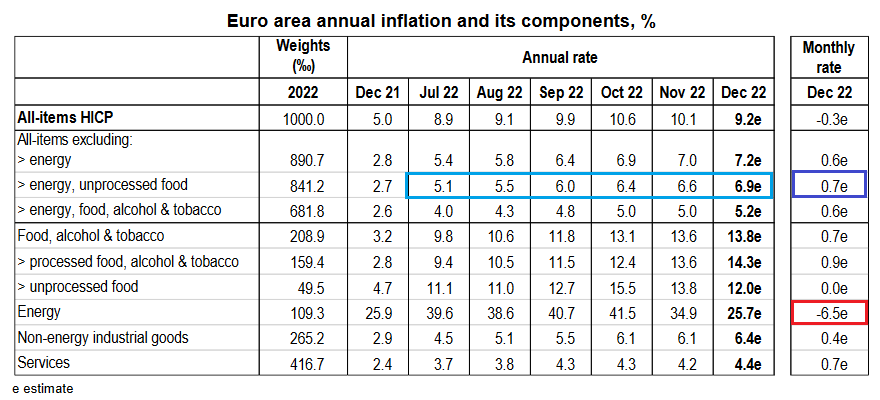

As evidence, Eurozone headline inflation declined from 10.1% YoY in November to 9.2% YoY in December (released on Jan. 6). Yet, while the 0.3% month-over-month (MoM) decline made investors feel like the inflation battle was over, please remember that the devil is in the details.

Please see below:

To explain, the red rectangle above shows that energy prices declined by 6.5% MoM in December, which unsurprisingly, drove the headline CPI’s decline. Conversely, the dark blue bar above shows that core inflation increased by 0.7% MoM, which marked a 6.9% YoY increase and a new 2022 high. Furthermore, if you focus your attention on the light blue rectangle, you can see that Eurozone core inflation has increased YoY in every month since July.

Therefore, when the news media puts out a headline along the lines of “Euro area inflation slows to 9.2% in December,” the crowd shoots first and asks questions later. In other words, they buy the narrative without doing their homework.

So, while the recent economic data and Fed officials have been profoundly hawkish, investors’ expectations materially contrast the fundamental realities. Likewise, while the crowd cried wolf about a recession in July and October, we warned that their pessimism was premature. We wrote on Dec. 7:

The red line above tracks the U.S. 10-2 spread, which subtracts the U.S. 2-Year Treasury yield (2Y) from the U.S. 10-Year Treasury yield (10Y). In a nutshell: when the 2Y exceeds the 10Y, it's the bond market's way of warning about a forthcoming recession; and the development occurs because the 2Y is pricing in a higher U.S. federal funds rate (FFR), while the 10Y is pricing in weaker economic growth.

Also, with yield curve inversion (10Y < 2Y) the talk of the town in recent days, the narrative proclaims that a recession is imminent. But, that's not what we see….

The 10-2 spread is becoming more negative, and the last three recessions did not occur when the spread was declining.

To that point, the 10-2 spread turned negative in December 1988, and the recession arrived in July 1990 (~20-month lag). The 10-2 spread also turned negative in February 2000 and the recession arrived in February 2001 (~12-month lag). In addition, the 10-2 spread turned negative in February 2006 and the recession arrived in December 2007 (~22-month lag)….

The moral of the story is that the 10-2 spread needs to turn positive before recession fears are valid.

As such, with recession fears abating, the fundamentals continue to unfold as expected. However, the crowd still misses the mark as it relates to a higher FFR. With the U.S. labor market and consumer spending still resilient, the economic backdrop supports higher interest rates, not lower.

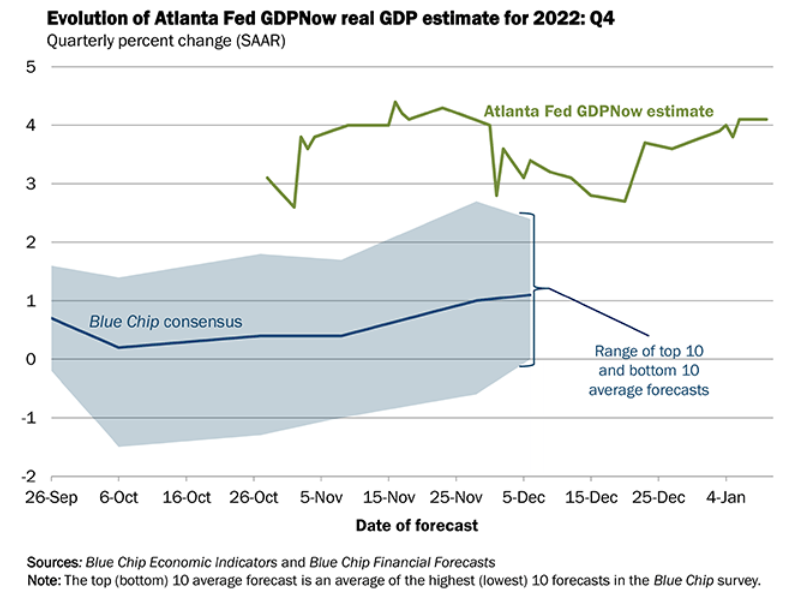

Please see below:

To explain, the Atlanta Fed increased its fourth-quarter real GDP growth estimate (the green line above) from 3.8% on Jan. 5 to 4.1% on Jan. 10. The report stated:

“The nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 3.2 percent and 5.8 percent, respectively, to 3.5 percent and 6.8 percent, respectively.”

Similarly, S&P Global reported on Jan. 11 that Q4 real GDP could be even more hawkish.

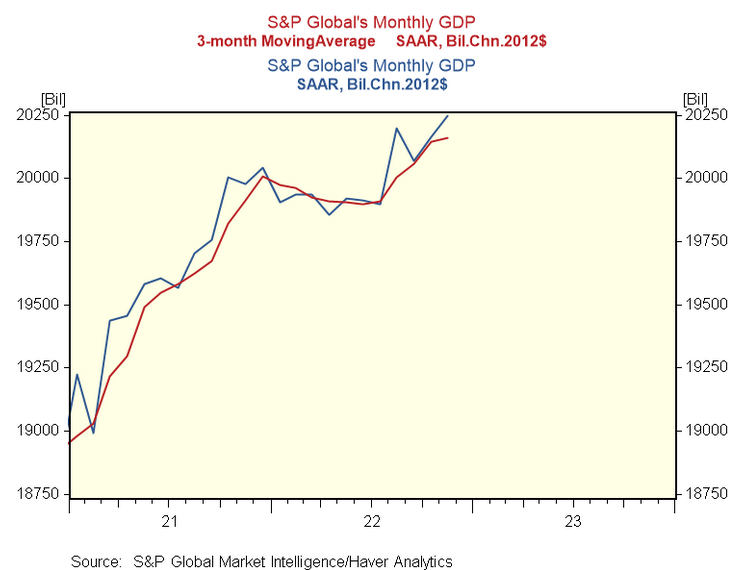

Please see below:

To explain, the blue and red lines above track the dollar value of S&P Global’s monthly and three-month moving average of expected real GDP. As you can see, both metrics continue to hit higher highs, despite investors’ hopes for demand destruction and 2023 rate cuts. Moreover, Renaissance Macro wrote on Jan. 11:

“S&P Global’s Monthly U.S. real GDP measure jumped sharply in October and November. Over these two months, real GDP has advanced 5.5% SAAR. If we assume zero growth in December, Q4 GDP (average of Oct-Dec against average of Jul-Sep) would still climb 3.3% at an annual rate. Strong.”

Therefore, please remember that U.S. real GDP growth was running at roughly 2% pre-pandemic, and with the U.S. unemployment rate at a ~50-year low and the YoY core CPI near a 40-year high, investors’ pivot expectations are out of whack with fundamental reality.

Finally, we’ve warned repeatedly that wage inflation is the canary in the coal mine. In nutshell: wages are sticky and don’t jump around as much MoM as oil and commodity prices. Furthermore, higher wages allow Americans to absorb price increases that match their salary increases. So, if wages run at 5%+, it’s nearly impossible to reduce output inflation below 5%.

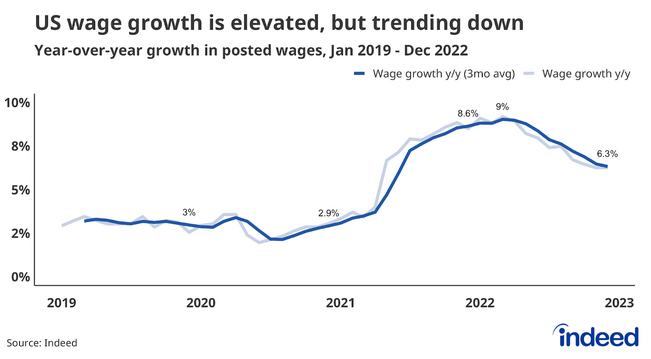

Speaking of which, Indeed updated its Wage Tracker on Jan. 10. An excerpt read:

“Posted wages grew 6.3% YoY in December 2022, a pace more than twice December 2019’s measurement of 3%. Gains in posted wages remain strong but continued to decline coming in below November’s 6.5% rate.”

Consequently, while wage inflation declined by 20 basis points YoY in December, a metric north of 6% is more than 3x the Fed’s desired target. On top of that, continued declines at this pace would take nearly 22 months for Indeed’s measure of wage inflation to fall to 2%. As a result, the crowd materially underestimates the hawkish realities that should commence in the months ahead.

Overall, the CPI release garners a lot of attention, but one month’s print is meaningless from a medium-term perspective. Moreover, while the bulls don’t care about the details, the U.S. economy is far from the carnage that often coincides with dovish pivots; and while the gold price, like many risk assets, is happy to ride the upward momentum, a profound wake-up call should materialize when reality re-emerges.

How do you see CPI-day unfolding? Will the bulls push prices higher, or does the front-run on Jan. 11 set the stage for a reversal? And why are investors worried about missing a melt-up; do you buy their optimism?

Silver Still Can’t Hold $24

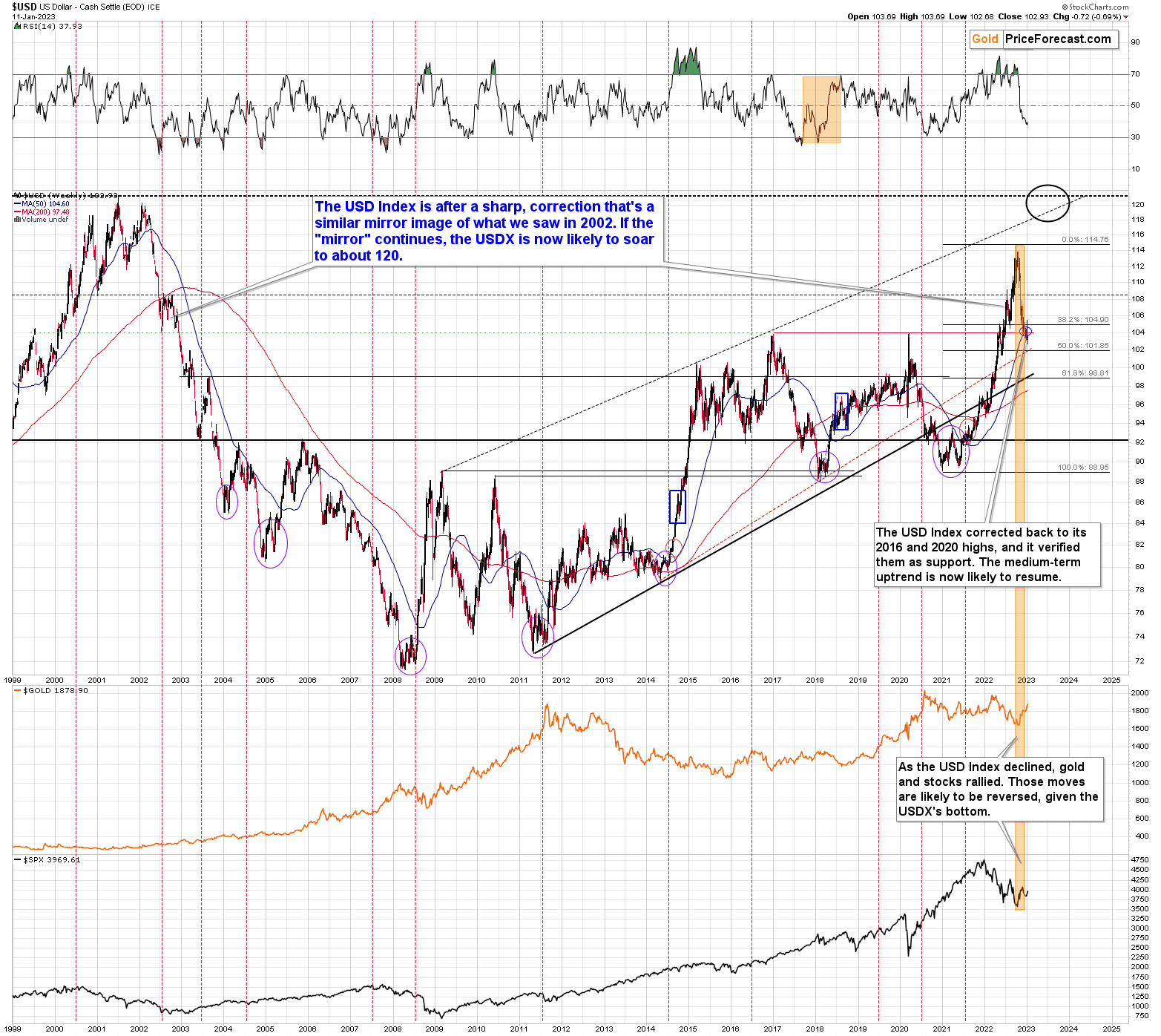

While the pair have consolidated recently amid the false pivot optimism, we expect the USD Index and real yields to surpass their 2022 highs in 2023. With the crowd underestimating the resiliency of inflation and overestimating the likelihood of a dovish pivot, a higher FFR should drive a late 2023 recession, not a premature collapse in demand.

Therefore, while the PMs assume that the liquidity drain is nearing its end (please don’t forget about QT), interest rates are nowhere near the levels that have historically curbed inflation. As such, this bear market rally should fail like the others did in 2022.

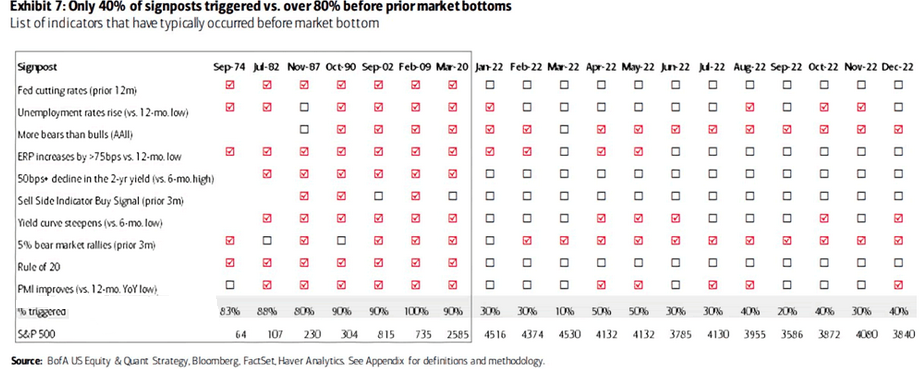

For example, Bank of America’s checklist of bear market bottom indicators shows that only 40% have been triggered, with 80%+ the norm throughout history.

Please see below:

To explain, the table on the left (Sep-74 to Mar-20) shows how fundamental developments like the Fed cutting interest rates, the Rule of 20, and a rising unemployment rate are often present when the S&P 500 forms a long-term bottom. Conversely, if you analyze the right side of the table (Dec-22), you can see that only four of the 10 boxes are checked off.

As a result, investors ‘disdain for history is present from many angles, and their faith in the Fed has clouded their judgment. Consequently, with more pain poised to confront the general stock market, the silver price should hit new lows alongside the S&P 500.

To that point, we’ve warned on numerous occasions that nine of the last 10 bouts of rising inflation have ended with recessions; and with high inflation (like today) during the 1970s/1980s resulting in four recessions within ~12 years, history and fundamental reality are not on the bulls’ side.

More importantly, when recessions arrive, the S&P 500 often suffers mass liquidations.

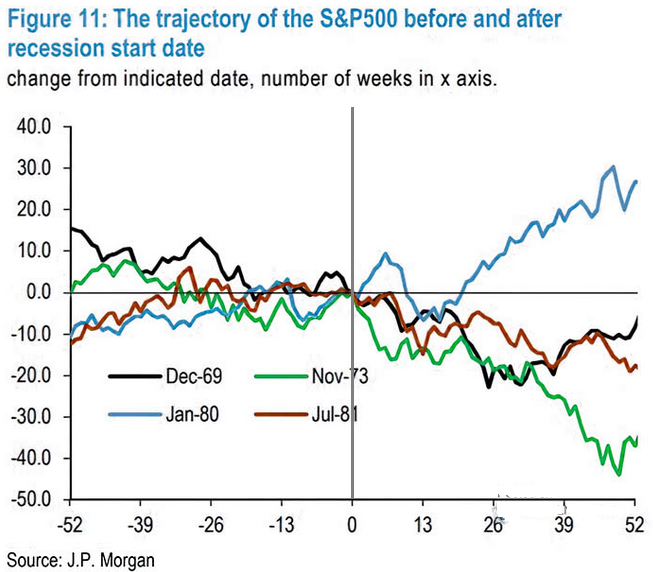

Please see below:

To explain, the colored lines above track the performance of the S&P 500 before and after recessions arrived from 1969 to 1981. If you analyze the vertical gray line in the middle (at 0), you can see that when the recessions hit in 1969, 1973 and 1981, the S&P 500 sunk to new lows and remained underwater.

Similarly (and conversely), the S&P 500 sunk to a new low in 1980, but the decline was modest and a rally soon followed. But, that recession was much shorter than the other three, so the mild economic interruption was easy to overlook; and while a dovish pivot is viewed as risk assets’ liberator, history suggests otherwise. To explain, we wrote on Nov. 7:

The candlesticks above track the performance of the S&P 500, while the blue line above tracks the FFR. If you analyze the vertical gray line on the left side of the chart, you can see that when the Fed cut the FFR dramatically in April 1970, the S&P 500 went from down ~14% to bottoming down ~32%.

Likewise, the vertical gray line on the right side of the chart shows how when the Fed cut the FFR dramatically in July 1974, the S&P 500 went from down ~17% to bottoming down ~39%. Therefore, when real pivots occur, it's bearish, and asset liquidations are already underway (…).

The S&P 500 rallied sharply when the FFR was cut dramatically in April 1980. However, the recession was over relatively quickly, so investors’ reaction to lower interest rates and brighter economic days was rational (…).

Remember, the 1980 recession only lasted six months, while 1970 lasted 11 months, 1974 lasted 17 months and 1981 lasted 17 months. Furthermore, since this recession hasn’t even started, and little to no inflation progress has occurred, we’re still early in this cycle.

So, while the blue line from the preceding J.P. Morgan chart shows the S&P 500 largely shrugged off a recession in 1980, it wasn’t long before another malaise hit in 1981 and the S&P 500 fell off a cliff. Consequently, history shows that inflation does not go quietly into the night, and an extremely unlikely pivot is not the savior investors think it is.

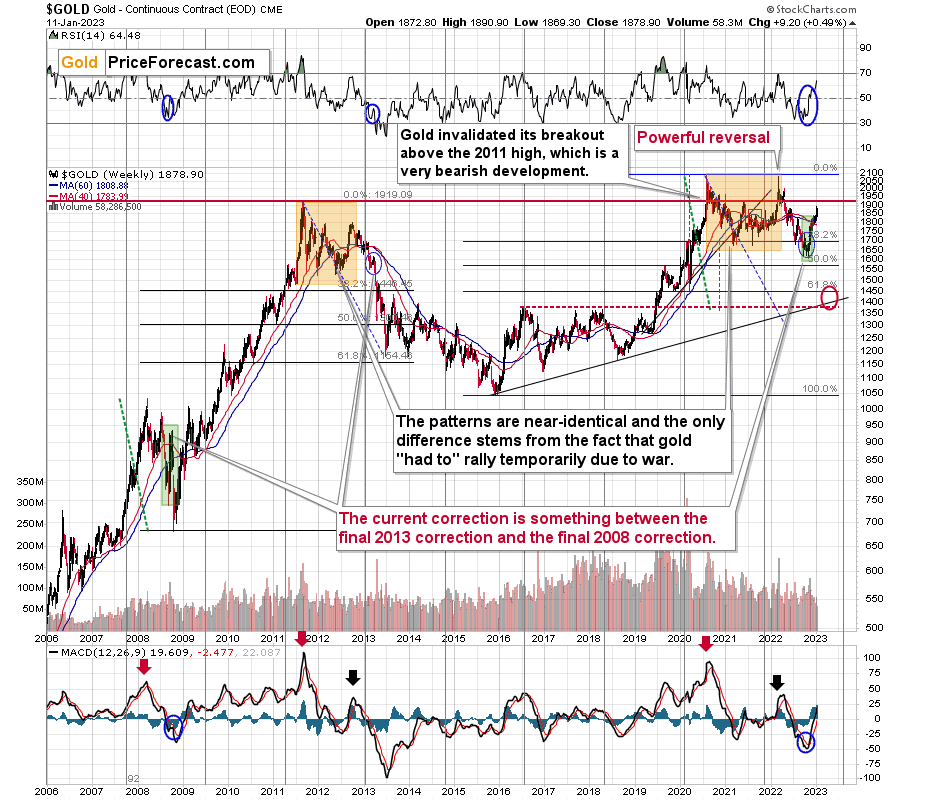

Finally, while the crowd prices in rate cuts in 2023, Boston Fed President Susan Collins expects a continued rise in the FFR. She said on Jan. 11:

“I think 25 or 50 would be reasonable [in February]; I’d lean at this stage to 25, but it’s very data-dependent…. If we go to slower, more judicious rate increases, it could take us three rate increases to get there, and then holding through the end of 2023, that still seems like a reasonable outlook to me.”

Thus, please remember that rate hikes of any size are hawkish, and she is the latest Fed official to push back against a dovish pivot.

Please see below:

Overall, little has changed in the financial markets, as sentiment continues to diverge from the fundamentals. With the U.S. economy refusing to collapse, the bulls’ pivot hopes are less about weak economic data and more about wishful thinking. So, while a potential recession could elicit a dovish pivot, the silver price made its 2022 lows alongside the S&P 500, and if the latter comes undone in 2023, the white metal should follow suit.

What do you think? Why do investors have faith in the Fed, despite the harsh historical lessons? Can Powell control the fundamentals? Or, are investors wrong to follow the post-GFC playbook?

The Bottom Line

Volatility often reigns during CPI releases, and wild swings may unfold across financial assets. But, while the results create daily drama, the price action has little impact over the medium term. As a result, it’s important to fade the narratives and focus on the incoming data.

In conclusion, the PMs were mixed on Jan. 11, as gold ended the day in the green. Moreover, the USD Index was flat and the U.S. 10-Year real yield declined. Conversely, we expect a reversal of fortunes over the medium term, and the PMs should hit new lows before this bear market ends.

Technically Speaking

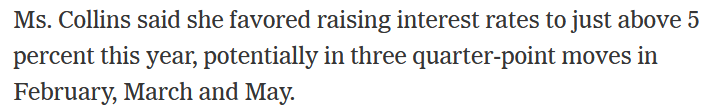

Let’s start today’s technical discussion with a quick check of copper prices.

Overall, everything I wrote about it last week remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

No market moves up or down in a straight line (well, the 2008 slide appears to have been an exception), and a short-term correction doesn’t necessarily invalidate the bigger trend. For the last couple of months, copper has been trading sideways, but it didn’t change much regarding the outlook.

In fact, it made my previous target area even more likely. You see, the consolidation patterns are often followed by a move that’s similar to the move that preceded them. In this case, the previous 2022 decline was quite significant, and if it is repeated, one can expect copper to decline well below 3.

Actually, copper could decline profoundly and bottom in the $2.0-2.4 area. That’s where we have rising, long-term support lines and also the previous – 2016 and 2020 – lows.

Flag patterns (which we just saw in copper) tend to be followed by price moves that are similar to ones that preceded them. I marked this on the above chart with red, dashed lines. This method supports a copper price’s move to around $2.6.

Given the recent flag pattern and the size of the previous decline (and its pace), it seems quite likely that it could take another 2-8 months for copper to move to about $2.4. Late April / early May seem the most likely time target given the current data.

Interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged.

Again, copper is after invalidation of a major breakout, a decline, and a correction. Copper prices currently SCREAM that it’s a variation of 2008 all over again. This is extremely bearish for mining stocks (especially juniors) and silver.

On a short-term basis, copper moved to the 50% Fibonacci retracement, just like other markets. And just like it is the case with other markets, this doesn’t turn this corrective rally into something more than that. At least not yet.

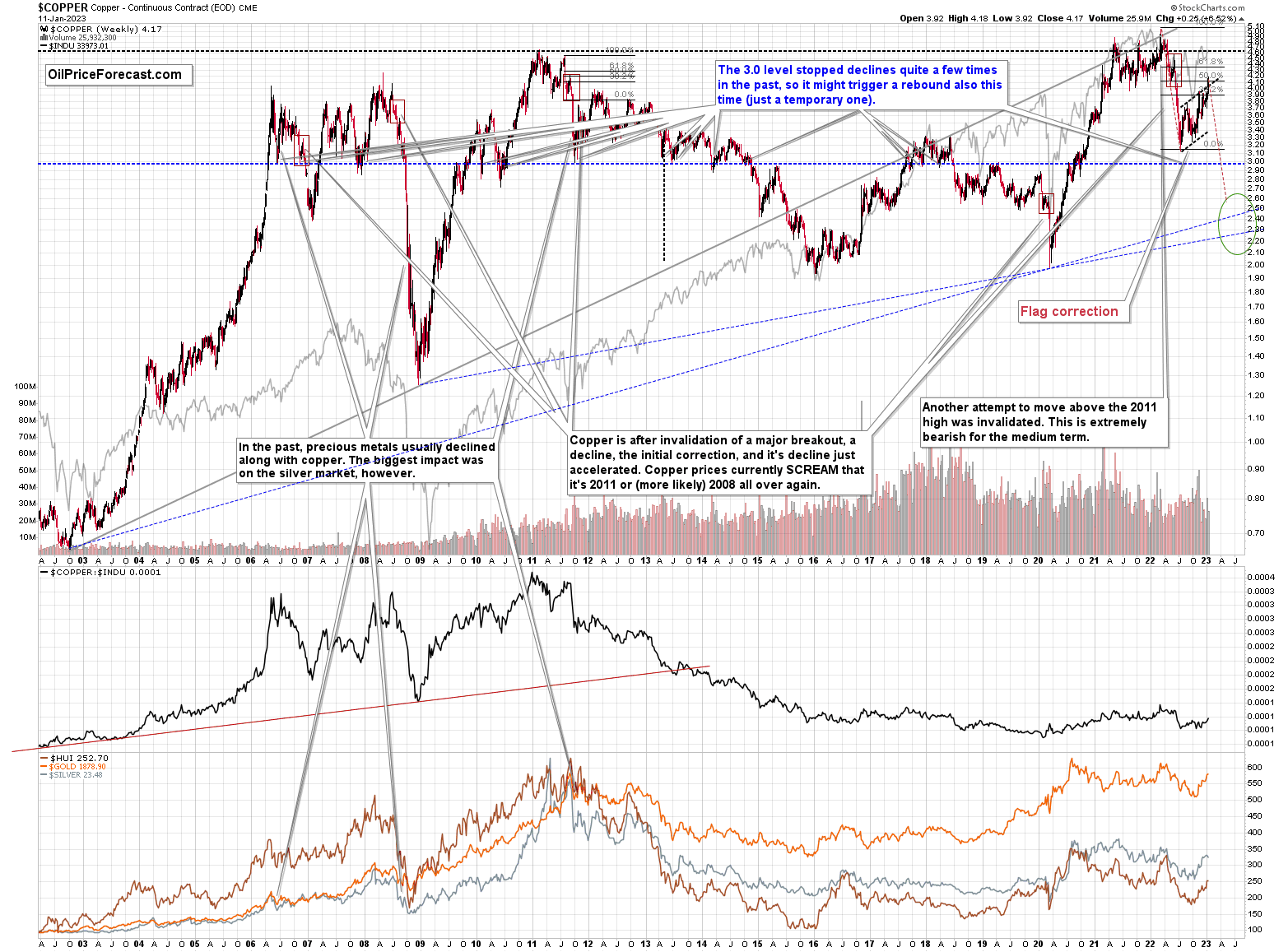

Having said that, let’s check junior miners’ really big picture.

I previously commented on the above chart in the following way:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

Just like it was the case in 2008, the move higher that we saw before the final (biggest) slide in gold, silver, and gold stocks (lower part of the chart), we didn’t see a visible rally in the TSX Venture Index. Just as the index paused back then, it paused right now.

Currently, it’s trading at about 600, and back then, it consolidated at about 2500. The price levels are different, but the overall shape of the price moves (lack thereof) is similar. This serves as a signal, that the recent upswing in the PMs was not to be trusted.

The above is one of the weakest (from the technical point of view) charts that is see across the board right now. There is a strong long-term downtrend visible in the TSX Venture Index, and if stocks slide similarly as they did in 2008, the TSXV could truly plunge – perhaps even to the 300 level or lower.

The important short-term detail is that the TSXV just broke to new yearly lows. This is a major (yet barely noticed by most) indication that the next big move lower is about to start.

Having said that, let’s turn to gold.

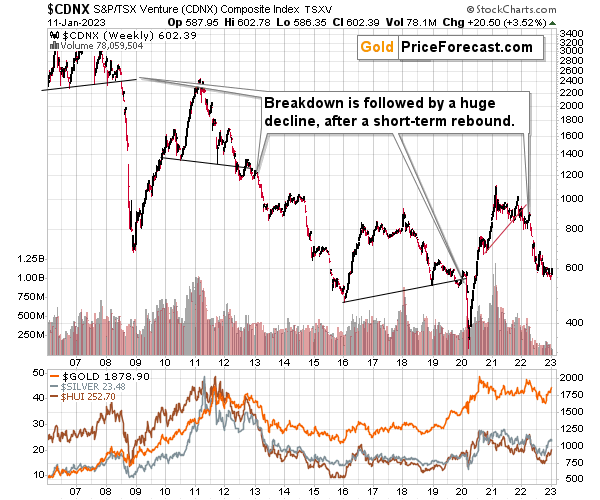

Let’s start with context:

Between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet gold failed to rally to new highs.

In fact, it’s trading very close to its 2011 high, which tells you something about the strength of this market. It’s almost absent.

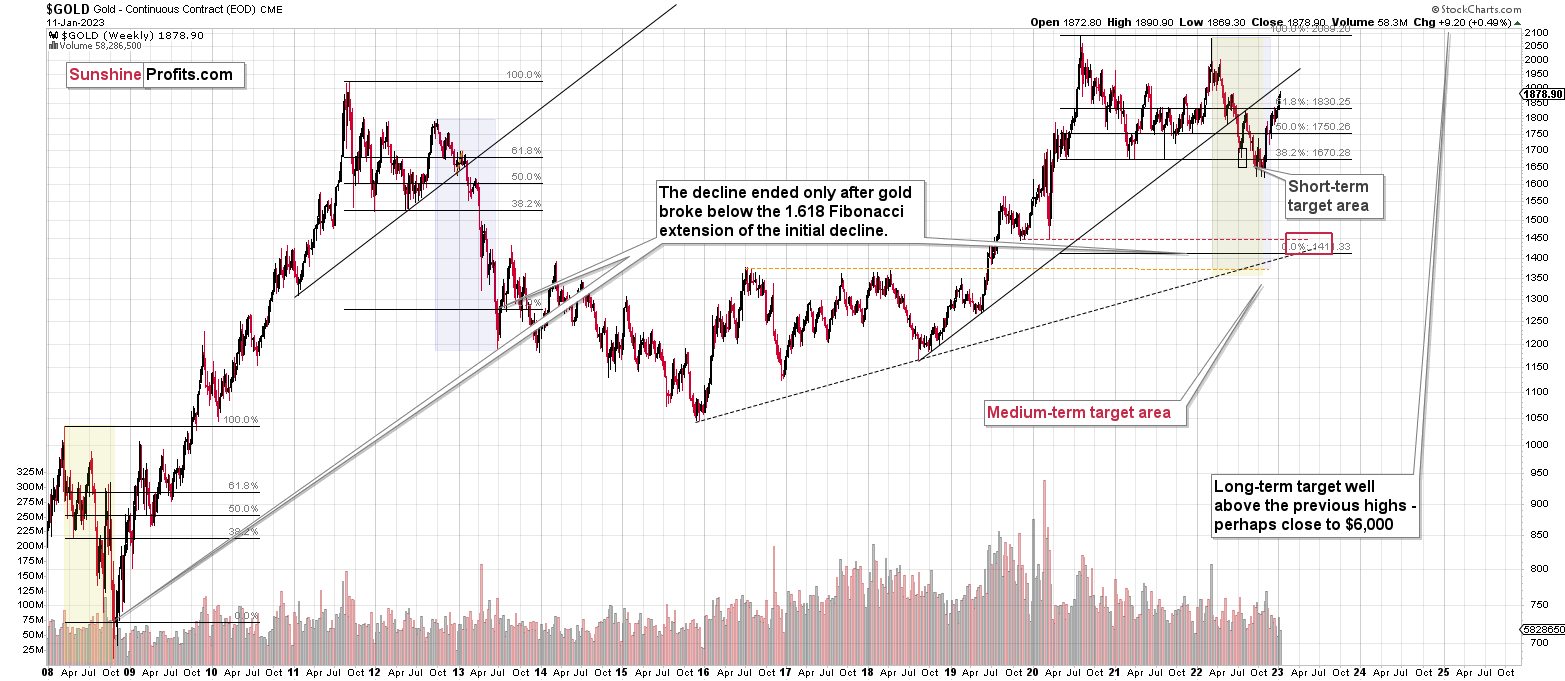

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. We can also spot similarities between now and 2008. The long-term gold price chart below provides details.

Looking at the gold market from a broader point of view, the corrective upswing that we saw recently is something between what we saw in 2013 and what we saw in 2008.

The recent move higher was bigger than what we saw in 2013 but smaller than what we saw in 2008.

No wonder – the current situation in general is similar to both. In fact, that’s why I’ve been writing about this dual similarity for many months now.

Back in 2013, the final of the pre-slide corrective upswings ended with gold below its 40- and 60- week moving averages (marked with red and blue, respectively).

Back in 2008, the final of the pre-slide corrective upswings took gold visibly above both above-mentioned moving averages.

And now? We saw a move above both moving averages, but only a bit above them – the move was not as profound as the one that we saw in 2008.

The most interesting thing about the above is that when gold did finally move above those moving averages in 2008, it meant that the rally was practically over and that it was the perfect time to be shorting the precious metals market – especially mining stocks.

Now, as far as the link to 2013 is concerned, it remains perfectly intact, with the additional note that the final corrective upswing is bigger this time – more like what we saw in 2008.

Gold is sometimes forced to react to some geo-political events as the safe-haven buying kicks in, but these moves are usually short-term lived. Looking at long-term charts helps to keep things in proper perspective.

Consequently, my previous comments remain up-to-date:

Sure, the situations are not identical, as this time we had a Russian invasion of Ukraine that pushed gold temporarily higher. Other than that, the situations are extremely similar.

Based on the stage of the self-similarity and the confirmed breakdown below the $1,700 level, gold is now likely to slide.

Based on the analogy to 2013, it’s not only likely to slide, it’s likely to slide profoundly in a sharp manner. These may be the last days or hours before the slide fully begins.

How low is gold likely to go during this upcoming big medium-term decline? Perhaps as low as its 2020 low, around $1,450-1,500. Then, after a rebound, quite likely to be at or slightly below $1,400.

I realize this is far from the current price, but nonetheless, this target area appears justified in my opinion. There are two important Fibonacci retracements based on the 2015-2020 rally that gold can bounce from (it recently bounced from the 38.2% retracement). These are 50% and 61.8% retracements.

The support provided by the 61.8% retracement is strengthened by the 2020 low and the support provided by the 50% retracement is strengthened by the 2019 high.

However, based on gold’s self-similarity to 2013, it seems that we’re about to see a slide that’s bigger than what we’ve been seeing so far this year. This time – based on the similarity – gold is likely to decline profoundly, but no longer in the back-and-forth mode. If gold formed its next local low at the 50% retracement (so at about $1,560), then it might do so still within the declining, short-term trend channel (sometime in September).

However, if gold is to stick to the link to 2013, then it should decline more rapidly. In this case, the technique that can help us estimate the short-term target is the one that says that after a breakdown from a trend channel, price is likely to move approximately by as much as the height of the previous trend channel. In this case, gold could break below the trend channel soon and then decline even more. Based on the height of the trend channel, the above means that a move to the 61.8% retracement as the next downside target is more likely than a move to the 50% retracement.

I previously wrote that the above-mentioned decline in gold would likely be linked to a breakdown in the EUR/USD below 1, and we already saw both: decline in gold, and a breakdown in the EUR/USD below 1. The implications remain bearish.

Having said that, let’s zoom in to see gold’s short-term price moves.

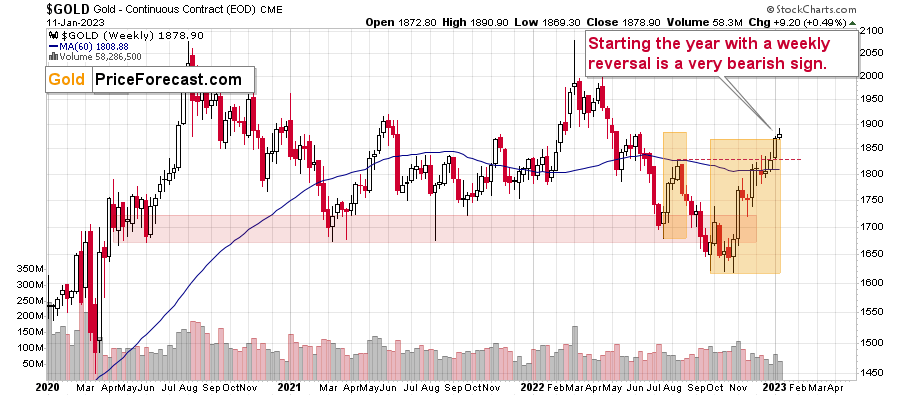

Gold started this year with a quick rally, but it was mostly erased. It’s still above its mid-2022 high, but will it stay there for much longer?

On the above chart, you can see gold price shown as weekly candlesticks.

Gold recently moved above its August highs, but stopped – approximately – at its June highs. This doesn’t have to be the top, but it’s quite likely to be one, especially that gold recently moved quite close to the most prominent of its Fibonacci retracement levels – the 61.8% one. But you’ll see that more clearly on the following short-term gold chart. For now, I would like you to note the shape of this week’s gold performance so far.

Gold reversed. This might not be something very important per se, because there are two more sessions this week, however, when one compares it to the performance of silver and junior mining stocks (GDXJ) that both declined so far this week, it becomes something that should make gold bulls concerned.

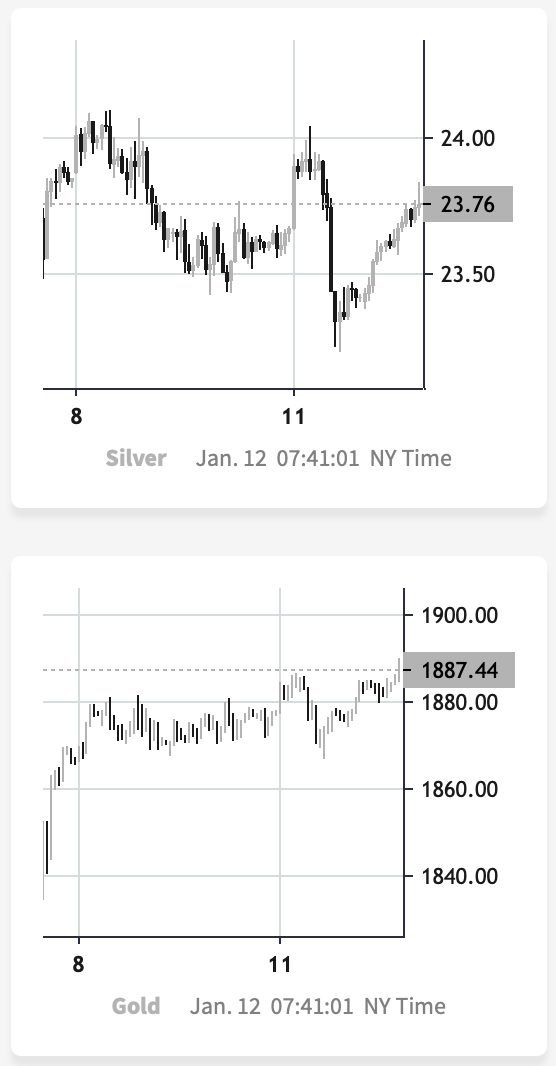

On the chart below (courtesy of https://SilverPriceForecast.com), you can see that while gold moved slightly above its recent short-term highs, silver is far from doing the same thing. In fact, silver has serious problems with staying above the $24 level.

The orange rectangles on the previous chart represent the corrective upswings from approximately the previous local lows. There are two of them, and back in 2013, there was just one corrective upswing, before gold truly plunged.

However, please remember that history doesn’t repeat itself to the letter – it rhymes. This means that two corrections instead of one are still within the scope of the similarity, especially that the first correction wasn’t as big as the 2008 one.

The current situation is truly special, as the rate hikes are something that we haven’t seen in a long time. The same goes for the level of concern about the inflation that’s “out there”. The latter implies that when faced with a decision whether to fight inflation or help the economy, the Fed is likely to lean toward the former. And that’s bearish for assets like gold.

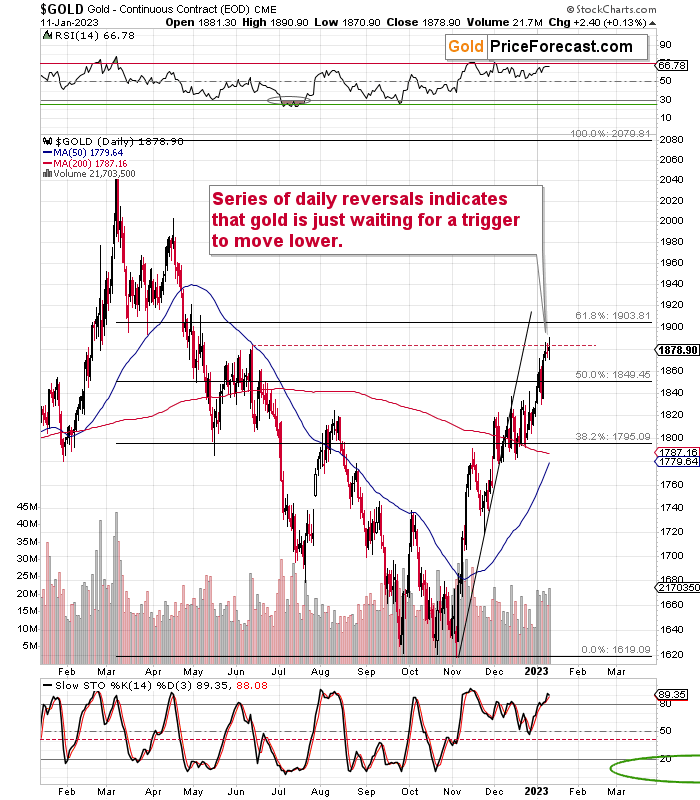

Series of daily reversals indicates that gold is just waiting for a trigger to move lower.

The RSI indicator is trading very close to 70, which means that it’s pointing to a condition that’s not yet clearly overbought, but it’s close to being overbought.

If gold moved higher and reached its 61.8% Fibonacci retracement level, then the odds are that the RSI would move to the 70 level, thus creating a very convincing sell signal.

The above is actually what could happen as the markets overreact to the CPI numbers that are released today, regardless of what the numbers actually are.

However, does gold need this to happen before declining?

It doesn’t.

Gold moved slightly above its June 2022 high and then it moved back below it. That’s an invalidation of a breakout, which by itself is a bearish indication. The fact that we saw several intraday reversals recently makes it even more likely that gold moves lower in the near term.

Having said that, let’s take a closer look at the silver market.

While silver had outperformed gold in recent weeks, it finally declined in a bigger way recently.

Why would this be the case? I spoke about it in last week’s video analysis, but to clarify once again, silver’s outperformance of gold is something based on who enters the market at specific times (the investment public tends to go in at the end of the rally and it tends to favor silver over gold), while gold is owned and bought primarily by the “big players.”

Tax loss harvesting in late December and early-January buy-backs is a reason why the entire market might have rallied initially this year, and it might have distorted the fact that silver did continue to outperform gold for weeks.

Now, it finally declined significantly recently, and it’s clear that it doesn’t want to stay neither above the $24 level, nor its 61.8% Fibonacci retracement, suggesting that the rally is now completely over.

The implications are bearish for the short term.

Also, my previous comments about the relative performance of silver and miners in December remain up-to-date:

What a boring month!

At least for those who monitor the performance of junior mining stocks. It’s after the Dec. 31 close, and the monthly price change for the GDXJ ETF is $0.12 (0.34%). That’s very little – next to nothing.

During the same time, gold futures rose by $66.30 (3.77%) and silver prices rose by $2.26 (10.38%) in December.

I know that I’ve been writing about this over and over again, but please note how extreme this signal is! It’s crystal-clear even on a monthly basis. The signal, of course, comes from markets’ relative performance.

Miners tend to underperform the gold price close to market tops, and silver tends to outperform close to market tops. The above monthly numbers are practically screaming: “it’s a top!” As always, very few are listening, as it’s easy to get carried away by the primary emotion that’s out there in the market, and when prices are rallying, people become bullish. They tend to ignore the signs and focus on the feelings.

Even the wording in the messages that we receive changes. The phrases “I feel the market is about to move higher” or “it seems to me that this rally won’t end” are common, but messages with indications and evidence supporting that bullish case are very rare or (usually) absent.

Please note that while I’ve been analyzing the precious metals sector’s outlook recently, my trading focus has been on the junior mining stocks – and indeed, miners have barely moved higher this month, even despite a sizable move lower in the USD Index.

But you said that miners are driven by stocks, and the S&P 500 is down by over 5% this month. Aren’t miners weak just because of the stocks? As a result, there is no underperformance of gold—no bearish indication? No.

While it’s true that stocks’ performance tends to impact juniors’ prices, it’s also true – to a considerable extent – in the case of the silver market.

Silver’s price hasn’t been weak this month. Quite the opposite – silver soared by over 10%.

If silver soared so much, then apparently the impact the stock market had on the precious metals sector was not as significant. Consequently, it’s very likely that the indications coming from the relative performance of miners and silver are truly bearish for the precious metals sector.

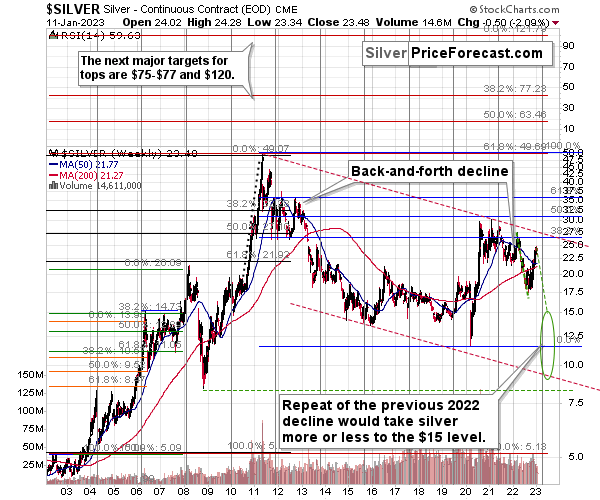

Looking at silver from a long-term point of view helps to see the forest, not just individual trees.

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

What happens after corrections are over (as indicated by, i.e., silver’s outperformance)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Besides, the long-term turning point for silver is due in several months, and if silver repeats its previous 2022 decline, then it will bottom close to the turning point and also close to the $15 level– in the first half of 2023.

It’s likely to repeat its previous 2022, because that’s what tends to happen after flag patterns, and what you see on silver’s short-term chart between September and yesterday appears to be a flag pattern.

However, will silver only repeat its previous 2022 performance and not decline more than it already has?

Based on the analogies to 2008 and 2013, the latter is more likely. The 2013 slide was bigger than the initial decline that we saw in 2012. And the final 2008 slide was WAY bigger than what we saw before it.

Due to its industrial uses, silver is known to move more than gold, in particular when the stock market is moving in the same way as gold does. Since I think that gold and stocks are both likely to slide, silver is indeed likely to decline in a truly profound manner. Quite likely lower than just $15.

Consequently, my prediction for silver prices remains bearish, as does the outlook for the rest of the precious metals sector.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in mining stocks.

History tends to repeat itself. Not to the letter, but in general. The reason is that while economic circumstances change and technology advances, the decisions to buy and sell are still mostly based on two key emotions: fear and greed. They don’t change, and once similar things happen, people’s emotions emerge in similar ways, thus making specific historical events repeat themselves to a certain extent.

For example, right now, gold stocks are declining similarly to how they did in 2008 and in 2012-2013.

For now, gold stocks are practically flat this week, despite the rally in stocks. The situation being what it is on the gold market (as discussed above) and the stock market (as I’ll discuss below), it seems to be only a matter of time before gold stocks slide.

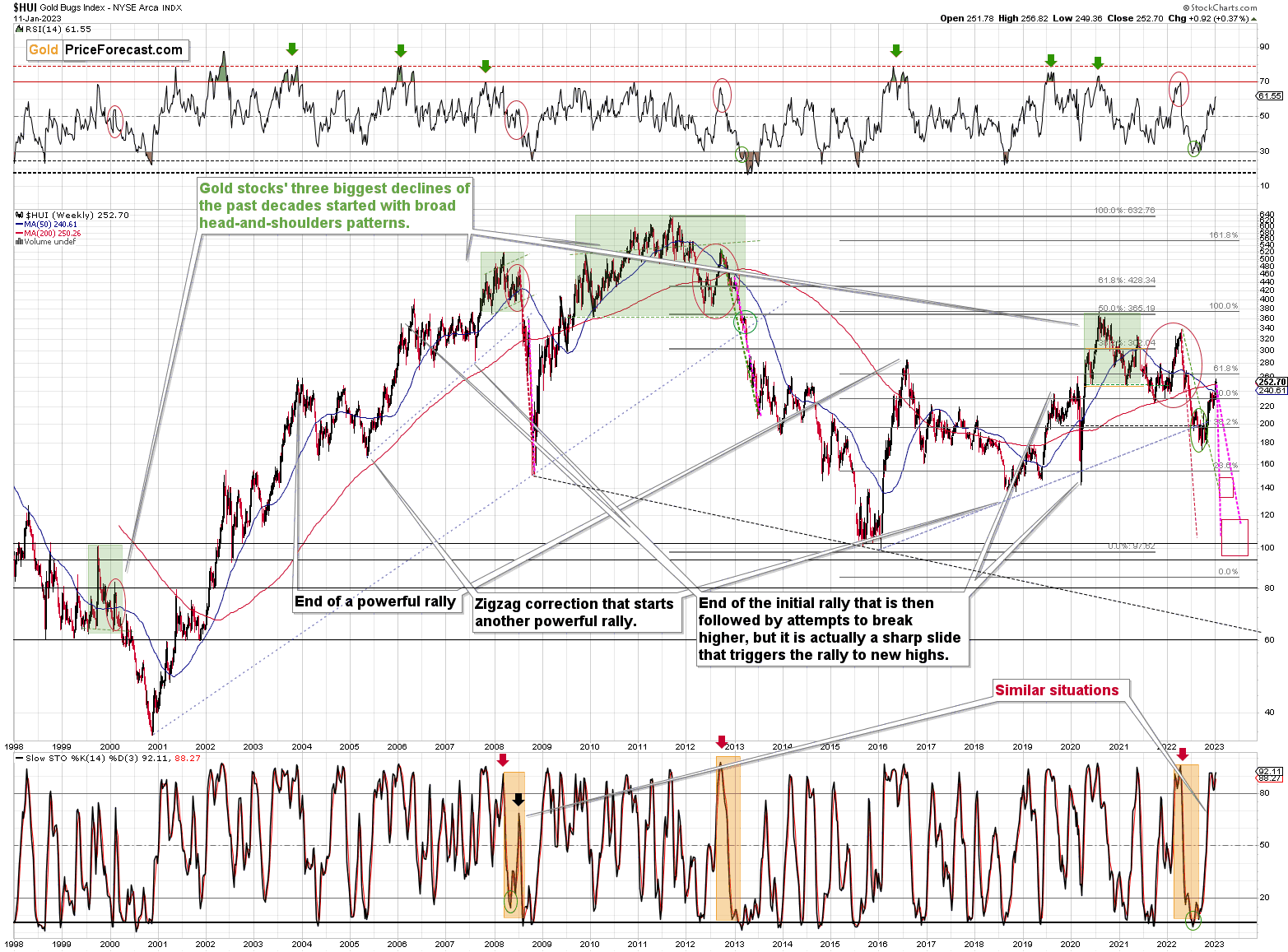

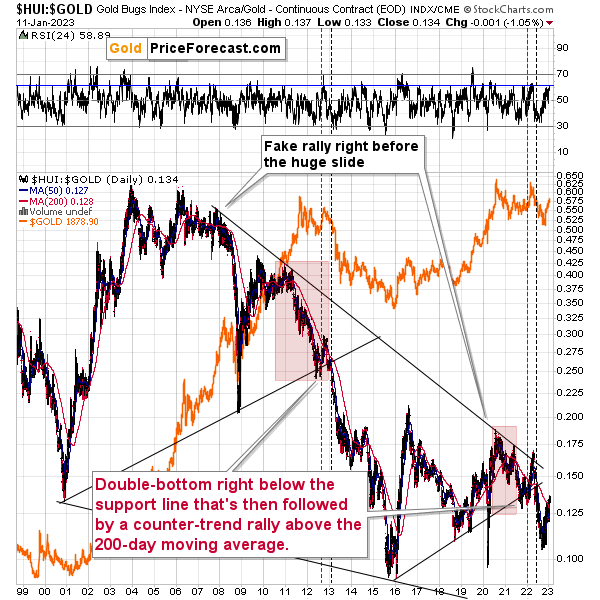

For many months, I’ve been writing that the situation in the HUI Index is analogous to what we saw in 2008 and in 2013. Those declines were somewhat similar, yet different, and what we see now is indeed somewhere in between of those declines – in terms of the shape of the decline.

At first, the HUI Index declined just like it did in 2013, and the early-2022 rally appears to be similar to the late-2012 rally. However, the correction that we saw recently is also similar to the late-2012 rally.

Since the history doesn’t repeat itself to the letter, but it rhymes, is it that odd that we now saw two corrective upswings instead of one? Not necessarily.

This is especially the case that the 2008 decline had one sizable correction during the big decline. It’s not clearly visible on the above chart due to the pace of the 2008 slide, but it’s definitely there. You can see it more clearly in one of the below charts.

So, no, the recent rally is not an invalidation of the analogies to the previous patterns, it continues to rhyme with them in its own way. And the extremely bearish implications for the following months remain intact.

How low can the HUI Index fall during the next big downswing?

As it’s the case with gold and silver, a move back to the 2020 lows is definitely in the cards. Please note that this level is also strengthened (as support) by other major lows: the 2019, 2014, and 2008 ones.

However, I wouldn’t rule out a move even lower on a temporary basis. If gold were to decline to about $1,450-1,500, it would mean that it would double its current 2022 decline. If the HUI Index does that, it will move below 150.

So, all in all, 100-150 is my current target area for the upcoming slide in the HUI Index.

All right, let’s zoom in and see how mining stocks declined in 2008.

Back then, the GDXJ ETF was not yet trading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and it erased about 70% of the miners’ value. The biggest part of the decline happened in the final month, though.

However, the really interesting thing about that decline – that might also be very useful this time – is that there were five very short-term declines that took the GDX about 30% lower.

I marked those declines with red rectangles. After that, a corrective upswing started. During those corrective upswings, the GDX rallied by 14.8-41.6%.

Do you know how much the GDX ETF has rallied from its September 2022 bottom? It moved up by 46.7%. This means that the move higher now is very similar to the corrective (!) upswing that we saw in September 2008. The analogy was not broken – it remains intact, and it points to much lower prices in the future.

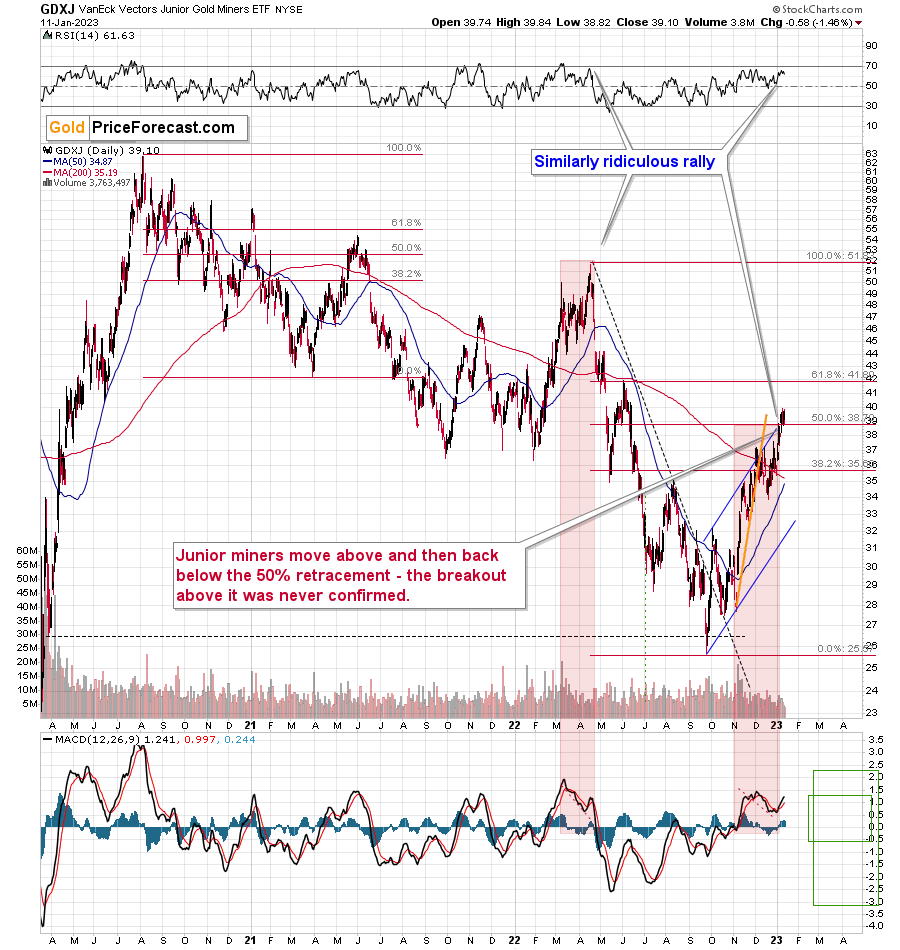

Junior miners are trying to move above their 50% Fibonacci retracement based on the 2022 decline.

They are trying, and they are failing, at least on an intraday basis.

Moreover, the current situation is very similar to what we saw in April 2022, and I marked that with red rectangles.

The rather flat top at first, and then a false breakout. That’s how the 2022 decline started. And it’s quite possible that it’s the way in which the 2023 decline started as well.

Speaking of analogies, the recent rally is similar to also the previous short-term rally, and the similarity is present also on the silver market, which was strong (before the top) in both cases.

Back then (in mid-2021), junior miners had corrected a bit more than half of the preceding decline before sliding again, and this time, they corrected approximately half of the preceding decline.

Interestingly, after the mid-2021 correction, the pace of the decline picked up, and miners declined almost twice as fast. And yes, this could happen in the following months as well.

And yes, this means that another decline could take the GDXJ all the way down to its 2020 low, or very close to it.

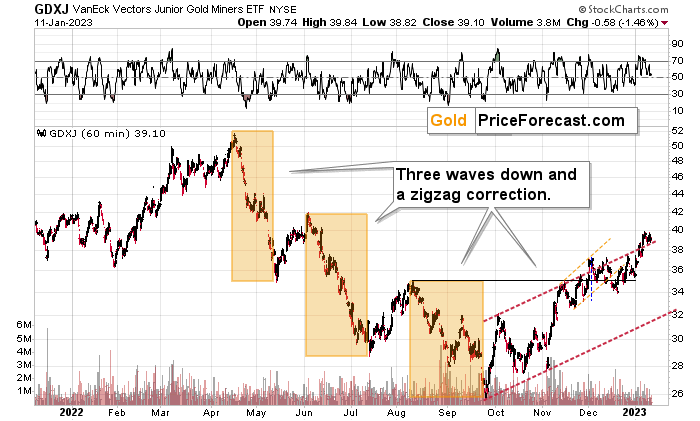

On the below chart, I marked just how perfectly the recent price moves played out according to the Elliott Wave Theory.

Of course, EWT is not the only tool that one could use, and I find other technical tools more useful, but still, this kind of pattern-following is uncanny.

The classic EWT pattern is three waves down (I marked those with orange rectangles) and then a correction consisting of two smaller waves.

That’s exactly what we have seen in recent months. The September–now pattern appears to be the above-mentioned correction. This created an ABC correction (flag) pattern.

I previously wrote that the Dec. 1 small breakout above the upper red line didn’t have meaningful bullish implications as it hadn’t been confirmed. And indeed, it was invalidated. The same happened very recently.

Now, since this pattern is complete, another huge 3-stage move lower can – and is likely – to unfold. This is very bearish for junior mining stocks (as well as for gold, silver, and probably other commodities and stocks), and the fact that juniors are already showing weakness relative to gold (the latter was almost flat yesterday, while miners declined) serves as a bearish confirmation. As always, I can’t guarantee anything, but in my view, the profits that can be reaped on this upcoming slide can be enormous.

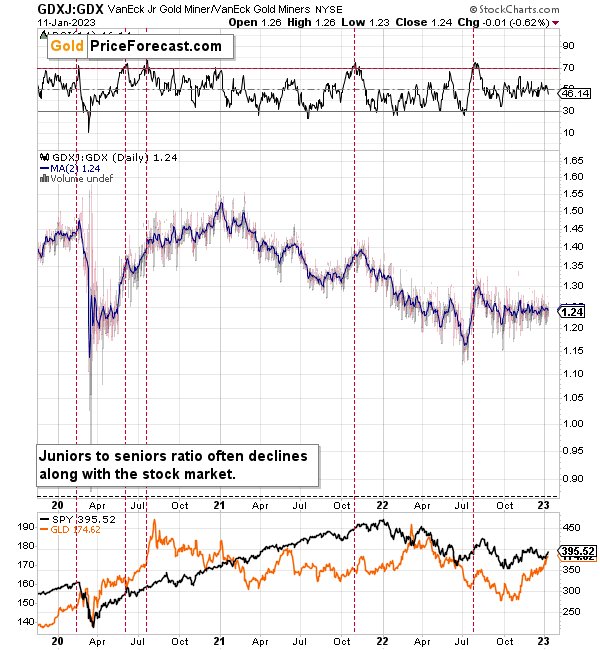

Meanwhile, the relative performance of junior miners compared to senior miners continues to deteriorate in a medium-term trend.

During this quick upswing, juniors rallied relative to seniors, but this is just a very short-term move that’s within a short-, and medium-term downtrends.

This implies bigger declines in the GDXJ in the future.

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI to gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

Recently, we saw a quick upswing in the ratio, but that’s not a game-changer – even the biggest declines had corrections in the past.

If history is to rhyme, we’re about to see a profound decline. In fact, we’re likely already past its beginning.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices of gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

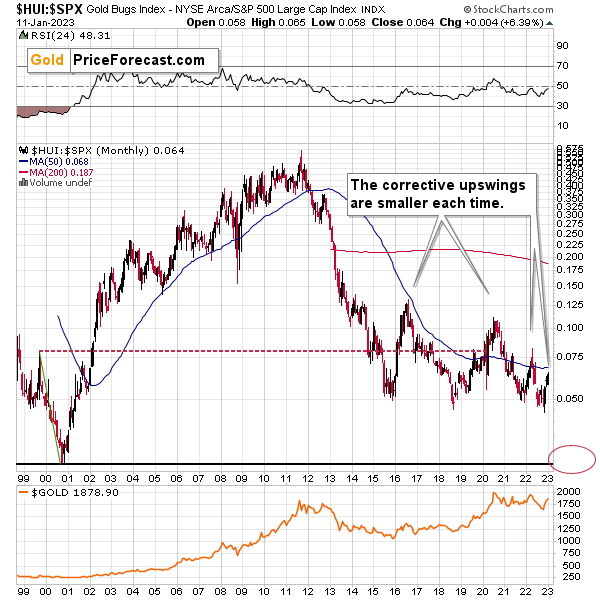

Interestingly, the situation in the gold stocks to other stocks ratio (HUI Index vs. S&P 500 Index) provides the same implications but from a different angle.

The corrective upswings that we’ve been seeing since 2015 are getting smaller and smaller. The current one is visibly smaller than what we saw last year.

Consequently, it seems that the ratio is ripe for a breakdown below the 0.05 level. The next support is provided by the all-time low at 0.026. And yes, with the ratio at 0.065 right now, this implies a decline by about 60%. If the HUI Index were to decline by 60% right now, it would have to move to about 100. If the stock market declined as well, it would imply the HUI was even lower.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… just stocks) and that’s exactly what’s likely to happen.

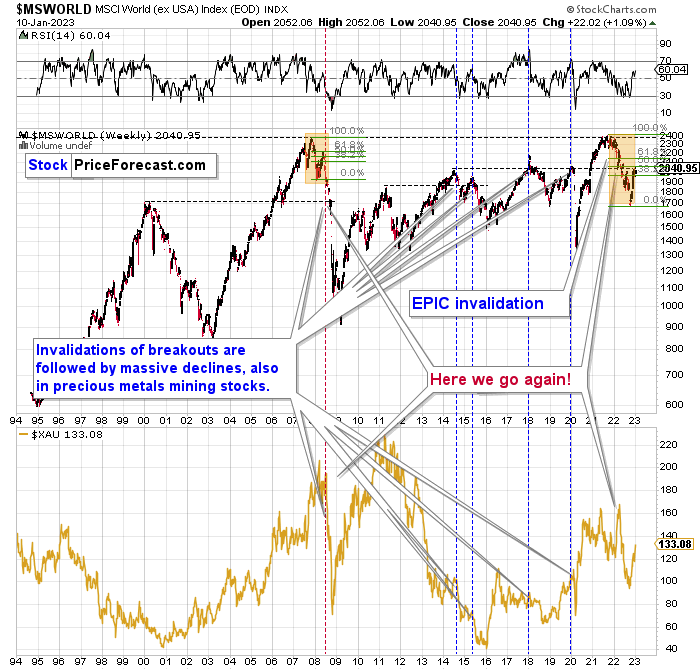

Just like what we saw in the case of copper, gold, and mining stocks, world stocks corrected about 38.2% of their preceding decline.

And recently, they corrected a bit more – almost half of the preceding decline.

Please note that the initial decline was now bigger than what we saw in 2008. Back then, stocks corrected about 61.8% of their initial decline before tumbling. If stocks are not able to do the same thing now – and they might not be – then the following slide could be even bigger than what we saw in 2008. Naturally, this would be profoundly bearish for junior mining stocks.

This means that nothing really changed, and the situation remains extremely bearish based, i.e., on the analogy to what we saw after previous invalidations of long-term breakouts.

As a reminder, in early 2022, I wrote that the situation was very bearish as invalidations of previous breakouts were usually followed by massive declines – not just in stocks but also in precious metals.

When stocks invalidated their 2006 breakout in 2008, their prices truly crumbled.

We also saw that on a smaller scale in 2014, 2015, and early 2018.

We’re seeing it right now.

To clarify, we’re actually seeing the aftermath of the invalidation. The huge decline is already taking place.

The difference between now and 2008 is that back then the slide was more volatile, and we didn’t really see a visible correction during the plunge. This time, the decline is more measured, and we saw a correction to one of the most classic retracements imaginable – the 38.2% one. This correction doesn’t change the trend, which remains down.

Based on what happened in 2008, it seems that stocks are about to move much lower in the following months.

Let’s take a look at the markets from a more short-term point of view and from the U.S. perspective.

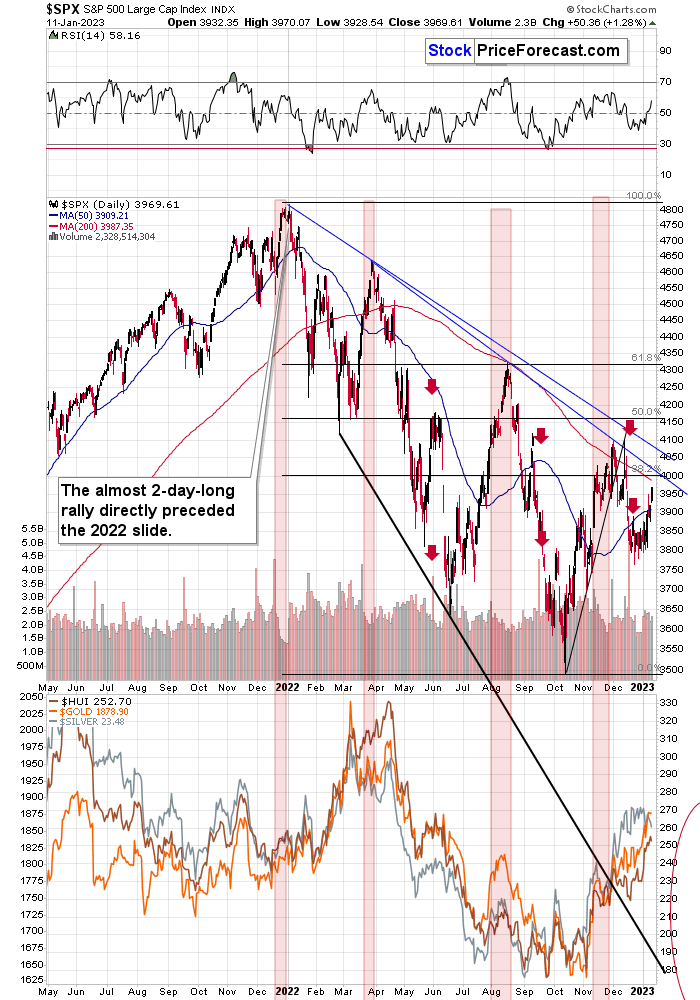

The S&P 500, like global stocks, corrected a bit more than the 38.2% of the previous decline. And now they turned south, invalidating this small breakout. At the same time, they broke below the rising support line, which makes the outlook even more bearish. Consequently, my previous comments on the above chart remain up-to-date:

The broad market moved lower this week, and there are two good reasons to think that this time, the small move lower is just the beginning of a much bigger move to the downside.

One of the reasons is that this move lower came right after the triangle-vertex-based turning point. The declining black and red lines (both dashed) intersect at more or less the very recent top. As their name says, those turning points mark… Well, turning points. And since the most recent short-term move was to the upside, it currently has bearish implications.

The second reason is that stocks now broke below their rising support line (marked with a solid black line), and that’s not what happened during the two previous small moves lower.

The analogy in the price-volume link (marked with red rectangles) also points to much lower prices in the stock market.

Additionally, please note that stocks tried to move above their previous highs and the declining blue resistance line – and they failed. The invalidation served as yet another sell signal. It’s absolutely no wonder that we’re seeing a significant short-term decline right now.

Stocks corrected recently, and it seems that they are ready to slide any day now, as the premise of Fed’s dovish U-turn seems overly exaggerated, in my view.

Why is this important for gold and silver investors and traders? Because the last two big moves took place more or less in line with each other – in stocks and in precious metals (and miners). The slide in stocks could also trigger something similar in the case of commodities like crude oil. The same thing is likely to happen again this time, especially given what’s happening in the USD Index.

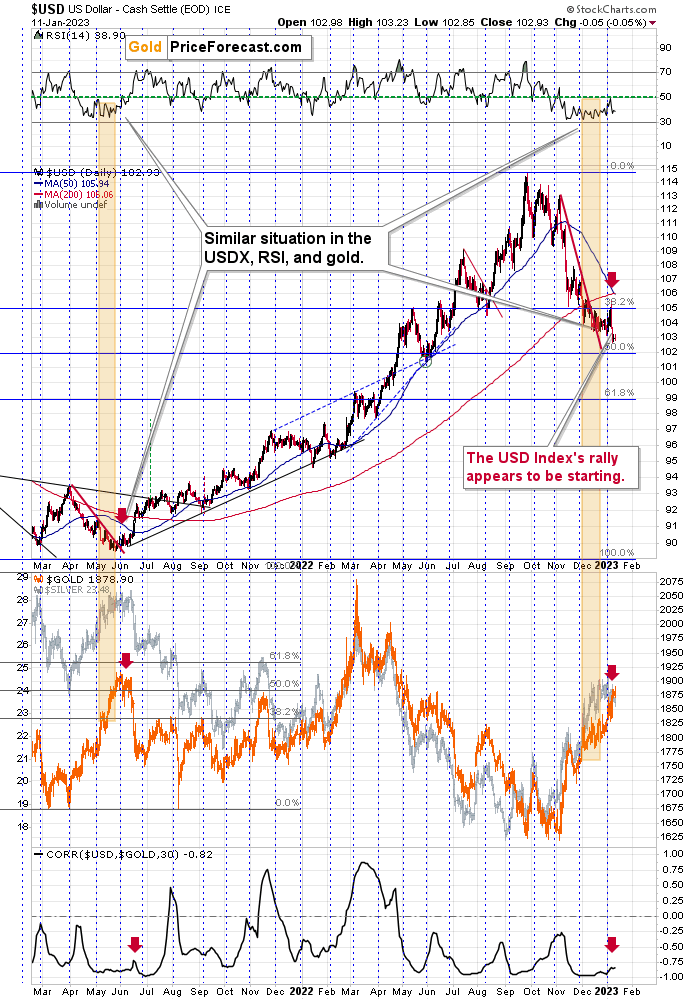

Namely, the USD Index finally showed sizable short-term strength and moved higher in a meaningful way.

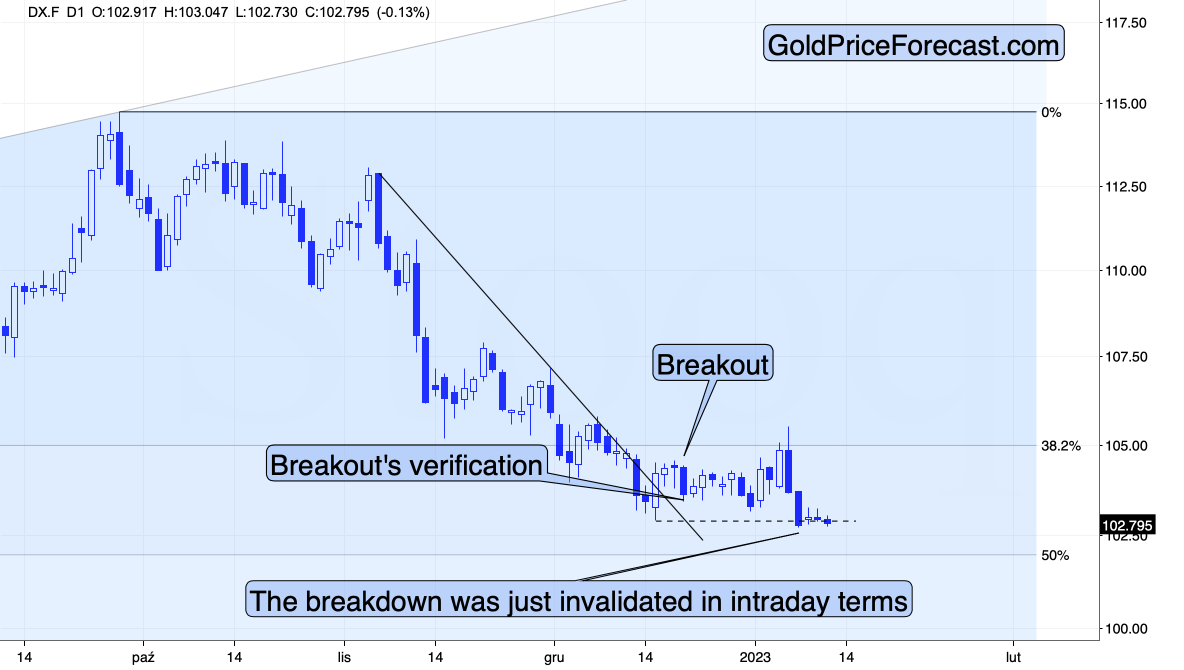

Yes, it did move lower shortly thereafter, but what happened is bullish, nonetheless. It’s more clearly visibly once we zoom in.

As you can see the breakout above the declining resistance line was confirmed.

You can also see that the breakdown below the mid-Dec. intraday lows was not confirmed. In fact, it was invalidated, and right now we see yet another attempt for the USDX to confirm it.

The bullishness of the above-mentioned breakout is more important than the unconfirmed breakdown.

This means that the very strong support provided by the previous long-term highs, is likely to trigger a substantial rally after all.

As I indicated previously, the 2016 and 2020 tops (as well as the 2002 low and the 1999 top) currently serve as very strong support at about 104 level.

To clarify, the higher of those highs has 103.5 as the highest daily closing price, and the lower one is 103.29.

This means that the move below those levels is just tiny and likely to be reversed.

This means that gold, silver, and mining stocks are likely to decline profoundly as they are very negatively correlated with the USD Index.

Also, after a similar correction in 2000, the USD Index bottomed a bit below its 200-day moving average. And, guess what – the USDX almost moved below the same average recently. Consequently, another rally could indeed be in the cards.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over (or about to be over) and that the next big move lower is already underway (or that it’s about to start).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

We received a few messages over e-mail, but as we are moving to our new platform, we will be transferring them below the articles as comments – and that’s where we’ll be replying to them.

Asking your questions below the articles or in the spaces called “Ask the Community” or “Position Sizes” directly will help us deliver a reply sooner. In some cases, someone from the community might reply and help even before we do.

Please remember about the Pillars of our Community, especially about the Kindness of Speech Pillar.

Also, if there’s anything that you’re unhappy with, it’s best to send us a message at [email protected].

Please note that this section is going to go away within the next 1-8 weeks, as you can add comments/questions below the article on Golden Meadow – the platform that we’re using to provide our analyses. Your notification e-mails include an invitation link that allows you to access the “Gold Trading Alerts” space.

Also, if you haven’t had the chance to see the video, in which I’m talking about the new platform and why we essentially moved from Sunshine Profits to Golden Meadow, I strongly encourage you to do so:

Summary

Summing up, it seems that the major bottom in the USD Index is in (or at hand), while the correction in stocks, gold, silver, and mining stocks is over – or very close to being over.

Gold and junior miners corrected less than 61.8% of their 2022 decline, while silver corrected over 61.8% of the decline. Silver’s move above the 61.8% Fibonacci retracement was already invalidated, suggesting that the next big move lower is starting or about to start.

Now, as more investors realize that interest rates will have to rise sooner than expected, the prices of precious metals and mining stocks (as well as other stocks) are likely to fall. In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. And while I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $22.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $14.32

SLV profit-take exit price: $13.42

ZSL profit-take exit price: $48.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $16.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $36.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief